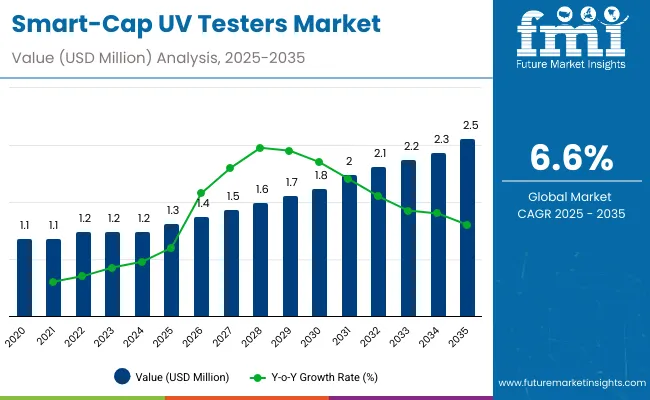

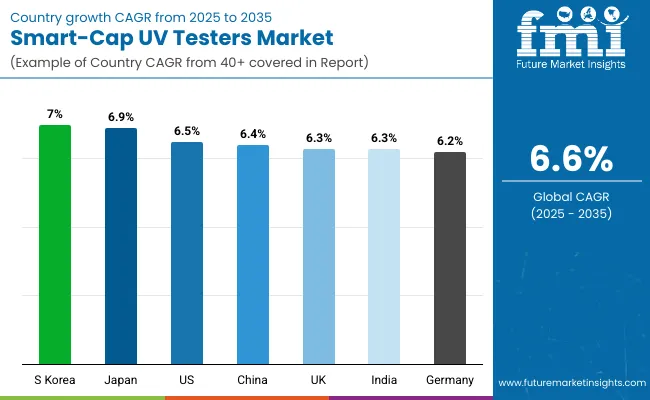

The Smart-Cap UV Testers Market will expand from USD 1.3 billion in 2025 to USD 2.5 billion by 2035, registering a CAGR of 6.6%. Growth is driven by increasing adoption of UV-based disinfection and quality control solutions across packaging and food sectors. Smart sensor-integrated testers dominate due to enhanced accuracy and digital connectivity. Between 2025 and 2030, AI-assisted UV calibration will account for USD 0.6 billion in growth. From 2030 to 2035, real-time IoT-enabled UV performance analytics will drive additional expansion.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Industry Value (2035F) | USD 2.5 billion |

| CAGR (2025 to 2035) | 6.6% |

Between 2020 and 2024, the market expanded due to hygiene awareness and UV sterilization technology integration in consumer packaging. Smart sensors and IoT-based monitoring enhanced UV validation in bottle caps and reusable containers. By 2035, the market will reach USD 2.5 billion, supported by AI diagnostics, multi-spectrum UV verification, and recyclable smart closures. Asia-Pacific will dominate as UV packaging testing becomes essential for safety compliance and consumer product innovation.

Growth is driven by surging demand for contactless sterilization in beverage and healthcare packaging. Consumers’ preference for reusable smart bottles and caps is accelerating UV quality testing integration. IoT-enabled testers provide automated calibration, data analytics, and durability validation, aligning with sustainability and health safety regulations across food, cosmetic, and pharmaceutical packaging industries worldwide.

The market is segmented by technology, application, material compatibility, end-use industry, and region. Technologies include smart sensor-integrated testers, UV intensity meters, and wireless IoT-enabled testers. Applications span beverage bottle caps, pharmaceutical containers, and cosmetic packaging. End-use industries include food & beverages, pharmaceuticals, and cosmetics.

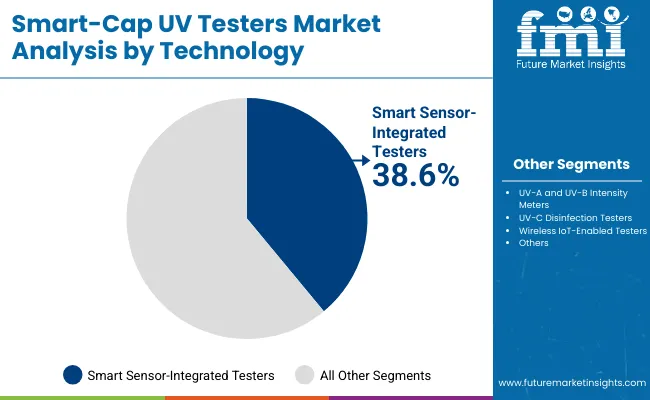

Smart sensor-integrated testers will account for 38.6% share in 2025 due to advanced accuracy and automation in UV verification. These systems offer real-time data tracking and calibration consistency. By 2035, AI-powered smart testers will dominate, ensuring faster validation, reduced maintenance, and improved efficiency in beverage and healthcare packaging quality control lines.

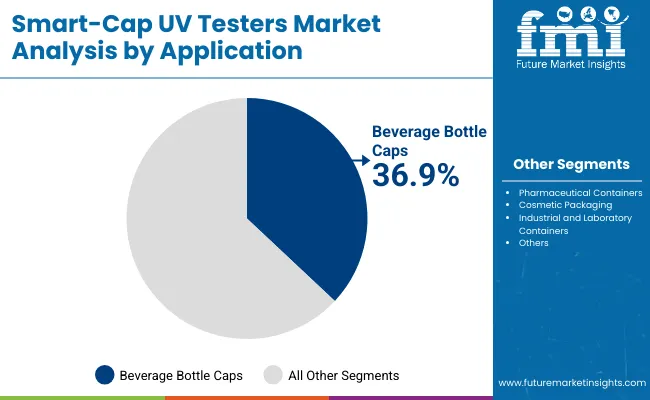

Beverage bottle caps will hold 36.9% share in 2025, driven by global adoption of UV-enabled smart bottles ensuring hygiene and sterilization. Integration of embedded sensors supports automated testing. By 2035, rising demand for reusable water bottles and sterilizable beverage caps will further boost segment growth across North America, Europe, and Asia.

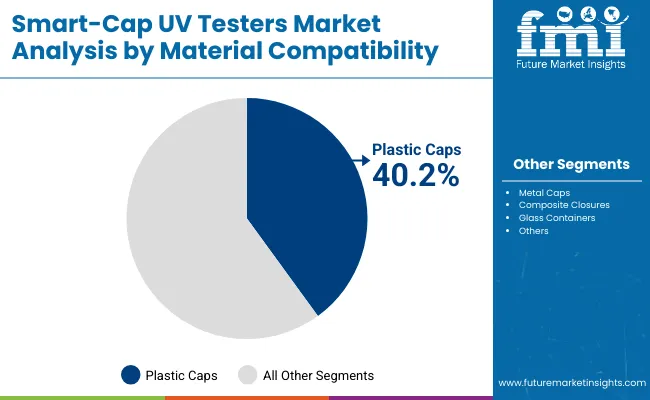

Plastic caps will represent 40.2% share in 2025, favored for cost efficiency and compatibility with embedded electronics. These materials enable UV penetration and sensor integration. By 2035, recyclable plastic composites will gain traction as sustainability policies promote eco-designed smart packaging for household and beverage products.

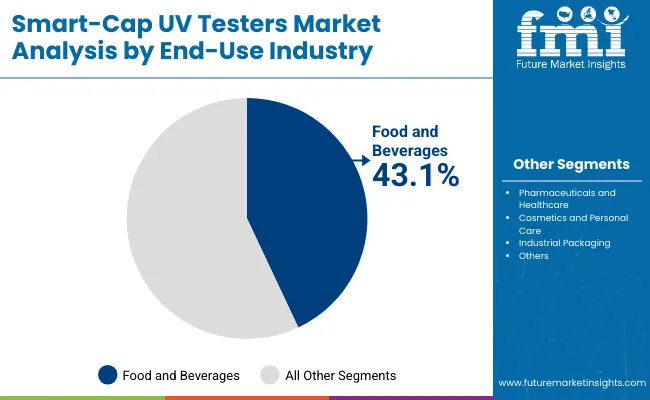

The food and beverages segment will lead with 43.1% share in 2025, driven by UV verification demand in drinkware and container safety. By 2035, digitized UV monitoring systems and portable test solutions will reinforce hygiene protocols and product traceability for beverage and nutrition industries.

Growing health awareness, hygiene certification standards, and demand for reusable UV-integrated packaging drive market growth.

High product development cost and limited consumer awareness in developing economies slow adoption.

Emerging demand for IoT-enabled UV systems and energy-efficient smart caps creates scope for digital packaging innovation.

Leading trends include hybrid UV testing technology, wireless IoT connectivity, battery-efficient designs, and smart diagnostic platforms integrating cloud-based performance analytics for UV verification.

The global smart-cap UV testers market is expanding as hygiene, digital health, and connected packaging trends gain momentum across consumer and industrial segments. Asia-Pacific leads technological adoption, particularly in smart hydration and reusable bottle applications, while North America and Europe focus on IoT-based UV safety and compliance systems. Growth is supported by demand for real-time sterilization verification, AI-enabled diagnostics, and eco-smart product innovation in personal care, food, and beverage packaging industries.

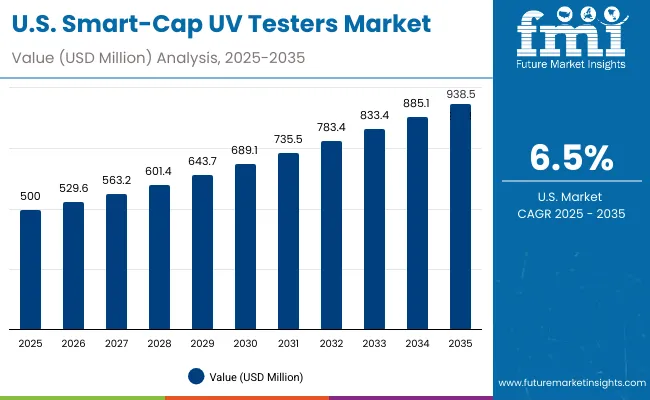

The USA will grow at 6.5% CAGR, driven by FDA-certified packaging and advancements in smart bottle manufacturing. UV testing modules are being integrated into reusable containers to improve hygiene assurance and consumer confidence. Sustainability initiatives and connected device platforms are encouraging the development of UV-enabled refillable systems. IoT-integrated smart cap solutions are expanding across commercial, medical, and hydration product categories for precision sterilization validation.

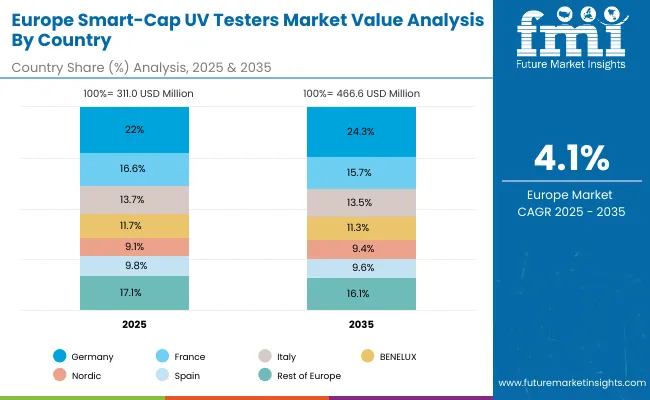

Germany will expand at 6.2% CAGR, supported by precision manufacturing and sustainability-led innovation. UV-based safety verification technologies are being embedded into industrial packaging and lab-grade containers. Smart sensor systems are improving calibration accuracy and reliability for automated testing environments. The country’s strong export base in intelligent packaging components continues to reinforce its position as a hub for high-quality UV-cap production.

The UK will grow at 6.3% CAGR, focusing on premium hydration and personal care packaging solutions. Luxury water bottle and sports drink brands are increasingly adopting smart UV testing caps to elevate consumer trust. Safety certifications for digital hygiene products are stimulating market penetration. Integration of AI and digital diagnostics into smart packaging platforms is enhancing transparency and traceability across production chains.

China will grow at 6.4% CAGR, leading mass-scale production and export of UV-enabled smart caps. OEM collaborations are expanding manufacturing efficiency for smart and connected packaging components. Rapid adoption of AI-enabled UV testing systems is supporting domestic brands in water, beverage, and wellness categories. Continued government support for smart manufacturing is driving digital quality control and sterilization system integration.

India will grow at 6.3% CAGR, driven by urbanization, wellness awareness, and hygiene-focused consumer behavior. Demand for sterilized drinkware and smart hydration devices is surging among urban consumers. Local manufacturing of smart product components is increasing under the "Make in India" initiative. Government-led hygiene and wellness programs are further accelerating adoption of UV-based packaging systems.

Japan will grow at 6.9% CAGR, pioneering compact UV-cap designs integrated with data logging and real-time monitoring. Miniaturized modules are leading innovation in both consumer and medical-grade smart packaging. AI-based analytics are enhancing predictive maintenance and safety monitoring. The export of food-grade smart UV packaging systems is strengthening Japan’s position as a leader in intelligent sterilization technology.

South Korea will lead with 7.0% CAGR, driven by technological convergence in packaging and hygiene sectors. K-tech packaging firms are scaling production of AI-enabled smart hydration systems. UV verification technology is becoming integral to the country’s hygiene export ecosystem. Smart packaging startups are driving innovation in real-time sterilization, supported by government funding and global sustainability initiatives.

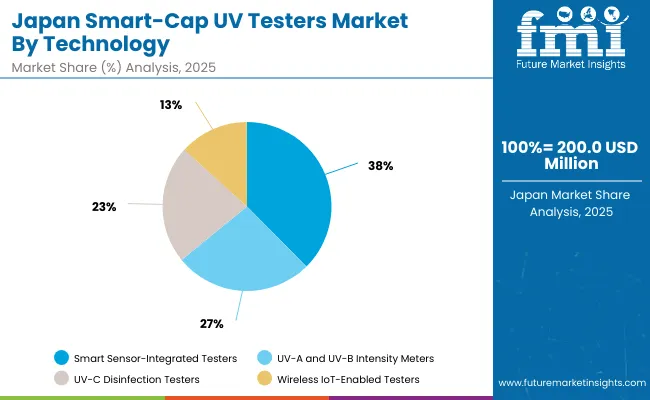

Japan’s smart-cap UV testers market, valued at USD 200.0 million in 2025, is led by smart sensor-integrated testers that provide precise UV calibration and real-time data analytics. UV-A and UV-B intensity meters are widely adopted in packaging validation and hygiene monitoring systems. UV-C disinfection testers play a vital role in sterilization quality control, while wireless IoT-enabled testers support automated testing workflows. Japan’s robust innovation ecosystem continues to enhance smart packaging and digital testing technologies.

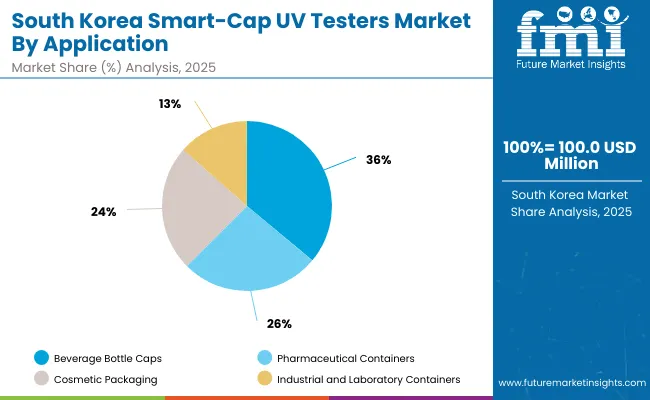

South Korea’s smart-cap UV testers market, valued at USD 100.0 million in 2025, is dominated by beverage bottle caps driven by rising demand for consumer safety and freshness assurance. Pharmaceutical containers follow, reflecting stringent UV sterilization standards in healthcare packaging. Cosmetic packaging applications expand as brands prioritize contamination-free storage. Industrial and laboratory containers utilize advanced testers for controlled UV exposure monitoring. South Korea’s manufacturing precision strengthens UV-based packaging validation systems.

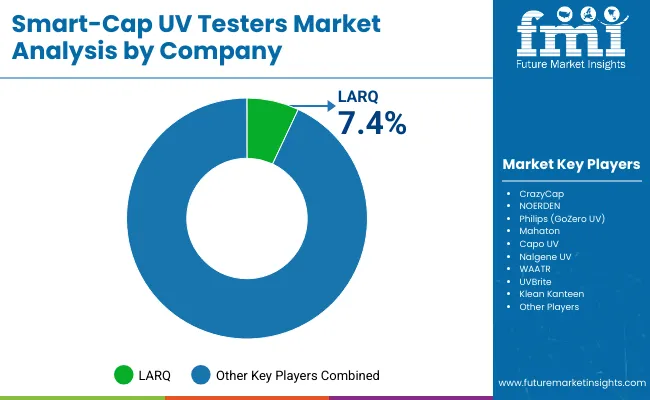

The market is moderately consolidated with LARQ, CrazyCap, NOERDEN, Philips (GoZero UV), Mahaton, Capo UV, Nalgene UV, WAATR, UVBrite, and KleanKanteen as key players. These companies lead with AI-based sterilization testers, energy-efficient UV modules, and recyclable smart bottle designs. LARQ and CrazyCap dominate in premium hydration solutions, while Philips (GoZero UV) and Mahaton focus on integrating IoT-enabled health monitoring into packaging.

Key Developments of Smart-Cap UV Testers Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| By Technology | Smart Sensor, UV-A/B, UV-C, Wireless IoT |

| By Application | Beverage Caps, Pharma Containers, Cosmetic Packaging |

| By Material | Plastic, Metal, Composite, Glass |

| By End-Use Industry | Food & Beverages, Pharma, Cosmetics, Industrial |

| Key Companies Profiled | LARQ, CrazyCap, NOERDEN, Philips (GoZero UV), Mahaton, Capo UV, Nalgene UV, WAATR, UVBrite, Klean Kanteen |

| Additional Attributes | Growth driven by smart hygiene tech, UV-based safety testing, and IoT-enabled verification systems. |

The Smart-Cap UV Testers Market is valued at USD 1.3 billion in 2025.

The Smart-Cap UV Testers Market will reach USD 2.5 billion by 2035.

The Smart-Cap UV Testers Market is expected to grow at a CAGR of 6.6%.

Smart sensor-integrated testers lead with 38.6% market share in 2025.

Plastic caps dominate material compatibility with a 40.2% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UVC Upper Air Disinfection Unit Market Size and Share Forecast Outlook 2025 to 2035

UVC Surface Disinfection System Market Size and Share Forecast Outlook 2025 to 2035

UV-C Sterilizing Conveyors Market Analysis - Size and Share Forecast Outlook 2025 to 2035

UV Curable Resin and Formulated Products Market Size and Share Forecast Outlook 2025 to 2035

UV Stabilized Films Market Size and Share Forecast Outlook 2025 to 2035

UV Absorbers Market Size and Share Forecast Outlook 2025 to 2035

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

UV-Protecting Polymers Market Size and Share Forecast Outlook 2025 to 2035

UV-C LED Market Size and Share Forecast Outlook 2025 to 2035

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

UV and Light Sensitive Packaging Market Size and Share Forecast Outlook 2025 to 2035

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

UV Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

UVI Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

UV Protected Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

UVC Disinfection Product Market Report – Demand, Trends & Forecast 2025–2035

Uveal Melanoma Treatment Market – Growth & Forecast 2025 to 2035

UV LED Printers Market Growth - Trends & Forecast 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA