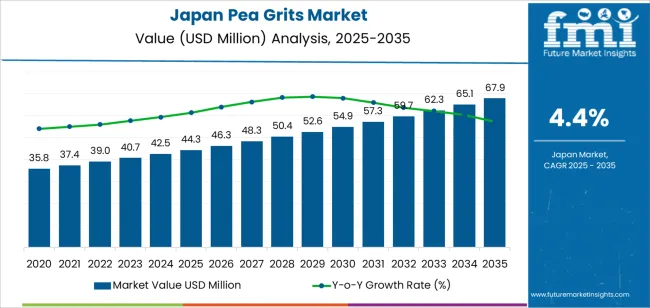

The demand for pea grits in Japan is projected to reach USD 67.9 million by 2035, reflecting an absolute increase of USD 23.6 million over the forecast period. The demand, valued at USD 44.3 million in 2025, is expected to grow at a CAGR of 4.4%. This growth is driven by the increasing adoption of plant-based protein sources and the rising demand for sustainable, gluten-free ingredients in food products.

Pea grits, a valuable byproduct of pea protein extraction, are becoming increasingly popular in food manufacturing for their versatility and nutritional benefits. They are used as an ingredient in plant-based meat substitutes, snacks, bakery items, and various processed foods. As consumers in Japan continue to shift toward healthier and more sustainable dietary choices, the demand for pea-based ingredients like pea grits is expected to rise.

The increasing interest in alternative protein sources, combined with growing awareness of the environmental impact of animal-based proteins, is accelerating the adoption of pea-based products in Japan. Innovations in pea grit processing, which enhance its texture and functionality in various food applications, will also contribute to its growth. As Japan continues to focus on health-conscious, eco-friendly food options, pea grits are set to become an important ingredient in the country's evolving food landscape.

The early growth curve for the demand for pea grits in Japan between 2025 and 2030 shows a gradual and moderate increase, with demand rising from USD 44.3 million to USD 46.3 million. This phase reflects steady growth as the industry for pea-based ingredients continues to expand, driven by rising interest in plant-based diets and the increasing adoption of pea grits in food manufacturing. During this period, the demand will be supported by growing awareness of the nutritional and environmental benefits of plant-based protein sources, but the pace of growth remains consistent and measured.

From 2030 to 2035, the growth curve experiences a significant acceleration, with demand increasing from USD 46.3 million to USD 67.9 million. This sharper rise reflects a shift in consumer behavior, as plant-based diets become more mainstream and the demand for alternative proteins expands. Innovations in pea grit processing technologies and their increasing use in a wide variety of food products will further contribute to this rapid growth. As the environmental impact of animal-based proteins continues to be a concern for consumers, demand for plant-based products, including pea grits, is expected to accelerate significantly.

| Metric | Value |

|---|---|

| Japan Pea Grits Value (2025) | USD 44.3 million |

| Japan Pea Grits Forecast Value (2035) | USD 67.9 million |

| Japan Pea Grits Forecast CAGR (2025 to 2035) | 4.4% |

The demand for pea grits in Japan is growing due to the rising interest in plant-based ingredients and sustainable food options. Pea grits, made from yellow peas, are increasingly being used as a source of plant-based protein in a variety of food products, including meat alternatives, snacks, and protein-enriched foods. As consumers in Japan shift towards more health-conscious and environmentally friendly diets, the demand for pea-based ingredients like pea grits continues to rise.

The growing trend of reducing animal product consumption, combined with an increasing awareness of the environmental benefits of plant-based foods, is a significant driver for the demand for pea grits. Peas are seen as a more sustainable alternative to traditional protein sources such as meat, as they require fewer resources to grow and have a lower environmental footprint. This trend aligns with Japan’s focus on sustainability and innovation in food production.

The health benefits of pea grits, such as being high in protein, fiber, and essential amino acids, are contributing to their increasing popularity in both mainstream and specialized food industrys. The expansion of the plant-based food sector and the growth in vegan, vegetarian, and flexitarian diets are expected to continue driving the demand for pea grits in Japan. Despite challenges such as the need for better processing technologies, the industry for pea grits is expected to grow steadily as more consumers embrace plant-based nutrition.

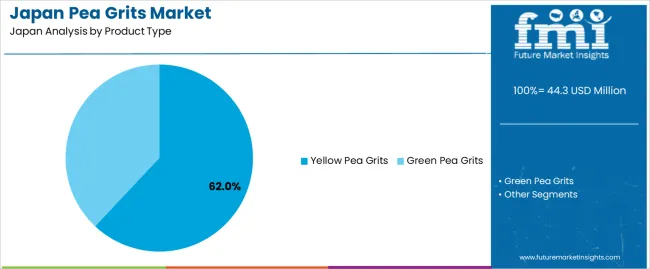

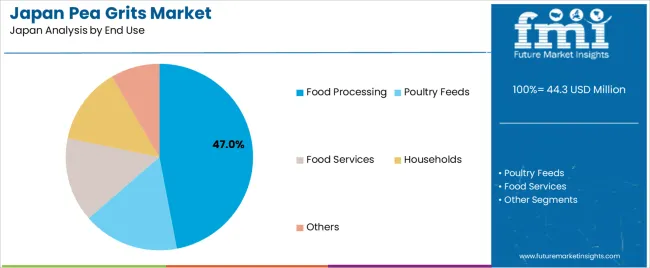

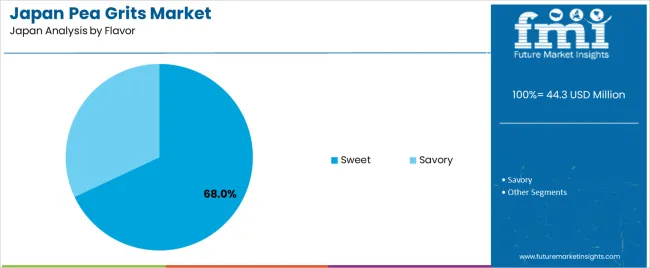

Demand is segmented by product type, end use, flavor, and distribution channel. By product type, demand is divided into yellow pea grits and green pea grits, with yellow pea grits leading the demand. Based on end use, demand is categorized into food processing, poultry feeds, food services, households, and others. In terms of flavor, demand is divided into sweet and savory. Regionally, demand is divided into Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan.

Yellow pea grits account for 62% of the demand for pea grits in Japan. Yellow peas are favored for their neutral flavor, which makes them versatile for use in a wide variety of applications. Yellow pea grits are commonly used in food processing, particularly for producing plant-based protein products, snacks, and soups. Their high protein and fiber content, combined with their smooth texture and mild flavor, makes them an ideal ingredient for plant-based food formulations. Yellow peas are also easier to process compared to other types of peas, which further contributes to their dominance. As consumer demand for plant-based products and protein-enriched foods increases in Japan, yellow pea grits are expected to maintain their leadership due to their functional properties and ability to meet the growing demand for sustainable, plant-based ingredients.

The food processing sector accounts for 47% of the demand for pea grits in Japan. Pea grits are widely used in the production of processed food products, including plant-based protein foods, snacks, and ready-to-eat meals. Their high nutritional value, including protein and fiber content, makes them an attractive ingredient for health-conscious consumers seeking plant-based and functional foods. Pea grits act as a binder, thickener, and stabilizer in food formulations, further driving their demand in the food processing industry. The growing trend toward plant-based diets and the increasing popularity of vegan and vegetarian food products are fueling the need for pea grits as a reliable and cost-effective ingredient. As Japanese consumers continue to embrace healthier food options, the demand for pea grits in the food processing sector is expected to continue growing.

The sweet flavor accounts for 68% of the demand for pea grits in Japan. Sweet pea grits are in high demand due to their natural sweetness, which makes them ideal for use in food products such as breakfast cereals, snack bars, and plant-based protein snacks. They are also used in plant-based dairy alternatives like yogurt and ice cream, where they provide a smooth texture and mild flavor. The demand for sweet pea grits has risen as consumers increasingly seek healthier alternatives to sugary foods, and as plant-based diets gain popularity. Sweet pea grits, free from artificial sweeteners and added sugars, are highly valued in the creation of healthy snacks and other products. The preference for natural sweetness in food products has reinforced sweet pea grits as the dominant flavor in the industry.

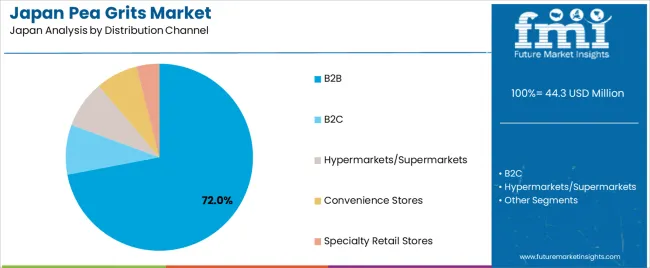

The B2B (business-to-business) distribution channel accounts for 72% of the demand for pea grits in Japan. The B2B channel is dominant due to the large-scale demand from food manufacturers, processors, and suppliers who purchase pea grits in bulk for various applications. The demand for pea grits in food processing, poultry feeds, and other industrial uses is met primarily through B2B channels, ensuring a consistent and cost-efficient supply. Long-term relationships between suppliers and manufacturers, along with larger order volumes, make B2B transactions stable and profitable. As the industry for plant-based products continues to expand, B2B distribution remains the dominant channel for pea grits, providing reliable access to these products for businesses across the food industry. The ongoing growth of plant-based food products in Japan reinforces the strength and importance of the B2B distribution channel in the pea grits industry.

Pea fragments serve as plant‑derived protein and functional ingredients in bakery, snacks, meat‑alternative products and nutrition bars. Key drivers include growing interest in high‑protein, gluten‑free and allergen‑friendly foods, and the need for diversified plant protein sources beyond soy. Restraints include limited consumer familiarity with pea grits in Japanese cuisine, higher import costs and challenges in integration into traditional Japanese food formats.

Demand for pea grits in Japan is growing because manufacturers are seeking versatile, plant‑based ingredients that align with health‑conscious and clean‑label trends. Japanese consumers increasingly look for nutritional value such as higher protein content and allergen‑free credentials in their food choices. Pea grits offer a differentiated option to soy or wheat‑based ingredients, especially in snack and reformulated food categories. Meanwhile, as Japan’s food industry experiments with reformulation and innovation in plant‑centric nutrition, pea grits become an attractive choice for food developers seeking both functional performance and nutritional credibility.

Technological and ingredient innovations are enabling uptake of pea grits in Japan by improving processing quality, flavour profile and application compatibility. Advances include finer milling of pea grits to reduce “grittiness”, removal of off‑flavours, and improved dispersibility for inclusion in bakery mixes, extruded snacks or nutrition‑bar matrices. Suppliers are also introducing pea‑grit formats tailored for Asian formulations such as smaller particle sizes or customised blends for high‑moisture applications. These improvements make pea grits more user‑friendly for Japanese food manufacturers, supporting broader adoption despite traditional dietary patterns.

Despite potential, the adoption of pea grits in Japan faces several challenges. A major limitation is consumer and industry familiarity pea grits are less established in Japanese food culture compared with soy or rice‑derived ingredients, making formulation adoption and consumer acceptance slower. Cost‑competitiveness is another barrier: imported pulse ingredients and specialist processing add cost versus more mainstream ingredients, which may deter usage in price‑sensitive applications. Integration into existing Japanese food manufacturing systems can require reformulation efforts adjusting texture, flavour or processing behavior which increases development time and complexity.

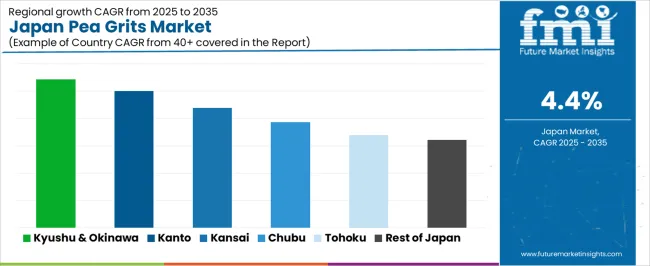

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.4% |

| Kanto | 5.0% |

| Kinki | 4.4% |

| Chubu | 3.9% |

| Tohoku | 3.4% |

| Rest of Japan | 3.2% |

The demand for pea grits in Japan is experiencing steady growth across various regions, with Kyushu & Okinawa leading at a 5.4% CAGR. This growth is driven by the increasing adoption of plant-based products and alternative ingredients in food manufacturing. Kanto follows at 5.0%, supported by its high concentration of food manufacturers and a strong demand for healthy, plant-based options. Kinki records a 4.4% CAGR, while Chubu shows a 3.9% CAGR, driven by steady growth in food processing and alternative ingredient adoption. Tohoku and the Rest of Japan show slower but consistent growth at 3.4% and 3.2%, respectively, as regional food industries continue to modernize.

Kyushu & Okinawa is experiencing the fastest growth in demand for pea grits in Japan, with a 5.4% CAGR. The region's food manufacturing and agriculture sectors are increasingly adopting plant-based ingredients like pea grits to cater to the growing demand for healthier, gluten-free, and sustainable food products. As consumer preferences shift toward plant-based diets, pea grits have gained popularity for their high protein content and versatility in a variety of applications, including snacks, plant-based meat alternatives, and bakery products.

Moreover, Kyushu & Okinawa’s agricultural base and increasing focus on sustainable food production have contributed to the region’s rising adoption of pea grits as an alternative to traditional grains. The region’s food producers are capitalizing on the growing health-conscious industry by incorporating pea grits into their product offerings, further boosting demand. As Kyushu & Okinawa continues to evolve its food production systems to meet consumer demand for plant-based and functional ingredients, the industry for pea grits is expected to continue its strong growth.

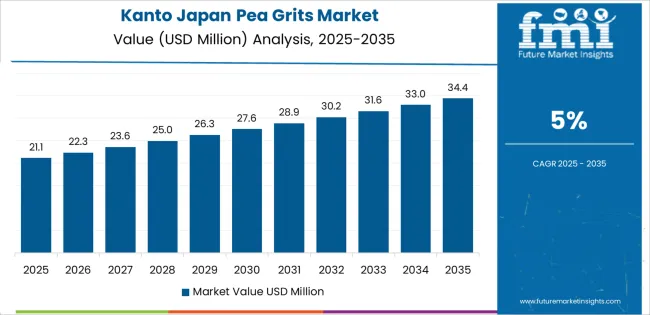

Kanto is seeing strong demand for pea grits, with a 5.0% CAGR. As the region that includes Tokyo, Kanto is a major hub for food production, and its food manufacturers are increasingly incorporating pea grits into a wide range of products. The growing consumer preference for healthier, plant-based alternatives in both everyday foods and specialized health products is a significant driver of this demand. As Kanto’s population becomes more health-conscious, there is an increasing demand for plant-based, gluten-free ingredients like pea grits.

The region's food industry is also responding to the growing trend for sustainable, eco-friendly ingredients. Pea grits, being plant-based and rich in protein, are viewed as a nutritious and sustainable ingredient for food production. With Kanto’s focus on innovation and food trends, the demand for pea grits is expected to continue rising. As food manufacturers in the region explore new applications for pea grits, including in dairy alternatives and protein-rich products, this trend will further fuel growth.

Kinki, including Osaka and Kyoto, is witnessing steady growth in the demand for pea grits, with a 4.4% CAGR. The region’s strong manufacturing and food sectors are key contributors to this trend. As consumers in Kinki continue to seek healthier and more sustainable food options, pea grits are becoming a popular ingredient due to their plant-based nature and nutritional benefits. The region’s food manufacturers are incorporating pea grits into a variety of products, ranging from snacks to bakery goods, to meet consumer demand for functional and plant-based ingredients.

The Kinki region’s food industry is increasingly adopting gluten-free and allergen-free ingredients in response to the growing awareness of food sensitivities. Pea grits, being naturally free of gluten, fit well into this trend. The steady growth in the demand for pea grits in Kinki is supported by the region’s established food processing infrastructure, which continues to innovate and meet consumer demand for healthier food solutions.

Chubu is seeing moderate growth in the demand for pea grits, with a 3.9% CAGR. The region’s strong industrial base, particularly in food manufacturing, is contributing to the increasing use of pea grits in food products. As Chubu’s food processing sector continues to diversify and cater to the growing demand for plant-based and health-conscious food options, the use of pea grits as an alternative ingredient is rising.

While growth in Chubu is slower compared to other regions like Kyushu or Kanto, the adoption of pea grits is being driven by an increasing number of food producers who are incorporating more plant-based ingredients into their offerings. The region’s growing interest in sustainable food production and plant-based alternatives is likely to further fuel demand for pea grits in the coming years. As the region’s food industry continues to innovate and align with global food trends, the adoption of pea grits will gradually increase.

Tohoku is experiencing steady growth in the demand for pea grits, with a 3.4% CAGR. The region’s food production and agricultural sectors are slowly adopting plant-based and alternative ingredients in response to rising health trends and consumer demand for more sustainable food options. While Tohoku’s growth in the adoption of pea grits is slower compared to more urbanized regions, there is an increasing awareness of the nutritional benefits and versatility of plant-based ingredients, which is contributing to the region’s steady growth.

As local food manufacturers in Tohoku continue to experiment with plant-based ingredients and expand their offerings, the use of pea grits is likely to rise. The region’s focus on sustainable agriculture and food production methods is driving the adoption of alternative ingredients like pea grits in both mainstream and specialized products. As these trends continue to evolve, the demand for pea grits in Tohoku will continue to grow, albeit at a more gradual pace.

The Rest of Japan, which includes smaller rural regions, is experiencing moderate growth in the demand for pea grits, with a 3.2% CAGR. While the adoption of pea grits in these regions is slower, there is an increasing awareness of the health and environmental benefits of plant-based ingredients. As local food industries and manufacturers modernize and seek alternatives to traditional grains, the demand for pea grits as a sustainable and nutritious ingredient is growing.

The steady shift toward plant-based diets and healthier food options, even in more rural regions, is driving the use of pea grits in food production. While the growth rate is slower compared to urban centers, the continued adoption of sustainable and functional ingredients is expected to support the demand for pea grits in the Rest of Japan. As more businesses in these regions invest in plant-based and gluten-free offerings, the demand for pea grits will continue to rise, contributing to the overall industry growth.

The demand for pea grits in Japan is steadily increasing as food manufacturers place greater emphasis on plant-based proteins, functional nutrition, and ingredient versatility. Pea grits coarse fragments of peas rich in protein and fiber are being integrated into applications such as meat alternatives, snacks, cereals, and fortified foods. Given Japan’s growing interest in health-conscious diets and sustainable ingredients, these grits offer compelling benefits in texture, nutrition, and clean-label positioning.

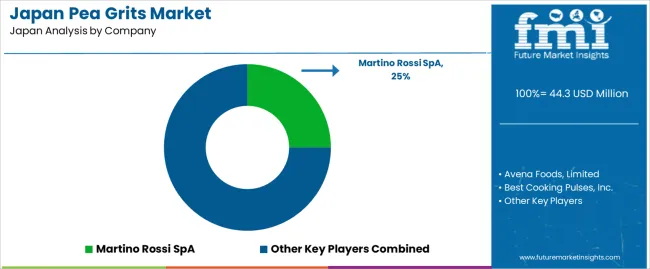

Within the Japanese industry, Martino Rossi SpA holds a leading share of approximately 25.0%, reflecting its strong footprint and ability to supply processed pea grits aligned with Japan’s stringent quality standards. Other notable suppliers include Avena Foods, Limited, Best Cooking Pulses, Inc., ADM, and Ingredion, all of which support the Japanese demand by providing pea grits or related ingredients tailored for local food formulators.

Key drivers of demand in Japan include the continued growth of plant-based and vegan food products, the need for allergen-friendly and gluten-free ingredients, and the expansion of functional food segments aimed at aging populations. Pea grits offer manufacturers both nutritional and functional advantages, enabling ingredient diversification and cleaner label claims. While challenges such as higher raw material costs and competition from alternative proteins persist, the overall outlook for pea grits demand in Japan remains strong. Manufacturers and ingredient suppliers are increasingly focused on delivering high-quality, texturally compatible, and nutritionally rich pea-based solutions to meet evolving consumer expectations and formulation needs.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Product Type | Yellow Pea Grits, Green Pea Grits |

| End Use | Food Processing, Poultry Feeds, Food Services, Households, Others |

| Flavor | Sweet, Savory |

| Distribution Channel | B2B, B2C, Hypermarkets/Supermarkets, Convenience Stores, Specialty Retail Stores |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Players Profiled | Martino Rossi SpA, Avena Foods, Limited, Best Cooking Pulses, Inc., ADM, Ingredion |

| Additional Attributes | Dollar sales by product type, end use, flavor, distribution channel, and regional trends |

The global demand for pea grits in Japan is estimated to be valued at USD 44.3 million in 2025.

The demand for pea grits in Japan is projected to reach USD 67.9 million by 2035.

The demand for pea grits in Japan is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in Japan are yellow pea grits and green pea grits.

In terms of end use, food processing segment is expected to command 47.0% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA