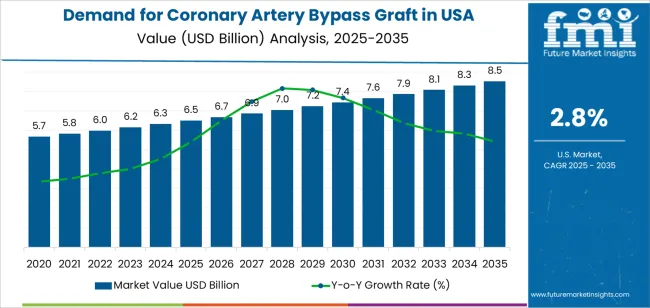

The demand for coronary artery bypass graft (CABG) procedures in the USA is expected to grow from USD 6.5 billion in 2025 to USD 8.5 billion by 2035, reflecting a CAGR of 2.8%. CABG remains a critical procedure in the treatment of coronary artery disease, particularly for patients with significant blockages or when angioplasty is not effective. An aging population influences the demand for CABG procedures, the increasing prevalence of heart disease, and advancements in surgical techniques and post-operative care. CABG surgeries are expected to continue to be a mainstay treatment option for patients who require more comprehensive cardiac intervention.

While the market for CABG procedures will see modest growth, it will also face challenges from the rise of minimally invasive procedures, such as robotic surgeries and angioplasty, that offer alternatives to traditional open-heart surgery. Furthermore, prevention strategies, including lifestyle changes and early detection through cardiac screenings, may reduce the need for surgical interventions over time.

The acceleration and deceleration pattern for CABG procedures in the USA shows a steady, gradual increase in demand over the forecast period, with some variations in growth rates as market dynamics evolve.

Between 2025 and 2030, the market will grow from USD 6.5 billion to USD 7.4 billion, contributing USD 0.9 billion in value. This phase will see an acceleration in demand as the aging population requires more heart surgeries, particularly in response to increasing cardiovascular diseases and lifestyle factors. The early acceleration is fueled by continued advancements in surgical techniques and better post-operative care that enable patients to recover faster and live longer.

From 2030 to 2035, the market will grow from USD 7.4 billion to USD 8.5 billion, adding USD 1.1 billion in value. This period will likely see moderate deceleration as minimally invasive treatments, angioplasty, and robotic surgeries begin to become more widely adopted, offering patients less invasive alternatives. Moreover, a growing emphasis on preventive care, early detection, and cardiac rehabilitation will likely reduce the need for more invasive surgeries like CABG. While CABG will continue to be necessary for high-risk patients and those with severe coronary artery disease, its growth will slow as these alternatives and preventive measures gain prominence. The deceleration in this phase reflects a shift in treatment options available to patients and greater focus on prevention and minimally invasive techniques.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 6.5 billion |

| Industry Forecast Value (2035) | USD 8.5 billion |

| Industry Forecast CAGR (2025-2035) | 2.8% |

Demand for coronary artery bypass graft surgery in the USA is rising due to the persistent high prevalence of coronary artery disease (CAD), which remains a leading cause of morbidity and mortality among adults. Many patients with multi vessel disease, left main coronary artery blockages or diabetes receive CABG as the recommended treatment, particularly where percutaneous interventions are less effective. This broad clinical need supports consistent demand for CABG procedures, graft materials and associated surgical services.

Another important factor is the advancement in surgical techniques and graft technologies, which enhance outcomes and expand eligibility for CABG. Innovations such as minimally invasive and robotic assisted CABG, improved conduit preservation solutions and faster post operative recovery protocols encourage both clinicians and hospitals to adopt surgery rather than conservative management. At the same time, the well established USA healthcare infrastructure, strong reimbursement frameworks for cardiac surgery and the high volume of tertiary care centres reinforce the market. Challenges include the growing competition from percutaneous interventions, cost pressures in hospital systems and the need for comprehensive post surgical care. Nevertheless, the combination of large disease burden and technical progress means that demand for CABG in the USA is expected to maintain steady growth.

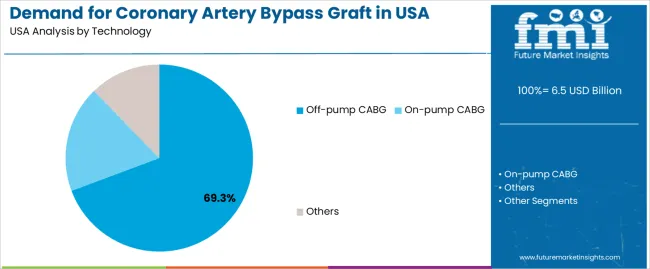

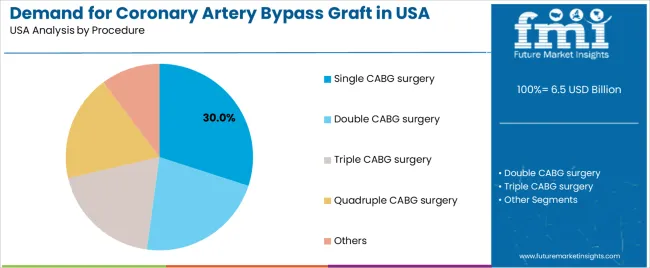

The demand for coronary artery bypass graft (CABG) procedures in the USA is primarily driven by technology and procedure type. The leading technology is off-pump CABG, which holds 69.3% of the market share, while single CABG surgery is the most common procedure, accounting for 30% of the demand. CABG is a critical surgery used to treat coronary artery disease (CAD) by rerouting blood around blocked arteries to improve blood flow to the heart. The growing prevalence of cardiovascular diseases and advances in surgical techniques continue to drive demand for CABG surgeries in the USA.

Off-pump CABG leads the market, capturing 69.3% of the demand for coronary artery bypass grafting technologies in the USA. This technique involves performing the bypass surgery without using a heart-lung machine to temporarily take over the heart's pumping function. Off-pump CABG is preferred because it avoids the potential complications associated with on-pump surgery, such as stroke, infection, and other risks linked to the use of the heart-lung machine.

The off-pump method is also associated with shorter recovery times and less trauma to the heart, making it an attractive option for patients with underlying conditions, such as diabetes, or those at higher risk of complications. As awareness of the benefits of off-pump CABG grows, and as patients and surgeons continue to prioritize minimally invasive techniques, the demand for off-pump procedures is expected to remain strong in the USA, driving the overall CABG market.

Single CABG surgery is the leading procedure in the USA, accounting for 30% of the demand for coronary artery bypass grafting. Single CABG involves the bypass of one coronary artery that has become blocked or narrowed due to coronary artery disease. This procedure is the most commonly performed type of CABG because it is often sufficient for patients with a single blockage, particularly in the early stages of coronary artery disease.

The demand for single CABG surgery is primarily driven by the high incidence of isolated blockages in coronary arteries, where a single bypass is sufficient to restore blood flow. As medical advances and diagnostic tools continue to improve, single CABG surgeries remain a standard approach for patients with less extensive coronary artery disease. Despite the availability of more complex procedures, such as double, triple, and quadruple bypass surgeries, the relative simplicity and effectiveness of single CABG continue to make it the most frequently performed procedure in coronary artery bypass grafting.

Demand for CABG surgery in the United States remains significant due to the persistent prevalence of advanced coronary artery disease, especially among patients with multivessel and left main blockages. Although newer techniques like percutaneous coronary interventions (PCI) have grown, CABG continues to serve as the gold standard for complex disease, supporting steady procedural volume of approximately 300,000 400,000 cases annually. Outcomes improvements, surgical innovations and aging patient populations drive baseline demand, while shifts in disease management, preventative care and minimally invasive alternatives influence longer term trends.

Several drivers support ongoing demand for CABG surgery. First, the ageing USA population and the high incidence of comorbidities such as diabetes, hypertension and chronic coronary artery disease increase the pool of patients requiring surgical revascularisation. Second, guideline based care recommends CABG for patients with complex anatomy (for example multivessel disease or left main involvement), reinforcing use of the procedure. Third, advancements in surgical techniques, such as arterial grafting, minimally invasive approaches and improved perioperative care, enhance outcomes and expand eligibility. Fourth, increasing awareness and access to cardiac diagnostics and referrals mean that more eligible patients are identified for surgical treatment.

Despite demand remaining robust, there are notable restraints. The growth of less invasive alternatives, such as PCI with drug eluting stents, reduces the number of patients directed toward open surgery. Improvements in medical therapy and preventive cardiology also limit the number of patients progressing to surgical level disease. High procedural cost, resource intensity (operating theatre, ICU stay) and patient risk profile (older, sicker patients) may deter surgery. Additionally, workforce constraints, regional access disparities and hospital capacity limitations can constrain growth in some markets.

Key trends shaping demand include increasing adoption of multi arterial grafting strategies that may improve long term outcomes, thereby influencing surgical selection criteria and referral patterns. Minimally invasive and hybrid revascularisation approaches (combining surgical grafting with PCI) are gaining traction in selected centres, potentially shifting procedural mix. Digital health, robotic assistance and advanced imaging are improving surgical planning and recovery, making CABG more accessible to higher risk patients. Finally, emphasis on value based care and bundled payments is encouraging optimisation of perioperative pathways and may influence volumes and hospital choice for CABG delivery.

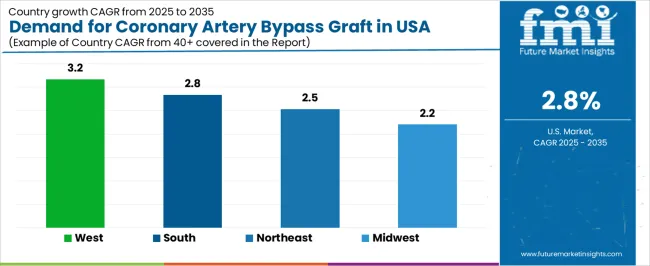

The demand for Coronary Artery Bypass Graft (CABG) surgery in the USA is influenced by an aging population, the prevalence of cardiovascular diseases, and increasing awareness of heart health. CABG is a critical surgical procedure used to treat patients with severe coronary artery disease (CAD), typically when other less invasive treatments have not been effective. The rising rates of obesity, diabetes, and hypertension, which are common risk factors for CAD, are contributing to the demand for CABG surgeries across the country.

Additionally, advances in medical technology and surgical techniques are improving outcomes, making CABG a more viable option for many patients. Regional variations in demand are influenced by factors such as population demographics, the prevalence of heart disease, and access to healthcare services. The West leads in demand due to higher levels of healthcare access, while the South, Northeast, and Midwest follow with steady adoption influenced by regional healthcare infrastructure and cardiovascular disease rates.

| Region | CAGR (2025-2035) |

|---|---|

| West | 3.2% |

| South | 2.8% |

| Northeast | 2.5% |

| Midwest | 2.2% |

The West region leads the USA in the demand for Coronary Artery Bypass Graft (CABG) surgeries with a CAGR of 3.2%. The West is home to some of the country’s most advanced healthcare facilities and leading heart centers, which contribute to higher rates of diagnosis and treatment for coronary artery disease (CAD). States like California, Oregon, and Washington have a large population of elderly individuals who are more likely to develop heart disease, driving the demand for CABG surgeries.

The region’s significant focus on health and wellness, combined with a high rate of healthcare access and technological advancements in heart surgery, supports this demand. Additionally, lifestyle factors such as a higher incidence of obesity, diabetes, and hypertension in certain parts of the West also contribute to the prevalence of CAD, increasing the need for CABG surgeries. As healthcare technology continues to evolve, the demand for CABG will continue to grow, supported by improved outcomes and greater accessibility to heart surgeries.

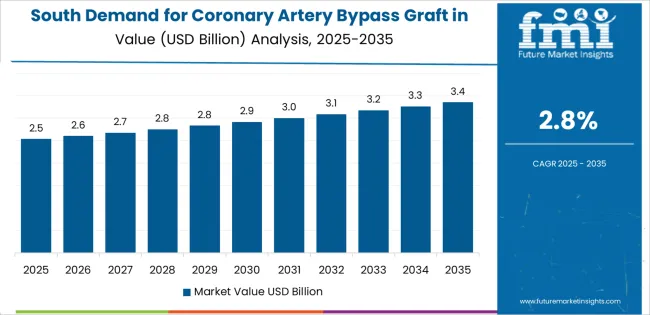

The South region shows strong demand for CABG surgeries with a CAGR of 2.8%. The South has a higher prevalence of risk factors for cardiovascular diseases, such as obesity, diabetes, and hypertension, all of which contribute to the growing need for CABG. States like Texas, Florida, and Georgia have large populations with significant cardiovascular disease rates, driving the demand for heart surgeries, including CABG.

The South’s healthcare infrastructure has been improving in recent years, and more patients now have access to quality cardiac care, further fueling the demand for CABG. Additionally, the aging population in the South, with a growing number of individuals reaching the age where heart disease becomes more prevalent, contributes to the increased number of CABG procedures. As preventive heart care awareness rises in the region, the demand for CABG will continue to be an important component of the heart disease treatment landscape.

The Northeast shows steady demand for CABG surgeries with a CAGR of 2.5%. The region has a significant number of specialized cardiac centers and a high level of healthcare access, which contributes to a steady number of CABG surgeries. The prevalence of cardiovascular disease in the Northeast is driven by factors such as high rates of smoking, poor diet, and high cholesterol, which are significant risk factors for coronary artery disease.

Cities like New York, Boston, and Philadelphia have advanced heart care facilities and a well-established healthcare system, ensuring a steady demand for CABG. Additionally, the region’s aging population, particularly in cities with a high concentration of elderly individuals, contributes to the continued need for coronary artery bypass surgery. Despite steady demand, the adoption of less invasive procedures, such as angioplasty, could moderate CABG growth in the Northeast.

The Midwest shows moderate growth in CABG demand with a CAGR of 2.2%. The region has a high incidence of cardiovascular diseases due to risk factors such as obesity, diabetes, and a lack of access to preventive care in some rural areas. The demand for CABG is influenced by the region’s aging population, which is at a higher risk for heart disease.

While the Midwest has strong healthcare facilities in major cities like Chicago, Detroit, and Cleveland, there are disparities in healthcare access in more rural areas, which could limit the region's overall demand for CABG. However, as healthcare services continue to improve and reach more rural communities, the demand for CABG in the Midwest is expected to grow steadily. Additionally, the rise in heart disease awareness and more advanced surgical options will continue to support CABG demand in the region.

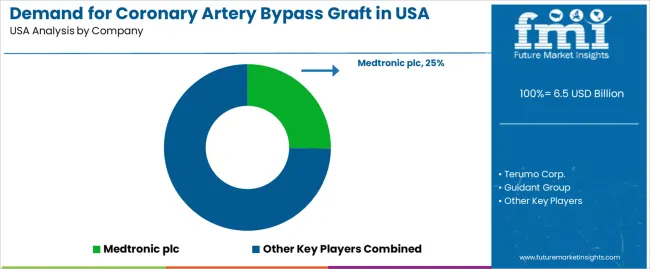

The coronary artery bypass graft (CABG) industry in the United States is driven by the growing prevalence of coronary artery disease (CAD) and the increasing demand for effective surgical treatments. Companies such as Medtronic plc (holding approximately 25.2% market share), Terumo Corp., Guidant Group, and Getinge AB are key players in this industry, providing innovative surgical instruments, grafts, and medical devices used in coronary artery bypass procedures. CABG surgeries are critical for patients with severe blockages in coronary arteries, and advancements in surgical techniques, graft materials, and devices continue to shape the market.

Competition in the CABG industry is largely driven by the development of advanced graft materials, the reliability of surgical instruments, and innovations in minimally invasive techniques. Companies focus on enhancing the performance and longevity of grafts, with new materials like synthetic grafts and biologically compatible coatings gaining attention.

Additionally, the growing trend toward minimally invasive surgeries, such as endoscopic or robotic-assisted procedures, has led to advancements in tools and devices that make these surgeries less invasive and reduce recovery times. Marketing materials often highlight product features such as graft durability, ease of use for surgeons, and improved patient outcomes. By aligning their products with the ongoing need for effective, minimally invasive, and reliable coronary artery bypass solutions, these companies aim to strengthen their position in the USA CABG industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Technology | Off-pump CABG, On-pump CABG, Others |

| Procedure | Single CABG surgery, Double CABG surgery, Triple CABG surgery, Quadruple CABG surgery, Others |

| Key Companies Profiled | Medtronic plc, Terumo Corp., Guidant Group, Getinge AB |

| Additional Attributes | The market analysis includes dollar sales by technology and procedure categories. It also covers regional demand trends in the United States, particularly driven by the increasing incidence of coronary artery diseases and the growing number of CABG procedures. The competitive landscape highlights major manufacturers focusing on innovations in off-pump and on-pump CABG technologies. Trends in the growing demand for advanced coronary surgery techniques and the development of minimally invasive procedures are explored, along with advancements in surgical tools and grafting technologies. |

The global demand for coronary artery bypass graft in USA is estimated to be valued at USD 6.5 billion in 2025.

The market size for the demand for coronary artery bypass graft in USA is projected to reach USD 8.5 billion by 2035.

The demand for coronary artery bypass graft in USA is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in demand for coronary artery bypass graft in USA are off-pump cabg, on-pump cabg and others.

In terms of procedure, single cabg surgery segment to command 30.0% share in the demand for coronary artery bypass graft in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA