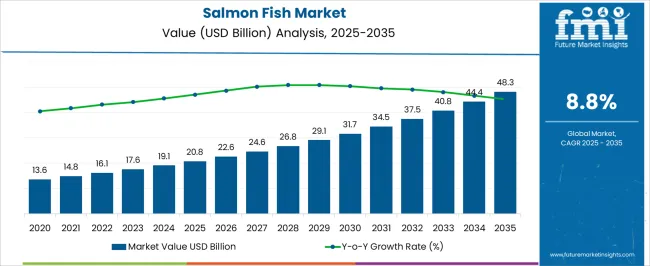

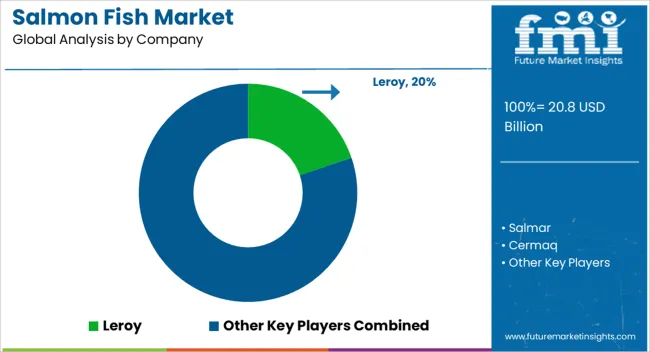

The salmon fish market is estimated to be valued at USD 20.8 billion in 2025 and is projected to reach USD 48.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period.

Demand growth is anticipated to be shaped by the rising preference for protein-rich diets and the increasing awareness of salmon’s nutritional benefits, such as omega-3 fatty acids and lean protein, which have become central to consumer health choices. Expanding aquaculture activities in countries like Norway, Chile, and Scotland are expected to strengthen supply networks, while technological improvements in fish farming and feed optimization are ensuring higher yields and improved quality. The market is also benefiting from the growing integration of salmon into ready-to-eat meals and frozen food products, catering to busy urban lifestyles. Expansion in retail chains, online grocery platforms, and specialty seafood outlets is making salmon more accessible across developed and developing regions.

The hospitality sector and quick-service restaurants are also playing a pivotal role in shaping demand, with salmon being adopted in global cuisines from sushi to grilled dishes. Trade partnerships and government-backed seafood export initiatives are broadening cross-border opportunities, creating a more competitive landscape. With rising disposable incomes and premiumization trends in seafood consumption, the salmon fish market is set for a strong growth trajectory.

| Metric | Value |

|---|---|

| Salmon Fish Market Estimated Value in (2025 E) | USD 20.8 billion |

| Salmon Fish Market Forecast Value in (2035 F) | USD 48.3 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The salmon fish market is shaped by five interconnected parent markets that together define its growth path and product adoption. The seafood and aquaculture market contributes the largest share at 40%, supported by large-scale farming operations in Norway, Chile, and Scotland that ensure steady global supply. The processed food and ready-to-eat meals segment holds 25%, as salmon is increasingly used in frozen, canned, and convenience formats catering to urban consumers with busy lifestyles. The foodservice and hospitality market accounts for 15%, where salmon is a premium choice in global cuisines such as sushi, fine dining, and fast-casual restaurants, driving consistent menu innovation.

The retail and e-commerce market contributes 12%, powered by supermarkets, hypermarkets, and online seafood delivery platforms that expand consumer reach and accessibility. The health and wellness market adds 8%, as the high demand for omega-3-rich diets and protein supplements drives salmon adoption in nutraceuticals and fitness-oriented meal plans. Collectively, these parent markets ensure strong dollar sales and market share growth, with aquaculture and processed food leading over 65% of total demand. The sector’s future trajectory is anticipated to gain further strength from cross-border trade, export initiatives, and premiumization trends that position salmon as a central driver in global seafood consumption.

The salmon fish market is experiencing consistent growth driven by rising consumer preference for high protein, omega 3 rich diets and the increasing availability of sustainably farmed salmon. Advancements in aquaculture technology, improved breeding practices, and stringent quality control measures have enhanced product supply while maintaining nutritional integrity.

Growing health awareness, coupled with the expansion of premium seafood offerings in retail and foodservice channels, is supporting market demand. Additionally, the shift toward traceable and eco certified products is influencing purchasing decisions, particularly in developed markets.

With strong distribution networks and innovation in preservation and packaging, the market outlook remains positive, bolstered by the convergence of health, sustainability, and culinary trends.

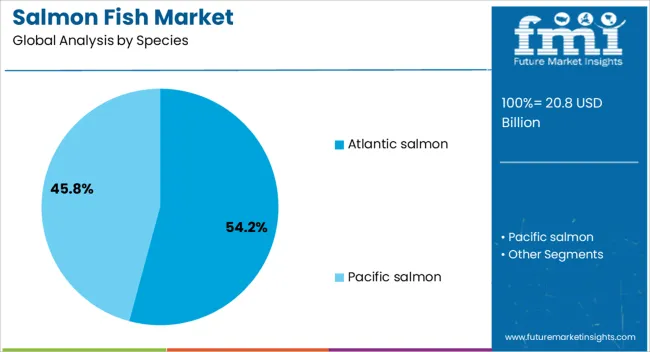

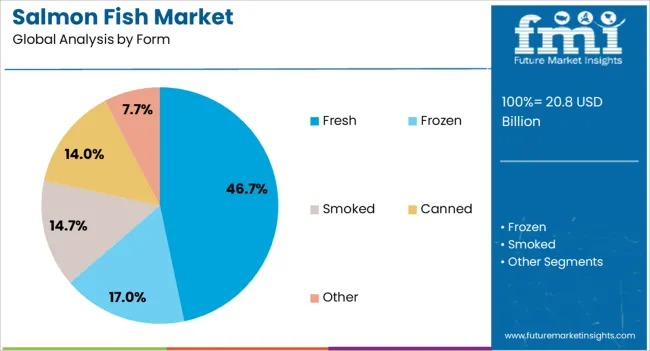

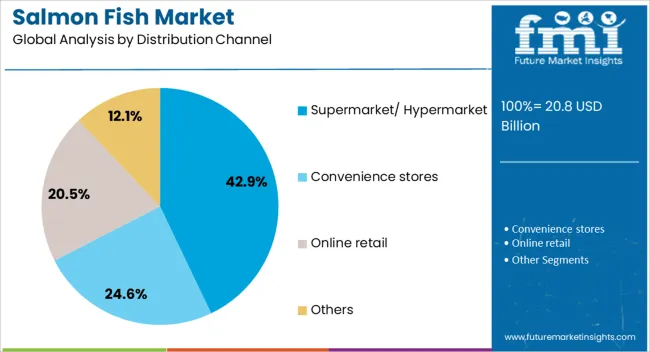

The salmon fish market is segmented by species, form, distribution channel, and geographic regions. By species, salmon fish market is divided into Atlantic salmon and Pacific salmon. In terms of form, salmon fish market is classified into fresh, frozen, smoked, canned, and other. Based on distribution channel, salmon fish market is segmented into supermarket/ hypermarket, convenience stores, online retail, and others. Regionally, the salmon fish industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Atlantic salmon species segment is projected to hold 54.20% of the total market revenue by 2025, positioning it as the leading species category. This dominance is attributed to its consistent availability, mild flavor profile, and versatility in culinary applications.

Aquaculture advancements have enabled stable production volumes and quality consistency, meeting both domestic and export demand.

Strong brand recognition and consumer familiarity further reinforce its market presence, while sustainable farming certifications have boosted its acceptance among environmentally conscious buyers.

The fresh form segment is expected to account for 46.70% of total market revenue by 2025, making it the most prominent product form. Fresh salmon is favored for its premium quality, taste, and high nutritional value.

The growth of chilled supply chains and advancements in cold storage technology have extended shelf life, enabling broader retail availability.

Consumer preference for minimally processed seafood, along with the rising popularity of home cooking and gourmet recipes, has further strengthened demand for fresh salmon.

The supermarket and hypermarket distribution channel segment is anticipated to capture 42.90% of the market share by 2025, establishing it as the leading sales channel. The dominance of this segment is supported by the extensive product variety, competitive pricing, and convenience offered by large retail formats.

The availability of fresh and packaged salmon under one roof, along with promotional campaigns and in store sampling, has encouraged higher consumer engagement.

Furthermore, strategic placement in chilled seafood sections and partnerships with certified sustainable suppliers have reinforced consumer trust and repeat purchases.

The salmon fish market is gaining strength through aquaculture expansion, rising protein-rich diet demand, and convenience-driven product formats. Foodservice adoption has further solidified salmon’s position as a premium global seafood choice.

The salmon fish market is projected to expand as global consumers prioritize healthier and protein-rich diets. Salmon, being a rich source of omega-3 fatty acids, vitamins, and minerals, has become a staple in both developed and developing regions. Rising awareness of lifestyle-related diseases has pushed consumers toward nutrient-dense food options, where salmon is seen as a premium protein alternative to red meat. Fitness enthusiasts, wellness-focused individuals, and families seeking balanced nutrition are significantly contributing to demand. The integration of salmon into everyday diets across restaurants, packaged meals, and home cooking is creating a positive outlook. This health-driven consumption trend has made salmon one of the most preferred choices in global seafood markets.

The global salmon fish market is strongly supported by rapid expansion in aquaculture production. Countries such as Norway, Chile, Scotland, and Canada dominate supply through large-scale fish farming, ensuring year-round availability. Advances in feed optimization, disease management, and farming technologies are improving yield efficiency while lowering production costs. The growing reliance on aquaculture has reduced the pressure on wild-caught salmon, making farm-raised salmon the backbone of global trade. Investments in hatcheries, offshore farming, and integrated supply chains are allowing producers to meet rising demand. With aquaculture contributing the largest share to overall salmon supply, its expansion plays a central role in shaping long-term market growth.

The salmon fish market is experiencing strong momentum due to the rise in processed and convenience food categories. Salmon-based products such as smoked fillets, frozen portions, canned salmon, and ready-to-eat meals are increasingly available across retail and e-commerce platforms. These formats cater to busy lifestyles, offering consumers an easy way to include seafood in daily meals without compromising nutrition. Growth in frozen and packaged seafood has also expanded salmon’s presence in global trade, especially in regions where fresh salmon is less accessible. Processors are diversifying product lines with flavored, marinated, and portion-controlled packs, reinforcing salmon’s versatility. This shift toward convenience formats continues to capture a growing segment of modern food consumption.

The hospitality sector is a powerful driver of salmon consumption worldwide. Salmon has become a core feature in diverse culinary styles, from sushi and sashimi in Asia to grilled fillets and gourmet recipes in Europe and North America. Restaurants, hotels, and fast-casual dining outlets are integrating salmon into menus as consumers demand premium seafood experiences. The growing middle-class population in emerging economies is fueling out-of-home dining, expanding salmon’s reach across new markets. Partnerships between salmon producers and global foodservice chains are creating supply stability and standardization. With its premium image and culinary flexibility, salmon has secured a dominant role in the global foodservice industry, further reinforcing its upward demand trajectory.

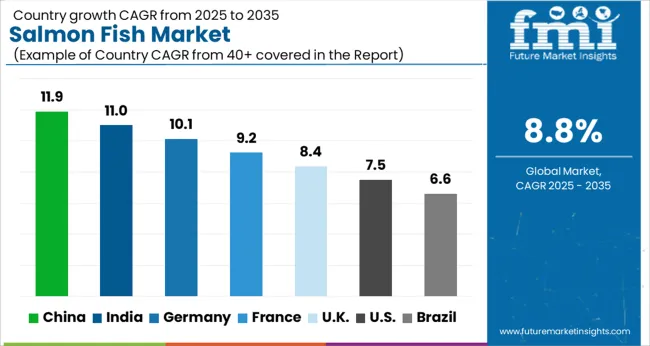

| Country | CAGR |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.4% |

| USA | 7.5% |

| Brazil | 6.6% |

The global salmon fish market is projected to grow at a CAGR of 8.8% between 2025 and 2035. China and India, representing the fast-growing BRICS economies, lead in both production capacity and consumption demand, driven by rising protein-rich diets and aquaculture expansion. Germany, the United Kingdom, and the United States, as major OECD members, focus on premium seafood consumption, processed salmon products, and high-quality import channels. Growth is supported by increasing retail penetration, ready-to-eat meals, and foodservice integration across restaurants and hospitality sectors. Asia drives supply volume and export potential, while Europe and North America emphasize quality, health-focused offerings, and diversified culinary adoption. The analysis covers over 40 countries, highlighting key markets and regional consumption patterns.

The salmon fish market in China is projected to grow at a CAGR of 11.9% from 2025 to 2035, driven by rising disposable incomes, increasing health awareness, and growing preference for protein-rich diets. Large-scale investments in aquaculture farms across coastal provinces are enhancing domestic supply, while imports from Norway and Chile continue to supplement high-quality demand. Retail chains and e-commerce platforms are expanding their seafood offerings, making salmon more accessible to urban consumers. The foodservice sector is also adopting salmon extensively, from sushi bars to premium restaurants, further boosting demand. Government initiatives supporting sustainable aquaculture practices and seafood quality standards are strengthening market trust. Domestic producers are scaling production while improving feed and farming techniques to meet quality and safety expectations.

India’s salmon fish market is expected to grow at a CAGR of 11.0%, fueled by rising health-conscious consumers and increasing urban demand for seafood. While domestic aquaculture is expanding slowly, imports from Norway, Scotland, and Chile are filling the gap to meet premium seafood demand. Processed salmon products, such as ready-to-eat fillets and frozen portions, are gaining popularity among urban households and office professionals. The growth of supermarkets, hypermarkets, and online grocery platforms is improving market penetration and accessibility. Foodservice chains and luxury restaurants are adopting salmon for sushi, grilled dishes, and international cuisine menus. Government initiatives promoting cold-chain infrastructure and seafood safety are enhancing consumer confidence and supply stability.

Germany’s salmon fish market is projected to grow at a CAGR of 10.1% from 2025 to 2035, driven by strong consumer preference for healthy diets and premium seafood. Imports dominate the market, particularly from Norway, Scotland, and Chile, ensuring year-round availability of fresh and frozen salmon. Processed salmon products, including smoked fillets and packaged portions, are widely consumed across households and convenience-driven buyers. The retail sector, including supermarkets and specialty stores, is expanding offerings to cater to health-conscious consumers. Restaurants and catering services are increasingly incorporating salmon into menus due to its culinary versatility. Government regulations on seafood quality, traceability, and cold-chain logistics enhance consumer trust and supply chain reliability.

The salmon fish market in the United Kingdom is expected to grow at a CAGR of 8.4% from 2025 to 2035, supported by strong consumer awareness of omega-3 benefits and protein-rich diets. Imports from Norway, Chile, and Scotland dominate supply, supplemented by local aquaculture operations. Retail channels, including supermarkets and online grocery platforms, are expanding offerings in fresh, frozen, and ready-to-eat salmon products. Foodservice and hospitality sectors are increasingly adopting salmon for premium menus, sushi, and grilled dishes. Government and industry-led seafood certification programs enhance consumer confidence, ensuring adherence to quality and traceability standards. The growing trend of health-oriented diets and convenient seafood consumption continues to drive demand across urban and suburban populations.

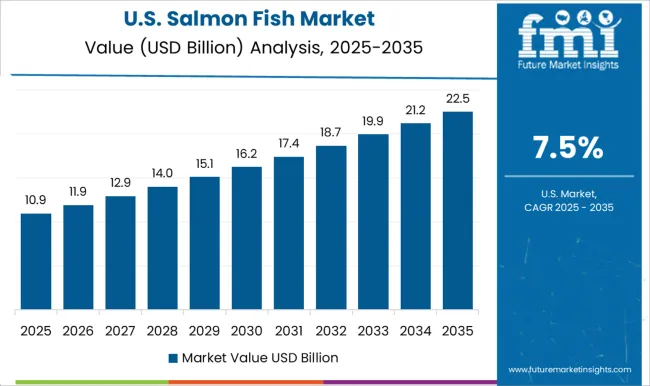

The USA salmon fish market is projected to grow at a CAGR of 7.5% from 2025 to 2035, fueled by rising demand for healthy, protein-rich, and omega-3-enriched diets. Imports from Norway, Chile, and Canada dominate the market, while domestic aquaculture contributes to specialty segments. Retailers and online grocery platforms are increasingly offering fresh, frozen, and ready-to-eat salmon products, catering to health-conscious consumers and convenience-driven buyers. The restaurant and hospitality sectors are adopting salmon extensively for sushi, grilled entrees, and international cuisine, driving premium consumption. Quality certification, cold-chain logistics, and traceability programs enhance market confidence. The focus on functional foods and healthy eating habits continues to strengthen salmon’s position as a preferred seafood choice.

Competition in the salmon fish market is defined by aquaculture scale, quality management, and supply chain efficiency. Mowi ASA leads globally with extensive farming operations in Norway, Chile, and Scotland, leveraging advanced feed management and integrated logistics to ensure consistent product quality and year-round supply. Cermaq follows closely, focusing on sustainable aquaculture practices, disease management, and regional expansion to meet growing international demand. Leroy and Salmar capitalize on strong domestic presence in Norway, emphasizing selective breeding, farm optimization, and premium product lines targeted at retail and foodservice sectors.

Bakkafrost has positioned itself in high-value markets with superior cold-chain logistics, traceability, and specialty salmon products catering to European and North American consumers. SEA DELIGHT GROUP, Nordlaks Produkter, and Atlantic Sapphire focus on niche segments, including organic, land-based, and offshore farming, offering differentiated products to health-conscious and premium consumers. Ideal Foods and BluGlacier specialize in frozen and processed salmon products, targeting convenience-driven retail and e-commerce channels. Market strategies revolve around yield improvement, disease prevention, and product diversification, with emphasis on smoked, frozen, fillet, and ready-to-eat formats.

Differentiation is achieved through quality certifications, traceability programs, and cold-chain logistics ensuring freshness. Partnerships with retail chains, foodservice providers, and international distributors strengthen market presence. Innovation in feed formulation, aquaculture technology, and sustainability-oriented practices is highlighted in product offerings, enhancing nutritional value, flavor, and shelf life. Strong focus on premium positioning, brand recognition, and global exports continues to shape competitive dynamics across North America, Europe, and Asia.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.8 billion |

| Species | Atlantic salmon and Pacific salmon |

| Form | Fresh, Frozen, Smoked, Canned, and Other |

| Distribution Channel | Supermarket/ Hypermarket, Convenience stores, Online retail, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Leroy, Salmar, Cermaq, Mowi ASA, Bakkafrost, SEA DELIGHT GROUP, Nordlaks Produkter, Atlantic Sapphire, Ideal Foods, and BluGlacier |

| Additional Attributes | Dollar sales, share, aquaculture expansion, import-export trends, processed product demand, retail penetration, foodservice adoption,price trends, and consumer preferences. |

The global salmon fish market is estimated to be valued at USD 20.8 billion in 2025.

The market size for the salmon fish market is projected to reach USD 48.3 billion by 2035.

The salmon fish market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in salmon fish market are atlantic salmon and pacific salmon.

In terms of form, fresh segment to command 46.7% share in the salmon fish market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA