The mycelium foam trays market will grow from USD 1.5 billion in 2025 to USD 2.8 billion by 2035, at a CAGR of 6.6%. The mycelium foam trays market is being shaped by rising interest in fungal-based packaging across Asia Pacific, Europe, and North America. Growth from 2025 to 2035 is supported by the expanding use of mycelium structures, which offer thermal stability, low weight, and natural biodegradability, making them strong contenders against EPS and PU foam trays. Asia Pacific is well-positioned to dominate production, driven by active materials research in China, India, and South Korea, as well as the expansion of regional food-service and retail packaging units. South Korea is set to post the highest CAGR at 7.2%, supported by its strong bioprocessing base and rapid commercialization of engineered mycelium blends.

Between 2025 and 2030, advances in 3D-grown mycelium trays are expected to improve design flexibility, helping manufacturers in China and India scale custom shapes for e-commerce and protective food packaging. Europe will maintain leadership in regulatory direction, with Germany, the Netherlands, and France pushing strict compostability validation and reinforcing quality standards for fungal-based materials. The United States will focus on performance stability and thermal control for chilled and fresh food categories. Market momentum is driven by cross-regional production shifts, growth in natural-material engineering, and country-level preference for cleaner, non-synthetic packaging formats.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.5 billion |

| Industry Value (2035F) | USD 2.8 billion |

| CAGR (2025 to 2035) | 6.6% |

From 2020 to 2024, mycelium-based materials transitioned from niche innovation to mainstream adoption. Major packaging manufacturers integrated compostable mycelium foams into protective and food-grade trays. By 2035, the market will reach USD 2.8 billion as global brands commit to eliminating non-biodegradable packaging. Asia-Pacific will serve as a high-volume manufacturing hub, while North America and Europe drive R&D in functional biofoam composites and scalable growth technologies.

Market growth is driven by environmental legislation against plastics, rising demand for sustainable packaging, and advancements in biofabrication. Mycelium foam trays offer moisture resistance, structural strength, and full compostability, ideal for perishable goods and retail packaging. Brand sustainability targets and government initiatives continue to accelerate their commercial adoption.

The market is segmented by material type, tray type, manufacturing process, end-use industry, and region. Materials include pure mycelium foam, mycelium-plant fiber blends, mycelium-paper pulp composites, and mycelium-biopolymer hybrids. Tray types include food service trays, produce trays, meat and poultry trays, electronics protection trays, and industrial trays. Manufacturing processes comprise molded mycelium forming, pressed mycelium sheets, and 3D-grown mycelium structures. End-use industries include food & beverages, retail & e-commerce, electronics, industrial goods, and healthcare.

Pure mycelium foam is projected to hold 37.9% of the market in 2025, driven by its low density, insulation capability, and complete biodegradability. It serves as a viable alternative to expanded polystyrene (EPS) in food and protective packaging, offering both strength and compostability.

Its natural resilience ensures product protection during transport while meeting sustainability mandates. As brands phase out petroleum-based foams, pure mycelium foam has emerged as the preferred substrate for eco-conscious packaging. Continuous R&D into controlled growth techniques enhances scalability and consistency in commercial production.

Food service trays are expected to capture 40.6% of the market in 2025, supported by rising demand from restaurants, meal delivery platforms, and institutional catering. These trays combine heat resistance, moisture balance, and premium aesthetics suited for ready-to-eat and takeaway applications.

Their compostable nature and compatibility with automated filling systems enhance convenience and reduce plastic waste. Regulatory pressure to replace single-use plastics strengthens adoption in quick-service and premium dining segments. As food delivery and sustainability converge, food service trays maintain market leadership.

Molded mycelium forming is projected to account for 39.2% of the market in 2025, driven by its ability to deliver consistent shapes and dimensions. The process minimizes material waste while producing durable, customizable trays suitable for high-speed packaging lines.

It allows integration with advanced molds and automated presses for efficient batch production. Manufacturers leverage this method to achieve lightweight yet sturdy structures for hot and cold food applications. As industrial-scale compostable packaging gains traction, molded mycelium forming remains the preferred production approach.

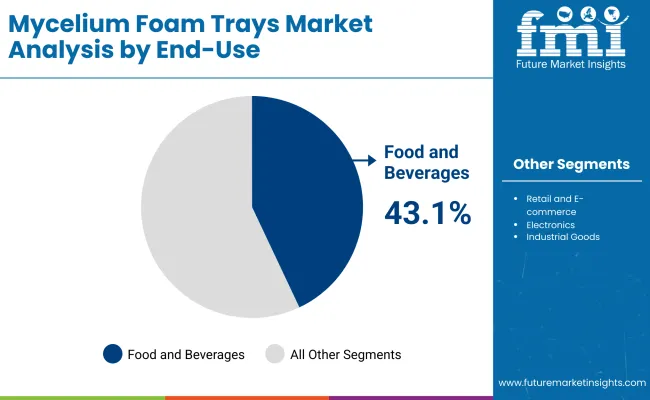

The food and beverage sector is expected to dominate with 43.1% of the market in 2025, propelled by global restrictions on EPS and expanded sustainability commitments from major food chains. Mycelium trays support compostable packaging goals while maintaining functionality and appearance.

Retailers and meal delivery operators are increasingly sourcing renewable trays for portioned meals and takeaway offerings. Adoption aligns with circular economy initiatives and waste reduction targets. As consumer preference for biodegradable packaging accelerates, food and beverages remain the leading end-use industry for mycelium foam trays.

The market is primarily driven by the global ban on single-use plastics and the rapid shift toward sustainable, fiber-based packaging. Rising corporate ESG commitments are accelerating the replacement of plastic coatings with renewable nanocellulose alternatives. Demand from food and consumer goods sectors for recyclable, compostable, and high-barrier materials continues to boost market expansion.

Growth is restrained by higher production and processing costs compared to conventional polymer coatings. Limited availability of water-resistant nanocellulose formulations reduces usability in high-moisture environments. Scalability challenges, along with the lack of standardized performance testing, further delay mass commercialization in cost-sensitive markets.

Emerging agro-residue fibers and automated forming technologies are unlocking new avenues for innovation. Integration of nanocellulose with bio-based or mineral fillers is enhancing barrier performance while supporting recyclability. Expanding R&D in bio-coating technologies offers manufacturers the chance to meet sustainability targets without compromising functionality or aesthetics.

The market is witnessing a shift toward bamboo and cellulose blend coatings for improved strength and flexibility. Lightweight packaging designs and wet-molding automation are optimizing efficiency and reducing production waste. Ongoing development of multi-functional coatings; combining oxygen, grease, and moisture resistanceis setting new standards for next-generation sustainable packaging.

The global mycelium foam trays market is expanding steadily as sustainability standards and biodegradable materials gain commercial traction. Asia-Pacific leads the market with cost-efficient manufacturing, industrial scalability, and government-backed innovation in bio-packaging. North America prioritizes product certification, safety compliance, and performance testing for food-grade packaging. Meanwhile, Europe drives adoption through strong regulatory frameworks and circular economy initiatives promoting compostable, bio-based materials. Integration of mycelium composites into mainstream packaging continues to accelerate across food service, retail, and logistics sectors.

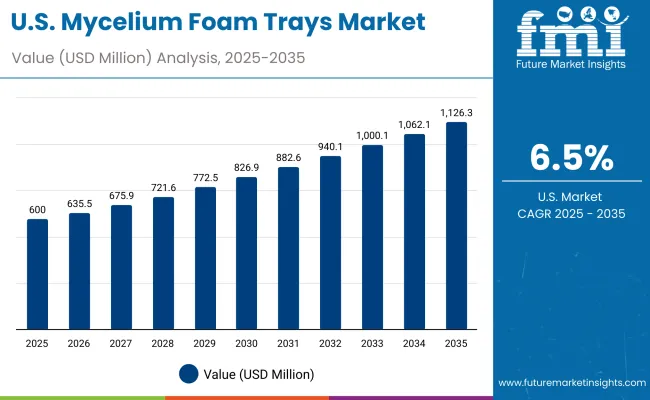

The USA will grow at 6.5% CAGR, driven by partnerships between bio-packaging startups and major food manufacturers. Rapid expansion of food-grade mycelium tray adoption supports sustainability targets across grocery and delivery chains. Increased investment in hybrid biofoam and composite R&D enhances the performance and scalability of eco-friendly packaging.

Germany will expand at 6.3% CAGR, supported by national composting initiatives and EU recycling directives. Mycelium-based composites are replacing plastic clamshells in fresh produce and deli packaging. Integration of biodegradable trays into established food packaging infrastructure reinforces circular economy objectives.

The UK will grow at 6.4% CAGR, propelled by the rise of eco-friendly retail and meal delivery packaging. Innovation in reusable mycelium tray coatings extends shelf life and product protection. Cross-industry partnerships are enhancing supply chain access to certified, eco-labeled packaging materials.

China will grow at 6.4% CAGR, underpinned by strong government incentives for biodegradable materials and circular manufacturing. Domestic bio-packaging startups are scaling rapidly, supported by high-capacity mycelium cultivation facilities. Exports of affordable, compostable trays are strengthening China’s global position in sustainable packaging markets.

India will grow at 6.3% CAGR, driven by sustainability initiatives across the food delivery and catering industries. Local production under the "Make in India" framework enhances accessibility and cost competitiveness. The hospitality sector’s shift toward eco-safe tableware further supports the transition from plastic to mycelium foam trays.

Japan will grow at 7.1% CAGR, leading innovation in automated, precision-molded bio-tray manufacturing. The nation’s emphasis on clean-label retail packaging has accelerated adoption of mycelium-based food containers. Integration of robotics and quality control systems enhances production consistency and export potential.

South Korea will lead with 7.2% CAGR, driven by heavy R&D investment in hybrid biofoam systems. The electronics and food sectors are key demand contributors, leveraging high-strength and lightweight properties of mycelium composites. Exports of advanced bio-packaging machinery further enhance the country’s regional dominance.

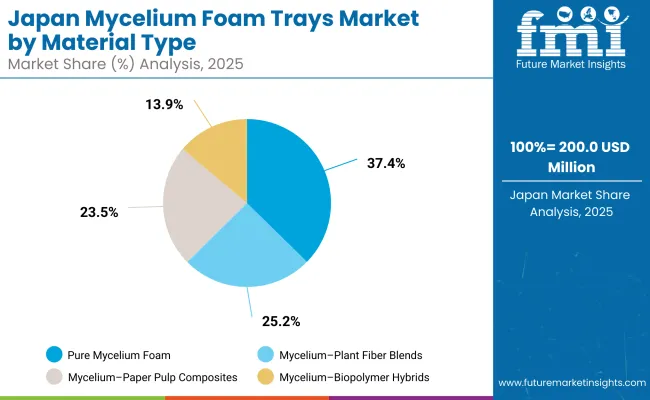

Japan’s mycelium foam trays market, valued at USD 200million in 2025, is dominated by pure mycelium foam, accounting for 36.9% share owing to its biodegradability and cushioning properties. Mycelium-plant fiber blends enhance structural strength, while mycelium-paper pulp composites improve formability. Mycelium-biopolymer hybrids cater to high-moisture packaging needs in premium food applications.

South Korea’s mycelium foam trays market, worth USD 100million in 2025, is led by food service trays, capturing 42.6% share driven by restaurant and ready-meal packaging adoption. Produce trays support fresh food logistics, while meat and poultry trays ensure contamination-free packaging. Electronics protection trays gain traction for sustainable shock absorption.

The market is moderately fragmented with leading players including Ecovative Design, GROWN bio, Mushroom Packaging, Magical Mushroom Company, Ferrier Industrial, Mushroom Material, Shroompac, PackagingBee, Mycelium Inspired, and BIOHM. Companies focus on biofabrication efficiency, compostable tray certifications, and hybrid fiber-mycology innovation.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion (2025) |

| By Material Type | Pure Mycelium Foam, Mycelium-Plant Fiber Blends, Mycelium-Paper Pulp Composites, Mycelium-Biopolymer Hybrids |

| By Tray Type | Food Service, Produce, Meat & Poultry, Electronics, Industrial |

| By Manufacturing Process | Molded Forming, Pressed Sheets, 3D-Grown Structures |

| By End-Use Industry | Food & Beverages, Retail & E-commerce, Electronics, Industrial, Healthcare |

| Key Companies Profiled | Ecovative Design, GROWN bio, Mushroom Packaging, Magical Mushroom Company, Ferrier Industrial, Mushroom Material, Shroompac, PackagingBee, Mycelium Inspired, and BIOHM |

| Additional Attributes | Market driven by plastic alternatives, circular economy initiatives, and bio- molding automation |

The market is valued at USD 1.5 billion in 2025, supported by increased adoption of compostable trays.

The market will reach USD 2.8 billion by 2035, driven by biofabrication advancements and regulatory compliance.

The market is forecast to expand at a CAGR of 6.6% during the study period.

Pure Mycelium Foam dominates with a 37.9 % share, favored for strength and compostability.

The Food and Beverage sector leads with a 43.1% share, driven by bans on plastic and demand for biodegradable trays.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mycelium Packaging Market Size and Share Forecast Outlook 2025 to 2035

Mycelium Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Mycelium Leather Market Trends & Industry Growth Forecast 2024-2034

Foam Type Vacuum Gripping System Market Size and Share Forecast Outlook 2025 to 2035

Foam Mixing Machine Market Size and Share Forecast Outlook 2025 to 2035

Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Granulate Market Size and Share Forecast Outlook 2025 to 2035

Foam Plastics Market Size and Share Forecast Outlook 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Market Size and Share Forecast Outlook 2025 to 2035

Foamer Pump Market Size, Share & Forecast 2025 to 2035

Foam Food Container Market Size and Share Forecast Outlook 2025 to 2035

Foam Mesh Sleeves Market Growth - Demand & Forecast 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Foamer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA