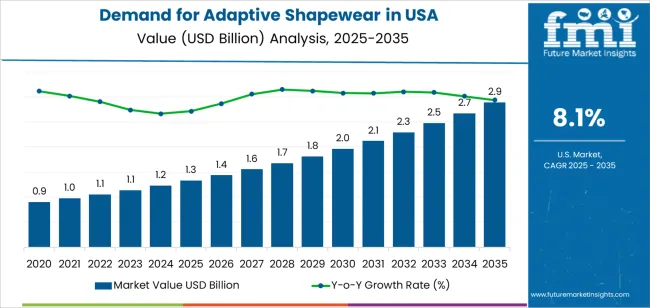

The demand for adaptive shapewear in the USA is projected to grow from USD 1.3 billion in 2025 to USD 2.9 billion by 2035, reflecting a CAGR of 8.1%. Adaptive shapewear, designed to offer comfort, support, and customized fit, has gained popularity due to its growing demand in the fashion, fitness, and post-surgery recovery segments. The increased awareness around body positivity, the demand for inclusive fashion, and advancements in fabric technology are driving the growth of the adaptive shapewear market. As more people look for tailored solutions for both aesthetic and functional needs, adaptive shapewear is becoming a mainstream category within the apparel industry.

The market will benefit from trends such as personalized comfort, technological innovations in textile materials, and sustainability, which will lead to wider adoption among consumers. In addition, post-operative wear and maternity shapewear are expanding the use cases for this product. As the inclusive beauty and wellness movement continues to grow, there will be increasing opportunities for manufacturers to innovate and provide more adaptive, comfortable, and stylish shapewear that caters to a broader range of body types and preferences.

The CAGR analysis for the adaptive shapewear market in the USA indicates strong and consistent growth over the forecast period from 2025 to 2035. Starting at USD 1.3 billion in 2025, the market will expand to USD 2.9 billion by 2035, resulting in an absolute growth of USD 1.6 billion. The CAGR of 8.1% reflects the increasing consumer demand for comfort-oriented and inclusive shapewear. This growth is expected to be driven by innovations in fabric technology that offer better breathability, stretchability, and support while maintaining aesthetic appeal. As consumer interest in adaptive wear for specific body types continues to rise, along with growing acceptance of inclusive beauty trends, the demand for shapewear solutions that cater to both form and function will continue to grow steadily.

Between 2025 and 2030, the market will grow from USD 1.3 billion to approximately USD 2.0 billion, contributing USD 0.7 billion in growth. This phase will witness accelerating demand driven by innovations in post-surgery shapewear, athleisure, and inclusive sizing. From 2030 to 2035, the market will continue its upward trajectory, reaching USD 2.9 billion, adding USD 0.9 billion. The second half of the forecast period will see further market expansion, as adaptive shapewear becomes a staple across a variety of categories, including maternity wear, post-operative wear, and inclusive fashion. The CAGR of 8.1% signifies a sustained and healthy growth trend driven by consumer preferences, technological improvements, and greater product offerings tailored to meet diverse needs in the shapewear market.

| Metric | Value |

|---|---|

| USA Adaptive Shapewear Sales Value (2025) | USD 1.3 billion |

| USA Adaptive Shapewear Forecast Value (2035) | USD 2.9 billion |

| USA Adaptive Shapewear Forecast CAGR (2025-2035) | 8.1% |

The demand for adaptive shapewear in the USA is increasing as inclusivity and representation become more prominent in fashion and apparel industries. Adaptive shapewear refers to garments designed to accommodate a range of body types, physical abilities, and changing post surgical or post partum needs, offering both functional support and aesthetic appeal. Consumers who require or prefer adaptive features such as easy closures, adjustable fits, and soft materials may not find suitable options in standard shapewear lines, prompting brand innovation and market growth. Retailers and direct to consumer brands are responding by offering specialized adaptive shapewear collections, which supports broader accessibility and personalization.

Another driver is the crossover of activewear and shapewear trends, where consumers seek garments that not only shape but also support comfort, mobility, and daily wear functionality. Features such as breathable fabrics, seamless construction, and wire free designs make adaptive shapewear appealing for both medical related use and general wellness segments. The rise of e-commerce and social media visibility for inclusive apparel also expands market reach and introduces new consumers to adaptive shapewear solutions. Challenges remain in terms of production cost, fit customization, and consumer education about adaptive categories, but the increasing demand for garments that combine support, inclusivity and style suggests that the adaptive shapewear market in the USA is poised for continued growth.

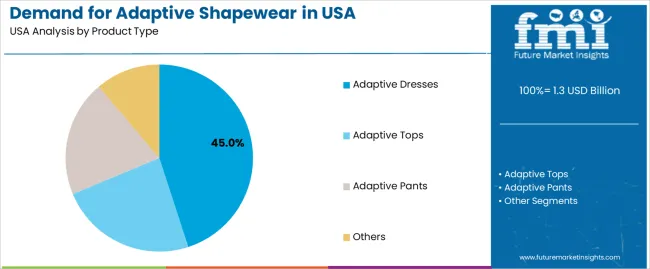

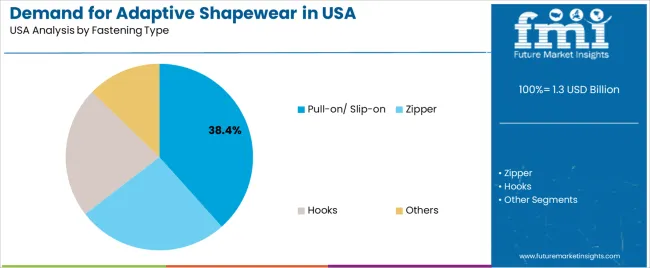

The demand for adaptive shapewear in the USA is driven by two key factors: product type and fastening type. The leading product type is adaptive dresses, which capture 45% of the market share, while pull-on/slip-on fastening types dominate, accounting for 38.4% of the demand. Adaptive shapewear is designed to provide comfort, support, and ease of use for individuals with mobility challenges, disabilities, or those recovering from surgery. As awareness and demand for adaptive clothing solutions grow, particularly among elderly populations and people with disabilities, the adaptive shapewear market continues to expand, offering increased convenience and improved quality of life.

Adaptive dresses are the leading product type in the adaptive shapewear market, accounting for 45% of the demand. These dresses are designed with features that make them easy to put on and take off, particularly for individuals with limited mobility. Adaptive dresses are often designed with open-back styles, side openings, or other modifications that make dressing more accessible for people with physical challenges, elderly individuals, or those undergoing medical treatment or rehabilitation.

The popularity of adaptive dresses is growing due to their practical and functional features, which allow for easy dressing without compromising on style. These dresses provide comfort and ease of movement while offering a range of fashionable designs. The increasing focus on inclusivity in fashion and the demand for clothing that caters to people with disabilities are major factors contributing to the demand for adaptive dresses. As more brands and retailers embrace adaptive fashion, the demand for adaptive dresses in the shapewear market is expected to continue rising, reinforcing their dominant position in the market.

The pull-on/slip-on fastening type leads the demand for adaptive shapewear in the USA, capturing 38.4% of the market share. Pull-on and slip-on designs are highly favored in adaptive shapewear due to their simplicity and ease of use. These fastening types require minimal dexterity, making them ideal for individuals with limited hand strength, coordination issues, or those recovering from surgery. The ability to easily slip garments on and off without dealing with complicated closures is a key factor driving their popularity.

The demand for pull-on/slip-on fastening types is closely tied to the growing need for comfortable, functional, and user-friendly clothing for individuals with physical limitations. The convenience of pull-on shapewear also appeals to caregivers and medical professionals who assist people with daily dressing. As the adaptive fashion market continues to expand and focus on meeting the needs of people with mobility challenges, the pull-on/slip-on fastening type is expected to remain the leading choice in the adaptive shapewear sector.

The adaptive shapewear market in the USA is driven by increasing consumer demand for inclusive fashion, body positivity, and comfort. Shapewear designed for people with mobility challenges, post-surgery recovery, and diverse body types is gaining traction, particularly as consumers look for products that enhance comfort and fit. E-commerce platforms and direct-to-consumer models are expanding the accessibility of adaptive shapewear. At the same time, the market is influenced by competition from traditional shapewear brands and the challenges of achieving perfect fit and comfort.

What Are The Primary Growth Drivers For Adaptive Shapewear Demand in the United States?

Growth is driven by the increasing demand for inclusive sizing and adaptive features in apparel, catering to a wider range of body types. Technological advancements in fabric design, such as seamless knitting, breathable, and moisture-wicking materials, are further supporting market expansion. Additionally, the growing popularity of body-positive movements and the push for adaptive solutions for mobility-challenged individuals are contributing to the rise in demand for shapewear. The increasing presence of adaptive shapewear brands in online retail and social media platforms is also helping to reach new consumers.

What Are The Key Restraints Affecting Adaptive Shapewear Demand in the United States?

Despite favorable trends, the market faces several challenges. High competition from traditional shapewear brands, which may offer lower-priced or more widely available products, can limit the growth of adaptive shapewear. Fit, comfort, and sizing consistency also remain challenges, as the market for adaptive wear requires very precise product engineering. Additionally, consumer awareness of adaptive shapewear is still developing, which may slow adoption in mainstream markets. Price sensitivity and the perception of adaptive shapewear as a niche product can also limit its broader acceptance.

What Are The Key Trends Shaping Adaptive Shapewear Demand in the United States?

Several trends are shaping the adaptive shapewear market. There is growing interest in seamless, inclusive sizing lines that cater to a wide range of body types, including plus sizes and specialized needs such as post-surgery recovery. Innovations in fabric technology, such as smart textiles and adjustable fits, are making adaptive shapewear more comfortable and versatile. Subscription and direct-to-consumer models are gaining traction, with brands offering personalized fit options and creating a loyal customer base. Additionally, the rise of social media-driven body positivity and inclusive brand campaigns is enhancing visibility and driving demand for adaptive shapewear.

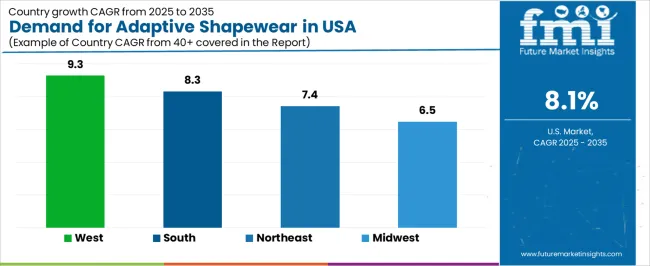

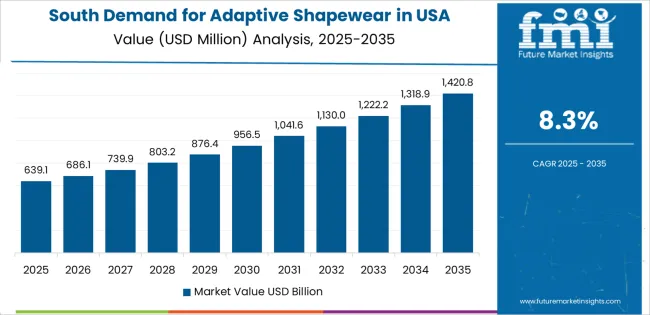

The demand for adaptive shapewear in the USA is rising as consumers increasingly seek comfort, style, and functionality in their clothing choices. Adaptive shapewear, designed to provide support and shaping while also offering ease of use and flexibility, is becoming popular for people of all body types, including those with mobility challenges or medical conditions. The rising focus on inclusivity, body positivity, and wellness is driving the adoption of adaptive shapewear, particularly in the retail and e-commerce markets. Additionally, as people become more focused on self-care and comfort, the demand for shapewear that provides both aesthetic and functional benefits continues to grow. Regional variations in demand are influenced by factors such as population demographics, fashion trends, and regional preferences. The West leads in demand, driven by fashion-forward trends and wellness-driven lifestyles, while other regions such as the South, Northeast, and Midwest show steady adoption due to their growing focus on comfort and inclusivity. This analysis explores the factors driving the demand for adaptive shapewear across different regions of the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 9.3% |

| South | 8.3% |

| Northeast | 7.4% |

| Midwest | 6.5% |

The West region leads the USA in adaptive shapewear demand with a CAGR of 9.3%. The West is known for its progressive fashion trends, wellness-driven lifestyles, and focus on body positivity, all of which contribute to the rising popularity of adaptive shapewear. Cities like Los Angeles, San Francisco, and Seattle are hubs for fashion and inclusive beauty, where the demand for comfortable, functional clothing that caters to a diverse range of body types is strong.

The West's emphasis on inclusivity, self-care, and health-conscious living further fuels the demand for adaptive shapewear. With an increasing number of consumers seeking clothing that offers both aesthetic appeal and functionality, the West remains the leading region for the growth of adaptive shapewear. The region’s active lifestyle and growing e-commerce platforms also make adaptive shapewear a convenient and popular choice among consumers.

The South shows strong demand for adaptive shapewear with a CAGR of 8.3%. The region's growing focus on comfort and inclusivity in fashion, combined with its rising health-conscious consumer base, contributes to the steady growth of adaptive shapewear demand. In particular, states like Texas, Florida, and Georgia, which have large populations and diverse demographics, see an increasing demand for shapewear products that prioritize both comfort and style.

Additionally, the South has a strong retail presence, with many consumers seeking clothing that offers both aesthetic appeal and functional benefits for their everyday lives. The growing focus on self-care and wellness, along with the region’s increasing interest in inclusive and adaptive clothing solutions, ensures a steady rise in demand for shapewear designed to fit a wide variety of body types.

The Northeast demonstrates steady demand for adaptive shapewear with a CAGR of 7.4%. The Northeast, home to major fashion capitals like New York City, has a strong demand for adaptive shapewear driven by both fashion-forward consumers and those seeking comfort-driven solutions. The region’s diverse population, which includes people of all body types and ages, is increasingly embracing adaptive shapewear as a way to combine style with practicality.

The Northeast’s growing focus on inclusivity and body positivity within the fashion industry is also driving the demand for adaptive shapewear. With the increasing popularity of diverse beauty standards and clothing that promotes self-confidence, the demand for shapewear that fits a variety of needs and preferences is on the rise. The region’s robust retail and e-commerce infrastructure further supports the growing popularity of adaptive shapewear.

The Midwest shows moderate growth in adaptive shapewear demand with a CAGR of 6.5%. The Midwest, with its large manufacturing base and diverse demographic, is gradually adopting adaptive shapewear as more consumers look for functional clothing options that combine comfort and support. While growth in this region is slower than in the West and South, the demand for shapewear that provides both aesthetic benefits and physical support is growing, particularly among consumers in urban centers like Chicago and Detroit.

As body positivity and inclusivity continue to gain importance, the Midwest is seeing an increased preference for adaptive shapewear, especially for people seeking solutions for mobility challenges or comfort. The region’s traditional focus on practicality and value for money ensures that adaptive shapewear is seen as a valuable addition to everyday clothing. The increasing awareness of self-care and wellness trends is expected to drive steady growth in the demand for adaptive shapewear in the Midwest.

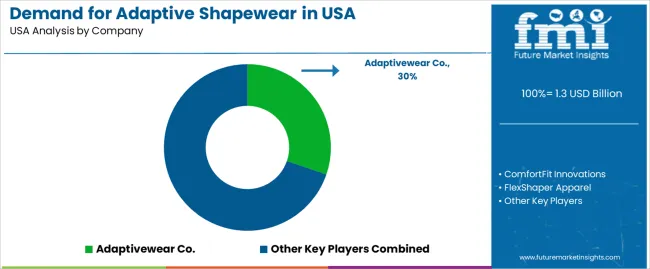

Demand for adaptive shapewear in the United States is growing as consumers seek comfortable, inclusive, and functional clothing options that cater to a variety of body shapes and needs. Companies like Adaptivewear Co. (holding approximately 30.3% market share), ComfortFit Innovations, FlexShaper Apparel, EmbraceWear, and BodyEase Solutions are key players in this market. Adaptive shapewear is designed to offer support, shaping, and flexibility, particularly for individuals with specific needs, including those with mobility impairments, post-surgery recovery, or special requirements due to age or health conditions.

Competition in the adaptive shapewear market is driven by innovation in fabric technology, design, and ease of use. Many companies focus on creating shapewear that provides comfort without compromising on style, offering solutions like adjustable fastenings, seamless designs, and stretchy materials that accommodate various body types. Another key aspect is the emphasis on inclusivity and customization, with brands expanding their size ranges and incorporating features that cater to different physical abilities and body proportions. Marketing materials often highlight features such as fabric breathability, support levels, ease of wearing, and discreet design. By aligning their offerings with the growing demand for functional, comfortable, and adaptive clothing solutions, these companies aim to strengthen their position in the USA adaptive shapewear market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product Type | Adaptive Dresses, Adaptive Tops, Adaptive Pants, Others |

| Fastening Type | Pull-on/Slip-on, Zipper, Hooks, Others |

| Key Companies Profiled | Adaptivewear Co., ComfortFit Innovations, FlexShaper Apparel, EmbraceWear, BodyEase Solutions |

| Additional Attributes | The market analysis includes dollar sales by product type and fastening type categories. It also covers regional demand trends in the United States, driven by the growing adoption of adaptive clothing solutions for individuals with disabilities or limited mobility. The competitive landscape focuses on key companies innovating in adaptive shapewear designs, comfort, and functionality. Trends in the demand for easy-to-wear and inclusive fashion, as well as advancements in adaptive clothing technologies, are explored. |

The global demand for adaptive shapewear in USA is estimated to be valued at USD 1.3 billion in 2025.

The market size for the demand for adaptive shapewear in USA is projected to reach USD 2.9 billion by 2035.

The demand for adaptive shapewear in USA is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in demand for adaptive shapewear in USA are adaptive dresses, adaptive tops, adaptive pants and others.

In terms of fastening type, pull-on/ slip-on segment to command 38.4% share in the demand for adaptive shapewear in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA