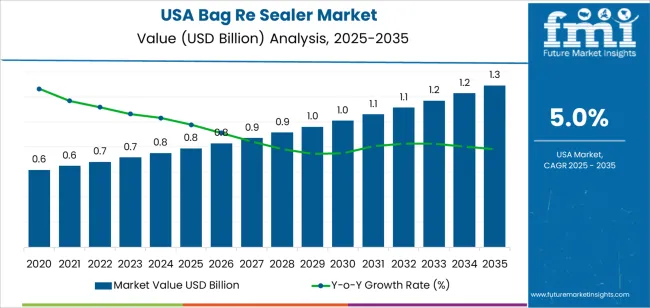

Bag resealer demand in the USA is valued at USD 0.8 billion in 2025 and is projected to reach USD 1.3 billion by 2035 at a CAGR of 5.0%. Early growth is driven by steady household adoption and small-business adoption across food storage, retail packaging, and home organization. Snack foods, frozen products, pet food, and specialty dry goods account for a large share of consumer-driven demand as resealing extends shelf life and reduces waste at the point of use. Manual and battery-powered handheld sealers dominate unit sales due to low cost and ease of use. E-commerce channels and mass merchants serve as primary distribution points, with private label products supporting consistent baseline volumes.

After 2030, demand growth becomes more application-diversified than consumer-only driven. Market value rises from about USD 1.0 billion in 2030 toward USD 1.3 billion by 2035 as small commercial users increase adoption across bakeries, delis, specialty food stores, and home-based food enterprises. Light-duty tabletop sealers are gaining wider adoption in cottage food operations and direct-to-consumer shipping setups. Product differentiation shifts toward stronger sealing elements, adjustable heat control, and compatibility with thicker multilayer films. Pricing trends remain tied to component input costs and evolving packaging materials rather than to sharp changes in consumer purchasing behavior. Growth in later years reflects steady integration of resealing into routine food handling and small-scale packaging practices across the USA.

Bag re-sealers represent a utility-driven household accessory category whose demand is shaped by food storage behavior, waste reduction habits, and small-kitchen convenience rather than by appliance replacement cycles. Demand in USA increases from USD 0.8 billion in 2025 to USD 0.9 billion by 2030, adding USD 0.1 billion in absolute value. This phase reflects steady penetration across grocery retail, home organization products, and value-oriented household goods where re-sealing supports portion control and freshness retention. Growth is reinforced by direct-to-consumer gadgets, kitchen accessory bundles, and impulse purchases at checkout counters. Value expansion during this period remains controlled, supported by consistent volume turnover rather than pricing escalation.

From 2030 to 2035, the market expands from USD 0.9 billion to USD 1.3 billion, adding USD 0.4 billion in the second half of the decade. This back-weighted acceleration reflects wider adoption linked to home meal preparation frequency, bulk food purchasing behavior, and expansion of frozen and snack food consumption. Rising demand for reusable food storage solutions and compact kitchen tools supports higher unit throughput across e-commerce and mass retail. As designs evolve toward heat sealing, vacuum compatibility, and multi-bag formats, average selling prices rise alongside volume. Bag re-sealers are shifting from novelty kitchen tools to routine household storage accessories, strengthening long-term demand momentum.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 0.8 billion |

| Forecast Value (2035) | USD 1.3 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

Demand for bag re-sealers in the USA increased over time as both consumers and businesses sought reliable solutions for resealing flexible packaging. Growth in pre-packaged foods, meal kits, snacks, and retail packaging created frequent need for resealable closure systems. Households adopting meal prepping and bulk-buying found resealers useful to preserve freshness and reduce waste. Small food producers, convenience stores, and specialty food retailers also adopted resealers to extend shelf life, maintain product quality, and improve packaging flexibility. Sealing devices replaced manual bag closure methods and supported a convenient, clean, and secure alternative for a wide variety of bag formats, from simple snack bags to larger food pouches.

Future demand in the USA will be shaped by evolving retail, logistics and consumer consumption habits. Growth in e-commerce, ready-to-eat meals, and on-the-go snack consumption will increase reliance on resealable packaging. Manufacturers may invest more in bag re-sealing machines to support small-batch production and flexible packaging formats. Sustainability and waste-reduction concerns will raise demand for resealing solutions that allow consumers to reuse packaging rather than discard half-used items. However, adoption may be tempered by competition from full vacuum-sealing systems, cost sensitivity among smaller producers, and varying regulatory requirements for sealed food packaging. The bag re-sealer segment is likely to grow through demand for convenience, flexibility, and waste reduction rather than volume alone.

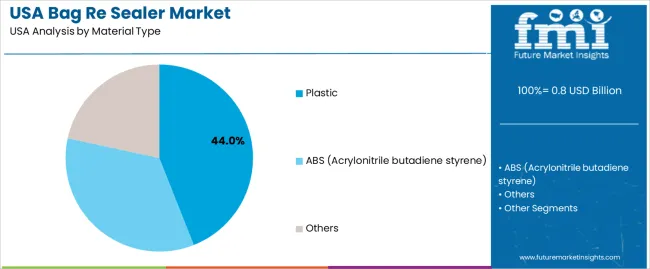

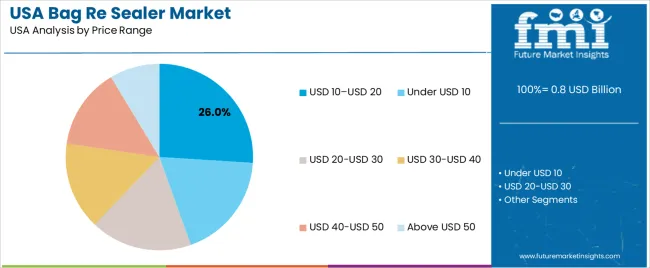

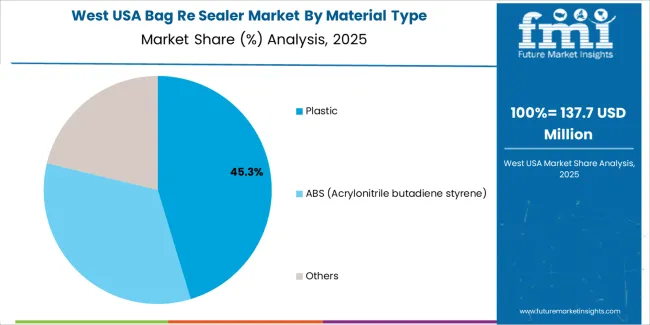

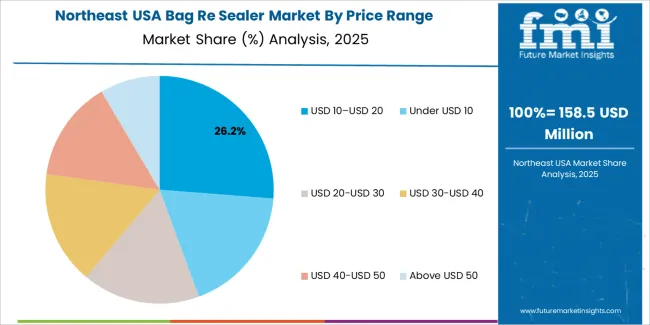

The demand for bag re sealers in the USA is structured by material type and price range. Plastic models account for 44% of total demand, followed by ABS based units and other mixed material constructions used in household and small commercial sealing tasks. By price range, products priced between USD 10 and USD 20 represent 26.0% of total sales, followed by under USD 10, USD 20 to USD 30, USD 30 to USD 40, USD 40 to USD 50, and above USD 50 categories. Demand behavior is shaped by household food storage habits, durability expectations, portability needs, and replacement frequency. These segments reflect how affordability, build quality, and everyday utility define purchasing behavior for bag re sealing devices across the USA.

Plastic accounts for 44% of total bag re sealer demand in the USA due to its light weight, cost efficiency, and ease of mass production. Plastic housings support handheld and compact designs that are convenient for kitchen drawers, travel use, and quick access during food storage. Consumers favor plastic units for sealing snack bags, frozen food pouches, and dry goods packaging due to simple operation and low purchase cost. Plastic materials also allow manufacturers to integrate ergonomic grips, battery compartments, and heating elements with minimal structural complexity.

Plastic re sealers also benefit from shorter production cycles and high output efficiency, which keeps retail pricing competitive. Replacement demand remains steady because plastic models are often treated as low cost convenience appliances rather than long life equipment. Online retail platforms and multi pack promotions further reinforce plastic dominance. These affordability, portability, and high volume manufacturing advantages sustain plastic as the leading material type in the USA bag re sealer demand structure.

The USD 10 to USD 20 price range accounts for 26.0% of total bag re sealer demand in the USA due to its balance between affordability and perceived product quality. Consumers in this range expect durable heating elements, stable sealing performance, and improved build quality compared with entry level models. Products in this band often include battery operation, indicator lights, and enhanced sealing width, which support wider household use across dry and frozen food storage applications.

Retailers favor this segment due to strong turnover rates and low return risk. Gift purchasing and add on sales during kitchen appliance promotions also support recurring volume in this band. Consumers view this price range as low risk for trial while offering greater reliability than under USD 10 products. These value perception, feature inclusion, and repeat buying patterns position the USD 10 to USD 20 bracket as the dominant price segment for bag re sealers in the USA.

Bag re-sealers in the USA are increasingly treated as everyday food management tools rather than novelty devices. Rising grocery costs push households to minimize food waste, especially for snacks, frozen foods, coffee, and bulk pantry items. Large-format club store packaging intensifies this need since opened packages often exceed short-term consumption. Home freezing of leftovers and meal-prep portions also increases resealing frequency. These cost-control and storage-efficiency pressures anchor re-sealers as practical extensions of modern food storage habits rather than optional accessories.

Bulk purchasing behavior strongly influences bag re-sealer demand in the USA. Families buying large snack packs, frozen foods, grains, and pet food require repeated package reopening and closure. Pet owners, in particular, rely on resealing to preserve aroma and prevent pest exposure. Freezer use for vegetables, meats, and prepared meals also drives adoption, as unsealed bags lead to freezer burn and texture loss. These storage realities create repeated-use demand across kitchens that prioritize long-term preservation over single-use convenience.

Bag re-sealer adoption in the USA is restrained by durability concerns and low perceived long-term value in the lower-price segment. Many heat-based sealers fail after short use due to battery failure, heating element wear, or weak plastic construction. Manual clip-style sealers often lose clamping strength over time. Consumers frequently treat resealers as replaceable tools rather than durable appliances, which limits premium upgrade behavior. This short replacement cycle sustains unit volume but restricts strong brand loyalty or high-margin category expansion.

Bag re-sealers in the USA are evolving toward multi-function tools that combine sealing, cutting, vacuum compatibility, and magnetic storage. Sustainability-focused consumers use resealers to reduce disposable zipper bag dependence by extending the life of original packaging. Minimalist kitchens favor compact, drawer-stored resealers over counter appliances. Rechargeable battery formats are replacing disposable cells for environmental and cost reasons. These shifts show demand moving away from novelty sealing devices toward integrated, reuse-driven kitchen utility tools aligned with waste-reduction behavior.

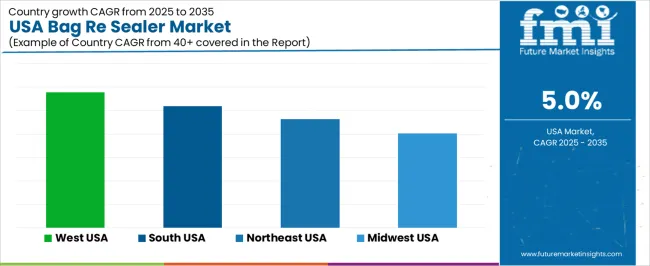

| Region | CAGR (%) |

|---|---|

| West | 5.8% |

| South | 5.2% |

| Northeast | 4.6% |

| Midwest | 4.0% |

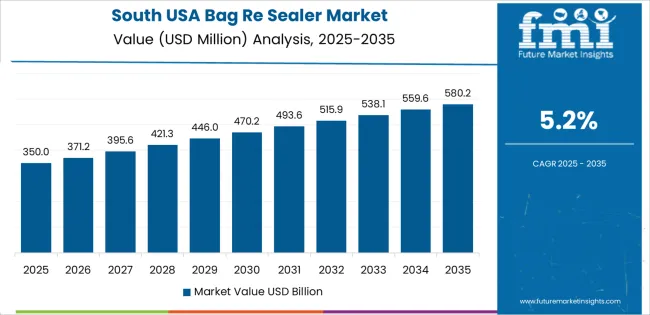

The demand for bag re sealers in the USA shows steady growth across all regions, with the West leading at a 5.8% CAGR. Growth in this region is supported by high usage in food packaging, snack processing, and household storage applications, along with strong penetration of small kitchen appliances and packaging accessories. The South follows at 5.2%, driven by expanding food manufacturing, retail packaging needs, and rising adoption of reusable packaging solutions. The Northeast records 4.6% growth, supported by urban household demand, commercial foodservice storage requirements, and replacement purchases. The Midwest shows comparatively moderate growth at 4.0%, reflecting stable demand from food processors, slower adoption of convenience sealing tools, and longer product replacement cycles.

Growth in the West reflects a CAGR of 5.8% through 2035 for bag re sealer demand, supported by strong adoption across food storage, home organization, and small scale commercial packaging. Health focused households rely on resealing tools for portion control and shelf life extension of snacks and frozen foods. Meal preparation trends also increase use across urban households. Small bakeries and artisan food producers apply resealers for product freshness during short distribution cycles. Demand remains lifestyle and convenience driven, with repeat purchasing influenced by durability, ease of use, and compact storage formats.

The South advances at a CAGR of 5.2% through 2035 for bag re sealer demand, driven by growing family households, rising snack consumption, and wider use across home based food businesses. Warm climate increases reliance on moisture protection for stored foods. Cottage food producers use resealers for packaging baked goods, dry mixes, and confectionery items. Mass merchandisers and discount retailers dominate regional product distribution. Demand remains volume driven and price sensitive, with consumers favoring simple manual and battery powered models for everyday storage and light commercial use.

The Northeast records a CAGR of 4.6% through 2035 for bag re sealer demand, shaped by compact urban kitchens, high food waste awareness, and dense convenience food consumption. Apartment living increases reliance on space efficient food storage tools. Office snack programs and shared kitchens also contribute recurring purchase demand. Specialty kitchenware stores and ecommerce platforms support regional availability. Demand remains replacement led rather than first time adoption led, with consistent sales driven by wear, portability needs, and changing food storage habits across urban households and institutional breakroom settings.

The Midwest expands at a CAGR of 4.0% through 2035 for bag re sealer demand, supported by stable household formation, home cooking traditions, and steady use across food storage and seasonal bulk purchasing. Large pantry storage practices encourage resealing tools for dry goods and frozen foods. Consumer preference favors simple mechanical designs with long service life. Farm households also apply resealers for seed and feed storage. Demand remains necessity driven and predictable, aligned with controlled spending habits and steady replacement cycles rather than rapid lifestyle driven product upgrades.

Demand for bag resealers in the USA is rising as households and small food businesses increase the use of resealable packaging to preserve food freshness, extend shelf life of perishable items, and reduce food waste. Consumers are more likely to purchase bulk or larger-quantity food products, then reseal portions for later use. The growth of meal prep culture, home cooking, and bulk buying supports this shift. Convenience, ease of use, and the desire to maintain hygiene and product quality motivate adoption. The popularity of reusable and resealable storage aligns with broader consumer interest in organized kitchens and efficient food storage practices.

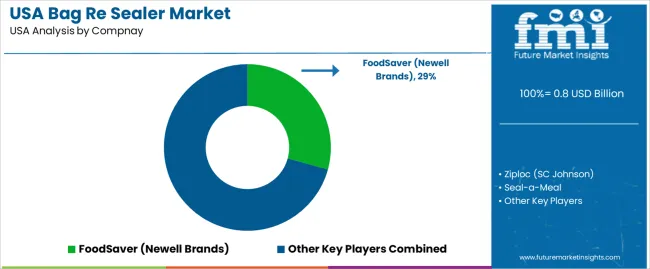

Key suppliers shaping the bag resealer market in the USA include FoodSaver (Newell Brands), Ziploc (SC Johnson), Seal a Meal, Hamilton Beach Brands, and Crenova. FoodSaver holds a strong position with vacuum seal systems and accessories targeting households that value long term food preservation. Ziploc leverages its brand recognition and offers accessible resealing products. Seal a Meal and Hamilton Beach serve mid range buyers looking for affordable, easy to use sealing devices. Crenova caters to budget conscious users seeking compact, simple resealer solutions. Together these firms provide a range of products from entry level to premium vacuum seal and resealing devices, shaping market supply and consumer adoption across diverse household segments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Material Type | Plastic, ABS (Acrylonitrile butadiene styrene), Others |

| Price Range | USD 10–USD 20, Under USD 10, USD 20–USD 30, USD 30–USD 40, USD 40–USD 50, Above USD 50 |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | FoodSaver (Newell Brands), Ziploc (SC Johnson), Seal-a-Meal, Hamilton Beach Brands, Crenova |

| Additional Attributes | Dollar by sales by material type, Dollar by sales by price range, Dollar by sales by region, Regional CAGR, Household and small business adoption, Consumer convenience and food storage trends, Frozen and snack food usage patterns, Compact and multi-function product design, E-commerce and mass merchant penetration, Sustainability use cases and reusable packaging integration, Value-driven repeat purchase behavior, Compatibility with multi-layer films and tabletop sealing systems |

The demand for bag re sealer in USA is estimated to be valued at USD 0.8 billion in 2025.

The market size for the bag re sealer in USA is projected to reach USD 1.3 billion by 2035.

The demand for bag re sealer in USA is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in bag re sealer in USA are plastic, abs (acrylonitrile butadiene styrene) and others.

In terms of price range, usd 10–usd 20 segment is expected to command 26.0% share in the bag re sealer in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Reusable Wine Bags Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Reusable Wine Bags Companies

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

The USA & Canada Bag-in-Box Market Size and Share Forecast Outlook 2025 to 2035

Demand for Bag-In-Box Packaging in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Heavy Duty Bag and Sack in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Magazine and Literature Bag in USA Size and Share Forecast Outlook 2025 to 2035

Bag Feed Seal Pouch Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag in Tube Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Tableware Products Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-box Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bag Making Machine Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Bag On Valve Product Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA