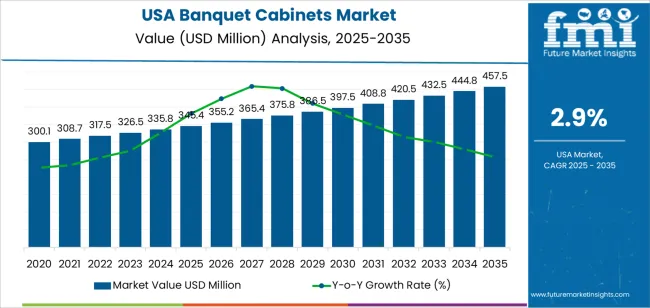

The demand for banquet cabinets in the USA is expected to grow from USD 345.4 million in 2025 to USD 457.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 2.9%. Banquet cabinets, essential for organizing and storing event supplies, dishes, and service equipment, are in steady demand within the hospitality industry. As the event, catering, and hospitality industries continue to grow, the need for durable, efficient storage solutions like banquet cabinets is expected to increase over the forecast period.

The market will experience consistent growth, with demand increasing from USD 345.4 million in 2025 to USD 355.2 million in 2026, USD 365.4 million in 2027, and USD 375.8 million in 2028. By 2029, the demand for banquet cabinets will reach USD 386.5 million, continuing to rise steadily through the 2030s. By 2035, the demand for banquet cabinets is expected to reach USD 457.5 million, driven by the continued growth in the hospitality and event sectors, alongside the increasing need for better storage and organizational solutions.

The growth contribution index for banquet cabinets highlights that the market’s growth is primarily driven by steady increases in the demand for event storage solutions, with a moderate year-on-year growth rate. The index suggests that the early years (2025–2029) will account for a significant portion of the overall market growth, with each year contributing to the steady increase in demand for banquet cabinets. As the market matures, the contributions to growth will remain steady, with demand continuing to rise gradually throughout the forecast period.

The largest contribution to overall market growth is expected in the middle years (2026–2029), where the rate of growth remains steady, driven by increasing investments in event infrastructure, particularly in mid-sized venues and catering services. In the latter part of the forecast period (2030–2035), while growth contributions may moderate slightly, the market will continue to grow at a steady pace due to the ongoing adoption of banquet cabinets as essential organizational tools in the hospitality and events sectors. The index shows a stable, incremental increase in demand, with contributions consistently driven by steady industry expansion.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 345.4 million |

| Industry Forecast Value (2035) | USD 457.5 million |

| Industry Forecast CAGR (2025 to 2035) | 2.9% |

Demand for banquet cabinets in the USA is increasing as the hospitality, catering and event industries expand. Hotels, convention centres, banquet halls and catering services regularly host large events, weddings, corporate functions and banquets. These venues require efficient, reliable storage and food holding systems capable of handling large volumes of meals and serving setups. Banquet cabinets - used to store, hold, and transport food trays and plates under controlled temperature and hygiene conditions - help such venues manage high volume service without compromising on food quality or presentation. As the frequency and scale of events and catering operations rise, the need for banquet cabinets grows.

At the same time, changes in service standards, food safety expectations, and operational efficiency support increasing adoption. Modern banquet cabinets often offer temperature control, mobility, modular storage and durability. These features allow venues to maintain meal temperature during transport, streamline workflows in kitchens and banquet halls, and meet hygiene and safety requirements. Demand is driven by growing emphasis on guest experience, consistent service quality, and flexibility in event catering and food service operations. As hospitality, corporate events, and social gathering sectors continue to expand, demand for banquet cabinets in the USA is likely to keep rising steadily over coming years.

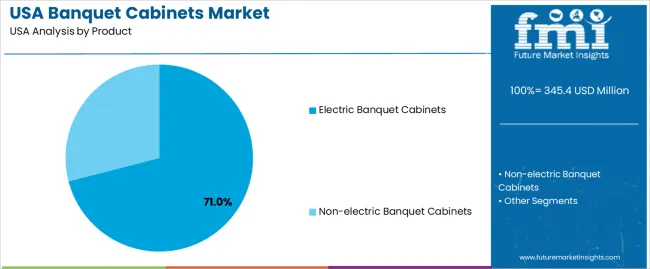

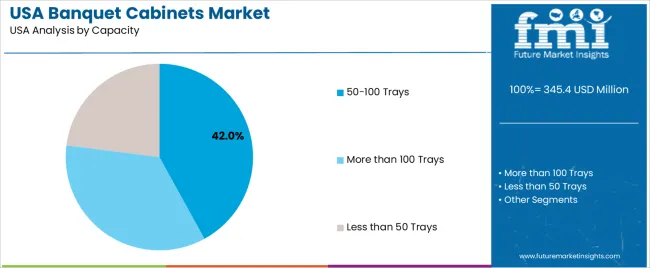

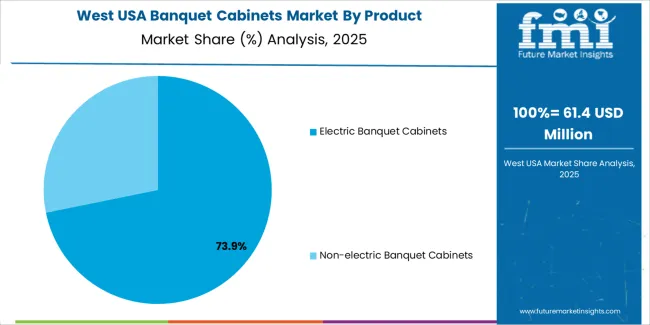

The demand for banquet cabinets in the USA is primarily driven by product and capacity. The leading product type is electric banquet cabinets, which account for 71% of the market share, while the most common capacity is 50-100 trays, capturing 42% of the demand. Banquet cabinets are essential for keeping large quantities of food warm and organized during events, catering services, and food service operations. The increasing demand for efficient and effective food storage solutions continues to drive the popularity of both electric and non-electric banquet cabinets in various sectors, including hospitality, healthcare, and institutional catering.

Electric banquet cabinets lead the demand for banquet cabinets in the USA, holding 71% of the market share. Electric banquet cabinets are equipped with heating elements that maintain food at optimal temperatures, ensuring that dishes are kept warm and fresh for long periods, even during extended events. These cabinets are especially popular in commercial foodservice operations, such as hotels, event venues, and large-scale catering services, where food needs to be transported and served efficiently while maintaining its quality.

The demand for electric banquet cabinets is driven by their ability to handle high-volume food service requirements and their convenience in maintaining consistent temperatures. With the increasing number of large-scale events and the demand for high-quality service, electric banquet cabinets provide a reliable solution for caterers and hospitality providers. As foodservice operations continue to prioritize efficiency, food quality, and service speed, electric banquet cabinets are expected to remain the dominant choice in the USA, providing valuable support for events ranging from conferences to weddings.

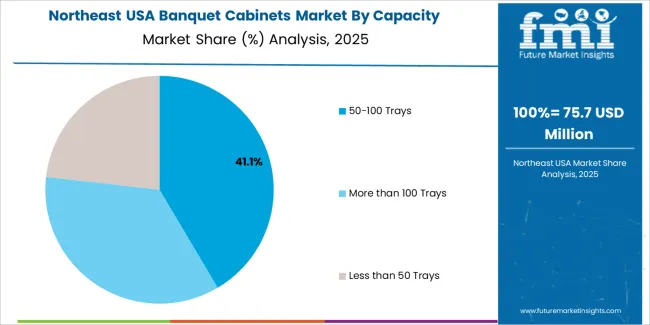

50-100 trays capacity leads the demand for banquet cabinets in the USA, capturing 42% of the market share. This capacity range is ideal for medium-sized events and foodservice operations, allowing for the storage and transport of sufficient quantities of food while maintaining temperature and organization. The 50-100 tray capacity is particularly useful for buffets, large meetings, and institutional catering services, where a substantial amount of food must be kept warm and ready for service.

The demand for banquet cabinets with a 50-100 tray capacity is driven by their balance of size and efficiency. These cabinets are large enough to accommodate the needs of most events while still being manageable in terms of space and ease of transport. As the demand for event catering services continues to grow, particularly in corporate, hospitality, and educational sectors, the 50-100 tray capacity range will remain a popular choice for banquet cabinets in the USA. The versatility and capacity of these cabinets make them a valuable tool for ensuring smooth and efficient foodservice operations.

Demand for banquet cabinets in the USA is increasing as the hospitality and event services sectors expand. Hotels, banquet halls, catering services, and venues hosting weddings or corporate events are installing more banquet cabinets to store, transport, and serve food and beverages efficiently. As catering and banquet events rebound post pandemic and the food service industry grows, facilities increasingly rely on banquet cabinets to manage large scale meal service. The trend toward buffets, large gatherings, and institutional catering supports a steady rise in requirements for banquet grade storage and holding solutions.

What are the Drivers of Demand for Banquet Cabinets in the USA?

Several factors drive rising demand for banquet cabinets in the USA. Growth in events such as weddings, corporate conferences, banquets and social gatherings increases the need for reliable food holding and serving solutions. Hotels and catering services expanding their banquet and event capacity invest in cabinets to ensure efficient food storage and service during large events. The growth of the broader food service equipment market - including restaurants, hotels, and institutional kitchens - pushes demand for high quality cabinets as part of standard kitchen and service infrastructure. Demand is also supported by the need for temperature controlled or insulated cabinets to maintain food safety and quality before serving. As venues seek to upgrade service standards and meet hygiene and operational efficiency requirements, banquet cabinets become a critical asset.

What are the Restraints on Demand for Banquet Cabinets in the USA?

Despite growing demand, several restraints may limit uptake of banquet cabinets. High upfront cost can be a barrier, especially for smaller venues or low volume catering businesses that cannot justify investment in specialized cabinetry. Maintenance and operational costs - including cleaning, energy for insulated or heated cabinets, and wear and tear - may deter purchase or long term use. Space constraints and storage limitations can make it difficult for smaller or older kitchens to accommodate large banquet cabinets. Additionally, variability in event frequency - some venues may have irregular banquet schedules - reduces the incentive to invest in permanent cabinet installations. In segments where demand for events or banquets is limited, simpler serving setups or outsourcing may be preferred over investing in dedicated cabinetry.

What are the Key Trends Influencing Demand for Banquet Cabinets in the USA?

Key trends shaping the demand for banquet cabinets include increasing demand for temperature controlled and insulated food holding solutions as food safety standards rise. Venues and catering services prefer cabinets that offer mobility, modularity, and flexibility to suit different event scales and layouts. There is also increased interest in multifunctional cabinets that can store, transport, and serve food while preserving temperature and quality. Growth in the food service and hospitality equipment market overall supports broader adoption of high quality cabinets as standard equipment in hotels, restaurants, and institutional kitchens. As catering and banquet services modernize, demand for durable, efficient, and professional grade banquet cabinets continues to climb.

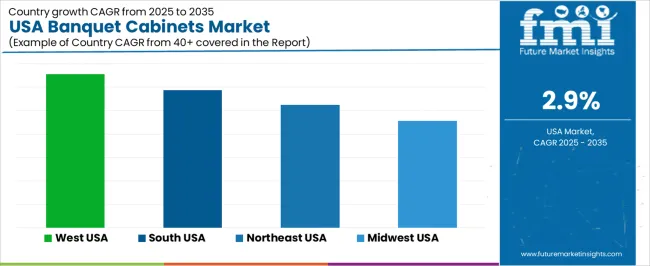

The demand for banquet cabinets in the USA is expected to show steady growth across all regions, with the West USA leading with a projected CAGR of 3.3%. The South USA follows at 2.9%, the Northeast USA at 2.6%, and the Midwest USA at 2.3%. These regional variations reflect differences in the hospitality and catering sectors, event sizes, and demand for efficient food service equipment. The growth in demand for banquet cabinets is primarily driven by the increasing need for organization, food storage, and transport in large-scale event venues, hotels, and banquet halls.

| Region | CAGR (%) |

|---|---|

| West USA | 3.3 |

| South USA | 2.9 |

| Northeast USA | 2.6 |

| Midwest USA | 2.3 |

In the West USA, the demand for banquet cabinets is expected to grow at a CAGR of 3.3%. The region has a robust hospitality and event industry, with a high concentration of large hotels, resorts, and convention centers that require efficient food storage and transportation solutions. Banquet cabinets play a critical role in keeping food at the right temperature and organized during events, which is essential for providing quality service in fast-paced, high-demand environments. The region's strong tourism sector, particularly in cities like Las Vegas, Los Angeles, and San Francisco, further drives demand for banquet cabinets. Additionally, the growing focus on food safety, storage, and presentation in large-scale catering events continues to support the increasing adoption of banquet cabinets in the West USA.

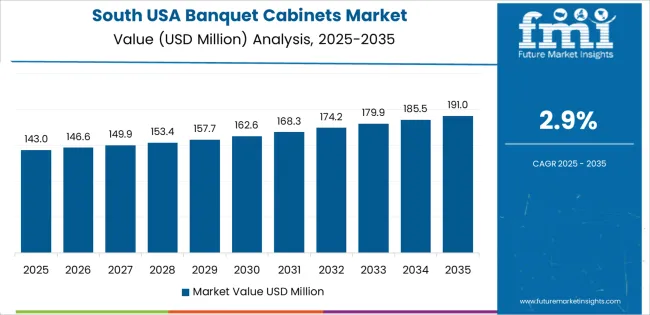

In the South USA, the demand for banquet cabinets is projected to grow at a CAGR of 2.9%. The region’s expanding hospitality industry, combined with a growing number of large-scale events, contributes to this steady growth. The South is home to numerous hotels, resorts, and event venues that host banquets, conferences, and social gatherings. Banquet cabinets are essential in these settings to ensure that food remains organized, fresh, and at the proper temperature during transport and service. The region’s focus on quality service, particularly in high-demand food service environments, encourages the use of banquet cabinets to streamline operations. The increasing trend toward outdoor events and weddings also contributes to the growing need for banquet cabinets, as food storage and transport become more complex in non-traditional venues.

In the Northeast USA, the demand for banquet cabinets is expected to grow at a CAGR of 2.6%. The region’s high population density and concentration of large event venues, hotels, and catering services are key drivers of this demand. Major cities such as New York, Boston, and Philadelphia host frequent banquets, conferences, and corporate events, all of which require efficient food storage and transport solutions. Banquet cabinets are essential for keeping food items organized and at the right temperature during service, especially in high-profile, fast-paced events. As the demand for high-quality food service continues to rise in the Northeast, banquet cabinets will play an increasingly important role in ensuring food safety and efficient service in these venues.

In the Midwest USA, the demand for banquet cabinets is projected to grow at a CAGR of 2.3%. While growth in this region is slower compared to other areas, it is still steady due to the importance of banquet cabinets in large-scale food service operations. The Midwest has a number of event venues, hotels, and catering companies that rely on banquet cabinets to organize and transport food efficiently. As the region continues to focus on improving operational efficiency in food service, the demand for banquet cabinets will continue to grow, albeit at a slower pace than in more event-heavy regions. Additionally, the trend toward larger events, such as conventions and weddings, is likely to drive incremental growth in the demand for banquet cabinets in the Midwest.

Demand for banquet cabinets in the USA is rising. The growth is driven by expansion in hospitality, hotels, event venues, catering services and banquet halls. These facilities increasingly require efficient solutions for food storage, holding and serving during events. Banquet cabinets help maintain food temperature, enable batch cooking workflows and support safe food handling at scale. The rising number of large scale events such as weddings, corporate gatherings and banquets contributes to demand for reliable, durable cabinets designed for heavy use. Recent trends indicate growing interest in temperature controlled, modular and customizable banquet storage systems.

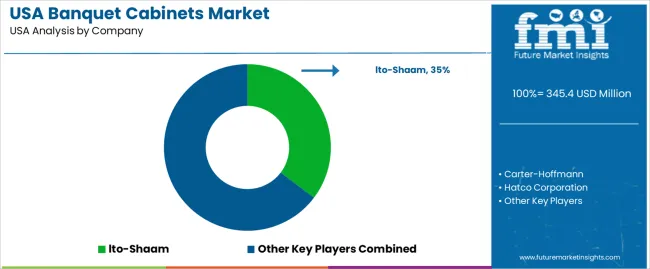

In that competitive environment several firms occupy leading positions. Among them Alto-Shaam, Inc. holds about 35.3% market share. Other established competitors include Carter-Hoffmann, Hatco Corporation, Henny Penny and Hobart Corporation. These companies supply banquet cabinets, heated holding systems and related storage and food service equipment for hospitality and institutional clients. They differentiate through product features such as heat retention performance, humidity control, modular shelving, capacity for large tray volumes, mobility, ease of sanitation, and compliance with food safety standards. Many of them focus on delivering solutions suited for large volume meal service in hotels, convention centers and catering operations. The market remains dynamic as firms continue innovation in cabinet designs, flexibility and operational support to meet evolving hospitality industry demands.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | USA |

| Product | Electric Banquet Cabinets, Non-electric Banquet Cabinets |

| Capacity | 50-100 Trays, More than 100 Trays, Less than 50 Trays |

| End-Use Industry | Hotels and Restaurants, Catering Services, Event Management Companies, Hospitals and Healthcare Facilities, Educational Institutions |

| Key Companies Profiled | Alto-Shaam, Carter-Hoffmann, Hatco Corporation, Henny Penny, Hobart Corporation |

| Additional Attributes | Dollar sales by product type, capacity, and end-use industry show strong demand for electric banquet cabinets, particularly in hotels, restaurants, and catering services. The 50-100 tray capacity is most common, though larger cabinets are used in high-volume food service environments. Leading companies like Alto-Shaam, Hatco, and Hobart are significant players, offering reliable and efficient food warming and holding solutions. The market is expected to grow as demand for catering and event management services continues, along with increased foodservice operations across healthcare and educational institutions. |

The demand for banquet cabinets in USA is estimated to be valued at USD 345.4 million in 2025.

The market size for the banquet cabinets in USA is projected to reach USD 457.5 million by 2035.

The demand for banquet cabinets in USA is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in banquet cabinets in USA are electric banquet cabinets and non-electric banquet cabinets.

In terms of capacity, 50-100 trays segment is expected to command 42.0% share in the banquet cabinets in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Banquet Cabinets Market – Storage & Heating Solutions 2025-2035

Banquet Carts and Heated Cabinets Market

Demand for Banquet Carts in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA