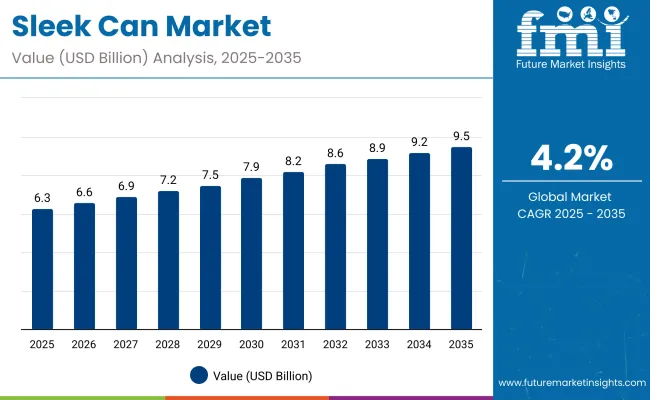

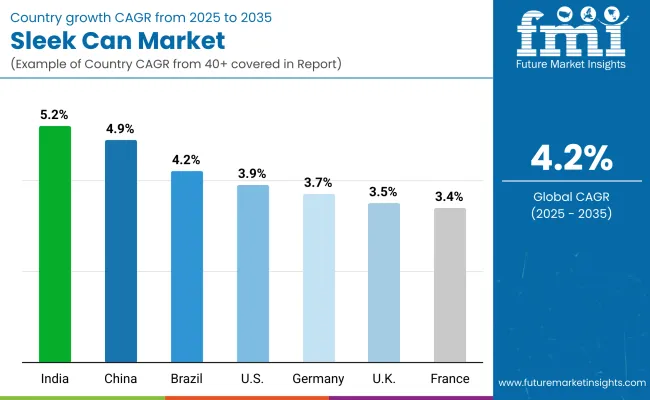

The sleek can market is expected to grow from USD 6.3 billion in 2025 to USD 9.5 billion by 2035, resulting in a total increase of USD 3.2 billion over the forecast decade. This represents a 50.8% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 4.2%. Over ten years, the market grows by a 1.5 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6.3 billion |

| Industry Value (2035F) | USD 9.5 billion |

| CAGR (2025 to 2035) | 4.2% |

In the first five years (2025-2030), the market progresses from USD 6.3 billion to USD 7.6 billion, contributing USD 1.3 billion, or 40.6% of total decade growth. This phase is shaped by rising demand in energy drinks and carbonated soft drinks, where sleek formats enhance branding and portability. Premium positioning in North America and Europe drives strong adoption.

In the second half (2030-2035), the market grows from USD 7.6 billion to USD 9.5 billion, adding USD 1.9 billion, or 59.4% of the total growth. This acceleration is supported by lightweight aluminium innovations, recyclability improvements, and expansion in functional beverage packaging. Growth is reinforced by breweries and nutraceutical brands adopting sleek cans for differentiation, ensuring their place as a preferred format in global beverage markets.

From 2020 to 2024, the sleek can market expanded from USD 5.4 billion to USD 6.0 billion, driven by strong adoption in energy drinks, functional beverages, and premium alcoholic drinks. Nearly 70% of revenue was dominated by major can manufacturers focused on light weighting, design appeal, and recyclability. Leading firms such as Ball Corporation, Crown Holdings, and Ardagh Group emphasized high-speed production, BPA-free coatings, and improved printability. Differentiation centered on portability, stackability, and shelf impact, while smart-label integration remained a secondary innovation. Service-led offerings such as design consulting contributed under 12% of revenues, as most beverage brands opted for direct procurement of cans in bulk.

By 2035, the sleek cans market will reach USD 9.5 billion, growing at a CAGR of 4.20%, with sustainable aluminum innovations and digitally enhanced cans representing over 40% of total value. Competition will intensify as new players introduce bio-coated metals, AR-enabled interactive packaging, and modular customization options. Established leaders are adapting with hybrid models combining manufacturing excellence with design-driven differentiation and IoT traceability. Emerging companies such as Canpack, Envases, and CCL Industries are gaining momentum with eco-aligned finishes, variable-size capabilities, and advanced decoration technologies that meet evolving consumer demand for both sustainability and premium beverage presentation.

The rising popularity of energy drinks, sparkling water, and premium ready-to-drink beverages is fueling growth in the sleek can market. These cans provide a modern, stylish look and excellent branding opportunities, appealing to younger consumers and lifestyle-focused buyers. Lightweight construction and recyclability further support adoption across beverage categories.

Sleek cans featuring aluminum bodies, high-resolution printing, and tamper-evident closures are gaining traction for their ability to preserve taste and carbonation. Their stackability, reduced material usage, and compatibility with automated filling lines enhance operational efficiency. Sustainability initiatives promoting recyclable metal packaging also contribute to strong global market expansion.

The market is segmented by material, capacity, application, end-use industry, and region. Material segmentation includes aluminum, steel, tinplate, composite laminates (metal-plastic hybrids), and bio-based coated metals, each offering durability, lightweight features, and sustainability benefits. Capacity covers small (150 ml-250 ml), medium (251 ml-355 ml), and large (356 ml-500 ml and above), aligning with beverage portion preferences and branding needs.

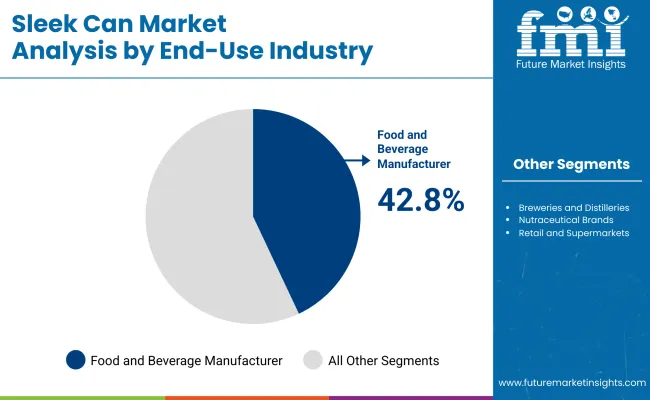

Applications include carbonated soft drinks, energy drinks, alcoholic beverages, functional and nutritional drinks, bottled water, and ready-to-drink coffee and tea, supporting diverse consumption trends. End-use industries consist of food and beverage manufacturers, breweries and distilleries, nutraceutical brands, retail and supermarkets, and the food service sector. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

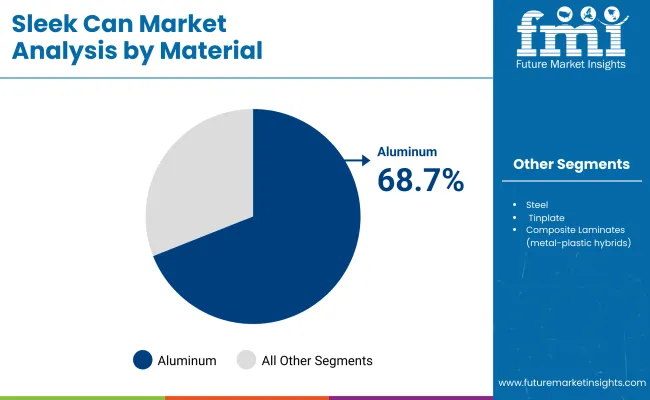

Aluminum is forecast to account for 68.7% of the sleek can market in 2025, supported by its lightweight structure, durability, and strong recyclability. Its high barrier properties protect beverages from light and oxygen exposure, ensuring taste preservation and extended shelf life. Brands also prefer aluminum for its premium feel and sustainability profile.

Rising consumer demand for eco-friendly packaging has accelerated the transition from steel and tinplate to aluminum. Innovations in coating and printing technologies enhance branding opportunities, while infinite recyclability strengthens environmental appeal. The material’s compatibility with diverse beverages reinforces its leadership in the sleek can segment.

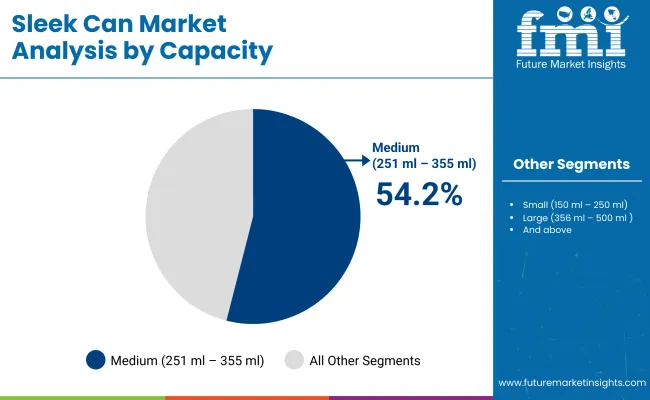

Medium-sized cans (251-355 ml) are projected to hold 54.2% of the market in 2025, driven by their suitability for carbonated drinks, energy beverages, and functional drinks. Their balance between portability and portion control makes them the most widely accepted format worldwide.

Adoption is fueled by their dominance in vending, retail, and on-the-go consumption channels. Beverage companies rely on this size for cost-efficient filling and compatibility with existing production lines. Medium capacity cans also allow effective packaging for limited-edition launches and multipack promotions.

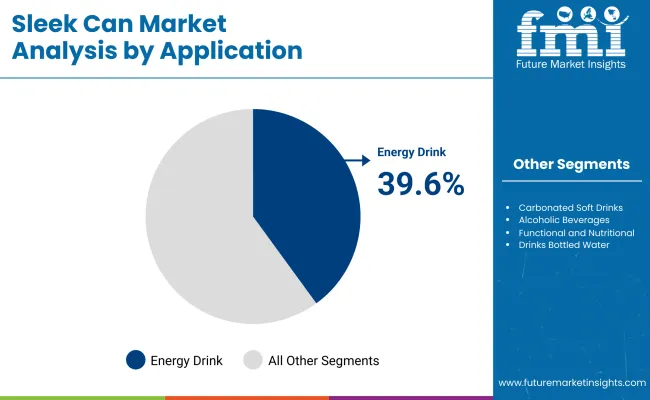

Energy drinks are expected to capture 39.6% of demand in 2025, as sleek cans align with the category’s branding and lifestyle-driven appeal. The slim design emphasizes modernity, mobility, and premium positioning, resonating strongly with younger demographics and athletes.

The functional beverage boom has reinforced this trend, with sleek cans enabling differentiation on crowded shelves. Their ability to accommodate nitrogen flushing and barrier linings enhances product stability. Marketing strategies highlighting convenience and energy-boosting benefits further cement sleek cans as the preferred format for energy drinks.

Food and beverage manufacturers are projected to account for 42.8% of demand in 2025, as they represent the largest producers of carbonated, energy, and functional beverages. Sleek cans are favored for their ability to support mass production, branding consistency, and product shelf appeal.

Manufacturers benefit from streamlined logistics, as cans offer stacking efficiency and reduced transportation costs. Partnerships with packaging companies ensure consistent supply of high-quality aluminum formats. As global beverage demand expands, large-scale producers continue to anchor sleek can adoption.

The sleek can market is growing as beverage brands adopt slim, lightweight packaging to enhance shelf appeal and reduce material usage. Rising consumption of energy drinks, RTD coffee, and functional beverages supports demand. However, high production costs and recycling challenges limit broader adoption. Trends in eco-friendly coatings, customizable printing, and lightweight aluminum are driving market innovation.

Premium Appeal, Convenience, and Functional Beverage Growth Driving Adoption

Sleek cans are increasingly chosen for their slim design, which offers a modern look and easy portability. Their strong visual appeal supports brand differentiation on crowded retail shelves. The format is especially popular in energy drinks, carbonated soft drinks, and functional beverages, aligning with lifestyle-focused consumer demand. Beverage companies also prefer sleek cans for their compatibility with chilled vending machines and convenience packaging channels. These factors are positioning sleek cans as a premium yet practical solution.

High Manufacturing Costs, Recycling Limitations, and Supply Challenges Restraining Growth

Adoption is hindered by the higher cost of producing sleek cans compared to standard formats, driven by specialized tooling and forming requirements. Recycling presents challenges due to multi-material laminates and coated interiors that complicate recovery processes. Raw material price volatility, particularly for aluminum, adds further uncertainty for manufacturers. Smaller beverage companies often struggle with limited access to sleek can production lines, restricting availability and raising costs. These constraints slow adoption outside premium beverage categories.

Eco-friendly Coatings, Light weighting, and Customization Trends Emerging

Key trends include the development of BPA-free and eco-friendly can linings that meet stringent regulatory standards. Lightweight aluminum innovations are reducing material use while maintaining strength and durability. Customizable high-definition printing and limited-edition designs are enhancing brand identity and consumer engagement. Growth in functional and nutraceutical beverages is further expanding the use of sleek cans, supported by sustainability commitments and increased investment in regional can production facilities. These trends are redefining sleek cans as a sustainable and consumer-driven packaging format.

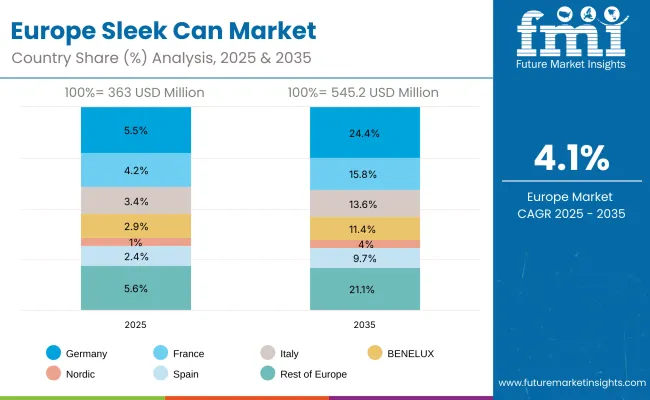

The global sleek can market is experiencing consistent growth, driven by rising demand for premium beverages, sustainable packaging, and portability. Asia-Pacific is emerging as the fastest-growing region, with India and China adopting sleek cans due to expanding energy drink and RTD beverage markets. Developed economies like the USA, Germany, and Japan emphasize recyclable aluminum formats, lightweight designs, and innovative finishes to meet consumer preferences and regulatory goals. Beverage makers worldwide continue shifting toward sleek formats to enhance branding and convenience.

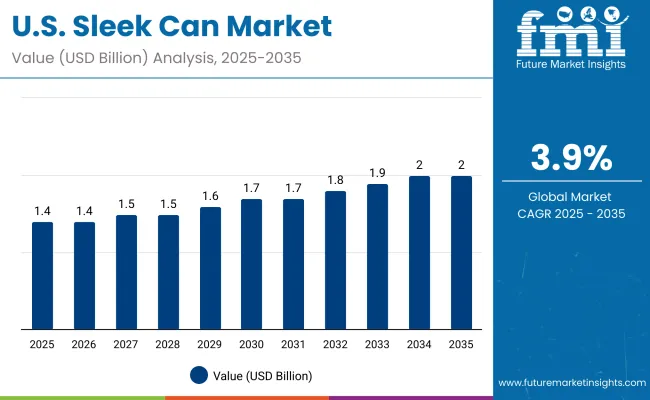

The USA market is projected to grow at a CAGR of 3.9% from 2025 to 2035, supported by rising demand for energy drinks, craft beverages, and functional drinks. Consumers increasingly prefer lightweight, recyclable packaging aligned with sustainability goals. Manufacturers are introducing customizable sleek can formats with advanced printing for branding. The growth of premium RTD cocktails and low-alcohol beverages is further fueling adoption, as sleek cans become a preferred option across breweries, health brands, and retailers.

Germany’s market is expected to grow at a CAGR of 3.7%, supported by strong demand for beer, energy drinks, and premium soft drinks. Stringent EU sustainability regulations are pushing beverage brands toward fully recyclable, lightweight aluminum cans. German OEMs are focusing on developing coatings and finishes that extend shelf life and preserve product quality. Rising exports of German beverages also support adoption of sleek cans, with an emphasis on durability, branding, and sustainability compliance.

The UK market is projected to grow at a CAGR of 3.5%, driven by rising demand for premium RTD cocktails, flavored waters, and energy drinks. Sleek cans are gaining traction in retail and e-commerce channels due to their convenience and branding advantages. Mid-sized producers and startups are adopting customizable cans for niche beverage launches. The shift toward recyclable, lightweight materials supports sustainability goals while appealing to environmentally conscious consumers.

China’s market is forecast to grow at a CAGR of 4.9%, fueled by strong demand for energy drinks, carbonated beverages, and functional drinks. Expanding urbanization and rising disposable incomes are driving adoption. Domestic manufacturers are scaling cost-effective sleek cans with advanced finishes for branding. Growth in online beverage retail and quick-service channels is further supporting adoption, making sleek cans a preferred choice for convenience, appeal, and export-oriented beverage packaging strategies.

India is forecast to record the fastest growth at a CAGR of 5.2%, supported by rising demand for energy drinks, functional beverages, and RTD cocktails. Growing middle-class consumption and urbanization are accelerating adoption of sleek cans for convenience and portability. Beverage brands are focusing on recyclable aluminum packaging aligned with global sustainability standards. Local manufacturers are scaling production to meet rising demand from both domestic consumers and export-oriented beverage producers.

Japan’s market is projected to grow at a CAGR of 3.6%, supported by demand in premium teas, health beverages, and functional drinks. Sleek cans are favored for compactness, portability, and premium presentation. Manufacturers are investing in innovative coatings and finishes that preserve delicate flavors and extend shelf life. Customizable cans with cultural designs are also gaining traction, appealing to both domestic and export consumers in Japan’s premium beverage segment.

South Korea’s market is expected to grow at a CAGR of 3.3%, supported by rising demand for energy drinks, flavored waters, and functional teas. Sleek cans are gaining popularity in K-beauty-inspired beverage collaborations, offering portability and style. Beverage startups are using sleek cans as a premium branding tool. Export-driven demand for K-drinks is also fueling adoption, with recyclable aluminum sleek cans positioned as both trendy and eco-friendly packaging solutions.

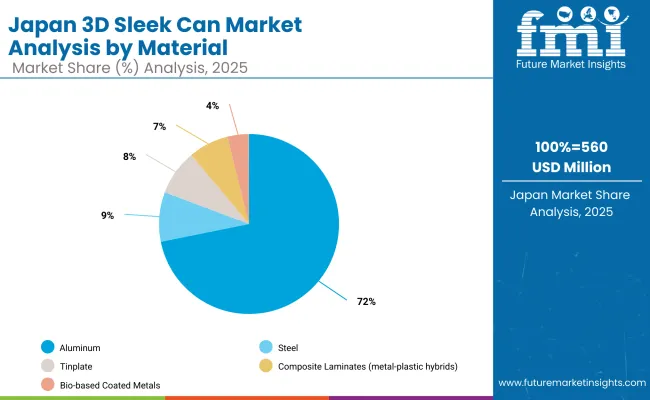

Japan’s sleek can market, valued at USD 560 million in 2025, is overwhelmingly led by aluminum with a 70.3% share, reflecting its dominance due to lightweight, recyclability, and premium appeal. Steel contributes 9.2%, tinplate accounts for 8.3%, composite laminates represent 7.3%, and bio-based coated metals stand at 4.9%. The strong position of aluminum highlights its suitability for beverages and energy drinks, aligning with consumer preference for convenience and sustainability. However, bio-based coated metals and composites are gradually expanding, signaling opportunities for eco-friendly innovation within Japan’s packaging sector.

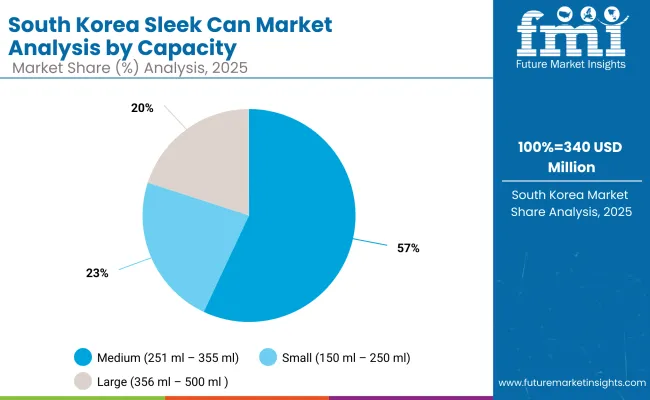

South Korea’s sleek can market in 2025, worth USD 340 million, is dominated by medium-capacity cans (251-355 ml), capturing 55.9% of share. Small cans (150-250 ml) follow with 14.0%, while large formats (356-500 ml and above) represent 12.7%. The dominance of medium-size cans reflects strong use in carbonated beverages, energy drinks, and ready-to-drink teas, catering to convenience-driven consumption. Small cans are increasingly preferred for portion control and health-conscious demand, while large sizes are used in multipacks and premium product launches. This distribution highlights South Korea’s diverse demand for sleek cans across different consumer groups and beverage categories.

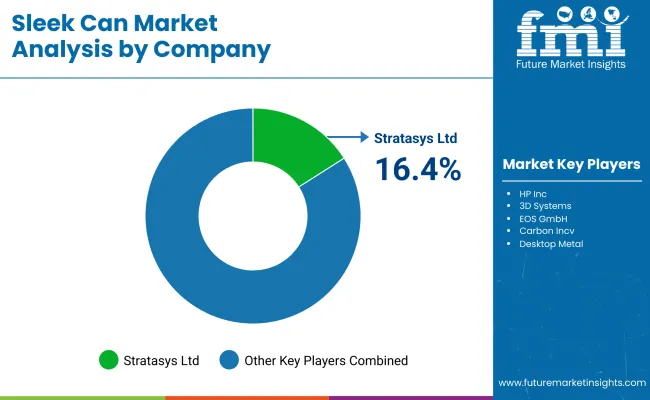

The sleek can market is moderately fragmented, with global can makers, regional packaging firms, and specialty producers competing across carbonated soft drinks, energy beverages, and alcoholic segments. Global leaders such as Ball Corporation, Crown Holdings, and Visy hold notable market share, driven by lightweight aluminum innovations, high-speed filling compatibility, and compliance with recycling and food safety standards. Their strategies increasingly emphasize sustainable sourcing, design differentiation, and regional production footprint expansion.

Established mid-sized players including Orora Beverage and Biopineoe are supporting adoption of slim-profile cans featuring advanced lithographic printing, improved barrier coatings, and ergonomic designs that appeal to health-conscious and premium beverage consumers. These companies are especially active in functional drinks and craft beverages, offering enhanced branding opportunities, reduced material usage, and tailored production flexibility.

Specialized providers such as Hiuier Pack focus on customized sleek can solutions for regional bottlers and niche markets. Their strengths lie in small-batch manufacturing, innovative surface finishes, and rapid prototyping, enabling beverage brands to test new formats, achieve greater shelf appeal, and cater to emerging consumer trends in personalization and sustainability-driven packaging.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 6.3 Billion |

| By Material | Aluminum, Steel, Tinplate, Composite Laminates (metal-plastic hybrids), Bio-based Coated Metals |

| By Capacity | Small (150 ml - 250 ml), Medium (251 ml - 355 ml), Large (356 ml - 500 ml and above) |

| By Application | Carbonated Soft Drinks, Energy Drinks, Alcoholic Beverages, Functional and Nutritional Drinks, Bottled Water, Ready-to-Drink Coffee and Tea |

| By End-Use Industry | Food and Beverage Manufacturers, Breweries and Distilleries, Nutraceutical Brands, Retail and Supermarkets, Foodservice Sector |

| Key Companies Profiled | Ball Corporation, Crown Holdings, Visy, Orora Beverage, Biopineoe, Hiuier Pack |

| Additional Attributes | Rising demand for aluminum sleek cans due to recyclability and lightweight properties, strong growth in energy and functional drinks fueling medium-capacity can use, breweries and distilleries driving premiumization through design-focused sleek cans, increasing adoption of bio-based coated metals to align with sustainability initiatives, and expanding retail and foodservice distribution enhancing accessibility across global markets. |

The global sleek can market is estimated to be valued at USD 6.3 billion in 2025.

The market size for the sleek can market is projected to reach USD 9.5 billion by 2035.

The sleek can market is expected to grow at a CAGR of 4.2% between 2025 and 2035.

The key materials in the sleek can market include aluminum, steel, tinplate, composite laminates (metal-plastic hybrids), and bio-based coated metals.

The aluminum segment is expected to account for the highest share of 68.7% in the sleek can market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.