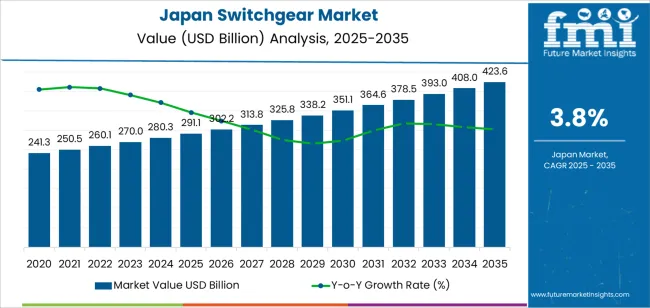

The demand for switchgear in Japan is valued at USD 291.1 billion in 2025 and is expected to reach USD 423.6 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.8%. This growth is driven by the increasing demand for reliable and efficient power distribution systems across industrial, commercial, and residential sectors. As Japan continues to focus on upgrading its infrastructure, particularly in energy generation, transmission, and distribution, the need for advanced switchgear solutions is expected to rise. Technological innovations in switchgear design, including the adoption of digital and smart grid technologies, further support the growing demand for these devices in the evolving energy landscape.

The market for switchgear in Japan is expected to show consistent growth over the forecast period, with annual demand moving from USD 241.3 billion in earlier years to USD 291.1 billion in 2025, and continuing to rise to USD 423.6 billion by 2035. The incremental growth year-on-year reflects a steady increase in infrastructure development and energy sector investments. The market progresses from USD 302.2 billion in 2026 to USD 313.8 billion in 2027, with continued expansion through to 2035. The sustained demand for switchgear is a result of both ongoing infrastructure modernization efforts and the growing integration of renewable energy sources into the grid, requiring more advanced power distribution solutions.

Demand in Japan for switchgear is projected to rise from USD 291.1 billion in 2025 to USD 423.6 billion by 2035, reflecting a compound annual growth rate (CAGR) of approximately 3.8%. Beginning at USD 241.3 billion in 2020, the value climbs gradually to USD 280.3 billion by 2024, reaching USD 291.1 billion in 2025. From 2025 to 2030, demand increases steadily to USD 338.2 billion, and by 2035 it attains USD 423.6 billion. Growth is supported by rising investment in electrical infrastructure, grid modernisation including renewable energy integration, and industrial automation.

The demand expansion is underpinned by several factors. The renewables driven shift in Japan’s power system and the push for smart grid installations create requirements for advanced switchgear with higher reliability, diagnostics and compact designs. Additionally, industrial facilities upgrading to industry 4.0 standards require modular, digitally enabled switchgear to optimise energy use. The ongoing replacement cycle of ageing infrastructure, along with regulatory emphasis on safety and efficiency, will sustain the upward trend from USD 302.2 billion in 2026 toward USD 423.6 billion in 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 291.1 billion |

| Forecast Value (2035) | USD 423.6 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The demand for switchgear in Japan is increasingly influenced by the country’s efforts to modernize its power infrastructure and manage growing electricity needs. As Japan invests in grid upgrades and expands transmission and distribution networks, the need for devices that control, protect, and isolate electrical systems such as switchgear rises. The integration of renewable energy sources, especially solar and wind, places additional pressure on grid stability. That leads to higher adoption of switchgear solutions that handle variable loads and safeguard power systems. Healthcare facilities, data centres, manufacturing units and commercial buildings in Japan require reliable and efficient power distribution systems, which supports the demand for quality switchgear. Aging infrastructure and the shift toward electrification also contribute to increased procurement of switchgear units.

The regulatory and safety landscape in Japan further supports demand for switchgear equipment. Stricter standards for electrical safety, arc flash protection and fault isolation make compliant switchgear necessary across industries and utilities. Japan’s interest in smart grid implementations and monitoring systems for electrical assets also underlines the need for more sophisticated switchgear. As utilities and industrial users replace older units and adopt higher voltage or digital switchgear formats, the demand trajectory continues upward, although capital expenditure constraints and material cost volatility remain factors limiting some acceleration.

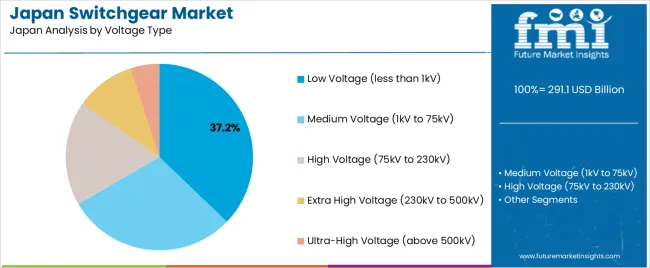

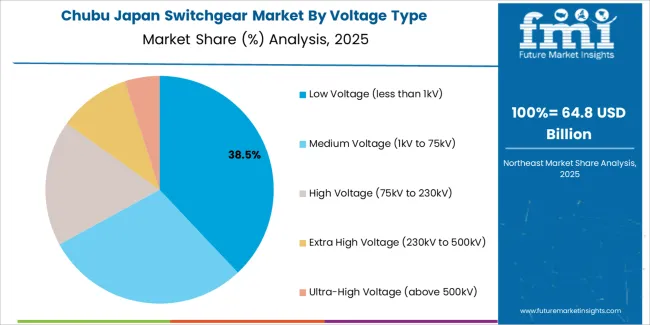

The demand for switchgear in Japan is shaped by both the component type and voltage type. The key component types include power distributor switch breakers, switch disconnectors, MCCBs (molded case circuit breakers), HRC (high rupturing capacity) fuses, and earth switches. Voltage types range from low voltage (less than 1kV) to ultra-high voltage (above 500kV), catering to different electrical infrastructure needs across residential, commercial, and industrial sectors. These segments reflect the increasing demand for reliable and safe electrical distribution systems, as well as the need for advanced technologies to manage energy efficiently across Japan's highly developed electrical grid.

Power distributor switch breakers account for 35% of the total demand for switchgear in Japan. These devices are essential for ensuring the safe distribution of electrical power, as they are designed to protect electrical circuits from overloads and short circuits. The demand for power distributor switch breakers is primarily driven by their reliability and the need to ensure continuous and safe power supply in both urban and industrial settings. These components are commonly used in substations, distribution networks, and electrical power systems, which makes them a crucial part of Japan's electrical infrastructure.

The growth in demand for power distributor switch breakers is also supported by the ongoing modernization of Japan’s electrical grid and the expansion of renewable energy integration. As the need for more flexible, efficient, and secure power distribution grows, the adoption of power distributor switch breakers increases. Their ability to provide fast and effective protection for electrical systems, as well as their widespread application across various voltage types, solidifies their dominant position in the switchgear market in Japan.

Low voltage switchgear (less than 1kV) accounts for 37.2% of the total demand in Japan. This segment is driven by the widespread use of low voltage systems in residential, commercial, and light industrial applications. Low voltage switchgear is essential for controlling and protecting electrical circuits in buildings, homes, and small industrial setups. The demand for low voltage switchgear is growing in Japan due to the increasing construction activities, the rise in urbanization, and the need for efficient electrical distribution systems in densely populated areas.

The adoption of low voltage switchgear is further supported by the growing focus on safety and energy efficiency. As Japan continues to invest in smart grid technologies and energy-efficient systems, the role of low voltage switchgear in ensuring the safe distribution and use of electricity is critical. Moreover, the increasing use of renewable energy sources in urban and residential areas also contributes to the demand for low voltage switchgear, as it helps regulate and distribute the power generated from solar panels and other small-scale renewable systems.

The demand for switchgear in Japan is largely driven by the country’s ongoing infrastructure upgrades, particularly in the energy sector. Japan's push for modernizing its electrical grid, as well as increasing adoption of renewable energy sources, necessitates the use of advanced switchgear for efficient power distribution and integration. Additionally, growing industrialization and the expansion of data centers require robust, reliable power solutions, which further supports the demand for high-quality switchgear. As the nation focuses on energy efficiency and sustainability, switchgear becomes an essential component in managing these systems effectively.

How is Japan’s focus on renewable energy influencing the demand for switchgear?

Japan’s commitment to increasing its renewable energy capacity is significantly driving demand for switchgear. As renewable energy installations, such as solar and wind farms, increase, the need for reliable and efficient energy distribution systems becomes critical. Switchgear is necessary to manage the variability of renewable energy sources and ensure smooth integration with the grid. Furthermore, the shift towards smart grids and energy storage solutions increases the need for more advanced switchgear that can handle complex, dynamic power flows while maintaining system stability.

What opportunities exist for switchgear in Japan’s industrial and commercial sectors?

An emerging opportunity for switchgear in Japan lies in the industrial and commercial sectors, particularly in the growing demand for power in data centers, manufacturing, and urban infrastructure projects. As industries and businesses continue to scale up their operations, the need for reliable, efficient power distribution systems becomes more crucial. Switchgear, especially advanced digital and smart versions, plays a key role in supporting these demands by ensuring optimal load management, preventing outages, and enhancing overall operational efficiency. Additionally, the shift towards automation and Industry 4.0 in Japan presents further growth opportunities for the switchgear market.

What challenges are limiting the growth of switchgear demand in Japan?

Despite the growing demand for switchgear in Japan, there are several challenges that may hinder its widespread adoption. The high initial costs of advanced switchgear systems can be a barrier, particularly for smaller businesses or those operating under tight budgets. Furthermore, space constraints in densely populated urban areas limit the installation of larger switchgear systems, which require significant space for optimal operation. Additionally, the complexity of integrating new switchgear with existing infrastructure and maintaining compatibility with different voltage and power systems presents challenges for end users and manufacturers alike.

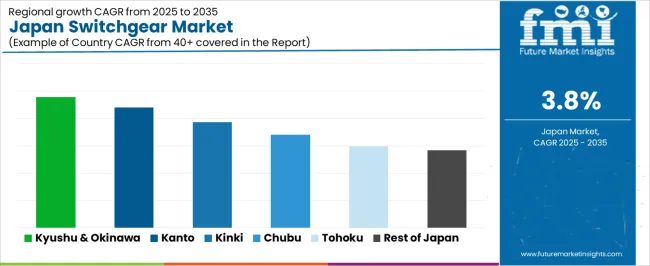

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.8% |

| Kanto | 4.4% |

| Kinki | 3.9% |

| Chubu | 3.4% |

| Tohoku | 3.0% |

| Rest of Japan | 2.8% |

The demand for switchgear in Japan is steadily growing across all regions. Kyushu and Okinawa lead with a 4.8% CAGR, driven by ongoing infrastructure development and increasing demand for energy-efficient electrical systems. Kanto follows at 4.4%, supported by its concentration of industrial and commercial sectors, where advanced electrical systems are essential. Kinki records 3.9%, benefiting from regional industrial activity and the integration of smart grid technologies. Chubu grows at 3.4%, with demand driven by manufacturing and energy sectors. Tohoku shows a 3.0% growth, and the rest of Japan records a 2.8% increase, reflecting steady demand for switchgear across various industries and infrastructure projects.

Kyushu & Okinawa is projected to grow at a CAGR of 4.8% through 2035 in demand for switchgear. The region’s increasing focus on renewable energy projects, particularly solar and wind, drives demand for reliable electrical equipment, including switchgear for grid integration and protection. As Kyushu & Okinawa continue to expand their power infrastructure, the need for high-quality, durable switchgear systems rises. The shift towards modernizing electrical networks and upgrading aging systems also boosts the adoption of advanced switchgear technologies in industrial and residential applications.

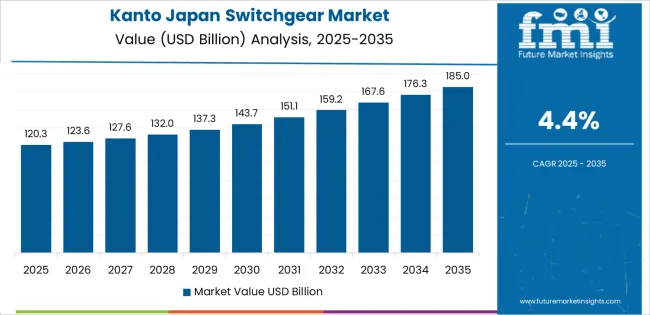

Kanto is projected to grow at a CAGR of 4.4% through 2035 in demand for switchgear. As Japan’s economic and industrial hub, Kanto, particularly Tokyo, leads the adoption of advanced electrical systems for its commercial and residential sectors. The region’s emphasis on energy efficiency, along with infrastructure modernization projects, drives the need for switchgear solutions to ensure safe and reliable power distribution. The growing focus on smart grids, automation, and renewable energy integration further accelerates the demand for switchgear technologies in Kanto’s utilities and industrial applications.

Kinki is projected to grow at a CAGR of 3.9% through 2035 in demand for switchgear. The region’s well-established industrial base, particularly in Osaka and Kyoto, contributes to the increasing adoption of switchgear for power distribution and protection. As industries continue to adopt automation technologies and renewable energy sources, the need for reliable and efficient electrical systems rises. Kinki’s push for sustainable urban development, along with its focus on improving energy security, further accelerates the demand for switchgear solutions in both industrial and residential applications.

Chubu is projected to grow at a CAGR of 3.4% through 2035 in demand for switchgear. The region’s diverse industrial landscape, including manufacturing and energy production, drives the adoption of electrical systems like switchgear. As Chubu’s energy grid continues to modernize and integrate renewable energy sources, the demand for high-performance switchgear solutions rises. In cities like Nagoya, the focus on industrial automation and power management solutions further accelerates the need for reliable switchgear systems. Additionally, ongoing infrastructure upgrades across the region contribute to the steady market growth.

Tohoku is projected to grow at a CAGR of 3.0% through 2035 in demand for switchgear. As the region works to improve its energy infrastructure, the adoption of modern electrical systems like switchgear is rising. With an aging energy grid and an increasing reliance on renewable energy sources, Tohoku is focused on upgrading its electrical systems for better efficiency and reliability. The demand for switchgear is driven by the region’s commitment to sustainable energy practices and its efforts to improve power distribution and protection, especially in rural and suburban areas.

The Rest of Japan is projected to grow at a CAGR of 2.8% through 2035 in demand for switchgear. Smaller cities and rural areas are increasingly adopting advanced electrical systems, including switchgear, to improve power distribution and protect infrastructure. The growing shift toward renewable energy and energy-efficient systems in these regions contributes to the demand for reliable and durable switchgear solutions. As the region modernizes its energy infrastructure and increases its focus on energy security, the need for switchgear to integrate and manage renewable power continues to rise.

The demand for switchgear in Japan is driven by increasing electricity consumption and the need for resilient power infrastructure. As industries expand and urbanisation continues, there is growing investment in transmission and distribution systems to maintain grid stability and avoid outages. The drive to integrate renewable energy sources like solar and wind adds complexity to power networks, creating demand for switchgear that offers improved protection, control and monitoring. Smart grid initiatives and the replacement of ageing infrastructure further push adoption of more advanced switchgear technologies that support digitalisation and efficiency.

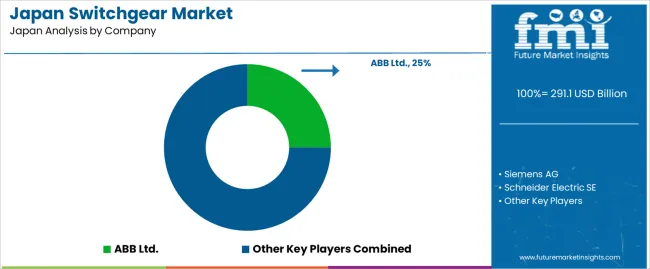

Key global companies active in Japan’s switchgear industry include ABB Ltd., Siemens AG, Schneider Electric SE, General Electric (GE) and Eaton Corporation. These firms supply a comprehensive range of low, medium and high voltage switchgear systems suited for utilities, industrial and commercial end users in Japan. They bring strong portfolios in digital monitoring, gas insulated switchgear and integrated control systems equipped to meet Japan’s technical and regulatory requirements. Their presence and product offerings position them to shape how the switchgear sector evolves under Japan’s infrastructure modernisation trends.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| End Use | T&D Utilities, Industrial, Commercial, Residential |

| Component Types | Power Distributor Switch Breaker, Switch Disconnector, MCCB, HRC Fuse, Earth Switch |

| Voltage Types | Low Voltage (less than 1kV), Medium Voltage (1kV to 75kV), High Voltage (75kV to 230kV), Extra High Voltage (230kV to 500kV), Ultra-High Voltage (above 500kV) |

| Construction Types | Outdoor, Indoor, Others |

| Insulation Types | Air Insulated Switchgear, Gas Insulated Switchgear, Oil Insulated Switchgear, Vacuum Insulated Switchgear |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | ABB Ltd., Siemens AG, Schneider Electric SE, General Electric (GE), Eaton Corporation |

| Additional Attributes | Dollar by sales across product types, voltage types, insulation types, end users, and regional distribution; trends in grid modernization and renewable energy integration influencing adoption across Japan |

The demand for switchgear in Japan is estimated to be valued at USD 291.1 billion in 2025.

The market size for the switchgear in Japan is projected to reach USD 423.6 billion by 2035.

The demand for switchgear in Japan is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in switchgear in Japan are power distributor switch breaker, switch disconnector, mccb, hrc fuse and earth switch.

In terms of voltage type, low voltage (less than 1kv) segment is expected to command 37.2% share in the switchgear in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA