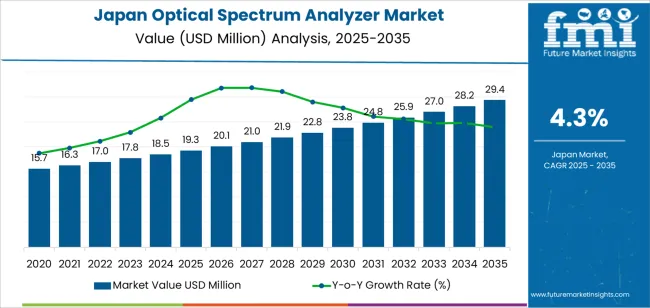

The demand for optical spectrum analyzers in Japan is expected to increase steadily from USD 19.3 million in 2025 to USD 29.4 million by 2035. This represents a consistent growth trajectory, driven by advancements in telecommunications, research, and high-speed data transmission infrastructure. As industries, particularly telecommunications and scientific research, continue to expand their use of optical technologies, the need for precise testing tools will grow. Optical spectrum analyzers are crucial for monitoring and analyzing optical signals, playing a key role in ensuring the quality and efficiency of high-speed data networks, which are vital in today’s digital landscape.

The rise of technologies such as 5G, fiber-optic networks, and increased internet speeds will significantly contribute to the growing demand for these devices. As the adoption of high-speed communication systems accelerates, industries will increasingly rely on optical spectrum analyzers for efficient signal analysis, troubleshooting, and system optimization. These devices enable accurate measurement of wavelength, power, and frequency, ensuring that optical networks operate at peak performance. The continuous advancement in data transmission technologies will drive the steady increase in demand for optical spectrum analyzers throughout the forecast period, with growth anticipated to be moderate initially, followed by sharper increases as optical communication systems mature and become more integral to various industries in Japan.

Between 2025 and 2030, the demand for optical spectrum analyzers in Japan is expected to grow from USD 19.3 million to approximately USD 25.9 million, adding USD 6.6 million. This phase will see gradual growth, driven by the ongoing development and deployment of 5G networks and advancements in optical communication systems. The integration of fiber optics into telecommunications and data infrastructure will increase the demand for these devices. However, during this phase, the market will still be maturing, and demand will be moderate as industries become more familiar with these advanced technologies. As businesses adopt optical solutions for high-speed data transmission, the growth rate will remain steady but not yet fully explosive.

From 2030 to 2035, the demand will accelerate significantly, rising from USD 25.9 million to USD 29.4 million, adding USD 3.5 million. This surge in demand reflects the widespread adoption of 5G networks, enhanced fiber-optic communication systems, and advancements in quantum computing and data transmission technologies. By 2035, the demand for optical spectrum analyzers will reach its peak, driven by the full-scale integration of optical technologies into various industries. This growth phase will reflect a matured market, with the widespread adoption of these devices in key industries like telecommunications, healthcare, and research, driven by the increasing reliance on high-performance testing tools.

| Metric | Value |

|---|---|

| Demand for Optical Spectrum Analyzer in Japan Value (2025) | USD 19.3 million |

| Demand for Optical Spectrum Analyzer in Japan Forecast Value (2035) | USD 29.4 million |

| Demand for Optical Spectrum Analyzer in Japan Forecast CAGR (2025 to 2035) | 4.3% |

The demand for optical spectrum analyzers (OSAs) in Japan is growing as the country continues to lead in sectors like telecommunications, semiconductor manufacturing, and fiber-optic communications. OSAs play a critical role in measuring and analyzing the optical spectrum in high‑speed networks, particularly in testing and validating the performance of dense wavelength division multiplexing (DWDM) systems and fiber-optic components. As Japan continues to push the boundaries of 5G technology, autonomous vehicles, and cloud computing, the need for accurate and reliable optical testing tools is growing rapidly.

Robust manufacturing base, especially in semiconductor and optical component production, further supports the demand for OSAs. The country’s focus on expanding fiber-optic infrastructure and enhancing data transmission capabilities requires more advanced and precise optical spectrum analysis to ensure efficient signal transmission and minimize network disruptions. These instruments also find increasing applications in the research and development of new optical communication technologies, such as coherent optics, which are pivotal to next-generation high-speed data transmission systems.

Advancements in optical spectrum analyzer technology such as higher resolution, faster data processing, and improved integration with digital platforms are also driving adoption. The growing focus on expanding 5G networks, coupled with the rise of data centers and cloud-based services, requires efficient optical monitoring systems to handle the growing volume of data traffic. As these trends continue, the demand for optical spectrum analyzers in Japan is expected to experience steady growth through 2035.

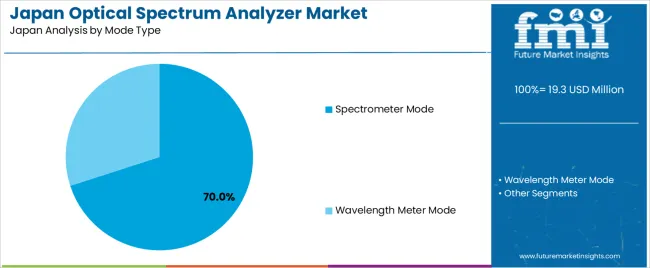

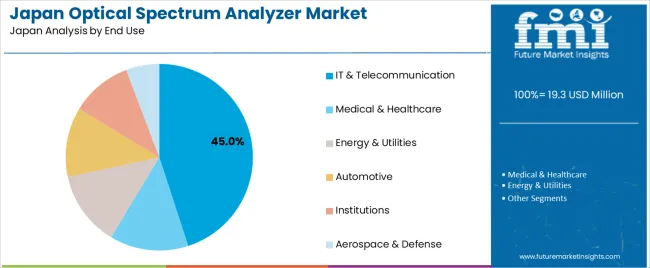

Demand for optical spectrum analyzers in Japan is segmented by product type, mode type, and end use. By product type, demand is divided into benchtop, portable, and handheld, with benchtop holding the largest share. The demand is also segmented by mode type, including spectrometer mode and wavelength meter mode. In terms of end use, demand is divided into IT & telecommunication, medical & healthcare, energy & utilities, automotive, institutions, and aerospace & defense. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

Benchtop optical spectrum analyzers account for 55% of the demand for optical spectrum analyzers in Japan. These units are favored in laboratories, research facilities, and production environments due to their precision and ability to handle complex measurements. Benchtop models offer more advanced features than portable or handheld units, making them ideal for settings where high performance is required, and space or mobility constraints are less of a concern. They provide higher resolution, broader bandwidth, and more detailed analysis, making them suitable for applications such as R&D, telecommunications, and optical testing.

The versatility and higher performance of benchtop models make them the preferred choice for industries that require in-depth analysis and highly accurate results. As the need for precise optical measurements continues to grow across sectors, particularly in telecommunications and research, the demand for benchtop optical spectrum analyzers will continue to dominate, particularly in specialized environments where accuracy and reliability are critical for success.

Spectrometer mode accounts for 70% of the demand for optical spectrum analyzers in Japan. This mode is preferred for its high-resolution capability, allowing for precise measurement of optical signals and light spectra. Spectrometer mode is crucial in various high-tech applications such as telecommunications, medical diagnostics, and scientific research, where detailed and accurate analysis is required. It enables the measurement of critical parameters like optical power, wavelength, and signal distortion, which are essential for maintaining the integrity of optical communication systems.

The versatility and high accuracy of spectrometer mode make it indispensable for industries where precision is key, particularly as optical technologies advance. The increasing demand for high-performance optical communication, as well as advancements in technologies such as 5G and fiber-optic networks, further drives the reliance on spectrometer mode. As these industries continue to evolve, spectrometer mode will remain the preferred option for optical spectrum analyzers, ensuring continued strong demand across Japan’s high-tech sectors.

IT & telecommunication account for 45% of the demand for optical spectrum analyzers in Japan. These analyzers are integral for network testing, maintenance, and optimization within the telecommunication sector, where they are used to assess the quality and integrity of optical signals. They help identify faults, ensure that networks are functioning optimally, and maintain the performance of high-speed data transmission systems. As the demand for reliable, high-performance communication networks increases, the need for precise and accurate optical measurement tools, such as spectrum analyzers, has grown.

The expanding fiber-optic networks and the implementation of 5G technology have significantly heightened the demand for these analyzers. These devices are crucial for evaluating the performance of optical signals in both legacy and emerging telecommunication technologies. With the continued evolution of the telecommunication sector and the increasing reliance on optical infrastructure, IT & telecommunication will remain the dominant end-use sector, driving sustained demand for optical spectrum analyzers in Japan.

Optical spectrum analyzers enable measurement of optical signals, wavelengths and spectral integrity critical in telecom, data‑centre, research and component‑manufacturing applications. Key drivers include the rollout and densification of 5G and fibre backhaul networks, higher throughput demands in data‑centres, growth of silicon photonics and optical device manufacturing in Japan, and strong domestic emphasis on precision measurement equipment. Restraints include high initial equipment cost, rapid obsolescence of measurement systems as optical standards evolve tight competition from international test‑equipment suppliers, and the requirement for specialised calibration and deep measurement expertise.

In Japan, demand for optical spectrum analyzers is growing because the country is a leading centre for photonics, optical‑device manufacturing and telecommunications infrastructure upgrades. As operators and industrial firms implement high‑speed fibre links, dense wavelength‑division multiplexing (DWDM) networks and optical modules with stringent performance requirements, measurement tools such as optical spectrum analyzers become essential. R&D in optical communications, in semiconductor‑photonic integration and in precision manufacturing further drives demand. The industry also benefits from Japan’s culture of high quality, precision instrumentation and the need for domestic suppliers and service support. Consequently, companies and research organisations invest in advanced analyzers to validate optical performance and maintain competitiveness.

Technological innovations are expanding the use of optical spectrum analyzers in Japan by improving measurement resolution, speed, form factor and integration with digital workflows. Modern analyzers support broader wavelength ranges (including SWIR), higher dynamic range, better resolution for coherent optics and deeper analytics (e.g., AI‑based anomaly detection). Portable and field‑deployable units enable on‑site testing in fibre installations, while benchtop systems support manufacturing and R&D. Innovations such as compact optical modules, faster sweep times, enhanced software and automation are making these instruments more usable and cost‑effective for Japanese firms. As photonics manufacturing and optical communications demand grows, these innovations make spectrum analyzers more attractive.

Despite growth, the adoption of optical spectrum analyzers in Japan faces several challenges. One major barrier is the high upfront cost of advanced analyzers, which may deter smaller firms or research labs. Rapid evolution of optical communications (e.g., new modulation formats, wider wavelengths) can render equipment obsolete more quickly, requiring frequent upgrades. Calibration, maintenance and the need for skilled personnel to interpret measurements further raise the total cost of ownership. Domestic industry competition from foreign suppliers or second‑hand equipment can restrict growth in the premium segment. Lastly, for some applications the ROI of specialized analyzers may not be clear, slowing investment decisions.

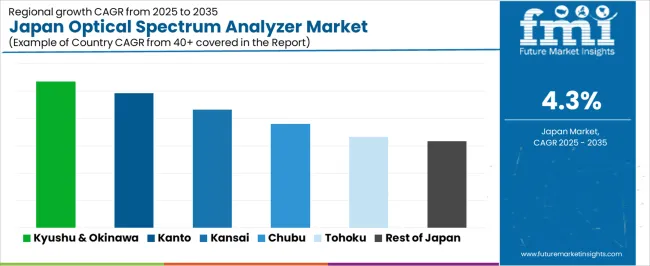

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.3% |

| Kanto | 4.9% |

| Kinki | 4.3% |

| Chubu | 3.8% |

| Tohoku | 3.3% |

| Rest of Japan | 3.2% |

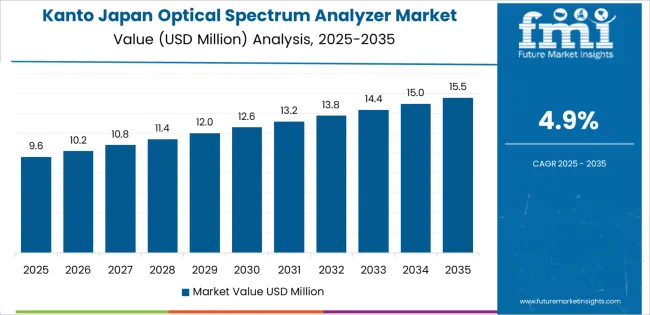

The demand for optical spectrum analyzers in Japan is growing steadily across all regions, with Kyushu & Okinawa leading at a 5.3% CAGR. This growth is driven by increasing applications in telecommunications, R&D, and the rising demand for high-precision measurement tools. Kanto follows with a 4.9% CAGR, influenced by the strong presence of tech and telecommunications industries in cities like Tokyo and Yokohama. Kinki shows a 4.3% CAGR, supported by its advanced manufacturing and tech sector. Chubu experiences a 3.8% CAGR, with growing demand for optical measurement in industrial applications. Tohoku and the Rest of Japan show more moderate growth at 3.3% and 3.2%, respectively, driven by expanding adoption in telecommunications and research applications.

Kyushu & Okinawa is seeing the highest demand for optical spectrum analyzers in Japan, with a 5.3% CAGR. This growth is primarily driven by the increasing need for high-performance optical measurement tools in the telecommunications and research sectors. Kyushu, with cities like Fukuoka, is becoming a hub for innovation in optical communications and technology development, contributing to the rising demand for optical spectrum analyzers.

Okinawa is also playing a role in driving demand due to its expanding focus on R&D and the growth of tech-driven industries. The region’s increasing investment in advanced telecommunications infrastructure and the growing number of research initiatives focusing on optical networks is further accelerating the need for optical spectrum analyzers. As businesses in Kyushu & Okinawa continue to invest in cutting-edge technologies for optical testing, the demand for these devices is expected to remain strong in the coming years.

Kanto is experiencing strong growth in demand for optical spectrum analyzers, with a 4.9% CAGR. The region, particularly Tokyo and Yokohama, is home to some of Japan’s largest telecommunications and technology companies, which are driving the adoption of optical spectrum analyzers. These devices are essential for monitoring and optimizing the performance of high-speed optical networks, making them crucial for the region's growing telecommunications and IT sectors.

The increasing focus on 5G network deployment, optical fiber communications, and high-performance testing equipment is further accelerating demand. As the Kanto region continues to lead in technological advancements and the digital economy, the need for precise and reliable measurement tools like optical spectrum analyzers will continue to rise. The region’s strong infrastructure, coupled with its ongoing focus on technological innovation, ensures that the demand for optical spectrum analyzers will remain high.

Kinki is seeing steady growth in demand for optical spectrum analyzers, with a 4.3% CAGR. The region, which includes major cities like Osaka and Kyoto, is a center for high-tech industries and manufacturing, contributing to the rising demand for precision measurement tools. Optical spectrum analyzers are critical for applications in telecommunications, research and development, and the manufacturing of optical devices, all of which are key sectors in Kinki.

The region’s strong industrial base, particularly in electronics and optical technology, is fueling the adoption of these devices. As Kinki continues to invest in advancing its telecommunications infrastructure and high-tech manufacturing capabilities, the demand for optical spectrum analyzers will continue to grow. The region’s focus on technological innovation and industrial applications is driving the need for reliable and precise optical measurement solutions.

Chubu is experiencing moderate growth in demand for optical spectrum analyzers, with a 3.8% CAGR. The region’s expanding industrial sector, particularly in cities like Nagoya, is driving demand for these devices. Chubu is home to a strong automotive and electronics manufacturing base, and as industries adopt more advanced optical measurement techniques, the need for optical spectrum analyzers is rising.

The growing demand for optical testing tools in manufacturing processes, telecommunications, and R&D is contributing to steady growth in Chubu. As the region continues to embrace cutting-edge technologies, such as advanced optical fiber networks and high-speed communication systems, the demand for precise measurement solutions will continue to increase. The region’s industrial focus and growing adoption of optical technologies will support the ongoing demand for optical spectrum analyzers.

Tohoku is seeing moderate growth in demand for optical spectrum analyzers, with a 3.3% CAGR. The region’s growing telecommunications and research sectors are the primary drivers behind this trend. As Tohoku continues to develop its infrastructure and increase its focus on high-tech industries, there is a growing need for precise optical testing equipment to support these advancements.

The region’s focus on improving its telecommunications networks and expanding R&D in optical technologies is driving demand for optical spectrum analyzers. As more companies and research institutions in Tohoku adopt advanced optical testing methods, the need for reliable and accurate spectrum analyzers will continue to rise. With growing interest in improving connectivity and technology infrastructure, Tohoku is expected to see steady growth in the adoption of these devices.

The Rest of Japan is experiencing steady but moderate growth in demand for optical spectrum analyzers, with a 3.2% CAGR. While demand in rural and less industrialized regions is slower compared to urban centers, there is still a growing interest in optical technologies for telecommunications and research applications. As businesses and institutions in these areas invest in modernizing their telecommunications networks and R&D efforts, the need for optical spectrum analyzers is increasing.

The Rest of Japan’s expanding tech infrastructure, combined with a growing focus on precision testing and quality assurance in optical systems, is supporting the demand for these devices. The continued push for high-speed internet, 5G network development, and improved telecommunications systems in rural areas is expected to drive the demand for optical spectrum analyzers in the coming years, even if at a slower pace than in more urbanized regions.

Demand for optical spectrum analyzers in Japan is gaining strong traction, driven by the nation’s advanced telecommunications infrastructure and leadership in photonics and precision optics. With the rollout of ultra‑high‑speed fibre networks, increasing deployment of coherent optical links, and the push for metro and data‑centre upgrades, Japanese users are investing in instruments capable of fine spectral resolution and reliable performance in rigorous applications. Japan’s emphasis on measurement accuracy and equipment reliability further underscores demand for high‑performance analyzers designed for optical communication, manufacturing, and research environments.

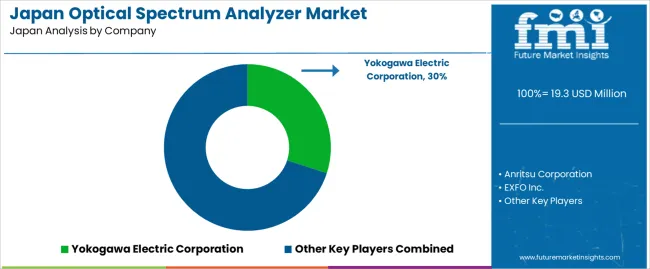

Within the Japanese industry, Yokogawa Electric Corporation captures an estimated 30.0% share, reflecting its strong reputation, well‑established distribution and service footprint in high‑precision optical test equipment. Other significant suppliers include Anritsu Corporation, EXFO Inc., Keysight Technologies, and VIAVI Solutions Inc., each offering instruments tailored to Japanese fibre‑optic networks, photonics manufacturing, or lab‑based optical R&D applications.

Key growth drivers in Japan include the deployment of 400 G/800 G coherent optical systems, expansion of silicon‑photonics production, and rigorous quality‑control requirements in optical network manufacturing and installation. Japan’s research institutions and industrial users demand analyzers with extremely fine wavelength and power sensitivity, spurring uptake of advanced platforms. While high equipment costs and the need for specialised calibration support remain challenges, the outlook for optical spectrum analyzers in Japan is positive, benefiting from continuous infrastructure investment, increasing telecom demands, and Japan’s emphasis on precision measurement.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Product Type | Benchtop, Portable, Handheld |

| Mode Type | Spectrometer Mode, Wavelength Meter Mode |

| End Use | IT & Telecommunication, Medical & Healthcare, Energy & Utilities, Automotive, Institutions, Aerospace & Defense |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Players Profiled | Yokogawa Electric Corporation, Anritsu Corporation, EXFO Inc., Keysight Technologies, VIAVI Solutions Inc. |

| Additional Attributes | Dollar sales by product type, mode type, end use, and regional trends focused on telecom, healthcare, and industrial applications |

The global demand for optical spectrum analyzer in japan is estimated to be valued at USD 19.3 million in 2025.

The market size for the demand for optical spectrum analyzer in japan is projected to reach USD 29.4 million by 2035.

The demand for optical spectrum analyzer in japan is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in demand for optical spectrum analyzer in japan are benchtop, portable and handheld.

In terms of mode type, spectrometer mode segment to command 70.0% share in the demand for optical spectrum analyzer in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA