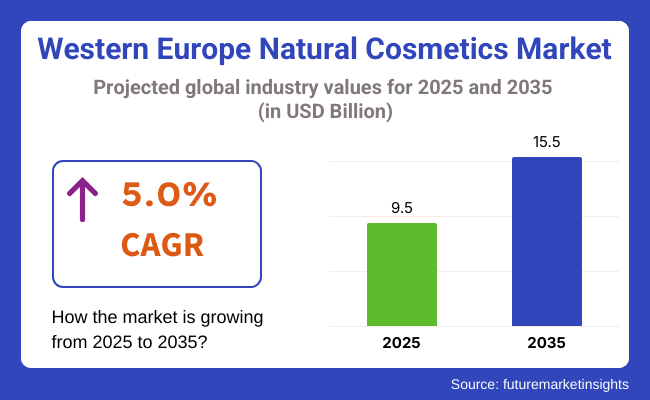

The Europe Natural Cosmetics Market was valued at USD 21.6 billion in 2025 and is projected to grow with a 6.4% CAGR from 2025 to 2035. The regional industry valuation will be USD 40.0 billion in 2035. A major growth driver is the trend across Europe toward clean-label, ethically sourced beauty products with strong consumer values in terms of wellness and sustainability.

Europe is at the forefront of the natural cosmetics trend, and Germany, France, and the Scandinavian nations are at the forefront of the demand. Consumers are embracing plant-based ingredients, minimal chemical processing, and cruelty-free status. EU-wide schemes for regulation, such as the Cosmetics Regulation (EC) No. 1223/2009, provide a scheme and strict foundation for safety and transparency, which provides the European marketplace with a maturity advantage over other marketplaces.

Consumer health and environmental sensitivity are making brands think out of the box with biodegradable packaging, waterless formats, and multifunctional products. European consumers are also growing more interested in dermatologically approved, allergen-free products, which have hurried product R&D in botanicals and bioactives that are sustainably sourced from European and worldwide ecosystems.

Online channels are revolutionizing natural cosmetics sales and marketing in Europe. Direct-to-consumer channels and social media influencers are leaders in building trust and community. It is key among millennials and Gen Z, who dominate Berlin, Paris and Stockholm city regions. They expect ethical sincerity and instantaneous access to a brand's values.

Throughout the forecast period, Europe Natural Cosmetics Market companies are looking beyond clean beauty to embrace regenerative business practices. These include carbon-neutral production, closed-loop supply chains and ethical partnerships for sourcing, all of which align with the European Union's Green Deal aspirations and broader consumer agendas.

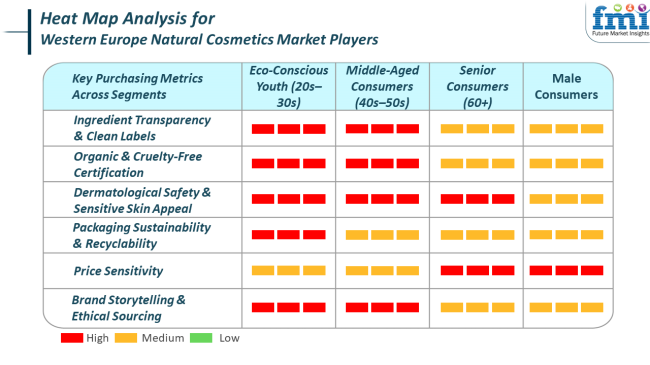

In Europe, consumer trends reflect strong cross-sector demand for safety, efficacy, and sustainability. Segments like healthcare and environmental monitoring prioritize formulations with proven dermatological benefits and minimal ecological impact. Regulatory compliance within the EU further intensifies product scrutiny, ensuring that only rigorously tested and safely manufactured goods reach European shelves.

European buyers place significant emphasis on ingredient transparency and functional efficacy. Accuracy in labeling-especially around allergen declarations, organic certifications, and eco-claims-is paramount to maintaining consumer trust. As such, brand success in Europe increasingly hinges on scientific credibility and full traceability across the value chain.

While natural cosmetics typically command a premium price in Europe, especially in regions like France and the Netherlands, growing alignment between personal wellness and planetary health reduces cost sensitivity among affluent consumers. The proliferation of digital tools-from mobile INCI analyzers to AI-driven skincare diagnostics-is also redefining the purchasing journey, giving European consumers greater control and confidence in their choices.

Europe is positioned for robust growth, but it faces several region-specific risks. Volatility in the availability and cost of certified organic raw materials poses a significant threat, particularly given Europe’s climate-sensitive agricultural regions and the continent’s high reliance on imported botanicals.

Consumer skepticism around greenwashing is a critical reputational risk. With rising awareness of misleading marketing, European regulatory agencies are tightening oversight on product claims, sustainability credentials, and labeling accuracy. Brands that fail to substantiate claims or misrepresent ingredient integrity may face legal penalties and erosion of market credibility.

Market saturation is another growing concern, particularly in mature regions such as Western Europe. As more brands enter the natural space, differentiating through innovation, heritage, and localized sourcing becomes vital. To thrive, European manufacturers must invest in science-driven product development, cultivate transparent supplier relationships, and embed EU-aligned environmental ethics at every level of their operations.

Between 2020 and 2024, the natural cosmetics market in Europe grew exponentially due to increasing awareness among consumers regarding health, sustainability, and the environment. Consumers in Europe became increasingly demanding transparency in ingredients, resulting in the popularity of vegan, clean-label, cruelty-free, and organic-certified cosmetics.

The pandemic further accelerated this transition as people became increasingly conscious about what they apply to their skin. Brands accordingly reformulated goods to eliminate chemical synthetics adopted minimalist formulations and adhered to responsible sourcing.

Systems of regulation and eco-certification also became prominent, prompting companies to shift to stricter green guidelines. Niche and indie players selling locally manufactured sustainable cosmetics joined the fray as well, introducing even more segmentation in the competitive arena.

In the period from 2025 to 2035, the natural cosmetics market will remain tech-powered and targeted. Biotech and green chemistry innovations will lead the way in plant-based actives and zero-waste formulation. Personalization will increase with AI-based skin analysis and customized skincare routines.

Packaging will shift to circular models, such as refill points and biodegradable packaging. Consumers will also select traceable supply chains and carbon-neutral manufacturing brands. The combination of scientific efficacy, ethical standards, and digital innovation will define the next decade of natural beauty in Europe.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Health-conscious, ingredient-aware, sustainability-driven | Personalized, tech-enabled, impact-driven consumption |

| Vegan, cruelty-free, organic, and minimal-ingredient cosmetics | Biotech-enhanced, custom-formulated, and high-performance green beauty |

| Natural formulation with emphasis on ethical sourcing | AI diagnostics, biotech activities, digital skin profiling |

| Recyclable, sustainable packaging | Circular packaging paradigms, refillable, biodegradable packaging |

| Ethical, transparent, and niche-oriented brands make gains | Climate-neutral, AI-personalized, science-based brands win |

| Climate-neutral, AI-personalized, science-based brands lead | Increased role of EU eco-labels and certifications |

| Appearance of indie players and legacy player reformulation | Embedding of carbon disclosure and traceability of all ingredients |

| Appearance of indie players and legacy player reformulation | Appearance of indie players and legacy player reformulation |

| Country | CAGR (%) |

|---|---|

| UK | 7.4% |

| France | 7.6% |

| Germany | 7.2% |

| Italy | 6.9% |

The UK will expand at 7.4% CAGR during the study period. Increasing awareness of clean beauty and ethical sourcing has had a profound influence on consumption patterns, hence fueling the growing demand for natural cosmetics in the skincare, haircare, and personal hygiene industries. The UK has benefited from a mature ecosystem of indigenous organic homegrown brands, regulation transparency, and a rising trend towards cruelty-free and vegan-certified products.

Younger consumers, especially in urban regions, are driving the clean beauty trend with their focus on transparency, sustainability, and wellness-oriented lifestyles. Merchants across the country are boosting natural cosmetic offerings in both offline and online platforms.

Influencer marketing and online penetration are assuming central roles in making standalone, niche natural cosmetic players more visible and accessible. UK government action on sustainability and post-Brexit labeling and ingredient disclosure reform is also expected to structure the industry further, rendering it credible and safe. Product innovation in de-layered formulations, biodegradable packaging, and functional botanicals will continue to drive strong growth up to 2035.

France is expected to witness a 7.6% CAGR during the forecast period. As the traditional world leader in cosmetics, France is also experiencing a rise in sustainable and health-driven consumption. Increasing culture-driven attention on beauty and skin care, together with the burgeoning need for ingredients derived from nature and eco-approved products, is propelling the industry.

French consumers are highly engaged and informed and inclined towards brands with traceable supply chains, minimal synthetic additives, and balanced formulas. French natural cosmetics companies are benefiting from government-backed labeling schemes such as COSMOS and Ecocert, which provide consumer confidence and brand differentiation.

The country's rich tradition of apothecary-led beauty and botanical formulation expertise is being applied to meet contemporary requirements for clean beauty. Mass-market and luxury retailers are both expanding shelf space for green and organic cosmetics. Continued innovation with multifunctional products and green brand positioning will be expected to maintain strong momentum throughout the forecast period.

Germany is expected to grow at 7.2% CAGR during the research period. Germany is among Europe's largest hubs producing organic cosmetics, driven by consumers' confidence in organic certification, ingredient transparency, and sustainability. A cultural predisposition towards natural and health-focused consumption has fueled a high demand for natural personal care solutions.

German consumers are highly attuned to product labels, environmental packaging, and corporate values, and therefore, the industry is highly sensitive to certified natural cosmetic brands. Domestic and international firms alike are investing in expanding portfolios that meet strict German and EU green standards. Health food stores and pharmacies are key distribution channels, offering wide availability to certified natural ranges of cosmetics.

The country's leadership in green chemistry and regulatory compliance enables continued innovation in preservative-free, dermatologically tested, and ecologically friendly cosmetic solutions. Growth is also being fueled by rising consumer demand for minimalist skincare routines and multitasking products with plant-derived ingredients.

Italy will expand by 6.9% CAGR during the forecast period. Consumers in Italy increasingly prefer natural and botanical beauty products following the country's herbal medicine and artisanal skincare traditions. The trend shift is most evident in facial care, body oils, and aromatherapy cosmetics.

Millennials and Gen Z shoppers are key growth drivers, actively seeking out paraben-free, sulfate-free, silicone-free, and fragrance-free products. Domestic players with a legacy of plant-based products are growing robustly, capitalizing on the country's rich biodiversity and Mediterranean food ingredients. Specialty beauty stores and pharmacies are driving the distribution of products, often offering education-based sales experiences.

Consumer attitudes are very much shaped by product appearance, ingredient provenance, and the promotion of a natural way of life. With Italy continuing to commit to sustainable agriculture and green packaging, the industry is set to continue steady growth in the next decade.

Bottles & jars are the top packaging form, with an estimated 40-45% market share. They are favored for skincare and haircare products like creams, serums, and oils that must be kept in airtight or UV-safe packaging. Weleda and Dr.

Hauschka are prominent players who consistently use glass or PET bottles to emphasize product purity and sustainability. With increasing awareness among consumers about the impact of packaging, the majority of brands are shifting towards refillable jar packaging and lightweight recycled packaging.

In the period 2025 to 2035, this segment will grow at a steady pace (CAGR 6.2%) as there is constant investment in circular packaging technology in Germany, France, and the Scandinavian countries. Tubes represent the second-largest package format, with approximately 30-35% of the market share.

Their application in facial wash, hand creams, and sunscreens owes to convenience, cleanliness, and controlled dispensing. Natural European brands like Lavera and Melvita are increasingly adopting mono-material, recyclable tubes or bio-based plastics. Portability and less waste, as required by consumers, are making this format more prevalent, especially where there is strict environmental legislation. Expected growth (CAGR 6.5%) will be driven by material innovation and regulatory conformity with EU packaging directives that will become effective by 2030.

The women segment dominates with a share of around 55-60% of consumer demand. Women are the primary buyers of skincare, body care, and wellness-related products, often choosing clean-label formulations with efficacy and transparency. Brands such as Madara, Korres, and Natura Siberica tailor anti-aging, hydration, and pigmentation solutions to this audience, using plant-based actives and transparent sourcing.

Ongoing shifts toward minimalism, hormone-safe products, and sustainability are reinforcing this segment's strength. Through 2035, it is projected to grow at a CAGR of 6.8%, largely propelled by millennial and Gen Z preferences across Western Europe. Unisex products form the secondary sub-segment and are estimated to hold a 20-25% share. They focus on smell, packaging, and functionality neutrality, drawing from a broad consumer base that values simplicity and openness.

REN Clean Skincare and Stop the Water While Using Me! are companies that emphasize eco-awareness and global use. Unisex also reduces SKU complexity and supports zero-waste branding. The category is anticipated to grow at a CAGR of 7%, driven by evolving gender norms and demand for streamlined routines.

Premium product positioning, clean-label certifications, and the fast-evolving direct-to-consumer ecosystem characterize the Natural Cosmetics industry in Europe. They are the pioneer players in the field, thereby commanding strong regional brand equity for their certified organic products through sustainability schemes and biodynamic sourcing practices.

Their growth is strengthened with integrated distribution from concept stores to e-commerce and sustained exposure to eco-conscious consumption. High-end dermocosmetics consolidators like Natura Bissé and Dr. Hauschka guarantee their loyal following by injecting clinically proven botanicals into wellness regimes for their beauty products. Meanwhile, Caudalie has established a major niche with the polyphenol-based formulations and anti-aging lines of vinotherapy.

In this competitive landscape, innovation comes hand-in-hand with traceability, EU-normative formulation, and third-party certification (for instance, NATRUE, COSMOS, and ECOCERT). A range of brands, Korres and Lavera included, are using the apothecary tradition coupled with regional herbal knowledge for local appeal while also scaling up thanks to international associations.

E-commerce optimization, influencer-led campaigns, and refillable-packaging programs are revolutionizing engagement and margin performance. Even with the saturation, the natural cosmetics space is expected to grow because increasing regulatory pressure is being exerted on synthetic ingredients along with rising demand for skin microbiome-safe products.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Weleda | 18-22% |

| L'Occitane en Provence | 14-18% |

| Natura Bissé | 10-14% |

| Dr. Hauschka | 8-12% |

| Caudalie | 6-10% |

| Other Players | 28-36% |

| Company Name | Offerings & Activities |

|---|---|

| Weleda | Organic skincare, biodynamic ingredients, eco-friendly packaging |

| L'Occitane en Provence | Luxury natural skincare, sustainability-focused, botanical extracts |

| Natura Bissé | High-end dermo-cosmetics, clinically proven botanicals |

| Dr. Hauschka | Luxury skincare, holistic beauty, plant-based ingredients |

| Caudalie | Vinotherapy, polyphenol-based formulations for anti-aging |

Key Company Insights

Weleda leads the production of organic cosmetics in Europe. Itaccounts for 18-22% of the industry. Known for sustainable production and biodynamic ingredients sourcing, Weleda is a go-to brand for consumers looking for transparency and quality. The next big player is L'Occitane en Provence, with an estimated share of 14-18%, which has been boosted by its skincare luxury claims and its focus on organic and botanical source ingredients. Sustainability issues like environmentally friendly packaging and the use of natural ingredients have helped retain its premium image in Europe.

Natura Bissé, with a share of 10-14%, has been characterized by its development of high-performance skincare that blends botanicals and scientific innovation. Clinical beauty solutions are the core of its line of offerings, which is why it commands the dermo-cosmetic segment. Dr. Hauschka has managed an 8-12% share of the industry, enhancing its legacy of holistic beauty and plant-based formulation. Caudalie specializes in producing polyphenol-rich anti-aging products, mostly in the vinotherapy area, with a share of around 6-10%. These are the brands that are trending in innovation, ingredient sourcing, and eco-friendly ways of production that are shaping the future of Europe Natural Cosmetics Market.

Other Key Players

The industry is segmented into skin and sun care, hair care, bath and shower products, men’s grooming, color cosmetics, fragrance and deodorant, and oral care. Skin and sun care includes body care, facial care, hand care, and sun care. Hair care covers 2-in-1 products, colorants, conditioners and treatments, hair loss treatments, salon professional hair care, shampoos, and styling agents. Bath and shower products consist of bar soap, bath additives, body powder, body wash, shower gel, and intimate hygiene products. Men’s grooming includes shaving products, both post-shave and pre-shave. Color cosmetics are divided into eye makeup, facial makeup, lip products, and nail products. Fragrance and deodorant products include fragrance and deodorant. Oral care consists of toothpaste and mouthwash.

By packaging type, the segmentation is into bottles and jars, tubes, pouches and sachets, and pencils and sticks.

By consumer orientation, the segmentation is into male, female, unisex, and baby & kids categories.

The segmentation is into supermarkets/hypermarkets, department stores, specialty stores, online sales channels (both direct to consumers and third party to consumers), exclusive brand stores, and other sales channels.

The segmentation is into organic cosmetics and inorganic cosmetics.

The industry is expected to reach USD 21.6 billion in 2025.

The industry valuation is projected to grow to USD 40.0 billion by 2035.

The UK, with a projected growth rate of 7.4%, is expected to see substantial growth in this industry.

Key players include Weleda, L'Occitane en Provence, Dr. Hauschka, Caudalie, REN Clean Skincare, Korres, Green People, Lavera, Natura Bissé, Argan Cosmetics, Natus Cosmetics, Savonnerie de l'Atlas, O Naturals, Bioaroma, Essaouira L'Authentique, Le Secret Naturel, Natura, O Boticário, L'Bel, Yanbal, Koraii Cosmética Natural, Ekos, and Asepxia.

Bottles and jars are widely used packaging types in the Europe Natural Cosmetics Market.

Table 1:Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 2:Volume (US$ million) Analysis By Product Type, 2018 to 2033

Table 3:Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 4:Volume (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 5:Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 6:Volume (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 7:Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 8:Volume (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 9:Value (US$ million) Analysis By Category Type, 2018 to 2033

Table 10:Volume (US$ million) Analysis By Category Type, 2018 to 2033

Table 11:Value (US$ million) Analysis By Country, 2018 to 2033

Table 12:Volume (US$ million) Analysis By Country, 2018 to 2033

Table 13:Germany Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 14:Germany Volume (US$ million) Analysis By Product Type, 2018 to 2033

Table 15:Germany Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 16:Germany Volume (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 17:Germany Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 18:Germany Volume (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 19:Germany Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 20:Germany Volume (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 21:Germany Value (US$ million) Analysis By Category Type, 2018 to 2033

Table 22:Germany Volume (US$ million) Analysis By Category Type, 2018 to 2033

Table 23:France Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 24:France Volume (US$ million) Analysis By Product Type, 2018 to 2033

Table 25:France Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 26:France Volume (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 27:France Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 28:France Volume (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 29:France Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 30:France Volume (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 31:France Value (US$ million) Analysis By Category Type, 2018 to 2033

Table 32:France Volume (US$ million) Analysis By Category Type, 2018 to 2033

Table 33:United Kingdom Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 34:United Kingdom Volume (US$ million) Analysis By Product Type, 2018 to 2033

Table 35:United Kingdom Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 36:United Kingdom Volume (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 37:United Kingdom Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 38:United Kingdom Volume (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 39:United Kingdom Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 40:United Kingdom Volume (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 41:United Kingdom Value (US$ million) Analysis By Category Type, 2018 to 2033

Table 42:United Kingdom Volume (US$ million) Analysis By Category Type, 2018 to 2033

Table 43:Italy Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 44:Italy Volume (US$ million) Analysis By Product Type, 2018 to 2033

Table 45:Italy Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 46:Italy Volume (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 47:Italy Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 48:Italy Volume (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 49:Italy Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 50:Italy Volume (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 51:Italy Value (US$ million) Analysis By Category Type, 2018 to 2033

Table 52:Italy Volume (US$ million) Analysis By Category Type, 2018 to 2033

Table 53:Spain Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 54:Spain Volume (US$ million) Analysis By Product Type, 2018 to 2033

Table 55:Spain Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 56:Spain Volume (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 57:Spain Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 58:Spain Volume (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 59:Spain Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 60:Spain Volume (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 61:Spain Value (US$ million) Analysis By Category Type, 2018 to 2033

Table 62:Spain Volume (US$ million) Analysis By Category Type, 2018 to 2033

Table 63:Poland Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 64:Poland Volume (US$ million) Analysis By Product Type, 2018 to 2033

Table 65:Poland Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 66:Poland Volume (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 67:Poland Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 68:Poland Volume (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 69:Poland Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 70:Poland Volume (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 71:Poland Value (US$ million) Analysis By Category Type, 2018 to 2033

Table 72:Poland Volume (US$ million) Analysis By Category Type, 2018 to 2033

Table 73:Belgium Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 74:Belgium Volume (US$ million) Analysis By Product Type, 2018 to 2033

Table 75:Belgium Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 76:Belgium Volume (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 77:Belgium Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 78:Belgium Volume (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 79:Belgium Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 80:Belgium Volume (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 81:Belgium Value (US$ million) Analysis By Category Type, 2018 to 2033

Table 82:Belgium Volume (US$ million) Analysis By Category Type, 2018 to 2033

Table 83:LuxembourgValue (US$ million) Analysis By Product Type, 2018 to 2033

Table 84:LuxembourgVolume (US$ million) Analysis By Product Type, 2018 to 2033

Table 85:LuxembourgValue (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 86:LuxembourgVolume (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 87:LuxembourgValue (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 88:LuxembourgVolume (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 89:LuxembourgValue (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 90:LuxembourgVolume (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 91:LuxembourgValue (US$ million) Analysis By Category Type, 2018 to 2033

Table 92:LuxembourgVolume (US$ million) Analysis By Category Type, 2018 to 2033

Table 93:Denmark Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 94:Denmark Volume (US$ million) Analysis By Product Type, 2018 to 2033

Table 95:Denmark Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 96:Denmark Volume (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 97:Denmark Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 98:Denmark Volume (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 99:Denmark Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 100:Denmark Volume (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 101:Denmark Value (US$ million) Analysis By Category Type, 2018 to 2033

Table 102:Denmark Volume (US$ million) Analysis By Category Type, 2018 to 2033

Table 103:Finland Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 104:Finland Volume (US$ million) Analysis By Product Type, 2018 to 2033

Table 105:Finland Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 106:Finland Volume (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 107:Finland Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 108:Finland Volume (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 109:Finland Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 110:Finland Volume (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 111:Finland Value (US$ million) Analysis By Category Type, 2018 to 2033

Table 112:Finland Volume (US$ million) Analysis By Category Type, 2018 to 2033

Table 113:Rest of Value (US$ million) Analysis By Product Type, 2018 to 2033

Table 114:Rest of Volume (US$ million) Analysis By Product Type, 2018 to 2033

Table 115:Rest of Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 116:Rest of Volume (US$ million) Analysis By Packaging Type, 2018 to 2033

Table 117:Rest of Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 118:Rest of Volume (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Table 119:Rest of Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 120:Rest of Volume (US$ million) Analysis By Sales Channel, 2018 to 2033

Table 121:Rest of Value (US$ million) Analysis By Category Type, 2018 to 2033

Table 122:Rest of Volume (US$ million) Analysis By Category Type, 2018 to 2033

Figure 01: Value (US$ million) and Volume (Units) Analysis, 2018 to 2022

Figure 02: Value (US$ million) and Volume (Units) Forecast, 2023 to 2033

Figure 03: Value (US$ million) Analysis, 2018 to 2022

Figure 04: Value (US$ million) Forecast, 2023 to 2033

Figure 05: Absolute $ Opportunity Value (US$ million), 2023 to 2033

Figure 06: Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 07: Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 08: Business Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 09: Business Attractiveness By Product Type, 2023 to 2033

Figure 10: Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Figure 11: Volume (Units) Analysis By Packaging Type, 2018 to 2033

Figure 12: Business Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 13: Business Attractiveness By Packaging Type, 2023 to 2033

Figure 14: Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Figure 15: Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 16: Business Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 17: Business Attractiveness By Consumer Orientation, 2023 to 2033

Figure 18: Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 19: Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 20: Business Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 21: Business Attractiveness By Sales Channel, 2023 to 2033

Figure 22: Value (US$ million) Analysis By Category Type, 2018 to 2033

Figure 23: Volume (Units) Analysis By Category Type, 2018 to 2033

Figure 24: Business Y-o-Y Growth (%) Projections, By Category Type, 2023 to 2033

Figure 25: Business Attractiveness By Category Type, 2023 to 2033

Figure 26: Value (US$ million) Analysis By Country, 2018 to 2033

Figure 27: Volume (Units) Analysis By Country, 2018 to 2033

Figure 28: Business Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 29: Business Attractiveness By Country, 2023 to 2033

Figure 30: Germany Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 31: Germany Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 32: Germany Business Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 33: Germany Business Attractiveness By Product Type, 2023 to 2033

Figure 34: Germany Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Figure 35: Germany Volume (Units) Analysis By Packaging Type, 2018 to 2033

Figure 36: Germany Business Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 37: Germany Business Attractiveness By Packaging Type, 2023 to 2033

Figure 38: Germany Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Figure 39: Germany Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 40: Germany Business Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 41: Germany Business Attractiveness By Consumer Orientation, 2023 to 2033

Figure 42: Germany Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 43: Germany Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 44: Germany Business Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 45: Germany Business Attractiveness By Sales Channel, 2023 to 2033

Figure 46: Germany Value (US$ million) Analysis By Category Type, 2018 to 2033

Figure 47: Germany Volume (Units) Analysis By Category Type, 2018 to 2033

Figure 48: Germany Business Y-o-Y Growth (%) Projections, By Category Type, 2023 to 2033

Figure 49: Germany Business Attractiveness By Category Type, 2023 to 2033

Figure 50: France Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 51: France Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 52: France Business Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 53: France Business Attractiveness By Product Type, 2023 to 2033

Figure 54: France Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Figure 55: France Volume (Units) Analysis By Packaging Type, 2018 to 2033

Figure 56: France Business Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 57: France Business Attractiveness By Packaging Type, 2023 to 2033

Figure 58: France Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Figure 59: France Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 60: France Business Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 61: France Business Attractiveness By Consumer Orientation, 2023 to 2033

Figure 62: France Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 63: France Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 64: France Business Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 65: France Business Attractiveness By Sales Channel, 2023 to 2033

Figure 66: France Value (US$ million) Analysis By Category Type, 2018 to 2033

Figure 67: France Volume (Units) Analysis By Category Type, 2018 to 2033

Figure 68: France Business Y-o-Y Growth (%) Projections, By Category Type, 2023 to 2033

Figure 69: France Business Attractiveness By Category Type, 2023 to 2033

Figure 70: United Kingdom Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 71: United Kingdom Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 72: United Kingdom Business Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 73: United Kingdom Business Attractiveness By Product Type, 2023 to 2033

Figure 74: United Kingdom Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Figure 75: United Kingdom Volume (Units) Analysis By Packaging Type, 2018 to 2033

Figure 76: United Kingdom Business Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 77: United Kingdom Business Attractiveness By Packaging Type, 2023 to 2033

Figure 78: United Kingdom Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Figure 79: United Kingdom Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 80: United Kingdom Business Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 81: United Kingdom Business Attractiveness By Consumer Orientation, 2023 to 2033

Figure 82: United Kingdom Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 83: United Kingdom Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 84: United Kingdom Business Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 85: United Kingdom Business Attractiveness By Sales Channel, 2023 to 2033

Figure 86: United Kingdom Value (US$ million) Analysis By Category Type, 2018 to 2033

Figure 87: United Kingdom Volume (Units) Analysis By Category Type, 2018 to 2033

Figure 88: United Kingdom Business Y-o-Y Growth (%) Projections, By Category Type, 2023 to 2033

Figure 89: United Kingdom Business Attractiveness By Category Type, 2023 to 2033

Figure 90: Italy Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 91: Italy Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 92: Italy Business Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 93: Italy Business Attractiveness By Product Type, 2023 to 2033

Figure 94: Italy Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Figure 95: Italy Volume (Units) Analysis By Packaging Type, 2018 to 2033

Figure 96: Italy Business Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 97: Italy Business Attractiveness By Packaging Type, 2023 to 2033

Figure 98: Italy Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Figure 99: Italy Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 100: Italy Business Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 101: Italy Business Attractiveness By Consumer Orientation, 2023 to 2033

Figure 102: Italy Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 103: Italy Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 104: Italy Business Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 105: Italy Business Attractiveness By Sales Channel, 2023 to 2033

Figure 106: Italy Value (US$ million) Analysis By Category Type, 2018 to 2033

Figure 107: Italy Volume (Units) Analysis By Category Type, 2018 to 2033

Figure 108: Italy Business Y-o-Y Growth (%) Projections, By Category Type, 2023 to 2033

Figure 109: Italy Business Attractiveness By Category Type, 2023 to 2033

Figure 110: Spain Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 111: Spain Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 112: Spain Business Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 113: Spain Business Attractiveness By Product Type, 2023 to 2033

Figure 114: Spain Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Figure 115: Spain Volume (Units) Analysis By Packaging Type, 2018 to 2033

Figure 116: Spain Business Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 117: Spain Business Attractiveness By Packaging Type, 2023 to 2033

Figure 118: Spain Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Figure 119: Spain Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 120: Spain Business Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 121: Spain Business Attractiveness By Consumer Orientation, 2023 to 2033

Figure 122: Spain Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 123: Spain Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 124: Spain Business Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 125: Spain Business Attractiveness By Sales Channel, 2023 to 2033

Figure 126: Spain Value (US$ million) Analysis By Category Type, 2018 to 2033

Figure 127: Spain Volume (Units) Analysis By Category Type, 2018 to 2033

Figure 128: Spain Business Y-o-Y Growth (%) Projections, By Category Type, 2023 to 2033

Figure 129: Spain Business Attractiveness By Category Type, 2023 to 2033

Figure 130: Poland Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 131: Poland Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 132: Poland Business Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 133: Poland Business Attractiveness By Product Type, 2023 to 2033

Figure 134: Poland Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Figure 135: Poland Volume (Units) Analysis By Packaging Type, 2018 to 2033

Figure 136: Poland Business Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 137: Poland Business Attractiveness By Packaging Type, 2023 to 2033

Figure 138: Poland Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Figure 139: Poland Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 140: Poland Business Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 141: Poland Business Attractiveness By Consumer Orientation, 2023 to 2033

Figure 142: Poland Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 143: Poland Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 144: Poland Business Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 145: Poland Business Attractiveness By Sales Channel, 2023 to 2033

Figure 146: Poland Value (US$ million) Analysis By Category Type, 2018 to 2033

Figure 147: Poland Volume (Units) Analysis By Category Type, 2018 to 2033

Figure 148: Poland Business Y-o-Y Growth (%) Projections, By Category Type, 2023 to 2033

Figure 149: Poland Business Attractiveness By Category Type, 2023 to 2033

Figure 150: Belgium Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 151: Belgium Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 152: Belgium Business Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 153: Belgium Business Attractiveness By Product Type, 2023 to 2033

Figure 154: Belgium Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Figure 155: Belgium Volume (Units) Analysis By Packaging Type, 2018 to 2033

Figure 156: Belgium Business Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 157: Belgium Business Attractiveness By Packaging Type, 2023 to 2033

Figure 158: Belgium Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Figure 159: Belgium Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 160: Belgium Business Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 161: Belgium Business Attractiveness By Consumer Orientation, 2023 to 2033

Figure 162: Belgium Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 163: Belgium Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 164: Belgium Business Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 165: Belgium Business Attractiveness By Sales Channel, 2023 to 2033

Figure 166: Belgium Value (US$ million) Analysis By Category Type, 2018 to 2033

Figure 167: Belgium Volume (Units) Analysis By Category Type, 2018 to 2033

Figure 168: Belgium Business Y-o-Y Growth (%) Projections, By Category Type, 2023 to 2033

Figure 169: Belgium Business Attractiveness By Category Type, 2023 to 2033

Figure 170: Luxembourg Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 171: Luxembourg Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 172: Luxembourg Business Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 173: Luxembourg Business Attractiveness By Product Type, 2023 to 2033

Figure 174: Luxembourg Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Figure 175: Luxembourg Volume (Units) Analysis By Packaging Type, 2018 to 2033

Figure 176: Luxembourg Business Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 177: Luxembourg Business Attractiveness By Packaging Type, 2023 to 2033

Figure 178: Luxembourg Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Figure 179: Luxembourg Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 180: Luxembourg Business Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 181: Luxembourg Business Attractiveness By Consumer Orientation, 2023 to 2033

Figure 182: Luxembourg Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 183: Luxembourg Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 184: Luxembourg Business Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 185: Luxembourg Business Attractiveness By Sales Channel, 2023 to 2033

Figure 186: Luxembourg Value (US$ million) Analysis By Category Type, 2018 to 2033

Figure 187: Luxembourg Volume (Units) Analysis By Category Type, 2018 to 2033

Figure 188: Luxembourg Business Y-o-Y Growth (%) Projections, By Category Type, 2023 to 2033

Figure 189: Luxembourg Business Attractiveness By Category Type, 2023 to 2033

Figure 190: Denmark Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 191: Denmark Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 192: Denmark Business Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 193: Denmark Business Attractiveness By Product Type, 2023 to 2033

Figure 194: Denmark Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Figure 195: Denmark Volume (Units) Analysis By Packaging Type, 2018 to 2033

Figure 196: Denmark Business Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 197: Denmark Business Attractiveness By Packaging Type, 2023 to 2033

Figure 198: Denmark Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Figure 199: Denmark Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 200: Denmark Business Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 201: Denmark Business Attractiveness By Consumer Orientation, 2023 to 2033

Figure 202: Denmark Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 203: Denmark Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 204: Denmark Business Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 205: Denmark Business Attractiveness By Sales Channel, 2023 to 2033

Figure 206: Denmark Value (US$ million) Analysis By Category Type, 2018 to 2033

Figure 207: Denmark Volume (Units) Analysis By Category Type, 2018 to 2033

Figure 208: Denmark Business Y-o-Y Growth (%) Projections, By Category Type, 2023 to 2033

Figure 209: Denmark Business Attractiveness By Category Type, 2023 to 2033

Figure 210: Finland Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 211: Finland Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 212: Finland Business Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 213: Finland Business Attractiveness By Product Type, 2023 to 2033

Figure 214: Finland Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Figure 215: Finland Volume (Units) Analysis By Packaging Type, 2018 to 2033

Figure 216: Finland Business Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 217: Finland Business Attractiveness By Packaging Type, 2023 to 2033

Figure 218: Finland Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Figure 219: Finland Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 220: Finland Business Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 221: Finland Business Attractiveness By Consumer Orientation, 2023 to 2033

Figure 222: Finland Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 223: Finland Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 224: Finland Business Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 225: Finland Business Attractiveness By Sales Channel, 2023 to 2033

Figure 226: Finland Value (US$ million) Analysis By Category Type, 2018 to 2033

Figure 227: Finland Volume (Units) Analysis By Category Type, 2018 to 2033

Figure 228: Finland Business Y-o-Y Growth (%) Projections, By Category Type, 2023 to 2033

Figure 229: Finland Business Attractiveness By Category Type, 2023 to 2033

Figure 230: Rest of Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 231: Rest of Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 232: Rest of Business Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 233: Rest of Business Attractiveness By Product Type, 2023 to 2033

Figure 234: Rest of Value (US$ million) Analysis By Packaging Type, 2018 to 2033

Figure 235: Rest of Volume (Units) Analysis By Packaging Type, 2018 to 2033

Figure 236: Rest of Business Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 237: Rest of Business Attractiveness By Packaging Type, 2023 to 2033

Figure 238: Rest of Value (US$ million) Analysis By Consumer Orientation, 2018 to 2033

Figure 239: Rest of Volume (Units) Analysis By Consumer Orientation, 2018 to 2033

Figure 240: Rest of Business Y-o-Y Growth (%) Projections, By Consumer Orientation, 2023 to 2033

Figure 241: Rest of Business Attractiveness By Consumer Orientation, 2023 to 2033

Figure 242: Rest of Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 243: Rest of Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 244: Rest of Business Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 245: Rest of Business Attractiveness By Sales Channel, 2023 to 2033

Figure 246: Rest of Value (US$ million) Analysis By Category Type, 2018 to 2033

Figure 247: Rest of Volume (Units) Analysis By Category Type, 2018 to 2033

Figure 248: Rest of Business Y-o-Y Growth (%) Projections, By Category Type, 2023 to 2033

Figure 249: Rest of Business Attractiveness By Category Type, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Natural Cosmetics Market Analysis - Size, Share & Trends 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA