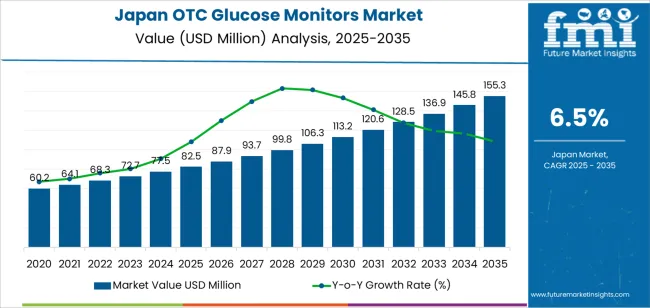

The demand for OTC (over-the-counter) glucose monitors in Japan is projected to grow from USD 82.5 million in 2025 to USD 155.3 million by 2035, reflecting a CAGR of 6.5%. OTC glucose monitors are increasingly being used by individuals to self-manage blood sugar levels, particularly in the context of rising diabetes and pre-diabetes cases. The market for OTC glucose monitors is driven by growing consumer awareness of diabetes, increasing health consciousness, and the need for self-monitoring of chronic conditions. With Japan's aging population and rising rates of metabolic diseases, demand for easy-to-use, cost-effective monitoring solutions will continue to expand.

The growth is also supported by advancements in glucose monitoring technology, such as the development of smaller, more accurate, and wireless devices that integrate with smartphones and provide real-time data. The increasing focus on preventive health and early disease detection is pushing the demand for OTC glucose monitors, which allow consumers to easily track their blood sugar levels at home, empowering patients to make informed decisions about their health.

The growth momentum analysis for OTC glucose monitors in Japan reveals an accelerating demand trend, with a steady upward trajectory expected throughout the forecast period.

Between 2025 and 2030, the market will grow from USD 82.5 million to USD 113.2 million, adding USD 30.7 million in value. This early phase of growth will be characterized by a moderate acceleration, driven by increasing consumer demand for health and wellness devices. The rise in self-care and preventive healthcare, particularly among the aging population, will boost the demand for user-friendly glucose monitoring systems. Furthermore, technological advancements in non-invasive glucose monitoring and smart device integration will make glucose monitors more accessible and appealing to a broader demographic.

From 2030 to 2035, the market will expand from USD 113.2 million to USD 155.3 million, adding USD 42.1 million in value. This phase will witness a stronger growth momentum, driven by the increasing integration of glucose monitoring systems with health management apps and fitness tracking technologies. As health-conscious consumers seek more personalized health solutions, and with improvements in accuracy and ease of use, the demand for OTC glucose monitors will continue to rise. The second phase of growth will benefit from continued technological improvements, increased public awareness of diabetes prevention, and greater acceptance of self-monitoring as a regular health practice. The market’s momentum will be sustained by consumer trends toward digital health and the rising prevalence of diabetes in Japan.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 82.5 million |

| Forecast Value (2035) | USD 155.3 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

Demand for over the counter (OTC) glucose monitors in Japan is increasing as diabetes prevalence, prediabetes and metabolic health awareness grow. With a significant adult population at risk for type 2 diabetes, more individuals are seeking easy to use self monitoring tools to manage blood glucose levels without relying solely on clinical visits. Home use glucometers and continuous glucose monitors (CGMs) are gaining traction as part of personal health management and lifestyle monitoring. The Japanese market for glucose monitoring devices was valued at around USD 909 million in 2024 and is expected to grow at a CAGR of approximately 7% through 2030.

Another factor boosting demand is the shift toward digital health platforms, remote monitoring and wellness oriented device adoption. Devices that integrate with smartphones, track trends and provide alerts appeal to Japanese consumers prioritising precision and convenience. In addition, retail pharmacy and e commerce channels support wider availability of non prescription monitoring tools. However, growth is moderated by factors such as reimbursement constraints, device accuracy concerns and market saturation in certain segments. Despite these challenges, the demand for OTC glucose monitors in Japan is expected to continue growing steadily as consumer interest in self health management and technology enabled monitoring increases.

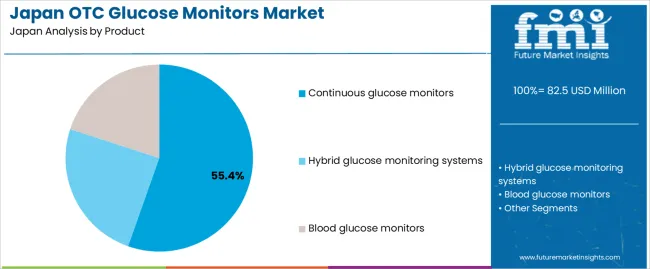

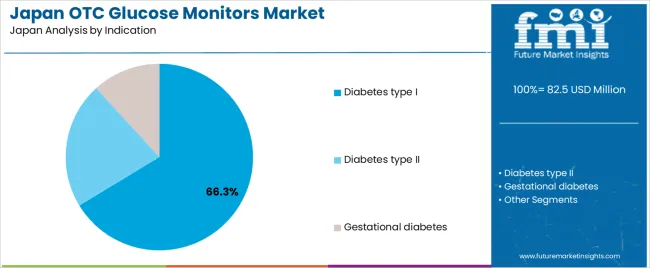

The demand for over-the-counter (OTC) glucose monitors in Japan is driven by product type and indication. The leading product type is continuous glucose monitors, holding 55% of the market share, while diabetes type I is the dominant indication, accounting for 66.3% of the demand. OTC glucose monitors are essential for managing blood glucose levels, particularly for individuals with diabetes, and they play a vital role in diabetes management by offering real-time data and improving the quality of life for users. The growing awareness of diabetes management and advancements in glucose monitoring technology continue to drive the demand for OTC glucose monitors in Japan.

Continuous glucose monitors (CGMs) lead the OTC glucose monitor market in Japan, capturing 55% of the demand. CGMs are advanced devices that offer continuous, real-time monitoring of blood glucose levels throughout the day and night. Unlike traditional blood glucose meters, CGMs use a sensor placed under the skin to measure glucose levels continuously, providing users with more accurate and timely data. This makes CGMs particularly valuable for individuals with diabetes type I, who need constant monitoring to manage their insulin levels and avoid dangerous fluctuations in blood sugar.

The growing demand for CGMs is driven by their ability to help users avoid hyperglycemia and hypoglycemia by providing real-time alerts and insights into their glucose trends. The convenience, precision, and ease of use associated with CGMs have made them increasingly popular among individuals seeking more comprehensive and efficient diabetes management solutions. As the healthcare industry in Japan continues to emphasize personalized care and innovative medical technologies, the demand for CGMs is expected to remain strong, reinforcing their dominance in the OTC glucose monitor market.

Diabetes type I is the largest indication for OTC glucose monitors in Japan, accounting for 66.3% of the market share. Diabetes type I is a chronic condition where the pancreas produces little or no insulin, requiring individuals to carefully monitor their blood glucose levels throughout the day. For people with diabetes type I, accurate and continuous glucose monitoring is essential to managing insulin therapy and maintaining stable blood sugar levels.

The prevalence of diabetes type I in Japan has driven the demand for more advanced glucose monitoring technologies, such as CGMs, which offer better insights into blood glucose levels and improve the ability to manage the disease. As the healthcare sector continues to focus on innovations in diabetes care and the increasing demand for real-time health data, the need for OTC glucose monitors-particularly for individuals with diabetes type I-will continue to grow. This ensures that diabetes type I remains the leading indication for OTC glucose monitors in Japan.

The demand for over the counter glucose monitors in Japan is growing as individuals increasingly engage in self monitoring of glycaemic status for diabetes management, metabolic health and preventive uses. Enhanced awareness of diabetes, pre diabetes and lifestyle driven glucose tracking underpins uptake of accessible monitoring devices. However, barriers such as reimbursement limitations, cost of advanced monitors and regulatory classifications affect adoption pace. At the same time, trends like integration of glucose monitors with mobile health apps, adoption of continuous glucose monitoring and direct to consumer retail channels are shaping the market.

Several factors support expansion in Japan. First, the high prevalence of diabetes and metabolic syndromes makes glucose monitoring a priority in both clinical and home settings. Second, consumer wellness interest and proactive health management behaviour encourage purchase of devices for lifestyle monitoring beyond diabetic use. Third, technological advancements in sensor accuracy, connectivity to smartphones and wearable compatibility enhance user appeal. Fourth, increasing availability of monitoring devices through pharmacies, online retail channels and OTC classifications lowers access barriers.

Despite positive momentum, the market faces constraints. Device cost remains a barrier, especially for advanced models such as continuous glucose monitors, limiting adoption among cost sensitive individuals without reimbursement. Regulatory and classification issues in Japan may restrict OTC availability of some high performance devices, slowing market expansion. Furthermore, consumer trust and awareness of device accuracy and usability may lag, reducing uptake. The incremental nature of demand in a mature health device market also limits rapid volume growth.

Notable trends include the shift from traditional finger stick glucometers to continuous glucose monitoring (CGM) systems available OTC or via less restrictive pathways, expanding monitoring use beyond insulin users. There is increasing integration of glucose monitors with mobile apps and digital health platforms, enabling real time tracking, trend analysis and lifestyle guidance. Wellness oriented consumers, not just diagnosed diabetic patients, are using OTC glucose monitoring for nutrition, fitness and metabolic health insights. Also, direct to consumer sales models and e commerce channels are growing as routes to market, supporting wider penetration.

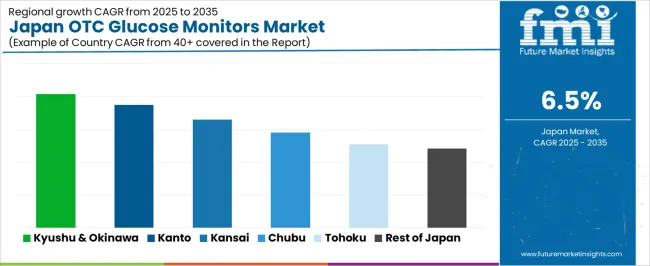

The demand for over-the-counter (OTC) glucose monitors in Japan is driven by several factors, including the country’s aging population, increasing prevalence of diabetes, and rising consumer awareness about health management. OTC glucose monitors are essential for individuals who need to track their blood sugar levels, either for managing diabetes or for preventive health reasons. With the growing focus on self-care, wellness, and the convenience of home health monitoring, more Japanese consumers are turning to OTC glucose monitors. The regional demand for these devices varies depending on factors such as population health, healthcare infrastructure, and consumer lifestyle preferences. Below is an analysis of the demand for OTC glucose monitors across different regions of Japan, highlighting key drivers in each area.

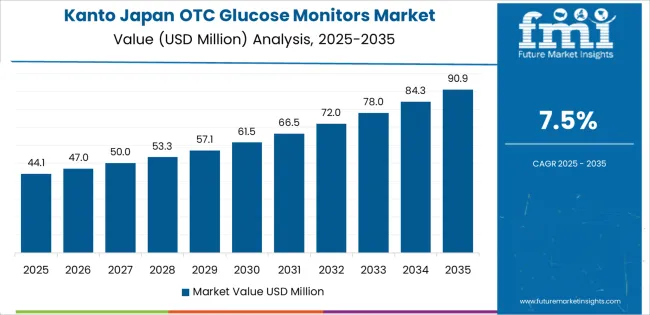

| Region | CAGR (2025 to 2035) |

|---|---|

| Kyushu & Okinawa | 8.2% |

| Kanto | 7.5% |

| Kinki | 6.6% |

| Chubu | 5.8% |

| Tohoku | 5.1% |

| Rest of Japan | 4.8% |

Kyushu & Okinawa leads the demand for OTC glucose monitors in Japan with a CAGR of 8.2%. The region’s growing elderly population and higher rates of diabetes contribute to the rising demand for glucose monitoring solutions. Kyushu & Okinawa is home to a significant number of people who are managing chronic health conditions, including diabetes, which increases the need for convenient and affordable health monitoring devices. Additionally, the region’s healthcare system is increasingly adopting home healthcare technologies, driving growth in self-monitoring devices. The emphasis on preventive health and the convenience of monitoring blood sugar at home, combined with greater accessibility to these devices, makes Kyushu & Okinawa the region with the highest growth in OTC glucose monitor demand.

The Kanto region, with a CAGR of 7.5%, shows strong demand for OTC glucose monitors. Kanto, home to Tokyo and its surrounding urban areas, has a large population of individuals with diabetes, as well as a significant aging demographic. The region’s high awareness of health and wellness trends, combined with advanced healthcare infrastructure, contributes to the growing adoption of OTC glucose monitors. In addition, the region’s focus on healthcare and technological innovation leads to increased demand for easy-to-use, at-home health monitoring solutions. With busy lifestyles and a growing interest in self-care, residents in Kanto are more likely to use OTC glucose monitors for both preventive and diagnostic purposes. The region’s higher disposable income and widespread availability of such devices in pharmacies and online platforms further support the market growth.

The Kinki region shows steady demand for OTC glucose monitors, with a CAGR of 6.6%. Kinki, which includes Osaka and Kyoto, has a large population with a growing number of elderly individuals who are more prone to chronic diseases like diabetes. As Japan’s second-largest urban area, Kinki has a high demand for healthcare services, including home-based health monitoring solutions. The region’s emphasis on quality and precision in healthcare services supports the adoption of OTC glucose monitors, as people look for reliable and accurate tools to manage their blood sugar levels. Additionally, the presence of retail chains and online platforms offering easy access to these products drives growth in the region. As Kinki’s population ages and healthcare access continues to improve, demand for OTC glucose monitors is expected to continue to rise steadily.

Chubu shows moderate growth in demand for OTC glucose monitors, with a CAGR of 5.8%. The region, which includes major cities like Nagoya, has a strong manufacturing base and a sizable population with a growing focus on health. As diabetes awareness rises and more people seek to manage their health proactively, the demand for OTC glucose monitors continues to increase. Chubu's healthcare infrastructure has been expanding, which improves access to self-care devices like glucose monitors. Additionally, the region’s residents are becoming more health-conscious, particularly in urban areas, where busy lifestyles and a focus on wellness make home health monitoring solutions attractive. As Chubu continues to develop its healthcare and retail sectors, the market for OTC glucose monitors is poised for steady growth.

Tohoku shows a CAGR of 5.1%, while the Rest of Japan follows with a CAGR of 4.8%. These regions experience slower growth in OTC glucose monitor demand compared to more urbanized areas like Kanto and Kyushu & Okinawa. While Tohoku and the Rest of Japan both have aging populations, their healthcare infrastructure is less advanced, and fewer people may be aware of or able to access home monitoring technologies like OTC glucose monitors. In rural areas, there may also be a slower adoption of such devices due to the higher reliance on traditional healthcare methods and less frequent usage of home-based health technologies. However, as awareness of diabetes and other chronic conditions grows, and as retail access to these products increases, demand for OTC glucose monitors will likely continue to rise at a moderate pace in these regions.

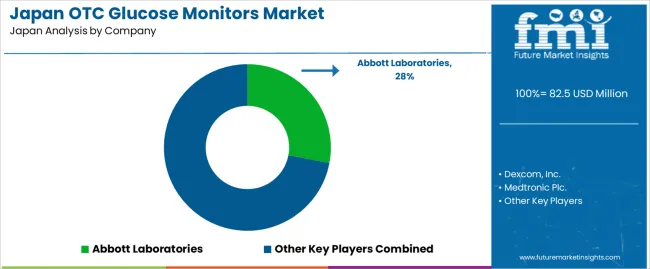

The OTC glucose monitors industry in Japan is experiencing growth as more individuals take control of their health and seek convenient, at-home solutions for monitoring blood sugar levels. Companies like Abbott Laboratories (holding approximately 28% market share), Dexcom, Inc., Medtronic Plc., Roche Diabetes Care, and Senseonics Holdings, Inc. are key players in this industry. With the increasing prevalence of diabetes and the demand for early detection and management, consumers are turning to over-the-counter (OTC) glucose monitors as an accessible way to track their blood glucose levels without a prescription.

Competition in the OTC glucose monitors industry is largely driven by technology, accuracy, and ease of use. Companies are focusing on developing highly accurate, user-friendly devices that provide real-time results and integrate with mobile applications for better data tracking and management. Innovations in continuous glucose monitoring (CGM) systems and non-invasive glucose monitoring technologies are creating competitive advantages. Another competitive factor is the ease of use and accessibility of these devices, with companies striving to provide affordable and reliable options for individuals managing diabetes or those who need to monitor their glucose levels periodically. Marketing materials often highlight features such as ease of calibration, comfort, accuracy, and compatibility with mobile apps. By aligning their products with the increasing demand for convenience, affordability, and precision, these companies aim to strengthen their position in the Japanese OTC glucose monitors industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Product | Continuous glucose monitors, Hybrid glucose monitoring systems, Blood glucose monitors |

| Indication | Diabetes type I, Diabetes type II, Gestational diabetes |

| Key Companies Profiled | Abbott Laboratories, Dexcom, Inc., Medtronic Plc., Roche Diabetes Care, Senseonics Holdings, Inc. |

| Additional Attributes | The market analysis includes dollar sales by product and indication categories. It also covers regional demand trends in Japan, driven by the increasing prevalence of diabetes and the adoption of OTC glucose monitors. The competitive landscape focuses on key manufacturers innovating in continuous and hybrid glucose monitoring systems. Trends in the growing demand for user-friendly glucose monitoring solutions are explored, along with advancements in sensor technology and integration with digital health platforms. |

The global demand for OTC glucose monitors in japan is estimated to be valued at USD 82.5 million in 2025.

The market size for the demand for OTC glucose monitors in japan is projected to reach USD 155.3 million by 2035.

The demand for OTC glucose monitors in japan is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in demand for OTC glucose monitors in japan are continuous glucose monitors, hybrid glucose monitoring systems and blood glucose monitors.

In terms of indication, diabetes type i segment to command 66.3% share in the demand for OTC glucose monitors in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA