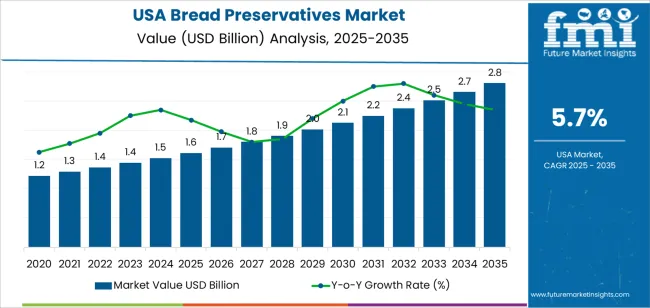

The demand for bread preservatives in the USA is expected to grow from USD 1.6 billion in 2025 to USD 2.8 billion by 2035, reflecting a CAGR of 5.7%. Bread preservatives are used in the bakery industry to extend the shelf life of bread products, preventing spoilage and preserving freshness. As demand for convenient, ready-to-eat foods continues to rise, bread preservatives will become increasingly important to ensure product longevity without harsh chemicals. The growing popularity of pre-packaged bread and bakery goods, combined with the rising demand for clean-label products with fewer additives, will drive market growth.

Advancements in natural preservatives derived from plant-based and organic sources will also drive market expansion as consumers become more health-conscious. The increasing demand for gluten-free and organic bread options will further enhance the market for bread preservatives, as manufacturers seek effective solutions to maintain freshness while meeting evolving consumer preferences. As the bread and bakery industry evolves to meet changing consumer tastes and expectations, the demand for preservatives will continue to rise, supporting market growth.

From 2025 to 2030, the demand for bread preservatives in the USA will grow from USD 1.6 billion to USD 2.1 billion, contributing an increase of USD 0.5 billion in value. During this phase, the market will experience steady growth, driven by the increasing need for longer shelf life and the expansion of the pre-packaged food sector. The adoption of natural preservatives and clean-label formulations will accelerate as consumer demand for healthier food options rises. The CAGR during this phase will be marked by steady incremental growth, as more bread manufacturers seek cost-effective and consumer-friendly preservatives. Additionally, the rise in snack foods and convenience bakery products will further fuel demand, particularly in the retail and foodservice sectors.

From 2030 to 2035, the market will grow from USD 2.1 billion to USD 2.8 billion, adding USD 0.7 billion in value. As the market matures, growth will continue at a slightly slower pace compared to earlier years, with a continued emphasis on sustainable, natural preservatives that cater to the growing demand for organic and gluten-free bread options. The CAGR in this phase will reflect more mature growth, with a focus on product differentiation and innovation in preservation technologies to meet the increasing consumer demand for clean, natural ingredients in bread and bakery products. Despite a slower growth rate, the market will continue expanding steadily, supported by regulatory trends and consumer preferences for healthier, longer-lasting products.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 1.6 billion |

| Industry Forecast Value (2035) | USD 2.8 billion |

| Industry Forecast CAGR (2025-2035) | 5.7% |

Demand for bread preservatives in the USA is supported by a sustained trend toward packaged and processed bread products that require longer shelf life and reliable freshness retention. The bakery sector continues to adopt preservatives such as propionates and sorbates to prevent mold, extend shelf stability and reduce waste. Manufacturers also face logistical demands, longer transport times, distribution across diverse channels and storage conditions that elevate the need for effective preservative systems.

Another factor is evolving consumer expectations around label transparency, ingredient origin and wellness. There is growing interest in "clean label" and naturally derived preservatives, which encourages formulators to explore enzyme based, plant extract or fermentation derived solutions. At the same time, industry participants must navigate regulatory constraints on maximum allowable levels, the cost competitiveness of conventional preservatives and shifts in baking process technologies. With the USA bread market remaining large and supply chain demands steady, the outlook suggests moderate growth for bread preservatives, around a 5.7% compound annual growth rate (CAGR) from 2025 to 2035, reflecting both ongoing need for shelf life extension and the transition toward cleaner label formats.

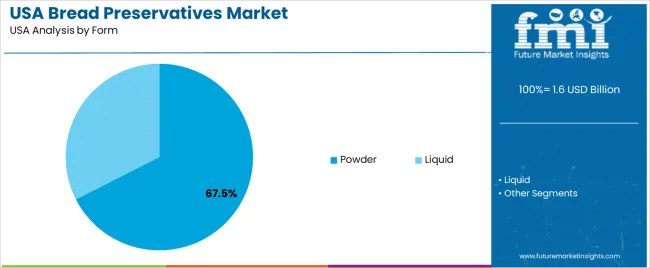

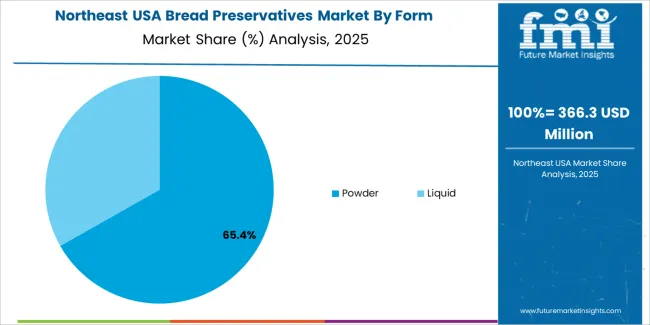

The demand for bread preservatives in the USA is primarily driven by type and form. The leading type is artificial bread preservatives, capturing 61% of the market share, while the dominant form is powder, accounting for 67.5% of the demand. Bread preservatives are essential in maintaining the freshness and shelf life of bakery products, and as consumer preferences evolve, manufacturers are increasingly turning to preservatives that meet both functional and regulatory requirements. The demand for artificial preservatives is higher due to their cost-effectiveness and ability to deliver longer shelf life, while the growing interest in natural preservatives is contributing to a shift in the market.

Artificial bread preservatives lead the demand for bread preservatives in the USA, holding 61% of the market share. These preservatives are widely used in commercial bread production due to their effectiveness in extending shelf life, preventing mold growth, and maintaining product quality over extended periods. Artificial preservatives, such as calcium propionate and sodium benzoate, are favored by manufacturers for their ability to prevent spoilage and maintain bread freshness, especially in products that need to withstand long shipping times and storage conditions.

The demand for artificial preservatives is driven by their lower cost, availability, and proven efficacy in extending the shelf life of bakery products. They are particularly useful in mass-produced breads that are distributed to a wide range of retailers, ensuring consistent quality for consumers. Additionally, the demand for convenience and longer-lasting products in the bread industry supports the continued use of artificial preservatives. Despite a growing shift towards more natural ingredients in consumer products, artificial preservatives continue to dominate due to their efficiency and affordability in large-scale bread production.

Powder form is the leading form for bread preservatives in the USA, capturing 67.5% of the demand. Powdered preservatives are widely used in the baking industry due to their ease of incorporation into dough mixtures, longer shelf life, and efficient handling. The powder form offers convenience in storage and application, allowing for precise dosage control and minimizing waste, making it an ideal choice for high-volume production.

The preference for powdered preservatives is driven by their compatibility with automated baking processes, where consistency and ease of use are critical. Powdered preservatives are also more stable and resistant to degradation compared to their liquid counterparts, which is particularly important for products that require extended shelf life. As the bread industry continues to focus on efficiency and product consistency, powdered bread preservatives will remain the preferred form, ensuring their dominant position in the market.

Demand for bread preservatives in the USA is driven by the need to extend shelf life, reduce waste and support large scale bakery and packaged bread production. The growth of convenience foods and e commerce driven distribution emphasises durability and freshness in bread lines. Meanwhile, rising consumer interest in clean label ingredients and regulatory pressure on additives moderate the pace of change. These factors combine to shape how formulators and ingredient suppliers respond to shifting bakery preservative requirements.

Several factors support growth. The high consumption of packaged and frozen bread products increases reliance on preservatives that inhibit mould and extend shelf life. Advances in preservative systems, such as enzyme based or plant extract solutions, enable formulators to meet clean label demands while maintaining performance. Growth in online and direct to consumer bakery offerings demands longer shelf life and stability during transit. In addition, waste reduction efforts among manufacturers and retailers amplify interest in effective preservative systems that reduce spoilage across supply chains.

Despite positive drivers, several constraints apply. Rising consumer concern regarding synthetic additives and preference for minimal ingredient bread formulations create pressure to reduce or replace conventional preservatives. Reformulation toward preservative free or "no additive" bread lines may reduce volume demand for traditional preservatives. Regulatory scrutiny and evolving labelling requirements increase compliance burden for preservative suppliers. Also, cost pressure in the bakery sector limits the budget available for higher cost natural or advanced technology preservative systems, limiting the speed of transition.

Important trends include increased development of natural and plant based preservative systems, such as vinegar derived acids, enzyme blends or botanical extracts, that meet both performance and clean label criteria. Multi function preservative systems that offer anti microbial protection and delay staling are gaining traction as formulators seek broader benefits. Ingredient suppliers are also focusing on transparent supply chains and eco certified bio based solutions, reflecting broader sustainability imperatives. Finally, partnership models between bakeries and preservative developers, customised formulation support, smaller batch innovations and pilot testing, are rising as the bakery market diversifies its product portfolio.

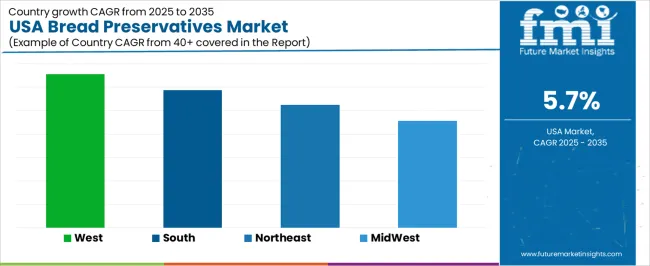

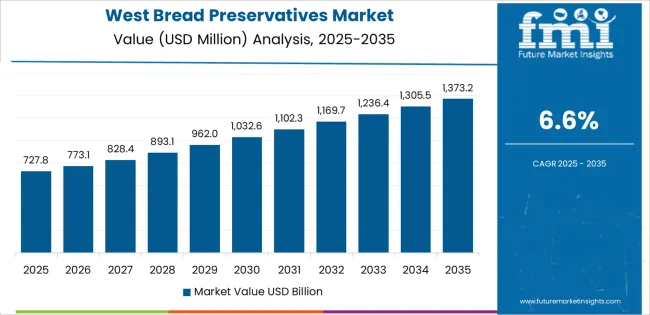

The demand for bread preservatives in the USA exhibits varying growth rates across regions, reflecting different market dynamics and consumer preferences. The West shows the highest growth, with a CAGR of 6.6%, driven by a strong food industry and increasing awareness of food preservation methods. The South follows with a CAGR of 5.9%, supported by a growing consumer base and an expanding food processing sector.

The Northeast sees a more modest growth rate of 5.2%, influenced by the region’s established food manufacturing sector and a steady demand for preservative solutions. The Midwest, while still growing, has the lowest growth at 4.6%, reflecting a slower pace of adoption in food preservation compared to other regions. These differences highlight the regional variations in bread preservative demand, influenced by local production, consumer behavior, and industry trends.

| Region | CAGR (2025-2035) |

|---|---|

| West | 6.6% |

| South | 5.9% |

| Northeast | 5.2% |

| Midwest | 4.6% |

The demand for bread preservatives in the West is projected to grow at a CAGR of 6.6%, driven by several factors, including the region’s large and dynamic food industry. The West, home to major food manufacturing hubs and a significant population, experiences a high demand for food products with extended shelf life. The growing popularity of packaged bread and baked goods, combined with a consumer focus on convenience and product longevity, drives the use of preservatives. Additionally, the region's innovative approach to food processing and packaging contributes to the increasing demand for preservatives that enhance product shelf life and quality. The food industry’s expansion, along with rising consumer awareness of food safety and quality, makes the West a key driver in the demand for bread preservatives.

In the South, the demand for bread preservatives is expected to grow at a CAGR of 5.9%, reflecting a region-wide expansion of the food processing and packaged food industries. The South’s rapidly growing food manufacturing sector is a key driver of this growth. Increasing consumer preferences for packaged bread and baked goods, which require preservatives for longer shelf life, are also contributing to the rising demand. The region’s climate, which can impact the freshness of bread and other baked goods, further drives the need for preservatives to maintain product quality. As the food industry continues to grow in the South, bread preservative demand is likely to increase, particularly as the region becomes a hub for food production and distribution.

In the Northeast, the demand for bread preservatives is projected to grow at a CAGR of 5.2%, reflecting the region’s established food manufacturing base and consistent demand for baked goods. The Northeast has a well-developed infrastructure for food processing and distribution, contributing to the steady use of preservatives in packaged bread. The region’s consumers are increasingly focused on convenience, which drives the demand for longer shelf life in bread and baked goods. Additionally, the growing awareness of food safety and quality standards in the region further fuels the adoption of preservatives to ensure product freshness. While growth is steady, the Northeast’s well-established market and consumer preferences for packaged products continue to sustain demand for bread preservatives.

The demand for bread preservatives in the Midwest is projected to grow at a slower rate of 4.6%, influenced by regional consumer preferences and slower adoption of food preservation technologies. The Midwest’s food industry is large, but it tends to have more localized production and a greater emphasis on fresh, locally sourced bread and baked goods. While packaged bread and shelf-stable products are still in demand, the region is slower to embrace the widespread use of preservatives compared to other parts of the country.

However, as consumer preferences evolve and the food manufacturing industry in the Midwest grows, the demand for preservatives is expected to rise, albeit at a more moderate pace. This slower growth rate is likely to be influenced by traditional consumption patterns and a more cautious approach to food additives in the region.

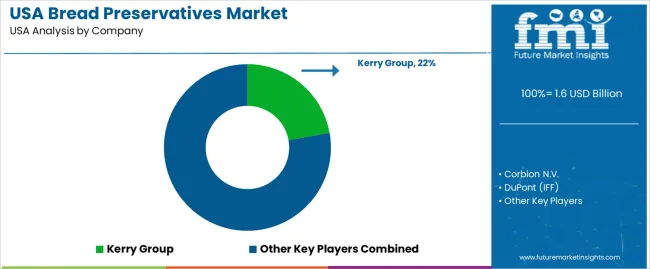

Demand in the United States for bread preservatives is increasing as commercial bakeries and packaged bread producers seek to extend shelf life, reduce waste, and maintain product freshness. The North American bread preservative market is projected to grow, with a compound annual growth rate of around 5.1%. Key companies in this sector include Kerry Group (holding about 22.2% market share), Corbion N.V., DuPont (now part of IFF), Kemin Industries, and Puratos Group. These firms provide chemical and natural preservative systems designed to support large-scale bread production and distribution.

Competition in the bread preservative industry is focused on formulation effectiveness, clean-label compatibility, and regulatory compliance. Companies are developing preservative solutions that prevent mold growth and staling while meeting growing demand for gluten-free, organic, and minimal additive products. Natural alternatives such as enzymes and plant-based extracts are becoming more popular. Another key competitive factor is the ability to tailor preservatives for different bread formats, packaging types, and processing conditions. Marketing often highlights shelf-life extension, texture preservation, microbial inhibition, and regulatory safety approvals. By addressing the needs of bakeries and retailers for freshness, convenience, and sustainability, these companies aim to strengthen their position in the USA bread preservatives market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Type | Artificial Bread Preservatives, Natural Bread Preservatives |

| Form | Powder, Liquid |

| Function | Reducing Agents, Enzymes, Oxidants |

| Key Companies Profiled | Kerry Group, Corbion N.V., DuPont (IFF), Kemin Industries, Puratos Group |

| Additional Attributes | The market analysis includes dollar sales by type, form, function, and company categories. It also covers regional demand trends in the USA, particularly driven by the increasing use of preservatives to extend bread shelf life and maintain quality. The competitive landscape highlights key players focusing on innovations in both artificial and natural bread preservatives. Trends in the growing demand for natural ingredients and clean-label preservatives are explored, along with advancements in preservation technologies and formulations for enhanced bread quality and extended freshness. |

The demand for bread preservatives in usa is estimated to be valued at USD 1.6 billion in 2025.

The market size for the bread preservatives in usa is projected to reach USD 2.8 billion by 2035.

The demand for bread preservatives in usa is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in bread preservatives in usa are artificial bread preservatives and natural bread preservatives.

In terms of form, powder segment is expected to command 67.5% share in the bread preservatives in usa in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bread Preservatives Market Insights – Trends & Forecast 2025 to 2035

USA Plant Based Preservatives Market Report – Trends & Innovations 2025-2035

Demand for Bread Preservatives in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bread Crumbs in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Breadcrumbs Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA