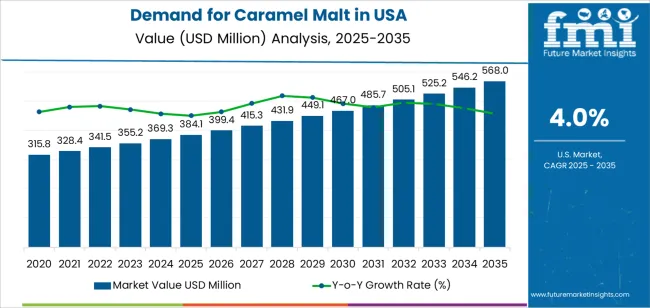

The USA caramel malt demand is valued at USD 384.1 million in 2025 and is forecasted to reach USD 568.0 million by 2035, growing at a CAGR of 4.0%. Demand is supported by steady expansion in craft brewing, increased production of specialty beer styles, and rising use of caramel malt in flavor and color development for lagers, ales, and malt-forward beverages. Caramel malt is widely used to enhance body, sweetness, and stability, supporting its consistent uptake across commercial breweries and independent craft producers.

Light caramel malt represents the leading colour segment due to its versatility in large-volume beer styles and its role in providing mild sweetness, balanced color, and clean malt character. Light variants are preferred for consistent performance in pale ales, lagers, and blended malt formulations. Advances in controlled kilning, moisture uniformity, and batch consistency are improving flavor reproducibility for high-volume brewers.

Demand is strongest in the West, South, and Northeast, where craft beer production, consumer experimentation, and brewery density are highest. Growth is supported by ongoing facility expansions and development of new beer styles targeted at regional industries. Key suppliers include Bairds Malt Limited, Weyermann, Castle Malting, Thomas Fawcett Malting, and Great Western Malting, focusing on grain quality, precise kilning processes, and consistent flavor development.

Breakpoint analysis shows two transition stages shaped by brewing demand, product diversification, and shifting consumption patterns. The first breakpoint, expected between 2026 and 2029, will coincide with steady growth in craft and regional breweries that rely on caramel malt for color, flavor development, and body enhancement. Wider use in specialty beer styles and incremental expansion in small-batch production will support this early phase.

A second breakpoint is likely between 2031 and 2033 as the industry shifts from expansion to more stable, process-driven demand. Larger breweries will optimize formulations and streamline ingredient sourcing, producing steadier procurement patterns. Growth will moderate as consumption stabilizes and product use becomes more standardized across brewing categories. Incremental gains will come from cleaner-label malt varieties and improved processing consistency rather than sharp volume increases. The overall breakpoint pattern reflects an industry moving from early craft-driven acceleration to mature, predictable USAge supported by formulation needs, production efficiency, and continued interest in differentiated malt profiles within the brewing sector.

| Metric | Value |

|---|---|

| USA Caramel Malt Sales Value (2025) | USD 384.1 million |

| USA Caramel Malt Forecast Value (2035) | USD 568.0 million |

| USA Caramel Malt Forecast CAGR (2025-2035) | 4.0% |

Demand for caramel malt in the United States is growing alongside the expansion of craft brewing and specialty beverage production. Caramel malt provides colour, body and sweet-caramel flavour profiles sought by brewers for amber ales, porters and other artisan styles. The rise in craft distilling and non-alcoholic malt beverages further supports the ingredient’s appeal in diversified end-use categories. US-based breweries and maltsters are actively upgrading ingredient portfolios to meet consumer demand for complex texture and flavour, which in turn drives higher procurement of specialty malts such as caramel malt.

Regional craft beer industry also influences regional malt-buying trends and support local sourcing of caramel malt varieties. Product innovation in baking and confectionery reinforces crossover usage of caramel malt in non-brew applications, increasing demand. Constraints include raw-material cost volatility and competition from alternative malt types or adjuncts that may offer similar colour effects at lower cost. Shifts in beverage consumption, such as growth of hard seltzer and low-alcohol segments, could reduce demand growth for traditional malt-based beverages and moderate overall consumption of caramel malt in the USA.

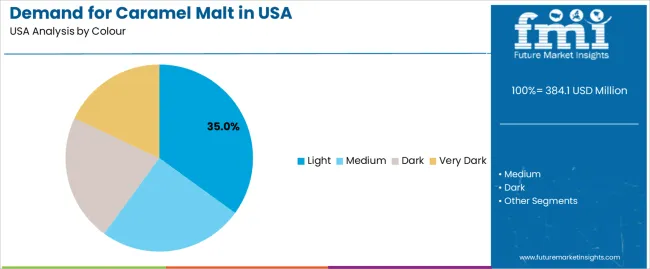

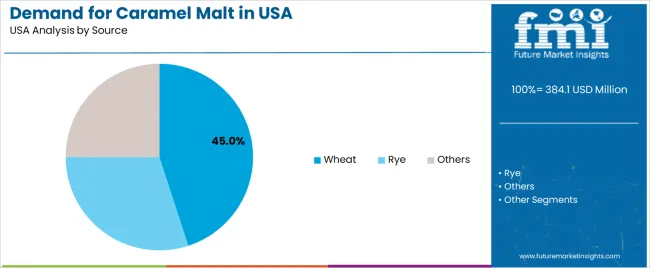

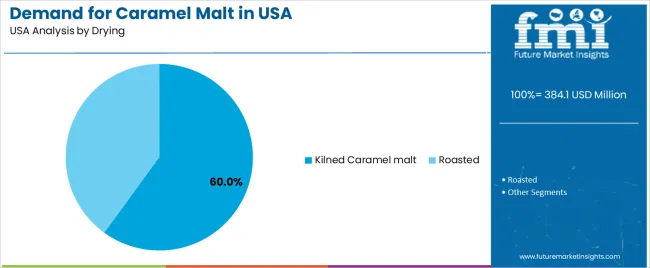

Demand for caramel malt in the United States is segmented by colour, source, and drying method. Breweries across both large-scale and craft operations use caramel malt to control flavour, colour, mouthfeel, and foam stability in a wide range of beer styles. The distribution of demand across these segments reflects formulation choices, production consistency requirements, and evolving consumer preferences. Each segment contributes differently to recipe development, batch standardization, and style-specific brewing needs.

Light caramel malt holds 35.0% of USA demand and leads the colour categories. Breweries use it to add mild sweetness, light toffee notes, and moderate body without introducing strong roasted flavours. These characteristics support lagers, pale ales, blonde ales, and session-style beers that require balanced flavour and dependable mouthfeel. Light caramel malt also improves foam retention and contributes to consistent batch performance in both commercial and craft brewing. Medium caramel malt accounts for 25.0%, dark for 22.0%, and very dark for 18.0%, each serving amber styles and specialty recipes that need deeper colour and stronger caramelization.

Key drivers and attributes:

Wheat-based caramel malt accounts for 45.0% of USA demand, making it the leading source category. Brewers use wheat caramel malt to achieve smoother mouthfeel, improved head retention, and lighter flavour expression in beer styles such as wheat ales and hefeweizens. Wheat-derived caramel malt also supports predictable colour performance and stable extraction properties, which are valued in craft and commercial operations. Rye-based caramel malt holds 30.0% and provides a notable spice profile used in rye ales and experimental formulations. The remaining 25.0% includes barley and other grain types used for traditional ale and lager recipes.

Key drivers and attributes:

Kilned caramel malt holds 60.0% of USA demand and leads all drying-method categories. Kilning produces controlled sugar caramelization and precise colour formation, which supports stable mashing, predictable extraction, and consistent fermentation performance. Breweries use kilned caramel malt when targeting balanced sweetness, moderate colour, and reliable production characteristics across high-volume and craft workflows. Roasted caramel malt accounts for 40.0% and is used for deeper colour, stronger caramel intensity, and burnt sugar notes required in stouts, porters, and high-colour seasonal styles.

Key drivers and attributes:

Growing craft-beer production, expansion of specialty malt USAge, and rising interest in premium flavor profiles are driving demand.

Demand for caramel malt in the United States is increasing as craft breweries continue to develop beers that rely on specialty malts for flavor, color, and body. Caramel malt supports American styles such as amber ales, brown ales, red lagers, and malt-forward IPAs, which require controlled sweetness and stable foam characteristics. Growth in small and mid-sized breweries strengthens consumption because these producers use wider ranges of malt varieties per batch. Food manufacturers in bakery, snack, and flavor-development sectors are also adopting caramel malt to introduce roasted or caramelized notes in value-added products. Rising consumer interest in artisanal ingredients and differentiated flavor experiences increases demand across beverage and food applications.

Declining mainstream beer consumption, raw-material cost fluctuations, and competition from alternative malts are restraining growth.

Total beer consumption in the United States has been trending downward, which reduces base malt usage and constrains volume growth for specialty malts such as caramel malt. Variability in barley supply, weather-driven yield changes, and cost adjustments in malting operations influence production stability and pricing levels for caramelized malts. Some producers are replacing caramel malt with roasted malts, hybrid crystal malts, or flavor extracts to achieve similar sensory results at lower cost or with improved process efficiency. Consolidation among breweries also reduces the number of buyers purchasing a broad malt portfolio, which limits incremental malt diversity in large production systems.

Shift toward small-batch specialty styles, rising demand from non-alcoholic malt beverages, and expanded use in food applications are shaping industry trends.

Craft producers are formulating small-batch beers with layered malt profiles that require multiple caramel malt grades to achieve specific color and flavor targets. Growth in non-alcoholic craft beer and malt-based beverages is increasing the need for caramel malts that provide body and sweetness without relying on fermentation. Food companies are incorporating caramel malt into cereals, baked goods, and flavor concentrates to create natural caramelized notes. These trends support steady demand and broaden the application base for caramel malt in the United States.

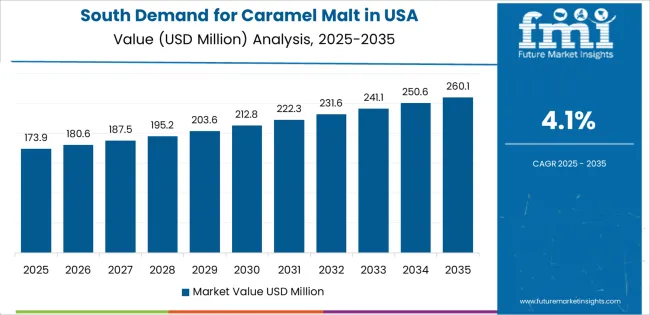

The demand for caramel malt in the United States continues to expand as regional breweries increase production of malt-forward beer styles, adopt specialty malt variations, and strengthen distribution across local and national channels. The West leads with a 4.6% CAGR, followed by the South (4.1%), the Northeast (3.7%), and the Midwest (3.2%). Craft brewing density, product diversification, climate-driven preferences, and broader consumer interest in fuller-bodied ale styles influence long-term demand. Caramel malt remains widely used for enhancing color, flavor stability, and body across amber ales, red ales, porters, and select lagers.

| Region | CAGR (2025-2035) |

|---|---|

| West | 4.6% |

| South | 4.1% |

| Northeast | 3.7% |

| Midwest | 3.2% |

The West grows at 4.6% CAGR, supported by a concentrated craft-brewing landscape, strong preference for balanced ale profiles, and increased use of caramel malt in specialty beer styles. Breweries across California, Oregon, Colorado, and Washington rely on caramel malt to moderate bitterness in hop-focused formulations while adding body and flavor depth. Shelf rotation for regional beers remains strong due to high taproom visitation rates and well-established distribution channels. Brewers use multiple caramel malt grades to create color consistency across flagship and limited-release offerings. Growth in small and mid-scale breweries contributes to rising procurement of specialty malt varieties.

The South grows at 4.1% CAGR, driven by expanding craft breweries, broader taproom expansion, and increased interest in malt-balanced beer styles suited to regional taste preferences. Breweries across Texas, Florida, Georgia, and North Carolina integrate caramel malt to produce smooth, moderately sweet ales with deeper color tones. Rising beer tourism, seasonal product rotations, and growth in mid-sized regional breweries contribute to steady demand. Brewpubs and taprooms emphasize consistent malt profiles for house ales, raising procurement of caramel malt grades with predictable fermentability and color outcomes.

The Northeast grows at 3.7% CAGR, supported by established craft-brewing clusters, strong specialty-beer retail channels, and rising production of malt-centric ale styles. Breweries in New York, Pennsylvania, Massachusetts, and Vermont incorporate caramel malt to achieve balanced flavor, moderate sweetness, and fuller mouthfeel. Seasonal demand increases during colder months when consumers favor richer, malt-forward styles. Breweries maintain consistent use of caramel malt across year-round flagships, contributing to stable procurement volumes. Specialty stores and local distribution networks support steady movement of malt-influenced ales within the region.

The Midwest grows at 3.2% CAGR, supported by long-standing brewing culture, stable production of lagers and amber ales, and consistent use of caramel malt in regional beer styles. Breweries across Michigan, Wisconsin, Illinois, and Minnesota adopt caramel malt for body enhancement, color improvement, and flavor consistency. Proximity to agricultural and malting facilities ensures stable supply for both small and large breweries. Growth trends remain moderate because breweries maintain traditional formulations with incremental diversification into malt-forward specialty releases. Regional distribution networks provide reliable demand but limited acceleration compared with higher-growth regions.

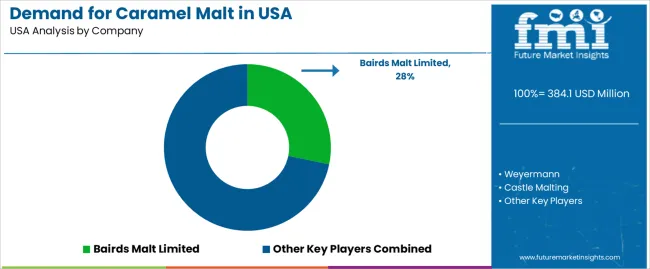

The caramel malt industry in the United States is moderately concentrated, with a mix of domestic and international maltsters supplying breweries, distilleries, and specialty beverage producers. Bairds Malt Limited holds the leading position with an estimated 28.2% share, supported by consistent malt quality, reliable color grading, and established supply relationships with craft and regional breweries. Its position is reinforced by stable production processes and dependable delivery schedules suited to high-volume buyers.

Weyermann, Castle Malting, and Thomas Fawcett Malting maintain strong competitive roles as international suppliers known for controlled roasting profiles and broad caramel malt ranges used in ale, lager, and specialty beer recipes. Their competitiveness relies on uniform batch characteristics, traceable sourcing, and flexibility across color and flavor specifications required by craft brewers. Great Western Malting strengthens domestic supply capacity through regional production, consistent base malt integration, and logistical advantages in serving West Coast and Midwest breweries.

Competition in the USA caramel malt segment centers on color consistency, flavor profile stability, moisture control, and supply reliability. Demand is influenced by ongoing craft beer production, seasonal beer releases requiring varied caramel malt intensities, and continued interest in malt-forward styles that depend on predictable sweetness and color contributions.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Colour | Light, Medium, Dark, Very Dark |

| Source | Wheat, Rye, Others |

| Drying | Kilned Caramel Malt, Roasted |

| Application | Beer, Food, Dairy and Frozen Products, Bakery and Confectionery, Others |

| End Use | Microbreweries, Large Breweries, Regional Breweries, Brewpubs, Home Brewers |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Bairds Malt Limited, Weyermann, Castle Malting, Thomas Fawcett Malting, Great Western Malting |

| Additional Attributes | Dollar sales by colour, source, drying method, and application categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of maltsters and specialty grain producers; developments in roasted and kilned caramel malt technologies; integration with craft beer production, large-scale brewing operations, and food ingredient manufacturing. |

The global demand for caramel malt in USA is estimated to be valued at USD 384.1 million in 2025.

The market size for the demand for caramel malt in USA is projected to reach USD 568.0 million by 2035.

The demand for caramel malt in USA is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in demand for caramel malt in USA are light, medium, dark and very dark.

In terms of source, wheat segment to command 45.0% share in the demand for caramel malt in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA