The jojoba oil market is expanding at a robust pace, supported by the growing consumer preference for natural and sustainable cosmetic ingredients. Derived from the seeds of the jojoba plant, the oil’s structural similarity to human sebum has increased its use in skincare, haircare, and pharmaceutical applications.

Market growth is further driven by rising awareness of clean beauty products and the shift away from synthetic emollients and mineral oils. The current market environment reflects strong demand from both personal care brands and industrial users seeking bio-based lubricants and functional additives.

Favorable agricultural conditions in key producing regions and advancements in cold-press extraction have improved yield and quality consistency. With sustainability and transparency becoming core purchase drivers, jojoba oil continues to gain traction across diverse end-use segments, ensuring a positive long-term outlook.

| Metric | Value |

|---|---|

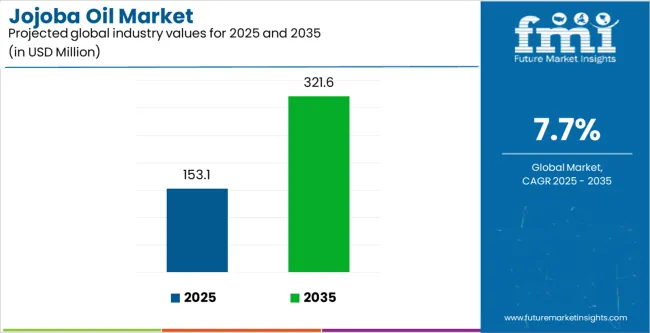

| Jojoba Oil Market Estimated Value in (2025 E) | USD 153.1 million |

| Jojoba Oil Market Forecast Value in (2035 F) | USD 321.6 million |

| Forecast CAGR (2025 to 2035) | 7.7% |

The market is segmented by Type, Application, and Sales and region. By Type, the market is divided into Cold Pressed and Refined. In terms of Application, the market is classified into Cosmetics And Personal Care, Pharmaceutical, Industrial, and Others. Based on Sales, the market is segmented into B2B and B2C. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

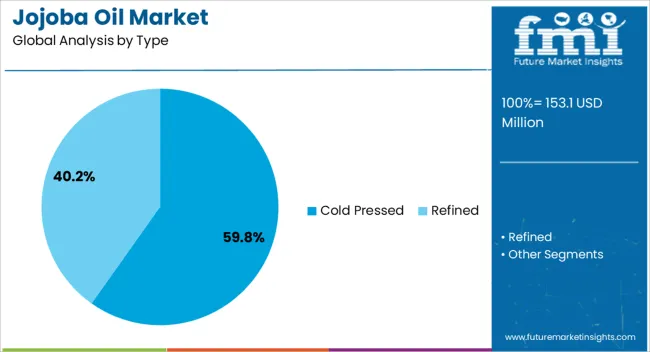

The cold pressed segment dominates the type category with approximately 59.8% share, owing to its superior purity and nutrient retention compared to refined alternatives. Cold pressing preserves the oil’s natural antioxidants, vitamins, and fatty acid composition, making it highly valued in cosmetic and therapeutic formulations.

The segment’s growth is reinforced by consumer demand for minimally processed, eco-friendly products with high efficacy. Increasing adoption in organic and premium skincare lines has elevated market positioning.

As manufacturers emphasize clean-label sourcing and sustainable production methods, the cold pressed segment is projected to sustain its leadership in the global jojoba oil market.

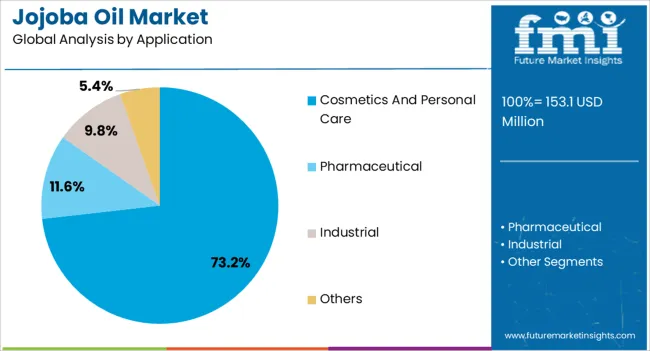

The cosmetics and personal care segment accounts for approximately 73.2% share in the application category, reflecting its dominance in driving jojoba oil consumption. The oil’s non-comedogenic and moisturizing properties make it a preferred ingredient in lotions, serums, and hair conditioners.

Rising consumer awareness of natural formulations and expanding product portfolios by beauty brands have reinforced growth. The segment also benefits from increasing global spending on skincare and haircare products, particularly in emerging economies.

With manufacturers prioritizing botanical ingredients for their multifunctional benefits, jojoba oil’s role in the cosmetics and personal care segment is expected to remain pivotal in the forecast period.

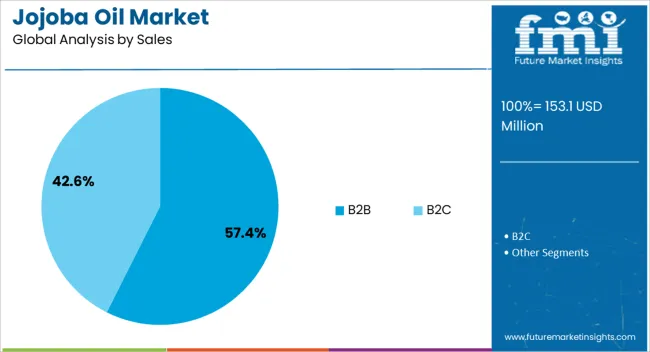

The B2B segment leads the sales category with approximately 57.4% share, driven by bulk procurement from cosmetic, pharmaceutical, and industrial manufacturers. Large-scale purchasing ensures cost efficiency and consistent supply for formulation purposes.

The segment benefits from established trade networks connecting raw material suppliers to processing industries across North America, Europe, and Asia-Pacific. As sustainability certifications gain importance in ingredient sourcing, B2B buyers increasingly favor traceable, ethically produced jojoba oil.

With expanding partnerships between growers and end-product manufacturers, the B2B segment is anticipated to maintain its market dominance in the coming years.

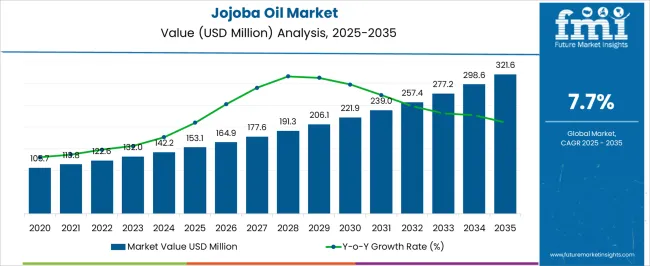

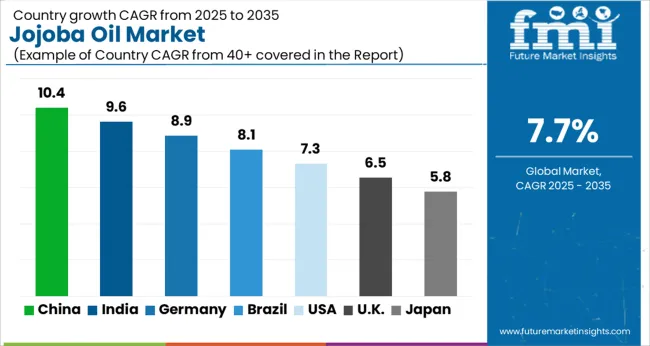

The scope for jojoba oil rose at a 9.2% CAGR between 2020 and 2025. The global market for jojoba oil is anticipated to grow at a moderate CAGR of 7.7% over the forecast period 2025 to 2035.

The market experienced steady growth during the historical period from 2020 to 2025, driven by increasing consumer awareness of natural and organic skincare products. Rising demand for jojoba oil in cosmetics, personal care products, and aromatherapy also contributed to market expansion during this period.

Growing interest in DIY beauty and wellness solutions fueled demand for jojoba oil as a versatile ingredient for homemade formulations. The clean beauty movement and preference for sustainable, ethically sourced ingredients further propelled the adoption of jojoba oil in skincare and haircare products.

Technological advancements in extraction and processing methods improved the efficiency and quality of jojoba oil production, making it more accessible to manufacturers and consumers.

Looking ahead to the forecast period from 2025 to 2035, the market is expected to witness significant growth. Continued growth of the jojoba oil market is anticipated as consumer demand for natural, plant based skincare ingredients persists. Expansion into emerging markets, particularly in Asia Pacific and Latin America, presents opportunities for market penetration and growth.

Innovation in product formulations, packaging, and distribution channels is anticipated to augment the market competitiveness and consumer engagement. Increasing adoption of jojoba oil in male grooming products and nutraceutical supplements diversifies market applications and revenue streams.

Collaboration and partnerships across industries enable market players to leverage synergies and explore new opportunities for product development and market expansion. Regulatory compliance and certification standards remain crucial for maintaining product quality, safety, and consumer trust in the jojoba oil market.

Jojoba oil production is subject to various factors such as climate conditions, pests, and agricultural practices. Fluctuations in supply due to these factors can affect market stability and pricing, impacting both suppliers and manufacturers.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by China and the United Kingdom. The countries are expected to lead the market through 2035.

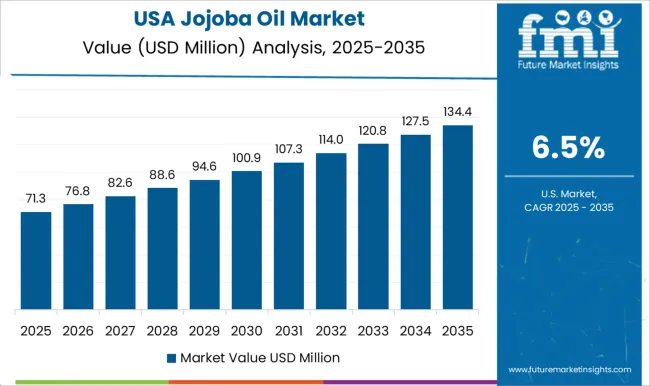

The jojoba oil market in the United States expected to expand at a CAGR of 7.9% through 2035. Consumers in the country are increasingly seeking natural and organic alternatives in their skincare, haircare, and personal care products. Jojoba oil, being a natural and plant based ingredient, aligns well with this trend. Its versatility and beneficial properties make it a popular choice for consumers looking for clean and sustainable beauty solutions.

Jojoba oil is known for its moisturizing, nourishing, and soothing properties, making it suitable for a variety of skincare applications. The demand for products containing jojoba oil is expected to grow, as consumers become more educated about skincare ingredients and their benefits.

The ability of Jojoba oil to mimic the natural oils of skin and its non comedogenic properties make it particularly attractive for individuals with sensitive or acne prone skin.

The jojoba oil market in the United Kingdom is anticipated to expand at a CAGR of 9.2% through 2035.The natural beauty market in the United Kingdom is expanding rapidly, driven by increasing consumer awareness of ingredient safety, concerns about synthetic chemicals, and the desire for sustainable products.

Jojoba oil, with its natural origin and minimal processing, is well suited to capitalize on this trend. Manufacturers and retailers are introducing more products containing jojoba oil to meet the demand for natural and organic beauty solutions. Companies in the United Kingdom are innovating with new product formulations and incorporating jojoba oil into a wide range of skincare, haircare, and cosmetic products.

From cleansers and moisturizers to hair serums and beard oils, jojoba oil adds value as a versatile and effective ingredient. Its compatibility with other ingredients and its ability to enhance product performance drive its inclusion in various formulations, contributing to market growth.

Jojoba oil trends in China are taking a turn for the better. A 13.4% CAGR is forecast for the country from 2025 to 2035. The influence of Western beauty trends is shaping consumer preferences in China, with more consumers seeking products that align with global beauty standards.

Jojoba oil, which is widely recognized in Western markets for its skincare benefits, is gaining popularity among Chinese consumers looking for effective and innovative beauty ingredients.

The Chinese skincare market is witnessing significant growth, driven by increasing focus of consumers on skincare and anti-aging solutions. The moisturizing, nourishing, and anti-aging properties of Jojoba oil make it a desirable ingredient in skincare products targeting hydration, rejuvenation, and wrinkle reduction.

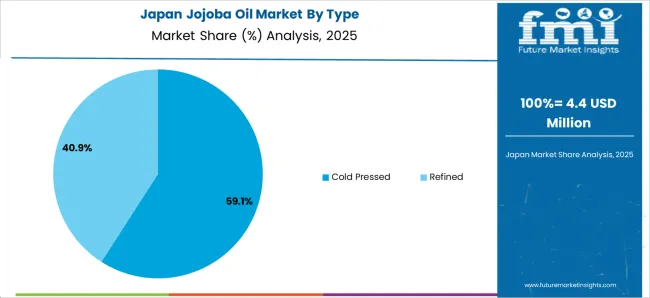

The jojoba oil market in Japan is poised to expand at a CAGR of 8.4% through 2035. Influencers, beauty bloggers, and social media platforms play a significant role in shaping consumer preferences and driving product trends in beauty market in Japan.

Jojoba oil has received positive attention from influencers and skincare experts for its nourishing and therapeutic properties. Endorsements and recommendations from influencers help raise awareness and generate interest in jojoba oil based products among Japanese consumers.

The availability of jojoba oil products through various distribution channels, including online retailers, specialty beauty stores, department stores, and drugstores, makes it accessible to consumers across Japan.

Manufacturers and retailers are expanding their distribution networks to reach new customers and capitalize on the growing demand for natural and premium beauty products, driving the growth of the jojoba oil market in Japan.

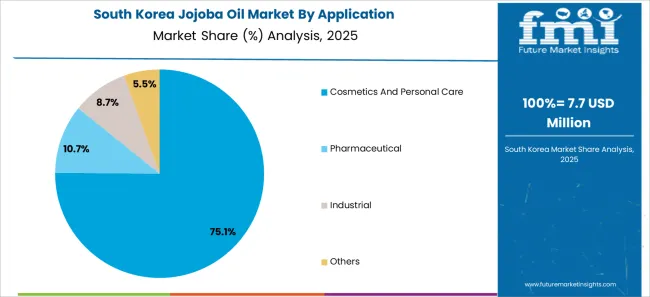

The jojoba oil market in Korea is anticipated to expand at a CAGR of 8.7% through 2035. Korean consumers favor lightweight and non greasy skincare formulations that absorb quickly into the skin without leaving a heavy or sticky residue.

The light texture and fast absorbing nature of Jojoba oil make it an ideal ingredient in moisturizers, serums, and essences designed for the Korean skincare routine. Its ability to provide intense hydration without feeling greasy appeals to consumers with oily or combination skin types.

Anti-pollution skincare has become a prominent trend in Korea, with growing concerns about environmental pollution and its impact on skin health. The protective properties of Jojoba oil help form a barrier on the surface of the skin, shielding it from environmental pollutants, free radicals, and UV radiation. Skincare products containing jojoba oil are marketed as effective solutions for combating pollution related skin damage and premature aging.

The below table highlights how cold pressed segment is projected to lead the market in terms of type, and is expected to account for a CAGR of 7.5% through 2035. Based on application, the cosmetics and personal care segment is expected to account for a CAGR of 7.4% through 2035.

| Category | CAGR through 2035 |

|---|---|

| Cold Pressed | 7.5% |

| Cosmetics and Personal Care | 7.4% |

Based on type, the cold pressed segment is expected to continue dominating the jojoba oil market. Cold pressed extraction involves pressing the jojoba seeds at low temperatures, typically below 120 degrees Fahrenheit, to extract the oil.

The gentle extraction process helps preserve the natural nutritional content of jojoba oil, including vitamins, minerals, and antioxidants. Consumers perceive cold pressed jojoba oil as a higher quality product with superior nutritional benefits, driving demand for this segment.

Cold pressed jojoba oil retains the natural aroma and flavor of the jojoba seeds, resulting in a more robust and authentic sensory experience compared to oils extracted using heat or chemicals. The distinct aroma and flavor profile of cold pressed jojoba oil appeal to consumers seeking premium and gourmet ingredients for culinary and cosmetic applications.

In terms of application, the cosmetics and personal care segment is expected to continue dominating the jojoba oil market. Jojoba oil is known for its exceptional moisturizing properties and its ability to mimic the natural sebum of skin. It penetrates deeply into the skin without clogging pores, making it suitable for all skin types, including oily and acne prone skin. The demand for moisturizing skincare products containing jojoba oil is driven by consumers seeking hydration, nourishment, and protection for their skin.

Jojoba oil possesses anti-inflammatory properties that help soothe and calm irritated or sensitive skin. It is commonly used in skincare formulations designed to alleviate redness, inflammation, and irritation caused by environmental stressors, allergies, or skin conditions such as eczema and psoriasis. The anti-inflammatory properties of jojoba oil contribute to its popularity in cosmetics and personal care products targeting sensitive or reactive skin.

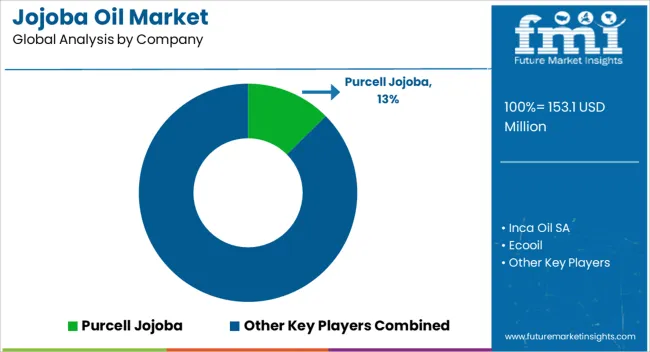

The competitive landscape of the jojoba oil market is characterized by several key players, ranging from large multinational corporations to small scale producers and distributors. The companies compete based on product quality, innovation, pricing, distribution networks, and marketing strategies.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 142.2 million |

| Projected Market Valuation in 2035 | USD 298.0 million |

| Value-based CAGR 2025 to 2035 | 7.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Type, Application, Sales, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Purcell Jojoba; Inca Oil SA; Ecooil;ConnOils LLC; Jojoba Naturals; JD Jojoba Desert; Hallstar; Nutrix International LLC; USA Organic Group Corp; OPW Ingredients GmbH |

The global jojoba oil market is estimated to be valued at USD 153.1 million in 2025.

The market size for the jojoba oil market is projected to reach USD 321.6 million by 2035.

The jojoba oil market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in jojoba oil market are cold pressed and refined.

In terms of application, cosmetics and personal care segment to command 73.2% share in the jojoba oil market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Jojoba Oil Infusions Market Size and Share Forecast Outlook 2025 to 2035

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA