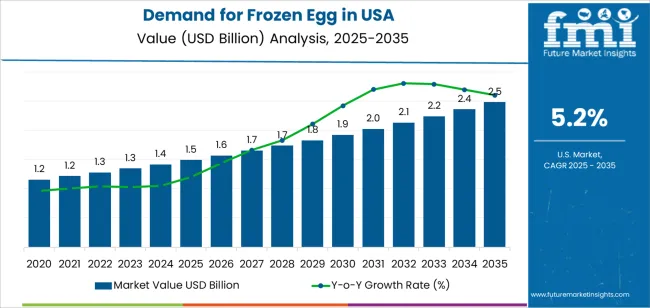

The demand for frozen egg in the USA is expected to grow from USD 1.5 billion in 2025 to USD 2.5 billion by 2035, reflecting a CAGR of 5.2%. Frozen eggs are increasingly used in the food processing, bakery, and food service industries, as they provide a convenient, cost-effective alternative to fresh eggs. As demand for processed foods, ready-to-eat meals, and bakery products continues to rise, frozen eggs will remain an essential ingredient. Their long shelf life, ease of storage, and consistent quality make them a favored choice for manufacturers in various food production sectors.

The market will also benefit from rising trends in food convenience, cost optimization, and the growing demand for egg-based products. The increasing popularity of plant-based alternatives, while notable, will not significantly impact the frozen egg segment, as the demand for traditional egg products, particularly for baking and cooking, continues to be high.

From 2025 to 2026, the demand for frozen eggs in the USA is expected to grow from USD 1.5 billion to USD 1.6 billion, reflecting a YoY increase of 6.7%. This early growth is driven by the increasing demand for processed food, convenience foods, and bakery products, where frozen eggs are often used due to their cost-effectiveness and long shelf life. As food manufacturers look for efficient and reliable ingredients, frozen eggs will continue to be a preferred option, especially in commercial production of cakes, pastries, and other baked goods. This early growth also reflects the broader trend of increasing consumer demand for products with extended shelf life and ease of use.

From 2026 to 2035, the growth rate stabilizes, with YoY growth expected to remain relatively steady throughout the forecast period. The demand will continue to rise, with a slight decrease in the growth rate over time. For instance, between 2026 and 2027, the market will grow from USD 1.6 billion to USD 1.7 billion, marking a YoY increase of 6.3%, driven by the steady adoption of frozen eggs in the foodservice sector and quick-service restaurants. Later, from 2032 to 2033, demand will increase from USD 2.1 billion to USD 2.2 billion, showing a YoY growth of 4.8% as the segment matures. Throughout the period, the market will see consistent growth fueled by demand from commercial food production, baked goods industries, and ready-to-eat meal segments, even as the growth rate moderates toward the end of the forecast period.

| Metric | Value |

|---|---|

| USA Frozen Egg Industry Sales Value (2025) | USD 1.5 billion |

| USA Frozen Egg Industry Forecast Value (2035) | USD 2.5 billion |

| USA Frozen Egg Industry Forecast CAGR (2025-2035) | 5.2% |

Demand for frozen egg products in the USA is increasing as foodservice, bakery and prepared meal manufacturers seek ingredient solutions that deliver consistent functional performance, longer shelf life and streamlined operations. Frozen whole eggs, egg whites and yolks are valued for their ability to maintain emulsification, foaming and binding characteristics while supporting food safety and automation goals. As large scale food production and commercial kitchens expand their operations, the appeal of frozen egg inputs grows.

Another factor supporting demand is the growth of convenience oriented food trends and the rise of ready to eat meals, snack production and bakery items that require quality egg ingredients with minimal handling. Suppliers are investing in processing technologies and controlled freezing systems to meet these needs. Despite some pressure from fluctuating shell egg supplies and broader ingredient cost volatility, the functional and operational advantages of frozen egg solutions ensure that demand in the USA remains solid and is projected to grow steadily.

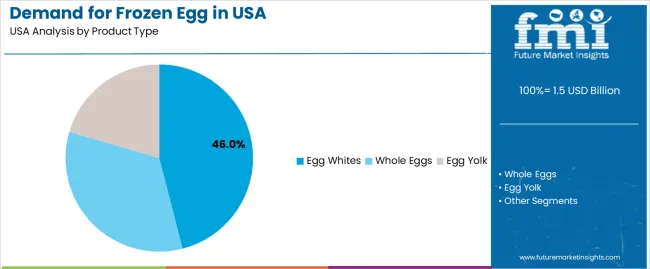

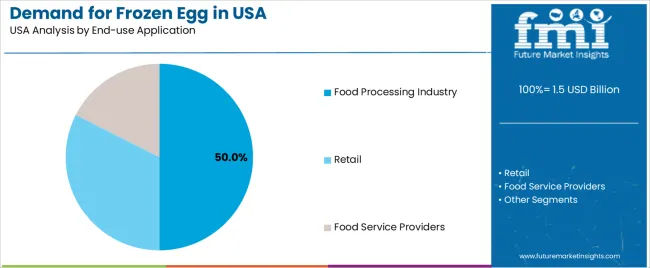

The demand for frozen eggs in the USA is largely driven by product type and end-use application. The leading product type is egg whites, which account for 46% of the market share, while the dominant end-use application is the food processing industry, which captures 50% of the demand. Frozen eggs are highly valued in the food industry due to their extended shelf life, convenience, and consistency in quality. As the demand for convenient and cost-effective ingredients in large-scale food production increases, the demand for frozen eggs continues to grow, particularly in the food processing and food service sectors.

Egg whites are the leading product type in the frozen egg market, holding 46% of the demand. Frozen egg whites are highly popular in both the food processing and food service industries due to their versatility and ease of use in various recipes. They are primarily used for their high protein content and their ability to stabilize and create structure in products such as meringues, cakes, pastries, and dressings. Their extended shelf life and ability to maintain consistent quality make them an ideal ingredient for large-scale food production.

Frozen egg whites are especially valued in the food processing industry for applications that require large quantities of eggs, as they are more cost-effective and easier to store compared to fresh eggs. Additionally, the growing focus on high-protein diets and healthier food options has driven the demand for egg whites, further strengthening their position as the dominant product type in the frozen egg market. With the continued need for efficiency and quality in food manufacturing, frozen egg whites will remain a key ingredient in many processed foods and food service offerings.

The food processing industry is the largest end-use sector for frozen eggs in the USA, accounting for 50% of the demand. In this sector, frozen eggs are a staple ingredient due to their ability to provide consistency and reduce waste in large-scale food production. Frozen eggs are used in a wide range of food products, including baked goods, sauces, ice cream, and prepared meals. The ability to store and transport frozen eggs without the risk of spoilage ensures that they are a convenient and reliable choice for manufacturers.

The food processing industry's growth, driven by the increasing demand for convenience foods, packaged meals, and ready-to-eat products, is a major factor driving the demand for frozen eggs. As manufacturers focus on improving efficiency, extending shelf life, and maintaining product quality, the need for frozen eggs in bulk continues to rise. Additionally, the shift towards more sustainable and cost-effective food production methods ensures that the food processing industry will remain a dominant player in the demand for frozen eggs in the USA.

Demand for frozen egg products in the USA is shaped by the increasing use of egg ingredients in food manufacturing, foodservice and catering operations, as well as the advantages these formats offer in terms of storage, standardisation and food safety control. The shift toward convenient, ready to use ingredients benefits frozen eggs. At the same time, supply chain disruptions (such as avian influenza), cost pressures and competition from fresh eggs or liquid alternatives influence how demand evolves.

Several factors drive growth. First, growth of the bakery, confectionery, frozen dessert and prepared meal industries increases need for processed egg inputs; frozen egg formats provide consistent functionality (foaming, emulsification) and ease of use. Second, foodservice and institutional operators (restaurants, catering, quick service) increasingly favour frozen or semi prepared egg formats to reduce labour and improve batch consistency. Third, growing perception of eggs as a protein rich ingredient supports inclusion of egg components in processed snacks and ready to eat meals, enhancing demand for frozen egg whites and yolks. Fourth, improvements in cold chain infrastructure and processing technology make frozen egg solutions more viable across broad geographies.

Despite favourable conditions, there are notable constraints. First, consumer and processor perceptions of frozen versus fresh eggs may hinder use in certain premium or retail shell egg applications, limiting substitution. Second, outbreaks of avian influenza or flocks’ health issues can reduce supply of raw egg inputs and increase cost, which impacts processed egg formats. Third, higher processing, storage and logistics costs for frozen products compared with fresh eggs can reduce margin for manufacturers or processors. Finally, competition from other formats such as liquid egg, dried egg powder or plant based alternatives may compete for the same applications.

Key trends include increased focus on specialised frozen egg ingredients such as high purity egg whites, yolks and whole egg blends tailored for industrial bakery and food processing use. There is rising adoption of frozen eggs in convenience and ready to eat meal manufacturing, driven by demand for shorter prep solutions and nutrition rich ingredients. Food safety and traceability are highlighted, with processors choosing pasteurised and standardised frozen egg products. Supply chain tightness and cold storage efficiency are also gaining more focus, influencing where processors locate plants and how inventory is managed.

The demand for frozen eggs in the USA is increasing due to their long shelf life, convenience, and versatility in various industries such as food processing, baking, and foodservice. Frozen eggs are commonly used in the food industry for products like baked goods, sauces, dressings, and processed foods, as they provide consistent quality and are easy to store and transport. Additionally, the growing trend of convenience foods, coupled with the rising demand for food safety and sustainability, is boosting the adoption of frozen eggs.

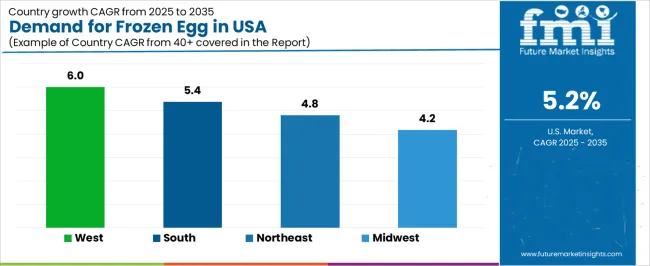

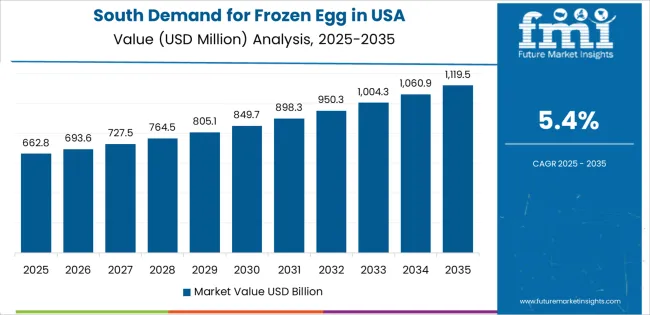

Regional demand varies based on the concentration of food processing facilities, population density, and culinary preferences. The West leads in demand due to its large food manufacturing and foodservice sectors, followed by the South, Northeast, and Midwest, where frozen eggs are also widely used in the food industry. This analysis explores the factors driving the demand for frozen eggs across different regions of the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 6% |

| South | 5.4% |

| Northeast | 4.8% |

| Midwest | 4.2% |

The West region leads the USA in the demand for frozen eggs with a CAGR of 6%. The region’s strong food manufacturing, foodservice, and bakery sectors are key drivers of this demand. States like California, which is known for its large-scale food processing and production facilities, require substantial amounts of frozen eggs for use in a wide range of food products, including baked goods, sauces, and prepared meals.

The West’s emphasis on convenience foods, along with a growing trend for sustainable and safe food ingredients, supports the rise of frozen egg USAge. Additionally, the region’s proximity to international markets and large-scale distribution networks makes frozen eggs a convenient and cost-effective option for manufacturers. As the demand for processed and ready-to-eat foods continues to grow, so will the demand for frozen eggs in the West.

The South region shows strong demand for frozen eggs with a CAGR of 5.4%. The South is home to a robust food manufacturing industry, including major producers of baked goods, convenience foods, and ready-to-eat meals, all of which use frozen eggs as key ingredients. The region’s large agricultural sector, particularly in states like Georgia and Arkansas, also plays a role in the availability of eggs for freezing and processing.

As foodservice chains and food manufacturers in the South continue to expand, the demand for frozen eggs as an efficient and cost-effective ingredient is rising. The region's growing population and increasing demand for quick and easy meal options further fuel the need for frozen eggs. With an increasing focus on food safety, consistency, and sustainability, the demand for frozen eggs will continue to grow in the South.

The Northeast region demonstrates steady demand for frozen eggs with a CAGR of 4.8%. The region's large food processing industry, including bakeries, foodservice operations, and manufacturers of frozen meals, contributes to a consistent demand for frozen eggs. Additionally, the region’s focus on high-quality, convenience-oriented food products supports the growing adoption of frozen eggs as a versatile ingredient.

The Northeast’s urban population, combined with the region’s high consumption of processed and packaged foods, further supports demand. Furthermore, the increasing popularity of convenience foods and bakery items in the region continues to drive the need for frozen eggs in these sectors. While growth in the Northeast is steady, the demand for frozen eggs remains strong due to the region’s focus on food safety, quality, and convenience.

The Midwest region shows moderate growth in the demand for frozen eggs with a CAGR of 4.2%. The Midwest, known for its agricultural production, including a strong poultry farming sector, has a steady supply of eggs available for freezing and processing. Frozen eggs are widely used in food processing, particularly in baked goods, ready-to-eat meals, and restaurant chains, which are prevalent in the region.

The Midwest’s strong manufacturing base, combined with an increasing demand for convenience foods and quick-service restaurant products, contributes to consistent demand for frozen eggs. While growth in the Midwest is slower compared to the West and South, the region’s continued focus on food manufacturing and agriculture ensures steady use of frozen eggs as a critical ingredient in various food products.

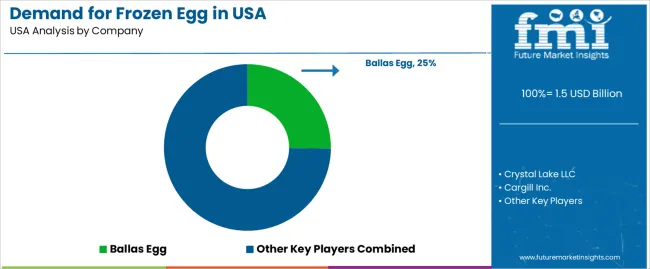

Demand for frozen egg products in the United States is increasing, driven by the growth of the foodservice industry, convenience-oriented food production, and the need for consistent, shelf-stable ingredients. Companies like Ballas Egg (holding approximately 25.2% market share), Crystal Lake LLC, Cargill Inc., Pace Farm, and Sonstegard Foods are key players in this market. Frozen eggs, which include whole eggs, egg whites, and egg yolks, are widely used in commercial food production, bakery products, sauces, dressings, and as a critical ingredient in packaged foods.

The competition in the frozen egg market is driven by several factors, including product quality, pricing, supply chain reliability, and sustainability. Companies are focusing on delivering high-quality frozen egg products that maintain the taste, texture, and nutritional value of fresh eggs. Another area of focus is ensuring food safety and compliance with regulations, which is essential for maintaining consumer trust in the products.

With the growing demand for clean-label and sustainable products, companies are also exploring ways to offer eggs from cage-free, organic, and other ethically sourced hens. Marketing materials typically emphasize product specifications such as pasteurization, storage requirements, volume availability, and use cases in different food applications. By aligning their offerings with the growing demand for quality, convenience, and sustainable sourcing, these companies aim to strengthen their position in the USA frozen egg market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product Type | Whole Eggs, Egg Whites, Egg Yolk |

| End-Use Application | Food Processing Industry, Retail, Food Service Providers |

| Key Companies Profiled | Ballas Egg, Crystal Lake LLC, Cargill Inc., Pace Farm, Sonstegard Foods |

| Additional Attributes | The market analysis includes dollar sales by product type and end-use application categories. It also covers regional demand trends in the United States, particularly driven by growth in the food processing industry and retail sectors. The competitive landscape highlights major suppliers in the frozen egg market, focusing on innovations in egg processing and packaging. Trends in the increasing demand for egg whites and whole eggs for food production and service applications are explored, along with advances in product quality and supply chain efficiency. |

The global demand for frozen egg in USA is estimated to be valued at USD 1.5 billion in 2025.

The market size for the demand for frozen egg in USA is projected to reach USD 2.5 billion by 2035.

The demand for frozen egg in USA is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in demand for frozen egg in USA are egg whites, whole eggs and egg yolk.

In terms of end-use application, food processing industry segment to command 50.0% share in the demand for frozen egg in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA