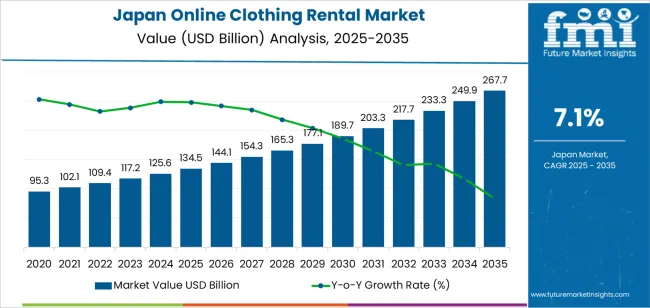

The demand for online clothing rental in Japan is expected to grow from USD 134.5 billion in 2025 to USD 267.7 billion by 2035, reflecting a CAGR of 7.1%. The market for clothing rental is driven by several factors, including the increasing demand for sustainable fashion, the growing popularity of cost-effective clothing solutions, and a shift in consumer behavior toward experience-based consumption over ownership. With the younger generation more inclined to rent rather than purchase clothes, especially for special occasions and everyday wear, the market is set to benefit from the demand for flexible, eco-friendly, and stylish options.

Technological advancements, such as AI-driven personalized fashion recommendations and improved logistics for rentals, will further fuel the market's growth. Additionally, the rise of subscription-based rental models and the increasing acceptance of second-hand and rental clothing will support the expansion of online clothing rental services across Japan.

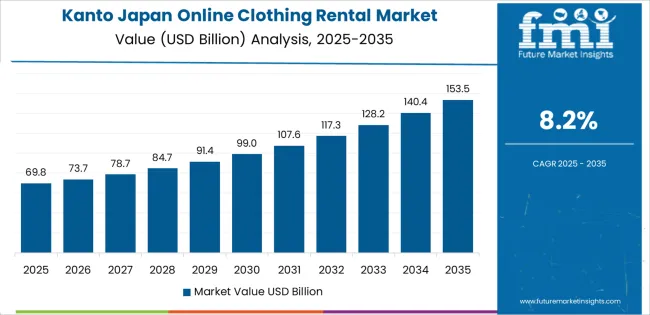

The compound absolute growth analysis for online clothing rental in Japan indicates a steady and consistent increase in market value over the forecast period from 2025 to 2035.

From 2025 to 2030, the market will grow from USD 134.5 billion to USD 189.7 billion, contributing an absolute growth of USD 55.2 billion. This early phase will witness accelerated growth, driven by the rise of sustainability concerns, consumer interest in flexible clothing options, and the increased adoption of digital solutions for clothing rentals. The absolute growth during this period reflects the early adoption of rental services in various consumer segments, particularly for formal wear and fashion-forward consumers who wish to rent instead of purchase.

From 2030 to 2035, the market will grow from USD 189.7 billion to USD 267.7 billion, contributing another USD 78.0 billion in value. This later phase will continue to see strong growth, driven by wider market penetration, the mainstreaming of clothing rental services, and the growing trend of digital-first solutions in the fashion industry. The market will benefit from enhanced convenience, increased variety, and the growing popularity of subscription models as consumers embrace accessibility and cost-efficiency. The absolute growth in the latter part of the forecast period reflects the maturation of the market, with stronger demand across all categories, including casual wear, luxury fashion, and specialized rentals for events and seasonal wear.

The total compound absolute growth over the forecast period is USD 133.2 billion, indicating significant expansion of the online clothing rental market as it gains traction in mainstream consumer behavior. The market’s continued growth will be driven by evolving consumer preferences and advancements in rental technology.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 134.5 billion |

| Forecast Value (2035) | USD 267.7 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

Demand for online clothing rental in Japan is rising as consumers increasingly prioritize access over ownership, driven by sustainability concerns and a desire for more wardrobe variety at lower cost. Younger Japanese shoppers, influenced by fastmoving fashion trends and social media, are more open to renting designer or premium apparel for special occasions rather than purchasing items they may only wear once. Online rental platforms offering subscription models and onetime rentals help meet these needs by providing convenience, flexible options and fast delivery. The growth of tourism and business travel in Japan also contributes, as visitors and professionals seek temporary wardrobe solutions without permanently purchasing new items.

Another factor supporting market growth is the shift in retail behavior toward digital channels and the increased focus on the circular economy. Brands and rental services collaborate to extend the lifecycle of garments, enhance brand reach, and improve customer engagement through curated collections and styling services. Improvements in logistics, mobile apps, sizefit tools and garment care systems reduce barriers to adoption. Nonetheless, the Japanese market faces challenges such as rigorous hygiene expectations, strong preferences for brandnew items, and the complexity of garment inventory management. Despite these constraints, the combination of sustainability focus, fashionforward consumer segments and digital rental infrastructure suggests that demand for online clothing rental in Japan will continue to expand steadily.

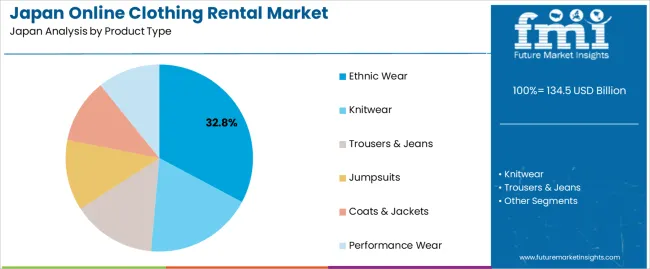

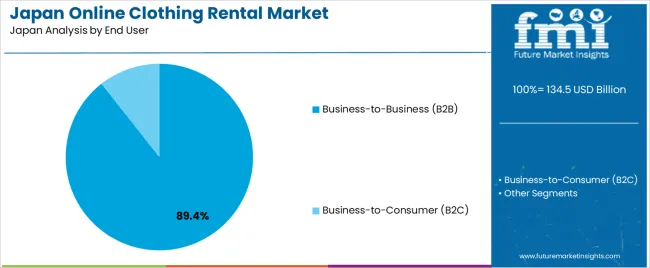

The demand for online clothing rental in Japan is primarily driven by product type and end-user segment. The leading product type is ethnic wear, which holds 33% of the market share, while the dominant end-user segment is business-to-business (B2B), accounting for 89.4% of the demand. Online clothing rental services are growing in popularity as they offer convenience, sustainability, and cost-effectiveness for both individual consumers and businesses. In Japan, this trend is further accelerated by the cultural importance of fashion, the popularity of rental services for special occasions, and the growing focus on sustainable consumption.

Ethnic wear leads the market for online clothing rental in Japan, capturing 33% of the demand. Ethnic and traditional attire, such as kimonos, saris, or other culturally significant garments, is commonly rented for special occasions like weddings, festivals, or cultural ceremonies. The high cost of purchasing ethnic wear, coupled with the limited frequency of use, makes renting an attractive option for consumers.

The demand for ethnic wear in online rental services is also driven by the increasing diversity in Japan's population and the popularity of renting garments for events that require specific cultural attire. Renting ethnic wear allows individuals to access high-quality, traditional outfits without the financial burden of purchasing them. Additionally, as sustainability and eco-consciousness continue to influence consumer purchasing decisions, renting ethnic wear aligns with the desire to reduce textile waste. As these trends continue, ethnic wear is expected to remain a leading product category in Japan's online clothing rental market.

Business-to-business (B2B) is the leading end-user segment in the online clothing rental market in Japan, capturing 89.4% of the demand. In the B2B sector, online clothing rental services are utilized by businesses in industries such as fashion, entertainment, and corporate events, where rental clothing is required for photo shoots, fashion shows, promotional events, and employee uniforms. The B2B model offers companies the flexibility to rent high-quality clothing without the need for large capital investments or long-term commitments.

B2B demand for rental clothing is driven by the need for businesses to keep up with changing trends, seasonal demands, and the need for diverse outfits without maintaining a large inventory. Renting garments for temporary or specific uses allows companies to access a wide range of styles and sizes while minimizing storage costs and reducing waste. The growing trend of eco-friendly and sustainable business practices, combined with the convenience of renting, ensures that B2B demand will remain the dominant force in Japan's online clothing rental market.

Demand for online clothing rental in Japan is shaped by increasing consumer interest in fashion variety, sustainability, and convenience. Urban shoppers and younger demographics are embracing accessoverownership models, particularly for occasion wear and premium brands. Logistics and digital platforms support this shift, while the country’s compact living spaces and culture of minimalism lean toward rental solutions. At the same time, slow growth in new apparel spend and a strong tradition of ownership constrain the pace of uptake.

Several factors support expansion in Japan. First, rising environmental and sustainability awareness encourages consumers to opt for rental rather than purchase to reduce textile waste. Second, younger consumers and urban professionals want frequent wardrobe refreshes without high cost, making rental attractive for premium or designer items. Third, improved ecommerce platforms, mobile access and streamlined logistics make rental services more accessible and convenient in Japan’s dense cities. Fourth, demand for formalwear, event wear and designer pieces that are worn infrequently creates natural usecases for rental models and helps drive acceptance of online clothing rental.

Despite positive momentum, some constraints remain. Cultural norms still favour ownership and personal collection of apparel, which may slow adoption of rental models in mainstream segments. Fit, sizing, hygiene and garment condition concerns can reduce consumer confidence in rental services. Additionally, high labour and logistics costs in Japan, combined with garment maintenance and rapid turnover, raise operational costs and may limit profitability in rental platforms. The relative maturity of Japan’s fashion retail market means incremental growth is more difficult than in lowerpenetration regions.

Emerging trends include a shift from onetime event rentals toward subscriptionbased wardrobe access covering casual, workwear and lifestyle garments. Virtual tryon technologies and AIdriven styling suggestions are becoming more common to improve fit and user experience in online rental. Peertopeer rental models and circularfashion platforms are gaining traction among ecoaware consumers. There is also increased collaboration between rental platforms and traditional fashion brands, enabling designer collections and limitededition drops specifically for rental, enhancing appeal and diversifying offerings.

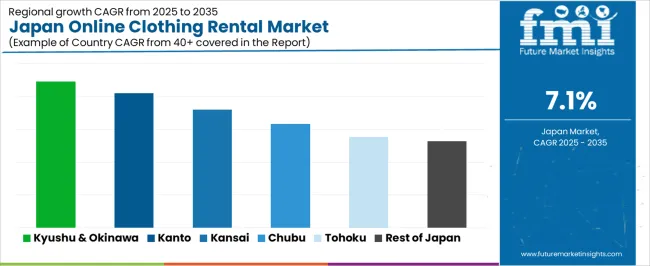

The demand for online clothing rental in Japan is growing as consumers increasingly prioritize sustainability, convenience, and affordability in their fashion choices. Online clothing rental services offer consumers the opportunity to access high-quality, trendy clothing without the commitment of ownership, making it a popular choice for individuals who want variety in their wardrobes but are concerned about the environmental impact of fast fashion. Factors such as Japan's fashion-forward culture, high-tech adoption, and growing environmental awareness are contributing to the rise of online clothing rental services. Additionally, the need for formal wear for events, the popularity of eco-conscious living, and the rising cost of fast fashion are fueling demand. The regional variation in demand reflects different socio-economic conditions, population densities, and fashion culture in Japan. Below is a breakdown of demand across various regions, highlighting key drivers in each area.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 8.9% |

| Kanto | 8.2% |

| Kinki | 7.2% |

| Chubu | 6.3% |

| Tohoku | 5.6% |

| Rest of Japan | 5.3% |

Kyushu & Okinawa leads the demand for online clothing rental in Japan with a CAGR of 8.9%. The region has a growing interest in sustainable living and fashion, as well as a significant number of tourists who often prefer renting clothing for special events or vacations, rather than purchasing new items. The aging population in Kyushu & Okinawa also drives the need for convenient, affordable clothing options, as older adults seek to reduce the frequency of purchasing new items while still maintaining a stylish wardrobe.

Okinawa's tourism-driven economy is another factor, as visitors often rent clothing for formal events or sightseeing. The region’s residents, along with an increasing awareness of the environmental impact of fast fashion, are fueling the adoption of online rental services. With high demand for variety and eco-conscious options, Kyushu & Okinawa's rental market is expanding rapidly, supported by both local residents and visitors alike.

Kanto, with a CAGR of 8.2%, shows strong demand for online clothing rental. As Japan's most populous and economically vibrant region, Kanto, particularly Tokyo, is a hub for fashion-conscious consumers who are eager to access trendy, high-quality clothing for various occasions. The region’s busy lifestyle, combined with a focus on sustainability, makes online clothing rental a popular choice among urban residents who need variety without the burden of ownership.

Kanto's high disposable income and familiarity with online shopping also contribute to the region’s rapid adoption of clothing rental services. Additionally, Tokyo's position as a global fashion center means that trends spread quickly, and rental services are increasingly seen as a convenient, stylish, and eco-friendly option for both everyday wear and special events. The region's growing awareness of sustainable fashion practices continues to drive demand for online rental services.

Kinki, with a CAGR of 7.2%, shows steady demand for online clothing rental. Kinki, which includes Osaka and Kyoto, is a major cultural and economic center in Japan, with a diverse population that values both fashion and sustainability. The demand for online clothing rental in this region is driven by the growing middle class, which seeks affordable and convenient options for both everyday clothing and special occasions.

The presence of numerous fashion-forward residents, especially in urban areas like Osaka, supports the market for trendy clothing rental services. As Kinki continues to invest in e-commerce and digital retail platforms, access to online clothing rental services is improving. The steady increase in awareness of eco-friendly fashion practices and the growing availability of rental options further supports the continued demand in Kinki.

Chubu, with a CAGR of 6.3%, demonstrates moderate growth in the online clothing rental market. Chubu, which includes Nagoya and surrounding areas, has a strong manufacturing and industrial base, with a growing interest in lifestyle and fashion among its urban population. The region’s demand for online clothing rental is influenced by increasing awareness of sustainability, coupled with the busy, professional lifestyles of its residents who seek convenience and variety in their wardrobes.

Although the market is growing more slowly compared to regions like Kyushu & Okinawa and Kanto, Chubu’s increasing adoption of e-commerce and fashion rental services points to a steady rise in demand. As consumers become more accustomed to online shopping and sustainable fashion options, demand for clothing rental services in Chubu will continue to grow.

Tohoku, with a CAGR of 5.6%, and the Rest of Japan, with a CAGR of 5.3%, show slower growth in demand for online clothing rental compared to other regions. These areas are more rural and less industrialized, which affects the rapid adoption of fashion trends and the widespread use of online rental services. While there is some demand for clothing rental in these regions, it is driven more by consumers looking for occasional formal wear or those interested in sustainable fashion.

The slower adoption of e-commerce and less exposure to the fast-paced fashion trends seen in urban centers contribute to more gradual growth. However, as awareness of sustainability and convenience continues to rise, these regions are expected to see steady growth in demand for online clothing rental services in the coming years, though at a slower pace compared to more urbanized areas.

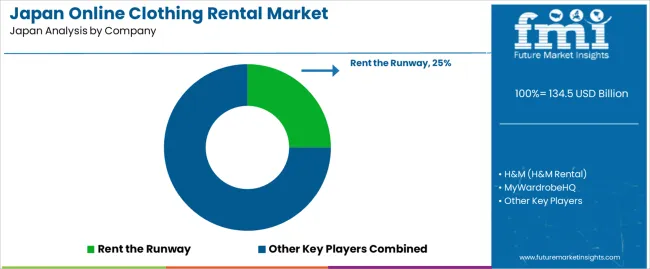

The online clothing rental industry in Japan is growing as consumers increasingly seek sustainable and cost-effective fashion options. Companies like Rent the Runway (holding approximately 25% market share), H&M (H&M Rental), MyWardrobeHQ, Le Tote, and GlamCorner are key players in this market. The rising trend toward sustainability, alongside the desire for variety without long-term commitment, is driving the demand for rental clothing in Japan. Consumers are turning to rental services for access to high-quality fashion at a fraction of the cost, especially for special events, seasonal wear, or luxury items.

Competition in the online clothing rental industry is focused on convenience, affordability, and product variety. Companies differentiate themselves by offering a wide range of clothing styles, from everyday wear to high-end designer pieces, catering to diverse tastes and occasions. Subscription-based models, free shipping, and easy returns are some of the competitive advantages companies use to attract customers. Additionally, firms are focusing on offering a seamless online experience, with intuitive websites and mobile apps that make browsing and selecting clothing easy.

There is also a growing emphasis on eco-friendly practices, such as the use of sustainable fabrics and promoting circular fashion. Marketing materials often highlight convenience, cost savings, environmental impact, and access to exclusive or designer brands. By aligning their offerings with the increasing demand for flexible, sustainable, and fashionable clothing, these companies aim to strengthen their position in the Japanese online clothing rental industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Product Type | Ethnic Wear, Knitwear, Trousers & Jeans, Jumpsuits, Coats & Jackets, Performance Wear |

| End User | Business-to-Consumer (B2C), Business-to-Business (B2B) |

| Key Companies Profiled | Rent the Runway, H&M (H&M Rental), MyWardrobeHQ, Le Tote, GlamCorner |

| Additional Attributes | The market analysis includes dollar sales by product type and end-user categories. It also covers regional demand trends in Japan, particularly driven by the growing popularity of online clothing rental services. The competitive landscape highlights key players in the online rental clothing market, focusing on their service offerings and business models. Trends in the increasing demand for sustainable fashion, convenience, and variety in clothing options are explored, along with advancements in rental platforms, logistics, and customer service. |

The global demand for online clothing rental in japan is estimated to be valued at USD 134.5 billion in 2025.

The market size for the demand for online clothing rental in japan is projected to reach USD 267.7 billion by 2035.

The demand for online clothing rental in japan is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in demand for online clothing rental in japan are ethnic wear, knitwear, trousers & jeans, jumpsuits, coats & jackets and performance wear.

In terms of end user, business-to-business (b2b) segment to command 89.4% share in the demand for online clothing rental in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA