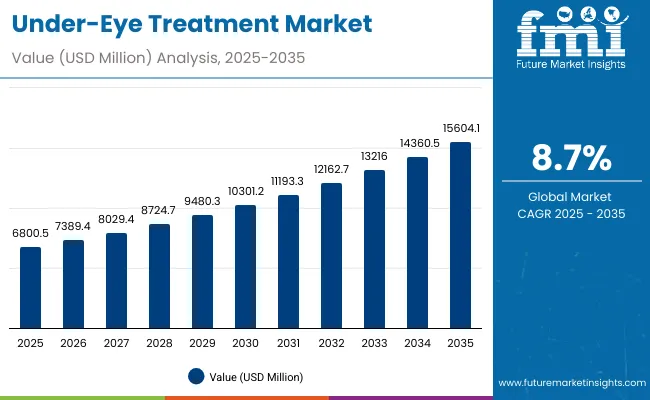

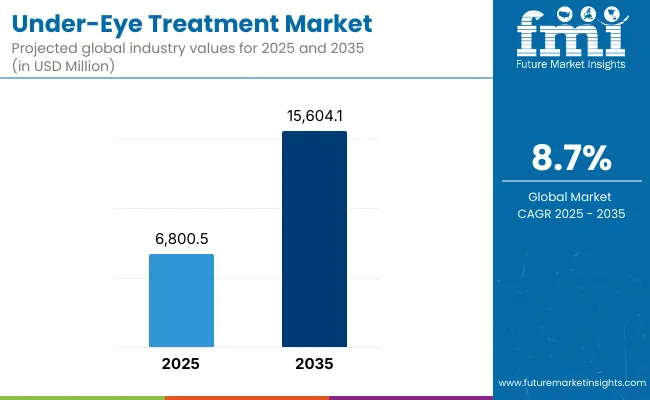

A valuation of USD 6,800.5 million is anticipated for the global under-eye treatment market in 2025, which is forecasted to reach USD 15,604.1 million by 2035. This reflects a near 2.3X expansion in market size, driven by heightened consumer focus on targeted skincare. Over the decade, the industry is expected to add nearly USD 8,803.6 million in incremental opportunity, progressing at a CAGR of 8.7%.

Under-Eye Treatment Market Key Takeaways

| Metric | Value |

|---|---|

| Under-Eye Treatment Market Estimated Value in (2025E) | USD 6,800.5 million |

| Under-Eye Treatment Market Forecast Value in (2035F) | USD 15,604.1 million |

| Forecast CAGR (2025 to 2035) | 8.70% |

The first phase of growth from 2025 to 2030 is projected to advance from USD 6,800.5 million to USD 10,301.2 million, contributing USD 3,500.7 million or nearly 40% of the total decade expansion. Strong demand during this period is likely to stem from digital-first sales channels and the widening acceptance of dermatologist-tested solutions.

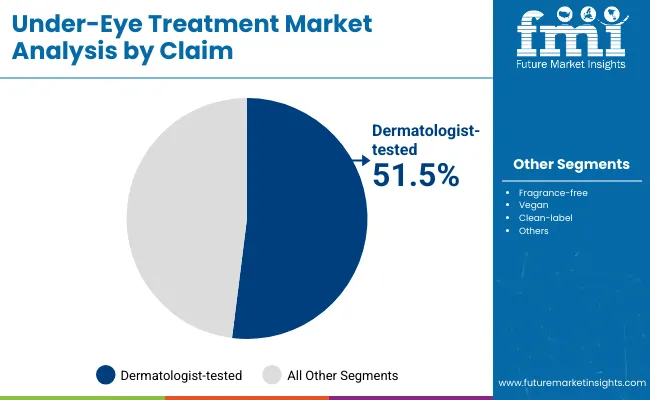

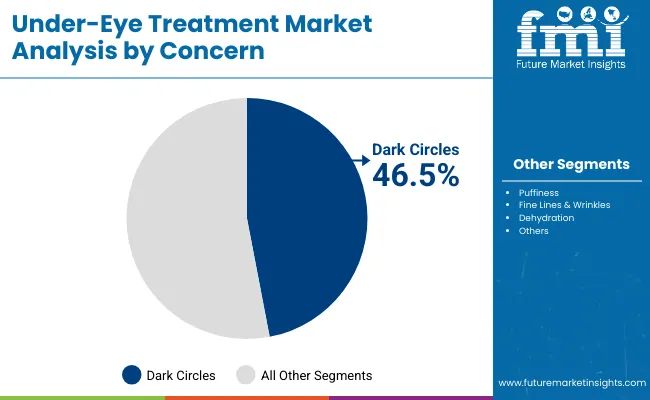

Between 2030 and 2035, the market is predicted to accelerate further, rising from USD 10,301.2 million to USD 15,604.1 million. This latter half will deliver USD 5,302.9 million in absolute gains, equivalent to over 60% of decade growth. Intensifying adoption across Asia, particularly in China and India, is expected to play a critical role in this surge, supported by premiumization and rising disposable incomes. Segmental dominance is anticipated from dermatologist-tested formulations, which are set to capture 51.5% of value in 2025, reflecting consumer preference for safe and clinically endorsed solutions. In terms of concerns, dark circles will represent the leading share at 46.5%, underscoring demand for corrective and preventive treatments. Together, these factors are poised to define the long-term outlook of the under-eye treatment industry.

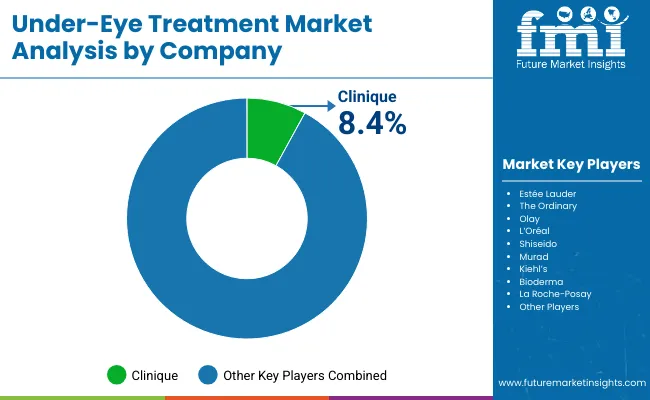

From 2020 to 2024, steady momentum was established in skincare, setting the stage for accelerated growth in under-eye treatments. By 2025, demand is projected to reach USD 6,800.5 million, driven by a rising preference for targeted solutions addressing dark circles and puffiness. Competitive dynamics have been shaped by global beauty leaders, with Clinique expected to secure an 8.4% global share in 2025.

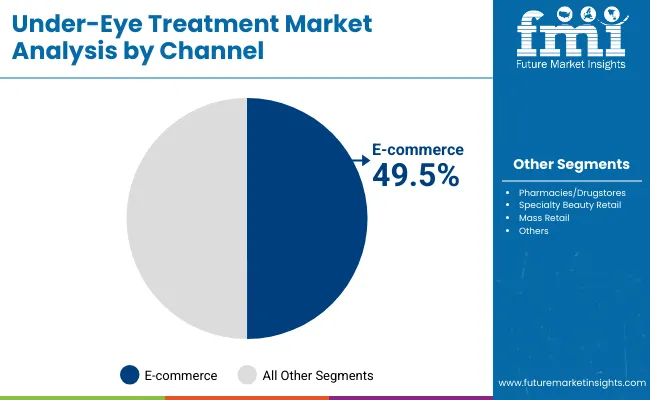

Over the forecast horizon, revenue is anticipated to more than double, climbing to USD 15,604.1 million by 2035. The transition will be underpinned by strong digital adoption, with e-commerce forecasted to account for nearly half of global value in 2025. Consumer trust in dermatologist-tested and clinically validated formulations is projected to reinforce dominance in claims-based segmentation, while Asia-Pacific, led by China and India, is expected to deliver the fastest growth. The competitive advantage is shifting toward clean-label, science-backed innovations, with established leaders increasingly challenged by agile entrants offering transparent and dermatologist-driven solutions.

Growth in the under-eye treatment market is being propelled by rising consumer awareness of targeted skincare solutions and an increasing emphasis on aesthetic wellness. The prevalence of dark circles, puffiness, fine lines, and dehydration is being amplified by lifestyle factors such as stress, screen exposure, and lack of sleep, which are driving higher adoption of specialized treatments. Demand is further being reinforced by the surge in dermatologist-tested and clinically validated formulations, as consumer trust in scientifically backed claims continues to expand.

Digital transformation is also playing a pivotal role, as e-commerce platforms are making premium skincare more accessible to global consumers, especially across emerging economies. Rapid growth in China and India is being enabled by rising disposable incomes and the premiumization trend in beauty routines. Clean-label, vegan, and transparent formulations are increasingly being sought, indicating that consumer preference for safe, effective, and ethical products will anchor the next decade of growth.

The under-eye treatment market is segmented by claim, channel, and concern, reflecting the evolving priorities of global consumers. Claim-based segmentation highlights dermatologist-tested and other product formats, with clinical validation expected to sustain long-term adoption. Channel segmentation divides the market between e-commerce and traditional retail outlets, where online platforms are projected to accelerate global reach and personalization. Concern-based segmentation covers dark circles, puffiness, fine lines, and dehydration, with dark circles anticipated to dominate given lifestyle-driven prevalence. Together, these segments reveal a market shaped by consumer trust in safety, rapid digital transformation, and heightened awareness of visible skin health. Future growth is expected to be reinforced by premiumization, clean-label innovations, and targeted solutions designed to address both preventive and corrective skincare needs.

| Claim | Market Value Share, 2025 |

|---|---|

| Dermatologist-tested | 51.5% |

| Others | 48.5% |

Dermatologist-tested solutions are projected to command 51.5% share in 2025, valued at USD 3,503.3 million. This dominance is expected to be sustained as consumers increasingly prioritize safety, transparency, and clinically validated skincare. Trust in dermatologist-backed claims is anticipated to anchor long-term adoption, reinforcing premium positioning in both developed and emerging regions. Others will contribute 48.5% share, generating USD 3,297.2 million in value, reflecting continued appeal for alternative claims. However, market momentum is likely to remain strongest for dermatologist-tested formulations, which are positioned as credible, science-driven solutions addressing evolving under-eye concerns.

| Channel | Market Value Share, 2025 |

|---|---|

| E-commerce | 49.5% |

| Others | 50.5% |

E-commerce channels are expected to hold 49.5% share in 2025, equivalent to USD 3,365.7 million. This growth is being driven by enhanced digital penetration, convenience-led purchasing, and personalized shopping experiences that are fostering consumer loyalty. Although offline and other retail channels collectively maintain a slightly higher 50.5% share with USD 3,434.6 million in value, the digital channel is predicted to expand at a faster pace. E-commerce platforms are expected to strengthen global access, particularly in Asia-Pacific, by offering targeted marketing and broader assortments. This trend is anticipated to reinforce e-commerce as a cornerstone of under-eye treatment distribution over the coming decade.

| Concern | Market Value Share, 2025 |

|---|---|

| Dark circles | 46.5% |

| Others | 53.5% |

Dark circles are projected to represent 46.5% of the under-eye treatment market in 2025, with value sales reaching USD 3,159.6 million. This segment’s prominence is attributed to lifestyle-driven stress, digital exposure, and inadequate sleep, which have amplified the prevalence of under-eye discoloration. While other concerns, including puffiness, fine lines, and dehydration, collectively account for 53.5% of value, translating to USD 3,640.7 million, dark circles are expected to remain the primary consumer priority. Preventive skincare adoption and multifunctional treatments are forecasted to sustain momentum in this category, reinforcing its long-term role as a critical driver of under-eye treatment demand.

While concerns around affordability and product differentiation persist, the under-eye treatment market is being reshaped by scientific validation, evolving consumer lifestyles, and digital transformation. Long-term momentum is expected as demand aligns with advanced formulations and omni-channel distribution strategies.

Clinical Validation and Trust-Building

A critical growth driver is the rising influence of clinical validation in shaping consumer trust. Under-eye treatments positioned as dermatologist-tested or clinically endorsed are capturing premium demand, with a 51.5% share forecasted in 2025. This emphasis on efficacy is not only elevating brand credibility but also fostering repeat purchases. As consumer literacy around skincare science increases, product adoption is being fueled by claims supported by dermatological evidence. Future growth is expected to be anchored by deeper collaborations between cosmetic science and medical research, creating a pathway for innovative, clinically proven formulations that deliver measurable results and sustainable market credibility.

Digital Commerce as a Core Growth Platform

A defining trend in the under-eye treatment market is the rapid integration of digital-first sales models, with e-commerce expected to capture 49.5% of value in 2025. Unlike traditional retail, online platforms provide data-driven personalization, wider assortment access, and real-time consumer engagement. This shift is reshaping competitive strategies, compelling brands to prioritize omnichannel integration and targeted digital campaigns. Growth is anticipated to be reinforced by AI-driven diagnostics, subscription-based replenishment models, and influencer-led digital ecosystems. As consumer journeys move increasingly online, the digital commerce channel is projected to transition from being a supplementary distribution format to the primary driver of global value creation.

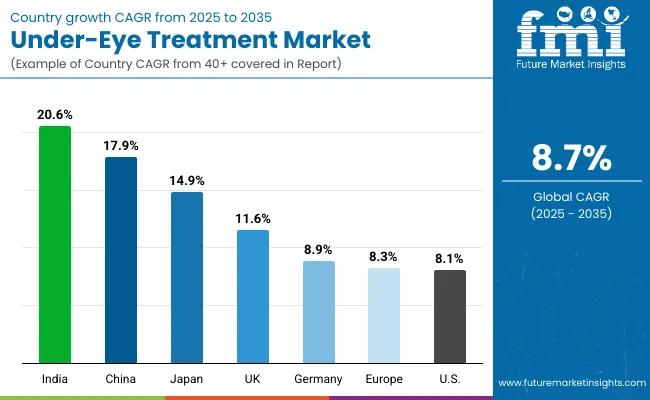

| Country | CAGR |

|---|---|

| China | 17.9% |

| USA | 8.1% |

| India | 20.6% |

| UK | 11.6% |

| Germany | 8.9% |

| Japan | 14.9% |

The global under-eye treatment market is anticipated to demonstrate strong geographic variation in growth, with Asia projected to lead expansion through 2035. India is forecasted to record the highest CAGR at 20.6%, driven by rising disposable incomes, a growing youth population, and accelerated digital adoption that is transforming beauty consumption. China is expected to follow closely with a 17.9% CAGR, supported by its rapidly expanding e-commerce ecosystem and the premiumization trend in personal care. Both countries are likely to remain the central pillars of market acceleration, reshaping global competitive dynamics.

Japan is projected to deliver a 14.9% CAGR, with advanced skincare culture and strong consumer demand for clinically validated products fueling long-term growth. In Europe, moderate growth is anticipated, with Germany at 8.9%, the UK at 11.6%, and the regional average at 8.3%, supported by the maturity of the beauty industry and compliance-driven demand for safe, science-backed formulations. The USA is forecasted to grow at 8.1%, reflecting a mature but resilient market where digital channels and wellness-led preferences sustain demand. Collectively, these growth patterns highlight the global transition toward dermatologist-tested, clean-label, and digitally accessible under-eye solutions, positioning Asia-Pacific as the most transformative region for the decade ahead.

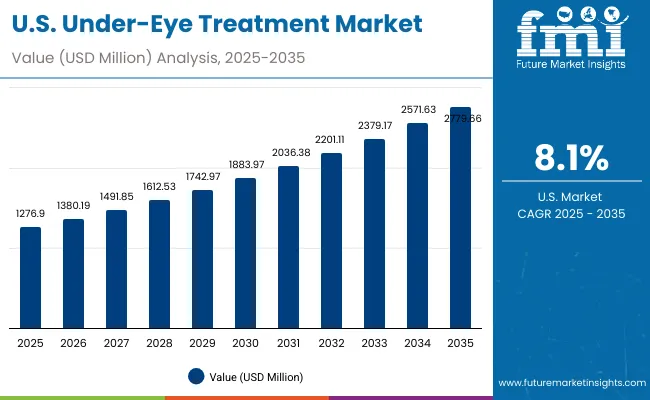

| Year | USA Under-Eye Treatment Market (USD Million) |

|---|---|

| 2025 | 1,276.90 |

| 2026 | 1,380.19 |

| 2027 | 1,491.85 |

| 2028 | 1,612.53 |

| 2029 | 1,742.97 |

| 2030 | 1,883.97 |

| 2031 | 2,036.38 |

| 2032 | 2,201.11 |

| 2033 | 2,379.17 |

| 2034 | 2,571.63 |

| 2035 | 2,779.66 |

The USA under-eye treatment market is projected to grow at a CAGR of 8.1% from 2025 to 2035, rising from USD 1,276.9 million in 2025 to USD 2,779.7 million by 2035. Growth is expected to be sustained by strong consumer trust in dermatologist-tested solutions, which lead national adoption patterns. Digital commerce expansion is anticipated to enhance reach, with e-commerce contributing significantly to distribution efficiency and personalization.

Premiumization in skincare routines and increased awareness of lifestyle-induced under-eye concerns are forecasted to anchor steady long-term growth. Clean-label and vegan formulations are increasingly being integrated into consumer preferences, encouraging brands to align innovation with transparency and ethical positioning. Intensifying competition is expected as global leaders consolidate presence and domestic players emphasize science-driven credibility.

The UK under-eye treatment market is projected to expand at a CAGR of 11.6% from 2025 to 2035, supported by strong consumer preference for advanced skincare solutions and a digitally integrated retail ecosystem. Valuations are expected to strengthen steadily as consumers adopt dermatologist-tested and clinically backed products that align with transparency and safety. Digital penetration is anticipated to reinforce accessibility, while cultural emphasis on premium wellness and beauty is forecasted to sustain high-value purchases. Growth will also be supported by strong innovation in clean-label and sustainable offerings, reflecting the evolving values of younger demographics.

The India under-eye treatment market is forecasted to grow at the fastest global CAGR of 20.6% between 2025 and 2035, driven by rising disposable incomes, urbanization, and expanding access to digital retail. Rapid adoption of e-commerce is anticipated to elevate availability across diverse consumer bases, while growing awareness of targeted skincare solutions is set to sustain momentum. Dermatologist-tested formulations are expected to capture stronger demand as consumer trust in validated claims expands. Premiumization of beauty routines is also predicted to accelerate, supported by aspirational purchasing patterns and lifestyle-driven under-eye concerns. India is positioned as a central growth engine, reshaping global competitive strategies.

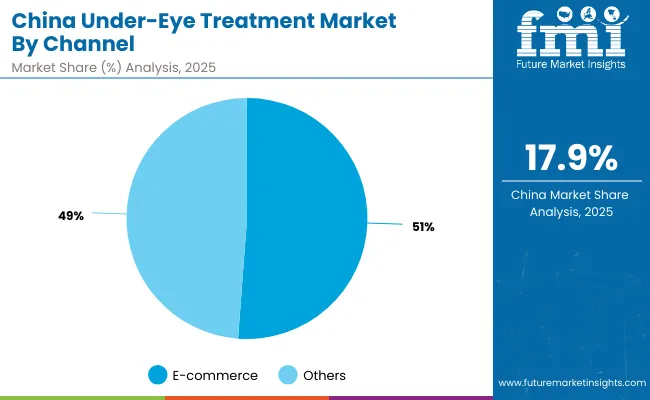

The China under-eye treatment market is anticipated to expand at a CAGR of 17.9% from 2025 to 2035, making it one of the fastest-growing regional markets. Growth is expected to be led by strong e-commerce ecosystems that provide broad consumer reach and real-time engagement. Premium skincare adoption is projected to accelerate as disposable incomes rise, with a strong emphasis on dermatologist-tested, clinically validated, and clean-label solutions. Urbanization, digital-first lifestyles, and wellness awareness are anticipated to further reinforce growth, positioning China as a pivotal driver of the global under-eye treatment industry.

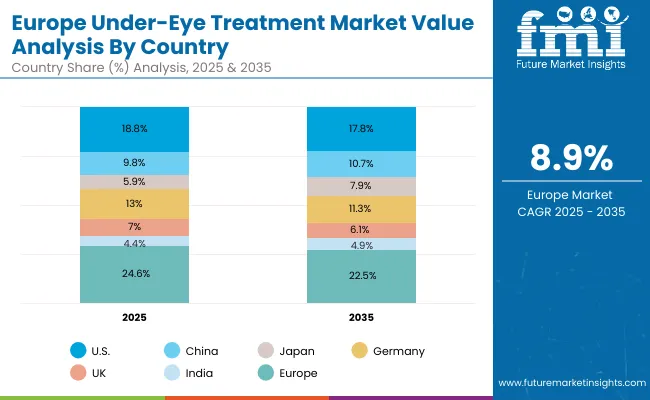

| Country | 2025 |

|---|---|

| USA | 18.8% |

| China | 9.8% |

| Japan | 5.9% |

| Germany | 13.0% |

| UK | 7.0% |

| India | 4.4% |

| Country | 2035 |

|---|---|

| USA | 17.8% |

| China | 10.7% |

| Japan | 7.9% |

| Germany | 11.3% |

| UK | 6.1% |

| India | 4.9% |

The Germany under-eye treatment market is projected to grow at a CAGR of 8.9% between 2025 and 2035, supported by its mature but evolving beauty industry. Growth is anticipated to be driven by the high acceptance of dermatologist-tested products, which resonate strongly with consumer demand for credibility and safety. E-commerce adoption is expected to continue expanding, although physical specialty retail is projected to maintain relevance in the distribution landscape. The market is also likely to be reinforced by sustainable, vegan, and clean-label innovations, as ethical consumption becomes increasingly prioritized by consumers. Germany is positioned to remain a critical European anchor for long-term growth.

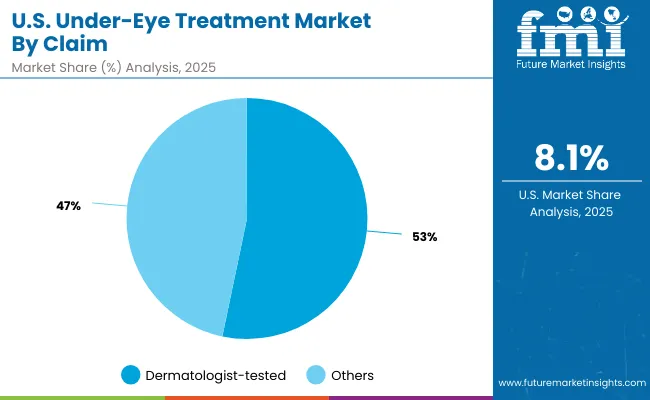

| USA by Claim | Market Value Share, 2025 |

|---|---|

| Dermatologist-tested | 53.3% |

| Others | 46.7% |

The USA under-eye treatment market is projected at USD 1,276.9 million in 2025. Dermatologist-tested claims contribute 53.3%, equal to USD 681.0 million, while other claims hold 46.7%, or USD 595.9 million. This clear preference for dermatologist-tested products underscores the importance of credibility, trust, and clinical validation in shaping consumer choices. Stronger adoption of these claims has been reinforced by rising awareness of skin sensitivity and growing demand for safe, science-backed treatments.

This dominance is also supported by the premium positioning of dermatologist-endorsed formulations, which align with evolving consumer values around transparency and efficacy. Although other claims continue to maintain significant share, long-term momentum is forecasted to remain in favor of medically validated offerings. Competitive strategies are expected to revolve around deeper integration of clinical research, consumer education, and targeted digital marketing campaigns to strengthen credibility.

| China by Channel | Market Value Share, 2025 |

|---|---|

| E-commerce | 51.2% |

| Others | 48.8% |

The China under-eye treatment market is projected at USD 667.6 million in 2025. E-commerce channels contribute 51.2%, equal to USD 342.1 million, while other retail formats hold 48.8%, or USD 325.5 million. This narrow yet clear dominance of e-commerce highlights the central role of digital-first ecosystems in shaping consumer behavior in China. With strong penetration of online platforms and growing trust in digital transactions, consumers are expected to increasingly favor personalized, convenient, and premium skincare purchases online.

The growth of e-commerce is being reinforced by innovative engagement strategies, including AI-driven diagnostics, influencer-led marketing, and subscription-based delivery. While offline retail continues to hold nearly half of the market, its long-term momentum is expected to be challenged by the agility and breadth of digital platforms. The competitive landscape is anticipated to be defined by brands capable of blending credibility, science-backed claims, and digital reach.

| Company | Global Value Share 2025 |

|---|---|

| Clinique | 8.4% |

| Others | 91.6% |

The under-eye treatment market is moderately fragmented, with global leaders, established beauty conglomerates, and niche specialists competing to address diverse consumer concerns. Clinique is recognized as the leading brand, holding 8.4% global value share in 2025, while all other competitors collectively account for 91.6%. This distribution reflects both the scale of competition and the absence of a single dominant player.

Clinique’s leadership is attributed to its dermatologist-tested product positioning, which strongly aligns with rising consumer demand for clinically validated and safe formulations. The brand’s strength lies in consistent innovation and effective integration across digital and offline retail platforms, particularly in developed markets. Its credibility has reinforced premium adoption, making it the benchmark competitor within the space.

Other key players active in the global under-eye treatment category include Estée Lauder, L’Oréal, Shiseido, The Ordinary, Olay, Murad, Kiehl’s, Bioderma, and La Roche-Posay. Their strategies are increasingly centered on clean-label claims, vegan formulations, and e-commerce-led distribution to capture wider audiences. Competitive differentiation is projected to shift further toward transparency, clinical backing, and digital engagement, as consumers prioritize science-based and ethical solutions.

Overall, Clinique dominated the market in 2024 as well, holding the largest global share of around 8%, underscoring its long-standing leadership. The remaining market was divided among multiple global and regional players, emphasizing the fragmented and innovation-driven nature of this industry.

Key Developments in Under-Eye Treatment Market

| Item | Value |

|---|---|

| Quantitative | USD 6,800.5 million (2025E); USD 15,604.1 million (2035F); CAGR 8.7% (2025-2035) |

| Claims (Component analogue) | Dermatologist-tested; Others |

| Channels (Range analogue) | E-commerce; Others (specialty beauty retail, pharmacies/drugstores, mass retail) |

| Concerns (Technology analogue) | Dark circles; Others (puffiness, fine lines & wrinkles, dehydration) |

| Product Types (Type analogue) | Creams; Serums; Masks/patches; Roll-ons |

| Active Ingredients (Analytical lens) | Caffeine; Hyaluronic acid; Retinol; Vitamin C; Peptides |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; United Kingdom; Germany; Japan; Europe (aggregate) |

| Key Companies Profiled | Clinique; Estée Lauder; The Ordinary; Olay; L’Oréal; Shiseido; Murad; Kiehl’s; Bioderma; La Roche-Posay |

| Additional Attributes | 51.5% share for dermatologist-tested claims (2025); E-commerce at 49.5% share (2025); Dark circles at 46.5% share (2025); China and India as fastest growers (17.9% & 20.6% CAGR respectively); Premiumization, clean-label/vegan positioning, and clinical validation emphasized; AI-assisted personalization, subscription replenishment, and influencer-led digital commerce shaping go-to-market; USA value trajectory from USD 1,276.9 million (2025) to USD 2,779.7 million (2035). |

The global Under-Eye Treatment Market is estimated to be valued at USD 6,800.5 million in 2025.

The market size for the Under-Eye Treatment Market is projected to reach USD 15,604.1 million by 2035.

The Under-Eye Treatment Market is expected to grow at a CAGR of 8.7% between 2025 and 2035.

The key product types in the Under-Eye Treatment Market include creams, serums, masks/patches, and roll-ons.

In terms of concerns, the dark circles segment is projected to command 46.5% share in the Under-Eye Treatment Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA