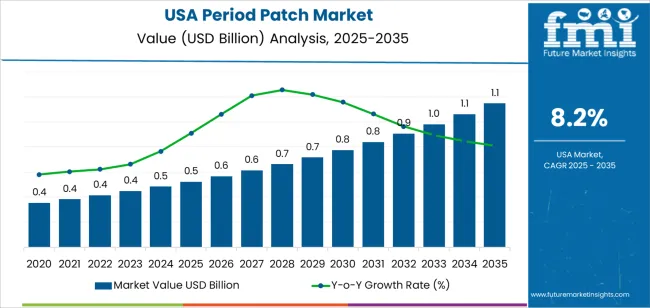

The demand for period patches in the USA is projected to grow from USD 0.5 billion in 2025 to USD 1.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.2%. Period patches, which are wearable devices designed to help with menstrual discomfort, are gaining popularity due to their convenience, non-invasive nature, and effectiveness. As consumers increasingly seek alternative methods for managing menstrual health and comfort, the market for period patches is expected to grow rapidly, driven by growing awareness and the demand for health-focused, natural products.

The market will see consistent growth, starting at USD 0.5 billion in 2025 and increasing to USD 0.6 billion in 2026, and USD 0.6 billion in 2027. By 2028, the demand for period patches will reach USD 0.7 billion, continuing its steady rise through the early 2030s. By 2035, the demand for period patches is forecasted to reach USD 1.1 billion, driven by an increasing number of consumers opting for alternative menstrual care solutions.

The period patch market in the USA is expected to grow steadily over the next decade. From USD 0.5 billion in 2025, the market will gradually rise to USD 0.6 billion in 2026 and USD 0.6 billion in 2027. The market will continue to expand, reaching USD 0.7 billion in 2028 and USD 0.8 billion in 2029. By 2035, the market for period patches is projected to reach USD 1.1 billion, driven by increasing adoption of alternative menstrual products and the growing awareness of menstrual health.

The compound annual growth rate (CAGR) for the period patch market in the USA is 8.2%. This reflects strong and steady growth, driven by increasing consumer interest in convenient, effective, and natural menstrual care solutions. With the continued rise in awareness and demand for alternative menstrual products, the market is expected to expand rapidly over the forecast period, with the CAGR highlighting the continued growth potential of this emerging category in the health and wellness industry.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 0.5 billion |

| Industry Forecast Value (2035) | USD 1.1 billion |

| Industry Forecast CAGR (2025-2035) | 8.2% |

Demand for period patches in the USA is increasing as more consumers seek non invasive, convenient alternatives for menstrual symptom relief. Period patches including heat patches and pain relief patches offer a discreet way to help manage cramps, discomfort, or other menstrual symptoms without pills or invasive treatments. As awareness of menstrual health grows and more people look for comfort oriented solutions, patches become a popular option. Growing acceptance of menstrual hygiene products beyond traditional pads and tampons supports uptake of patches among users seeking comfort, convenience, and privacy.

At the same time trends toward wellness, self care, and easy to use health products strengthen adoption of period patches. Many consumers view patches as part of broader efforts to manage menstrual health proactively rather than responding reactively. The shift toward convenience and over the counter wellness drives interest in period patches especially among younger and working populations. Improvements in patch design, comfort, and effectiveness such as better adhesion, longer wear time, and temperature or pain relief functionality increase their appeal. As cultural openness toward menstruation increases and consumer preferences evolve toward comfortable, discreet and effective menstrual care, demand for period patches in the USA is likely to continue growing steadily in coming years.

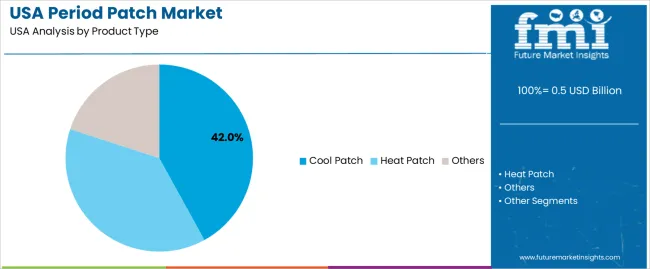

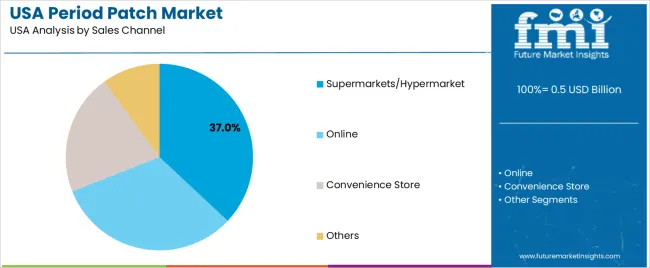

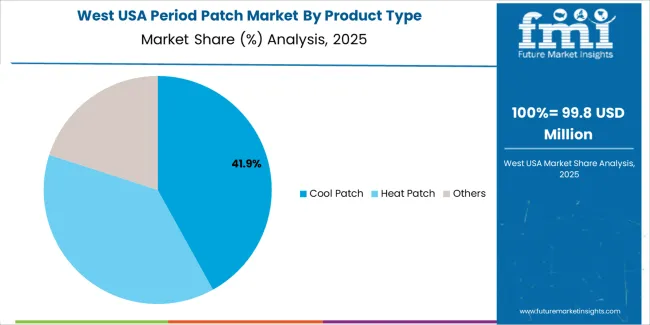

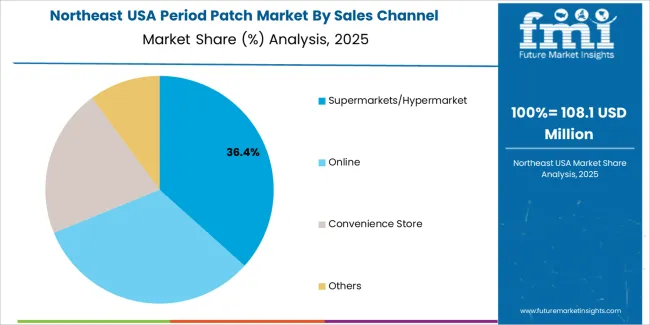

The demand for period patches in the USA is primarily driven by product type and sales channel. The leading product type is cool patches, accounting for 42% of the market share, while supermarkets/hypermarkets dominate the sales channel, capturing 37% of the demand. Period patches, designed to provide relief from menstrual discomfort, are becoming increasingly popular among consumers looking for convenient and effective solutions. As awareness of alternative menstrual care products rises, the demand for period patches continues to grow, particularly in the retail and online spaces.

Cool patches lead the demand for period patches in the USA, holding 42% of the market share. These patches are designed to provide a cooling effect that helps alleviate menstrual cramps and discomfort. The cooling sensation is typically achieved through ingredients that provide a refreshing, soothing effect on the skin, offering relief without the need for heating elements. Cool patches are especially popular among consumers seeking a quick, convenient, and non-invasive way to manage menstrual pain.

The demand for cool patches is driven by their effectiveness in providing targeted relief during menstruation. Many consumers prefer cool patches over other methods, such as pain medication, because they offer a more natural, on-the-spot solution without requiring oral consumption. The growing demand for non-pharmaceutical menstrual care products and a preference for more natural remedies have significantly contributed to the popularity of cool patches. As the market for alternative period products continues to expand, cool patches are expected to remain a leading choice for menstrual relief in the USA.

Supermarkets/hypermarkets lead the sales channel demand for period patches in the USA, capturing 37% of the market share. These retail outlets provide widespread access to period patches, offering convenience for consumers who prefer to purchase these products in person. Supermarkets and hypermarkets typically feature a variety of menstrual care products, including period patches, which can be easily accessed during routine shopping trips.

The demand for period patches through supermarkets and hypermarkets is driven by their high foot traffic, accessibility, and the ease of purchasing multiple items in one trip. As consumers increasingly seek convenience in their shopping experiences, these retail locations continue to be the preferred choice for many when purchasing menstrual care products. The ability to buy period patches alongside other everyday essentials makes supermarkets and hypermarkets a dominant sales channel in the period patch market. As the demand for such products grows, this retail channel is expected to maintain a significant role in meeting consumer needs for menstrual relief.

Demand for period patches in the USA is on the rise. As more individuals seek comfortable, discreet and convenient solutions to manage menstrual pain or discomfort, adoption of period patches has increased. The broader growth in feminine hygiene and menstrual care markets underpins this trend, offering period patches as an alternative or complement to traditional products such as pads, tampons or heat wraps. As awareness around menstrual health and personal comfort grows, period patches are gaining traction among consumers looking for effective, easy to use pain relief and menstrual care.

Several factors drive demand for period patches in the USA. First, growing awareness of menstrual health and pain management encourages users to seek alternatives to over the counter painkillers and traditional heat solutions. Period patches offer discreet, portable and non invasive relief for cramps or discomfort. Second, increasing acceptance of feminine hygiene innovations supports uptake. As social conversations around menstruation become more open and stigma reduces, more consumers explore modern menstrual care products including patches. Third, convenience seeking lifestyles boost appeal: busy individuals, working women, and those looking for discreet solutions during daily activities find patches attractive. Fourth, rising demand for varied menstrual care formats reusable or single use, herbal or medicated supports market expansion. Finally, growth in online retail and wider distribution makes patches more accessible across regions, increasing adoption beyond urban centers.

Despite growing interest, several constraints may limit wider adoption of period patches in the USA. One restraint is cost: patches may be priced higher than conventional sanitary products or generic heat wraps, which could deter cost conscious buyers. Another issue is consumer skepticism or habit: many women are accustomed to pads, tampons or traditional heat based remedies and may be hesitant to switch to newer solutions. Third, effectiveness varies by individual: some users may not find patches as effective as other pain relief methods, which can suppress repeat purchases. Fourth, regulatory scrutiny or concerns about skin sensitivity and safety may influence adoption potential buyers may prefer familiar, well trusted products over newer menstrual aids. Finally, for occasional or light menstrual symptoms, users may not perceive enough benefit from investing in patches, limiting their market to those with moderate to severe or persistent discomfort.

Key trends shaping demand for period patches in the USA include rising emphasis on menstrual health and comfort, with greater acceptance of alternative menstrual care solutions. There is increasing demand for discreet, portable, and non invasive products that fit modern lifestyles where convenience and flexibility matter. Another trend is diversification of menstrual products alongside pads and tampons, patches join the range of hygiene and pain relief options, offering more choice. Growing innovation in patch technology such as heat patches, herbal infused patches, longer wear patches and skin friendly adhesive formulations is improving comfort and effectiveness, drawing more consumers. Consumer preference for sustainability and reusable options is emerging, prompting brands to offer environmentally friendly versions. Finally, increased visibility and availability through online retail, subscription models, and direct to consumer channels are helping period patches reach wider demographics, including younger users and those in underserved or remote areas.

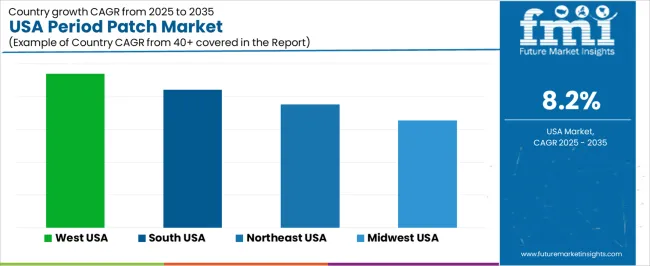

The demand for period patches in the USA is expected to grow across all regions, with the West USA leading at a CAGR of 9.4%. The South USA follows with a CAGR of 8.4%, driven by increasing consumer awareness and demand for alternative menstrual products. The Northeast USA is projected to grow at 7.5%, while the Midwest USA shows slightly slower growth at 6.5%. These differences in growth rates are influenced by factors such as regional preferences for menstrual products, awareness of alternative solutions, and the availability of period patch products in the local retail market.

| Region | CAGR (%) |

|---|---|

| West USA | 9.4 |

| South USA | 8.4 |

| Northeast USA | 7.5 |

| Midwest USA | 6.5 |

In the West USA, the demand for period patches is projected to grow at a CAGR of 9.4%. The region is known for its progressive stance on health and wellness, with a growing interest in natural and alternative products. Consumers in states like California are increasingly opting for organic and non-invasive menstrual care solutions. Period patches, which are designed to alleviate menstrual cramps using natural ingredients like menthol or essential oils, appeal to the West’s health-conscious population. Additionally, the West USA has a large population of women seeking more convenient and discreet menstrual products, further driving demand for period patches. The region’s focus on innovation, sustainability, and wellness ensures strong growth in this market.

In the South USA, the demand for period patches is expected to grow at a CAGR of 8.4%, driven by changing consumer preferences toward more convenient and comfortable menstrual products. The South has seen a rise in the adoption of natural health and wellness solutions, including period patches. These products are becoming popular due to their ability to provide targeted relief from menstrual discomfort without the use of oral medication. The increasing awareness about alternative menstrual care products, combined with the growing retail availability of period patches, contributes to this rise in demand. The South’s relatively large and diverse population, including a strong base of women who are seeking discreet and easy-to-use menstrual products, ensures continued growth in this market.

In the Northeast USA, the demand for period patches is projected to grow at a CAGR of 7.5%. The Northeast has a high concentration of health-conscious consumers who are more likely to adopt alternative and sustainable products, including period patches. In urban centers such as New York and Boston, women are increasingly seeking products that provide convenience and comfort, particularly those that offer relief from menstrual cramps without the side effects associated with traditional medications. The growing availability of period patches in health and wellness stores, coupled with increased marketing and awareness campaigns, is driving adoption. The Northeast’s progressive approach to health trends ensures steady demand growth for period patches in this region.

In the Midwest USA, the demand for period patches is expected to grow at a CAGR of 6.5%. While the growth rate is slower compared to other regions, the Midwest’s steady interest in health and wellness products supports the market for period patches. The region’s growing awareness of alternative menstrual products, along with the increasing availability of period patches in stores and online, contributes to gradual demand growth. As more women seek out non-medicated and discreet solutions for managing menstrual discomfort, period patches are gaining traction. However, due to regional preferences and more traditional USAge of other menstrual products, such as pads and tampons, the demand in the Midwest is growing at a moderate pace.

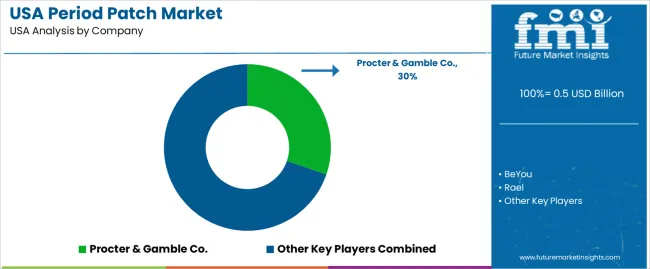

The market for period patches in the USA shows a shift toward non invasive, convenient menstrual care. One leading firm is Procter & Gamble Co. with an estimated share of about 30.3%. Other noted companies include BeYou, Rael, Cora and The Good Patch. These firms supply patches targeting menstrual discomfort, cramp relief, and convenience oriented menstrual hygiene solutions. Customer preferences lean toward comfort, discreetness, ease of use and reduced reliance on traditional painkillers or sanitary products.

Competition among these suppliers centres on strategies such as product type diversity, ingredient transparency, and channel reach. Some companies emphasise natural or plant based patches with herbal or organic formulations. Others stress heat based patches or transdermal pain relief technologies that offer drug free relief from menstrual cramps. Distribution strategies often include online retail, pharmacies and supermarkets. Brochures and spec sheets highlight patch adhesion quality, duration of effect, comfort under clothing and ease of disposal. The market remains dynamic as companies refine offerings to match evolving consumer expectations around menstrual health, convenience and wellness.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product Type | Cool Patch, Heat Patch, Others |

| Sales Channel | Supermarkets/Hypermarkets, Online, Convenience Store, Others |

| Key Companies Profiled | Procter & Gamble Co., BeYou, Rael, Cora, The Good Patch |

| Additional Attributes | The demand for period patches in the USA is driven by growing awareness and preference for alternative methods of menstrual pain relief. Cool and heat patches are popular choices, with each providing relief through different temperature-based mechanisms. The market also includes other types of period patches with various formulations and benefits. Sales channels for period patches are diverse, with supermarkets and hypermarkets being traditional retail hubs, while online sales are growing significantly due to the convenience and accessibility they offer. Companies like Procter & Gamble, Rael, and The Good Patch are key players, offering innovative products designed to ease menstrual discomfort. The market is expected to expand as consumers increasingly seek effective, non-invasive solutions for menstrual pain management. |

The demand for period patch in USA is estimated to be valued at USD 0.5 billion in 2025.

The market size for the period patch in USA is projected to reach USD 1.1 billion by 2035.

The demand for period patch in USA is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in period patch in USA are cool patch, heat patch and others.

In terms of sales channel, supermarkets/hypermarket segment is expected to command 37.0% share in the period patch in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Period Panties Market Report – Trends, Demand & Outlook 2025-2035

Period Patch Market Trends – Demand, Growth & Forecast 2025 to 2035

Period Patch Market Share Analysis

Reusable Period Panties Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

A Detailed Global Analysis of Brand Share for the Reusable Period Panties Market

Demand for Period Panties in USA Size and Share Forecast Outlook 2025 to 2035

Periodontal Gel Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Patch and Remediation Software Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Period Panties Market Analysis – Size, Growth & Forecast 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA