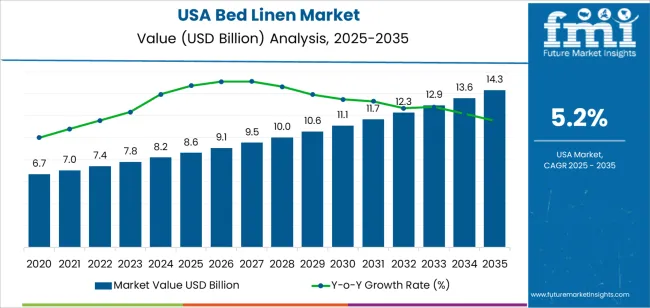

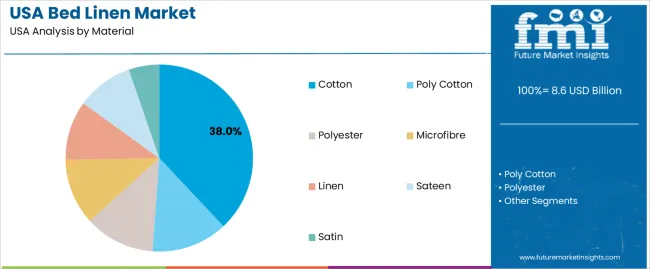

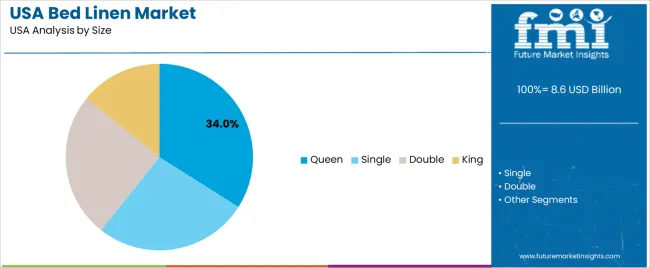

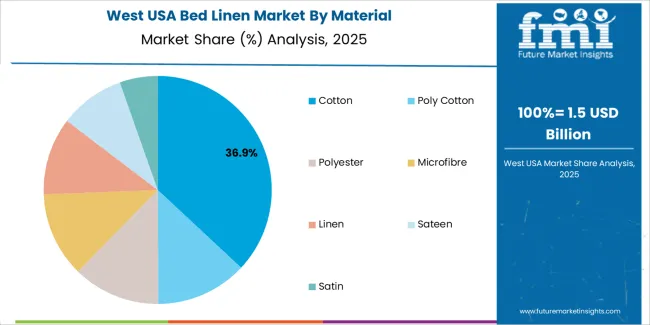

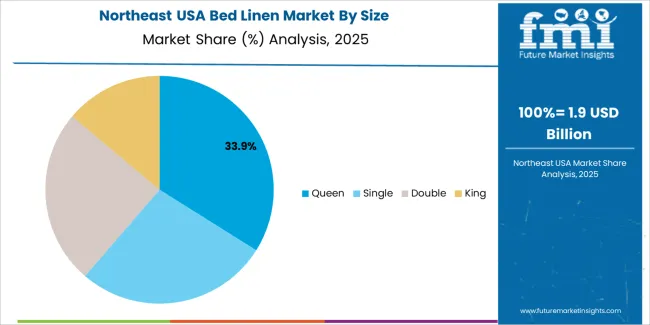

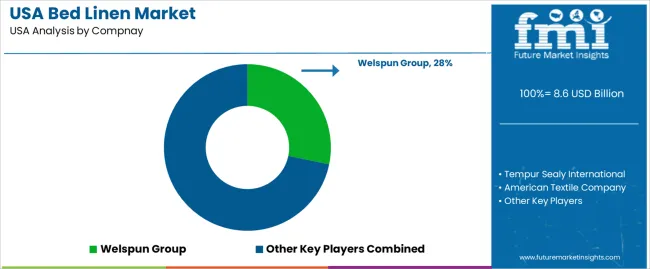

Bed linen demand in the USA is valued at USD 8.6 billion in 2025 and is projected to reach USD 14.3 billion by 2035 at a CAGR of 5.2%. Market expansion during the early forecast years is shaped by stable household formation, steady housing turnover, and replacement-driven purchasing rather than first-time ownership. Cotton holds the largest material share at 38% due to its durability and wash performance, while poly-cotton and polyester support value-oriented retail segments. Queen-size bedding accounts for 34% of sales, reflecting the dominance of mid-sized mattresses in primary bedrooms and rental housing. Floral patterns lead with 29% share, driven by mass retail demand, while geometric and striped designs maintain steady traction across mid-price collections.

From 2030 onward, value growth becomes more brand and channel structured than volume led. Demand rises from about USD 11.1 billion in 2030 toward USD 14.3 billion by 2035 as premiumization strengthens in online-native bedding brands and direct-to-consumer formats. King-size sets gain incremental share as larger bed formats expand in suburban housing. Sateen, linen, and satin materials grow faster in the premium segment as consumers prioritize texture, thread structure, and finish. Key suppliers active in the USA include Welspun Group, Tempur Sealy International, American Textile Company, Brooklinen, and Boll & Branch. Competitive positioning centers on fabric sourcing control, consistency across seasonal collections, private label programs for national retailers, and fast inventory rotation aligned with home furnishing refresh cycles.

Bed linen demand in USA follows household formation, housing turnover, and hospitality refurbishment cycles more closely than fashion-driven textile segments. Demand increases from USD 8.6 billion in 2025 to USD 9.1 billion by 2026 and USD 9.5 billion by 2027, reaching USD 10.6 billion by 2030 and adding USD 2.0 billion from the 2025 base. This phase reflects stable replacement purchasing driven by residential consumption, short-term rental turnover, and hotel renovation schedules rather than sharp lifestyle shifts. Product mix evolution toward higher thread counts, durable easy-care fabrics, and temperature-regulating weaves supports value growth while unit volumes remain structurally steady.

From 2030 to 2035, the market expands from USD 10.6 billion to USD 14.3 billion, adding USD 3.7 billion within five years. This back-weighted acceleration reflects diversification of buying channels through direct-to-consumer brands, subscription bedding models, and hospitality-grade linens entering residential retail. Value per set rises with demand for performance fabrics, allergen-resistant finishes, and coordinated bedroom collections. Growth is reinforced by higher bedding refresh frequency tied to remote work lifestyles and short-term accommodation inventory expansion, shifting the category from basic replacement purchasing toward lifestyle-driven spending progression.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 8.6 billion |

| Forecast Value (2035) | USD 14.3 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The demand for bed linen in the USA grew steadily as home ownership, remodeling activity, and consumer interest in interior comfort and aesthetics increased. As households invested in bedding, bed frames, and bedroom furniture, bed linen sheets, pillowcases, duvet covers became a standard home essential. Retail furniture stores, bedding specialty stores, and online retailers all expanded their selections, offering a range from budget basics to premium fabric sets. Lifestyle influences such as interior design trends, seasonal refreshes, and gifting occasions (e.g. weddings) contributed to regular demand cycles. Sales through discount retailers and mass merchandisers helped sustain a stable baseline demand across income levels.

Looking ahead, demand for bed linen in the USA will be shaped more by changing consumer preferences than by growth in household formation. Sustainability concerns, interest in natural or organic fabrics, and demand for linen blends may gain more traction among buyers seeking quality and durability. E-commerce will continue to influence demand through easy access to variety, size options, and reviews. At the same time, replacement cycles may lengthen if consumers shift toward investing in fewer but higher-quality bed linens. Competition from alternative bedding formats, such as blankets or multi-functional bedding, could limit growth in standard sheet sets.

The demand for bed linen in the USA is structured by material type and size preference. Cotton accounts for 38% of total demand, followed by poly cotton, polyester, microfibre, linen, sateen, and satin used across different price and comfort segments. By size, queen size represents 34.0% of total consumption, followed by single, double, and king sizes. Demand behavior is shaped by comfort expectations, fabric durability, washing performance, climate suitability, and mattress size standardization. These segments reflect how household preferences, hospitality requirements, and seasonal replacement cycles guide bed linen purchasing patterns across residential and institutional markets in the USA.

Cotton accounts for 38% of total bed linen demand in the USA due to its breathable structure, moisture absorption capability, and comfort across varied climate conditions. Cotton sheets regulate body temperature effectively, which supports year round USAge across households in both warmer and colder regions. Consumers favor cotton for its soft texture and reduced surface irritation, especially in direct skin contact applications such as fitted sheets and pillowcases. Hotels and healthcare facilities also rely on cotton due to its durability under frequent industrial washing and heat exposure.

Cotton also offers wide fabric count variation, which allows brands to serve economy, mid-range, and premium bedding categories using the same base fiber. Domestic and imported cotton supply remains stable across the USA textile supply chain. Stain resistance treatments and wrinkle control finishes have further improved cotton performance in hospitality settings. These comfort, durability, and supply reliability factors together sustain cotton as the dominant material segment in the USA bed linen demand structure.

Queen size accounts for 34.0% of total bed linen demand in the USA due to its position as the most widely adopted mattress size in residential housing. Queen beds offer a balance between space efficiency and sleeping comfort, which suits both individual sleepers and couples across apartments, suburban homes, and rental properties. Furniture retailers and mattress manufacturers continue to prioritize queen size offerings, which directly drives associated linen demand across replacement and first purchase cycles.

Hospitality demand also supports queen size dominance across mid-scale hotels, serviced apartments, and guest accommodations. Inventory standardization around queen size simplifies linen management, laundry operations, and procurement planning for multi-unit operators. E-commerce platforms and retail chains also stock the widest assortment in queen dimensions due to higher turnover rates. These bedding adoption trends, hospitality USAge patterns, and retail stocking practices position queen size as the leading bed linen size category in the USA.

Bed linen demand in the USA is shaped less by décor trends and more by routine wear, hygiene expectations, and lifestyle turnover. Frequent washing cycles, use of high-temperature dryers, and daily contact lead to faster fabric breakdown than in most other home textiles. Large household size variation, pet ownership, and allergy management also shorten replacement cycles. College housing, military residences, and short-term rentals generate recurring bulk demand tied to occupancy turnover. These daily-use realities anchor bed linen as a repeat-purchase household necessity rather than a long-life furnishing item.

Hotels, vacation rentals, hospitals, and student housing account for a substantial share of commercial bed linen consumption in the USA. High guest turnover requires frequent laundering and faster replacement due to staining, shrinkage, and fiber fatigue. Short-stay rental platforms have expanded linen demand into private homes that now operate like micro-hospitality units. Property managers standardize purchases across multiple units, favoring consistent sizing and fabric performance. Healthcare facilities drive demand for institutional-grade sheets with strict durability and sanitation requirements. These non-residential use cases quietly generate constant background volume for the bed linen industry.

Bed linen purchasing in the USA is increasingly shaped by value comparison across big-box retail, direct-to-consumer brands, and online marketplaces. Consumers balance price against thread count, fabric claims, and durability promises. Rising utility costs make low-durability fabrics less attractive due to higher lifetime cost. Online reviews strongly influence perceived quality, shifting demand toward brands associated with wash resilience and consistent sizing. Private-label programs at major retailers also redirect demand away from legacy brands. These cost and behavior shifts reshape how households approach bed linen replacement decisions.

Bed linen demand in the USA reflects strong regional climate influence. Warmer southern regions favor lightweight cotton percale and moisture-managing blends, while northern states sustain demand for flannel and thermal weaves. Remote work and extended at-home time increase emphasis on comfort-driven textures rather than formal bedroom presentation. Neutral color palettes and layered bedding aesthetics dominate urban markets. Performance features such as wrinkle resistance, deep-pocket fit, and temperature regulation influence repeat buying more than decorative patterns. These preferences show bed linen shifting toward functional comfort customization rather than purely visual bedroom styling.

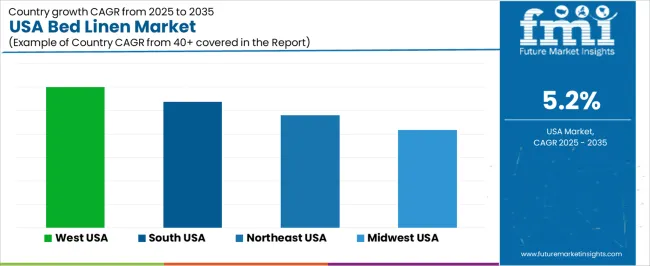

| Region | CAGR (%) |

|---|---|

| West | 6.0% |

| South | 5.4% |

| Northeast | 4.8% |

| Midwest | 4.2% |

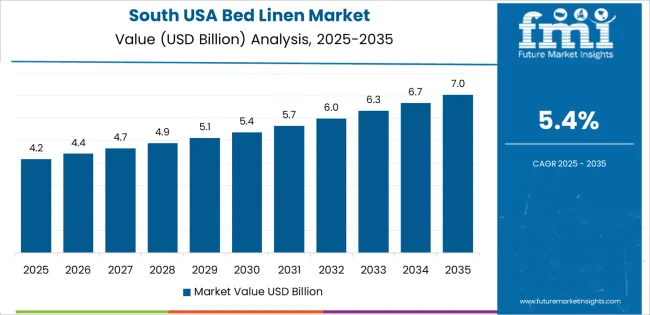

The demand for bed linen in the USA shows steady regional variation, with the West leading at a 6.0% CAGR. Growth in this region is supported by strong housing activity, high demand from hospitality and short term rental segments, and premium home furnishing consumption. The South follows at 5.4%, driven by population growth, rising residential construction, and steady demand from budget and mid-range hospitality properties. The Northeast records 4.8% growth, supported by replacement demand from urban households and institutional buyers such as hotels and healthcare facilities. The Midwest shows comparatively moderate growth at 4.2%, reflecting stable household demand, slower housing turnover, and more price sensitive consumer purchasing behavior.

Expansion in the West reflects a CAGR of 6.0% through 2035 for bed linen demand, supported by strong residential renovation activity, premium home furnishing purchases, and steady hospitality sector upgrades. Urban apartment living increases demand for frequent linen replacement tied to short term rentals and multi family housing. Higher disposable income supports demand for branded and designer collections. Online direct to consumer platforms strengthen regional accessibility. Demand remains design and lifestyle driven, with steady replacement cycles across both residential buyers and commercial users such as hotels and serviced apartments.

The South advances at a CAGR of 5.4% through 2035 for bed linen demand, driven by population growth, suburban housing expansion, and rising hospitality development. New home construction supports first fit linen purchases across family households. Warm climate conditions favor lightweight cotton and blended fabric products with higher seasonal turnover. Large format retail chains dominate sales volume through value oriented assortments. Demand remains volume driven rather than trend driven, with consistent purchasing linked to steady household formation and expanding regional lodging infrastructure.

The Northeast records a CAGR of 4.8% through 2035 for bed linen demand, shaped by compact urban households, strong seasonal bedding demand, and stable hotel refurbishment activity. Cold winters support demand for thermal and layered bed linen categories. High proportion of rented housing increases replacement frequency across shared living spaces. Department stores and specialty home retailers remain important distribution channels. Demand remains replacement led rather than expansion driven, with consistent purchasing tied to household turnover and periodic hospitality renovations across dense metropolitan markets.

The Midwest expands at a CAGR of 4.2% through 2035 for bed linen demand, supported by stable household formation, family oriented communities, and steady brick and mortar retail presence. Practical purchasing behavior emphasizes durability, easy care fabrics, and value pricing. Seasonal changes drive moderate replacement cycles aligned with climate transitions. Independent retailers and regional chains dominate distribution. Demand remains necessity driven rather than fashion driven, with predictable purchasing patterns aligned with household budget planning and slower housing mobility across semi urban and rural communities.

Demand for bed linen in the USA is growing as more households and rental properties seek comfort, quality sleep, and home style upgrades. Rising interest in sleep health and wellness encourages consumers to invest in higher quality sheets, pillowcases, and duvet covers that offer softness, durability, and improved hygiene. Growth in new housing, apartment turnover, and the hospitality sector (hotels, short term rentals) adds to demand for bedding replacements and upgrades. Consumers increasingly see bedroom décor and bedding as part of lifestyle and comfort, which supports demand for varied materials (cotton, blends), thread counts, and design styles. E commerce expansion and direct to consumer bedding brands also make quality linens more accessible nationwide.

Key players influencing the USA bed linen market include Welspun Group, Tempur Sealy International, American Textile Company, Brooklinen, and Boll & Branch. Welspun supplies large volumes of home textile products, often covering mid to value oriented segments. Tempur Sealy, known for mattresses and sleep related products, extends its footprint with complementary bedding lines. American Textile Company serves both retail and institutional segments including hotels and rental properties. Brooklinen and Boll & Branch focus on the direct to consumer niche, offering premium bedding with emphasis on material quality, comfort, and modern aesthetics. Together, these firms meet a range of customer needs from budget friendly basics to premium, design conscious bedding - shaping how bed linen demand evolves across the USA.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Material | Cotton, Poly Cotton, Polyester, Microfibre, Linen, Sateen, Satin |

| Size | Queen, Single, Double, King |

| Pattern | Floral, Abstract, Geometric, Striped, Checkered, Modern, Paisley |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Welspun Group, Tempur Sealy International, American Textile Company, Brooklinen, Boll & Branch |

| Additional Attributes | Dollar by sales by material, Dollar by sales by size, Dollar by sales by pattern, Dollar by sales by region, Regional CAGR, Premiumization trends, Direct-to-consumer growth, Replacement cycle influence, Hospitality sector contribution, Lifestyle and design-driven purchasing |

The demand for bed linen in USA is estimated to be valued at USD 8.6 billion in 2025.

The market size for the bed linen in USA is projected to reach USD 14.3 billion by 2035.

The demand for bed linen in USA is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in bed linen in USA are cotton, poly cotton, polyester, microfibre, linen, sateen and satin.

In terms of size, queen segment is expected to command 34.0% share in the bed linen in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bed Linen Market Trends - Growth & Industry Forecast to 2035

Demand for Electric Stakebed Truck in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Bed Head Panel Market Size and Share Forecast Outlook 2025 to 2035

Bedless Hospitals Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA