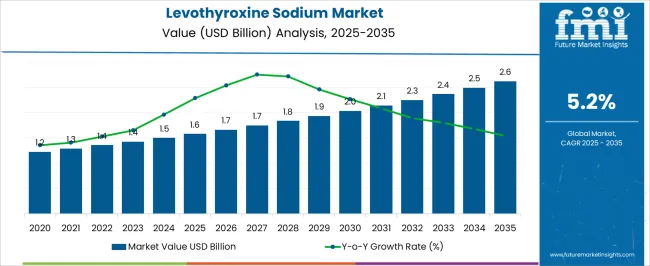

The Levothyroxine Sodium Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Levothyroxine Sodium Market Estimated Value in (2025 E) | USD 1.6 billion |

| Levothyroxine Sodium Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Levothyroxine Sodium market is experiencing sustained growth, driven by the increasing prevalence of hypothyroidism and other thyroid-related disorders across both developed and emerging regions. In 2025, growing awareness of thyroid health, combined with routine screening programs, is facilitating early diagnosis and treatment, thereby increasing demand for Levothyroxine Sodium. The market is being shaped by ongoing improvements in formulation stability, patient compliance strategies, and the expansion of healthcare infrastructure.

Oral therapy remains the mainstay of treatment due to its ease of use, predictable absorption, and long-standing clinical acceptance. Additionally, patient education initiatives and the availability of generic alternatives have enhanced accessibility, particularly in regions with high unmet medical needs.

The focus on personalized dosing and improved monitoring of thyroid hormone levels is also supporting the adoption of Levothyroxine Sodium As populations age and thyroid disorders become more prevalent, demand is expected to remain robust, with opportunities for manufacturers to optimize formulation technologies and distribution networks to meet growing clinical and commercial requirements.

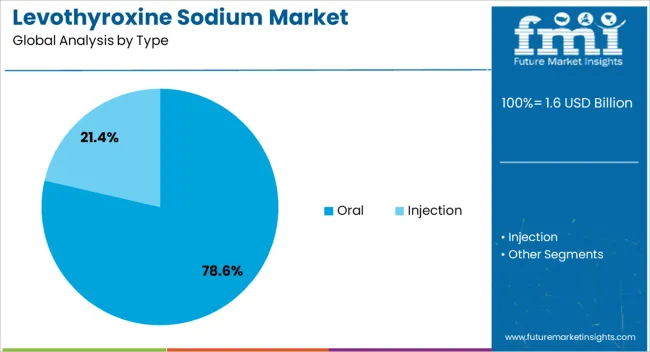

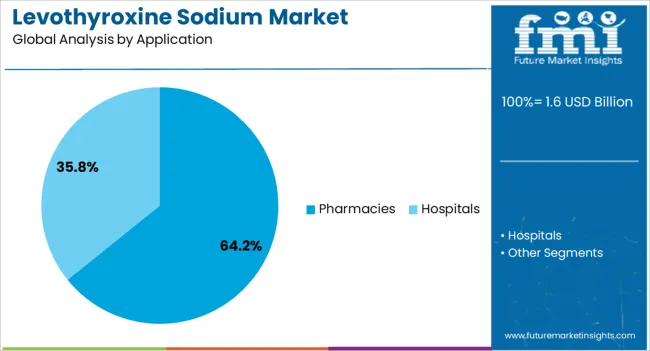

The levothyroxine sodium market is segmented by type, application, and geographic regions. By type, levothyroxine sodium market is divided into Oral and Injection. In terms of application, levothyroxine sodium market is classified into Pharmacies and Hospitals. Regionally, the levothyroxine sodium industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oral type segment is projected to hold 78.60% of the Levothyroxine Sodium market revenue share in 2025, making it the leading form of administration. This leadership is being attributed to the convenience and familiarity of oral tablets, which allow for precise dosing adjustments according to patient-specific thyroid hormone levels. The segment has benefitted from the well-established efficacy and safety profile of oral therapy, which has been validated through decades of clinical use.

Adoption has been further supported by patient preference, as oral tablets are easy to self-administer and integrate into daily routines, thereby improving adherence. The availability of multiple strengths and generic options has expanded accessibility, particularly in regions with high patient volumes.

Healthcare providers favor oral formulations for their stability, reproducibility, and ability to provide predictable pharmacokinetic profiles, which are critical for long-term management of thyroid disorders The continued focus on adherence monitoring, dose optimization, and patient convenience is expected to sustain the oral segment’s leading position in the market over the coming years.

The pharmacy application segment is expected to account for 64.20% of the total Levothyroxine Sodium market revenue in 2025, emerging as the dominant distribution channel. This leading position is being supported by the widespread availability of Levothyroxine Sodium through retail and hospital pharmacies, ensuring rapid and convenient access for patients.

The segment’s growth has been reinforced by established supply chains, strong pharmacist-patient engagement, and counseling programs that enhance adherence and proper usage. Pharmacies provide a trusted environment for dispensing and patient education, particularly in outpatient care settings where thyroid hormone monitoring is routine.

The ability to offer multiple brands and strengths within a single location has further strengthened this segment, allowing for tailored therapy according to individual patient needs As awareness regarding thyroid health continues to increase and routine monitoring becomes more common, pharmacies are expected to remain the preferred point of access for Levothyroxine Sodium, providing both convenience and reliable support for patients managing chronic thyroid disorders.

Levothyroxine sodium is a narrow therapeutic range, the effect of which significantly depends on its level of potency or bioavailability. Administering a drug product of lesser potency or bioavailability to a patient who has conditions controlled by other products, could result in a suboptimal response and hypothyroidism. On the other hand, drug with higher potency could result in a noxious manifestation of hyperthyroidism, including cardiac arrhythmia, palpitations, and cardiac pain, thereby, making its significantly important to administer just the right dose of levothyroxine sodium to patients with coronary heart disease. Lowest effective dose of levothyroxine must be titrated to lower the risk of osteoporosis—a condition mostly found in woman.

Treatment of hypothyroidism or underactive thyroid disease remains the single largest application of levothyroxine sodium—with treatment goals to correct catabolic imbalances and reverse clinical progressions. As per the American Association of Clinical Endocrinologists (AACE), of nearly 27 million people suffering from various thyroid disorders, most people suffer from hypothyroidism—autoimmune thyroiditis and odine deficiency being the most common causes. An increase in demand for levothyroxine to treat thyroid cancer, apart from decreasing the size of an enlarged thyroid gland, could drive up the sales of levothyroxine sodium products in the coming years.

Mostly used under the branded umbrella of Synthyroid, that received its FDA-Approved status only in 2002, the food and drug regulatory body also considers generic levothyroxine drugs to be as effective as the branded ones. Moreover, the American Thyroid Association (ATA) has found no better thyroid hormone replacements than levothyroxine, thereby, supplementing to the higher global adoption of levothyroxine sodium. The thyroid association, in its guidelines for treating underactive thyroid gland, confirms that levothyroxine sodium (brand or generics) would remain the most preferred treatment choice for hypothyroidism. Moreover, as per ATa's task force on thyroid replacement, alternative preparations including levothyroxine–including liothyronine combination therapy, or thyroid extract therapy, or others were not found to have any superior finding compared to levothyroxine monotherapy, making it the most preferred hypothyroidism treatment arrangement.

FDA imposes tight regulations on oral levothyroxine sodium products—that have been plagued by potency and stability problems. In a recent development, the food and drug regulatory body alerted API distributor, repackagers, compounders, and finished drug manufacturers pertaining to the recall of porcine thyroid API- a product of Sichuan Friendly Pharmaceutical Co. Limited, based in China, in the wake of unreliable quality API. The FDA laboratory found inconsistent levels of active ingredients—levothyroxine and liothyronine—leading to permanent health conditions, if used. In a subsequent development, Westminster Pharmaceuticals recalled its unexpired lot of levothyroxine and liothyronine as a precautionary measure as some of its products were made manufacturers using Sichuan Friendly Pharmaceutical Co. Limited's active ingredients.

Considering that the efficiency of hypothyroidism adequately depends on the dosage of levothyroxine sodium—which requires adjustments annually, arising from lack of medication persistence, dosage errors, changes in dietary habits, body mass, and medical conditions, and use of concomitant medications, studies indicate that oral absorption of levothyroxine could remain inefficient by foods including coffee beverages, certain foods, and drug. Researchers have found that hypothyroid patients treated with levothyroxine sodium gel capsules may experience less thyroid hormone fluctuations compared to levothyroxine tablets.

From the formulations standpoints, another study indicates that patients with suboptimal TSH on tablet LT4, could significantly improving the TSH levels by switching to liquid formulation of levothyroxine sodium, wherein the dosage remains unchanged.

Changeover to liquid formulations have been suggested considering the reduced efficacy of levothyroxine (LT4) owing to factors such as intestinal disorders, gastric diseases, and concomitant intake of some drugs that might interfere with the absorption of levothyroxine. Apart from formulations, dosage timings of levothyroxine sodium- mornings of bed time- is studied to show a substantial improvement in the thyroid improvement level, with changes in the serum lipid level.

Although organ transplantation remains the most preferred treatment for end-stage organ diseases, suitable organ donors often fail to meet the perquisites of organ transplantation. Hemodynamic, endocrine, and metabolic instabilities, in brain dead cases, often translate into potential organs being lost. Vasopressors are often used to battle hemodynamic instability—often a resultant of low thyroxine levels, and present cardiovascular collapse. High dosage of vasopressors are required to retrieve organs fit for transplantation. Research indicates that administering intravenous bolus of levothyroxine sodium in brain dead patients could significantly reduce vasopressor in patients. Nearly all organ procurement organizations in US are presently using levothyroxine in varying measures.

Lannett Company, Inc. and Amneal Pharmaceuticals recently entered a distribution agreement, with Amneal taking over marketing and distribution of Lannett's Levothyroxine sodium tablets, effective from December 1, 2025 till the mid-March 2025. In another development, Amneal recently announced a 10-year license and supply agreement with Jerome Stevens Pharmaceuticals, Inc. for the former's levothyroxine sodium tablets, beginning March 23, 2025.

For a detailed analysis of the competitive landscape, write to our expert analysts at press@futuremarketinsights.com or media@persistencemarketresearch.com

The research report on levothyroxine sodium presents a comprehensive analysis, assaying some key aspects including market dynamics, segmentation analysis, and coopetition profiling. Apart from the historical data analysis, the report on levothyroxine sodium also highlights present growth, year-on-year growth, and forecast—providing a better understanding of the levothyroxine sodium market.

Apart from an in-depth analysis of the key market dynamics shaping the growth trajectory of levothyroxine sodium market, the report also offers an elaborate segmental analysis, on the basis of Disease Indication, covering, Hypothyroidism, Thyroid Cancer, Myxedema Coma, and Goiter.

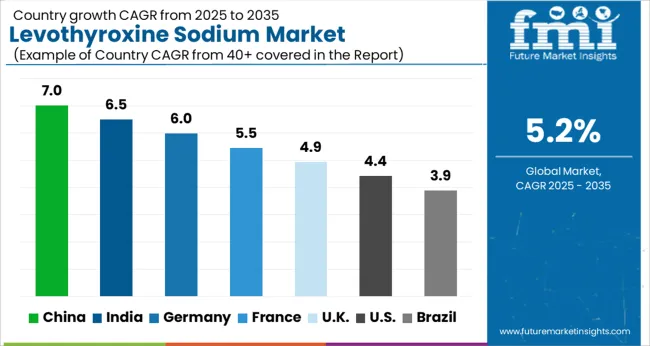

| Countries | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The Levothyroxine Sodium Market is expected to register a CAGR of 5.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.0%, followed by India at 6.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.9%, yet still underscores a broadly positive trajectory for the global Levothyroxine Sodium Market.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.0%. The USA Levothyroxine Sodium Market is estimated to be valued at USD 593.0 million in 2025 and is anticipated to reach a valuation of USD 913.9 million by 2035. Sales are projected to rise at a CAGR of 4.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 74.4 million and USD 54.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Type | Oral and Injection |

| Application | Pharmacies and Hospitals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

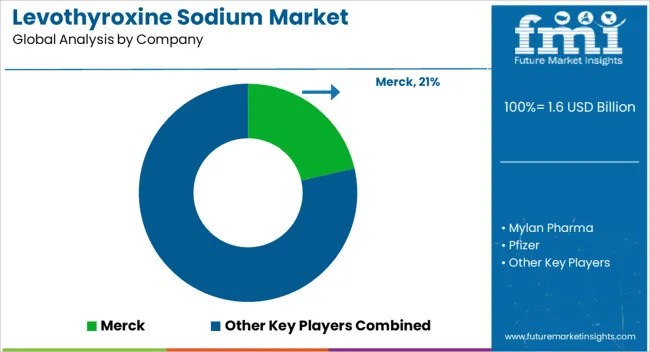

| Key Companies Profiled | Merck, Mylan Pharma, Pfizer, Lannett Company, Novartis, Fresenius Kabi, IBSA, and Piramal Critical Care |

The global levothyroxine sodium market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the levothyroxine sodium market is projected to reach USD 2.6 billion by 2035.

The levothyroxine sodium market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in levothyroxine sodium market are oral and injection.

In terms of application, pharmacies segment to command 64.2% share in the levothyroxine sodium market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium Bisulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Formate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Borohydride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caprylate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Caseinate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Iodide Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauryl Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Cumenesulfonate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Stearoyl Lactate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Hydrosulfite Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium-Ion Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sodium Hyaluronate Crosslinked Market Size and Share Forecast Outlook 2025 to 2035

Sodium Sulfur Batteries Market Size and Share Forecast Outlook 2025 to 2035

Sodium Malate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Thiosulphate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Lauroyl Isethionate Market Size and Share Forecast Outlook 2025 to 2035

Sodium Metasilicate Pentahydrate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA