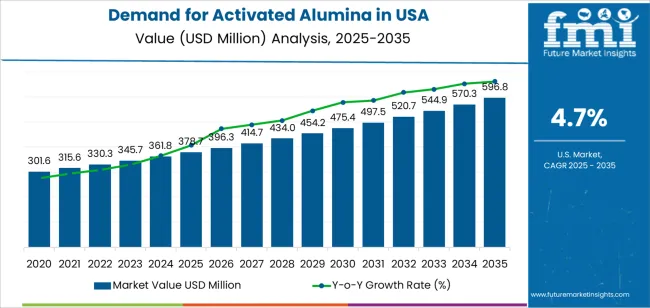

The demand for activated alumina in the USA is projected to grow from USD 378.7 million in 2025 to USD 596.8 million by 2035, reflecting a CAGR of 4.7%. Activated alumina is widely used in a variety of industries, including water treatment, petroleum refining, gas processing, and air drying, where it serves as an adsorbent material. The market growth is driven by increasing demand for sustainable and efficient filtration technologies, as well as the growing need for water purification, air separation, and desiccant applications. As industries face rising environmental concerns and regulatory pressure to improve air and water quality, the demand for activated alumina is expected to continue growing steadily.

The market will also benefit from advancements in production technologies, regulatory mandates, and increasing investments in environmentally friendly solutions. As new applications in pharmaceuticals, cosmetics, and food industries emerge, the scope for activated alumina is expanding. The increase in water and air pollution in urban centers further supports demand for filtration and drying systems. Over the forecast period, innovations and improvements in adsorbent properties, recycling capabilities, and cost-effectiveness of activated alumina will ensure that it remains a dominant player in its market segment.

The Market Share Erosion or Gain Analysis for activated alumina in the USA reveals a steady gain in market share over the 2025 to 2035 period, despite the presence of alternative materials and competitive products in the market. The market is expected to grow from USD 378.7 million in 2025 to USD 596.8 million by 2035, which represents an absolute dollar increase of USD 218.1 million over the next decade.

Between 2025 and 2030, the market will expand from USD 378.7 million to USD 475.4 million, which shows a solid growth trajectory driven by consistent demand in key industries such as water treatment, air purification, and oil refining. During this period, activated alumina’s market share will remain strong as regulatory pressures increase on businesses to adopt more efficient and eco-friendly filtration systems. The material's unique properties, including high adsorption capacity and durability, will help it maintain competitive advantage against alternative filtration media.

In the latter half of the forecast period (2030–2035), the market will grow from USD 475.4 million to USD 596.8 million, with continued market share gains. The increasing adoption of activated alumina in emerging applications, combined with advancements in adsorption technology and production processes, will enable it to capture additional market share. While alternatives such as zeolites or synthetic polymers may present competition, activated alumina will continue to see growth due to its proven efficiency, versatility, and sustainability in addressing industrial filtration needs. The market will experience more moderate competition during this period as its positioning in key applications remains strong and the material evolves with technological advances. Thus, the activated alumina segment will likely experience market share gains throughout the forecast period.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 378.8 million |

| Forecast Value (2035) | USD 596.8 million |

| Forecast CAGR (2025-2035) | 4.7% |

Demand for activated alumina in the USA is being driven by its essential role in industrial processes such as water treatment, oil refining and gas purification. In the water treatment sector it is used as an adsorbent to remove contaminants such as fluoride and arsenic from municipal supplies. As environmental regulations tighten and water infrastructure renewals progress, the need for effective adsorption media like activated alumina increases. In the oil and gas industry the material is valued for its ability to dehydrate natural gas streams and support sulfur removal catalysts, and expanding refining and chemical processing capacity in regions such as Texas and Louisiana is contributing to sustained demand.

Another supporting factor is the growth of specialty applications in chemical manufacturing, air and gas drying, and advanced catalyst supports. Domestic producers supply high purity grades for demanding uses while lower grade import streams cater to bulk applications. Analysts estimate the North America activated alumina market will grow at roughly 4 %,5 % annually over the coming years. Despite positive trends, growth is moderated by substitution risks from alternative adsorbents, energy intensive production costs, and global import competition. Nevertheless, the continued requirement for reliable adsorbents in compliance driven end uses keeps activated alumina a stable component of the USA industrial chemicals market.

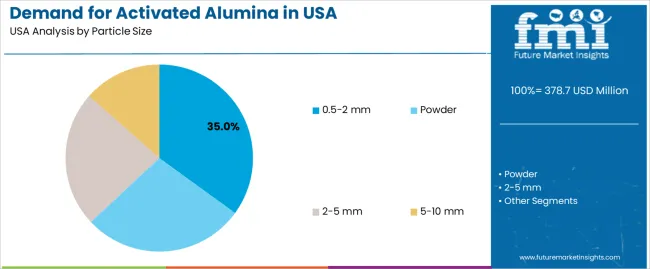

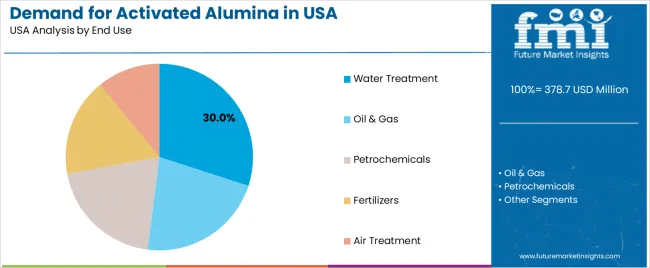

The demand for activated alumina in the USA is driven by two key factors: particle size and end use. The 0.5-2 mm particle size is the leading segment, capturing 35% of the market share. In terms of end use, water treatment is the dominant application, accounting for 30% of the demand. Activated alumina is widely used in industries where its ability to absorb impurities and contaminants is essential, including water purification, air treatment, and oil and gas processing. As regulations around water quality and environmental standards continue to tighten, the demand for activated alumina for these applications remains strong.

The 0.5-2 mm particle size holds the largest share in the activated alumina market, with 35% of total demand in the USA. This particle size is widely used because it offers an ideal balance between surface area and permeability, making it highly effective for adsorption processes, especially in water treatment and air filtration. Activated alumina in this range is particularly well-suited for applications that require high adsorption capacity, such as the removal of fluoride, arsenic, and other heavy metals from water, or for use in gas and air treatment systems.

The 0.5-2 mm size is also preferred for its efficiency in a range of industrial processes, providing effective filtration while maintaining a high flow rate. This versatility in various end-use applications, particularly in water purification and environmental applications, contributes to its market dominance. As industries continue to focus on improving water quality and meeting stringent environmental standards, the demand for activated alumina with this particle size is expected to remain strong.

The water treatment sector leads the demand for activated alumina in the USA, accounting for 30% of the market share. Activated alumina is widely used in water treatment processes for removing contaminants such as fluoride, arsenic, and other heavy metals, making it a key component in ensuring clean and safe drinking water. Its high surface area and adsorption capacity make it an ideal material for these applications, allowing for effective filtration and purification.

The growing focus on improving water quality, driven by public health concerns and stricter regulations on water contamination, is a major factor behind the high demand for activated alumina in water treatment. As environmental regulations become more stringent and municipalities and industries invest in advanced water purification technologies, the demand for activated alumina is expected to continue to grow. The water treatment sector’s leadership in the market ensures that activated alumina remains a critical component in ensuring the safety and sustainability of water resources across the USA.

Demand for activated alumina in the United States is driven by its wide applications across water treatment, gas dehydration, catalysts in petrochemical and refining, and adsorption in industrial processes. As regulatory standards tighten for water and air quality, demand for effective adsorbents such as activated alumina increases. At the same time, the market is influenced by raw material availability, energy costs in activation processes, and competition from alternative adsorbents such as silica gel and molecular sieves.

What Are The Primary Growth Drivers For Activated Alumina Demand in the United States?

Key drivers include growing water treatment infrastructure upgrades in municipalities, where activated alumina removes arsenic, fluoride and other contaminants. The expansion of natural gas production and processing requires dehydration and sulfur removal equipment, in which activated alumina is widely used. Industrial growth in pharmaceuticals, chemicals and air separation plants also supports demand for high purity adsorbents and catalysts. Furthermore, rising awareness of clean air requirements in manufacturing and the adoption of stricter emission control technology increase need for activated alumina in adsorption and catalytic support roles.

What Are The Key Restraints Affecting Activated Alumina Demand in the United States?

Despite favourable trends, the market faces several restraints. The cost of high quality activated alumina with desired pore structure and adsorption properties can be elevated, limiting uptake in cost sensitive projects or processes. Availability of alternative adsorbents offering lower cost or tailored performance, such as molecular sieves or advanced polymeric adsorbents, can reduce demand. Moreover, fluctuations in energy and raw material costs impact production economics and pricing stability, which can constrain purchasing decisions. Finally, some industrial segments are experiencing slower growth or replacement cycles, reducing incremental demand for new adsorbent stock.

What Are The Key Trends Shaping Demand for Activated Alumina in the United States?

Emerging trends include development of higher efficiency activated alumina grades with enhanced adsorption capacities, tailored pore distributions and longer cycle life to reduce total cost of ownership. There is increasing interest in regenerated and reusable activated alumina beds, improving sustainability and lowering waste. Growth of niche applications—such as hydrogen purification, biogas upgrading and carbon capture pre treatment—is opening new demand segments. Furthermore, digital monitoring and smart bed management tools are being integrated with adsorption systems to optimise performance, driving demand for activated alumina compatible with advanced instrumentation.

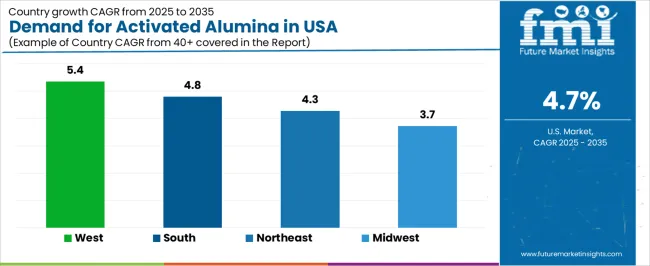

The demand for activated alumina in the USA is growing due to its wide range of applications, including water treatment, air purification, chemical processing, and as a desiccant in various industries. Activated alumina’s ability to absorb moisture, remove impurities, and act as a catalyst carrier in industrial applications is driving its increasing adoption. The demand is also supported by the need for clean water solutions, stringent environmental regulations, and the growing focus on sustainable industrial practices. Regional demand varies based on industrial activity, regulatory pressures, and environmental concerns. The West leads in demand due to its strong presence in chemical manufacturing and environmental technologies, while the South, Northeast, and Midwest follow with steady adoption across water treatment facilities, industrial processes, and air purification needs. This analysis explores the factors contributing to activated alumina demand across the USA.

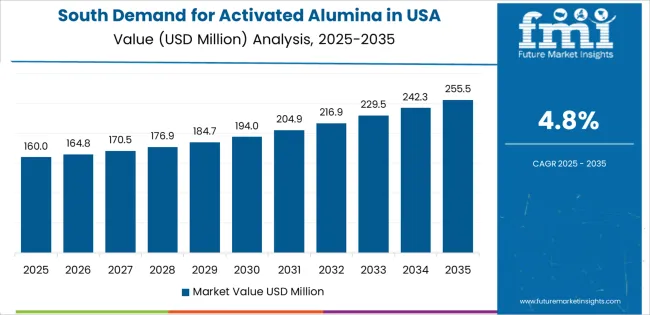

| Region | CAGR (2025-2035) |

|---|---|

| West | 5.4% |

| South | 4.8% |

| Northeast | 4.3% |

| Midwest | 3.7% |

The West region leads the USA activated alumina market with a CAGR of 5.4%. The region’s strong focus on environmental sustainability, along with significant activity in water treatment and air purification sectors, is driving demand for activated alumina. States like California, which have stringent environmental regulations and a large number of industrial and municipal water treatment plants, are major contributors to the market's growth.

The West is also home to key industries such as chemical processing, petroleum refining, and electronics manufacturing, all of which rely on activated alumina for applications like catalyst supports and desiccants. The rising adoption of advanced environmental technologies, such as air and water filtration systems in the region, is further boosting the demand for activated alumina. With the ongoing focus on clean energy, water conservation, and environmental protection, the West remains the strongest regional market for activated alumina.

The South region shows a solid CAGR of 4.8%. The demand for activated alumina in the South is driven by its application in water treatment, particularly in rural and urban areas where the need for clean drinking water is increasing. The region’s growing industrial base, including the chemical, petroleum, and manufacturing sectors, also contributes to the demand for activated alumina for use in desiccants, catalyst supports, and moisture removal processes.

With significant population growth and a rising focus on environmental protection, many Southern states are investing in advanced water filtration systems, which increases the need for activated alumina as a water purifier. Additionally, the region's increasing focus on sustainability and green technologies in industries like oil and gas further supports demand. As infrastructure development continues and environmental regulations tighten, the need for activated alumina in the South will continue to grow steadily.

The Northeast region demonstrates a stable CAGR of 4.3%. The Northeast has a high concentration of water treatment facilities, industrial plants, and research institutions, which drive the demand for activated alumina. The need for effective air and water filtration systems to meet stringent environmental standards is a major factor fueling demand for activated alumina in the region.

The region’s industrial activities, especially in chemicals and pharmaceuticals, require high-performance desiccants and catalyst supports, both of which are applications of activated alumina. Furthermore, urban centers in the Northeast are increasingly adopting sustainable solutions for water purification, boosting the demand for activated alumina. As the region continues to prioritize environmental sustainability and enhance its water treatment infrastructure, the demand for activated alumina will continue to grow steadily.

The Midwest region shows a moderate CAGR of 3.7%. The Midwest has a well-established industrial base, with a strong focus on agriculture, manufacturing, and chemical processing, all of which drive the demand for activated alumina. The use of activated alumina in water treatment and moisture control is increasingly important in this region, especially in agricultural areas where water purification is a key concern.

The region’s manufacturing facilities and refineries also require activated alumina for use in catalytic processes and as a desiccant. While the demand is not as high as in the West or South, it remains steady due to the region’s ongoing industrial activities and water treatment initiatives. As demand for clean water and sustainable industrial practices grows, the market for activated alumina in the Midwest will continue to expand, albeit at a more moderate pace compared to other regions.

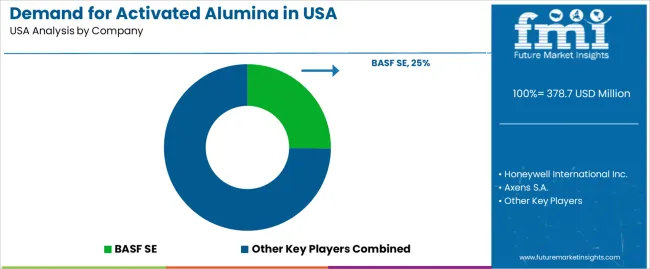

Demand for activated alumina in the United States continues to rise, driven by its widespread applications in industries such as water treatment, petrochemical, and air purification. Companies such as BASF SE (holding approximately 25.2% share), Honeywell International Inc., Axens S.A., Sumitomo Chemical Co., Ltd., and Porocel Industries LLC (Evonik) are key players in the market. Activated alumina is primarily used for removing impurities, particularly fluoride, arsenic, and other contaminants from water, as well as in catalytic processes for refining and petrochemical production. The market is expanding due to increasing environmental concerns, stricter regulatory requirements for water quality, and growing industrial demand for filtration solutions.

The competition in the activated alumina market is driven by product performance, customization, and application-specific solutions. One strategy focuses on improving the material’s adsorptive capacity and regeneration ability, making it more efficient in water and air treatment processes. Another strategic focus is the development of activated alumina that can withstand harsh industrial conditions, including high temperatures and pressures, particularly for use in catalytic processes in the petrochemical and refinery industries. Companies are also emphasizing their ability to provide tailored solutions for various industries and applications. Marketing materials often highlight product features such as surface area, pore size, moisture content, and chemical stability. By aligning their offerings with the growing demand for cleaner water, environmental sustainability, and more efficient industrial processes, these companies aim to strengthen their market presence in the activated alumina sector.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | North America |

| Particle Size | 0.5-2 mm, Powder, 2-5 mm, 5-10 mm |

| End Use | Water Treatment, Oil & Gas, Petrochemicals, Fertilizers, Air Treatment |

| Key Companies Profiled | BASF SE, Honeywell International Inc., Axens S.A., Sumitomo Chemical Co., Ltd., Porocel Industries LLC (Evonik) |

| Additional Attributes | The market analysis includes dollar sales by particle size and end-use categories. It also covers regional demand trends in the United States, particularly in water treatment, oil & gas, petrochemicals, and air treatment sectors. The competitive landscape highlights key manufacturers focusing on innovations in activated alumina technologies. Trends in the growing demand for energy-efficient and sustainable materials in industrial applications are explored, along with advancements in alumina production and regeneration processes. |

The global demand for activated alumina in USA is estimated to be valued at USD 378.7 million in 2025.

The market size for the demand for activated alumina in USA is projected to reach USD 596.8 million by 2035.

The demand for activated alumina in USA is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in demand for activated alumina in USA are 0.5-2 mm, powder, 2-5 mm and 5-10 mm.

In terms of end use, water treatment segment to command 30.0% share in the demand for activated alumina in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA