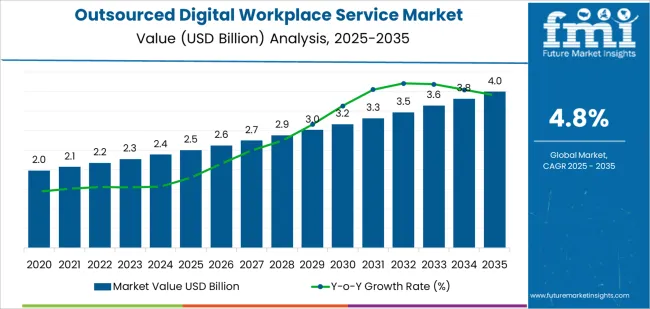

The global outsourced digital workplace service market is valued at USD 2.5 billion in 2025 and is projected to reach USD 4.0 billion by 2035, reflecting a CAGR of 4.8%. Early growth is driven by the increasing shift toward remote and hybrid work environments, which require businesses to adopt digital workplace services that can manage, secure, and optimize their virtual operations. Outsourced services, including cloud management, IT support, collaboration tools, and cybersecurity solutions, become essential as companies strive for flexibility, scalability, and cost-efficiency in managing their digital infrastructure.

Through the forecast period, demand for outsourced services grows steadily as businesses continue to prioritize digital transformation, workforce collaboration, and employee experience. As companies further automate processes and embrace advanced workplace technologies, the market experiences consistent, stable growth. In the later years, innovation in AI-driven workplace solutions, enhanced security protocols, and deeper integration of cloud-based platforms sustain the market's expansion. By 2035, the outsourced digital workplace services market continues to thrive, supported by ongoing organizational needs for seamless, secure, and efficient remote operations.

Between 2025 and 2030, the Outsourced Digital Workplace Service Market expands from USD 2.5 billion to USD 3.2 billion, generating USD 0.7 billion in additional value. The first breakpoint occurs around 2027 to 2028, where the annual growth rate accelerates from approximately USD 0.1 billion to USD 0.2 billion. This shift is driven by increased adoption of cloud-based collaboration tools, remote work enablement, and the widespread need for IT support services across industries. As enterprises seek to scale their digital workplace infrastructure, the demand for outsourced services such as cloud management, security, and virtual collaboration tools grows significantly.

From 2030 to 2035, the market grows from USD 3.2 billion to USD 4.0 billion, adding USD 0.8 billion. The second breakpoint appears around 2032 to 2033, when the market experiences a more robust surge in adoption, with annual growth rising to USD 0.3 billion or more. This acceleration is fueled by digital transformation efforts, increased use of AI-driven workplace solutions, and a shift toward hybrid work models. By 2035, the market reaches its peak, driven by continuous investments in the digital workplace, automation tools, and the integration of next-gen collaboration and productivity platforms across global enterprises.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.5 billion |

| Market Forecast Value (2035) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

Demand for outsourced digital workplace services is increasing as organizations shift to hybrid work models and require scalable IT support frameworks for distributed teams. These services include endpoint management, collaboration-platform integration, virtual desktop infrastructure, and workflow automation. By outsourcing digital workplace operations, companies reduce capital investment in-house and improve flexibility during fluctuating demand. Providers focus on delivering secure access, unified communication, and productivity analytics across remote, mobile, and on-site users. As businesses prioritize employee experience and productivity in hybrid environments, outsourcing partners enable consistent support across locations and devices, reinforcing market growth across sectors such as finance, technology, healthcare, and manufacturing.

Market expansion is also supported by rising cybersecurity demands, workforce mobility, and demand for data-driven insights into productivity and end-user experience. Outsourcing firms implement zero trust access frameworks, device based IAM solutions, and proactive service-desk models to maintain support quality and security. Enterprises preparing for digital transformation engage providers to manage change, streamline toolchains, and rationalize collaboration platforms. Although vendors face challenges in aligning SLAs with rapidly evolving workplace technologies, standardized outsourcing frameworks and improved remote support tools lower entry barriers. As hybrid and mobile work arrangements continue to proliferate globally, the outsourced digital workplace service market is positioned for sustained expansion.

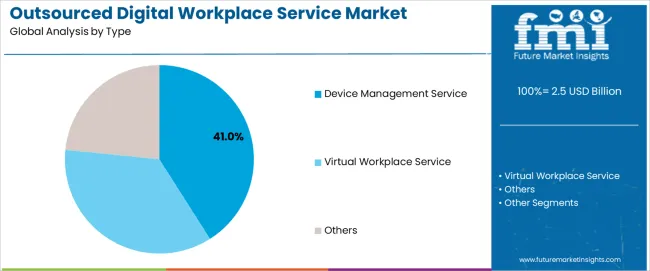

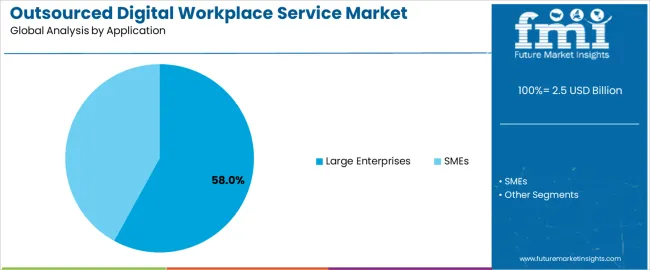

The outsourced digital workplace service market is segmented by type, application, and region. By type, the market is divided into device management services, virtual workplace services, and others. Based on application, it is categorized into large enterprises, SMEs, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differences in organizational IT needs, digital transformation adoption, and regional outsourcing trends.

The device management service segment accounts for approximately 41.0% of the global outsourced digital workplace service market in 2025, making it the leading type category. This position is driven by the increasing complexity of managing a wide array of devices used in digital workplaces, such as laptops, mobile phones, tablets, and IoT devices. Device management services help organizations ensure that these devices are secure, compliant, and functioning optimally, which is essential for maintaining productivity and protecting sensitive data.

With the shift to remote and hybrid work environments, device management services have become more crucial, as organizations need to manage devices across various locations and network environments. This service includes tasks such as software updates, security patches, asset tracking, and troubleshooting. Adoption is strong in North America, Europe, and East Asia, where digital workplace solutions are integral to business operations. Device management services maintain their lead because they provide essential support for the increasing number of connected devices in corporate environments, ensuring operational efficiency, data security, and seamless remote work capabilities.

The large enterprises segment represents about 58.0% of the total outsourced digital workplace service market in 2025, making it the dominant application category. This position reflects the extensive IT infrastructure and complex needs of large organizations, which require comprehensive, scalable solutions for managing digital workplaces across multiple teams and geographies. Large enterprises need outsourced services to handle the complexity of device management, virtual workspaces, security measures, and compliance issues at scale.

Outsourcing digital workplace services allows large enterprises to focus on their core business operations while relying on specialized service providers to handle the technical aspects of workplace management. This is particularly valuable for enterprises with a dispersed workforce, including remote and hybrid employees. Adoption is particularly strong in North America, Europe, and East Asia, where large corporations are increasingly integrating cloud-based platforms, AI tools, and advanced IT systems to support their digital workplace strategies. The large enterprise segment retains its leading position due to the ongoing need for high-capacity, secure, and customizable digital workplace services that support workforce productivity and operational continuity across complex organizational structures.

The outsourced digital workplace service market is expanding as organizations increasingly rely on external providers to consult, implement and support digital-workplace solutions that enhance employee experience, productivity and device/application management. Services typically cover endpoint support, desktop as a service (DaaS), application provisioning, collaboration tools and field services for hybrid work environments. Growth is driven by rise of remote work, desire to optimise IT spending and the shift toward outcome based service models. However, adoption faces restraints such as vendor integration complexity, security concerns and variable service quality across regions. Providers are advancing AI enabled service desks, zero touch device provisioning and composable platforms to meet demand.

Companies are supporting distributed, hybrid and mobile workforces, which increases the complexity of managing endpoints, applications and user support across locations and device types. Outsourcing providers offer scalable service desk, remote monitoring, device provisioning and application management capabilities that help organisations maintain productivity while reducing in house IT burden. As end users demand seamless access from any device, any location, vendors that offer comprehensive digital workplace service bundles become increasingly essential.

Adoption is limited by concerns around data security, loss of control over endpoint management and inconsistent user experience standards among different providers. Legacy device fleets or on premises systems may not integrate smoothly with outsourced models. Some organisations resist moving to outsourced models because of reputational risk if user support fails or security incidents arise. Additionally, varying regulatory requirements across countries increase the complexity and cost of managing global service desk and device management contracts.

Emerging trends include AI driven, proactive service desk automation, self healing device management and digital experience analytics that measure employee sentiment and IT productivity. Providers are also offering cloud native DaaS platforms, micro service modular support models and subscription based pricing aligned with outcomes rather than assets. Focus on sustainability is growing, with lifecycle management of devices and green IT practices becoming differentiators. As organisations prioritise user experience and flexibility over cost centre IT, service vendors are shifting toward partnership based delivery rather than pure cost arbitrage.

| Country | CAGR (%) |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| Brazil | 5.0% |

| USA | 4.6% |

| UK | 4.1% |

| Japan | 3.6% |

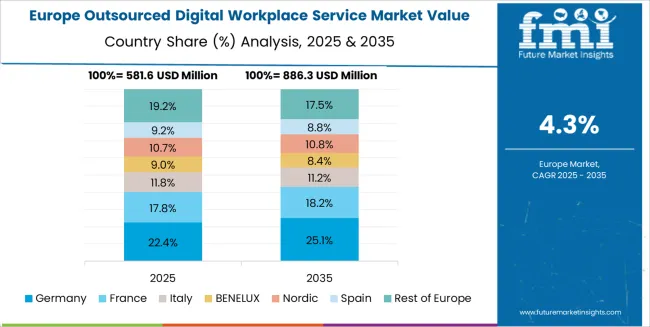

The Outsourced Digital Workplace Service Market is growing steadily across global regions, with China leading at a 6.5% CAGR through 2035, driven by large-scale digital transformation efforts, increasing demand for cloud-based collaboration tools, and rapid adoption of remote work solutions. India follows at 6.0%, supported by the expansion of the IT outsourcing industry, rising digital literacy, and growing need for flexible, scalable workplace services.

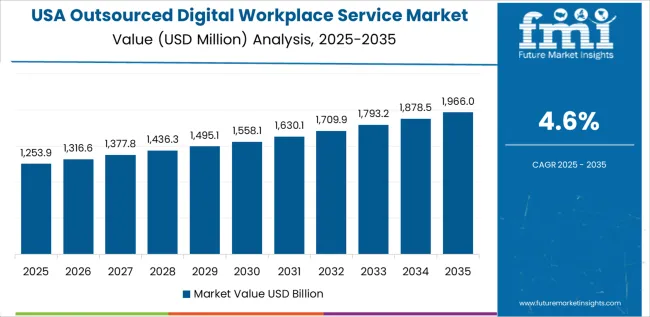

Germany records 5.5%, reflecting strong demand for high-quality IT infrastructure management, compliance with stringent EU regulations, and increasing reliance on managed services for workplace efficiency. Brazil grows at 5.0%, benefiting from expanding digital adoption in businesses and improved connectivity infrastructure. The USA, at 4.6%, remains a key market focusing on AI-driven workplace services and automation, while the UK (4.1%) and Japan (3.6%) prioritize innovation in cloud computing, virtual collaboration, and workforce productivity solutions.

China is projected to grow at a CAGR of 6.5% through 2035 in the outsourced digital workplace service market. Increasing adoption of cloud computing, remote work solutions, and digital collaboration tools by enterprises drives demand for outsourced services. Local businesses seek third-party providers to manage and optimise IT infrastructure, improve digital workflows, and enhance employee productivity. Manufacturers focus on providing flexible, scalable digital workplace solutions that integrate with existing systems. The market benefits from government policies supporting digitalisation across public and private sectors, creating further growth opportunities for outsourced services.

India is projected to grow at a CAGR of 6% through 2035 in the outsourced digital workplace service market. With increasing digitalisation in business processes and the rise of remote work culture, Indian enterprises are seeking third-party service providers to manage their IT environments. Outsourced digital workplace services offer businesses cost-effective solutions to scale their operations, enhance productivity, and manage technology needs efficiently. Additionally, the growing use of automation tools, AI, and data analytics further accelerates the demand for outsourced digital services in sectors such as manufacturing, IT, and services.

Germany is projected to grow at a CAGR of 5.5% through 2035 in the outsourced digital workplace service market. As businesses strive for digital transformation, demand for advanced IT infrastructure services grows. Companies are outsourcing digital workplace services to manage and maintain their IT environments, allowing them to focus on core activities. Key drivers include the need for efficient collaboration tools, cloud management, and data security. Germany’s strong industrial base and commitment to digitalisation create ample opportunities for service providers. Market growth is supported by businesses focusing on technology integration and digital workplace optimisation.

Brazil is projected to grow at a CAGR of 5% through 2035 in the outsourced digital workplace service market. Increasing workplace digitalisation and the rise of hybrid and remote work models drive demand for IT service outsourcing. Brazilian companies are increasingly adopting cloud-based solutions and collaboration tools to improve productivity and streamline communication. Service providers offer scalable, tailored digital workplace solutions to support Brazil’s evolving business environment. The expansion of the e-commerce, technology, and financial sectors further propels the need for outsourced services to optimise workflows, enhance security, and integrate new technologies.

USA is projected to grow at a CAGR of 4.6% through 2035 in the outsourced digital workplace service market. As businesses seek to reduce operational costs and improve productivity, outsourced digital services are increasingly being adopted. Companies are outsourcing IT management, cloud services, and digital workplace tools to reduce infrastructure investments and operational complexities. The increasing need for cybersecurity, data management, and compliance further supports market growth. Additionally, remote work adoption, digital transformation, and the shift towards cloud platforms create sustained demand for outsourced services that optimise workflows and enhance overall business performance.

UK is projected to grow at a CAGR of 4.1% through 2035 in the outsourced digital workplace service market. The rapid adoption of cloud technologies, digital collaboration platforms, and automation tools drives businesses in the UK to outsource their IT services. Service providers offer tailored solutions for managing IT infrastructure, data security, and workflow optimisation. The growing demand for digital transformation, particularly in financial services and retail, also accelerates the market’s growth. The UK’s focus on tech-driven business solutions and the need for flexible, remote workplace solutions support the ongoing growth of outsourced digital services.

Japan is projected to grow at a CAGR of 3.6% through 2035 in the outsourced digital workplace service market. Japan’s ongoing digitalisation efforts across various industries contribute to the growing demand for outsourced IT services. With businesses striving for digital transformation, especially in manufacturing, finance, and retail, there is an increasing need for cloud-based solutions, cybersecurity, and digital collaboration tools. Service providers are adapting to the unique needs of Japanese businesses by offering customised solutions to streamline workflows, ensure data security, and optimise IT infrastructure. The market is further supported by Japan’s focus on innovation and technological integration.

The global outsourced digital workplace service market is highly competitive, driven by large IT services and consulting firms offering comprehensive digital transformation solutions to enhance workplace productivity, collaboration, and user experience. HCLTech, Tata Consultancy Services, and Accenture hold leading positions through end-to-end digital workplace solutions that include cloud integration, collaboration tools, IT support, and security services tailored for enterprise clients.

Atos, Wipro, DXC Technology, and Unisys strengthen their market presence with customized services that optimize IT infrastructure, user support, and digital workspace management for global organizations. Infosys, Stefanini, and Capgemini offer additional capabilities in digital transformation and employee experience management, focusing on automation, data analytics, and AI-driven solutions for workplace efficiency.

Kyndryl, Cognizant, and NTT DATA Group enhance their competitive offerings with managed services, hybrid cloud solutions, and workplace modernization tools that improve both remote and in-office employee productivity. Ricoh, Tech Mahindra, and Computacenter contribute through managed IT services, document management, and collaborative work environment setups for organizations of various sizes. TEKsystems, Compucom, and Buchanan Technologies broaden the market with flexible, customer-specific solutions that cater to SMBs and enterprise clients.

Competition is shaped by service reliability, scalability, user experience integration, and the ability to drive seamless cloud, mobility, and collaboration capabilities. Strategic differentiation depends on robust managed services, digital tool integration, and long-term customer support models. As businesses continue to adapt to hybrid and remote working environments, firms that can offer scalable, secure, and efficient digital workplace solutions are positioned for long-term success in this market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Device Management Service, Virtual Workplace Service, Others |

| Application | Large Enterprises, SMEs |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and others |

| Key Companies Profiled | HCLTech, Tata Consultancy Services, Accenture, Atos, Wipro, DXC Technology, Unisys, Infosys, Stefanini, Capgemini, Kyndryl, Cognizant, NTT DATA Group, Ricoh, Tech Mahindra, Computacenter, TEKsystems, Compucom, Buchanan Technologies |

| Additional Attributes | Market share by type and application, organizational adoption trends for remote work and digital transformation, demand for hybrid IT management and workplace optimization, integration with cloud and mobility, automation in workplace services. |

East Asia

Europe

North America

South Asia

Latin America

Middle East & Africa

Eastern Europe

The global outsourced digital workplace service market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the outsourced digital workplace service market is projected to reach USD 4.0 billion by 2035.

The outsourced digital workplace service market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in outsourced digital workplace service market are device management service, virtual workplace service and others.

In terms of application, large enterprises segment to command 58.0% share in the outsourced digital workplace service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Outsourced Testing Services Market Insights – Trends & Forecast 2025 to 2035

Digital Hall Effect Gaussmeter Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Digital Rights Management Market Size and Share Forecast Outlook 2025 to 2035

Digital Liquid Filling Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Transformation Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Digital X-Ray Equipment Market Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Digital Health Market Forecast and Outlook 2025 to 2035

Digital Pen Market Forecast and Outlook 2025 to 2035

Digital X-ray Market Size and Share Forecast Outlook 2025 to 2035

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Digital Pump Controller Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Digital Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Digital Battlefield Market Size and Share Forecast Outlook 2025 to 2035

Digital Product Passport Software Market Size and Share Forecast Outlook 2025 to 2035

Digital Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Digital Shipyard Market Size and Share Forecast Outlook 2025 to 2035

Digital Freight Matching Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA