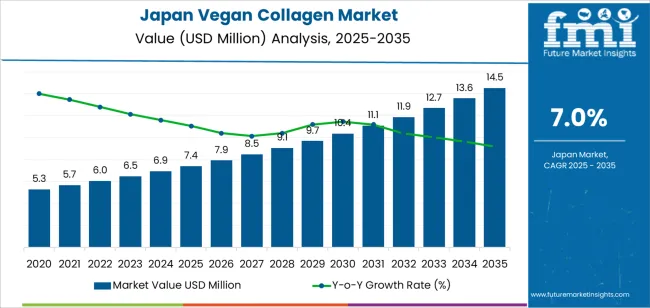

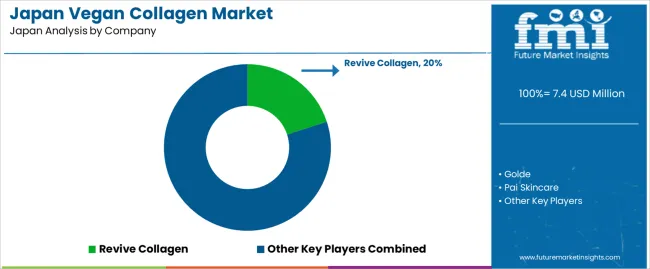

The Japan vegan collagen demand is valued at USD 7.4 million in 2025 and is forecasted to reach USD 14.5 million by 2035, corresponding to a CAGR of 7.0%. Demand is supported by the broader use of plant-derived functional ingredients in nutraceuticals, beauty-from-within formulations, and specialty dietary supplements. Vegan collagen alternatives are produced without animal inputs and are used in skin-health, joint-support, and general wellness products. Their incorporation into powders, capsules, beverages, and fortified foods contributes to steady uptake across retail and e-commerce channels.

Algae-based collagen remains the leading source type. Its amino-acid profile, product stability, and suitability for clean-label formulations support wide use in supplement manufacturing. Algae-derived ingredients also align with preferences for plant-based materials and non-animal processing, which encourages adoption in premium nutritional products. Their compatibility with vitamin blends and antioxidant formulations supports continued inclusion in consumer health portfolios.

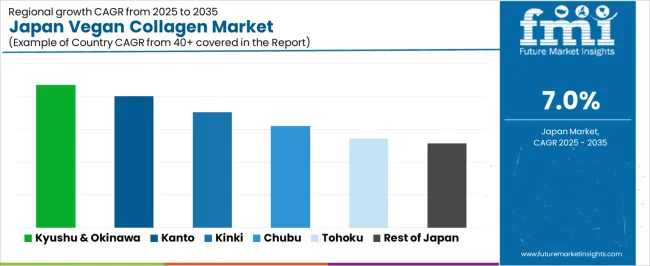

Kyushu & Okinawa, Kanto, and Kinki register the strongest demand due to concentrated sales of dietary supplements, high urban purchasing power, and established distribution networks for health and wellness products. These regions also host manufacturers and contract formulators that integrate plant-based collagen into functional nutrition lines. Revive Collagen, Golde, Pai Skincare, Unived, SMPNutra, and Olena Health are the principal suppliers. Their portfolios include algae-based collagen formulations, plant-derived protein blends, and wellness supplements developed for skin support and daily nutritional routines.

The growth contribution index shows that early contributions from 2025 to 2029 are led by dietary-supplement manufacturers and functional-food producers incorporating plant-derived collagen alternatives into beauty-from-within and joint-support formulations. Early growth is supported by steady uptake among consumers seeking non-animal ingredients, along with expanding use of algae-based and fermentation-derived collagen analogues in capsules, powders, and ready-to-mix products. These applications form the core early contribution base.

Between 2030 and 2035, contributions broaden as cosmetic-ingredient suppliers, beverage formulators, and wellness brands integrate vegan collagen into skin-health products and fortified drinks. Late-period gains are shaped by better bioavailability data, improved process yields in microbial-fermentation systems, and wider product placement across retail and e-commerce channels. Incremental contributions arise from growing use in hybrid formulations that combine collagen analogues with vitamins, minerals, and botanical extracts. The contribution pattern reflects an early phase centred on supplements and functional-nutrition products, followed by a later phase in which cosmetic and beverage applications strengthen their role, producing a balanced, multi-sector contribution to long-term growth across Japan’s vegan-collagen ecosystem.

| Metric | Value |

|---|---|

| Japan Vegan Collagen Sales Value (2025) | USD 7.4 million |

| Japan Vegan Collagen Forecast Value (2035) | USD 14.5 million |

| Japan Vegan Collagen Forecast CAGR (2025 to 2035) | 7.0% |

Demand for vegan collagen in Japan is increasing as consumers shift toward plant-based and cruelty-free beauty and wellness products. Many users seek alternatives to animal-derived collagen due to ethical concerns, allergic reactions or dietary restrictions, which boosts interest in vegan or lab-grown collagen formulations. Growth in personal-care and nutraceutical categories, especially among younger adults who value clean-label ingredients and sustainability, supports industry expansion.

The mature Japanese skincare industry emphasizes anti-ageing, skin elasticity and wellness trends, which aligns with the functional positioning of vegan collagen supplements and topical products. E-commerce, social-media influence and advances in biotechnology also make these products more visible and accessible. Constraints include higher pricing of vegan collagen compared with conventional sources, limited long-term clinical data for certain plant-based or recombinant formats, and cautious regulatory or consumer acceptance in some segments. Some brands may delay full launch until product claims, supply-chain transparency and cost parity improve.

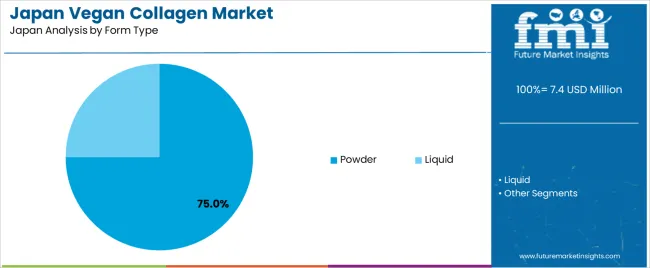

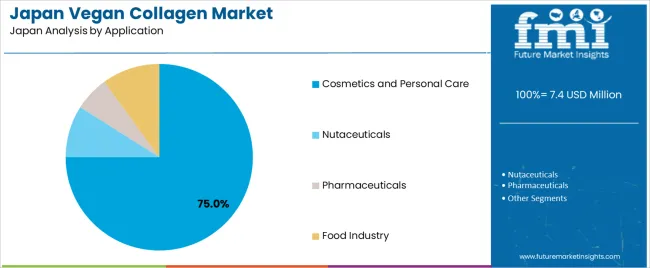

Demand for vegan collagen in Japan reflects interest in plant-derived functional ingredients used across beauty, nutrition, and wellness applications. Source-type preferences relate to nutrient composition, extraction efficiency, and compatibility with formulation processes. Form-type distribution corresponds to consumer convenience, solubility needs, and product-development choices. Application patterns show how cosmetic, nutraceutical, pharmaceutical, and food sectors incorporate vegan collagen into topical and ingestible products.

Algae-derived collagen holds 35.0% of national demand and represents the leading source type. Algae provide polysaccharide structures and amino-acid compositions suited to topical and ingestible formulations requiring plant-based collagen analogues. Fruit-based sources account for 29.0%, supporting antioxidant-rich extracts used in beauty and wellness products. Vegetable-derived sources represent 26.0%, contributing fibre-rich matrices that support collagen-mimicking formulations. Other sources hold 10.0%, including emerging botanical materials used for specialised blends. Source-type distribution reflects extraction efficiency, active-compound stability, and compatibility with Japanese cosmetic and nutraceutical product lines.

Key drivers and attributes:

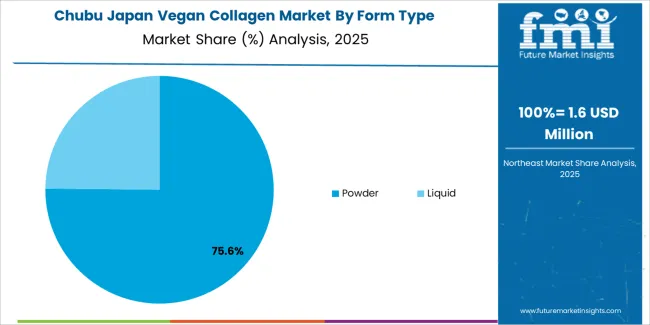

Powdered vegan collagen holds 75.0% of national demand and represents the dominant form type. Powders support flexible dosing, stable shelf life, and integration into beauty supplements, functional beverages, and food applications. Liquid formats account for 25.0%, used in ready-to-drink products, concentrated boosters, and cosmetic-serum formulations requiring rapid absorption. Form-type distribution reflects differences in storage, solubility, and formulation compatibility across Japan’s consumer-health and personal-care sectors. Producers adopt powder formats for ease of transport and long-term stability, while liquid forms support targeted applications in premium skincare and functional beverages.

Key drivers and attributes:

Cosmetics and personal care hold 75.0% of national demand and form the leading application segment. Vegan collagen is used in creams, serums, masks, and haircare formulations that emphasise plant-derived actives and hydration support. Nutraceuticals represent 9.0%, incorporating vegan collagen into functional supplements aimed at beauty-from-within products. Food-industry applications account for 10.0%, supporting functional beverages and fortified foods. Pharmaceuticals represent 6.0%, using plant-derived collagen analogues in emerging formulations requiring biocompatibility. Application distribution reflects Japan’s strong personal-care sector and preference for botanical-based skincare ingredients.

Key drivers and attributes:

Growth in ecofriendly beauty preferences, rising interest in plant-based supplements, and ageing population wellness focus are driving demand.

In Japan, demand for vegan collagen products is increasing as beauty- and wellness-oriented consumers seek alternatives to animal-derived supplements. The growing awareness of ecofriendly, cruelty-free formulations and clean-label ingredients supports interest in vegan collagen. Since Japan has a large ageing population, many consumers are searching for nutraceuticals and skincare supplements that support skin health, elasticity and joint wellness without animal sourcing. Brands are responding with formulations based on plant proteins, algae-derived ingredients and microbial fermentation that appeal to vegan, vegetarian and flexitarian segments.

Cost premium, limited consumer understanding and regulatory classification challenges restrain broader adoption.

Vegan collagen tends to carry a higher price point than conventional bovine or marine-derived collagen supplements, which may limit uptake among cost-sensitive consumers. Some consumers in Japan remain unfamiliar with the concept of vegan collagen and may question its efficacy compared with traditional collagen sources, which slows trial and repeat purchase. Regulatory scrutiny around supplement claims and sourcing can also complicate product approvals and marketing in the Japanese industry, increasing risk and moderating growth.

Expansion of premium vegan nutraceuticals, collaboration between beauty and supplement brands, and increased digital direct-to-consumer models define trends.

Manufacturers and brands in Japan are launching vegan collagen supplements that combine skin-beauty benefits, anti-ageing claims and plant-based credentials to appeal to younger and wellness-focused consumers. Beauty brands are partnering with nutraceutical firms to integrate vegan collagen into skincare routines and ingestible supplements, bridging internal and external beauty categories. Online and direct-to-consumer channels are expanding, enabling brands to reach niche vegan audiences, communicate product purity and source transparency, and offer subscription models tailored for repeat users. These trends support steady growth in vegan collagen demand in Japan’s beauty and wellness industry.

Demand for vegan collagen in Japan is rising through 2035 as consumers seek plant-derived, fermentation-based, and allergen-free alternatives to traditional collagen. Growth is influenced by expanding interest in clean-label personal care, ethical sourcing preferences, and the integration of vegan collagen into beauty supplements, functional beverages, and topical skincare. Domestic brands and manufacturers adopt fermentation-derived collagen to support product differentiation and compliance with evolving sustainability expectations.

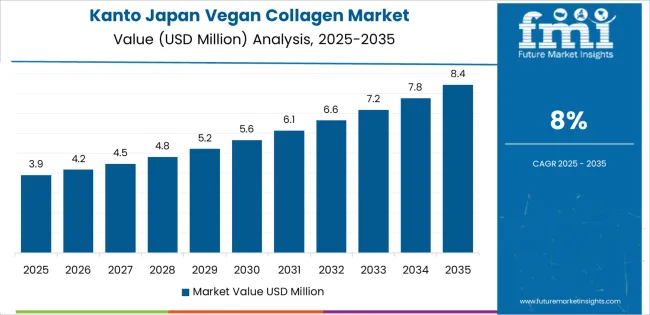

Online retail platforms accelerate awareness across younger demographics, while established beauty and wellness companies add vegan collagen lines to meet emerging consumer preferences. Kyushu & Okinawa lead with 8.7%, followed by Kanto (8.0%), Kinki (7.0%), Chubu (6.2%), Tohoku (5.4%), and the Rest of Japan (5.2%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 8.7% |

| Kanto | 8.0% |

| Kinki | 7.0% |

| Chubu | 6.2% |

| Tohoku | 5.4% |

| Rest of Japan | 5.2% |

Kyushu & Okinawa grow at 8.7% CAGR, supported by strong consumer interest in natural beauty ingredients, regional production of plant-based supplements, and active wellness tourism. Manufacturers in Fukuoka and Kagoshima incorporate fermentation-derived collagen peptides into beauty drinks, gummies, and supplement powders. Retailers across urban centers promote vegan collagen products alongside broader plant-based nutrition categories. Wellness resorts in Okinawa offer vegan-collagen-enhanced beverages and skincare formulations to health-focused visitors. University-linked research groups in Kyushu continue exploring plant and microbial sources of collagen alternatives, supporting domestic innovation.

Kanto grows at 8.0% CAGR, driven by dense consumer industries, strong health and beauty retail ecosystems, and high adoption of functional supplements across Tokyo, Kanagawa, and Saitama. Beauty brands integrate vegan collagen into premium skincare lines and liquid supplements targeting anti-aging and hydration claims. Online marketplaces accelerate awareness among younger consumers seeking ethical, animal-free products. Food and beverage companies experiment with vegan-collagen-infused drinks and nutritional formulations. R&D centers across Tokyo collaborate with biotechnology firms exploring microbial-collagen production to support future expansion.

Kinki grows at 7.0% CAGR, supported by wellness-oriented consumers, beauty-product retailers, and manufacturing activity across Osaka, Kyoto, and Hyogo. Local supplement brands introduce vegan collagen powders and capsules targeting hydration and skin elasticity. Retail pharmacies promote plant-derived collagen products within functional nutrition shelves. Skincare manufacturers adopt fermentation-derived collagen for serums and creams requiring stable, high-purity ingredients. Wellness communities across Kyoto and Nara increasingly integrate vegan collagen into everyday nutrition routines.

Chubu grows at 6.2% CAGR, shaped by manufacturing capabilities, functional-food development, and regional consumer interest across Aichi, Shizuoka, and Gifu. Food and beverage companies integrate vegan-collagen ingredients into health drinks, nutritional jellies, and fortified snacks. Supplement manufacturers adopt plant-based collagen formulations to expand clean-label product lines. Beauty retailers highlight vegan collagen in anti-aging and hydration-focused categories. Local biotechnology firms explore microbial fermentation methods to improve ingredient quality and stability.

Tohoku grows at 5.4% CAGR, supported by rising interest in natural dietary supplements, regional wellness programs, and broader availability of plant-derived collagen products across Miyagi, Fukushima, and Akita. Consumers adopt vegan collagen powders and drinks for daily beauty routines. Pharmacies and regional retailers add vegan-collagen categories to meet increasing demand for clean-label formulations. Food producers explore collagen-infused beverages for local industries. Although adoption is slower than in major metropolitan regions, steady growth reflects expanding awareness and product availability.

The Rest of Japan grows at 5.2% CAGR, supported by gradual expansion of plant-based product lines, increased availability of vegan collagen in pharmacies, and rising interest in ethical beauty across smaller cities and towns. Consumers use vegan collagen in powder, capsule, and drink formats for routine health and beauty goals. Local supplement makers introduce limited-edition formulations targeting hydration and elasticity. Although industry penetration is lower than in large urban centers, consistent demand from health-conscious consumers drives steady uptake.

Demand for vegan collagen in Japan is shaped by a group of beauty-nutrition and plant-based supplement developers supplying functional beverages, capsules, and powdered formulations. Revive Collagen holds the leading position with an estimated 20.0% share, supported by controlled plant-derived peptide formulations, consistent product solubility, and strong placement within beauty-supplement channels. Its position is reinforced by predictable flavour stability and reliable supply suited to Japan’s appearance-focused wellness segment.

Golde and Pai Skincare follow as significant participants. Golde supplies plant-based collagen blends characterised by stable dispersibility and clean-label ingredient profiles aligned with Japanese consumer preferences. Pai Skincare maintains a presence through plant-derived ingestible products positioned for skin-health routines that emphasise gentle formulations and traceable botanical sourcing. Unived contributes capability with vegan collagen boosters containing amino-acid structures designed to support collagen synthesis pathways, offering consistent composition and compatibility with daily supplementation habits.

SMPNutra supports mid-scale brands through contract manufacturing of vegan collagen products, providing stable formulation control, batch consistency, and efficient production turnaround. Olena Health adds further depth with plant-based collagen products tailored to wellness-driven consumers seeking predictable daily-use performance.

Competition across this segment centres on amino-acid profile accuracy, formulation stability, clean-label compliance, bioavailability, and reliable sensory characteristics. Demand continues to expand as Japanese consumers focus on plant-based beauty nutrition, favour products with traceable botanical origins, and adopt vegan collagen formulations as part of established skin- and wellness-support routines.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Source Type | Fruit, Vegetables, Algae, Others |

| Form Type | Powder, Liquid |

| Application | Cosmetics and Personal Care, Nutaceuticals, Pharmaceuticals, Food Industry |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Revive Collagen, Golde, Pai Skincare, Unived, SMPNutra, Olena Health |

| Additional Attributes | Dollar sales by source type, form type, and application categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of vegan collagen and plant-derived peptide producers; developments in algae-based collagen synthesis, fermentation-derived collagen alternatives, and clean-label personal care ingredients; integration with beauty supplements, topical skincare formulations, functional foods, and pharmaceutical-grade nutraceutical products in Japan. |

The demand for vegan collagen in Japan is estimated to be valued at USD 7.4 million in 2025.

The market size for the vegan collagen in Japan is projected to reach USD 14.5 million by 2035.

The demand for vegan collagen in Japan is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in vegan collagen in Japan are fruit, vegetables, algae and others.

In terms of form type, powder segment is expected to command 75.0% share in the vegan collagen in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA