The USA citrus molasses demand is valued at USD 323.4 million in 2025 and is expected to reach USD 610.3 million by 2035, growing at a CAGR of 6.6%. Demand is supported by expanding use of citrus molasses in animal feed formulation, fermentation processes, and flavoring applications within food and beverage manufacturing. Its high sugar content and nutrient profile make it a consistent ingredient for livestock feed, while its natural acidity and aroma support applications in specialty sweeteners and fermentation substrates.

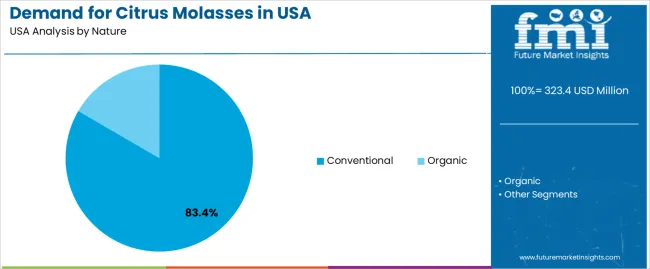

Conventional citrus molasses represents the leading nature segment due to its broad availability, cost efficiency, and suitability for high-volume feed and industrial uses. Conventional variants offer stable composition and are widely adopted across large-scale feed mills, bioprocessing facilities, and blending operations. Continued development of standardized processing and quality control techniques is improving batch consistency and supply reliability.

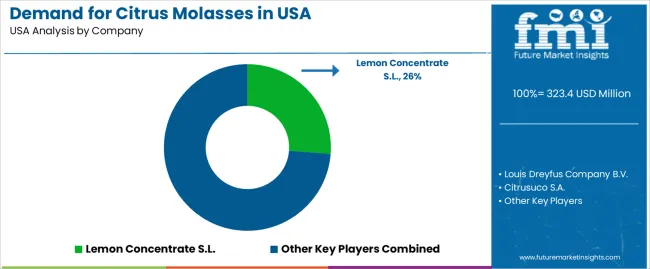

The West, South, and Northeast show the strongest demand, driven by active livestock industries, concentrated feed production, and diversified food processing capability. Regional citrus processing operations further support supply alignment with downstream users. Key suppliers include Lemon Concentrate S.L., Louis Dreyfus Company B.V., Citrusuco S.A., Citromax Group, and Sucocitrico Cutrale Ltd., focusing on raw material sourcing, process efficiency, and consistent product quality.

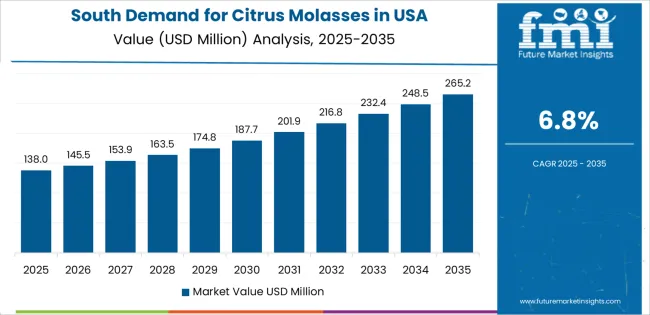

Year-on-year growth analysis shows a consistent upward trajectory supported by steady use of citrus molasses in feed applications, fermentation inputs, and specialty food formulations. Between 2025 and 2028, YoY growth will remain close to the long-term average as processors expand utilization of by-products from citrus-juice production and as demand strengthens in livestock-nutrition programs. Stable raw-material availability across major citrus-producing states will support predictable annual increases.

From 2029 to 2032, YoY growth may show minor variation due to fluctuations in citrus output, weather-related supply conditions, and price adjustments in competing feed carbohydrates. Despite these shifts, recurring industrial use will maintain a steady baseline. Between 2033 and 2035, YoY growth is expected to stabilize near mid-single-digit levels as procurement patterns mature and supply chains become more standardized. Incremental gains will come from improved processing consistency and wider use in value-added feed blends. The YoY pattern reflects a resilient segment shaped by predictable agricultural cycles, stable end-use demand, and the continued role of citrus molasses as a functional ingredient in USA feed and fermentation systems.

| Metric | Value |

|---|---|

| USA Citrus Molasses Sales Value (2025) | USD 323.4 million |

| USA Citrus Molasses Forecast Value (2035) | USD 610.3 million |

| USA Citrus Molasses Forecast CAGR (2025-2035) | 6.6% |

Demand for citrus molasses in the USA is growing because feed manufacturers and livestock producers increasingly look for cost-effective energy sources that also support ecofriendly goals. Citrus molasses is a by-product of citrus processing and provides digestible carbohydrates and palatability enhancement in ruminant diets used in dairy, beef and sheep operations. Producers operating near citrus processing hubs value this ingredient for its cost advantages compared with more expensive energy supplements. The growth of circular economy practices and waste valorisation in the food-processing sector further supports adoption of citrus molasses as a resource-efficient feed ingredient.

Interest in clean-label and environmentally friendly feed inputs bolsters demand among farms that emphasise ecofriendly supply chains. Constraints include geographic limitations in processing and distribution, which may increase freight cost for distant livestock regions. Seasonal variability in citrus peel availability and logistics for liquid by-products also affect supply consistency. Some feed formulators may prefer more standard ingredients or may be cautious about variability in composition across citrus molasses batches.

Demand for citrus molasses in the United States is shaped by production methods, distribution channel structures, and USAge requirements across feed, industrial, and biofuel sectors. Industry distribution reflects cost-efficiency priorities, nutritional value expectations, and the suitability of citrus molasses for bulk-use categories involving livestock nutrition and industrial processing.

Conventional citrus molasses holds 83.4% of USA demand and represents the dominant nature segment. Its high share reflects large-scale availability, cost efficiency, and suitability for bulk applications requiring consistent nutritional or processing performance. Conventional molasses is produced from widely sourced citrus residues, enabling stable supply for feed producers, pulp manufacturers, and industrial processors. Organic citrus molasses accounts for 16.6%, serving niche industries focused on certified organic livestock feed, premium products, and limited industrial applications. Organic variants have a smaller footprint due to higher production costs, limited supply, and narrower application compatibility.

Key drivers and attributes:

The B2B segment holds an estimated 68.0% share of USA demand. Bulk purchasers in the feed industry, industrial processors, and pulp manufacturers procure citrus molasses directly to support consistent throughput, formulation stability, and supply-chain planning. B2B transactions reflect the product’s high-volume use and need for predictable logistics, storage, and delivery arrangements. The B2C segment accounts for 32.0%, serving small-scale farms, specialty feed producers, and individual buyers through retail or online channels. B2C volumes remain modest due to limited household applications and the dominance of industrial-use categories.

Key drivers and attributes:

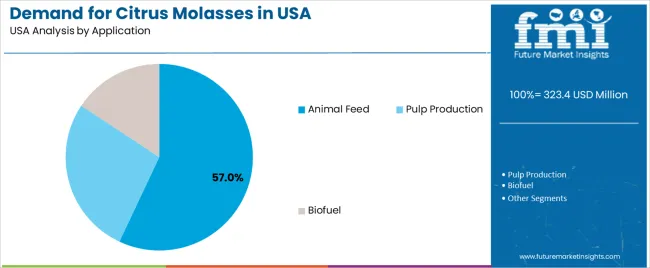

Animal feed accounts for an estimated 57.0% of USA demand for citrus molasses and represents the leading application segment. Citrus molasses supports feed formulation by improving palatability, providing energy density, and offering binding properties for pelleted and mixed feeds. Pulp production holds 28.0%, where citrus molasses functions as a fermentation substrate and processing aid in fiber-derived products. The biofuel segment represents 15.0%, using citrus molasses as a sugar source for fermentation-based ethanol or biogas systems. Application distribution reflects differences in scale, processing requirements, and economic viability across feed and industrial operations.

Key drivers and attributes:

Growing livestock feed demand, valorisation of citrus-processing by-products, and increased interest in cost-effective energy-rich feed ingredients are driving demand.

Demand for citrus molasses in the United States is supported by the dairy and beef industries which require high-energy feed components that also improve palatability and intake in ruminants. Citrus processing plants in states such as Florida generate substantial by-product streams which can be processed into citrus molasses for feed-use, increasing local availability and reducing transportation cost. The push for circular-economy practices in agriculture, converting peel and pulp waste into valuable by-product ingredients, strengthens the case for citrus molasses use. Feed-formulators increasingly adopt alternative energy sources to diversify away from conventional grains, supporting incremental uptake of citrus molasses in farm rations. A recent estimate suggests the USA segment may grow at a compound annual growth rate (CAGR) of around 6.6% through 2035.

Seasonality of supply, transport logistics of liquid by-products, and variability in composition diminish growth potential.

Citrus molasses production is inherently seasonal, driven by citrus harvest patterns. This places pressure on inventory systems and can affect year-round supply for livestock operators. The liquid nature of many citrus molasses products incurs high freight and storage costs for operations located far from citrus-processing centres, which can reduce economic viability in some regions. Quality and composition of citrus molasses vary by citrus variety, processing method and concentration level, requiring feed-formulators to conduct frequent testing and formulation adjustments, which adds operational complexity and can discourage use in cost-sensitive operations.

Expansion of organic-certified citrus molasses, increased use in ruminant dairy feeding programs, and strengthened supply chain partnerships between citrus processors and feed mills define industry trends.

Suppliers are developing organic-certified grades of citrus molasses to meet demand from premium dairy and beef operations that target organic or ecofriendly production credentials. Nutritionists are increasingly specifying citrus molasses in transition cow rations and high-producing dairy cow diets to enhance energy density and improve feed intake while aligning with ecofriendly goals. Citrus processing companies and feed-mill operators are forming alliances to secure by-product supply, standardise quality parameters, and optimise logistics, which strengthens the foundation for broader usage in USA feed industries.

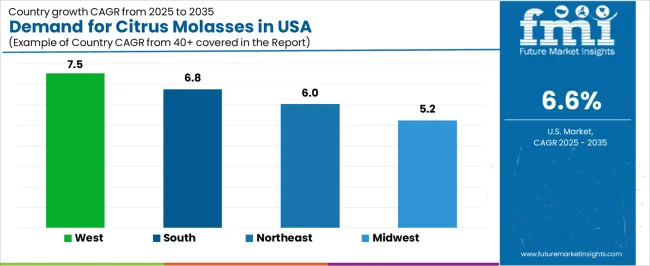

Demand for citrus molasses in the United States is increasing through 2035, supported by expanding use in animal feed formulations, broader incorporation in fermentation and yeast-production processes, and growing interest in natural sweetener bases for specialized industrial applications. Regional trends reflect agricultural activity, feed-production density, and availability of citrus-processing by-products. The West leads with a 7.5% CAGR, followed by the South (6.8%), the Northeast (6.0%), and the Midwest (5.2%). Demand is shaped by livestock-production patterns, ingredient substitution in feed mills, and increased adoption of citrus-derived inputs in biochemical and fermentation facilities.

| Region | CAGR (2025-2035) |

|---|---|

| West | 7.5% |

| South | 6.8% |

| Northeast | 6.0% |

| Midwest | 5.2% |

The West grows at 7.5% CAGR, supported by strong livestock-feed activity, established citrus-processing operations, and broader use of citrus molasses in fermentation-based industries. States such as California and Arizona maintain consistent supply of citrus by-products used for molasses extraction, enabling regional feed mills to incorporate citrus molasses as an energy component in cattle and dairy formulations. Fermentation facilities adopt citrus molasses for yeast propagation, organic acid production, and specialized bioprocessing applications. Demand is reinforced by local availability, which lowers transport costs and encourages higher blending rates. Regional interest in natural feed additives contributes to steady annual USAge.

The South grows at 6.8% CAGR, driven by active cattle, poultry, and mixed-feed production across states such as Texas, Florida, Georgia, and Alabama. Florida’s citrus-processing facilities supply significant by-product volumes, enabling broader availability of citrus molasses for feed applications. Feed manufacturers use citrus molasses for palatability improvement, energy enhancement, and ingredient blending across ruminant diets. Fermentation facilities adopt citrus molasses for biochemical processing. Distribution networks expand through feed cooperatives and agricultural suppliers, supporting consistent annual demand.

The Northeast grows at 6.0% CAGR, supported by stable dairy and cattle operations and increased use of citrus molasses in regional feed mills seeking alternative carbohydrate sources. States including New York, Pennsylvania, and Vermont adopt citrus molasses to enhance feed texture, manage ingredient consistency, and improve ration palatability. Fermentation facilities add moderate demand for specialty applications involving yeast cultivation and microbial processes. Higher transport distances from citrus-producing regions influence pricing but do not inhibit adoption due to the ingredient’s utility in dairy-oriented feed blends.

The Midwest grows at 5.2% CAGR, supported by large-scale livestock operations, steady feed-production activity, and increased interest in carbohydrate-rich feed additives. States including Wisconsin, Illinois, Iowa, and Minnesota maintain reliable demand across ruminant diets where citrus molasses improves feed handling, mixing uniformity, and palatability. Feed mills use citrus molasses as part of energy-blend strategies, especially where diversification beyond grain-based inputs is required. Fermentation facilities contribute small but steady demand through process applications. Growth remains moderate due to distance from citrus-processing centers and stable feed-industry purchasing patterns.

Demand for citrus molasses in the USA is shaped by a concentrated group of international processors supplying feed, fermentation, and flavor-related applications. Lemon Concentrate S.L. holds the leading position with an estimated 26.2% share, supported by consistent sourcing from controlled citrus-growing regions and stable supply of high-solids molasses suited to animal nutrition and industrial use. Its position is reinforced by reliable quality parameters, controlled acidity profiles, and long-standing export relationships.

Louis Dreyfus Company B.V. and Citrusuco S.A. follow as significant participants, supplying orange-based and mixed-citrus molasses produced from large-scale juice extraction operations. Their competitive strengths include steady by-product availability, standardized soluble-sugar content, and logistics networks that support year-round shipments to USA feed manufacturers and fermentation plants. Citromax Group maintains a strong role through vertically integrated lemon operations in the Americas, offering molasses with consistent chemical characteristics suited to specialized fermentation processes.

Sucocitrico Cutrale Ltd. contributes substantial supply capacity through extensive Brazilian citrus operations, emphasizing stable delivery volumes and reliable product uniformity for commercial blending and feed applications. Competition across this segment centers on soluble-sugar consistency, acidity control, traceability, and logistics reliability. Demand is supported by continued use of citrus molasses as an energy-rich feed ingredient, wider application in fermentation substrates, and increasing utilization in flavor-adjacent industrial formulations where predictable composition and steady supply are essential.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Nature | Conventional, Organic |

| Sales Channel | B2B, B2C |

| Application | Animal Feed, Pulp Production, Biofuel |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Lemon Concentrate S.L., Louis Dreyfus Company B.V., Citrusuco S.A., Citromax Group, Sucocitrico Cutrale Ltd. |

| Additional Attributes | Dollar sales by nature, sales channel, and application categories; regional adoption trends across West, Midwest, South, and Northeast; competitive landscape of citrus processors and molasses suppliers; developments in organic citrus by-products and eco-friendly feed ingredients; integration with livestock nutrition, pulp manufacturing, and biofuel production. |

The global demand for citrus molasses in USA is estimated to be valued at USD 323.4 million in 2025.

The market size for the demand for citrus molasses in USA is projected to reach USD 610.3 million by 2035.

The demand for citrus molasses in USA is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in demand for citrus molasses in USA are conventional and organic.

In terms of sales channel, b2b segment to command 68.0% share in the demand for citrus molasses in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA