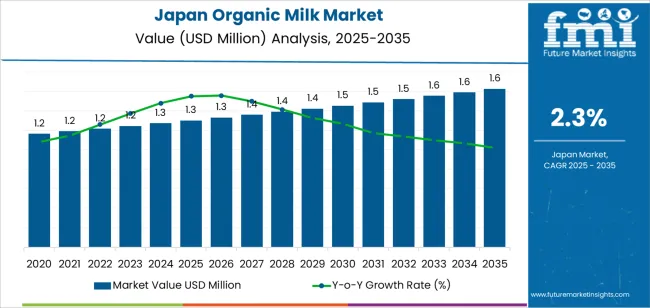

The demand for organic milk in Japan is expected to grow from USD 1.3 million in 2025 to USD 1.7 million by 2035, reflecting a CAGR of 2.3%. Organic milk is increasingly popular among consumers due to its perceived health benefits, including lower pesticide residues and a higher nutritional value than conventional milk. The demand for organic products, including milk, is driven by the growing trend of health-conscious eating and a rising awareness of sustainability and animal welfare. As consumers continue to prioritize natural, clean-label products, organic milk is becoming a preferred choice in Japan’s evolving dairy market.

The market for organic milk in Japan faces challenges such as high production costs, limited availability, and price sensitivity among consumers. Despite these challenges, the continued interest in plant-based diets, combined with the rising demand for eco-friendly products, will likely support steady growth in organic milk consumption. Furthermore, the increasing presence of organic dairy brands in retail outlets and supermarkets, along with expanding online sales, will continue to make organic milk more accessible to a broader consumer base, especially among younger and health-conscious populations.

The saturation point analysis for organic milk in Japan reveals that the market will reach a mature phase during the forecast period, where growth begins to slow down as consumer adoption stabilizes.

From 2025 to 2030, the demand will grow from USD 1.3 million to USD 1.5 million, contributing USD 0.2 million in value. The market will experience moderate acceleration during this phase, driven by the increasing awareness of organic milk benefits, the expansion of organic dairy offerings, and the growing preference for sustainable and natural products. This period will see steady growth as health-conscious consumers continue to adopt organic milk, but the growth rate will not be as sharp as earlier years, as the market approaches maturity. This indicates that the market is reaching a saturation point where the majority of the target population has integrated organic milk into their diet to some extent.

From 2030 to 2035, the market will grow from USD 1.5 million to USD 1.7 million, adding USD 0.2 million in value. The growth rate will decelerate further, as the market enters a more mature stage, where the increase in demand is primarily driven by replacement cycles rather than new adoption. During this period, organic milk will be a mainstream product in the dairy sector, with minimal new customer acquisition. The market will continue to expand, but at a slower, more incremental pace, as the market becomes increasingly saturated. The focus during this stage will be on brand differentiation, premiumization, and meeting the evolving preferences of a stable, well-established customer base. The saturation point will be reached as market demand stabilizes, and further growth will be driven by product innovation and efforts to maintain customer loyalty rather than large-scale adoption.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 1.3 million |

| Industry Forecast Value (2035) | USD 1.7 million |

| Industry Forecast CAGR (2025-2035) | 2.3% |

Demand for organic milk in Japan is increasing as consumers become more health conscious and environmentally aware. The organic dairy market in Japan reached about USD 1.61 billion in 2024 and is forecast to grow at a compound annual growth rate (CAGR) around 5.8 % between 2025 and 2033. Factors such as preference for products free from synthetic additives, hormones or pesticides, and the growing visibility of organic certification are supporting this shift in consumer behaviour. While organic milk forms just a segment of the overall dairy market, its growth reflects changing dietary habits and the rising appeal of premium, perceived safer food options.

Another contributing factor is the adoption of sustainable farming practices and transparent supply chains. Japanese consumers show increasing interest in animal welfare, sustainable agriculture, and local sourcing, which positions organic milk favourably within retail and e commerce channels. Meanwhile, demographic pressures such as an ageing population and rising disposable income in urban regions further encourage demand for high quality dairy products. Challenges include higher prices compared with conventional milk, limited production scale, and competition from plant based milk alternatives. Nonetheless, given the health and environmental trends, the demand for organic milk in Japan is expected to continue growing steadily.

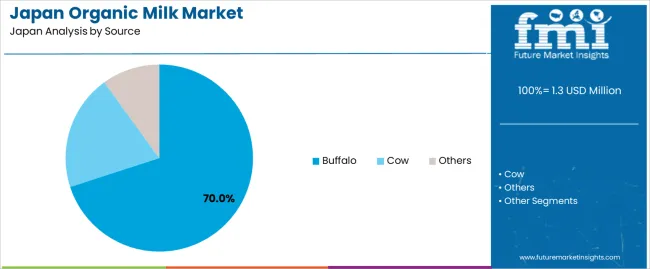

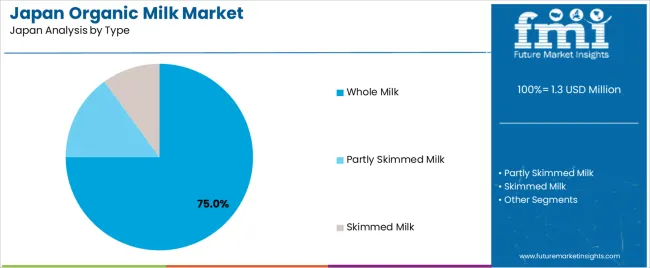

The demand for organic milk in Japan is primarily driven by source and type. The leading source is buffalo, capturing 70% of the market share, while the dominant type is whole milk, accounting for 75% of the demand. Organic milk is increasingly preferred by health-conscious consumers who seek dairy products free from synthetic chemicals and antibiotics. The growing trend towards healthier, natural food choices is fueling the demand for organic milk in Japan, with preferences varying by animal source and milk type.

Buffalo milk leads the market for organic milk in Japan, holding 70% of the demand. Buffalo milk is particularly valued for its rich, creamy texture and higher fat content compared to cow’s milk. This makes it especially popular for use in dairy products such as cheese, yogurt, and desserts. Organic buffalo milk is considered a premium product, often sought by consumers who prioritize both organic certification and the distinct qualities of buffalo milk.

The preference for buffalo milk in Japan is driven by its superior taste, texture, and nutritional profile. As organic products continue to be associated with higher quality and health benefits, buffalo milk's rich composition makes it the milk of choice for many Japanese consumers. Additionally, the increasing demand for specialty dairy products, like mozzarella and other cheeses traditionally made from buffalo milk, further boosts its popularity. The demand for organic buffalo milk is expected to continue growing as consumers in Japan become more discerning about the quality and origins of their dairy products.

Whole milk is the leading type of organic milk in Japan, accounting for 75% of the demand. Whole milk is preferred by consumers for its creamy texture, full flavor, and higher nutritional content, including fat-soluble vitamins and essential fatty acids. In Japan, where traditional dairy consumption habits favor rich and creamy products, whole milk remains the most popular choice for organic milk buyers.

The demand for whole organic milk is driven by its versatility in cooking, drinking, and use in other dairy products. Whole milk is commonly consumed as a beverage, in coffee or tea, and as an ingredient in a wide range of culinary applications, making it an essential item in many households. As consumers continue to value the health benefits of organic products, whole milk's role as a nutrient-dense and satisfying option ensures its dominant position in the organic milk market. With an increasing shift toward organic and health-conscious consumption, whole organic milk will likely maintain its leadership in the Japanese market.

What Are the Key Dynamics Influencing Demand for Organic Milk in Japan?

Demand for organic milk in Japan is growing amid heightened consumer interest in health and wellness foods and sustainably produced dairy. Urban households, in particular, are seeking products with cleaner label credentials and traceable origins. However, conventional dairy remains dominant and higher retail pricing for organic milk narrows the addressable consumer base. Together, evolving wellness preferences, sustainability awareness and cost constraints shape the market dynamics for organic milk in Japan.

Several factors support growth of organic milk in Japan. First, rising health consciousness among Japanese consumers leads to increased preference for dairy products free from antibiotics, synthetic hormones and chemical additives. Second, sustainability concerns and animal welfare considerations encourage selection of organic milk produced using eco friendly and pasture based systems. Third, convenience retail, online grocery and D2C models improve availability of premium organic dairy across urban regions. Fourth, premiumisation trends in food and beverage encourage manufacturers to launch “organic” versions of familiar dairy staples, thereby broadening consumer exposure and adoption.

What Are the Key Restraints Affecting Organic Milk Demand in Japan?

Despite positive momentum, several constraints limit expansion. Organic milk production in Japan is relatively small scale and feeds higher cost structures—reflected in premium retail pricing that restricts adoption among cost sensitive shoppers. Regulatory requirements and certification standards for organic dairy increase production burden for farmers and may limit supply scalability. Consumer habit in Japan still favours standard dairy milk, and substitution is gradual. Additionally, competition from plant based dairy alternatives and price promotions on conventional milk pose further barriers.

What Are the Key Trends Shaping Organic Milk Demand in Japan?

Important trends shaping the market include growth in functional, value added variations of organic milk such as milk enriched with probiotics, A2 protein or tailored for children and seniors which extend application beyond basic nutrition. Another trend is direct to consumer sourcing and transparency in origin, where premium organic milk is marketed via subscription or farm link models that appeal to trust seeking consumers. There is also an increasing focus on packaging innovations (aseptic cartons, small format premium bottles) and branding aligned with natural, local farm narratives. Finally, retail expansion of organic dairy into convenience stores and online channels enhances accessibility and encourages trial.

The demand for organic milk in Japan is driven by increasing consumer awareness of health, wellness, and sustainability. Organic milk, produced without the use of synthetic hormones, antibiotics, or pesticides, is seen as a healthier, more environmentally friendly alternative to conventional milk. As Japanese consumers become more health-conscious and seek natural, clean-label products, the demand for organic milk continues to grow. Additionally, the rise in concerns about food safety, environmental impact, and animal welfare has contributed to the increasing popularity of organic milk among both urban and rural populations.

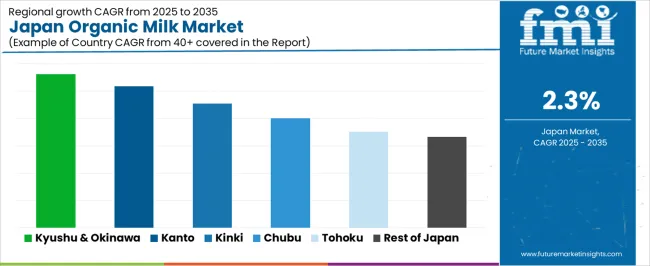

The demand for organic milk is also influenced by Japan’s strong regulatory framework around food quality, the growth of organic farming, and a rise in the number of supermarkets, health food stores, and online retailers offering organic products. Regional variations in demand reflect factors such as population density, income levels, and local availability of organic products. Below is an analysis of the demand for organic milk across different regions in Japan.

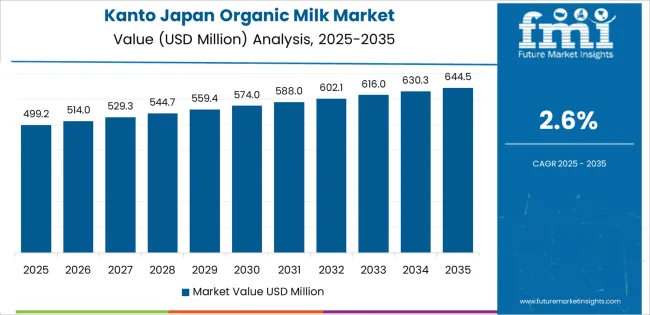

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 2.8% |

| Kanto | 2.6% |

| Kinki | 2.3% |

| Chubu | 2% |

| Tohoku | 1.8% |

| Rest of Japan | 1.7% |

Kyushu & Okinawa leads the demand for organic milk in Japan with a CAGR of 2.8%. The region’s increasing focus on health-conscious eating and sustainable agricultural practices has driven the adoption of organic products, including organic milk. Okinawa, in particular, is renowned for its long life expectancy and healthy diet, which emphasizes fresh, natural, and organic ingredients. This cultural emphasis on health and wellness supports the growing demand for organic milk.

Furthermore, Kyushu & Okinawa’s local agriculture and the growing presence of organic farming have led to greater availability of organic milk and related products in the region. The consumer base in this area is becoming more aware of the benefits of organic food, including the absence of chemicals, hormones, and antibiotics, which further fuels the demand for organic milk.

Kanto shows strong demand for organic milk with a CAGR of 2.6%. Kanto, particularly Tokyo, is Japan’s most populous and urbanized region, with a high concentration of health-conscious consumers and a large market for organic food products. The rising popularity of organic milk in Kanto can be attributed to the region’s focus on health, environmental sustainability, and product transparency.

As more consumers in Kanto embrace clean-label products and adopt healthier eating habits, the demand for organic milk continues to grow. The region’s strong retail infrastructure, with numerous supermarkets and specialty health food stores offering organic products, ensures that organic milk is widely available. As consumer awareness around the health benefits of organic milk increases, demand is expected to continue growing in Kanto.

Kinki, with a CAGR of 2.3%, shows steady demand for organic milk. The region, which includes Osaka, Kyoto, and Kobe, has a strong food culture, with a significant portion of the population focused on quality ingredients and nutrition. Kinki’s demand for organic milk is driven by the increasing consumer preference for health-conscious and environmentally friendly food products.

The steady demand in Kinki is also supported by the growing number of health food stores, supermarkets, and online retailers offering organic milk options. As more consumers in Kinki adopt organic diets and seek sustainable food choices, the demand for organic milk is expected to remain consistent, though at a slower growth rate compared to Kyushu & Okinawa and Kanto.

Chubu demonstrates moderate growth in the demand for organic milk with a CAGR of 2.0%. The region, which includes Nagoya and surrounding areas, has a significant manufacturing base, but also a growing consumer interest in healthy and sustainable food options. While the growth rate is slower than in more urbanized regions, the increasing awareness of the health benefits of organic milk is gradually driving demand.

The demand for organic milk in Chubu is also supported by the growing availability of organic products in supermarkets and retail outlets. As more consumers in the region turn toward organic and natural food products, the market for organic milk continues to expand, albeit at a more moderate pace compared to other regions.

Tohoku, with a CAGR of 1.8%, and the Rest of Japan, with a CAGR of 1.7%, show slower growth in the demand for organic milk. These regions have fewer urban centers and a lower concentration of consumers who actively seek organic food products. While the awareness of organic milk’s health benefits is gradually increasing, the adoption rate is slower compared to regions like Kyushu & Okinawa and Kanto.

The slower growth in Tohoku and the Rest of Japan is likely due to a combination of fewer health-focused consumers, limited availability of organic products, and a preference for traditional food options. However, as the demand for organic milk continues to rise across Japan and more retail outlets and health food stores offer organic products, the market in these regions is expected to experience gradual growth.

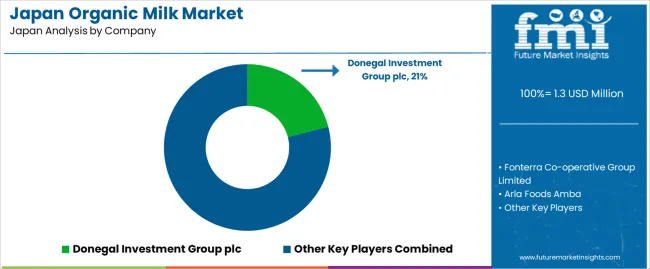

The demand for organic milk in Japan is increasing as consumers become more health-conscious and environmentally aware, driving the need for dairy products that are free from synthetic pesticides, hormones, and antibiotics. Companies like Donegal Investment Group plc (holding approximately 21% market share), Fonterra Co-operative Group Limited, Arla Foods Amba, Govind Milk and Milk Products, and Organic Valley are key players in this market. The growth in demand for organic milk is also influenced by Japan’s strong emphasis on sustainable farming practices and a preference for clean-label products.

Competition in the organic milk industry is largely driven by product quality, sourcing transparency, and sustainability. Companies are focusing on offering high-quality organic milk that meets stringent certification standards, ensuring that their products are genuinely organic and free from harmful additives. Another area of competition is distribution, with companies striving to reach a broader consumer base through supermarkets, health food stores, and online platforms. There is also an increasing emphasis on packaging innovation, with many companies seeking eco-friendly and convenient packaging solutions that appeal to environmentally-conscious consumers. Marketing materials typically highlight the purity, health benefits, and environmental advantages of organic milk, as well as the company’s commitment to sustainable farming practices. By aligning their offerings with the growing demand for high-quality, sustainable, and environmentally friendly products, these companies aim to strengthen their position in Japan’s organic milk market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Source | Buffalo, Cow, Others |

| Type | Whole Milk, Partly Skimmed Milk, Skimmed Milk |

| Pasteurization | Vat Pasteurization, Ultra-Pasteurization, High-Temperature Short Time (HTST) Method |

| Flavor | Flavored (Chocolate, Strawberry, Vanilla, Others), Non-Flavored |

| Packaging | Bottle, Tetra Packs, Pouches, Cans, Bulk Packs |

| Distribution Channel | Modern Trade, Retailer, Specialty Store, HORECA, Convenience Store |

| Key Companies Profiled | Donegal Investment Group plc, Fonterra Co-operative Group Limited, Arla Foods Amba, Govind Milk and Milk Products, Organic Valley |

| Additional Attributes | The market analysis includes dollar sales by source, type, pasteurization, flavor, packaging, and distribution channel categories. It also covers regional demand trends in Japan, driven by the increasing consumer preference for organic dairy products. The competitive landscape highlights major players focusing on innovations in organic milk production and packaging. Trends in the growing adoption of organic milk, particularly in modern trade, HORECA, and convenience stores, are explored, along with advancements in packaging types and distribution strategies. |

The demand for organic milk in Japan is estimated to be valued at USD 1.3 million in 2025.

The market size for the organic milk in Japan is projected to reach USD 1.6 million by 2035.

The demand for organic milk in Japan is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in organic milk in Japan are buffalo, cow and others.

In terms of type, whole milk segment is expected to command 75.0% share in the organic milk in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA