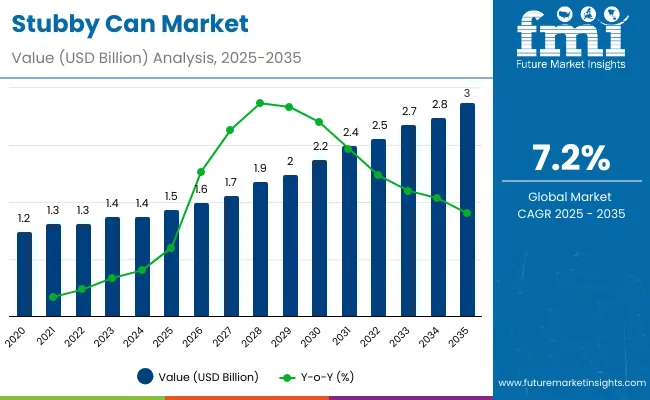

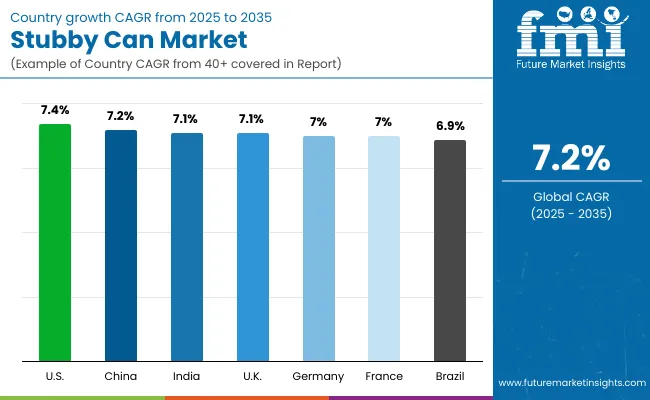

The stubby can market will expand from USD 1.5 billion in 2025 to USD 3.0 billion by 2035, doubling in value with a CAGR of 7.2%. This growth underscores strong consumer preference for sustainable, compact, and brand-differentiated beverage packaging. The industry will advance by a 2.0 multiple over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.5 billion |

| Industry Value (2035F) | USD 3.0 billion |

| CAGR (2025 to 2035) | 7.2% |

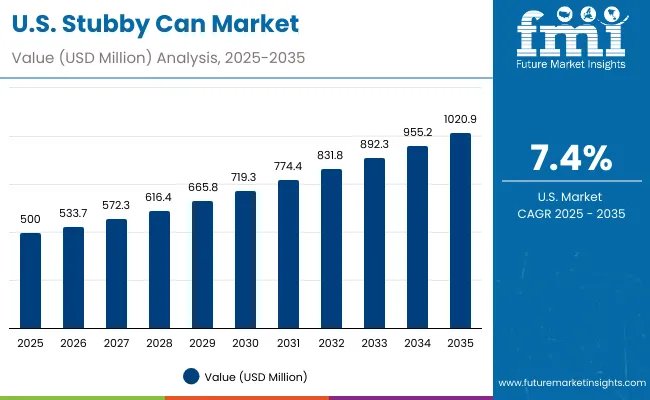

From 2025 to 2030, the market will increase from USD 1.5 billion to USD 2.1 billion, adding USD 0.6 billion or 40% of the decade’s growth. This phase reflects rising consumption of beer, carbonated soft drinks, and functional beverages in smaller serving sizes. Aluminum’s recyclability and shelf-life properties enhance its adoption by beverage companies and retailers.

Between 2030 and 2035, the market will expand from USD 2.1 billion to USD 3.0 billion, contributing USD 0.9 billion or 60% of decade growth. This period is defined by rapid adoption of recyclable aluminum, branding differentiation, and expansion of energy and RTD coffee applications. Lightweight formats and digital printing drive competitive momentum.

From 2020 to 2024, the stubby can market expanded steadily due to strong beer consumption, premiumization trends, and adoption of recyclable formats. Aluminum accounted for most revenues, with beverage manufacturers favoring its lightweighting and superior preservation properties. Companies emphasized branding differentiation through high-definition printing and novel shapes. Tinplate and composites played secondary roles, with uptake concentrated in specialty beverage niches.

By 2035, the market will reach USD 3.0 billion at a CAGR of 7.2%, led by aluminum stubby cans representing nearly half of the total value. Competitive intensity will grow as companies deliver innovative designs, recyclable coatings, and smart packaging solutions. Automation-ready manufacturing, eco-certifications, and hybrid aluminum composites will define the competitive edge. Asia-Pacific will lead demand, while developed markets strengthen adoption through premium positioning.

The stubby can market is expanding because of sustainability, portability, and consumer preference for compact packaging formats. Aluminum leads due to its infinite recyclability and ability to protect beverage quality, while medium-sized cans align with portion-control trends. Rising alcohol and soft drink demand supports consistent adoption.

Marketing and differentiation also drive growth, as breweries and beverage companies use stubby cans for branding appeal. Expansion of RTD coffee and energy drinks contributes to versatility in application. With global beverage consumption rising, stubby cans are becoming the preferred choice for convenience and eco-friendly appeal.

The stubby can market is segmented based on material, capacity, application, and end-use industry. Materials include aluminum, steel, tinplate, recycled aluminum, and composite laminates. Capacity categories are small (150 ml-250 ml), medium (251 ml-355 ml), and large (356 ml-500 ml and above). Applications span carbonated soft drinks, beer and alcoholic beverages, energy drinks, functional and nutritional drinks, and ready-to-drink coffee and tea. End-use industries include food and beverage manufacturers, breweries and distilleries, nutraceutical brands, retail and supermarkets, and the foodservice sector.

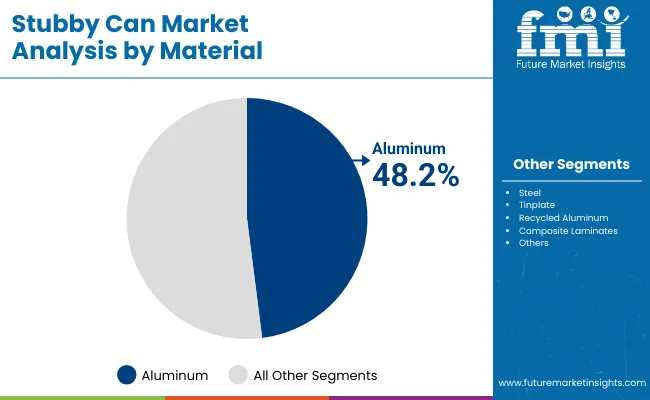

Aluminum will account for 48.2% of the market in 2025 due to its strength, lightweight nature, and infinite recyclability. Beverage manufacturers prefer aluminum for its superior barrier properties, ensuring longer shelf life and maintaining carbonation in soft drinks and alcoholic beverages. Its alignment with global sustainability goals reinforces its position as the most adopted material.

Further growth of aluminum stubby cans is supported by circular economy practices and consumer demand for eco-friendly choices. Recycled aluminum solutions are becoming integral to beverage packaging portfolios, while innovation in coatings ensures safety and freshness. Aluminum’s adaptability for premium designs and high-speed production machinery consolidates its leadership through 2035.

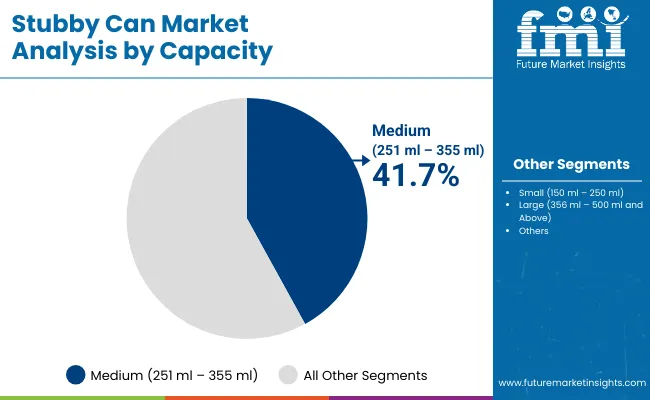

Medium-capacity cans (251-355 ml) are projected to account for 41.7% of demand in 2025. Their popularity reflects consumer preference for portion control, on-the-go convenience, and versatility across beverage types. Breweries and carbonated soft drink companies rely on medium cans for branding and affordability, enhancing their position as the leading capacity category.

Growth is reinforced by adoption in energy drinks and functional beverages. Medium cans strike a balance between affordability and sustainability while meeting global consumer lifestyles. Enhanced printing technologies allow greater brand visibility, making medium-sized stubby cans central to competitive differentiation in the beverage market.

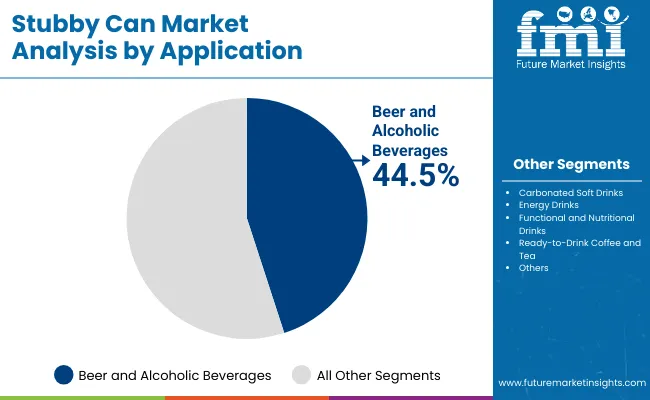

Beer and alcoholic beverages will account for 44.5% of demand in 2025. Stubby cans are favored in this segment for their portability, branding flexibility, and recyclability. Their compatibility with cold-chain storage and retail-ready presentation ensures continued adoption by breweries and distilleries worldwide.

The segment will benefit from premiumization, with breweries adopting stubby cans for limited editions and craft beer launches. Expansion of alcoholic beverage markets in Asia-Pacific and Latin America reinforces demand. Branding, durability, and global recycling systems ensure stubby cans remain dominant in alcoholic beverage packaging.

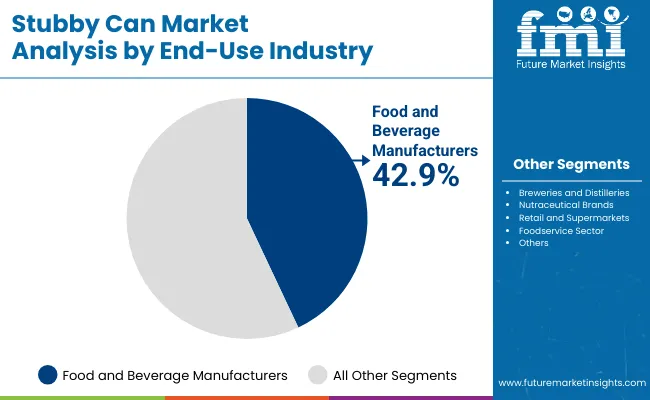

Food and beverage manufacturers will contribute 42.9% of market demand in 2025. Their large-scale production and reliance on recyclable, cost-effective packaging sustain demand for stubby cans. Beverage brands use cans as a medium to ensure quality, extend shelf life, and enhance consumer trust.

The segment’s leadership is reinforced by integration of automation and eco-labeling, making stubby cans ideal for large beverage corporations. Expansion of health-oriented drinks also encourages manufacturers to adopt stubby cans for functional products. With emphasis on branding and compliance, manufacturers will remain the core drivers of industry adoption.

The stubby can market is strongly driven by rising beverage consumption, sustainability mandates, and the shift toward recyclable aluminum packaging. Consumers increasingly prefer compact formats that balance convenience and portion control. Breweries and beverage manufacturers emphasize stubby cans for branding differentiation, while modernization of retail and expansion of RTD categories boost adoption globally.

Challenges include high production costs of aluminum compared to PET bottles and glass, as well as recycling infrastructure gaps in emerging markets. Competition from alternative packaging formats such as glass and flexible plastics also pressures adoption. For some beverage producers, high initial investment in canning lines further limits transition.Lightweighting innovations and advanced digital printing technologies are shaping the competitive landscape. Premium alcoholic beverages and craft launches are leveraging stubby cans for branding appeal, while energy drinks and functional beverages adopt compact cans for portability. Integration of recycled aluminum, automation-ready manufacturing, and sustainable coatings reflects long-term industry direction.

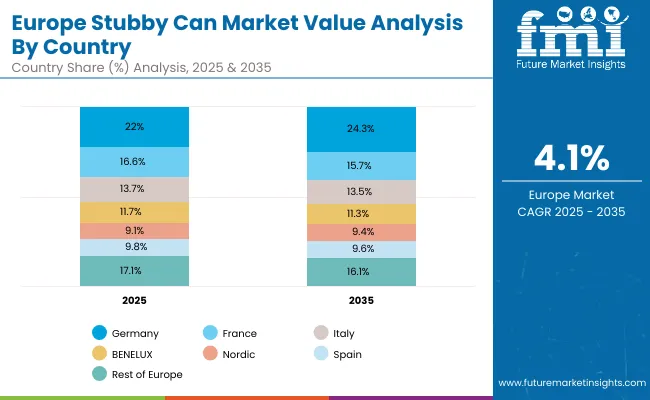

The global stubby can market is witnessing robust expansion, supported by rising beverage demand, sustainability mandates, and brand-driven adoption. Asia-Pacific is the fastest-growing region, with Japan and South Korea leading adoption due to strong beer and functional drink demand. Developed regions such as the USA, Germany, and the UK emphasize recyclable aluminum stubby cans, premiumization, and automation-ready production systems to align with sustainability and branding goals.

The USA stubby can market is forecast to expand at 7.4% CAGR between 2025 and 2035, driven by strong beer and carbonated beverage consumption. Regulatory support for recyclability and sustainability enhances aluminum adoption, while medium-capacity formats remain the preferred choice for both alcoholic and non-alcoholic drinks. Premium branding and expanding energy drink sales support continued growth, with supermarkets and breweries reinforcing high-volume adoption.

Germany’s stubby can market will grow at 7.0% CAGR during 2025-2035. Strong beer culture, advanced recycling systems, and strict packaging regulations reinforce aluminum adoption. Medium-sized cans dominate beer and soft drink packaging, aligning with portion-control preferences. Craft breweries and large beverage manufacturers both leverage stubby cans for branding, freshness, and sustainability, ensuring consistent growth across retail and foodservice segments.

The UK market is forecast to expand at 7.1% CAGR, driven by sustainability commitments, alcoholic beverage consumption, and retail partnerships. Breweries and distilleries are increasingly adopting recyclable stubby cans to meet eco-friendly goals while maintaining consumer appeal. Strong demand for premium alcoholic beverages, coupled with innovation in RTD drinks, is enhancing demand for aluminum-based stubby cans across supermarkets and on-trade channels.

China’s stubby can market is projected to grow at 7.2% CAGR. Rising disposable incomes, urbanization, and expanding retail networks boost beverage consumption, fuelingaluminum stubby can adoption. Premiumization of alcoholic drinks and growing energy drink demand create opportunities, while domestic beverage companies increasingly adopt medium-capacity cans for affordability and branding differentiation in mass-market products.

India’s market will expand at 7.1% CAGR during 2025-2035. Rising consumption of alcoholic beverages, expanding urban middle-class, and growing popularity of energy drinks boost demand for stubby cans. Medium-sized formats are widely preferred for affordability and convenience, while multinational breweries and beverage companies strengthen their presence in Indian retail channels with recyclable aluminum solutions.

Japan will be the fastest-growing market with a 7.9% CAGR. High beer consumption, premium beverage culture, and stringent recycling compliance drive stubby can adoption. RTD coffee, functional beverages, and energy drinks are strong growth contributors. Premium branding and high-definition printing innovations enhance appeal among Japanese consumers, ensuring aluminum stubby cans dominate across retail and foodservice segments.

South Korea’s market is set to grow at 7.8% CAGR. Strong beer and energy drink consumption, coupled with premium beverage positioning, support aluminum stubby can demand. Retail modernization and innovation in branding further boost adoption. Sustainability mandates and consumer preference for recyclable formats align with aluminum’s leadership, making South Korea a key growth driver within Asia-Pacific.

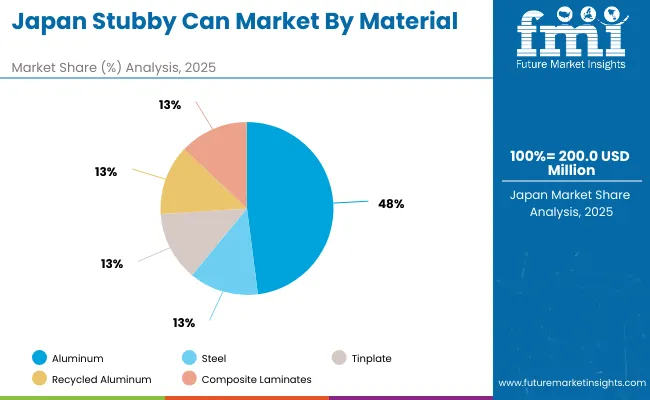

Japan’s stubby can market, valued at USD 200 million in 2025, is led by aluminum, holding 48.6% share due to its recyclability and lightweight benefits. Steel accounts for 16.4%, offering durability in beverage storage. Tinplate follows at 14.9%, primarily supporting niche applications in packaging. Recycled aluminum secures 12.9%, growing steadily with sustainability emphasis. Composite laminates, at 7.2%, serve specialized demand, especially in premium beverage packaging. This segmentation underscores Japan’s reliance on aluminum, while sustainability-driven adoption of recycled aluminum indicates market readiness for green transitions, supported by regulations and consumer preferences for eco-conscious packaging alternatives.

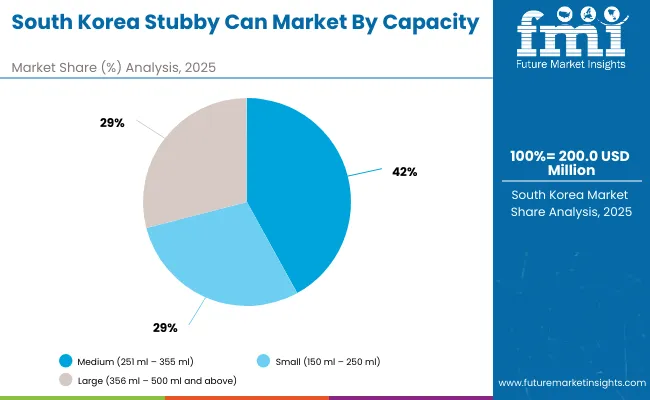

South Korea’s stubby can market, worth USD 200 million in 2025, is dominated by medium-sized cans (251-355 ml) with 41.1% share, preferred for carbonated drinks and convenience packaging. Small cans (150-250 ml) account for 17.8%, reflecting popularity in energy drinks and health beverages. Large cans (356-500 ml and above) hold 17.5%, catering to beer and alcoholic beverages. This distribution highlights consumer preference for medium sizes in everyday use, while smaller formats grow due to lifestyle shifts. Meanwhile, larger cans remain integral in the alcoholic segment, ensuring a balanced market that meets both daily convenience and leisure-driven consumption needs.

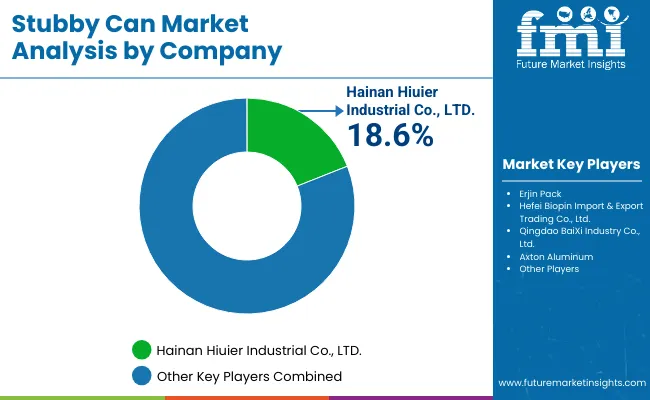

The stubby can market is moderately fragmented, with both global and regional companies competing on design, sustainability, and cost efficiency. Companies such as Hainan Hiuier Industrial, Erjin Pack, Hefei Biopin, Qingdao BaiXi Industry, and Axton Aluminum dominate the supply chain with aluminum-based stubby cans. Emphasis is placed on lightweighting, recyclability, and branding flexibility to appeal to beverage manufacturers worldwide.

Smaller firms contribute through contract manufacturing and specialized designs for craft breweries and niche beverage producers. Innovation in composite laminates and printing technologies drives premium packaging solutions. Competitive strategies increasingly focus on automation-ready lines and integration of recycled aluminum. The competitive landscape reflects a balance between scale efficiencies and innovative differentiation.

Key Developments of Stubby Can Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| By Material | Aluminum, Steel, Tinplate, Recycled Aluminum, Composite Laminates |

| By Capacity | Small (150 ml-250 ml), Medium (251 ml-355 ml), Large (356 ml-500 ml and above) |

| By Application | Carbonated Soft Drinks, Beer and Alcoholic Beverages, Energy Drinks, Functional and Nutritional Drinks, Ready-to-Drink Coffee and Tea |

| By End-Use Industry | Food and Beverage Manufacturers, Breweries and Distilleries, Nutraceutical Brands, Retail and Supermarkets, Foodservice Sector |

| Key Companies Profiled | Hainan Hiuier Industrial, Erjin Pack, Hefei Biopin, Qingdao BaiXi Industry, Axton Aluminum |

| Additional Attributes | Growth supported by recyclability, beer and soft drink demand, branding, automation, and sustainability goals. |

The Stubby Can Market will be valued at USD 1.5 billion in 2025.

The Stubby Can Market will reach USD 3.0 billion by 2035.

The Stubby Can Market will expand at a CAGR of 7.2% during 2025-2035.

The aluminum segment will lead the Stubby Can Market in 2025 with a 48.2% share.

The Asia-Pacific region will be the fastest-growing market, led by Japan at 7.9% CAGR.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canine Cancer Screening Services Market Size and Share Forecast Outlook 2025 to 2035

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Can Stack Motors Market Size and Share Forecast Outlook 2025 to 2035

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Canine Arthritis Treatment Market Forecast and Outlook 2025 to 2035

Can Stack Stepper Motors Market Forecast and Outlook 2025 to 2035

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canada Compact Wheel Loader Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Canada Straws Market Size and Share Forecast Outlook 2025 to 2035

Canthaxanthin Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Industry Analysis in the United Kingdom Size and Share Forecast Outlook 2025 to 2035

Canada Executive Education Program Market Size and Share Forecast Outlook 2025 to 2035

Can Packaging Market Size and Share Forecast Outlook 2025 to 2035

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Canada Eyeshadow Stick & Blush Stick Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA