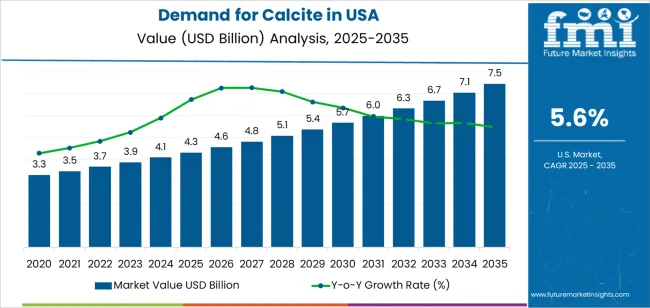

The demand for calcite in the USA is projected to grow from USD 4.3 billion in 2025 to USD 7.5 billion by 2035, reflecting a CAGR of 5.6%. Calcite, a naturally occurring mineral used in a wide variety of industries such as construction, plastics, paints and coatings, agriculture, and glass manufacturing, is in demand for its versatility and affordable properties. It plays an essential role in improving the performance, texture, and quality of numerous products. The growth of the calcite market is driven by its increasing use in environmentally friendly construction practices, where it serves as a primary ingredient in cement production, high-performance coatings, and plastics.

The expanding demand for green construction and sustainable building materials is likely to boost the need for calcite in the coming years. Additionally, government regulations and industry standards favoring low-emission materials will lead to increased adoption of calcite, as it helps reduce the carbon footprint of products such as cement and concrete. As demand continues to rise in industries like paint and coatings, plastics, and agriculture, calcite is expected to maintain its position as a critical material in various industrial processes.

The breakpoint analysis for calcite demand in the USA reveals key moments during the forecast period when growth accelerates or decelerates. From 2025 to 2030, the demand will grow from USD 4.3 billion to USD 5.7 billion, adding USD 1.4 billion in value. This early phase of growth is driven by strong demand in construction and agriculture, where calcite is widely used in cement production, soil conditioning, and fertilizer. However, a breakpoint may occur around 2027-2028, when growth begins to stabilize slightly as the calcite market becomes more mature, and demand in traditional sectors (such as paints and coatings) reaches a saturation point.

From 2030 to 2035, the market will continue to expand from USD 5.7 billion to USD 7.5 billion, adding another USD 1.8 billion. This later growth period will experience an accelerated increase, driven by the shift toward sustainable construction materials and green building practices. The breakpoint around 2032-2033 will reflect a faster adoption of calcite in environmentally conscious industries, as regulations and green initiatives become more prominent in the USA. The demand for calcite will further accelerate in these years, particularly in sectors like green construction and eco-friendly coatings. Thus, the second half of the forecast period will experience significant demand growth due to changing industry needs and the evolving regulatory landscape.

| Metric | Value |

|---|---|

| USA Calcite Industry Sales Value (2025) | USD 4.3 billion |

| USA Calcite Industry Forecast Value (2035) | USD 7.5 billion |

| USA Calcite Industry Forecast CAGR (2025-2035) | 5.6% |

Demand for calcite in the USA is being driven by its wide range of industrial uses in sectors such as construction, paper and pulp, plastics and coatings. In construction applications, calcite is used as a filler and additive in cement, concrete and mortar to improve strength, durability and cost efficiency. Increasing infrastructure investment and renovations of commercial and residential buildings in the USA support sustained offtake of calcite from this sector. In the paper and pulp industry, calcite serves as a functional mineral filler that enhances brightness, opacity and print quality while reducing reliance on higher cost cellulose fibres. Growth in packaging and specialty paper grades supports this trend.

Another driver is the rising use of calcite in the plastics, paints and coatings industries, where manufacturers favour natural mineral fillers to achieve lightweight, high performance materials and meet sustainability targets. Calcite is seen as an eco friendly alternative that can help producers reduce plastic content and satisfy consumer demand for cleaner label products. Agricultural and environmental applications, such as soil conditioning and water treatment, also contribute to demand in the USA. However, growth is moderated by challenges including raw material cost volatility, competition from synthetic alternatives like precipitated calcium carbonate, and regulatory or environmental constraints on mining operations. Despite these factors, the versatile industrial role of calcite and its alignment with sustainable manufacturing practices suggest demand in the USA will remain stable and gradually increase.

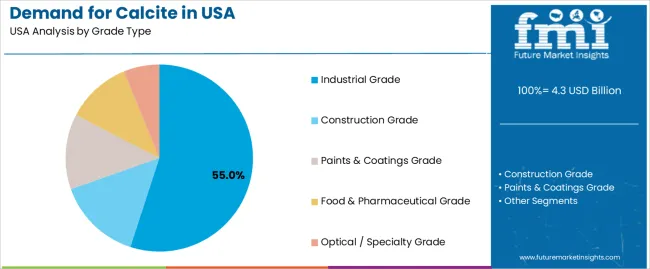

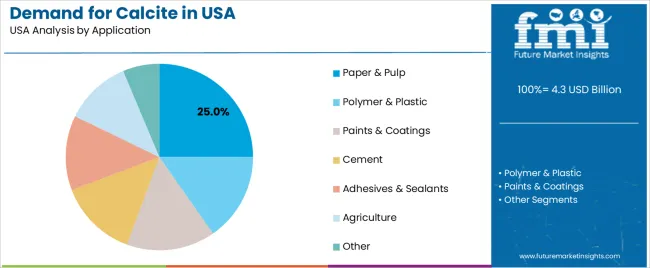

The demand for calcite in the USA is primarily driven by two factors: grade type and application. Industrial grade calcite leads the market, capturing 55% of the market share, while paper & pulp is the dominant application, accounting for 25% of the demand. Calcite, due to its versatility and natural properties, is used across several industries such as construction, paints & coatings, agriculture, and pharmaceuticals. The increasing demand for high-quality calcite in various industrial applications is fueled by its functional benefits, such as being an effective filler, a whitening agent, and a stabilizer in numerous products.

Industrial grade calcite leads the market with a 55% share due to its wide-ranging use in various industries. Industrial grade calcite is primarily used as a filler material in the production of plastics, rubber, adhesives, paints, coatings, and in the manufacturing of cement. Its abundance, low cost, and ability to improve the physical properties of products—such as enhancing whiteness, opacity, and consistency—make it highly desirable across different sectors.

One of the key drivers for industrial-grade calcite demand is its application in manufacturing processes, where it is used as a low-cost alternative to other materials. In plastics, for instance, calcite enhances strength, durability, and scratch resistance without significantly increasing production costs. The ongoing expansion of industries such as construction, paints & coatings, and plastic manufacturing further propels the demand for industrial-grade calcite. As industries continue to optimize their production processes, the need for calcite in these applications will sustain its market dominance.

The paper & pulp sector holds the largest share of 25% in the calcite application market in the USA. Calcite plays a crucial role in the production of paper and pulp as a brightening agent, filler, and coating material. It helps improve the opacity, smoothness, and printability of paper, making it an essential ingredient in the manufacture of high-quality papers used for books, magazines, and packaging materials.

The demand for calcite in the paper & pulp industry is closely tied to the continued consumption of paper products in the USA. Despite the rise of digital media, the paper and packaging industry remains strong, especially with growing consumer demands for eco-friendly and recyclable materials. Calcite helps improve the efficiency of paper production by acting as a cost-effective filler, enabling manufacturers to use less expensive raw materials without sacrificing product quality. As the demand for both traditional paper products and sustainable packaging increases, the paper & pulp industry will continue to drive the demand for calcite in the USA.

Demand for calcite in the United States is primarily driven by its role as a natural mineral used in a wide range of industrial applications including construction materials, paper and pulp, polymers, coatings and agriculture. The USA market is supported by domestic mining and processing but is influenced by global raw material pricing, environmental regulation of quarrying operations and competition from alternative fillers and synthetic calcium carbonate materials. The interplay of construction activity, manufacturing volumes and material substitution dynamics defines how demand for calcite evolves.

What Are The Primary Growth Drivers For Calcite Demand in the United States?

Several factors support growth in USA demand. First, continued investment in infrastructure and construction—particularly in concrete, mortar, road base and building materials—increases the use of calcite based fillers and aggregates. Second, the paper and packaging industries use ground or precipitated calcite as a filler to improve printability, brightness and cost efficiency. Third, polymers and coatings producers favour calcite for its functional attributes such as opacity, smoothness and cost reduction in plastics, paints and sealants. Fourth, agriculture and environmental applications use calcite for soil conditioning and water treatment, and interest in low carbon or natural mineral solutions supports uptake.

What Are The Key Restraints Affecting Calcite Demand in the United States?

Despite favourable conditions, the USA calcite market faces several constraints. The cost of mining, processing and transporting bulk mineral feedstock can increase if energy prices or regulatory compliance costs rise, which may reduce competitiveness. Alternative materials or synthetic fillers (such as precipitated calcium carbonate or engineered minerals) may offer comparable performance at lower cost or with tailored properties, limiting substitution in some segments. Environmental and permitting challenges associated with quarrying operations can delay production or increase cost, particularly near populated areas. Lastly, limited growth in certain end use markets—such as newsprint paper or commodity coatings—may moderate incremental demand.

What Are The Key Trends Shaping Calcite Demand in the United States?

Emerging trends in USA calcite demand include increasing use of fine and ultrafine calcite grades with controlled particle size and surface treatment, supporting advanced coatings, polymers and specialty applications. The construction sector is seeing demand for low carbon, high filler materials, positioning calcite as a contributor to sustainable building solutions. Domestic producers are leveraging higher recycled content and improved processing to reduce the environmental footprint of calcite supply. Additionally, diversification of applications such as hydrogen purification, water treatment and agricultural soil amendment are broadening the demand base for calcite beyond traditional industrial uses.

The demand for calcite in the USA is growing due to its versatile applications across industries like construction, agriculture, manufacturing, and paints and coatings. Calcite, a naturally occurring form of calcium carbonate, is widely used as a filler in various products, including plastics, rubber, and paper, as well as in agriculture for soil conditioning and pH balance. Its abundance, non-toxic nature, and cost-effectiveness make it an essential mineral for many industrial processes. Regional demand varies based on industrial activity, agricultural practices, and manufacturing presence. The West leads due to strong demand in construction and industrial sectors, while the South, Northeast, and Midwest show steady demand due to their own specific regional industries, including agriculture, manufacturing, and environmental applications. This analysis explores the key drivers of calcite demand across the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 6.4% |

| South | 5.8% |

| Northeast | 5.2% |

| Midwest | 4.5% |

The West region leads the USA calcite market with a CAGR of 6.4%. The region is home to a significant number of construction projects, mining operations, and manufacturing industries, all of which rely heavily on calcite as a raw material. Calcite is used as a filler in concrete, asphalt, and building materials, which are essential in the growing construction industry, particularly in states like California, Nevada, and Arizona.

The West’s manufacturing sector, including industries like automotive, paints and coatings, and plastics, also contributes to the high demand for calcite as a filler and pigment in these products. Additionally, the region's agricultural activities, especially in soil amendments and pH control, further boost demand. As the West continues to expand in construction, manufacturing, and agriculture, the demand for calcite will continue to grow at a rapid pace.

The South region shows a solid CAGR of 5.8%. The region's agricultural sector is a significant driver of calcite demand, as calcite is commonly used to improve soil quality and balance pH levels in farming operations. With a large number of agricultural activities, particularly in states like Texas, Georgia, and Florida, the demand for calcite in agriculture remains strong.

In addition, the South is home to a diverse range of manufacturing industries, including paper mills, plastics, and construction materials, which also require calcite as a key ingredient. The region’s expanding infrastructure development and construction projects further contribute to the demand for calcite, particularly in road construction, concrete production, and other building materials. The continued growth in agriculture, manufacturing, and construction in the South will ensure steady demand for calcite.

The Northeast region shows a steady CAGR of 5.2%. The Northeast has a strong industrial and manufacturing base, including industries such as paper production, paints and coatings, and plastics, all of which rely on calcite as a filler material. The region’s well-established construction industry also contributes to the demand for calcite, particularly for use in building materials like cement and concrete.

Agricultural demand for calcite in soil amendments is also prevalent in the Northeast, supporting steady consumption of this mineral. The region’s focus on environmental sustainability and green building practices further increases the use of calcite in eco-friendly products. As the Northeast continues to grow in construction, manufacturing, and agriculture, demand for calcite will remain consistent.

The Midwest region shows a moderate CAGR of 4.5%. The Midwest has a significant manufacturing base, particularly in industries like automotive, machinery, and packaging, which contribute to the demand for calcite as a filler material. Additionally, the region's strong agricultural presence, particularly in states like Iowa, Ohio, and Michigan, boosts demand for calcite in soil enhancement and agricultural applications.

The construction sector in the Midwest also drives demand for calcite, particularly in the production of concrete, cement, and other building materials. While the growth rate in the Midwest is slower compared to other regions, the ongoing industrial and agricultural activities ensure a steady need for calcite in various applications. As these industries continue to evolve and expand, demand for calcite will remain important in the Midwest.

Demand for calcite in the United States is growing due to its widespread use in various industries, including plastics, paints and coatings, paper, rubber, and construction. Companies such as Imerys S.A. (holding approximately 28.2% share), Omya AG, Minerals Technologies Inc., Huber Engineered Materials, and Nordkalk Corporation are major players in the market. Calcite, a naturally occurring form of calcium carbonate, is valued for its properties as a filler and extender, which help reduce costs and improve the quality of products in these sectors.

Competition in the calcite market is driven by product quality, supply chain reliability, and customization for specific applications. One key strategic focus is enhancing the purity and particle size distribution of calcite to meet the increasingly stringent requirements of industries such as pharmaceuticals and food processing, where high-grade, finely ground calcite is used as an excipient. Another approach emphasizes sustainability and the use of eco-friendly production methods, as demand for natural and non-toxic materials increases. Companies are also looking to expand their regional production capabilities to reduce logistics costs and ensure a stable supply of calcite for their customers. Marketing materials typically highlight product features such as particle size, surface area, brightness, and compatibility with various manufacturing processes. By aligning their products with the growing needs for high-performance and sustainable materials, these companies aim to strengthen their position in the USA calcite market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | North America |

| Grade Type | Industrial Grade, Construction Grade, Paints & Coatings Grade, Food & Pharmaceutical Grade, Optical / Specialty Grade |

| Application | Paper & Pulp, Polymer & Plastic, Paints & Coatings, Cement, Adhesives & Sealants, Agriculture, Other |

| Key Companies Profiled | Imerys S.A., Omya AG, Minerals Technologies Inc., Huber Engineered Materials, Nordkalk Corporation |

| Additional Attributes | The market analysis includes dollar sales by grade type and application categories. It also examines regional demand trends in the United States, driven by industries such as paper & pulp, paints & coatings, and polymer & plastic manufacturing. The competitive landscape focuses on key manufacturers innovating in calcite-based materials and their specialized applications. Trends in demand for high-quality grades for food, pharmaceutical, and optical industries are explored, along with advancements in calcite extraction and processing technologies. |

The global demand for calcite in USA is estimated to be valued at USD 4.3 billion in 2025.

The market size for the demand for calcite in USA is projected to reach USD 7.5 billion by 2035.

The demand for calcite in USA is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in demand for calcite in USA are industrial grade, construction grade, paints & coatings grade, food & pharmaceutical grade and optical / specialty grade.

In terms of application, paper & pulp segment to command 25.0% share in the demand for calcite in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA