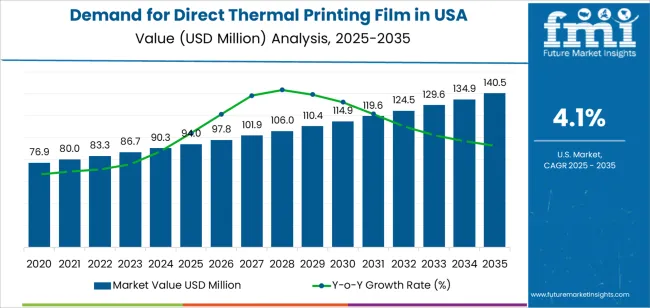

The demand for direct thermal printing film in the USA is expected to reach USD 140.3 million by 2035, reflecting an absolute increase of USD 46.3 million over the forecast period. The demand, valued at USD 94.0 million in 2025, is expected to grow at a robust 4.1% CAGR. This growth is primarily driven by the increasing adoption of direct thermal printing technology across various industries, particularly in retail, logistics, and healthcare, where efficiency and cost-effectiveness are key.

Direct thermal printing films are used for printing labels, receipts, and barcodes, with applications spanning retail, shipping, and healthcare industries. This printing technology is known for its reliability, cost-effectiveness, and ease of use. As businesses and organizations seek more efficient and affordable printing solutions, the demand for direct thermal printing film is expected to rise, particularly in environments where quick and high-volume printing is required. The retail sector, for example, uses direct thermal printing films for POS receipts and product labeling, while logistics companies use them for shipping labels and tracking.

The growing focus on cost-effective, eco-friendly, and low-maintenance printing solutions is contributing to the increasing adoption of direct thermal printing technology. Technological advancements that improve print quality and reduce costs are expected to drive further growth. The logistics and transportation sectors, which rely heavily on labeling and tracking solutions, are expected to be major contributors to this growth. The demand for direct thermal printing in the healthcare sector for patient identification labels and pharmaceutical packaging is expected to rise, further expanding the Industry.

Between 2025 and 2030, the demand for direct thermal printing film is projected to grow from USD 94.0 million to approximately USD 110.3 million, adding USD 16.3 million, which accounts for about 35.2% of the total forecasted growth for the decade. This period will see increased adoption in various sectors, driven by the rising need for efficient, cost-effective, and eco-friendly printing solutions.

From 2030 to 2035, the demand is expected to expand from approximately USD 110.3 million to USD 140.3 million, adding USD 30.0 million, which constitutes about 64.8% of the overall growth. This phase will be characterized by broader Industry adoption, continued technological advancements, and a growing need for scalable and efficient printing solutions, particularly in industries like logistics, retail, and healthcare.

| Metric | Value |

|---|---|

| Direct Thermal Printing Film Sales Value (2025) | USD 94.0 million |

| Direct Thermal Printing Film Forecast Value (2035) | USD 140.3 million |

| Direct Thermal Printing Film Forecast CAGR (2025-2035) | 4.10% |

The demand for direct thermal printing film in the USA is growing due to the increasing need for efficient, cost-effective, and environmentally friendly printing solutions. Direct thermal printing films are widely used in applications such as barcode labels, receipts, tickets, and shipping labels, where high-quality printing is required without the need for ink or toner. This technology is preferred in industries like retail, logistics, healthcare, and transportation due to its simplicity, reliability, and low operational costs.

The growing adoption of point-of-sale (POS) systems and the expansion of e-commerce are key drivers of this trend. As more businesses rely on barcode labels, shipping labels, and receipts for inventory management and transaction records, the demand for direct thermal printing films continues to rise. The increasing focus on automation and streamlining operational processes in industries such as logistics, manufacturing, and retail is further supporting the demand.

Advancements in direct thermal printing technology, including improved durability and high-quality image resolution, are also contributing to the growth. The shift towards more sustainable and paperless solutions, where direct thermal printing plays a role in reducing the need for ink and toner cartridges, is another factor driving growth. Despite challenges such as the limited shelf life of thermal prints and competition from alternative printing technologies, the overall demand for direct thermal printing films is expected to grow steadily as industries seek more efficient and sustainable printing options.

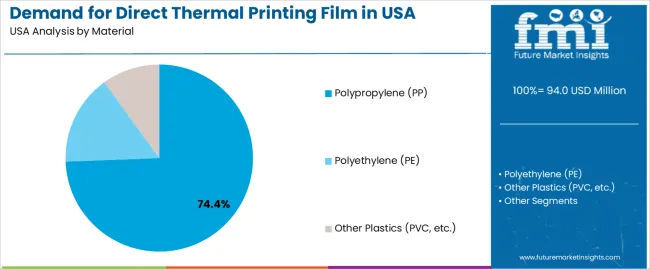

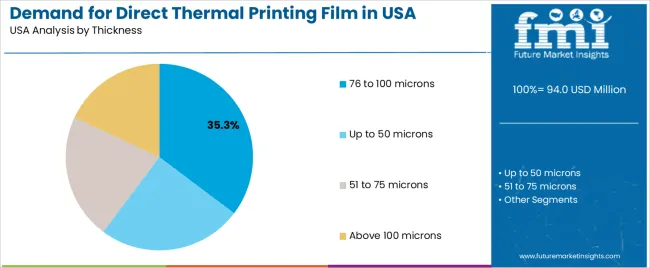

Demand is segmented by material, thickness, and region. By material, demand is divided into polypropylene (PP), polyethylene (PE), and other plastics such as PVC, with PP accounting for the largest share. By thickness, demand is segmented into 76-100 microns, up to 50 microns, 51-75 microns, and above 100 microns, with 76-100 microns representing the leading thickness category across the USA. Regionally, demand is divided into West, South, Northeast, and Midwest, with each region exhibiting distinct preferences for material and thickness based on local industrial and commercial requirements.

Polypropylene (PP) accounts for 74% of demand for direct thermal printing films in the USA, making it the dominant material category. PP is highly valued for its excellent printability, which allows for high-quality, clear images and text, crucial for applications such as retail labeling, food packaging, and logistics. Its durability and resistance to moisture, chemicals, and environmental factors further enhance its suitability for long-lasting applications, particularly in harsh conditions where exposure to heat and moisture is common.

PP’s versatility also makes it cost-effective compared to other materials, which has driven its widespread adoption across industries. The material’s strength in maintaining print quality, combined with its ability to withstand wear and tear during shipping and handling, makes it an ideal choice for high-volume applications. As consumer demand for reliable, durable packaging and labeling solutions continues to grow, polypropylene’s share of the Industry remains strong.

The 76-100 micron thickness range holds 35.3% of demand, making it the leading thickness segment in the USA. This thickness offers a balance between flexibility and durability, making it highly suitable for a wide range of applications, particularly in industrial and retail sectors. In environments such as shipping, barcoding, and inventory management, labels made from this thickness provide excellent resistance to tearing and wear, ensuring they remain legible and intact throughout their lifecycle.

The thickness range also offers optimal print quality, making it ideal for high-volume labeling systems where clear, durable prints are essential. This category’s popularity is driven by its versatility, as it can be used in both high-speed printing environments and for applications that require strong, long-lasting materials. The 76-100 micron range continues to dominate because it meets the performance needs of a wide variety of industries, from logistics to retail.

Direct thermal printing films offer key advantages such as no need for ink or ribbons, reducing operational costs. With the growth of e‑commerce, the need for durable, high‑quality printed labels, barcodes, and shipping tags is expanding. Key drivers include increased regulatory requirements, the rise of hybrid smart labels, and stronger demand for traceability and visibility in supply chains. Challenges such as higher costs, limited durability in harsh environments, and competition from alternative labelling solutions are slowing Industry growth.

Direct thermal printing film is gaining popularity in the USA because it provides a reliable, cost‑effective solution for printing high‑volume labels, tags, and barcodes, especially in industries like retail and logistics. The growing demand for quick turnaround in e‑commerce and on‑demand manufacturing drives the adoption of these films, as they require fewer consumables compared to traditional printing methods. These films are well‑suited for applications that require high clarity and durability, such as food safety labelling, pharmaceutical packaging, and inventory management. Technological innovations in film materials, such as enhanced coatings and eco‑friendly options, further boost their appeal in a Industry focused on performance and sustainability.

Technological innovations are driving growth in the direct thermal printing film Industry by improving print quality, durability, and cost‑effectiveness. Advancements in materials, including the development of high‑definition 3D thermal prints and coatings that improve the longevity of prints, are enhancing the functionality of these films. New developments in film thickness and surface coatings help improve the films' performance, especially in outdoor or harsh environments. Innovations such as integration with smart labels and the rise of hybrid printing systems are also driving demand for high‑performance direct thermal films. These innovations enable faster, more efficient printing and further enhance the versatility of direct thermal printing technology.

Despite strong demand, there are several challenges limiting the adoption of direct thermal printing films in the USA. One significant barrier is the higher cost compared to traditional paper-based thermal labels, which can deter smaller businesses or price-sensitive industries. Durability issues also pose a challenge, as direct thermal films may not perform well in extreme temperatures or environmental conditions. Compatibility issues with existing printing systems and hardware can also slow adoption, as businesses need to ensure the new films are compatible with their printers and supply chains. Supply chain disruptions, such as fluctuations in raw material costs or availability, can affect the consistency and pricing of these films, causing uncertainty for manufacturers.

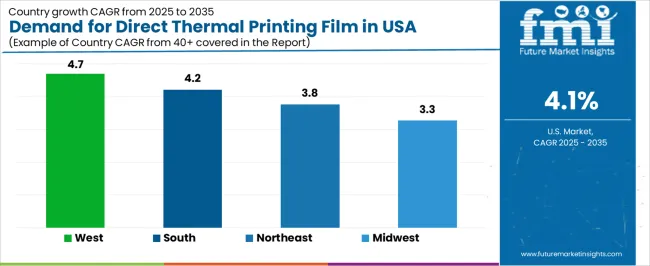

| Region | CAGR (%) |

|---|---|

| West | 4.7% |

| South | 4.2% |

| Northeast | 3.8% |

| Midwest | 3.3% |

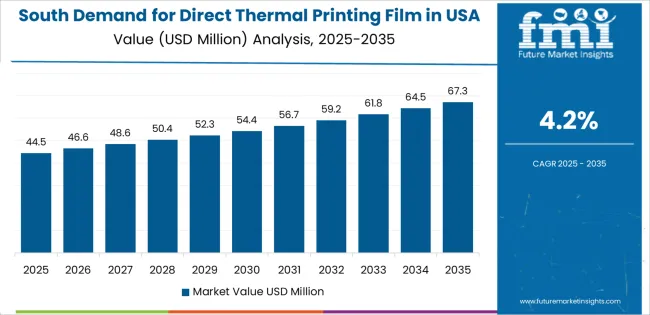

The demand for direct thermal printing film in the USA is expanding across various regions, with the West leading at a 4.7% CAGR. This growth is driven by the increasing adoption of direct thermal printing technology in industries like retail, logistics, and healthcare. The South follows with a 4.2% CAGR, supported by the region’s expanding commercial infrastructure and manufacturing activities. The Northeast shows a 3.8% CAGR, bolstered by a strong presence of businesses utilizing direct thermal printing for labeling and barcoding applications. The Midwest, while experiencing steady growth at 3.3%, continues to adopt direct thermal printing in packaging and inventory management sectors.

The West is experiencing the highest demand growth for direct thermal printing film in the USA, with a 4.7% CAGR. The region’s strong presence of retail, logistics, and e-commerce businesses is driving the demand for efficient and cost-effective labeling solutions. Cities like Los Angeles and San Francisco are hubs for commercial activity, where direct thermal printing is widely used for product labeling, barcoding, and inventory management. The growing emphasis on supply chain optimization in the West has increased the adoption of direct thermal printing solutions.

The region’s tech-driven economy and the rapid growth of e-commerce also contribute to the rise in demand for direct thermal printing films, particularly for shipping labels and receipts. With more businesses adopting automation and improving operational efficiencies, the use of direct thermal printing is expected to continue growing in the West, ensuring ongoing demand for thermal printing film.

The South is experiencing robust demand for direct thermal printing film, growing at a 4.2% CAGR. The region’s expanding commercial and manufacturing sectors, particularly in cities like Atlanta, Houston, and Miami, are key drivers of this growth. Industries such as logistics, retail, and food services, which require high-volume and high-quality printing solutions, are increasingly adopting direct thermal printing technology for labeling, receipts, and barcodes.

The South’s significant transportation and logistics network, including its distribution centers and warehouses, is contributing to the demand for direct thermal printing films, as efficient labeling is essential in inventory and shipment tracking. As businesses in the South continue to scale and adopt more automated processes, the need for direct thermal printing solutions will grow, boosting the demand for printing films in the region.

The Northeast is seeing steady growth in the demand for direct thermal printing film, with a 3.8% CAGR. The region’s strong commercial infrastructure and high concentration of businesses in industries like retail, healthcare, and logistics contribute to this growth. Major cities like New York and Boston are home to numerous businesses that rely on efficient, cost-effective labeling and barcoding solutions, driving the demand for direct thermal printing technology.

As e-commerce continues to grow and businesses adopt automation for labeling, packing, and shipping processes, the demand for direct thermal printing solutions in the Northeast is increasing. The region’s healthcare sector utilizes direct thermal printing for patient labels and pharmacy applications, further supporting the growth of this technology. As industries continue to seek more efficient printing solutions, the demand for direct thermal printing film in the Northeast will continue to rise.

The Midwest is experiencing moderate growth in the demand for direct thermal printing film, with a 3.3% CAGR. The region’s well-established manufacturing, retail, and distribution sectors are key drivers of this growth. Cities like Chicago, Detroit, and St. Louis are important commercial hubs where direct thermal printing is widely used for barcoding, product labeling, and inventory management in industries such as automotive, retail, and food processing.

As the Midwest continues to modernize its manufacturing and distribution processes, the demand for efficient printing technologies like direct thermal printing will continue to grow. The need for accurate and durable labeling solutions in packaging and logistics is a key factor contributing to the region’s steady demand for direct thermal printing film. As businesses in the Midwest increasingly adopt these technologies for improved operational efficiency, the demand for thermal printing film is expected to rise in the coming years.

The demand for direct thermal printing film in the USA is growing due to its widespread use in retail, logistics, and healthcare sectors. Direct thermal printing offers an efficient, cost-effective solution for printing labels, barcodes, and receipts without the need for ink, making it a preferred choice in environments that require fast, reliable printing solutions.

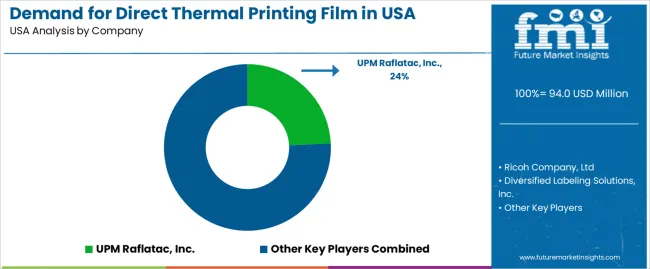

UPM Raflatac, Inc. leads the USA Industry with 24.2% of the demand share, thanks to its advanced thermal printing films that offer high-quality performance and durability. UPM Raflatac's strong position is attributed to its broad portfolio of label materials and commitment to sustainability, as the company continuously works on improving its products for a variety of applications.

Other major players contributing to the USA demand include Ricoh Company, Ltd., Diversified Labeling Solutions, Inc., McCourt Label Company, and Stylerite Label Corporation. Ricoh is known for its high-performance direct thermal printing solutions, which are widely used in retail and industrial applications. Diversified Labeling Solutions and McCourt Label Company focus on providing customized printing films that meet the needs of various industries, from inventory management to shipping logistics. Stylerite Label Corporation offers cost-effective, high-quality thermal films for label and barcode printing.

This growing demand is driven by the need for streamlined, ink-free printing processes that are essential in high-volume environments. With sectors like e-commerce, transportation, and healthcare expanding, the need for efficient and durable printing solutions continues to drive the adoption of direct thermal printing technology.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Material | Polypropylene (PP), Polyethylene (PE), Other Plastics (PVC, etc.) |

| Thickness | Up to 50 microns, 51 to 75 microns, 76 to 100 microns, Above 100 microns |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | UPM Raflatac, Inc., Ricoh Company, Ltd., Diversified Labeling Solutions, Inc., McCourt Label Company, Stylerite Label Corporation |

| Additional Attributes | Dollar sales by material and thickness categories, regional adoption trends, competitive landscape, advancements in direct thermal printing film technologies, integration with label printing and packaging industries. |

The global demand for direct thermal printing film in USA is estimated to be valued at USD 94.0 million in 2025.

The market size for the demand for direct thermal printing film in USA is projected to reach USD 140.5 million by 2035.

The demand for direct thermal printing film in USA is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in demand for direct thermal printing film in USA are polypropylene (pp), polyethylene (pe) and other plastics (pvc, etc.).

In terms of thickness, 76 to 100 microns segment to command 35.3% share in the demand for direct thermal printing film in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA