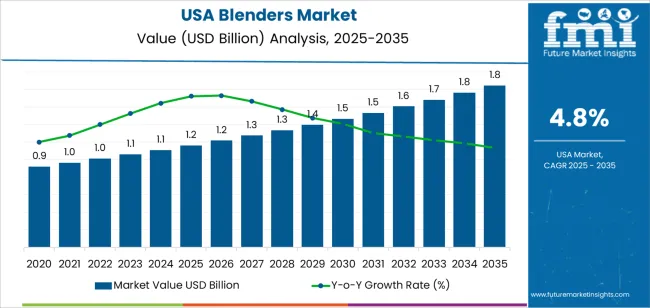

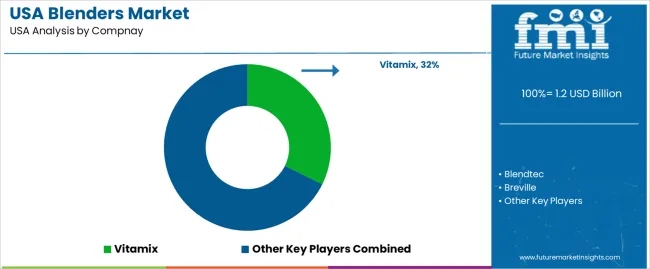

Demand for blenders in the USA is assessed at USD 1.2 billion in 2025 and is forecast to reach USD 1.8 billion by 2035 at a CAGR of 4.8%. Early growth reflects steady household-appliance replacement cycles rather than the rapid expansion of first-time buyers. Countertop blenders dominate sales due to everyday use in smoothies, soups, and food prep, while personal blenders support rising single-serve consumption habits. Demand is closely tied to grocery retail trends, home cooking frequency, and interest in nutritionally focused diets. Mid-priced models account for most unit volumes, with premium high-torque blenders contributing a disproportionate share of revenue through higher price points. E-commerce channels play a central role in product comparison and upgrade-driven purchasing.

From 2030 onward, value growth becomes more feature-led than volume-led. Demand rises from about USD 1.5 billion in 2030 toward USD 1.8 billion by 2035 as consumers prioritize quieter motors, preset programs, and durability over entry-level pricing. Commercial foodservice replacement also adds steady value through cafés, juice bars, and institutional kitchens, where duty cycles remain high. Multifunction blenders that combine chopping, heating, and emulsifying functions gain traction in compact urban kitchens. Competitive intensity centers on motor longevity, blade metallurgy, and thermal protection systems rather than aesthetic styling. Distribution remains anchored in mass merchants, specialty kitchen retailers, and direct-to-consumer brand channels that support higher-margin upgrade purchases.

Blender demand in USA is shaped less by appliance fashion cycles and more by long-term shifts in food preparation habits, health trends, and small kitchen electrification. Demand increases from USD 1.2 billion in 2025 to USD 1.5 billion by 2030, adding USD 0.3 billion in absolute value. This phase reflects steady household penetration of high-speed blenders, smoothie preparation, protein shake consumption, and home cooking frequency across urban and suburban households. Growth is supported by replacement of legacy low-powered units with higher torque, multi-function models that combine blending, grinding, and food processing. Commercial uptake across cafés, fitness centers, and quick-service beverage outlets also reinforces stable professional demand.

From 2030 to 2035, the market expands from USD 1.5 billion to USD 1.8 billion, adding another USD 0.3 billion in the second half of the decade. This back weighted pattern reflects gradual saturation in basic households but rising value per unit through premium product migration. Smart speed control, noise reduction housings, heated blending, and programmable nutrition presets raise average selling prices. Expansion of plant-based diets, functional beverage consumption, and compact urban kitchens sustains replacement demand. Growth shifts from unit volume expansion toward feature-driven upgrades, keeping blender demand on a structurally stable but value-enhancing trajectory through 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.2 billion |

| Forecast Value (2035) | USD 1.8 billion |

| Forecast CAGR (2025–2035) | 4.8% |

Demand for blenders in the USA was shaped initially by growing interest in home cooking, convenience, and beverage preparation. As households began to embrace cooking cultures that included smoothies, sauces, purees, and specialty drinks, the blender became a kitchen staple rather than a luxury item. The growth of health-focused diets, increased fruit and vegetable consumption, and the rise of home meal preparation contributed to steady blender adoption. Retailers including department stores, supermarkets, and online marketplaces expanded product offerings across price points, encouraging first-time buyers and replacements alike. Seasonal buying patterns and popularity of gift occasions also added demand peaks, particularly around holidays and promotional events.

Future demand for blenders in the USA will evolve in response to changing lifestyle patterns, appliance innovation, and health-oriented consumer choices. Demand will likely increase for high-performance, multifunctional blenders capable of handling tasks from smoothies to nut butters, soups, and frozen desserts, as cooking enthusiasts and health-conscious consumers demand versatility. As single-person and smaller households grow, compact and multifunction appliances may gain relevance over large kitchen setups. Competition from alternative appliances, such as immersion blenders, food processors, and specialized juice machines, may segment demand. Consumer interest in sustainability, energy efficiency, and countertop space optimisation may also steer purchases toward durable, easy-to-clean designs rather than frequent replacements.

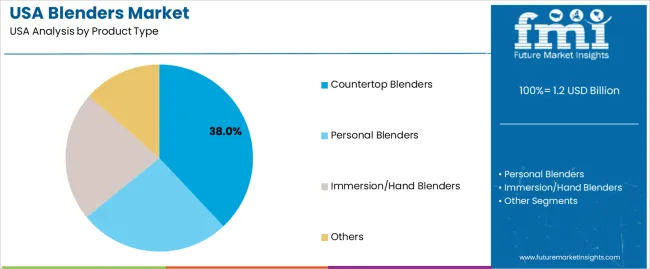

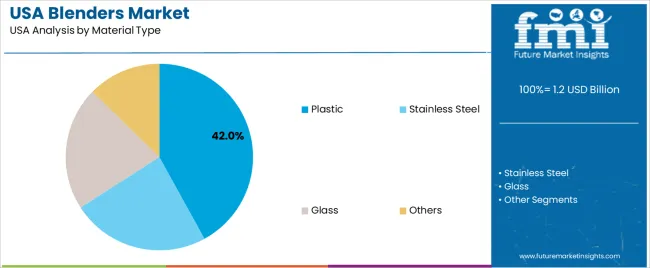

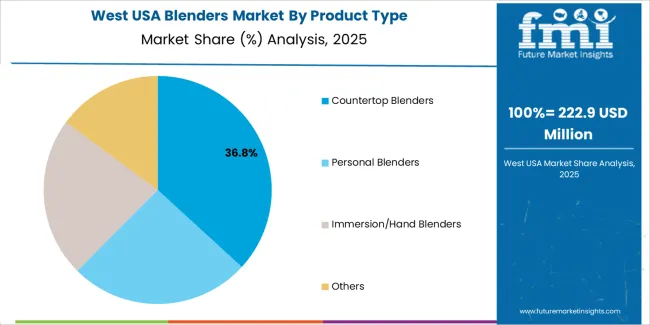

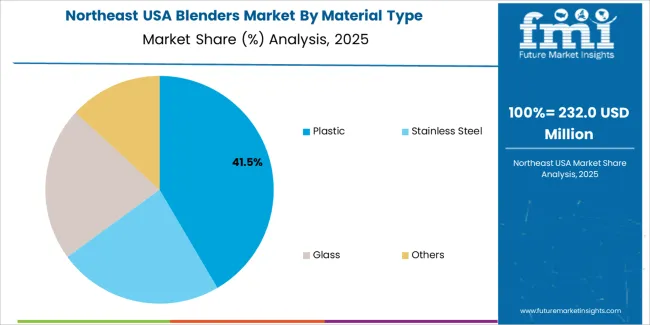

The demand for blenders in the USA is structured by product type and material type. Countertop blenders account for 38% of total demand, followed by personal blenders, immersion or hand blenders, and other specialty formats. By material type, plastic represents 42.0% of total consumption, followed by stainless steel, glass, and other materials. Demand behavior is shaped by household usage patterns, food preparation habits, durability expectations, and ease of cleaning. These segments reflect how kitchen layout, frequency of use, and safety requirements influence purchasing decisions across residential kitchens, foodservice outlets, and institutional dining facilities in the USA.

Countertop blenders account for 38% of total blender demand in the USA due to their versatility and suitability for high volume food preparation. These units are widely used for smoothies, soups, sauces, frozen drinks, and batters across households and foodservice operations. Their larger jar capacity and higher motor power support frequent and heavy-duty blending compared with portable or immersion models. Families, meal preparation users, and home bakers prefer countertop models for their ability to process large ingredient batches in a single cycle.

Countertop blenders also benefit from strong adoption across restaurants, cafes, and juice bars where menu consistency depends on reliable blending performance. Speed controls, preset programs, and thermal protection features improve operational reliability under repeated use. Replacement demand remains steady as motor wear and blade fatigue occur over long operating cycles. These versatility, capacity, and durability advantages sustain countertop blenders as the leading product type in the USA.

Plastic accounts for 42.0% of total material demand for blenders in the USA due to its light weight, impact resistance, and cost efficiency. Plastic housings and blending jars reduce overall appliance weight, which improves handling convenience for household users. Molded plastic components also support complex design shapes, integrated grips, and safety locking features that improve USAbility. These properties make plastic well suited for mass market countertop and personal blender models.

Plastic also supports high volume manufacturing with consistent tolerances and shorter production cycles than metal or glass. It allows competitive pricing across entry and mid range blender categories, which drives higher unit sales through large consumer electronics retailers and online platforms. Advances in food grade polymers have improved heat resistance and long term durability. These production efficiency, affordability, and functional design advantages position plastic as the dominant material type in the USA blender market.

Blenders in the USA have shifted from occasional-use appliances to daily food preparation tools. Smoothies, protein shakes, sauces, baby food, and home coffee drinks drive routine usage across age groups. Health-focused eating habits emphasize fresh ingredients that require mechanical blending rather than packaged alternatives. Small urban kitchens favor multi-use countertop appliances that replace several single-function tools. The rise of high-speed internet cooking content also normalizes blender-based recipes as part of daily meal preparation. These lifestyle shifts position blenders as functional kitchen infrastructure rather than optional convenience devices.

USA fitness culture heavily influences blender demand through protein shakes, supplement mixes, and meal replacement drinks. Home cooking trends push consumers toward fresh soups, salsas, nut butters, and plant-based sauces that require consistent blending power. Iced coffee, frozen cocktails, and non-dairy drinks also sustain seasonal demand spikes. College students and shared households favor compact personal blenders for individual use. Family households prioritize large-capacity, high-torque units. These parallel use cases fragment the market by power class, jar size, and motor durability rather than by price alone.

Blender demand in the USA is shaped by relatively short appliance lifespans driven by motor wear, blade dulling, and coupling failure. Many low- to mid-range blenders are treated as disposable due to repair costs exceeding replacement price. Heavy reliance on imported components exposes the category to freight cost volatility and supply disruptions. Warranty claims influence brand loyalty more than advertising. Consumers often replace rather than upgrade after failure, which flattens premium conversion rates. These replacement and repair economics create steady volume but restrict predictable long-term brand retention.

Blenders in the USA are evolving toward quieter operation to suit apartment living and early-morning use. Safety interlocks, overload protection, and sealed blade assemblies address rising liability expectations. Smart presets for smoothies, ice crushing, and soup heating simplify user control across skill levels. Some models integrate heating elements for hot blending, reducing dependence on separate cooktops. Travel-lid systems convert blending jars into portable drink containers. These shifts show blenders moving beyond raw motor power toward user-centered control, safety, and multifunctional convenience.

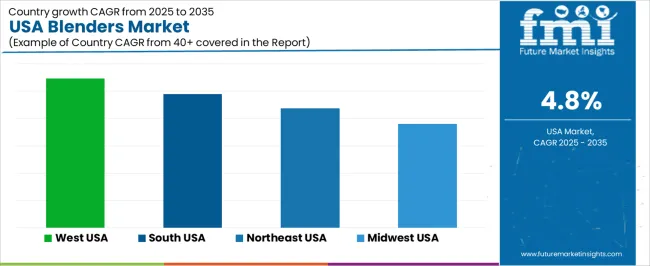

| Region | CAGR (%) |

|---|---|

| West | 5.5% |

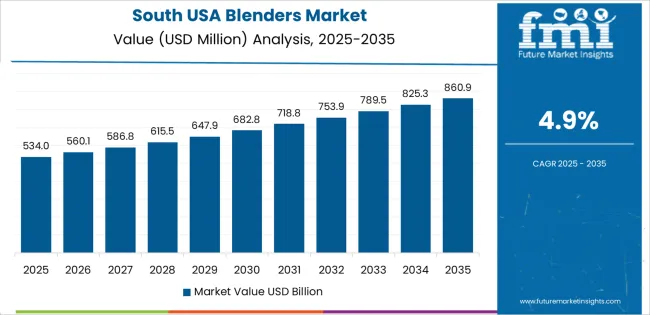

| South | 4.9% |

| Northeast | 4.4% |

| Midwest | 3.8% |

The demand for blenders in the USA is expanding steadily across regions, with the West leading at a 5.5% CAGR. Growth in this region is supported by strong adoption of health oriented diets, high penetration of smoothies and home based food preparation, and demand from fitness focused consumers. The South follows at 4.9%, driven by rising household appliance ownership, expanding retail distribution, and growing interest in convenient kitchen solutions. The Northeast records 4.4% growth, supported by urban household demand, replacement purchases, and steady sales through specialty appliance retailers. The Midwest shows comparatively moderate growth at 3.8%, reflecting stable appliance demand, longer replacement cycles, and more conservative spending patterns on small kitchen appliances.

Expansion in the West reflects a CAGR of 5.5% through 2035 for blender demand, supported by strong adoption of wellness oriented diets, home smoothie preparation, and premium kitchen appliance upgrades. Urban consumers favor high performance blenders for plant based diets, protein mixes, and fresh food processing. Food bloggers and nutrition focused households contribute to frequent appliance replacement cycles. Specialty appliance retailers and online platforms dominate premium product distribution. Demand remains lifestyle driven rather than necessity driven, with product differentiation based on motor power, blade design, and multifunction food preparation capability.

The South advances at a CAGR of 4.9% through 2035 for blender demand, driven by population growth, expanding suburban housing, and rising use of blenders for family meal preparation. Home cooking, iced beverages, and casual entertaining support stable appliance turnover. Warm climate conditions increase usage intensity for cold drinks and frozen desserts. Large format retail chains and warehouse clubs dominate distribution through value oriented pricing. Demand remains volume driven rather than feature driven, with households prioritizing durability, ease of maintenance, and affordable price points across mid range electric appliance categories.

The Northeast records a CAGR of 4.4% through 2035 for blender demand, shaped by compact kitchen layouts, steady apartment turnover, and rising use in quick meal preparation. Urban households favor compact countertop models suited for limited space. Convenience foods, soups, and single serve beverages support routine appliance usage. Specialty kitchenware stores and ecommerce platforms share distribution. Demand remains replacement led rather than expansion led, with moderate upgrade cycles influenced by appliance wear and evolving household needs rather than lifestyle trend shifts across dense residential markets.

The Midwest expands at a CAGR of 3.8% through 2035 for blender demand, supported by stable household formation, home cooking traditions, and steady brick and mortar retail access. Blenders are mainly used for food preparation, baking mixes, and seasonal beverages. Practical purchasing behavior favors long service life and basic functionality over premium feature sets. Regional home goods chains and mass merchandisers dominate sales. Demand remains necessity driven and predictable, aligned with slow replacement cycles and consistent appliance ownership patterns across family oriented suburban and semi-rural households.

Demand for blenders in the USA is rising as consumers increasingly prioritise home based cooking, convenience, and healthy eating habits. Growing interest in smoothies, homemade sauces, soups, and meal prep meals supports blender use. Urban lifestyles and busy schedules make versatile kitchen appliances that can quickly prepare nutritious food popular. In addition, rising demand for appliances that support diet trends veganism, protein shakes, low carb meals encourage blender purchases. Combined with expanding e commerce and online retail penetration, accessibility improves and households find it easier to replace or upgrade existing appliances.

Major brands shaping the USA blender market include Vitamix Blender, Blendtec Total Blender Classic, KitchenAid Artisan Power Blender, Ninja Nutri Professional Blender, and other global competitors. Vitamix and Blendtec lead the high performance segment, known for power and durability, favored by serious home cooks and health conscious users. KitchenAid and Ninja appeal to mainstream households seeking reliable, multipurpose blenders for everyday cooking. These companies shape the market through consistent innovation offering features such as high speed blending, multiple presets, and durable build and their broad distribution via retail and online channels.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Countertop Blenders, Personal Blenders, Immersion/Hand Blenders, Others |

| Material Type | Plastic, Stainless Steel, Glass, Others |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Vitamix, Blendtec, Breville, Ninja (SharkNinja), KitchenAid (Whirlpool) |

| Additional Attributes | Dollar by sales by product type, Dollar by sales by material type, Dollar by sales by region, Regional CAGR, Replacement cycles influence, Premium product migration, E-commerce distribution, Health and wellness trend influence, Commercial foodservice usage |

The demand for blenders in USA is estimated to be valued at USD 1.2 billion in 2025.

The market size for the blenders in USA is projected to reach USD 1.8 billion by 2035.

The demand for blenders in USA is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in blenders in USA are countertop blenders, personal blenders, immersion/hand blenders and others.

In terms of material type, plastic segment is expected to command 42.0% share in the blenders in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA