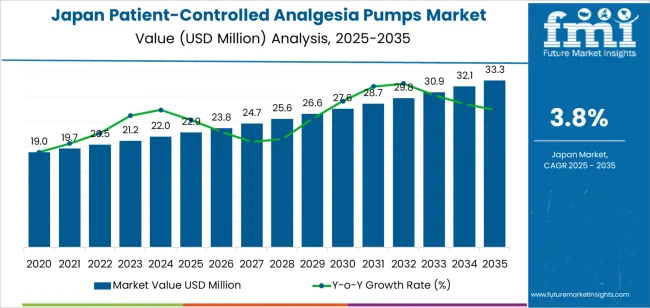

The demand for patient-controlled analgesia (PCA) pumps in Japan is projected to reach USD 33.3 million by 2035, reflecting an absolute increase of USD 10.4 million over the forecast period. Starting at USD 22.9 million in 2025, the demand is expected to grow at a steady CAGR of 3.8%. PCA pumps allow patients to self-administer controlled doses of pain medication, typically after surgery or during chronic pain management. These pumps are increasingly preferred due to their ability to provide patients with autonomy in pain management while maintaining the ability for healthcare providers to control dosages.

The primary drivers of this demand include the aging population in Japan, which is leading to higher incidences of surgeries and chronic conditions, the rise in post-operative and cancer pain treatments, and the growing emphasis on patient-centered care. The healthcare system’s focus on improving patient comfort and reducing healthcare costs will further fuel the adoption of PCA pumps. Technological advancements, such as integration with electronic health records (EHR) for better monitoring and safety features, will also contribute to the growth in demand for PCA pumps.

Between 2025 and 2030, the demand for PCA pumps is expected to grow from USD 22.9 million to USD 23.8 million, adding USD 0.9 million. This period represents 8.6% of the total forecasted growth for the decade. During this phase, the growth will be driven primarily by ongoing adoption within the healthcare sector, as more hospitals, outpatient clinics, and pain management centers incorporate PCA pumps into their pain management protocols. The growth will be moderate, as PCA pumps are already widely used in post-operative pain management, with a primary focus on improving patient comfort and reducing the need for intensive pain monitoring.

From 2030 to 2035, the demand will see an accelerated growth phase, with demand increasing from USD 23.8 million to USD 33.3 million, adding USD 9.5 million. This period accounts for 91.4% of the total forecasted growth and will be marked by a significant acceleration driven by several factors. As the aging population in Japan continues to grow, the demand for PCA pumps will rise due to the increased incidence of surgeries, chronic diseases, and cancer treatments requiring pain management. Technological advancements will play a key role in this growth.

| Metric | Value |

|---|---|

| Japan Patient-Controlled Analgesia Pumps Sales Value (2025) | USD 22.9 million |

| Patient-Controlled Analgesia Pumps Forecast Value (2035) | USD 33.3 million |

| Patient-Controlled Analgesia Pumps Forecast CAGR (2025 to 2035) | 3.8% |

The demand in Japan for patient-controlled analgesia pumps is rising as healthcare providers intensify their focus on effective post-operative pain management and enhanced patient recovery. With an aging population and a higher volume of surgeries, there is a growing requirement for devices that allow patients to self-administer analgesia safely and within prescribed limits. These pumps contribute to shorter hospital stays and improved patient satisfaction.

Advancements in pump technology, including safety lock‑out mechanisms, wireless connectivity, and programmable features, support their adoption in Japan’s advanced healthcare settings. Hospitals and ambulatory surgical centres increasingly value these innovations for reducing nursing workload, minimizing errors, and improving analgesic workflow. Moreover, Japan’s regulatory and hospital accreditation frameworks emphasise pain management protocols and quality care standards, which reinforces the need for advanced PCA pump solutions.

As the Japanese healthcare system continues to integrate patient-centred technologies and optimise perioperative care protocols, demand for patient-controlled analgesia pumps is expected to grow steadily. Hospitals prioritise reducing complications, improving outcomes, and ensuring efficient workflow making PCA systems a preferred tool in post‑operative pain care strategies.

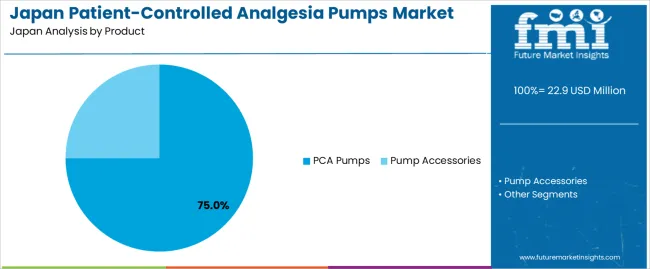

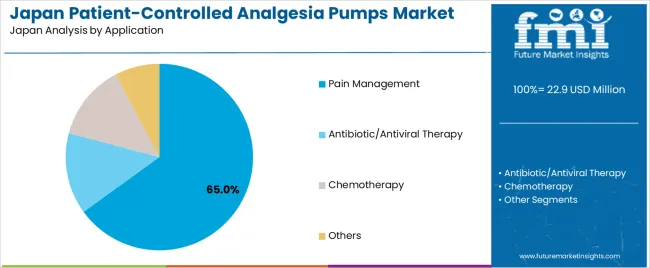

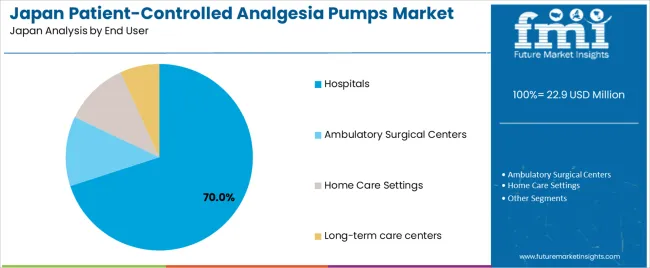

Demand is segmented by product, application, and end user. By product, demand is divided into PCA pumps and pump accessories, with PCA pumps holding the largest share. In terms of application, the industry is categorized into pain management, antibiotic/antiviral therapy, chemotherapy, and others, with pain management dominating the demand. The industry is also segmented by end user, including hospitals, ambulatory surgical centers, home care settings, and long-term care centers, with hospitals accounting for the largest share. Regionally, demand is divided into Kanto, Kinki, Chubu, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

PCA pumps account for 75% of the demand for patient-controlled analgesia pumps in Japan. These pumps are essential for providing patients with the ability to control their pain relief during and after surgery or for managing chronic pain. PCA pumps allow patients to administer controlled doses of analgesic medication through a button, offering personalized pain relief while minimizing the risk of overmedication.

The demand for PCA pumps is driven by the increasing number of surgical procedures and the need for effective pain management solutions. Hospitals and surgical centers prefer PCA pumps because they reduce the need for constant nurse intervention, allowing for better resource allocation and improving patient satisfaction. PCA pumps help ensure optimal pain management, which is crucial for faster recovery times and better overall patient outcomes. As the healthcare system continues to prioritize patient comfort and recovery, the demand for PCA pumps in Japan is expected to remain strong.

Pain management accounts for 65% of the demand for patient-controlled analgesia pumps in Japan. PCA pumps are primarily used for managing pain, especially post-surgery or in patients with chronic pain conditions. The ability of PCA pumps to offer real-time, patient-controlled pain relief has made them an essential tool in pain management protocols, improving the overall patient experience by giving them more control over their comfort levels.

As the demand for minimally invasive surgeries and outpatient procedures grows, so does the need for efficient and personalized pain management solutions. PCA pumps play a key role in these settings, as they allow for precise control of analgesia, improving recovery times and minimizing side effects associated with traditional pain management methods. With a growing focus on improving the quality of care and patient-centered treatment, the pain management application will continue to dominate the demand for PCA pumps in Japan.

Hospitals account for 70% of the demand for patient-controlled analgesia pumps in Japan. Hospitals are the primary setting for surgical procedures and inpatient care, making them the largest end user of PCA pumps. These devices are crucial for providing optimal pain relief in the postoperative period, especially after major surgeries, where precise and continuous pain management is required.

Hospitals also benefit from the use of PCA pumps because they streamline pain management, reducing the need for continuous nurse visits while offering patients autonomy in controlling their pain levels. This is particularly valuable in busy hospital settings where nurses can be better allocated to other critical tasks. As Japan’s healthcare system continues to emphasize patient-centered care and efficient pain management practices, hospitals will remain the dominant end user of PCA pumps, driving the ongoing demand for these devices.

PCA pumps systems allow patients to self‑administer analgesics under controlled settings, enhancing comfort and reducing nursing burden. Key drivers include the growth of minimally invasive surgeries, enhanced recovery after surgery (ERAS) programs, and a growing focus on medication safety and precision dosing. Restraints persist-these include high device costs, regulatory and reimbursement hurdles unique to the Japanese healthcare system, and the need for staff training and integration into existing hospital workflows.

In Japan, demand for PCA pumps is growing because healthcare providers are under increasing pressure to improve post‑operative outcomes and manage pain effectively in an environment where surgical volumes and outpatient care are rising. Japan’s rapidly ageing population requires more frequent surgeries and post‑operative pain support, and PCA pumps enable more efficient pain relief while facilitating faster mobilization and reduced length of stay. Hospitals are adopting advanced pain‑management protocols and technology upgrades, driving interest in modern PCA systems that support patient empowerment, digital monitoring and greater safety all contributing to rising demand.

Technological innovations are fueling growth in Japan’s PCA‑pump segment by introducing smarter, more connected solutions that align with the country’s advanced healthcare infrastructure. Next‑generation PCA pumps incorporate features such as dose‑error reduction software, wireless connectivity for remote monitoring, and compact designs suitable for both inpatient and home‑care settings. These advancements cater to Japan’s emphasis on patient safety, precision medicine and reduced hospital stays. Availability of systems that integrate with hospital electronic‑medical‑record (EMR) systems and support outpatient pain‑management models is increasing the appeal of PCA technology helping hospitals improve efficiency and broaden usage into home‑care environments, thereby supporting greater industry penetration.

Despite promising growth, several challenges are limiting broader adoption of PCA pumps in Japan. One major barrier is the high capital and operational cost, which can deter smaller hospitals or clinics from investing in advanced PCA systems. Another issue is regulatory and reimbursement complexity Japan’s healthcare system requires rigorous approval and demonstration of cost effectiveness, which slows procurement. Integration and training burdens are also significant: introducing a PCA program often involves changes in protocols, staff education and alignment with pharmacy/IT systems. Lastly, home‑care adoption remains nascent; although the potential is there, infrastructure, reimbursement and patient‑education gaps restrict the shift outside traditional hospital settings.

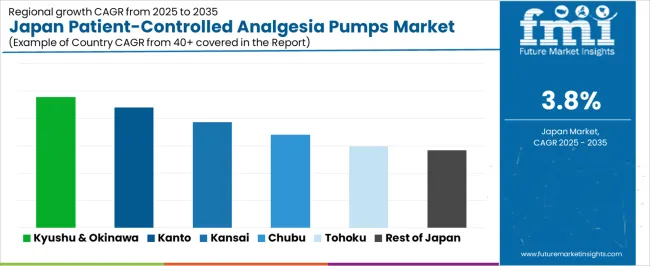

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.8% |

| Kanto | 4.4% |

| Kinki | 3.9% |

| Chubu | 3.4% |

| Tohoku | 3.0% |

| Rest of Japan | 2.8% |

The demand for patient-controlled analgesia (PCA) pumps in Japan is growing across all regions, with Kyushu & Okinawa leading at a 4.8% CAGR. This growth is primarily driven by the expansion of healthcare facilities and an increasing focus on improving postoperative recovery. Kanto follows with a 4.4% CAGR, supported by Tokyo’s advanced medical infrastructure. Kinki sees a 3.9% CAGR, driven by growing demand for pain management in major healthcare centers. Chubu experiences a 3.4% CAGR, influenced by increasing adoption in regional hospitals. Tohoku and the Rest of Japan show moderate growth at 3.0% and 2.8%, respectively, as access to modern medical technologies continues to improve.

Kyushu & Okinawa shows the strongest demand for patient-controlled analgesia (PCA) pumps in Japan, with a 4.8% CAGR. The region’s growth is shaped by a rising focus on pain-management services, especially within its expanding hospital networks. Cities such as Fukuoka are home to advanced medical centers that continue to adopt modern pain-relief technologies, including PCA pumps, to improve postoperative and chronic pain care. This aligns with the region’s emphasis on patient comfort and clinical efficiency, leading healthcare providers to integrate automated pain-control systems into routine practice.

Kyushu & Okinawa also benefit from an increase in surgical procedures driven by an aging population and higher patient inflow across major hospitals. As these facilities prioritize improved recovery protocols and safer pain-management methods, PCA pumps are becoming more widely used. Training programs for medical staff and investments in advanced medical devices further support this trend. With ongoing upgrades in healthcare infrastructure and rising awareness of effective pain-control options, Kyushu & Okinawa continue to lead national demand for PCA pump adoption.

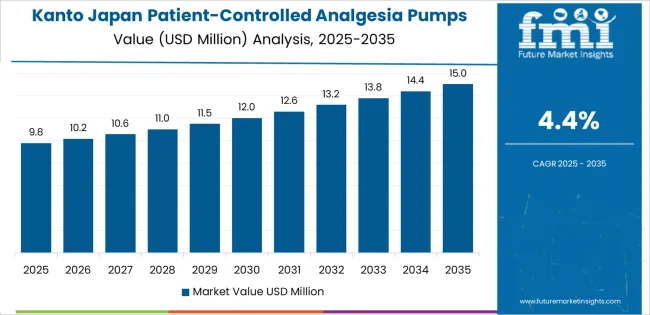

Kanto demonstrates strong growth in PCA pump demand, with a 4.4% CAGR, driven primarily by the region’s extensive healthcare ecosystem. Tokyo, the core of Kanto, hosts Japan’s leading hospitals, research institutions, and medical universities, all of which contribute to rapid adoption of advanced technologies. High patient volumes and a broad range of surgical procedures create consistent demand for reliable pain-management systems, making PCA pumps an essential tool in perioperative and postoperative care.

The region’s emphasis on precision medicine and improved clinical outcomes also influences the uptake of PCA pumps. Healthcare providers in Kanto prioritize technologies that support standardized, safe, and efficient pain-control protocols. Increased awareness of patient-controlled pain therapy among clinicians and patients further supports the growth trend. With continuous expansion of private hospitals, enhanced training programs, and strong investment in medical technology, the Kanto region remains a significant contributor to PCA pump demand, reflecting its leadership in Japan’s healthcare innovation landscape.

Kinki is experiencing steady demand for PCA pumps, showing a 3.9% CAGR. The region includes Osaka, Kobe, and Kyoto cities known for advanced healthcare institutions and academic research. Hospitals in these areas are increasingly adopting PCA pumps to support improved postoperative recovery, particularly for orthopedic, gastrointestinal, and cancer-related procedures. As patient expectations rise and medical facilities strive to enhance comfort and safety, PCA pumps are becoming a standard element in pain-management protocols.

Kinki’s strong presence of medical research centers and device manufacturers also influences adoption trends. These institutions contribute to clinician training, device evaluation, and the development of updated pain-relief guidelines. The region’s aging population, coupled with a rising number of complex surgical interventions, further drives the need for efficient pain-control systems. As hospitals modernize and integrate advanced technologies into clinical practice, Kinki continues to experience steady growth in PCA pump usage, supported by both clinical demand and technological advancement.

Chubu is seeing moderate growth in PCA pump demand, with a 3.4% CAGR. The region’s expansion is closely linked to improvements in healthcare access and the growing role of major cities like Nagoya, which host well-established hospitals and specialty centers. As these facilities increase the number of surgical procedures, the need for reliable pain-management tools, including PCA pumps, becomes more pronounced. Hospitals are integrating PCA pumps to support enhanced recovery pathways and reduce complications associated with traditional pain-relief methods.

Chubu’s healthcare providers are increasingly adopting modern medical technologies as part of broader infrastructure upgrades. Awareness about the benefits of patient-controlled analgesia continues to spread among both clinicians and patients, promoting wider usage. The presence of manufacturing industries in the region also supports training collaborations and technology adoption. Although growth is slower compared to Japan’s major metropolitan regions, Chubu remains an important contributor, with steady expansion driven by modernization efforts and rising demand for improved pain-control practices.

Tohoku shows a 3.0% CAGR in demand for PCA pumps, reflecting its ongoing efforts to enhance regional healthcare services. The region is gradually upgrading its hospitals and clinical facilities, creating stronger foundations for adopting advanced pain-management technologies. While historically less industrialized than Japan’s major hubs, Tohoku is increasingly emphasizing improved postoperative recovery and patient comfort, driving adoption of PCA pumps across more medical centers.

Aging demographics in Tohoku contribute to higher rates of chronic illnesses and surgeries, increasing the need for consistent and safe pain-management systems. Healthcare providers in the region are also benefiting from national programs that promote the use of modern medical equipment, leading to a greater understanding of PCA pump benefits. As access to specialized care improves and hospitals adopt updated clinical protocols, Tohoku is positioned for continuing growth in PCA pump demand.

The Rest of Japan is experiencing a 2.8% CAGR in PCA pump demand, driven by gradual improvements in local healthcare infrastructure. Smaller cities and rural hospitals are increasingly incorporating modern pain-management tools to improve patient care quality. Although the pace of adoption is slower than in major urban centers, there is clear progress in integrating PCA pumps into clinical practice, especially in postoperative care.

The rise in surgical procedures and greater awareness of advanced pain-control options among healthcare professionals contribute to growing demand. Government support for upgrading medical facilities also plays an important role, helping smaller hospitals adopt PCA pumps as part of broader modernization efforts. With ongoing improvements in hospital equipment, clinician training, and patient awareness, the Rest of Japan is expected to continue seeing steady growth in PCA pump usage.

The demand for patient‑controlled analgesia (PCA) pumps in Japan is on a steady upward trajectory as healthcare providers emphasize patient‑centric pain management and precision anesthesia monitoring. These devices enable patients to self‑administer pain medication within safe limits particularly valuable in postoperative care and settings focusing on enhanced recovery. With Japan’s aging population, rising number of surgical procedures, and focus on daycare surgery, the need for advanced PCA systems continues to grow.

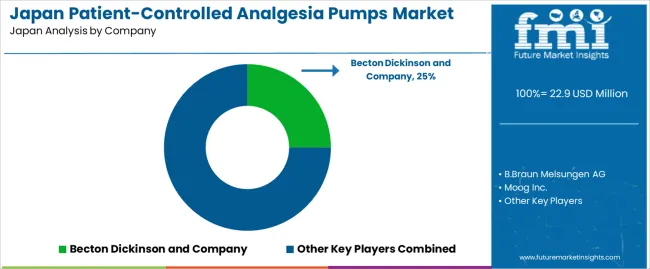

In the Japanese demand landscape, Becton Dickinson and Company holds an estimated 25.0% share, underscoring its strong position through its established portfolio of infusion and analgesia pumps in the Japanese industry. Other key players contributing significantly in Japan include B. Braun Melsungen AG, Moog Inc., Smiths Group/ICU Medical, and Fresenius SE & Co. KGaA, which provide specialized PCA devices and support services aligned with Japan’s clinical workflows and regulatory environment.

Key drivers of demand in Japan include the growing adoption of enhanced recovery after surgery (ERAS) protocols, increased use of ambulatory surgical centers, and rising interest in outpatient pain‑management solutions. Japan’s initiative to improve hospital efficiency and patient satisfaction supports greater use of smart pump technologies integrated with monitoring systems. While adoption is somewhat tempered by factors such as capital equipment cost, clinician training requirements, and integration with legacy hospital systems, the outlook remains positive. The demand for PCA pumps in Japan is expected to continue rising as hospitals and surgical centers increasingly prioritize tailored pain‑control strategies and streamlined postoperative care.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Product Type | PCA Pumps, Pump Accessories |

| Application | Pain Management, Antibiotic/Antiviral Therapy, Chemotherapy, Others |

| End User | Hospitals, Ambulatory Surgical Centers, Home Care Settings, Long-term Care Centers |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Players Profiled | Becton Dickinson and Company, B.Braun Melsungen AG, Moog Inc., Smiths Group/ICU Medical, Fresenius SE & Co. KGaA |

| Additional Attributes | Dollar sales by product type, application, and regional trends with a focus on pain management and chemotherapy treatments |

The global demand for patient-controlled analgesia pumps in japan is estimated to be valued at USD 22.9 million in 2025.

The market size for the demand for patient-controlled analgesia pumps in japan is projected to reach USD 33.3 million by 2035.

The demand for patient-controlled analgesia pumps in japan is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in demand for patient-controlled analgesia pumps in japan are pca pumps and pump accessories.

In terms of application, pain management segment to command 65.0% share in the demand for patient-controlled analgesia pumps in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA