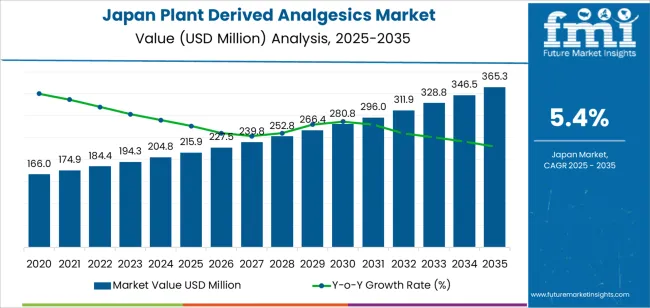

The demand for plant-derived analgesics in Japan is projected to grow from USD 215.9 million in 2025 to USD 365.3 million by 2035, reflecting a CAGR of 5.4%. Plant-derived analgesics, including ingredients like turmeric, cannabis-derived compounds, willow bark, and capsaicin, are becoming increasingly popular as natural alternatives to traditional synthetic pain relievers. Rising consumer awareness of the side effects of conventional pain medications, along with growing interest in holistic health and natural remedies, is driving the market for these products. Additionally, chronic pain management and the increasing aging population in Japan contribute to a sustained demand for effective, yet natural, pain relief solutions.

The market for plant-derived analgesics is expanding as more consumers turn to alternative pain management options. The growing availability of CBD-based products and other plant extracts in the wellness and healthcare sectors will further fuel the market's growth. As the acceptance of natural treatments continues to rise, the demand for these analgesics is expected to increase, especially in the context of self-care, preventive health, and pain management.

The saturation point analysis for plant-derived analgesics in Japan reveals key shifts in the market as demand continues to rise but eventually approaches its peak due to market maturity and competitive dynamics.

From 2025 to 2030, the market will grow from USD 215.9 million to USD 280.8 million, contributing USD 64.9 million in value. This early phase will be marked by strong growth as consumers increasingly seek natural pain relief solutions. The rise of plant-based pain management in various healthcare segments, especially for conditions such as arthritis and muscle pain, will drive this growth. This period represents the initial phase of rapid adoption, and the market will likely experience accelerated demand as new formulations and plant extracts are introduced.

After 2030, the market will experience a gradual slowdown in growth as it nears the saturation point. From 2030 to 2035, the market will grow from USD 280.8 million to USD 365.3 million, contributing USD 84.5 million in growth. Although the demand will continue to rise, the growth rate will begin to decelerate as the market matures and competition increases. Growth remains steady between 2025 and 2035, with similar annual expansion in both halves of the decade as plant-derived options become embedded in mainstream pain management

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 215.9 million |

| Forecast Value (2035) | USD 365.3 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

Demand for plant-derived analgesics in Japan is increasing as both patients and healthcare practitioners seek alternatives to conventional synthetic pain medications. Japan has a growing elderly population prone to chronic pain conditions, and the desire for treatments with fewer side effects supports greater interest in botanical pain-relief options. The broader analgesic market in Japan is expected to grow at a compound annual growth rate (CAGR) of around 6.7% through 2030.

In addition, Japan’s strong tradition of botanical medicine and its advanced pharmaceutical manufacturing sector support the development and adoption of plant-derived analgesics. Compounds from herbs, botanical extracts and natural pain-relief agents are increasingly being studied, standardised and integrated into mainstream and wellness-oriented pain management programmes. Nonetheless, challenges include regulatory approval pathways, variability in raw material quality, and competition from established synthetic analgesics. Despite these obstacles, the intersection of demographic need, botanical therapeutic interest and manufacturing capability suggest demand for plant-derived analgesics in Japan is positioned for steady growth.

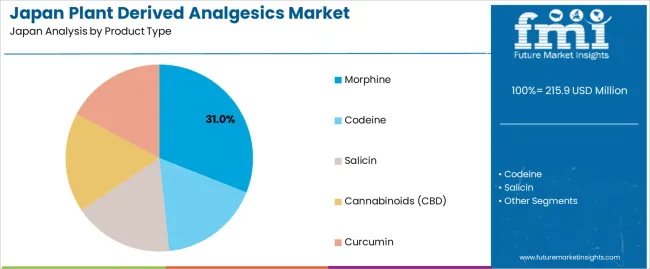

The demand for plant-derived analgesics in Japan is primarily driven by product type and formulation type. The leading product type is morphine, holding 31% of the market share, while tablets dominate the formulation type segment, accounting for 40.4% of the demand. Plant-derived analgesics, including opioids like morphine, cannabinoids (CBD), and natural compounds such as curcumin, are increasingly sought after for their pain-relieving properties. The growing awareness of natural and alternative pain management options has contributed to the continued demand for these products in Japan, especially in the treatment of chronic pain and other related conditions.

Morphine is the leading product type in the plant-derived analgesics market in Japan, capturing 31% of the demand. As one of the most widely used plant-based opioids, morphine, derived from the opium poppy, is critical in the management of moderate to severe pain, particularly in clinical and hospital settings. It is commonly prescribed for cancer pain, post-surgical recovery, and palliative care, making it an essential component of pain management strategies in Japan's healthcare system.

Despite growing concerns about opioid use and the search for alternatives, morphine remains a vital analgesic due to its effectiveness and proven track record in pain relief. The demand for morphine is primarily driven by its potent pain-relieving properties, as well as its ability to provide significant relief to patients suffering from acute pain. As the need for effective pain management solutions continues to grow, particularly among aging populations and those with chronic conditions, morphine will likely remain a dominant product in the plant-derived analgesics market in Japan.

Tablets are the leading formulation type for plant-derived analgesics in Japan, accounting for 40.4% of the demand. Tablets are favored due to their convenience, accurate dosing, and ease of storage. They are commonly used for both prescription and over-the-counter pain relief, offering a reliable and consistent way to administer plant-based analgesics such as morphine, codeine, or curcumin.

The demand for tablets is strong because they provide a controlled and consistent dose, which is essential in pain management, especially for chronic pain sufferers. Their widespread use in both healthcare settings and at home ensures their popularity among consumers seeking convenience and efficiency in pain relief. Additionally, the rising demand for pain management in Japan's aging population, as well as the continued focus on sustainable and natural pain relief options, will likely maintain the dominance of tablets in the plant-derived analgesic market.

Demand for plant-derived analgesics in Japan is driven by increasing consumer preference for natural and botanical pain-relief options amid a backdrop of ageing demographics and rising chronic pain incidence. While interest in clean-label and plant-based therapeutics supports market growth, regulatory classification, clinical evidence requirements and integration with conventional pharmaceuticals remain significant constraints. At the same time, innovation in formulation, extraction technologies and product delivery formats is expanding the range and appeal of botanical analgesics beyond traditional herbal uses.

Several factors support growth in Japan’s plant-derived analgesics segment. First, the ageing population and high prevalence of musculoskeletal disorders, neuropathic pain and joint-related discomfort create demand for analgesic options with fewer side-effects and better tolerability. Second, strong consumer inclination toward functional foods, supplements and natural health solutions aligns with botanical pain-relief products. Third, advancements in extraction methods, standardisation of plant-based APIs and improved formulations (including topical gels and patches) enhance efficacy and regulatory acceptability. Fourth, e-commerce growth and expanded retail access increase availability and consumer-awareness of plant-derived analgesic formats.

Despite promising potential, several restraints exist. Clinical evidence supporting botanical analgesics is still less robust than for conventional pharmaceuticals, which can limit physician endorsement and reimbursement. Regulatory ambiguity and classification challenges for plant-derived drugs in Japan may delay market entry or complicate approval pathways. Production cost of high-purity botanical extracts, combined with scale limitations, may restrict competitive pricing. Additionally, competition from established analgesics and consumer hesitancy about efficacy of natural alternatives can slow adoption among mainstream medical users.

Notable trends in Japan include increasing development of plant-based analgesics using novel botanicals and targeted pain-pathway extracts, expanding beyond traditional herbal formulations. There is growing adoption of advanced delivery systems-such as transdermal patches, topical gels and oral delivery formats-tailored for ease-of-use and minimal systemic exposure. Collaboration between pharmaceutical firms and botanical-extract specialists is enhancing standardisation and quality control of plant-derived analgesics. Finally, integration of these products into wellness-oriented retail channels and online health platforms is broadening their reach beyond clinical settings.

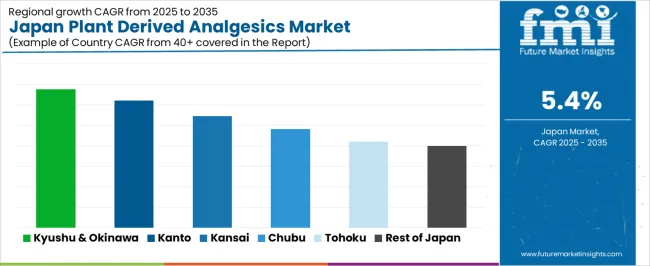

The demand for plant-derived analgesics in Japan is growing as consumers increasingly seek natural alternatives to synthetic pain relief medications. These analgesics, which include herbal remedies such as CBD, turmeric, and willow bark, are becoming popular due to their potential to manage pain and inflammation without the side effects typically associated with pharmaceutical products. Japan’s aging population, combined with rising awareness of the benefits of natural health solutions, contributes significantly to the market’s expansion. The regional demand for plant-derived analgesics varies based on factors such as lifestyle, healthcare infrastructure, and consumer preferences for natural wellness products. Below is a detailed regional breakdown of the demand for plant-derived analgesics across Japan.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 6.8% |

| Kanto | 6.2% |

| Kinki | 5.5% |

| Chubu | 4.8% |

| Tohoku | 4.2% |

| Rest of Japan | 4% |

Kyushu & Okinawa leads Japan in the demand for plant-derived analgesics, with a CAGR of 6.8%. The region's strong focus on natural wellness, along with its significant agricultural sector, supports the use of plant-based products for pain relief. Both Kyushu and Okinawa have a long history of utilizing herbal medicine, which contributes to the acceptance and demand for plant-derived remedies. Additionally, the region's aging population is a key driver, as older adults seek alternatives to synthetic medications for managing chronic pain conditions like arthritis and back pain.

Okinawa, in particular, is known for its centenarian population, with a cultural emphasis on holistic health practices, including the use of plant-based supplements. This cultural inclination towards natural health remedies makes Kyushu & Okinawa a prime market for plant-derived analgesics. Furthermore, growing awareness of the environmental and health benefits of plant-based alternatives further boosts their demand in the region.

Kanto shows strong demand for plant-derived analgesics with a CAGR of 6.2%. As Japan's economic and industrial hub, Kanto, which includes Tokyo, has a large population that is highly aware of health and wellness trends. In particular, urban residents in Tokyo and surrounding areas are increasingly adopting natural health solutions, including plant-derived analgesics, as part of their lifestyle choices. This growing awareness of the potential benefits of herbal pain relief products is further supported by the region's access to a wide range of wellness-focused retail and online platforms.

The region's healthcare infrastructure and emphasis on preventive medicine also contribute to the rising demand for natural alternatives to pharmaceutical pain relievers. Additionally, Kanto’s younger, health-conscious population is more inclined to seek out plant-derived solutions for managing minor aches and pains, fueling the continued growth of this market segment.

Kinki, with a CAGR of 5.5%, demonstrates steady demand for plant-derived analgesics. As a major manufacturing and industrial center, Kinki's urban areas, including Osaka and Kyoto, have a high concentration of consumers seeking effective, natural alternatives to manage pain and inflammation. The region’s large population, combined with growing health awareness, contributes to the rising use of plant-based analgesics.

Furthermore, Kinki’s strong retail sector provides easy access to a variety of wellness products, including plant-derived pain relief solutions. As more consumers in the region turn to holistic health practices and look for ways to reduce reliance on synthetic medications, the demand for plant-derived analgesics will continue to grow. Kinki's cultural openness to integrating natural products into daily routines further supports this demand.

Chubu demonstrates moderate growth in the demand for plant-derived analgesics, with a CAGR of 4.8%. The region's focus on traditional medicine and wellness, combined with the increasing popularity of plant-based health solutions, supports steady demand for these products. While Chubu is home to several industrial and commercial centers, its growth in the natural wellness sector is slightly slower compared to other regions like Kyushu & Okinawa and Kanto.

The region's aging population, particularly in rural areas, contributes to a steady demand for plant-derived analgesics, especially for conditions like arthritis and chronic pain. Chubu's healthcare infrastructure is improving, and as awareness of the benefits of natural remedies increases, the adoption of plant-based pain relief solutions will continue to grow at a moderate pace.

Tohoku shows a CAGR of 4.2%, while the Rest of Japan follows with a CAGR of 4.0%. These regions experience slower growth compared to more industrialized areas like Kanto and Kyushu & Okinawa. In Tohoku and the Rest of Japan, the market for plant-derived analgesics is driven by rural populations that seek affordable and accessible alternatives to pharmaceutical pain relievers. However, the overall adoption of plant-based health solutions is slower due to more traditional approaches to healthcare and lower levels of awareness about the benefits of natural remedies.

As access to plant-based products improves and awareness campaigns increase, demand in these regions will likely rise. However, it will remain more gradual compared to regions with higher concentrations of urban, health-conscious consumers. As the trend towards natural wellness continues to spread, Tohoku and the Rest of Japan are expected to see steady but slower adoption of plant-derived analgesics.

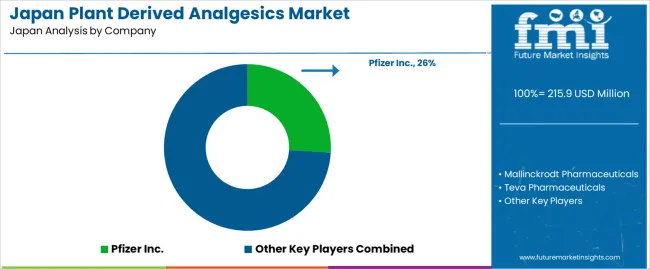

The plant-derived analgesics industry in Japan is growing as consumers seek natural, alternative pain relief solutions, driven by increasing awareness of the potential side effects of synthetic pain medications and a growing focus on holistic health. Companies like Pfizer Inc. (holding approximately 26% market share), Mallinckrodt Pharmaceuticals, Teva Pharmaceuticals, Johnson & Johnson, and NOW® Foods are key players in this industry. Plant-derived analgesics, including those made from ingredients such as turmeric, willow bark, and other herbal sources, are gaining popularity for their perceived safety and effectiveness in managing pain without the risks associated with opioids and other pharmaceuticals.

Competition in this industry is centered on the efficacy, formulation, and accessibility of plant-derived pain relief products. Companies are focusing on improving the bioavailability and potency of plant-based ingredients to offer consumers more effective solutions. Another area of competition is product innovation, with many companies combining plant-based ingredients with other complementary natural compounds to enhance their therapeutic effects.

Additionally, the rise in consumer demand for clean-label and sustainable products is pushing companies to focus on the natural sourcing of ingredients and the environmental impact of their products. Marketing materials often emphasize the natural, non-addictive, and anti-inflammatory properties of these analgesics, along with clinical evidence supporting their effectiveness. By aligning their products with the growing consumer demand for natural, safe, and effective pain relief options, these companies are strengthening their position in the Japanese plant-derived analgesics industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Product Type | Morphine, Codeine, Salicin, Cannabinoids (CBD), Curcumin |

| Formulation Type | Tablets, Capsules, Creams, Injectable forms, Oils |

| Key Companies Profiled | Pfizer Inc., Mallinckrodt Pharmaceuticals, Teva Pharmaceuticals, Johnson & Johnson, NOW® Foods |

| Additional Attributes | The market analysis includes dollar sales by product type and formulation type categories. It also covers regional demand trends in Japan, particularly driven by the growing adoption of plant-derived analgesics for pain management. The competitive landscape highlights major players focusing on innovations in both natural and pharmaceutical-grade analgesic solutions. Trends in the growing demand for CBD, curcumin, and other plant-based pain relief options are explored, along with advancements in formulation delivery methods. |

The global demand for plant derived analgesics in japan is estimated to be valued at USD 215.9 million in 2025.

The market size for the demand for plant derived analgesics in japan is projected to reach USD 365.3 million by 2035.

The demand for plant derived analgesics in japan is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in demand for plant derived analgesics in japan are morphine, codeine, salicin, cannabinoids (cbd) and curcumin.

In terms of formulation type, tablets segment to command 40.4% share in the demand for plant derived analgesics in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA