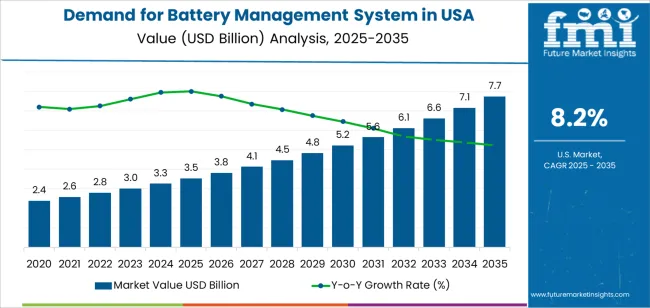

The demand for battery management systems (BMS) in the USA is valued at USD 3.5 billion in 2025 and is projected to reach USD 7.7 billion by 2035, reflecting a CAGR of 8.2%. Early growth is driven by the expanding adoption of electric vehicles (EVs), renewable energy systems, and portable electronic devices that rely on advanced battery technologies. Battery management systems play a crucial role in optimizing battery performance, extending lifespan, and ensuring safety in various applications, from EVs to industrial energy storage solutions. As the EV market continues to grow, particularly in response to government incentives and sustainability goals, demand for BMS will increase significantly.

As the market moves toward 2035, demand for battery management systems continues to rise, driven by growing adoption of large-scale energy storage solutions and advancements in battery technologies, such as solid-state batteries. The growth rate remains steady, though slightly moderating as the market matures and key applications like EVs reach broader market penetration. Manufacturers will continue to innovate by integrating artificial intelligence, predictive maintenance, and enhanced monitoring systems to optimize battery efficiency. This innovation, combined with the continued shift toward renewable energy and electric vehicles, will support sustained demand for BMS, ensuring continued growth through 2035.

Demand for battery management systems (BMS) in USA is expected to grow from USD 3.5 billion in 2025 to USD 7.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.2%. From USD 2.4 billion in 2020, demand steadily rises each year, reaching USD 3.5 billion by 2025. Between 2025 and 2030, demand will increase from USD 3.5 billion to USD 5.2 billion, followed by further growth from 2030 to 2035, adding another USD 2.5 billion. This growth is driven by the rising adoption of electric vehicles (EVs), the integration of renewable energy storage solutions, and advancements in battery technologies, which necessitate improved battery management systems to ensure safety, efficiency, and longer lifespan of batteries.

The significant expansion from 2025 onward is primarily attributed to the rapid development of the EV market, as battery management systems are essential for managing the performance, health, and safety of high-capacity EV batteries. Moreover, as industries like renewable energy and consumer electronics continue to integrate more efficient battery solutions, the demand for advanced BMS technology will rise. Additionally, improvements in BMS capabilities, such as enhanced monitoring, thermal management, and faster charging technologies, will further accelerate adoption. This upward trajectory signals a robust demand for BMS, positioning it as a crucial technology in both consumer and industrial sectors.

| Metric | Value |

|---|---|

| Sales Value (2025) | USD 3.5 billion |

| Forecast Value (2035) | USD 7.7 billion |

| Forecast CAGR (2025–2035) | 8.2% |

The demand for battery management systems (BMS) in the USA is growing as energy-storage applications and electric-mobility solutions scale rapidly. BMS units monitor cell voltage, temperature, state of charge, and health across battery packs, enabling safe and efficient operation in electric vehicles (EVs), grid-scale storage systems, and renewable-power installations. US manufacturers emphasize high-voltage compatibility, fault tolerance, and communication protocols that integrate with vehicle ECUs and energy-management systems. Growth is supported by federal incentives for EV adoption and renewable integration, making BMS a critical component for achieving performance, lifecycle, and regulatory targets.

New demand drivers include the expansion of residential and utility-scale battery installations, where BMS ensures optimal energy dispatch, thermal management, and pack longevity. With myriad battery chemistries in use, from lithium ion to emerging solid state formats, control-system versatility becomes a competitive differentiator. OEMs and storage system suppliers seek modular, scalable BMS architectures to align with fast changing pack designs. Although supply chain constraints for power semiconductor components pose challenges, increasing domestic manufacturing and standardization efforts strengthen BMS deployment. These factors together sustain robust growth in the USA’s demand for battery management systems.

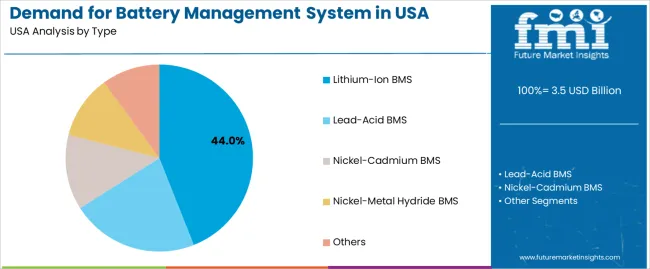

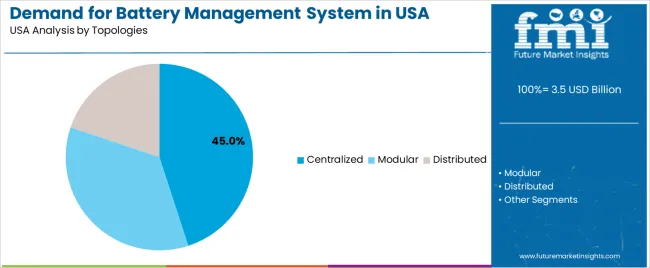

The demand for battery management systems in the USA is segmented by type and topologies. By type, the demand is divided into lithium-ion BMS, lead-acid BMS, nickel-cadmium BMS, nickel-metal hydride BMS, and others. Based on topologies, it is categorized into centralized, modular, and distributed. These segments reflect varying application needs and technical requirements based on the type of battery and system design.

The lithium-ion BMS segment accounts for approximately 44% of the total demand for battery management systems in the USA in 2025, making it the leading type category. This position is driven by the widespread use of lithium-ion batteries in applications ranging from consumer electronics, electric vehicles, and renewable energy storage to industrial equipment. Lithium-ion batteries are favored for their higher energy density, longer lifespan, and reduced environmental impact compared to other battery types, which contributes to the increasing demand for efficient battery management systems.

Adoption is particularly strong in the electric vehicle (EV) sector, where lithium-ion batteries are the preferred choice for their lightweight and high-performance capabilities. The demand for lithium-ion BMS is further boosted by the growing focus on energy storage solutions, as more industries turn to renewable energy sources that rely on efficient storage systems. The segment maintains its leadership due to the versatility and performance advantages of lithium-ion technology in high-demand applications.

The centralized topology segment represents about 45% of the total demand for battery management systems in the USA in 2025, making it the dominant topology category. This position is supported by the simplicity and cost-effectiveness of centralized BMS designs, where a single controller manages the entire battery pack. Centralized topologies are widely used in applications like electric vehicles and stationary energy storage systems, where battery management systems need to monitor and control large battery packs with minimal complexity.

Centralized systems are particularly beneficial for applications that require real-time monitoring of voltage, temperature, and state of charge across a battery pack. Adoption is strong in industries where scalability and reliability are key, such as in EVs and large-scale battery energy storage projects. Centralized topology maintains its lead due to its efficiency in managing simpler battery systems with fewer components, reducing costs and complexity while still offering high performance.

The demand for battery management systems in USA is rising as electric mobility, renewable energy storage and portable electronics advance. These systems monitor, protect and optimise rechargeable battery packs across electric vehicles (EVs), grid connected storage and consumer devices. Growth is driven by stronger EV penetration, expansion of utility scale energy storage and improved regulation for battery safety and lifespan. Adoption is constrained by cost pressures, technology complexity and supply chain logistics for high performance cells and sensors. BMS providers are developing next generation solutions that support higher voltage battery packs, cell level monitoring, and cloud based analytics for predictive maintenance.

How are EV adoption and energy storage growth driving BMS demand?

Demand is driven by rapid increases in EV sales and growth in grid scale and behind the meter battery storage projects. As battery pack sizes grow, so does the need for advanced BMS to ensure safety, manage thermal performance and extend service life. Developments in lithium ion and next generation chemistries place higher demands on monitoring and balancing systems. At the same time, USA energy storage capacity expansions require scalable BMS solutions to manage large arrays of battery modules, contributing to the rise in BMS demand.

What factors are restraining faster expansion of BMS deployments in the USA?

Adoption is limited by high development and integration costs, especially for systems designed to handle large capacity battery packs or unconventional chemistries. Fragmented regulation across states, inconsistencies in testing standards and variability in battery vendor specifications complicate design and deployment. Supply chain challenges such as sourcing precision sensors, microcontrollers and high voltage components add cost and risk. Some users also delay upgrades due to conservative investments in legacy systems or uncertainty in long term battery technology roadmaps.

What trends are shaping future developments in BMS technology in the USA?

Emerging trends include integration of cell level monitoring with embedded analytics to predict failure modes, adoption of wireless balancing circuits to reduce wiring complexity, and cloud connected BMS platforms that support remote diagnostics and firmware updates. Growth in second life battery deployments (for example, EV packs repurposed for energy storage) is driving demand for adaptable BMS architectures. As battery chemistries evolve (solid state, lithium sulphur) and vehicle electrification extends to heavy duty equipment, BMS solutions are shifting toward higher voltage platforms, modular design and system scalability.

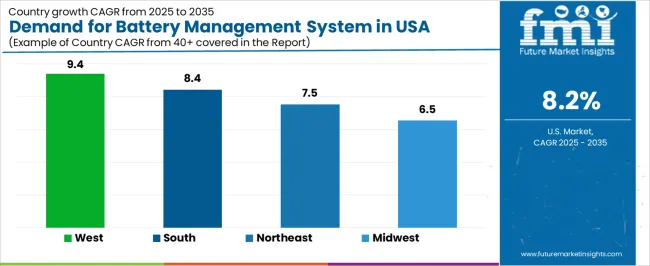

| Region | CAGR (%) |

|---|---|

| West | 9.4% |

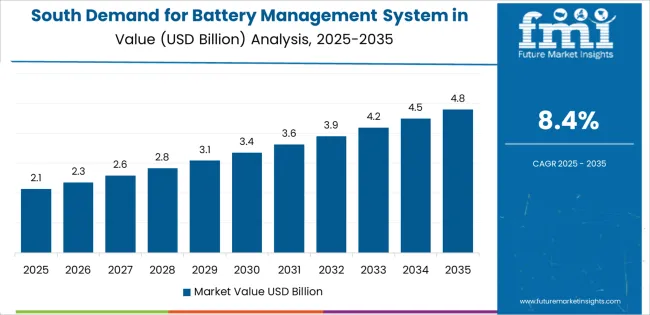

| South | 8.4% |

| Northeast | 7.5% |

| Midwest | 6.5% |

The demand for Battery Management Systems (BMS) in USA is growing steadily, with the West leading at a 9.4% CAGR, driven by a booming electric vehicle (EV) market, renewable energy storage solutions, and advancements in smart grid technologies. The South follows at 8.4%, supported by increasing EV adoption, a growing focus on energy storage, and manufacturing capabilities in states like Texas and Georgia. The Northeast records 7.5%, with strong demand from the region’s clean energy initiatives, EV infrastructure development, and government incentives. The Midwest grows at 6.5%, driven by growing electric vehicle production, rising demand for energy-efficient solutions, and an expanding industrial base focused on renewable energy and energy storage.

The West region of the USA is projected to grow at a CAGR of 9.4% through 2035 in demand for battery management systems (BMS). The region’s strong focus on renewable energy, electric vehicles (EVs), and high-tech industries drives the demand for advanced BMS. States like California, known for their push towards clean energy solutions, contribute significantly to the adoption of BMS in solar energy storage systems and electric vehicles. Growing EV production and an expanding renewable energy sector in the West continue to support the rising demand for efficient and reliable battery management solutions.

The South region of the USA is projected to grow at a CAGR of 8.4% through 2035 in demand for battery management systems. The region’s growing electric vehicle (EV) manufacturing base, along with the rise in renewable energy installations, boosts the demand for BMS. States like Texas and Tennessee, which are home to major EV manufacturers and battery production facilities, contribute to this growth. The South’s push for sustainable energy and increasing adoption of energy storage systems also drive the need for reliable BMS to manage and optimise battery life and performance.

The Northeast region of the USA is projected to grow at a CAGR of 7.5% through 2035 in demand for battery management systems. The region’s focus on innovation and clean energy technologies supports the demand for BMS, especially in the growing electric vehicle and energy storage sectors. States like New York and Massachusetts are actively working towards increasing EV adoption and enhancing battery storage solutions. The Northeast’s energy transition strategies, along with the push for smart grid integration, further stimulate the need for efficient and durable battery management systems.

The Midwest region of the USA is projected to grow at a CAGR of 6.5% through 2035 in demand for battery management systems. As the region’s automotive sector embraces electric vehicles (EVs), the demand for BMS grows to ensure efficient battery performance and longevity. Manufacturers in the Midwest increasingly adopt advanced BMS to optimise the operation of EVs and energy storage systems. The region’s robust manufacturing capabilities, including battery production, further support the market’s growth. As energy storage technologies expand, the need for advanced BMS to manage large-scale storage solutions continues to rise.

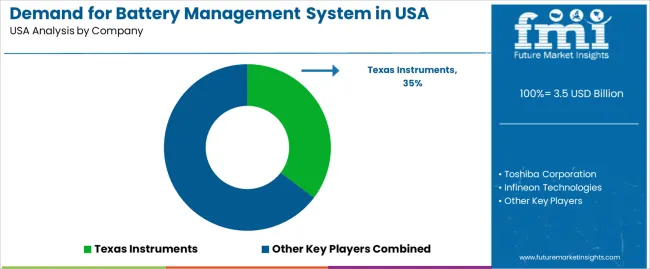

The demand for battery management systems (BMS) in USA is growing due to the increasing adoption of electric vehicles (EVs), renewable energy storage, and the widespread use of portable electronic devices. Texas Instruments leads the market with its advanced BMS solutions that ensure efficient, reliable, and safe battery operation across a variety of applications, from electric vehicles to consumer electronics. Toshiba Corporation strengthens the market with its innovative BMS technologies focused on optimizing performance, extending battery life, and enhancing safety in both automotive and industrial sectors. Infineon Technologies, STMicroelectronics, and NXP Semiconductors further contribute by providing integrated BMS solutions that support advanced energy storage systems, power management, and high-efficiency power conversion, catering to industries such as automotive, grid storage, and consumer electronics.

Key factors driving the growth of the BMS market in the USA include the accelerating shift toward electric vehicles, the growth of renewable energy installations requiring efficient energy storage, and the demand for longer-lasting, higher-capacity batteries in portable devices. As the push for sustainable energy solutions continues, the need for advanced BMS technologies to monitor, manage, and protect battery performance becomes increasingly critical. Competition in this market is shaped by innovations in battery life optimization, safety features, and scalability. Companies offering integrated, cost-effective, and high-performance solutions for a wide range of applications are positioned to capture significant market share as the demand for efficient and reliable energy storage systems continues to rise in the USA.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Lithium-Ion BMS, Lead-Acid BMS, Nickel-Cadmium BMS, Nickel-Metal Hydride BMS, Others |

| Regions Covered | Northeast, West, Midwest, South |

| Countries Covered | USA |

| Key Companies Profiled | Texas Instruments, Toshiba Corporation, Infineon Technologies, STMicroelectronics, NXP Semiconductors |

| Additional Attributes | Dollar sales by product type, demand by region, application growth trends, EV adoption, energy storage needs, battery safety, innovations in battery technologies, integration with renewable energy solutions. |

The global demand for battery management system in USA is estimated to be valued at USD 3.5 billion in 2025.

The market size for the demand for battery management system in USA is projected to reach USD 7.7 billion by 2035.

The demand for battery management system in USA is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in demand for battery management system in USA are lithium-ion bms, lead-acid bms, nickel-cadmium bms, nickel-metal hydride bms and others.

In terms of topologies, centralized segment to command 45.0% share in the demand for battery management system in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA