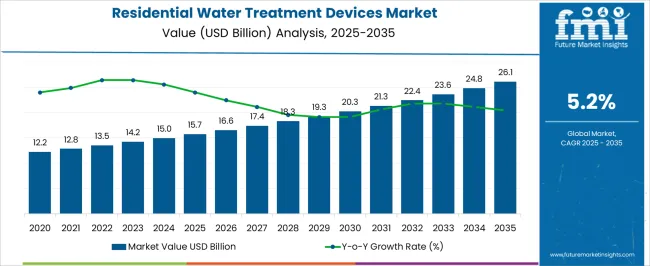

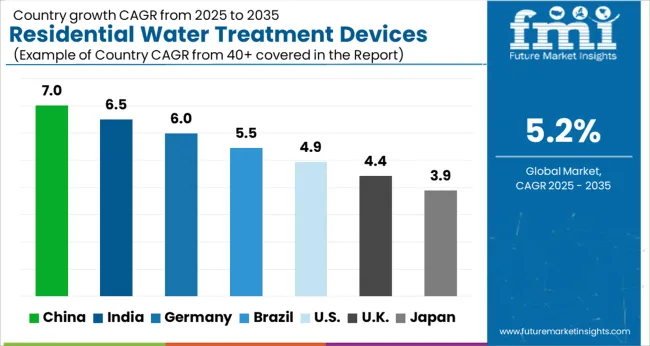

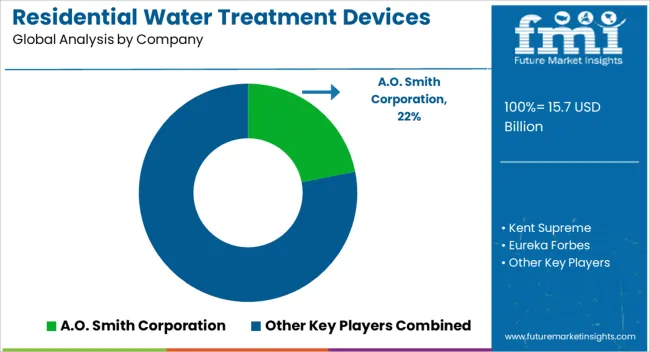

The Residential Water Treatment Devices Market is estimated to be valued at USD 15.7 billion in 2025 and is projected to reach USD 26.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Residential Water Treatment Devices Market Estimated Value in (2025 E) | USD 15.7 billion |

| Residential Water Treatment Devices Market Forecast Value in (2035 F) | USD 26.1 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The residential water treatment devices market is expanding steadily as households prioritize access to safe and clean drinking water in response to rising concerns about waterborne contaminants, heavy metals, and chemical pollutants. Growing urbanization, aging water infrastructure, and heightened consumer awareness regarding health risks are accelerating adoption across both developed and emerging economies.

Technological innovation in compact purification systems, smart monitoring features, and energy efficient designs has improved product appeal and accessibility. Additionally, supportive government initiatives on water quality standards and public health programs are encouraging widespread installation of household purification systems.

With increasing consumer willingness to invest in durable and reliable water treatment solutions, the market outlook remains strong, particularly in segments aligned with convenience, affordability, and point of use efficiency.

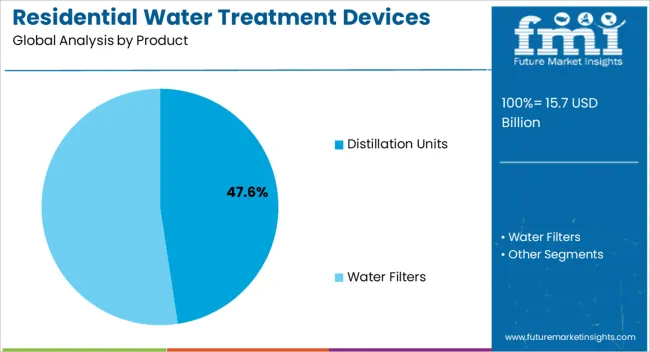

The distillation units segment is projected to hold 47.60% of total market revenue by 2025, establishing itself as the dominant product type. This growth is attributed to the ability of distillation systems to effectively remove a wide spectrum of contaminants including heavy metals, salts, and pathogens.

Their reliability in producing consistently pure water has made them particularly relevant in regions where water quality is highly variable. The long term cost effectiveness of distilled water generation and the rising demand for chemical free purification processes are further supporting adoption.

Distillation units continue to gain traction among health conscious households seeking premium solutions for safe and clean drinking water.

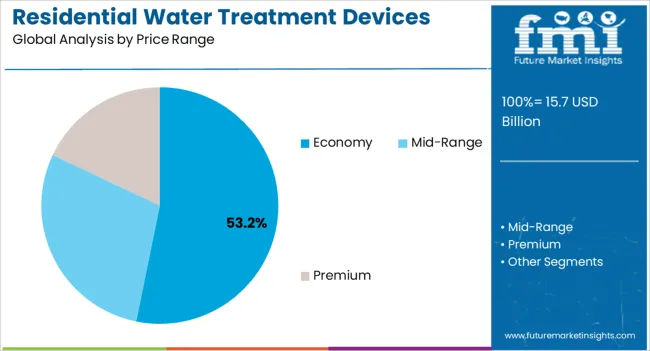

The economy price range segment is expected to contribute 53.20% of overall revenue by 2025, positioning it as the leading category in terms of affordability. This share is being driven by the widespread preference for cost effective devices that provide reliable purification without significant upfront investment.

The segment caters to middle income households and large urban populations where water quality concerns are pressing but budgetary considerations remain important. The availability of durable yet low maintenance systems within this price range has further supported its growth.

As awareness campaigns around safe drinking water expand, the economy segment continues to attract significant adoption due to its balance of effectiveness and affordability.

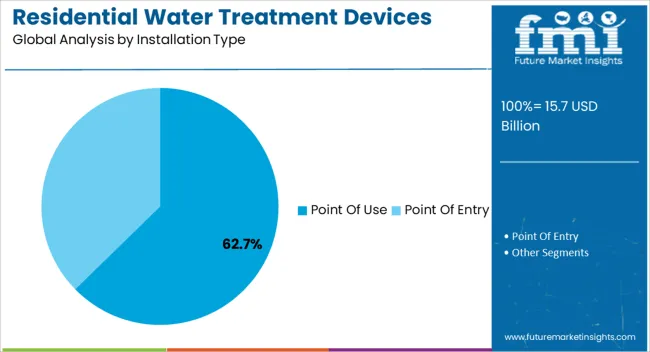

The point of use installation type is anticipated to account for 62.70% of total revenue by 2025, making it the most prominent installation category. This dominance is due to the convenience, efficiency, and flexibility offered by point of use systems, which treat water directly at consumption points such as kitchens and bathrooms.

Their compact size, lower installation costs, and ability to address specific household water concerns have increased their appeal among urban consumers. The growing adoption of modular and easily serviceable devices has further supported the expansion of this segment.

As consumer lifestyles emphasize convenience and on demand access to clean water, point of use systems remain the preferred choice in the residential water treatment devices market.

The market was grown significantly at a moderate pace between 2020 and 2025. The factors driving the market include growing waterborne disease concerns and increasing consumer demand for fresh and clean water. According to Future Market Insights, the market was valued at USD 11,794.2 million with a CAGR of 3.6% in 2020 and is projected at USD 23,721.0 million by 2035.

Asia Pacific is a significant growing region due to its rapid urbanization, rising population, and industrialization. Due to the increasing concerns about wastewater and excess water use, the manufacturers have developed water purification devices for residential uses. These devices help to recycle and reuse the quantity of water without any excess wastage.

Based on product type, water filters are anticipated to lead the global residential water treatment devices market by capturing a CAGR of 4% by 2035. The growing awareness of water filters for water purification and the causes of contaminated water fuel the demand for water filters.

Manufacturers and key companies are developing these water filters at a reasonable price for their consumers. Consumers do not have to spend a huge amount on these water filters. Therefore, the demand for water filters is rapidly increasing in the market growth in the coming years.

Based on the price range, consumers prefer to buy mid-range residential water treatment devices. This device is anticipated to collect a CAGR of 5%, with steady growth in the market by 2035. Consumers are looking for budget-friendly water treatment devices, with the availability of types of variants surging the market expansion.

Based on installation type, the point-of-use is leading the global market by capturing a CAGR of 6% by 2035. The contractors or municipality installed point-of-entry devices at the main water line to provide water for residential uses. The growing demand for clean and fresh water is increasing the adoption of this segment.

The increasing supply of contaminated water in residential is rising the installation of point-of-use. It is an essential process that provides water after treating its level of quality to residential complexes or buildings.

Based on sales channels, online retailing is dominating the global market by registering a CAGR of 6% by 2035. The growing technology, such as the Internet of Things, is increasing sales on the online platform. Consumers prefer to buy these products on a budget through online retailing compared to offline channels.

The key players launching their new products by collaborating with e-commerce websites are expanding the market. The manufacturers are strengthening their market by selling their products online during the forecast period.

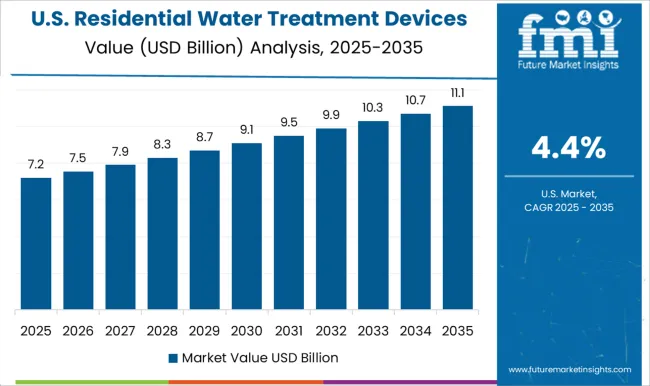

The United States residential water treatment devices market is estimated to lead the global market by capturing a maximum share of 18% by 2035. Consumers are growing concerned about a healthy life with the rising demand for clean and pure drinking water in the country. The United States uses more than 50 million gallons of water. The drinking water for consumers comes from various sources such as rivers, lakes, and reservoirs.

The United States consumers receive around 50,000 community water systems for drinking purposes nationwide. The government of the United States installed miles of pipelines for fresh drinking water. In the United States, around 6 to 7 gallons of water are wasted or polluted for different purposes such as cleaning, washing, and excess uses. These factors are anticipated to rises the demand for residential water treatment devices in the United States.

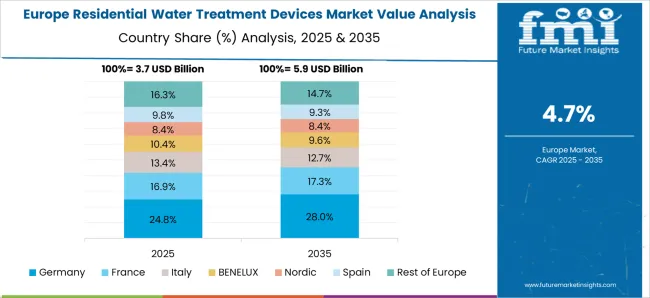

Germany is one of the significant nations in the global market, securing a relevant share of 5.3% by 2035. The rising groundwater and surface water pollution increase the demand for water testing devices in Germany. The major problem behind water pollution in the country is phosphorous and nitrates from fertilizers widely used in agriculture.

The rising water purification system and treatment devices with advanced water treatment apps are fueling the market growth in the country. German government launched several regulations for water protection, such as anti-pollution legislation and water waste taxes.

Due to these regulations, consumers can save water and use it accordingly without waste. Overall, water treatment's growing popularity is surging Germany's residential water treatment devices market in the coming years.

China is one of the significant nations in the Asia Pacific region that is anticipated to capture a share of 6.4% by 2035. The growing population, urbanization, and rising contaminated water are increasing the adoption of residential water treatment devices. The rising industrial, agricultural, and human hazardous waste is surging China's residential water treatment devices during the forecast period.

China is concerned about groundwater waste in 90% of cities in the country. China's government takes initiatives to reduce water waste and maintain water quality through these treatment devices. The water gets contaminated in rural areas for washing near the river, cleaning, and other industrial complexes. These factors continue to expand China's residential water treatment devices market in the coming years.

India is another nation in the Asia Pacific region that is estimated to collect a share of 12.0% by 2035. In India, around 70% of surface water is unsafe for human consumption, rapidly increasing the adoption of water testing devices. Nearly 40 million litres of water are from rivers, dams, and other sources to provide consumers with clean water.

According to a report by Indian Water Portal, diseases spread from contaminated water include typhoid, cholera, and viral hepatitis. These diseases cause mortality in several Indian states, including Uttar Pradesh, Odisha, and Bengal. The growing awareness of these diseases is increasing the country's sales of residential water treatment devices.

The market is fragmented by the present players who invest their amount in research and development activities. These players are innovating unique and advanced products as per consumers' requirements. The players play a crucial role in market expansion through their marketing methodologies. Their marketing strategies are mergers, acquisitions, agreements, partnerships, and product launches.

Other Essential Players in the Market:

Recent Developments in the Global Residential Water Treatment Devices Market are:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Countries Covered | United States, United Kingdom, Japan, India, China, Germany |

| Key Segments Covered | Product Type, Installation Type, Sales Channel, Region |

| Key Companies Profiled | A.O. Smith Corporation; Kent Supreme; Eureka Forbes; Panasonic; Aqua Care; 3M; Aquasana; Waterwise Inc.; Everpure; GE Appliances |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global residential water treatment devices market is estimated to be valued at USD 15.7 billion in 2025.

The market size for the residential water treatment devices market is projected to reach USD 26.1 billion by 2035.

The residential water treatment devices market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in residential water treatment devices market are distillation units and water filters.

In terms of price range, economy segment to command 53.2% share in the residential water treatment devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA