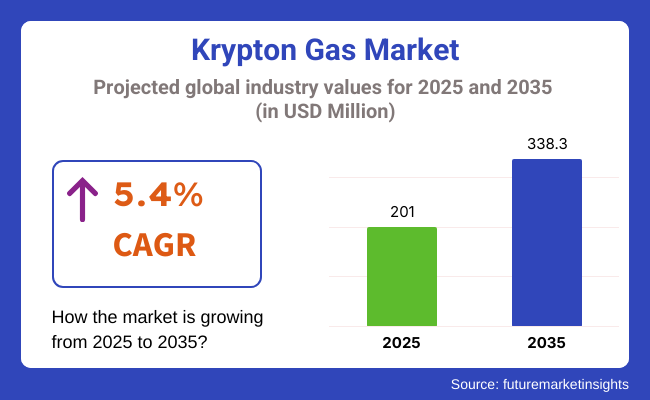

The global krypton gas industry is estimated at USD 201 million in 2025. A valuation of USD 338.3 million is projected by 2035, expanding at a CAGR of 5.4%. Growth is expected due to increased demand for inert noble gases in aerospace, semiconductor, and energy-efficient lighting applications.

Semiconductor manufacturers have been increasingly adopting krypton for deep ultraviolet (DUV) lithography processes. This trend was reinforced in 2025 by announcements from Applied Materials, which confirmed ongoing integration of krypton in photolithography systems to improve pattern resolution. Additionally, the company’s 2025 investor briefing noted that “demand for high-purity rare gases remains critical to advancing node scaling and chip production efficiency.”

Aerospace engineering has witness growing utilization of krypton in ion propulsion systems for satellites. Aerojet Rocketdyne in a 2024 technical update emphasized krypton’s “cost-efficiency and adequate thrust performance for low-Earth orbit satellite missions,” positioning it as a viable alternative to xenon. Lockheed Martin has reportedly expanded procurement contracts for krypton-based propulsion components to support its next-generation satellite fleet.

In lighting, demand has been sustained by applications in high-performance halogen and HID lamps. Ushio Inc., a Japan-based lighting manufacturer, disclosed in its 2025 annual bulletin that krypton-filled lamps continued to outperform standard halogen bulbs in luminous efficacy and service life. The company noted a 7% year-over-year growth in sales of krypton-based products across North America and Europe.

While the market outlook remains optimistic, several challenges persist. Supply limitations from traditional extraction sources such as air separation units have kept krypton prices volatile. In a 2024 sustainability report, Air Liquide acknowledged variability in krypton yields as “a constraint that necessitates innovation in gas recovery and purification technologies.” The firm has since invested in automated cryogenic separation units to enhance yield predictability and reduce losses.

Technological advancements are mitigating these constraints. The introduction of modular gas recovery systems in semiconductor fabs has been adopted in South Korea and Taiwan, where krypton recovery efficiency has been raised by over 18%, according to technical disclosures by Samsung’s gas utilities division in early 2025.

Geographically, Asia Pacific has emerged as a potential region for krypton gas demand due to the expansion of electronics manufacturing clusters and government incentives for clean satellite propulsion. The region’s share in global consumption is projected to exceed 35% by 2030, driven by aggressive investments from national space programs and consumer electronics firms.

The Krypton gas supply industry will continue to rely on several types of delivery modes between 2025 and 2035 to meet the specific supply needs of each type of industry. Cylinders will continue to play an essential role for small to medium volume industries such as lighting and laboratories, where portability, flexibility and ease of transport are required. They will acquire a industry share of approximately 50% in 2025.

Bulk and microbulk delivery systems will become more common in places where such large, stable gas supplies are needed, such as semiconductor manufacturing and aerospace. The systems will then be optimised to become more efficient, lowering logistical expenses as well as waste. Drum tanks are also likely to serve as crucial stabilizers for industries requiring these moderate gas volumes, maintaining relevance in lasers and high-tech manufacturing.

The trend towards environmental sustainability will drive drum tank technology innovation to reduce environmental impact. Additionally, in-situ supply systems will grow in prominence, particularly in applications that have continuous, high-pressure, high-precision gas delivery requirements, such as aerospace and medical technology, while providing continuous, high-quality supply for large-scale operations.

The use of Krypton gas across multiple industries will rise substantially during the forecast period. Krypton is anticipated to have advanced energy-efficient technologies, which would improve the performance of various specialized light bulbs and lamps, helping relevant sustainability goals. Its advanced lighting technology will enable new levels of commercial, residential, and industrial lighting systems.

In windows, Krypton’s superior thermal insulating properties will successfully challenge more entrenched technologies like Argon as regulations around energy consumption grow stricter. Windows demand for Krypton, especially as green building take hold. Windows is likely to hold a industry share of nearly 55% in 2025.

In lasers, Krypton will continue to play a critical role in precision and efficient operation, leading to its wider use in the medical, communication and defence technologies. In addition to this, the other category will also observe development and expansion into emerging sectors such as aerospace, quantum computing, and advanced manufacturing. Krypton will have more specialised roles in the other areas as new technologies will arise, like sensors, scientific research, and space exploration, that will lead to an overall growth in the industry.

| Countries/Region | Regulations/Policies Impacting Krypton Gas |

|---|---|

| United States | Environmental regulations under the Clean Air Act affect the production of Krypton, especially concerning its byproduct emissions. - Export controls on certain gases used in national security technologies, including Krypton. |

| European Union | EU REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations govern the use of Krypton in various industries. - Strict environmental guidelines limit emissions from gas production plants. |

| China | China’s Environmental Protection Law enforces stricter standards on the gas production industry, including rare gases like Krypton. - Export restrictions on certain gases, especially for high-tech and military applications, impact Krypton trade. |

| Russia | National regulations control the extraction and export of rare gases, with a focus on strategic technologies using Krypton. - Production facilities are subject to emissions standards under Russia’s environmental laws. |

| India | Limited regulations on the production and export of Krypton, but growing interest in controlling environmental impact from gas-related industries. - Export restrictions are imposed for specific uses in national defense and technology. |

| Japan | Japan has regulations on the handling of noble gases, focusing on minimizing environmental damage. - Export controls limit Krypton supply to certain high-tech sectors, especially in optics and aerospace. |

| 2020 to 2024 (Past Trends) | 2025 to 2035 (Future Outlook) |

|---|---|

| Market Demand: Stable demand, primarily from semiconductor manufacturing, aerospace, lighting (energy-efficient bulbs), and lasers/fiber optics. | Market Demand Growth: Increased demand, particularly from cutting-edge sectors like quantum computing, telecommunications (laser technologies), aerospace, and medical fields. |

| Supply Chain Disruptions: The COVID-19 pandemic and geopolitical tensions led to production interruptions and logistical delays, affecting availability and distribution. | Supply and Production Innovations: New extraction and production methods likely to emerge to meet rising demand. Investment in gas recycling and alternative production sources. |

| Geopolitical and Economic Factors: Trade restrictions, regulatory changes (particularly in China, the USA, and Europe), and geopolitical uncertainties impacted Krypton exports. | Geopolitical Stability and Trade: Potential improvement in international cooperation due to greater interdependence in high-tech sectors. Trade agreements may ease Krypton flow. |

| Technological Advancements: Demand for Krypton in lasers, high-tech communication systems, and optical applications increased as industries pursued precision and efficiency. | Diversified Applications: New applications in energy storage, advanced manufacturing, and medical technologies. Increased use of precision equipment as industries advance further. |

| Environmental Considerations: Regulatory pressures on emissions and environmental impact increased in line with global environmental awareness, influencing production methods. | Environmental Regulations: Stricter global environmental regulations will drive the adoption of sustainable production methods and more efficient technologies. |

The USA industry for Krypton gas has huge industry from cities, water resources protection, light illumination, and so on. Demand for more sustainable technologies and green building practices will lead to Krypton's energy-efficient windows industry growth.

Krypton demand will also increase due to the focus of the USA government on adopting advanced technologies such as quantum computing, high-precision lasers, etc. The country’s industry is likely to acquire a market share of nearly 25% in 2025. However, regulations around trade and the environment will also influence supply and demand and whether the USA industry will be competitive but sustainable,

Krypton gas will have a steady demand in various sectors of Germany. The country’s focus towards sustainability and green building regulations is likely to drive the industry for Krypton in windows to enhance thermal insulation. The country is a leader in high-tech manufacturing. The country will continue to see increasing demand for Krypton for use in laser technologies, scientific research, defense, and aerospace applications.

Further, there were innovations in gas production that will be largely determined by a country's energy policies and will aim to reduce environmental impact. Germany’s role in the EU guarantees compliance with strict environmental regulations, which further drives the industry. The country’s sector is expected to acquire a industry share of nearly 10% in 2025.

The demand for Krypton gas in Japan will be driven by its emphasis on precise technologies in the automotive, semiconductor, and laser industry s. As such, Krypton has a growing demand in laser applications (especially medical and communication) along with the country's ongoing growth in high-tech sectors.

The government’s ambitious plans for energy efficiency will help Japanese lighting and construction technologies, including Krypton-powered windows. Moreover, with the investment of Japan in space exploration and advanced technological systems, the demand will also continue to rise in the aerospace sector, which would, in turn, propel the demand for Krypton gas applications. Japan’s Krypton gas industry will have a industry share of approximately 2.9% by 2025.

The substantial growth of China's Krypton gas industry is primarily driven by the accelerating industrialization and technological development in the country. The industry will move at a CAGR of 6% in the upcoming decade.

Demand will be driven by the expanding semiconductor industry, which relies on Krypton in multiple manufacturing methods. Increased uptake of Krypton in windows due to China’s adoption of green building technologies and energy efficiency measures.

The country’s broad aerospace efforts, along with those in lasers and quantum technologies, will add to the demand for Krypton. Trade regulations and environmental policies may influence market dynamics, but China's ability to organize the production at scale means there will be a consistent supply for growing demand.

As energy-efficient lighting, windows and advanced technologies become more widely used, the UK Krypton gas industry will steadily expand in the United Kingdom. The demand of the industry will be driven by its emphasis on building sustainability and moving toward greener building material in the country. It is expected to spur the adoption of Krypton-filled windows for better insulation. The Krypton gas industry of the United Kingdom will move at a CAGR of 4.4% through 2035.

Moreover, the UK’s robust presence in aerospace, defense, and medical sectors will keep Krypton in high demand across niche uses such as lasers. The UK’s commitment to limit carbon emissions and compliance with EU-derived legislation will further support the industry for Krypton for a wide range of high-tech applications.

Moderate growth in the Indian Krypton gas industry will be largely attributed to growing demand from the semiconductor sector, medical technologies, and energy-efficient building technologies. India is a densely populated country. Struggling space and growing urbanisation require glass that helps conserve energy, leading to greater vexation for Krypton.

The expansion of advanced industries such as lasers, sensors, and communications technology will also drive demand for Krypton. While regulatory structures are still evolving, the rising focus in India on sustainable development and tech innovations will enable the adoption of Krypton across multiple use cases. India’s krypton gas industry will expand at a CAGR of 6.2% through the forecast period.

Australia's Krypton gas industry will register high growth as the nation concentrates on developing sustainable structures and energy-efficient technologies. The country has a industry share of nearly 5% in 2025.

Demand for Krypton in windows will hike up as government regulations promote the use of energy-efficient materials in the construction sector. Krypton will be used in high-precision applications, enabled by the country’s aerospace and defense sectors, as well as improvements in medical and laser technologies.

As Australia progressively adheres to global sustainability standards, the need for Krypton in green technology, such as windows and lighting, would rise, thereby supporting the industry growth.

The krypton gas industry's development is conditioned by the state of the global economy, technological evolution, increased industrial demand, and sustainability, among others. Demand for Krypton gas, especially among industries like semiconductor manufacturing, aerospace, and medical technologies, which require precision, will increase further among these industries as they grow.

The growing emphasis on energy-efficient and sustainable building practices will continue to drive demand for Krypton, especially in applications such as insulation in energy-efficient windows. The market is transforming sustainability, catalysed by stringent environmental policies that drive energy-efficient technology adoption in the lighting and construction segments.

This trend is aligned with the macroeconomic objectives of reducing carbon footprints and enabling energy efficiency. Meanwhile, the growth of high-tech segments, such as lasers and quantum computing, is driving up the importance of Krypton in specific applications.

Although supply chain disruptions and geopolitical tension can provide their challenges, technological advancements in production and recycling will drive the industry, resulting in a stable outlook for the Krypton gas industry over the forecasted years.

Technological advancements and sustainability initiatives fuel the growth opportunities in the Krypton gas industry. Krypton will continue to play a fundamental role in energy-efficient windows and specialized light bulbs as the need for energy-efficient solutions in lighting and building materials surges.

Moreover, high-tech sectors like aerospace, healthcare technology and semiconductors are expected to increase demand for Krypton, which is used in precision applications including lasers and manufacturing processes. Specialized technologies - such as quantum computing, space exploration and the like - also have huge growth potential for Krypton.

An important factor, with sustainability trends, will drive Krypton integration into construction, including green building practices and energy-efficient insulation solutions. It has a growing potential in industrialization and urbanisation (especially in Asia and Africa).

Strategically, corporations should seek to invest in new production technologies to meet the growing demand and facilitate greater productivity in their supply chains. They will focus on securing a steady demand through partnerships with industries such as aerospace and construction.

Emerging industry s will also be necessary to address new growth, especially in the case of developing infrastructure. Therefore, adapting to changing regulations and focusing on sustainable practices may enable companies to succeed in a industry place that increasingly values both environmental consciousness and innovation.

The industry is relatively fragmented, with both large multinational companies as well as some plants focused on Krypton gas. The markets are concentrated, with global producers like Linde, Air Products and Chemicals and Praxair controlling the industry to varying degrees by the use of their extended distribution networks, investment in technology and access to significant resources.

These Businesses also serve in high-volume needs for traditional enterprise-scale High Volume Manufacturing (HVM) applications. On the other hand, there are a high number of regional suppliers, especially in Asia and Europe, covering niche sectors and other applications including laser technology, medical equipment and energy efficiency. This fragmentation enables smaller players to cater to niche or high-end industry s, while the large players benefit from economies of scale.

The krypton gas industry saw significant consolidation in 2024, with major players strengthening their positions through strategic acquisitions. Air Liquide (21% industry share) acquired TechGas Specialties for €78 million, gaining proprietary purification technology. Linde plc (19%) purchased Singapore-based NoblePure to enhance its semiconductor industry presence and later merged its specialty gases division with its electronics business unit.

Air Products (16%) secured a 60% stake in South Korean distributor KryptonX, strengthening its Asian foothold. Messer Group (12%) expanded European operations by acquiring Regional Gas Works' Polish krypton facilities and completed the integration of three smaller distributors.

Matheson Tri-Gas (9%) purchased PureNobel's Japanese purification facilities, bolstering its high-purity capabilities. Other notable developments included a Blackstone-led consortium acquiring Ukrainian producer IceKrypton, Air Liquide forming a joint venture with SemiTech Industries for semiconductor applications, and a Chinese state-affiliated group purchasing a 25% stake in a former Gazprom-owned producer.

These movements reflect the industry's focus on semiconductor applications, regional consolidation, and vertical integration strategies to secure a position in this specialized industry.

The krypton gas industry witnessed several strategic partnerships in 2024 as companies aimed to strengthen market positions without full acquisitions. industry leader Air Liquide (21%) formed a joint development alliance with MedTech Imaging to advance krypton-based medical diagnostics technologies.

Linde plc (19%) established a strategic partnership with GlassTech, China's largest window manufacturer, securing preferential krypton supply agreements for premium insulated units. Air Products (16%) collaborated with Samsung Electronics on ultra-high-purity krypton for advanced semiconductor fabrication.

Messer Group (12%) joined forces with European research consortium CERN to develop specialized krypton applications for particle physics. Matheson Tri-Gas (9%) partnered with Tokyo Electron to co-develop krypton-based etching processes for next-generation chip manufacturing.

Additionally, a consortium of smaller regional producers formed the Global Krypton Alliance to collectively enhance distribution capabilities and compete with industry giants, particularly in emerging industries across Southeast Asia and Eastern Europe.

Krypton gas is mainly used in energy-efficient lighting, insulation for windows, lasers, and various high-tech applications like aerospace and semiconductor manufacturing.

The largest consumers of Krypton include the lighting industry, the construction sector (for energy-efficient windows), aerospace, semiconductor manufacturing, and medical sectors (particularly in laser technologies).

Krypton is primarily produced through the fractional distillation of liquefied air, a process that separates gases based on their boiling points.

Krypton’s excellent thermal insulation properties make it ideal for filling the gaps between panes in energy-efficient windows, improving energy savings and reducing heating and cooling costs.

Krypton is generally considered a non-toxic and safe gas, but its production and handling require careful management to minimize environmental impact.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Kilograms) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Supply Mode, 2018 to 2033

Table 4: Global Market Volume (Kilograms) Forecast by Supply Mode, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Kilograms) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Kilograms) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Supply Mode, 2018 to 2033

Table 10: North America Market Volume (Kilograms) Forecast by Supply Mode, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Kilograms) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Kilograms) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Supply Mode, 2018 to 2033

Table 16: Latin America Market Volume (Kilograms) Forecast by Supply Mode, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Kilograms) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Kilograms) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Supply Mode, 2018 to 2033

Table 22: Europe Market Volume (Kilograms) Forecast by Supply Mode, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Kilograms) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Kilograms) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Supply Mode, 2018 to 2033

Table 28: Asia Pacific Market Volume (Kilograms) Forecast by Supply Mode, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Kilograms) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Kilograms) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Supply Mode, 2018 to 2033

Table 34: MEA Market Volume (Kilograms) Forecast by Supply Mode, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Kilograms) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Supply Mode, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Kilograms) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Supply Mode, 2018 to 2033

Figure 9: Global Market Volume (Kilograms) Analysis by Supply Mode, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Supply Mode, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Supply Mode, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Kilograms) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Supply Mode, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Supply Mode, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Kilograms) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Supply Mode, 2018 to 2033

Figure 27: North America Market Volume (Kilograms) Analysis by Supply Mode, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Supply Mode, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Supply Mode, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Kilograms) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Supply Mode, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Supply Mode, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Kilograms) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Supply Mode, 2018 to 2033

Figure 45: Latin America Market Volume (Kilograms) Analysis by Supply Mode, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Supply Mode, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Supply Mode, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Kilograms) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Supply Mode, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Supply Mode, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Kilograms) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Supply Mode, 2018 to 2033

Figure 63: Europe Market Volume (Kilograms) Analysis by Supply Mode, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Supply Mode, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Supply Mode, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Kilograms) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Supply Mode, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Supply Mode, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Kilograms) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Supply Mode, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Kilograms) Analysis by Supply Mode, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Supply Mode, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Supply Mode, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Kilograms) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Supply Mode, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Supply Mode, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Kilograms) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Supply Mode, 2018 to 2033

Figure 99: MEA Market Volume (Kilograms) Analysis by Supply Mode, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Supply Mode, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Supply Mode, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Kilograms) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Supply Mode, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA