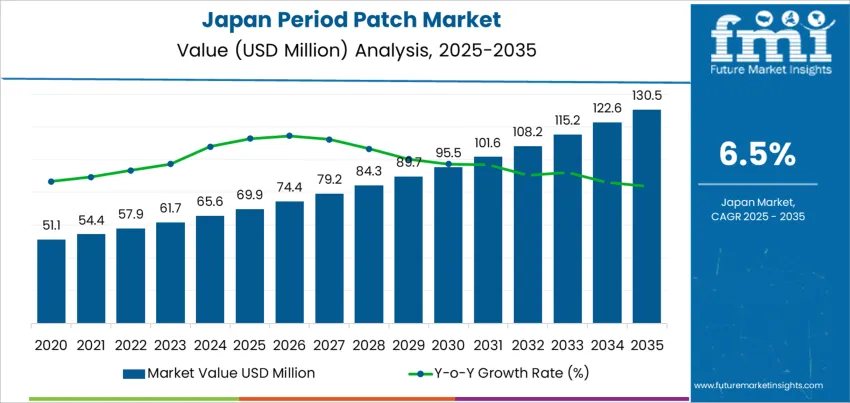

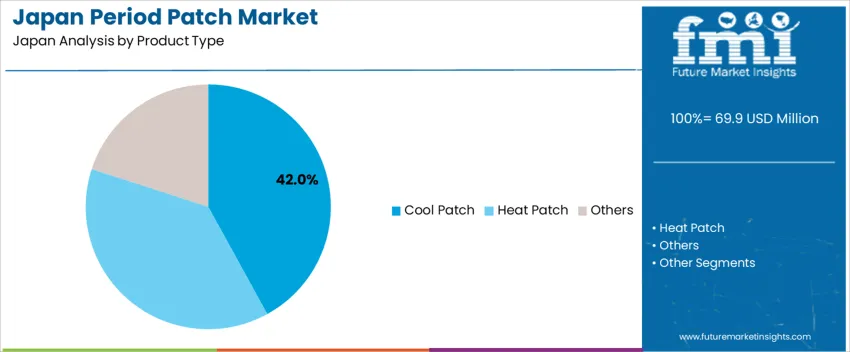

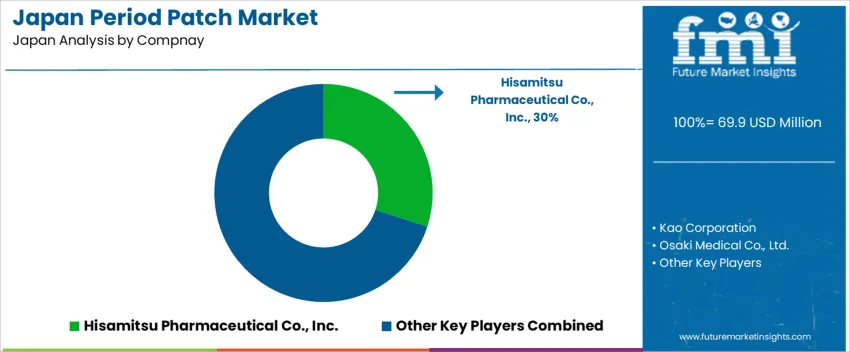

The Japan period patch demand is valued at USD 69.9 million in 2025 and is projected to reach USD 130.5 million by 2035, reflecting a CAGR of 6.5%. Demand is shaped by a rising preference for non-oral menstrual pain relief and increased awareness of self-care products that minimize systemic side effects. Broader adoption in younger consumer groups and expanded retail visibility through pharmacies and e-commerce channels support growth. Improved affordability and frequent product innovations in patch formulations also play a role. Cool patches represent the leading product category. These patches are selected for mild analgesic approaches that provide comfort through cooling sensations targeting abdominal discomfort. Ease of use, discreet application, and compatibility with daily activities contribute to recurring purchases and strong brand loyalty.

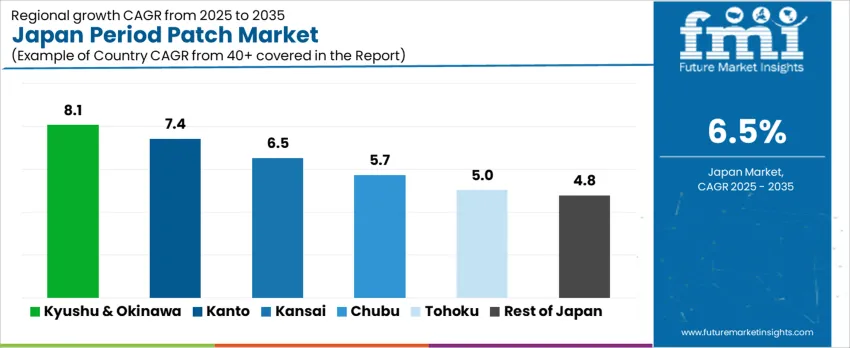

Kyushu & Okinawa, Kanto, and Kansai demonstrate the highest adoption levels due to dense retail distribution networks, established healthcare infrastructure, and heightened product visibility in urban markets. Regional consumer health campaigns addressing menstrual wellness contribute to further uptake. Key suppliers include Hisamitsu Pharmaceutical Co., Inc., Kao Corporation, Osaki Medical Co., Ltd., Kobayashi Pharmaceutical Co., Ltd., and Lion Corporation. Competitive priorities emphasize enhanced adhesion systems, skin-safe ingredients, improved cooling duration, and product lines tailored to varying pain-intensity needs.

Demand for period patches in Japan reflects a contribution structure led by health-conscious consumers seeking non-oral menstrual wellness options. The primary growth contribution comes from younger demographics and working women who favor discreet, heat-based or transdermal comfort solutions. Retail expansion through e-commerce channels increases accessibility, enabling steady incremental gains from convenience-driven purchasing.

A secondary contribution emerges from wellness positioning in drugstores and specialty health outlets. Branding that emphasizes comfort support without systemic medication appeals to users managing mild to moderate pain, adding niche volume. Product education influences adoption levels, and areas with higher awareness deliver stronger contributions compared to traditionally medication-reliant segments.

Medical recommendations contribute minimally but help reinforce credibility among sensitive users. Ecofriendly considerations in adhesive and base materials may also shift contribution over time as brands differentiate through recyclable packaging. The Growth Contribution Index therefore shows a category driven by targeted consumer needs rather than broad household penetration, generating steady, wellness-oriented growth within Japan’s menstrual-care landscape.

| Metric | Value |

|---|---|

| Japan Period Patch Sales Value (2025) | USD 69.9 million |

| Japan Period Patch Forecast Value (2035) | USD 130.5 million |

| Japan Period Patch Forecast CAGR (2025-2035) | 6.5% |

Demand for period patches in Japan is increasing because more women seek non-oral and non-invasive options to manage menstrual discomfort without relying solely on medication. Period patches deliver heat or topical active ingredients directly to the lower abdomen or back, which supports relief during daily activities, commuting and work environments common in Japan. Discreet sizing and thin materials allow patches to be worn under clothing with minimal visibility, which appeals to users who prefer practical solutions outside the home.

Pharmacies, convenience stores and e commerce platforms provide easy access to patches with different warming durations and ingredients such as menthol or herbal extracts. Broader awareness of women’s health encourages first time buyers to try supportive products that offer comfort while maintaining mobility. Increasing participation of women in full time employment reinforces demand for solutions that reduce disruption during work hours. Constraints include cost sensitivity for frequent monthly use, variability in perceived effectiveness and limited awareness among older consumers who are accustomed to traditional remedies or oral pain relief. Some users avoid certain formulations due to skin sensitivity or concerns about adhesives during extended wear.

Demand for period patches in Japan is shaped by the pursuit of non-oral menstrual pain relief options that prioritize comfort, discreet use, and minimal side effects. These patches are increasingly preferred by consumers looking for fast local relief without reliance on traditional analgesics. Growth is reinforced by high awareness of self-care products, strong participation of pharmacy retail chains, and wider online access to wellness brands. Innovation focuses on skin-safe adhesives, long-lasting temperature control, and compatibility with active lifestyles.

Cool patches account for 42.0%, reflecting widespread use for inflammation control, soothing effects, and suitability for individual’s sensitive to heat-based therapies. They are often preferred during warmer weather and for users experiencing swelling or discomfort without severe cramping. Heat patches follow at 38.0%, valued for relieving muscle constriction and tension, especially during peak pain episodes. These patches remain popular among working women seeking wearable, concealed relief throughout long commute or work hours. The other segment, representing 20.0%, includes aromatherapy patches and medicated variants formulated with herbal extracts tailored for natural wellness positioning. Product adoption aligns with Japan’s preference for topical therapies delivering targeted, residue-free comfort without interrupting daily activities.

Key Points:

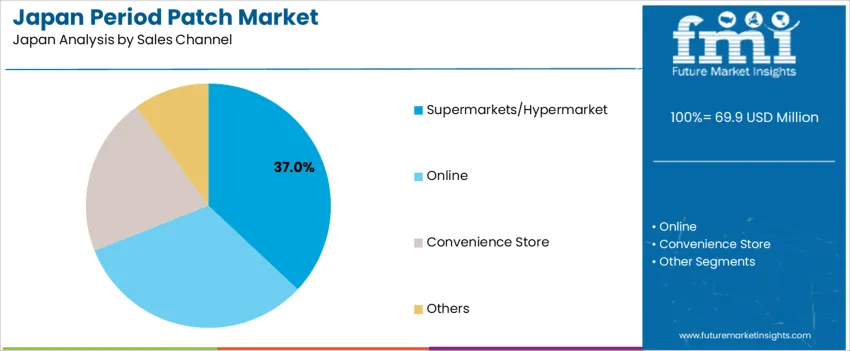

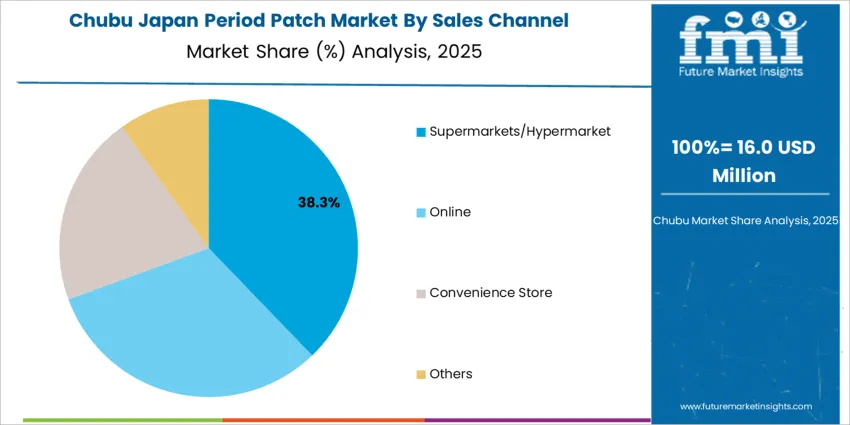

Supermarkets and hypermarkets account for 37.0%, supported by wide distribution, frequent household shopping trips, and familiarity with personal care categories placed in easily accessible aisles. Online sales represent 32.0%, growing due to privacy preference, subscription availability, and influencer-driven product discovery. Convenience stores capture 21.0%, benefiting from Japan’s dense retail network that supports impulse purchases and immediate relief needs. The other channels segment, at 10.0%, includes drugstores and specialty wellness shops where expert recommendations influence purchasing among first-time users. Channel dynamics reflect strong retail penetration, rising digital-first consumer behavior, and demand for easily restocked home-care essentials.

Key Points:

Growth of discreet menstrual pain management, increased workplace participation of women and rising acceptance of non-oral pain relief products are driving demand.

In Japan, period patch adoption grows as many women prefer convenient and discreet heat or herbal patches for menstrual discomfort during work and commuting. Companies encourage productivity and comfort initiatives, particularly in urban offices across Tokyo, Osaka and Nagoya, where long working hours lead to demand for portable relief solutions. Pharmacies and convenience stores near train stations carry a broad selection of menstrual-care products, improving accessibility for consumers seeking fast-purchase pain management. Younger women show increased interest in patches that provide localized relief without medication, supporting steady retail movement. Online beauty and wellness platforms promote subscription-based purchases for monthly supply plans, expanding distribution beyond traditional channels.

Cultural hesitation to discuss menstrual pain, price sensitivity compared with generic oral analgesics and limited consumer familiarity with newer patch types restrain demand.

Menstrual discomfort often remains a private topic in Japan, which may reduce open promotion and education about newer patch products. Oral painkillers remain inexpensive and widely recognized, creating cost comparison challenges for premium-priced patches. Some consumers remain unfamiliar with hydrogel or essential-oil-based patches and their expected duration of relief, delaying trial among first-time users. These cultural and economic factors contribute to selective adoption across age groups.

Shift toward heat-generating patches for commuter use, increased development of skin-friendly materials and rising demand in personalized wellness offerings define key trends.

Heat patches designed to be worn under clothes are gaining popularity among daily commuters who require comfort during travel on crowded rail networks. Manufacturers focus on gentle adhesives and breathable materials that reduce skin irritation during extended wear. Period-care brands are promoting patches as part of holistic wellness kits that include supplements, hygiene products and tracking apps tailored to individual cycle patterns. Retailers are expanding shelf visibility through bundled promotions in drugstores that target students and young professionals. These trends suggest growing but niche demand for period patches within Japan’s evolving feminine wellness industry.

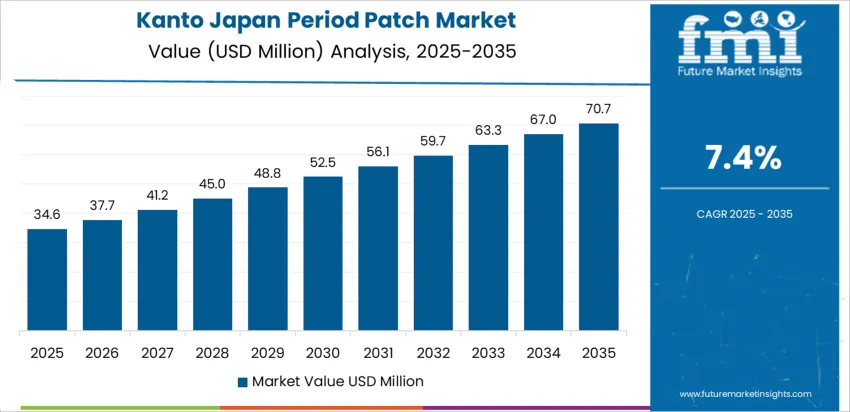

Demand for period patches in Japan is linked to consumer awareness of non-oral pain-relief options, product placement in pharmacies and convenience stores, and interest in discreet menstrual-care solutions. Usage expands in working-age and student populations who prefer wearable products with localized warmth or topical support during menstrual cycles. Regional variation reflects retail accessibility, healthcare engagement, and wellness-product adoption. Growth is led by Kyushu & Okinawa (8.1% CAGR), followed by Kanto (7.4%), Kansai (6.5%), Chubu (5.7%), Tohoku (5.0%), and the Rest of Japan (4.8%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 8.1% |

| Kanto | 7.4% |

| Kansai | 6.5% |

| Chubu | 5.7% |

| Tohoku | 5.0% |

| Rest of Japan | 4.8% |

Kyushu & Okinawa record 8.1% CAGR with retail adoption across pharmacies, supermarkets, and convenience channels where menstrual-care products maintain essential shelf space. Product purchasing increases among working women seeking discreet pain-support formats compatible with active daily routines. Tourism-driven commercial zones include wellness sections that reinforce awareness among travelers. Distribution in humid coastal climates encourages interest in breathable patch materials that remain comfortable under lightweight clothing. Consumer selection prioritizes adhesives that remain stable during movement. Regional clinics and women’s health education programs promote non-pharmaceutical relief alternatives, encouraging first-time trials. Retailers rotate pack sizes to support both emergency purchasing and monthly replenishment patterns. Subscription delivery services expand in urban pockets, improving visibility for newer formulations.

Kanto posts 7.4% CAGR driven by Tokyo’s dense retail landscape, high student populations, and widespread pharmacy networks offering multiple brand tiers. Commuters adopt period patches for flexibility during extended travel and workplace schedules. Corporate wellness initiatives introduce non-ingested menstrual support as part of personal-care education. Convenience stores position patches near analgesics and sanitary pads, enabling spontaneous purchasing when symptoms occur. E-commerce strengthens distribution with auto-reorder functions for routine cycles. Messaging emphasizes odor-free, thin-profile products compatible with fitted clothing worn in metropolitan settings. Consumers evaluate heat consistency, hypoallergenic backing, and reliable adhesion under dynamic temperature conditions in transit environments.

Kansai grows at 6.5% CAGR with Osaka, Kyoto, and Kobe supporting wellness trends through retail pharmacies and youth-oriented shopping districts. University areas contribute frequent single-pack purchases among students seeking affordable menstrual-support solutions. Tourism exposure enables rising brand recognition for heat-patch variations used during long walking periods. Retailers trial expanded shelf assortments with sensitive-skin materials suitable for frequent movement during cultural and leisure outings. Buyers monitor pricing to align with recurring usage cycles. Clear product instructions and visibility of dermatologist-tested labels influence decision confidence.

Chubu posts 5.7% CAGR as manufacturing cities maintain stable consumer demand for practical menstrual-support aids. Convenience stores near large workplaces support impulse buying during early symptom onset. Pharmacies distribute brand options featuring adjustable sizes suited for varied comfort preferences. Cold seasonal shifts create interest in warming patches during winter months. Retail planning uses predictable monthly sales patterns to maintain supply, especially near transit points. Marketing focuses on skin-friendly textures for extended wear.

Tohoku records 5.0% CAGR with purchasing driven by convenience access in smaller cities and emphasis on warming benefits in colder climates. Consumers favor breathable materials that avoid irritation during layered clothing use. Pharmacies highlight compact packaging suitable for handbags and school bags. Tourism peaks create additional sales through travel-friendly personal-care sections. Budget considerations influence brand rotation across menstrual cycles.

The Rest of Japan grows at 4.8% CAGR with steady usage in suburban and rural communities where pharmacies remain primary procurement channels. Women adopt patches for functional comfort during errands and household responsibilities. Retailers focus on trusted brands with clear labeling to reduce trial hesitation. Distribution aligns with routine stocking cycles associated with menstrual products.

Demand for period-pain patches in Japan is driven by suppliers of heat-therapy and topical support patches used for local cramp relief and muscle relaxation during menstruation. Hisamitsu Pharmaceutical Co., Inc. holds an estimated 30.0% share, supported by controlled adhesive performance, stable heat-delivery profiles, and strong availability throughout pharmacies and convenience stores. Its products maintain consistent skin adherence and predictable warmth duration suited to routine daily activity.

Kao Corporation maintains solid participation with heat patches designed for abdominal comfort and discreet use under clothing. Osaki Medical Co., Ltd. contributes presence in hospital-supply and consumer-retail channels where steady heat dispersion and flexible fabric backing are required. Kobayashi Pharmaceutical Co., Ltd. supports demand through compact patches formulated for persistent warming effects during extended wear. Lion Corporation adds targeted offerings positioned for ease of movement and breathable comfort.

Competition in Japan focuses on adhesive-skin compatibility, heat-retention stability, comfort during movement, and reliable domestic distribution. Demand continues as consumers seek non-oral pain-relief options that provide steady support throughout normal daily routines in Japan’s menstrual-care environment.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Cool Patch, Heat Patch, Others |

| Sales Channel | Supermarkets/Hypermarket, Online, Convenience Store, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Hisamitsu Pharmaceutical Co., Inc., Kao Corporation, Osaki Medical Co., Ltd., Kobayashi Pharmaceutical Co., Ltd., Lion Corporation |

| Additional Attributes | Sales by menstrual pain-relief technology including heating and cooling-based products; adoption among working women and younger consumers; regulatory compliance with healthcare and cosmetic classifications; innovation trends including herbal or aromatherapy patches; differentiation by adhesive sensitivity and product wear duration across retail and online distribution in Japan. |

The demand for period patch in Japan is estimated to be valued at USD 69.9 million in 2025.

The market size for the period patch in Japan is projected to reach USD 130.5 million by 2035.

The demand for period patch in Japan is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in period patch in Japan are cool patch, heat patch and others.

In terms of sales channel, supermarkets/hypermarket segment is expected to command 37.0% share in the period patch in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Period Patch Market Trends – Demand, Growth & Forecast 2025 to 2035

Period Patch Market Share Analysis

Demand for Period Patch in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Period Panties in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Periodontal Gel Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Patch and Remediation Software Market Size and Share Forecast Outlook 2025 to 2035

Period Panties Market Analysis – Size, Growth & Forecast 2025 to 2035

Periodontal Market Size and Share Forecast Outlook 2025 to 2035

Patchouli Oil Market Size, Growth, and Forecast for 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA