The global standard high precision power analyzers market is projected to reach USD 456.5 million by 2035, recording an absolute increase of USD 226.6 million over the forecast period. The market is valued at USD 229.9 million in 2025 and is set to rise at a CAGR of 7.1% during the assessment period. The market size is expected to grow by nearly 1.99X during the same period, supported by increasing demand for accurate power measurement in electric vehicle testing and renewable energy applications. High equipment costs and technical complexity may constrain adoption in cost-sensitive market segments.

Between 2025 and 2030, the standard high precision power analyzer market is projected to expand from USD 229.9 million to USD 324.0 million, resulting in a value increase of USD 94.1 million, which represents 41.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for electric vehicle component testing, product innovation in wireless connectivity and automated measurement capabilities, and expanding automotive manufacturing and renewable energy installation applications. Companies are establishing competitive positions through investment in measurement accuracy enhancement, specialized application development, and strategic market expansion across testing laboratories, automotive manufacturers, and emerging energy storage applications.

From 2030 to 2035, the market is forecast to grow from USD 324.0 million to USD 456.5 million, adding another USD 132.5 million, which constitutes 58.5% of the ten-year expansion. This period is expected to be characterized by expansion of specialized applications, including advanced power electronics testing and grid integration analysis tailored for specific industrial and renewable energy requirements, strategic collaborations between instrument manufacturers and automotive companies, and enhanced product positioning with improved measurement speed and comprehensive data analysis capabilities. The growing emphasis on energy efficiency optimization and grid modernization will drive demand for sophisticated power analyzers across diverse industrial and commercial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 229.9 million |

| Market Forecast Value (2035) | USD 456.5 million |

| Forecast CAGR (2025-2035) | 7.1% |

Standard high precision power analyzer market expands through enhanced measurement accuracy enabling reliable performance validation while reducing testing time and equipment costs compared to ultra-high precision alternatives. Electric vehicle development drives demand for power measurement instruments that can characterize motor efficiency, battery management systems, and charging infrastructure performance across diverse operating conditions. Renewable energy system installation creates opportunities for analyzers that can validate inverter efficiency, grid compliance, and power quality parameters during commissioning and maintenance activities. Industrial automation and smart manufacturing facilities require power measurement solutions that support energy management, process optimization, and regulatory compliance across manufacturing operations. Testing laboratories and research institutions prioritize analyzers that provide traceable measurements for product development and certification processes. Growth faces constraints from competition with lower-cost basic analyzers that may satisfy less demanding applications and alternative measurement technologies offering specialized capabilities at comparable price points.

The market is segmented by classification, application, and region. By classification, the market is divided into single phase and three phase. Based on application, the market is categorized into automotive, photovoltaic and energy storage, industrial, and others. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

The single-phase segment is projected to dominate the standard high precision power analyzers market, accounting for 58% share in 2025. Its leadership stems from its widespread utility across multiple industries, particularly in consumer electronics, automotive components, and residential power systems. Single-phase analyzers are favored for applications where complex three-phase analysis is unnecessary, offering a simpler, cost-effective, and equally reliable solution. This makes them particularly suitable for quality control laboratories, research facilities, and production environments, where maintaining accuracy while reducing operational costs is critical.

One of the defining strengths of single-phase analyzers is their ability to provide traceable measurement accuracy without excessive technical complexity. They are extensively applied in motor efficiency testing, power supply validation, and electronic component characterization, where high precision at the single-phase level is sufficient to support compliance with industry and regulatory standards. These analyzers are known for their ease of use, shorter training requirements, and straightforward integration into testing workflows, boosting adoption across small and mid-scale enterprises.

Manufacturers and testing laboratories also leverage these analyzers to detect power quality variations, optimize device efficiency, and ensure consistency in large-scale production. In consumer electronics, single-phase analyzers are invaluable for validating chargers, adapters, and home appliances, while in automotive, they assist in testing auxiliary systems and components requiring single-phase validation. Their versatility ensures the segment will continue to anchor growth in the standard high precision power analyzers market.

The automotive application segment is expected to represent 38% of global demand in 2025, cementing its role as the leading end-use market for standard high precision power analyzers. The automotive sector’s dominance is closely linked to the rapid transition toward electrification and advanced powertrain technologies, where highly accurate power measurement is indispensable. From electric motors and DC-DC converters to onboard chargers and battery management systems (BMS), modern vehicles are increasingly dependent on precision electronics that require reliable testing throughout development and production.

Standard high precision analyzers enable automotive manufacturers to validate efficiency, reduce energy losses, and optimize vehicle performance, all while ensuring compliance with tightening global energy consumption and emission standards. Testing laboratories and OEMs rely on these analyzers for endurance testing, charging system validation, and comprehensive component characterization across varying loads and environmental conditions. Their role becomes particularly critical in ensuring that EVs meet range optimization goals and regulatory performance requirements.

The segment benefits from the surge in EV production volumes, government-backed incentives, and consumer demand for mobility solutions. Beyond EVs, analyzers are also used for conventional automotive systems, including auxiliary electronics, where efficiency and performance remain critical. The rise of autonomous and connected vehicles, the demand for accurate power testing is expected to expand, further reinforcing the automotive industry’s reliance on precision analyzers.

The standard high precision power analyzers market is shaped by a combination of strong demand drivers, notable restraints, and evolving technology trends that influence its trajectory.

Drivers

A primary growth driver is the increasing adoption of electric vehicles (EVs), which require precise validation of motors, inverters, chargers, and battery management systems. Standard high-precision analyzers provide the accuracy needed to optimize performance and ensure regulatory compliance in EV production, creating demand. Manufacturing quality control initiatives across the electronics and automotive sectors are driving the need for measurement solutions that not only enhance testing speed but also ensure consistent accuracy in production environments. This aligns with broader energy efficiency compliance programs, where industries require traceable, high-accuracy instruments for regulatory reporting and system optimization. Together, these drivers highlight the instrument’s role in promoting efficiency, reliability, and compliance across various industries.

Restraints

Despite these opportunities, the market faces limitations. Budget constraints in small to mid-scale testing laboratories often slow adoption, as companies seek cost-effective alternatives. The technical complexity of analyzers necessitates specialized training and ongoing support services, adding to total ownership costs. Competition from basic measurement instruments that deliver “good enough” performance in less demanding applications also creates price pressures, particularly in cost-sensitive markets, limiting the adoption of premium analyzers.

Key Trends

Industry trends are increasingly centered on automation and digital connectivity. The integration of automated testing systems and wireless interfaces enhances productivity, reduces manual intervention, and supports remote monitoring capabilities. Material innovations and design improvements are expanding measurement speed, multi-channel capability, and functional flexibility. Rapid adoption is evident in automotive and renewable energy applications, where strict regulatory requirements justify the investment in advanced analyzers. Potential disruption from emerging alternative measurement technologies or reduced capital spending during economic downturns may challenge long-term growth.

The market faces cost and complexity barriers; its long-term expansion is strongly supported by the automotive electrification wave, renewable energy growth, and global efficiency compliance mandates, reinforced by innovations in automation and connectivity.

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| Brazil | 7.5% |

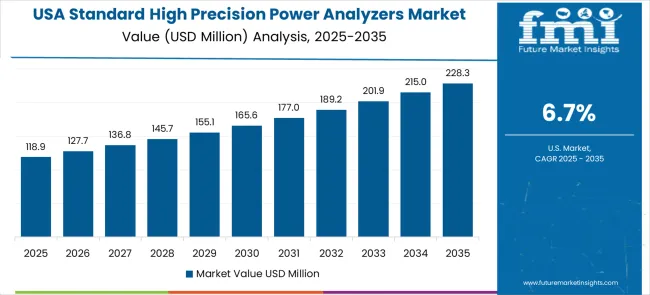

| USA | 6.7% |

| UK | 6% |

| Japan | 5.3% |

The standard high precision power analyzers market is gathering pace worldwide, with China taking the lead thanks to massive electric vehicle production and renewable energy deployment. Close behind, India benefits from industrial modernization and a growing automotive electronics sector, positioning itself as a strategic growth hub. Germany shows steady advancement, where automotive excellence and precision measurement expertise strengthen its role in the regional supply chain. Brazil is sharpening its focus on renewable energy development and industrial automation, signaling an ambition to capture niche opportunities. The USA stands out for its technology innovation leadership, and the UK and Japan continue to record consistent progress. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

The standard high precision power analyzers market in China is projected to grow at a CAGR of 9.6% from 2025 to 2035. China’s rapid industrialization and its dominance in electronics manufacturing create a substantial pull for precision power measurement tools. High precision analyzers are increasingly adopted in R&D labs, production lines, and quality testing centers for consumer electronics, EV powertrains, and renewable energy systems. The government’s aggressive push toward electrification and clean energy integration further supports demand, particularly for testing solar inverters, wind turbine systems, and battery storage solutions. Domestic instrument manufacturers are scaling capabilities, though foreign brands continue to dominate in high-end segments where ultra-low uncertainty and advanced data logging are required. As China accelerates exports of EVs and renewable equipment, demand for certification and compliance testing ensures uptake of analyzers.

The standard high precision power analyzers market in India is anticipated to expand at a CAGR of 8.9% from 2025 to 2035. India’s surging renewable energy investments and the government’s “Make in India” initiative have expanded the need for advanced test and measurement equipment. Power analyzers are critical in evaluating grid integration of solar and wind projects, inverter efficiency, and the performance of distributed energy systems. Rapid growth of the EV sector, along with localized battery production and charging infrastructure rollout, has also intensified demand for accurate power measurement tools. Indian R&D institutes and engineering companies are increasingly adopting analyzers to ensure compliance with global standards. While imports dominate the high-precision category, local suppliers are gaining ground in mid-range devices supported by cost competitiveness. Over the forecast period, industrial modernization and digital power monitoring will further drive market demand.

The standard high precision power analyzers market in Germany is projected to grow at a CAGR of 8.2% between 2025 and 2035. Germany’s strong base in automotive engineering, renewable energy, and precision manufacturing makes it one of Europe’s largest adopters of advanced power analyzers. Leading automotive OEMs and Tier-1 suppliers rely on these instruments for electric drivetrain validation, motor efficiency measurement, and battery system analysis. The country’s ambitious renewable energy transition (Energiewende) is driving investments in inverter and grid-connected system testing, creating steady demand for high-accuracy measurement devices. Germany also houses several leading metrology and test equipment firms, fostering innovation in multi-channel, digitalized, and portable power analyzers. Stricter EU regulations on energy efficiency and emissions further encourage adoption in both R&D and compliance labs. This highly regulated, innovation-driven environment positions Germany for consistent market growth through 2035.

The standard high precision power analyzers market in Brazil is forecast to grow at a CAGR of 7.5% from 2025 to 2035. Brazil’s expanding energy mix, including hydro, solar, and wind, has created demand for accurate testing and performance measurement of distributed power systems. With a large and evolving grid, utilities and energy companies increasingly rely on analyzers for power quality assessment, load analysis, and renewable integration. Brazil’s automotive industry, with growing EV adoption, adds another layer of demand for validation of electric drivetrains and charging stations. Import dependency remains high, with advanced instruments primarily supplied by global firms, though localized distributors are improving availability and after-sales support. Government initiatives toward grid modernization and investment in R&D centers across universities are expected to boost market uptake. Brazil’s growth is steady but dependent on foreign technology access and supportive infrastructure.

The standard high precision power analyzers market in the USA is expected to grow at a CAGR of 6.7% from 2025 to 2035. The USA market benefits from a strong concentration of R&D labs, semiconductor companies, and renewable energy developers, all of which require precise measurement tools for product development and compliance testing. EV adoption, led by Tesla and other automakers, fuels demand for testing battery systems, motors, and charging infrastructure. Aerospace and defense sectors also represent critical end-users, as they need ultra-reliable analyzers for mission-critical power system testing. While the USA houses leading test and measurement companies, global competition is strong, especially from Asia-based suppliers offering cost-efficient alternatives. The adoption of smart grids and decentralized energy storage systems will further accelerate deployment. Although growth is modest compared to Asia, the USA remains a technology leader with consistent baseline demand.

The standard high precision power analyzers market in the UK is anticipated to grow at a CAGR of 6% from 2025 to 2035. The UK is undergoing a gradual energy transition, emphasizing offshore wind, solar expansion, and smart grid projects, all of which require precise measurement tools for system validation. Universities and innovation hubs are adopting analyzers for advanced energy research, particularly in storage technologies and renewable integration. The country’s automotive sector, though smaller than Germany’s, is transitioning toward EVs, requiring analyzers for drivetrain and battery testing. Healthcare equipment and industrial automation sectors also provide a steady demand for precise power analysis. Import reliance is high, but partnerships between UK distributors and global suppliers ensure access to advanced products. With regulatory focus on carbon neutrality and efficiency standards, demand for analyzers is expected to remain resilient through 2035.

The standard high precision power analyzers market in Japan is forecast to grow at a CAGR of 5.3% between 2025 and 2035. Japan’s well-established electronics and automotive industries remain key drivers for analyzer adoption, particularly in R&D and production testing. EV development by Toyota, Honda, and Nissan creates consistent demand for power analyzers in validating the efficiency and safety of new propulsion systems. Japan’s investments in renewable energy and hydrogen fuel projects require precise monitoring and validation tools, albeit at a measured pace. Domestic instrument manufacturers continue to innovate in compact, multi-channel, and high-accuracy analyzers, giving Japan a technological edge. The relatively saturated consumer electronics market and slower industrial growth compared to China or India restrain the CAGR. Nonetheless, Japan’s commitment to precision engineering and quality assurance ensures ongoing demand from automotive, energy, and research applications.

The European standard high precision power analyzers market reflects mature industrial development with distinct national capabilities contributing to regional market stability. Germany anchors the region through automotive engineering excellence and precision measurement expertise, while France contributes through aerospace applications and industrial automation requiring reliable power measurement capabilities. The United Kingdom emphasizes industrial modernization and renewable energy applications with comprehensive measurement requirements.

Market development occurs through cross-border automotive supply chains and industrial equipment manufacturing operations serving multinational companies. Regulatory standards for automotive safety and energy efficiency create consistent measurement requirements across the region, while research collaboration supports technology advancement in power measurement and analysis applications. The regional market demonstrates stability through diversified industrial applications and established technical expertise, with growth driven by automotive electrification and renewable energy deployment rather than basic capacity expansion.

In Japan, the standard high precision power analyzers market is largely driven by the single phase analyzer segment, which accounts for 62% of total market revenues in 2025. The comprehensive measurement capabilities for consumer electronics testing and stringent quality control protocols mandated in automotive component manufacturing are key contributing factors. Three phase analyzers follow with a 33% share, primarily in industrial applications that integrate power system analysis with manufacturing process control requirements. Specialized configurations contribute only 5% as adoption in standard testing applications remains limited due to cost considerations and technical complexity.

In South Korea, the market is expected to remain dominated by automotive applications, which hold a 42% share in 2025. These applications typically represent the most demanding measurement requirements where analyzer reliability directly affects component validation and production testing in automotive manufacturing operations. Photovoltaic and energy storage applications and industrial applications each hold 29% market share, with increasing standardization in power measurement specifications across diverse industrial sectors. Other specialized applications account for the remaining share, but gradually gain traction in research and development activities due to expanding technology requirements and measurement capability needs.

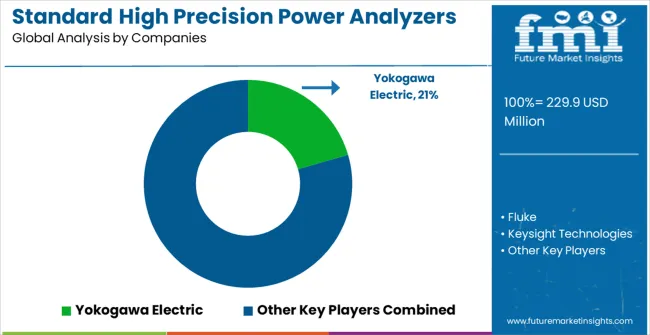

The standard high precision power analyzers market consists of approximately 15-20 meaningful participants with moderate concentration where the top five companies control roughly 55% of global market value. Competition emphasizes measurement reliability, technical support, and application expertise rather than commodity pricing strategies, reflecting the critical nature of power measurement applications requiring proven performance and regulatory compliance capabilities.

Leaders include Yokogawa Electric with comprehensive power analyzer portfolios and established customer relationships in automotive and industrial markets, leveraging advanced measurement technology and extensive technical support capabilities. Fluke provides reliable measurement instruments with emphasis on field service applications and industrial maintenance requirements, while Keysight Technologies offers advanced analyzer solutions targeting automotive testing and research applications requiring superior measurement accuracy and functionality.

Challengers encompass Hioki and Dewesoft, companies with specialized measurement technologies and regional market presence, while specialists include DEWETRON GmbH and Chroma ATE serving manufacturing and automated testing applications with customized solutions and comprehensive integration support. Emerging players like ZLG, Ainuo Instrument, and ZES ZIMMER Electronic Systems focus on cost-effective alternatives and regional market development, particularly in Asian markets where manufacturing scale enables competitive pricing and local customer support capabilities.

Standard high precision power analyzers (>0.03% - 0.05% accuracy) represent the mainstream segment of advanced power measurement instrumentation, providing essential electrical analysis capabilities for industrial applications, automotive testing, renewable energy systems, and manufacturing quality control where excellent accuracy is required at commercially viable price points. With the global market valued at $229.9 million in 2024 and projected to reach $456.5 million by 2030 (7.1% CAGR), this established test equipment sector serves as the backbone of power electronics development, energy efficiency validation, and electrical system optimization across diverse industries. The market features established Japanese precision instrument manufacturers (Yokogawa Electric, Hioki) competing with diversified measurement companies and emerging technology providers, while configuration variants (single phase and three phase) address different power system architectures across automotive power electronics, photovoltaic installations, energy storage systems, and industrial motor drives.

How Governments Could Strengthen Energy Standards and Manufacturing Competitiveness?

Energy Efficiency Regulatory Framework: Establish comprehensive energy efficiency standards for industrial equipment, electric vehicles, and renewable energy systems that require precise power measurement verification using certified high precision analyzers. Implement mandatory efficiency testing protocols for motors, drives, inverters, and power supplies that create consistent regulatory demand while supporting national energy conservation objectives and industrial competitiveness goals.

Manufacturing Quality Standards: Develop quality assurance requirements for electrical equipment manufacturers that mandate power measurement accuracy verification during production testing, creating systematic demand for precision analyzers while improving product reliability and export competitiveness. Support implementation of Industry 4.0 manufacturing standards that integrate automated power measurement systems with production quality control processes.

Research and Development Infrastructure: Fund technical universities, research institutions, and national laboratories with standardized high precision power analyzer specifications, creating anchor demand for advanced measurement equipment while supporting power electronics research, renewable energy technology development, and industrial automation advancement programs that enhance national technological capabilities.

Calibration and Standards Support: Establish national measurement institutes and calibration laboratories that provide traceable calibration services for high precision power analyzers, ensuring measurement accuracy and supporting export certification requirements. Provide funding for measurement standards development and international harmonization efforts that facilitate global trade in electrical products.

Electric Vehicle and Renewable Energy Incentives: Create testing infrastructure requirements for electric vehicle charging systems, solar inverters, and energy storage installations that mandate precision power measurement capabilities, driving equipment adoption while supporting clean energy deployment and automotive electrification targets through verified performance standards.

How Industry Bodies Could Advance Technical Standards and Market Development?

Measurement Standards Harmonization: Develop unified international standards for high precision power analyzer accuracy classes, calibration procedures, and measurement uncertainty specifications that enable consistent performance comparison across manufacturers and ensure reliable measurement results for regulatory compliance and quality assurance applications across global markets.

Application-Specific Testing Protocols: Create comprehensive technical standards for different power measurement applications including automotive powertrain testing procedures, industrial motor efficiency validation protocols, renewable energy system performance assessment methods, and manufacturing quality control measurement practices that standardize testing approaches and instrument requirements.

Professional Certification Programs: Establish specialized training and certification programs for test engineers, quality assurance professionals, and technicians covering high precision power measurement principles, proper analyzer operation, measurement uncertainty analysis, and calibration maintenance procedures that ensure reliable field applications and consistent measurement results.

Technology Integration Guidelines: Develop standards for integrating high precision power analyzers with automated test systems, manufacturing quality control platforms, and industrial IoT networks that enable seamless data exchange, automated measurement processes, and comprehensive performance monitoring across diverse industrial applications.

Market Education and Awareness: Coordinate industry-wide education programs that demonstrate the value of precision power measurement for energy efficiency, product quality, and regulatory compliance, helping expand market awareness and proper application of high precision analyzer technologies across traditional and emerging application sectors.

How OEMs and Technology Providers Could Strengthen the Ecosystem?

Integrated Measurement Solutions: Develop comprehensive power analysis platforms that combine high precision measurement capabilities with advanced analysis features including harmonic analysis, power quality assessment, efficiency mapping, transient capture, and automated reporting functions for complete power system characterization in integrated measurement solutions.

Industry-Specific Optimization: Engineer specialized in analyzer configurations optimized for specific applications including automotive powertrain testing, industrial motor analysis, renewable energy system validation, and manufacturing quality control that provide application-specific features, interfaces, and analysis capabilities while maintaining high precision measurement performance.

Automation and Integration Capabilities: Create comprehensive software platforms and hardware interfaces that enable seamless integration with automated test equipment, production testing systems, and manufacturing quality control networks, reducing test time while improving measurement repeatability and enabling comprehensive data management and analysis capabilities.

Cost-Effective Precision Solutions: Develop high precision analyzer architectures that deliver excellent measurement accuracy at commercially viable price points through advanced circuit design, manufacturing optimization, and modular construction approaches that make precision measurement accessible to broader industrial markets and smaller manufacturing operations.

User Interface Innovation: Implement intuitive user interfaces, touchscreen operation, and mobile device connectivity that simplify complex measurements, provide real-time data visualization, and enable remote monitoring capabilities that reduce operator training requirements while improving measurement efficiency and accessibility across diverse user skill levels.

How End Users and System Integrators Could Navigate Technology Selection?

Application Requirements Analysis: Evaluate high precision power analyzers based on specific measurement requirements including voltage/current ranges, frequency response, accuracy specifications, and environmental operating conditions rather than focusing solely on headline precision specifications that may exceed actual application needs and increase unnecessary costs.

Integration and Automation Strategy: Prioritize analyzers with comprehensive communication interfaces, automation capabilities, and software integration features that enable efficient connection with existing test systems, manufacturing equipment, and data management platforms while providing scalability for future measurement requirements and process improvements.

Total Cost of Ownership Optimization: Consider comprehensive cost factors including initial equipment purchase price, calibration service requirements, software licensing fees, training costs, and long-term technical support availability when selecting precision measurement equipment for production testing and quality assurance applications where reliability and serviceability are essential.

Calibration and Service Planning: Establish systematic calibration programs that account for high precision requirements while managing costs through efficient scheduling, multiple instrument coordination, and service provider selection that ensures measurement accuracy compliance without excessive downtime or service expenses that impact production operations.

Technical Support and Training Investment: Build strategic relationships with analyzer suppliers that provide comprehensive application engineering support, operator training programs, and ongoing technical assistance that maximize measurement accuracy and equipment utilization while ensuring proper implementation of precision measurement capabilities.

How Investors and Financial Enablers Could Unlock Market Growth?

Manufacturing Technology Investment: Finance development of next-generation high precision power analyzer technologies including improved measurement circuits, advanced signal processing, and cost reduction innovations that deliver enhanced performance while maintaining competitive pricing for broader market accessibility and industrial adoption.

Regional Manufacturing Expansion: Support establishment of regional manufacturing capabilities for high precision power analyzers in key markets with growing industrial automation, automotive electronics, and renewable energy sectors where local production can reduce costs, improve support, and accelerate market penetration through proximity advantages.

Application Solution Development: Invest in development of complete measurement solutions that combine high precision analyzers with industry-specific software, automation systems, and service packages for targeted applications including automotive testing, industrial quality control, and renewable energy validation that provide integrated value propositions.

Service and Support Network Development: Fund creation of comprehensive calibration, service, and technical support networks that provide equipment maintenance, training, and application assistance for high precision analyzers in regions where specialized measurement equipment requires expert support capabilities and rapid response services.

Technology Integration Ventures: Support companies developing complementary technologies including automated test systems, measurement data analytics platforms, industrial IoT integration solutions, and predictive maintenance systems that enhance the value and utility of high precision power analyzers in modern industrial and testing environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 229.9 million |

| Classification | Single Phase, Three Phase, Specialized Configurations |

| Application | Automotive, Photovoltaic and Energy Storage, Industrial, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Yokogawa Electric, Fluke, Keysight Technologies, Hioki, Dewesoft, DEWETRON GmbH, Chroma ATE, ZLG, Ainuo Instrument, ZES ZIMMER Electronic Systems, Newtons4th, Vitrek |

| Additional Attributes | Dollar sales by power range and measurement specifications, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established measurement instrument manufacturers and emerging technology providers, adoption patterns for automotive versus industrial applications, integration with automated testing systems and quality management platforms, innovations in measurement speed and connectivity capabilities, and development of specialized applications with enhanced calibration services and regulatory compliance features. |

The global Standard High Precision Power Analyzers Market is estimated to be valued at USD 229.9 million in 2025.

The market size for the Standard High Precision Power Analyzers Market is projected to reach USD 456.5 million by 2035.

The Standard High Precision Power Analyzers Market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in Standard High Precision Power Analyzers Market are single phase and three phase.

In terms of application, automotive segment to command 38.0% share in the Standard High Precision Power Analyzers Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ultra High Precision Power Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Economic Grade Precision Power Analyzers Market Size and Share Forecast Outlook 2025 to 2035

High Precision Microfluidic Pump Market Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

High-precision Confocal Sensor Market Size and Share Forecast Outlook 2025 to 2035

High-power Objective Lens Market Size and Share Forecast Outlook 2025 to 2035

High Precision Heavy Load Bearings Market Size and Share Forecast Outlook 2025 to 2035

High-precision Truss Robot Market Size and Share Forecast Outlook 2025 to 2035

High Power Double-Clad Fiber Bragg Grating Market Size and Share Forecast Outlook 2025 to 2035

High Precision Mechanical Machine Components Market Size and Share Forecast Outlook 2025 to 2035

Power Analyzers Market

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Automotive High Precision Positioning Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Direct Current Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Purity Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA