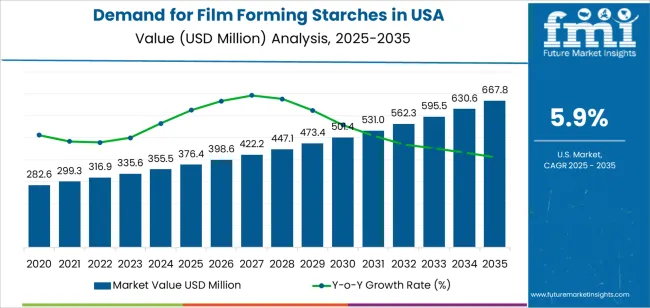

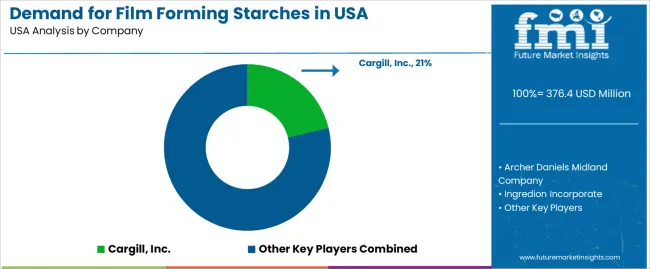

The demand for film-forming starches in the USA is projected to reach USD 667.2 million by 2035, reflecting an absolute increase of USD 290.8 million over the forecast period. The demand, valued at USD 376.4 million in 2025, is expected to grow at a robust CAGR of 5.90%. This growth is primarily driven by the increasing adoption of starch-based film-forming agents across industries such as food and beverages, pharmaceuticals, personal care, and biodegradable packaging.

The growth trajectory of film-forming starches in the USA shows both acceleration and deceleration throughout the forecast period. Between 2025 and 2030, the demand will grow steadily at a moderate pace, with an increase of approximately USD 22.2 million. This period reflects a consistent, albeit slower, adoption as industries begin to explore starch-based alternatives more seriously but have yet to fully shift from traditional materials.

From 2030 to 2035, the growth is expected to accelerate significantly, adding USD 268.6 million to the demand. This acceleration can be attributed to a combination of factors: increasing environmental regulations, consumer preference for eco-friendly products, and technological advancements in starch formulations that improve performance and versatility. The shift toward biodegradable packaging, especially in the food and beverage sector, will be a major contributor to this accelerated growth, as more industries adopt these solutions to meet consumer and regulatory demands for eco-friendly products.

Between 2025 and 2030, the demand for film-forming starches in the USA is projected to grow from USD 376.4 million to approximately USD 398.6 million, adding USD 22.2 million, which accounts for about 7.6% of the total forecasted growth for the decade. This period will see steady growth driven by the increasing demand for natural, biodegradable materials across various industries, including food coatings, packaging, and pharmaceuticals. As eco-consciousness becomes a key consumer concern, industries are turning to starch-based alternatives for both functional and environmental benefits, with a growing preference for materials that are renewable and biodegradable.

From 2030 to 2035, the demand is expected to expand significantly, from approximately USD 398.6 million to USD 667.2 million, adding USD 268.6 million, which constitutes about 92.4% of the total growth. This phase will be characterized by accelerated adoption of biodegradable packaging solutions, particularly in the food and beverage industries, as consumers increasingly prioritize eco-friendly products. Innovations in starch-based technologies that improve film strength, flexibility, and shelf life will further boost demand.

| Metric | Value |

|---|---|

| Film Forming Starches Value (2025) | USD 376.4 million |

| Film Forming Starches Forecast Value (2035) | USD 667.2 million |

| Film Forming Starches Forecast CAGR (2025-2035) | 5.90% |

The demand for film forming starches in the USA is growing due to the increasing use of starches in a variety of applications, particularly in the food, pharmaceutical, and cosmetic industries. Film forming starches are widely used as functional ingredients in food coatings, packaging materials, and controlled release systems for pharmaceuticals. These starches provide a natural, biodegradable alternative to synthetic materials, which is driving their adoption in industries seeking eco-friendlier and eco-friendly solutions.

The rising focus on eco-friendly packaging and green technologies is a key driver for the growth of film forming starches. In the food industry, these starches are used in edible coatings for products such as fruits and vegetables, helping to extend shelf life while maintaining food safety standards. The growing demand for gluten-free and plant-based alternatives in food products is fueling the use of starches derived from natural sources like corn, potato, and tapioca.

In the pharmaceutical sector, film forming starches are being increasingly used in drug delivery systems, where they provide controlled release properties for medications. The use of film forming starches in cosmetics, particularly in skin and hair care products, is also contributing to industry growth. As consumers seek more natural and biodegradable products, the demand for film forming starches as a key ingredient in these industries is expected to continue growing in the coming years.

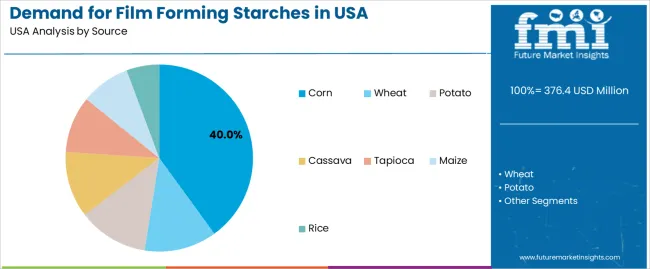

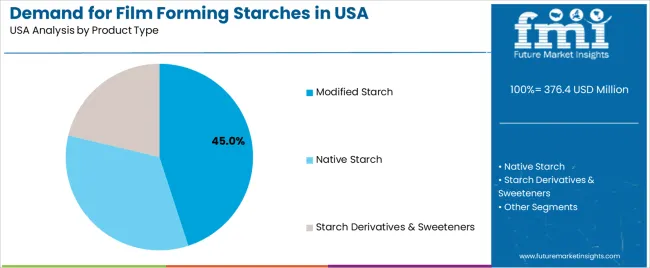

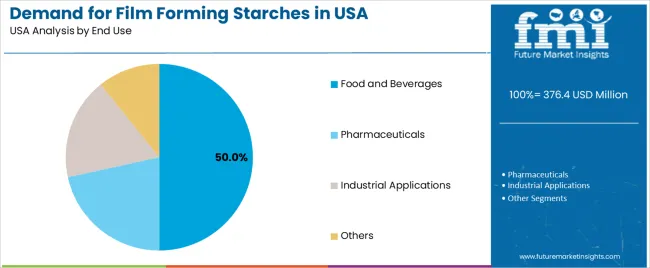

Demand is segmented by source, product type, end use, and region. By source, demand is divided into corn, wheat, potato, cassava, tapioca, maize, and rice. Based on product type, demand is categorized into modified starch, native starch, and starch derivatives & sweeteners. By end use, demand is segmented into food and beverages, pharmaceuticals, industrial applications, and others. Regionally, demand is divided into West, South, Northeast, and Midwest.

Corn accounts for 40% of the demand for film forming starches in the USA. Corn starch is widely used due to its excellent availability, cost-effectiveness, and versatility in a range of applications. In the food and beverage sector, corn starch serves as a thickening agent, stabilizer, and binder for products like sauces, soups, and beverages. It is used in the production of films for packaging due to its superior film-forming properties. The high yield and widespread cultivation of corn in the USA make it a reliable and cost-efficient source of starch. Its adaptability in the food industry, as well as in pharmaceuticals and industrial applications, has secured corn’s dominance in the film-forming starch sector across the country.

Modified starch accounts for 45% of the demand for film forming starches in the USA. Modified starches have superior functional properties, such as enhanced stability, texture, and viscosity, which make them suitable for a wide range of applications. In the food and beverage industry, they are used to improve the consistency and shelf life of products like sauces, dressings, dairy items, and baked goods. Modified starch is also essential in the pharmaceutical sector, where it is used as a binder or disintegrant in tablet formulations. The growing demand for products with improved functional characteristics and extended shelf life ensures that modified starch remains the leading product type in the film-forming starch industry. Its versatility and ability to be tailored for specific applications further reinforce its dominant position in the industry.

The food and beverages sector accounts for 50% of the demand for film forming starches in the USA. This is primarily due to the essential role of starches in enhancing the texture, stability, and shelf life of processed food products. Starches, particularly modified starches, are used as thickeners, stabilizers, and gelling agents in various food products such as sauces, soups, snacks, dairy, and beverages.

As consumer preferences for convenient, ready-to-eat, and packaged foods continue to rise, the food and beverage sector remains the largest consumer of film-forming starches. Moreover, starches are widely used in the production of food packaging films, further strengthening their position in the food sector. As the demand for processed and packaged food continues to grow, the food and beverages sector will remain the dominant driver of starch demand in the USA.

The West region accounts for a significant portion of the demand for film forming starches in the USA. This is driven by the region’s robust food processing industry, particularly in states like California, which is a major hub for food production, processing, and packaging. The West is also home to many large-scale manufacturers of starches used in the food, pharmaceutical, and industrial sectors.

The region’s demand is further supported by the growing trend of health-conscious consumers seeking organic and cleaner-label food products, which increases the need for organic and modified starches. The West’s established infrastructure for both food production and research, combined with a strong presence of innovation in the food and beverage sectors, drives the ongoing demand for film-forming starches. The region's leadership in both agricultural production and food manufacturing ensures its continued dominance in the starch sector.

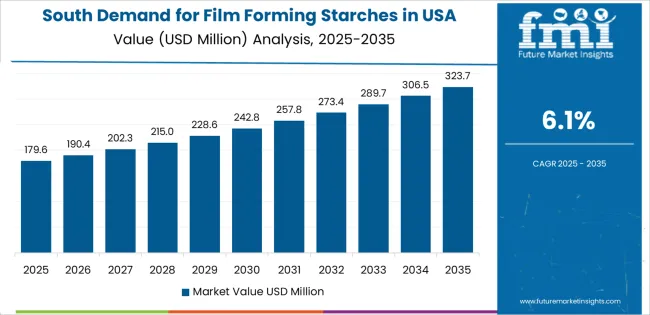

The South region also shows a significant demand for film forming starches, particularly in food processing applications. States like Texas, Georgia, and Florida are major centers for food production, especially in processed foods, snacks, and beverages, which rely heavily on starches as thickening agents, stabilizers, and binders. The region’s focus on the agricultural sector, including corn and wheat production, supports the availability of raw materials for starch production.

The South has a high concentration of industrial and manufacturing facilities, including those in the pharmaceutical and packaging industries, which further drives demand for starch-based ingredients. With an increasing trend towards convenience foods and ready-to-eat meals, the South’s demand for starches, especially for film-forming applications, is expected to continue growing.

Film forming starches provide functionalities such as film formation, stabilisation, and surface protection in food, pharmaceutical, personal‑care, and industrial coating applications. Key drivers include the push for clean‑label ingredients, rising interest in sustainable packaging, and increasing use of starch‑based films in food‑contact materials. Restraints include formulation challenges, such as moisture and mechanical durability, higher costs for specialised modified starches, and inertia in switching from established synthetic film‑forming systems.

In the USA, demand is growing because manufacturers and brands are under pressure from regulators and consumers to reduce synthetic polymers and replace them with natural alternatives. Many food and beverage, cosmetics, and packaging companies are integrating film‑forming starches to deliver edible films, protective coatings, and biodegradable laminate layers. The trend toward minimal‑processing, traceability, and plant‑derived ingredients supports this uptake. Starch‑based films are being seen as enablers of novel formats, such as edible packaging and soluble single‑use items, which align with e‑commerce demands and sgoals.

Technological advances are driving growth by improving performance and broadening the applicability of film‑forming starches in the USA industry. Innovations include modified starches with enhanced film‑forming ability, improved barrier properties, and compatibility with high‑speed processing lines in food and packaging. Novel additive systems such as plasticisers, nanoparticles, or blends with lipids enhance mechanical strength or reduce brittleness of starch films. These enhancements allow starch films to compete more closely with synthetic films, facilitating adoption by formulators seeking natural or sustainable options.

Despite strong potential, several challenges limit broader adoption of film‑forming starches in the USA. A significant barrier is performance under demanding conditions starch‑based films can be more sensitive to moisture, may have weaker mechanical strength, or less durability than synthetic alternatives. Higher cost or complexity of processing modified starches to achieve film‑forming functionality can deter switching in cost‑sensitive applications. Formulation and processing inertia, including compatibility with existing equipment and ensuring regulatory compliance for food‑contact or pharmaceutical applications, may slow adoption. Overcoming these constraints is crucial for film‑forming starches to gain deeper penetration in USA industrial applications.

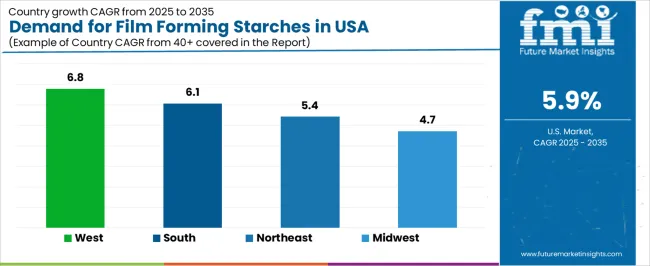

| Region | CAGR (%) |

|---|---|

| West | 6.8% |

| South | 6.1% |

| Northeast | 5.4% |

| Midwest | 4.7% |

The demand for film forming starches in the USA is growing across various regions, with the West leading at a 6.8% CAGR. This growth is driven by the expanding applications of film-forming starches in the food, pharmaceutical, and personal care industries. The South follows with a 6.1% CAGR, supported by the increasing use of these starches in the manufacturing of coatings, adhesives, and other industrial applications. The Northeast shows a 5.4% CAGR, driven by ongoing innovations in food processing and the growing demand for natural, eco-friendly ingredients. The Midwest, while growing at a more moderate 4.7%, continues to adopt film-forming starches in food production and packaging due to their functional and eco-friendly properties.

The West is experiencing the highest demand growth for film forming starches in the USA, with a 6.8% CAGR. The region's growing demand for eco-friendly and eco-friendly solutions, particularly in food packaging, personal care, and pharmaceutical industries, is driving the adoption of film-forming starches. States like California and Washington, with their focus on eco-consciousness and innovation, are contributing significantly to this trend. These starches are increasingly used in food coatings, edible films, and biodegradable packaging due to their natural and biodegradable properties.

The growing trend towards natural, clean-label ingredients in food and cosmetics is further driving the demand for film-forming starches. Consumers are increasingly seeking products that contain eco-friendly and non-toxic ingredients, making starch-based films an attractive option. The region’s ongoing focus on reducing plastic USAge and exploring alternative materials is expected to continue driving the demand for film-forming starches as an eco-friendly alternative.

The South is seeing strong growth in the demand for film forming starches, with a 6.1% CAGR. The region’s expanding manufacturing base, particularly in food production, pharmaceuticals, and packaging, is a major driver of this trend. States like Texas, Georgia, and Florida are becoming hubs for industries that use film-forming starches in coatings, adhesives, and food products. These starches are valued for their functional properties, including the ability to create strong, flexible films that enhance product stability and shelf life.

The increasing demand for eco-friendly and eco-friendly alternatives in the packaging and food sectors is also fueling the adoption of film-forming starches. As manufacturers in the South continue to focus on producing greener and healthier products, the demand for these starches is expected to rise. With the growing interest in reducing plastic waste and utilizing biodegradable materials, the South’s demand for film-forming starches is set to continue its upward trajectory.

The Northeast is experiencing steady growth in the demand for film forming starches, with a 5.4% CAGR. The region's strong presence in the food processing and pharmaceutical industries is a key factor driving this growth. Cities like New York and Boston, which are known for their focus on innovation and eco-consciousness, are contributing to the increasing use of starch-based films in food packaging, coatings, and nutritional products. These starches offer an eco-friendly, cost-effective alternative to synthetic materials in various applications.

The Northeast’s focus on health-conscious and environmentally aware consumers has also contributed to the rise in demand for natural, plant-based ingredients. Film-forming starches, which offer biodegradable and non-toxic properties, align with the region’s growing emphasis on clean-label products and eco-friendly manufacturing practices. As the food and pharmaceutical industries continue to innovate, the demand for these starches will likely continue to grow in the Northeast.

The Midwest is seeing steady growth in the demand for film forming starches, with a 4.7% CAGR. The region’s strong agricultural base, particularly in states like Illinois, Michigan, and Ohio, plays a significant role in driving the adoption of film-forming starches. The Midwest’s established food production and packaging industries are increasingly using starch-based films due to their functional properties and eco-friendly nature. These starches are utilized in a variety of food applications, from coatings to edible films, and are gaining traction in packaging as part of the movement toward reducing plastic waste.

The Midwest’s commitment to improving the nutritional value of food and exploring eco-friendlier packaging solutions is contributing to the rising use of film-forming starches. While growth in the Midwest is more moderate compared to other regions, the ongoing trend toward eco-consciousness and the need for natural, biodegradable materials in food production and packaging ensures continued demand for these starches. As food companies in the Midwest continue to prioritize eco-consciousness, the use of film-forming starches will likely see steady growth.

The demand for film forming starches in the USA is being driven by expanding applications in food and beverage packaging, pharmaceuticals, and personal‑care coatings. These specialty starches create thin, functional films that provide barrier, film‑forming and sustainability advantages ideal for manufacturers seeking natural‑origin ingredients with performance properties. In North America, where regulatory and consumer pressure support cleaner‑label and bio‑based solutions, film‑forming starches are becoming an increasingly preferred choice.

In the USA, Cargill, Inc. holds an estimated 21.2% share of demand for film‑forming starches, reflecting its strong product portfolio and broad customer base across food, packaging and industrial sectors. Other major contributors in the USA demand pool include the likes of Archer Daniels Midland Company (ADM), Ingredion Incorporated, and Tate & Lyle PLC, each supplying modified and native starch systems that meet functional and regulatory needs.

Key growth drivers in the USA include the shift toward sustainable and bio‑based coatings, increased use of edible films and biodegradable packaging, and rising consumption of fortified and convenience foods requiring advanced film‑forming starch solutions. Meanwhile, challenges such as competition from synthetic polymers and the requirement for high‑functional performance place pressure on adoption in cost‑sensitive segments. Overall, demand for film‑forming starches in the USA remains strong and looks set to grow, bolstered by sustainability trends, regulatory backing, and innovation in starch functionality.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Source | Corn, Wheat, Potato, Cassava, Tapioca, Maize, Rice |

| Product Type | Modified Starch, Native Starch, Starch Derivatives & Sweeteners |

| End Use | Food and Beverages, Pharmaceuticals, Industrial Applications, Others |

| Form | Dry, Liquid |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Cargill, Inc., Archer Daniels Midland Company, Ingredion Incorporated, Tate and Lyle PLC, AGRANA Beteiligungs AG |

| Additional Attributes | Dollar sales by source, product type, and end-use categories, regional adoption trends, competitive landscape, advancements in film-forming starch technologies, integration with food, beverage, and pharmaceutical industries. |

The global demand for film forming starches in USA is estimated to be valued at USD 376.4 million in 2025.

The market size for the demand for film forming starches in USA is projected to reach USD 667.8 million by 2035.

The demand for film forming starches in USA is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in demand for film forming starches in USA are corn, wheat, potato, cassava, tapioca, maize and rice.

In terms of product type, modified starch segment to command 45.0% share in the demand for film forming starches in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA