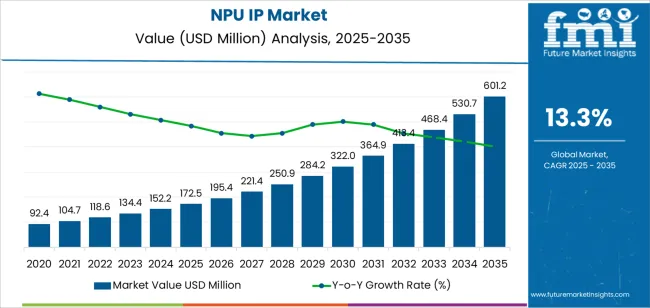

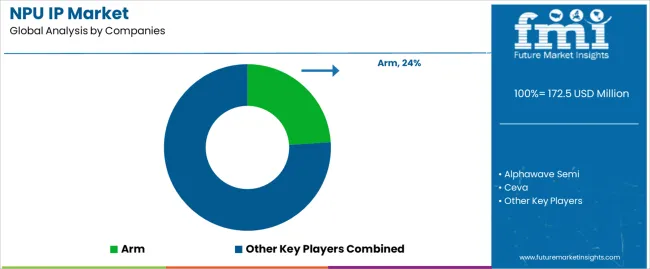

The NPU IP market is valued at USD 172.5 million in 2025 and is projected to reach USD 601.2 million by 2035, growing at a CAGR of 13.3%. Market expansion is driven by rising integration of artificial intelligence (AI) and machine learning (ML) workloads into consumer electronics, automotive systems, and industrial automation. Increasing demand for edge computing and real-time inference processing is promoting the use of neural processing unit (NPU) intellectual property (IP) cores in system-on-chip (SoC) architectures designed for energy-efficient AI acceleration.

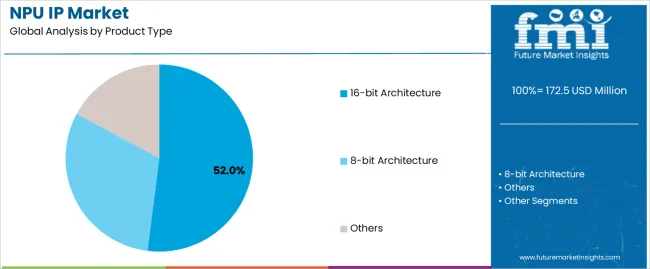

The 16-bit architecture segment represents the leading type, offering a balance of computational precision and low power consumption for embedded AI applications. This architecture supports efficient matrix multiplication, convolution operations, and dataflow optimization for deep neural networks. Continuous innovation in hardware-software co-design, quantization-aware training, and memory bandwidth management is enabling faster inference speeds and improved performance per watt across a range of edge and endpoint devices.

Asia Pacific leads global market growth, supported by semiconductor design expansion in China, South Korea, and Taiwan. Europe and North America sustain strong demand through AI adoption in autonomous systems, data centers, and smart infrastructure. Key market participants include Arm, Alphawave Semi, Ceva, Cadence, Synopsys, OPENEDGES, Chips & Media, Kneron, Verisilicon, and INVENTEC, focusing on scalable IP architecture, hardware optimization, and silicon-proven AI acceleration platforms.

Growth rate volatility analysis indicates a high initial fluctuation level, followed by stabilization as neural processing technologies mature and integration expands across end-use sectors. Between 2025 and 2028, volatility will remain elevated due to rapid innovation cycles, varying adoption rates among chipmakers, and evolving AI workloads. Early-stage product differentiation and competitive licensing models will create short-term growth spikes.

From 2029 to 2035, the volatility index is expected to decline as NPU IP architectures become standardized within semiconductor design ecosystems. Broader adoption across edge computing, autonomous systems, and embedded devices will lead to predictable demand patterns. Strategic collaborations between IP vendors and system-on-chip manufacturers will further reduce market instability by aligning product roadmaps. Despite initial variability, long-term volatility will remain moderate, supported by consistent demand for energy-efficient AI accelerators. The overall trend reflects a technology-driven market transitioning from experimental deployment to sustained commercial integration within the global semiconductor and AI infrastructure landscape.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 172.5 million |

| Market Forecast Value (2035) | USD 601.2 million |

| Forecast CAGR (2025 to 2035) | 13.3% |

The NPU IP market is expanding as the uptake of artificial intelligence and deep-learning applications increases across consumer, automotive, industrial and edge-computing sectors. Neural processing unit intellectual property enables chip designers to integrate specialized AI-acceleration hardware cores into system-on-chip (SoC) architectures without developing full designs in-house. Growing demands for on-device inference, real-time data processing and edge-AI functionality motivate licence of NPU cores to accelerate time-to-market and optimise performance. Architectural advances such as support for transformer models, sparsity handling and low-power operation further enhance the appeal of NPU-IP-enabled designs.

Emerging use-cases, such as autonomous driving, smart cameras, robotics and Internet of Things devices, contribute to rising requirement for embedded AI compute capacity and drive market growth. Ecosystem liberalisation and availability of scalable IP models support broader adoption across smaller SoC vendors. Constraints include high cost of development and verification of advanced IP, licensing complexity and long qualification cycles for safety- or reliability-critical environments.

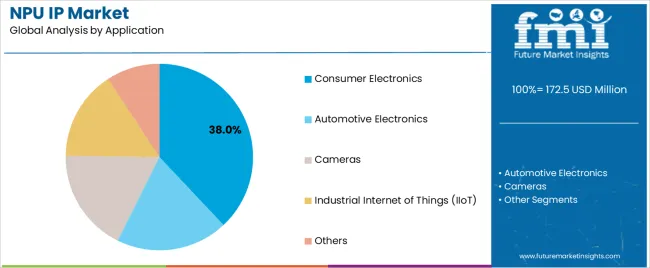

The NPU IP (Neural Processing Unit Intellectual Property) market is segmented by product type and application. By product type, the market is divided into 8-bit architecture, 16-bit architecture, and others. Based on application, it is categorized into consumer electronics, automotive electronics, cameras, industrial internet of things (IIoT), and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

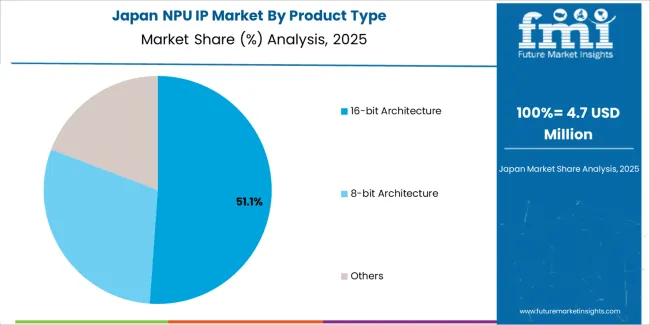

The 16-bit architecture segment holds the leading position in the NPU IP market, representing an estimated 52.0% of total market share in 2025. This dominance is attributed to the superior balance between computational accuracy, power efficiency, and processing throughput offered by 16-bit NPUs for AI inference workloads. These architectures are widely integrated into system-on-chip (SoC) designs used in mobile devices, automotive electronics, and embedded systems requiring high-performance edge computing capabilities.

16-bit NPUs support efficient deep learning operations such as convolutional neural networks (CNNs) and recurrent neural networks (RNNs), providing faster processing while optimizing memory and energy use. The 8-bit architecture segment, estimated at 33.0%, is expanding due to increased deployment in low-power AI edge applications such as smart home devices, IoT sensors, and cost-sensitive embedded systems. The others category, accounting for about 15.0%, includes specialized architectures and hybrid bit-width configurations designed for advanced AI acceleration tasks.

Key factors supporting the 16-bit architecture segment include:

The consumer electronics segment accounts for approximately 38.0% of the NPU IP market in 2025. This leadership is driven by the increasing integration of AI accelerators in smartphones, tablets, smart TVs, and wearable devices for applications such as image recognition, voice processing, and real-time data analytics. The demand for enhanced on-device AI performance continues to expand as manufacturers prioritize energy-efficient, low-latency processing capabilities to support next-generation smart features.

The automotive electronics segment follows, representing about 25.0% of the market, fueled by the rising adoption of NPUs in driver-assistance systems, in-vehicle infotainment, and autonomous driving platforms. The cameras segment accounts for 17.0%, supported by the use of NPUs in smart imaging, object tracking, and visual analytics. The IIoT segment contributes 13.0%, reflecting growing AI adoption in predictive maintenance and automation. The others category, comprising robotics and healthcare systems, holds the remaining 7.0%.

Primary dynamics driving demand from the consumer electronics segment include:

Rapid proliferation of on-device AI, edge computing and multi-core SoC architectures are driving market expansion.

The NPU IP market is growing as more semiconductor designers embed specialised neural-processing-unit (NPU) cores into system-on-chip (SoC) designs to accelerate machine-learning inference, vision recognition and natural-language tasks. Growing demand for AIenabled consumer electronics, automotive systems (such as advanced driver-assistance and autonomous driving), robotics and industrial automation increases the need for IP blocks that support high-throughput, low-power deep-learning workloads. The push for edge inference (rather than cloud-only) further boosts adoption of licensable NPU IP cores that integrate with CPUs and GPUs in heterogeneous computing platforms.

High IP development cost, rapid algorithmic change and competitive alternatives are restraining broader adoption.

Developing robust NPU IP involves substantial investment in architecture, verification and software tool-chain support, which raises entry barriers for smaller IP vendors or in emerging regions. Rapid evolution of AI algorithms and model topologies means NPU IP must be frequently updated or redesigned, reducing product life span. Alternative compute paths, such as GPUs, FPGAs or ASICs built in-house, offer competitive options, which can slow the licensing demand for NPU IP cores in some use-cases.

Trend toward scalable multi-channel IP, regional customisation for edge AI and integration into heterogeneous platforms define future direction.

IP providers are offering NPU cores that scale in MAC-units (multiply-accumulate operations) and support multiple precision levels (INT8, FP16, BF16) to serve diverse applications from wearables to data-centre accelerators. Regional demand in Asia-Pacific is rising due to strong electronics manufacturing, AI initiatives and local semiconductor design ecosystems. Growing importance of heterogeneous computing platforms combining CPU, GPU and NPU in a single SoC is reshaping how licencees select NPU IP, tool-chain compatibility, power-efficiency and domain-specific optimisations are becoming critical decision-factors.

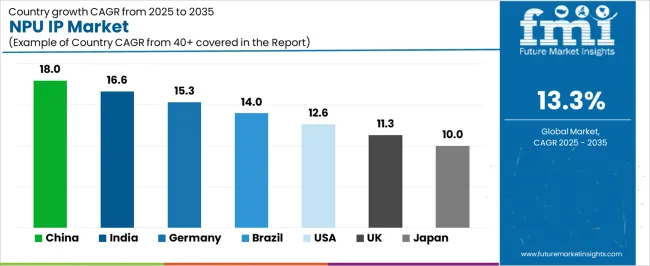

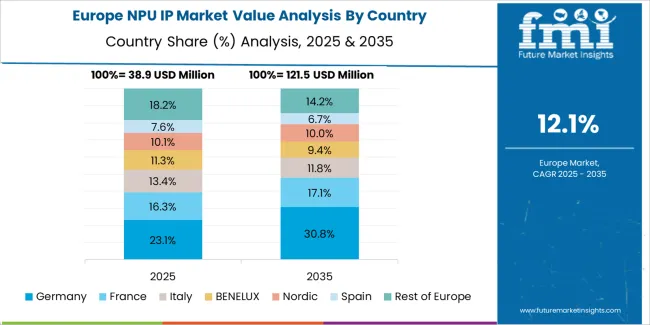

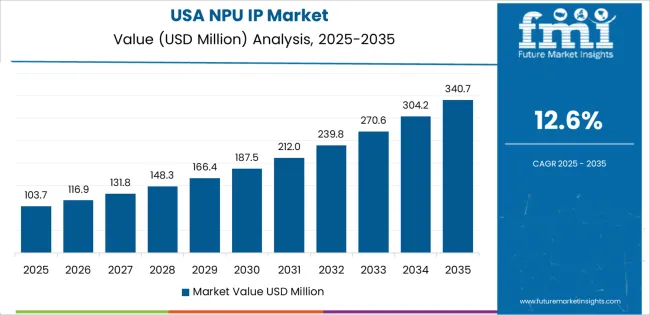

The global Neural Processing Unit Intellectual Property (NPU IP) market is expanding rapidly through 2035, supported by advancements in artificial intelligence (AI) hardware, edge computing, and semiconductor innovation. China leads with a 18.0% CAGR, followed by India at 16.6%, reflecting accelerated AI adoption and chip design localization. Germany grows at 15.3%, driven by embedded AI systems and automotive automation. Brazil records 14.0%, benefiting from industrial digitalization and cloud-edge integration. The United States grows at 12.6%, supported by high-end AI accelerator innovation, while the United Kingdom (11.3%) and Japan (10.0%) maintain stable development through research, precision manufacturing, and advanced semiconductor R&D.

| Country | CAGR (%) |

|---|---|

| China | 18.0 |

| India | 16.6 |

| Germany | 15.3 |

| Brazil | 14.0 |

| USA | 12.6 |

| UK | 11.3 |

| Japan | 10.0 |

China’s NPU IP market grows at 18.0% CAGR, driven by massive AI infrastructure expansion, domestic semiconductor independence, and strong policy support under the New Generation Artificial Intelligence Development Plan. Local chipmakers and IP design houses are developing AI accelerators optimized for edge computing, vision processing, and natural language tasks. Integration of NPU IP in smartphones, data centers, and autonomous systems is expanding rapidly. Partnerships between semiconductor fabs and AI software firms enhance compatibility and power efficiency. Government-backed funding and innovation zones, such as the Beijing AI Park, continue to foster R&D and large-scale deployment of localized neural network processors.

Key Market Factors:

India’s market grows at 16.6% CAGR, supported by semiconductor ecosystem development, AI policy frameworks, and growth in embedded computing. The Semicon India Programme and National AI Mission are driving domestic design capabilities for neural processors. Local startups are developing customizable NPU IP cores for image recognition, predictive analytics, and industrial automation. Collaboration between global semiconductor firms and Indian design centers accelerates innovation in energy-efficient AI chips. Adoption in defense electronics, smart city infrastructure, and medical diagnostics is strengthening the domestic demand base for low-power neural computing IP.

Market Development Factors:

Germany’s market grows at 15.3% CAGR, supported by its leadership in automotive electronics, robotics, and industrial automation. German semiconductor companies and research institutions are integrating NPU IP into embedded control systems for real-time data processing in autonomous vehicles and smart factories. The Industrie 4.0 framework promotes intelligent edge systems combining sensor data analytics with neural computation. Development of energy-efficient, FPGA-compatible neural processing cores is improving performance in industrial AI deployments. Partnerships between semiconductor design firms and automotive OEMs enhance integration standards for safety and predictive maintenance applications.

Key Market Characteristics:

Brazil’s market grows at 14.0% CAGR, supported by the digital transformation of industrial sectors, smart city initiatives, and emerging AI-driven automation. Domestic universities and tech startups are collaborating with international IP providers to develop AI acceleration modules for cloud and edge applications. Government-led projects under Brazilian Digital Transformation Strategy (E-Digital) promote AI research and computing capacity building. Industrial robotics and predictive maintenance solutions are incorporating embedded neural processors for efficiency optimization. The market benefits from growing investment in renewable energy automation and national semiconductor design programs.

Market Development Factors:

The United States grows at 12.6% CAGR, driven by continued innovation in AI chip design, cloud computing, and neural accelerator IP. Major semiconductor firms are licensing scalable NPU IP for data centers, autonomous systems, and high-performance computing (HPC). The CHIPS and Science Act strengthens domestic fabrication and design ecosystem competitiveness. R&D in neuromorphic and quantum-class AI processors enhances USA leadership in computational efficiency. Collaboration between cloud service providers and chip design firms supports AI infrastructure scaling across industries, while startups focus on low-latency, high-throughput neural cores for edge inference.

Key Market Factors:

The United Kingdom’s market grows at 11.3% CAGR, supported by academic research, AI hardware startups, and government-backed innovation programs. The UK AI Strategy and Innovate UK initiatives encourage domestic design of scalable neural processing architectures for autonomous and defense applications. Local semiconductor firms are licensing flexible NPU IP supporting multi-core configurations and high energy efficiency. Collaboration with European technology clusters enhances IP standardization and interoperability. The adoption of AI chipsets in smart infrastructure, robotics, and precision manufacturing drives continuous growth.

Market Development Factors:

Japan’s market grows at 10.0% CAGR, reflecting leadership in microelectronics, robotics, and advanced semiconductor materials. Domestic chipmakers are focusing on ultra-compact NPU IP designs optimized for embedded systems, autonomous mobility, and consumer electronics. Research under the Green Innovation Fund and Society 5.0 initiatives promotes ecofriendly semiconductor design and AI-enabled automation. Integration of NPU IP in sensor arrays, imaging systems, and robotics enhances energy efficiency and localized data processing. Collaboration between universities, research consortia, and semiconductor companies supports long-term innovation in low-power neural processors.

Key Market Characteristics:

The NPU (Neural Processing Unit) IP market is moderately consolidated, comprising around ten specialized semiconductor and design solution providers supplying licensed AI acceleration architectures to chipmakers and system integrators. Arm leads the market with an estimated 24% global share, supported by its widely adopted Ethos NPU architecture, which offers scalable AI compute capability across mobile, embedded, and edge devices. Its leadership is strengthened by a deep ecosystem of software toolchains, long-term licensing agreements, and consistent integration within major SoC platforms.

Alphawave Semi, Ceva, Cadence, and Synopsys follow as prominent competitors, leveraging strong IP portfolios and expertise in digital signal processing, AI compiler optimization, and hardware–software co-design. Their competitive advantage lies in delivering configurable, energy-efficient IP cores that address latency, throughput, and silicon area constraints for diverse AI workloads. OPENEDGES and Chips & Media focus on lightweight NPUs tailored for consumer electronics and embedded vision systems, emphasizing balance between computational density and power efficiency.

Emerging players such as Kneron, Verisilicon, and Inventec contribute to regional innovation through specialized AI accelerator designs optimized for edge computing and smart device integration. These companies compete through flexible licensing models and rapid design customization for OEM partners.

Competition in the NPU IP market centers on performance-per-watt, scalability, and software stack maturity. Growth is driven by rising demand for on-device AI processing, reduced data latency, and enhanced computational efficiency, as semiconductor companies increasingly integrate neural acceleration capabilities into next-generation SoCs for automotive, mobile, and IoT applications.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | 8-bit Architecture, 16-bit Architecture, Others |

| Application | Consumer Electronics, Automotive Electronics, Cameras, Industrial Internet of Things (IIoT), Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Arm, Alphawave Semi, Ceva, Cadence, Synopsys, OPENEDGES, Chips & Media, Kneron, Verisilicon, INVENTEC |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of neural processing unit (NPU) IP providers; advancements in low-power AI acceleration architectures; integration with edge computing, automotive vision, and smart device processors. |

The global NPU IP market is estimated to be valued at USD 172.5 million in 2025.

The market size for the NPU IP market is projected to reach USD 601.2 million by 2035.

The NPU IP market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in NPU IP market are 16-bit architecture, 8-bit architecture and others.

In terms of application, consumer electronics segment to command 38.0% share in the NPU IP market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

NPU IP for MCU Market Size and Share Forecast Outlook 2025 to 2035

Medical EMR Input Device Market Size and Share Forecast Outlook 2025 to 2035

IP TCG Market Size and Share Forecast Outlook 2025 to 2035

IPM Motors Market Size and Share Forecast Outlook 2025 to 2035

IP Pop Toy Market Size and Share Forecast Outlook 2025 to 2035

IP PBX Market Analysis - Size, Share, and Forecast 2025 to 2035

IP Camera Market Trends – Growth, Demand & Forecast 2025 to 2035

IP-MPLS VPN Services Market Insights – Trends & Forecast 2025 to 2035

IP Centrex Platforms Market

IP Multimedia Subsystem Market Report – Forecast 2016-2026

Lipid Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Lipidomics Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

RIP Software Market Size and Share Forecast Outlook 2025 to 2035

Bipolar Electrodialysis Membrane Market Size and Share Forecast Outlook 2025 to 2035

Liposuction Market Size and Share Forecast Outlook 2025 to 2035

Sip Feeds Market Forecast and Outlook 2025 to 2035

Pipeline Integrity Market Size and Share Forecast Outlook 2025 to 2035

Pipe Market Size and Share Forecast Outlook 2025 to 2035

Wiper Blade Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA