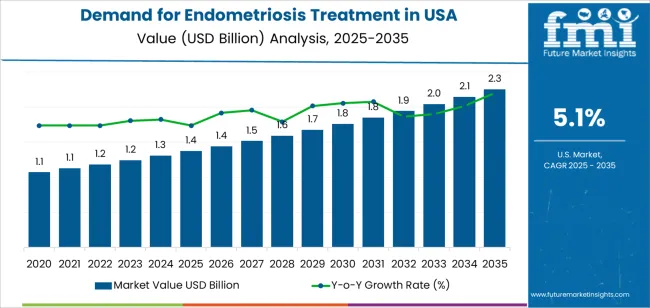

The demand for endometriosis treatment in the USA is projected to reach USD 2.3 billion by 2035, reflecting an absolute increase of USD 0.9 billion over the forecast period. The demand, valued at USD 1.4 billion in 2025, is expected to grow at a steady CAGR of 5%. This growth is driven by the increasing recognition of endometriosis as a prevalent and serious condition, with a growing focus on improved diagnostic techniques, more effective treatments, and better patient awareness.

Endometriosis, a condition where tissue similar to the lining of the uterus grows outside the uterus, can cause significant pain and infertility. As awareness of the condition rises, more women are being diagnosed, leading to an increasing demand for treatments. Advances in medical research and drug development, particularly in targeted therapies, are expected to improve the management of endometriosis symptoms and provide new treatment options. As healthcare systems continue to prioritize women's health, investment in research, diagnostics, and treatment options for endometriosis is likely to grow, further driving demand.

The shift toward personalized and biologic therapies, alongside the increasing acceptance of non-invasive treatments, will contribute to the demand for new and more effective solutions for women suffering from endometriosis.

The half-decade weighted growth analysis provides an insight into the distribution of growth between the early and later parts of the forecast period. From 2025 to 2030, the growth rate for the demand for endometriosis treatment in the USA will be moderate, with demand rising from USD 1.4 billion to USD 1.5 billion, an increase of USD 0.1 billion. This reflects a 5.7% increase, driven by incremental improvements in diagnosis and treatment options, such as pain management and hormonal therapies.

The next five years, from 2030 to 2035, will see much stronger growth, with the demand rising from USD 1.5 billion to USD 2.3 billion, adding USD 0.8 billion. This phase is expected to account for the 88.9% of the total growth during the decade, with a compounded growth of 53.3%. The acceleration will be driven by increased availability of advanced biologics and personalized therapies, along with improvements in diagnostic technology and treatment accessibility. The later half of the forecast period will see more significant advancements in research, resulting in more effective and targeted treatments.

| Metric | Value |

|---|---|

| USA Endometriosis Treatment Sales Value (2025) | USD 1.4 billion |

| USA Endometriosis Treatment Forecast Value (2035) | USD 2.3 billion |

| USA Endometriosis Treatment Forecast CAGR (2025 2035) | 5% |

The demand for endometriosis treatment in the USA is growing as awareness of the condition increases and more women seek care for a disease that was historically under-recognized. Endometriosis affects a significant number of women of reproductive age, and improved awareness is leading to earlier diagnoses and higher treatment uptake. Educational initiatives and better access to specialized care are supporting this trend, helping women seek timely interventions.

The development of advanced therapeutic options, including new hormone-based treatments, and minimally invasive surgical techniques is also contributing to the growing demand. These innovations help manage symptoms, reduce pain, and preserve fertility, which remains a priority for many patients. As treatment options improve, so does the quality of life for patients, which in turn boosts treatment demand.

Changes in healthcare policy, such as shifts in reimbursement frameworks and increased funding for women's health, are also playing a role. These adjustments make treatments more accessible and help integrate endometriosis care into standard healthcare practices. As a result, demand is expected to rise over the coming years, driven by both clinical need and the growing number of patients seeking better outcomes. This trend is likely to continue as more effective treatment options become available and awareness continues to grow.

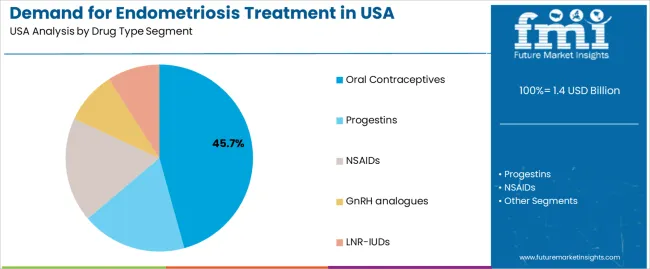

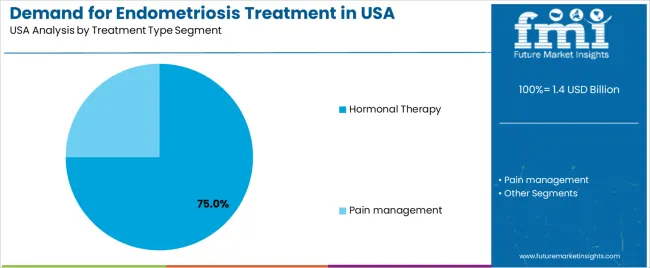

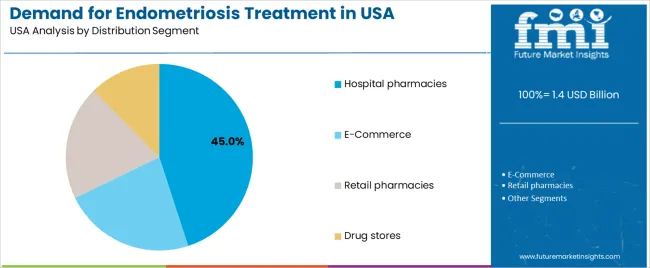

Demand is segmented by drug type, treatment type, and distribution channel. By drug type, demand is divided into oral contraceptives, progestins, NSAIDs, GnRH analogues, and LNR-IUDs, with oral contraceptives holding the largest share. Based on treatment type, demand is categorized into hormonal therapy and pain management, with hormonal therapy leading. Distribution includes hospital pharmacies, e-commerce, and retail pharmacies, with hospital pharmacies accounting for the highest share. Regionally, demand is divided into West, South, Northeast, and Midwest.

Oral contraceptives account for 46% of endometriosis treatment demand in the USA. They are widely preferred because they effectively reduce estrogen levels, helping to manage symptoms such as pelvic pain, inflammation, and menstrual irregularities. Oral contraceptives are also affordable, easily accessible, and commonly prescribed as a first-line treatment, making them a practical option for long-term symptom management. Their non-invasive nature and suitability for continuous use further contribute to their popularity among both patients and healthcare providers.

Another reason for their dominance is their dual benefit: regulating menstrual cycles while lowering the risk of symptom flare-ups. They are also widely used by patients with mild to moderate endometriosis who prefer to avoid more aggressive treatments such as GnRH analogues or surgical intervention. With increasing awareness of early diagnosis and proactive symptom control, oral contraceptives continue to be the most relied-upon treatment option in the USA. Their broad availability in both hospital and retail pharmacies supports their ongoing leadership in managing endometriosis symptoms.

Hormonal therapy accounts for 75% of endometriosis treatment demand because it directly targets the hormonal imbalances that drive lesion growth and pain. By suppressing estrogen production, hormonal therapy helps slow the progression of endometrial tissue growth outside the uterus. Treatments such as oral contraceptives, progestins, GnRH analogues, and LNR-IUDs all fall under this category, offering multiple options tailored to symptom severity and patient preference.

Hormonal therapy is also preferred because it is non-surgical and provides long-term symptom relief, making it suitable for chronic management of endometriosis. Many patients in the USA seek therapies that help reduce painful symptoms while preserving fertility, and hormonal options meet this need better than pain-only treatments. Moreover, ongoing research and improved drug formulations have expanded the effectiveness and tolerability of hormonal therapies. As more healthcare providers prioritize early intervention and continuous management, hormonal therapy remains the dominant and most trusted approach for controlling endometriosis-related symptoms.

Hospital pharmacies account for 45% of endometriosis treatment distribution in the USA, making them the leading channel. Their dominance is driven by the fact that many endometriosis patients receive initial diagnosis and treatment recommendations directly within hospital settings. Hospital pharmacies often stock advanced hormonal therapies, including injectables and specialized medications that may not be immediately available in retail locations, ensuring timely access to prescribed treatments.

Patients with moderate to severe symptoms frequently rely on specialist consultations, which are commonly linked to hospital systems. This increases the likelihood of prescriptions being filled at hospital pharmacies. Hospital-based pharmacists also provide guidance on managing side effects, adjusting hormonal therapy plans, and ensuring proper medication adherence, which enhances patient confidence and reliability. With hospitals playing a major role in diagnosing and managing chronic gynecological conditions, hospital pharmacies naturally remain a key distribution point for endometriosis therapies. As awareness and screening efforts continue to increase nationwide, hospital pharmacy demand is expected to grow.

Demand for endometriosis treatment in the USA is increasing as awareness of the condition grows, particularly among women of reproductive age. The primary treatments include hormonal therapies, pain management, and surgery. Key drivers include the rising recognition of the condition, the need for non‑invasive treatments, and increasing healthcare spending. Challenges such as the high cost of newer therapies, diagnostic delays, and insurance barriers continue to limit the full industry potential.

The demand for endometriosis treatment in the USA is increasing because more women are seeking effective management of chronic pelvic pain, infertility and impaired quality of life caused by the condition. As diagnosis rates improve, more patients are entering care pathways and requiring treatment. In addition, pharmaceutical advances such as oral therapies and novel hormonal agents are offering new options beyond traditional surgery and general pain relief, which encourages uptake. The societal and economic burden of undiagnosed or poorly managed disease is prompting healthcare systems and payers to support more proactive treatment strategies.

Innovations are a major growth factor in the USA endometriosis treatment arena. New therapeutic classes (such as gonadotropin‑releasing hormone antagonists), improved diagnostic tools (potentially biomarker or imaging based) and patient‑centric delivery formats (oral dosing, minimal‑invasive interventions) are enhancing treatment uptake. Better clinical trial activity and investment are broadening the pipeline for disease‑modifying treatments, which appeals to patients beyond symptom relief. These advances help address unmet needs, drive clinician confidence and expand the treatable patient population.

Despite strong growth drivers, the USA industry for endometriosis treatment faces several constraints. A major barrier is high cost and patient affordability innovative therapies often come with premium pricing and may face reimbursement hurdles. Diagnostic delay and under‑recognition remain significant many women experience symptoms for years before receiving a proper diagnosis, which limits treatment uptake. Another challenge is limited long‑term data on emerging therapies, making payers cautious. Side‑effect concerns and patient compliance with hormonal treatments can reduce sustained use, which impacts overall demand uptake.

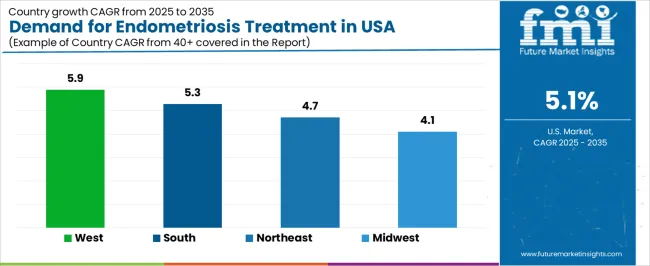

| Region | CAGR (%) |

|---|---|

| West | 5.9% |

| South | 5.3% |

| Northeast | 4.7% |

| Midwest | 4.1% |

The demand for endometriosis treatment in the USA is growing across regions, with the West leading at a 5.9% CAGR. This growth is primarily driven by the increasing number of diagnosed cases, growing patient awareness, and the expanding availability of therapies. The South follows at 5.3%, with rising demand for women’s health services in metropolitan and suburban areas. The Northeast shows a 4.7% CAGR, backed by strong academic medical centers and healthcare infrastructure supporting advanced treatment options. The Midwest experiences more moderate growth at 4.1%, influenced by ongoing improvements in access to care in less densely populated areas.

The West is experiencing the highest demand growth for endometriosis treatment in the USA, at a 5.9% CAGR. The region is home to many advanced healthcare facilities and leading specialists in women’s health, which contributes to early diagnosis and access to cutting-edge treatments. In particular, California and neighboring states are at the forefront of providing a wide range of treatment options, including advanced surgical procedures and novel therapies.

The growing focus on women’s reproductive health, as well as high patient awareness about endometriosis and its impact on fertility, is further boosting demand. The region’s robust insurance coverage and public awareness campaigns are increasing the number of women seeking treatment. As new therapies and minimally invasive surgeries become more widely available, the West will likely continue to lead the country in the adoption of endometriosis treatments.

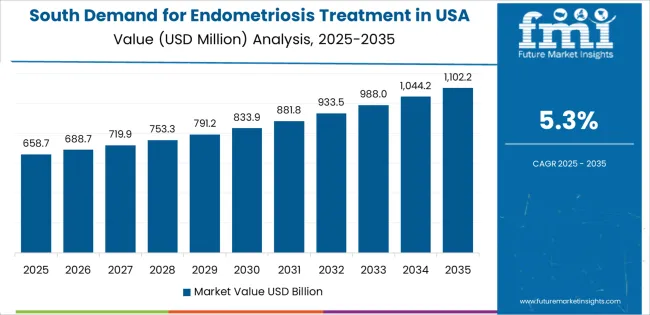

In the South, demand for endometriosis treatment is growing at a 5.3% CAGR. The region has seen an increase in women’s health services, particularly in metropolitan and suburban areas like Texas, Florida, and Georgia, which are now becoming hubs for specialized gynecology and surgical treatment. With the rise of e-commerce and telemedicine, many patients in the South now have greater access to resources and support, contributing to a higher diagnosis rate and treatment uptake.

A stronger focus on addressing women's health issues at both the private and government levels is accelerating the adoption of therapies. Awareness campaigns are helping women understand the severity of symptoms and the available treatment options, which, in turn, is leading to higher patient demand. As healthcare infrastructure and access continue to improve, the growth of endometriosis treatment in the South is expected to remain robust.

The Northeast is experiencing steady demand growth for endometriosis treatment, with a 4.7% CAGR. This region benefits from a high concentration of academic institutions, research organizations, and healthcare facilities that provide specialized care. Cities like New York and Boston have a strong network of specialists and advanced treatment options for endometriosis, leading to earlier diagnosis and more tailored therapies for patients.

The presence of top-tier medical centers also facilitates clinical trials and new treatment innovations, which increases the availability of cutting-edge therapies. High healthcare expenditure and better insurance coverage in the Northeast allow patients to access the latest advancements in treatment. As public awareness about the condition continues to rise, the demand for endometriosis treatment in the Northeast is expected to remain strong.

The Midwest is experiencing more moderate growth in demand for endometriosis treatment, with a 4.1% CAGR. This region has a mix of urban and rural populations, which can impact the speed of adoption of specialized care. In major cities like Chicago and Detroit, there is increasing access to high-quality women’s health services, but rural areas still face challenges in accessing specialized treatment.

Despite these challenges, the Midwest is seeing improvements in healthcare infrastructure, with more focus on women’s health in recent years. As healthcare providers in these areas enhance their services and more awareness is raised about the condition, the demand for endometriosis treatment is steadily increasing. The region’s healthcare evolution and growing access to treatment options ensure that demand will continue to rise, though at a slower rate compared to coastal regions.

Demand for treatments targeting endometriosis in the United States is witnessing significant growth, driven by increasing prevalence, heightened awareness, and the development of novel therapeutic options. Endometriosis which affects a substantial number of women of reproductive age poses both clinical and economic burdens, prompting healthcare providers to adopt advanced management strategies.

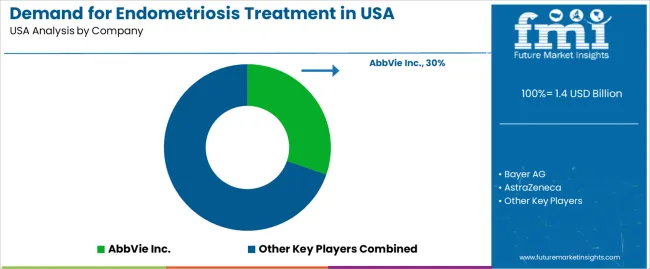

In the USA demand landscape, AbbVie Inc. holds a notable share of around 30.3%, underscoring its strong presence in the woman’s health and gynecological therapeutic area. Other key players supporting demand include Bayer AG, AstraZeneca, Pfizer Inc., and Teva Pharmaceutical Industries Ltd., each contributing through hormone therapies, pain‑management drugs, or emerging treatments aimed at managing endometriosis symptoms and associated fertility concerns.

Factors fueling demand include the rise in minimally invasive surgical procedures, growth in hormone‑based therapies, and increasing patient demand for effective non‑surgical interventions. The push toward personalized medicine and long‑term management of endometriosis rather than short‑term symptom relief is enhancing uptake of dedicated treatments. While challenges such as high treatment costs, diagnostic delays, and variable therapeutic response remain, the demand outlook remains strong. Healthcare systems and manufacturers are expected to focus on expanding access, enhancing patient education, and rolling out novel therapies that cater to this underserved condition.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Drug Type Segment | Oral Contraceptives, Progestins, NSAIDs, GnRH Analogues, LNR-IUDs |

| Treatment Type Segment | Hormonal Therapy, Pain Management |

| Distribution Segment | Hospital Pharmacies, E-Commerce, Retail Pharmacies, Drug Stores |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | AbbVie Inc., Bayer AG, AstraZeneca, Pfizer Inc., Teva Pharmaceutical Industries Ltd. |

| Additional Attributes | Dollar sales by drug type, treatment type, distribution segment, and regional trends |

The global demand for endometriosis treatment in USA is estimated to be valued at USD 1.4 billion in 2025.

The market size for the demand for endometriosis treatment in USA is projected to reach USD 2.3 billion by 2035.

The demand for endometriosis treatment in USA is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in demand for endometriosis treatment in USA are oral contraceptives, progestins, nsaids, gnrh analogues and lnr-iuds.

In terms of treatment type segment, hormonal therapy segment to command 75.0% share in the demand for endometriosis treatment in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA