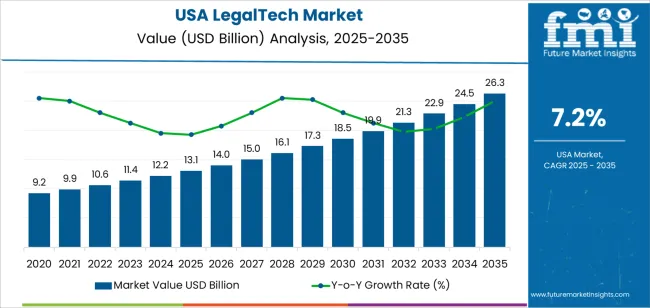

The USA LegalTech demand is valued at USD 13.1 billion in 2025 and is forecast to reach USD 26.3 billion by 2035, reflecting a CAGR of 7.2%. Adoption is shaped by expanding digital transformation within legal service delivery, including workflow optimization, digital document management, and automated compliance functions. Increasing reliance on AI-assisted review, rising volumes of electronically stored information, and continued demand for remote client collaboration also reinforce technology-led upgrades in law practices and corporate legal departments.

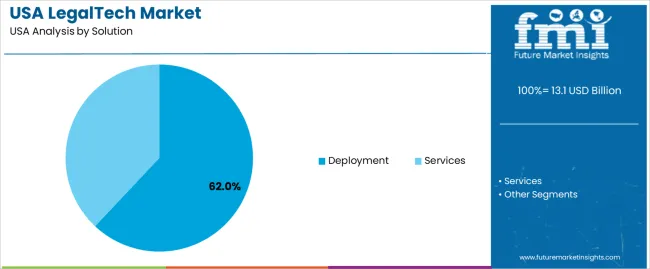

Deployment-led solutions dominate overall utilization. Cloud-enabled and hybrid deployments support scalable access to litigation tools, contract lifecycle management software, e-discovery platforms, and digital signature applications. These implementations reduce storage dependence, streamline internal processes, and support security and access-control improvements. Spending is further driven by cost management initiatives and the requirement for demonstrable audit trails across legal workflows.

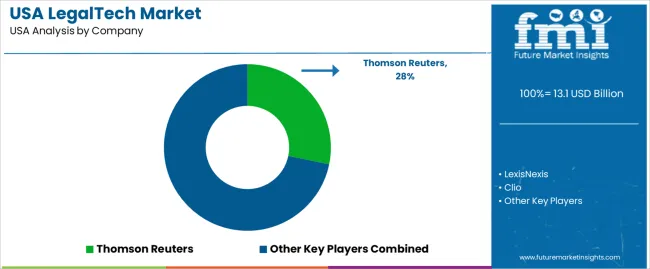

West USA, South USA, and Northeast USA demonstrate the strongest investment levels due to the high concentration of large law firms, technology startups, corporate headquarters, and legal BPO entities. Growth is also influenced by regulatory advances that encourage standardized digital compliance functions within public and private legal service institutions. Key suppliers include Thomson Reuters, LexisNexis, Clio, Relativity, and DocuSign. These companies provide solutions used in litigation management, electronic discovery, contract digitization, electronic notarization, and practice automation across enterprise and professional legal environments.

LegalTech demand in the United States demonstrates a strong upward growth profile over the next decade, driven by increasing adoption of digital legal workflows, automation of routine legal tasks, and rising investment in compliance technology. Early-period growth within the first half of the forecast cycle is expected to be driven primarily by law firms modernizing document review, e-discovery, contract management, and client-engagement processes. These operational upgrades reflect efficiency targets and cost-containment priorities across both large firms and mid-tier practices.

In the later years of the 10-year outlook, growth momentum is supported by broader deployment of AI-based analytics, predictive legal insights, and cybersecurity-focused legal infrastructure. Corporate legal departments increasingly integrate LegalTech solutions into risk assessment and regulatory compliance systems, expanding demand beyond the traditional law firm ecosystem.

The growth rate in the latter half of the period remains higher due to accelerated digital transformation, rising data volumes, and broader acceptance of cloud-native legal operations. Although implementation challenges and ethical considerations persist, the cumulative effect of technology adoption across litigation, contracts, and governance functions signals a steady growth trajectory and increasing contribution from enterprise-wide LegalTech integration over the decade.

| Metric | Value |

|---|---|

| USA LegalTech Sales Value (2025) | USD 13.1 billion |

| USA LegalTech Forecast Value (2035) | USD 26.3 billion |

| USA LegalTech Forecast CAGR (2025-2035) | 7.2% |

Demand for LegalTech in the USA is increasing because law firms, corporate legal departments and government agencies seek tools that improve efficiency, reduce cost and support compliance. Digital case management, e-discovery, contract automation and legal research platforms help attorneys manage high document volumes and shorten turnaround time for routine tasks. Adoption is supported by growth in remote and hybrid work structures, which require secure cloud systems for collaboration and data access across dispersed teams. Corporate legal teams use LegalTech to manage external counsel spend, track regulatory obligations and analyse legal risk through data reporting.

Artificial intelligence and automation strengthen demand by enabling document review, clause extraction and predictive analytics that reduce dependence on manual processes. Smaller firms benefit from subscription models that provide advanced capabilities without large upfront investment. Constraints include data security concerns, limited technical skills among legal staff and integration challenges with legacy software. Some firms delay adoption until clear return on investment is demonstrated. Ethical and regulatory considerations also influence the pace of implementation for AI-based legal tools.

Demand for LegalTech in the United States reflects ongoing digital transformation across legal service delivery, corporate compliance, and document-driven workflows. U.S. firms continue integrating software tools that standardize case tracking, automate contract activities, and support secure document storage. LegalTech adoption aligns with structured compliance requirements and productivity improvements sought in both private practices and corporate law teams. Cloud-based systems increasingly support remote collaboration, secure file sharing, and centralized workflow monitoring.

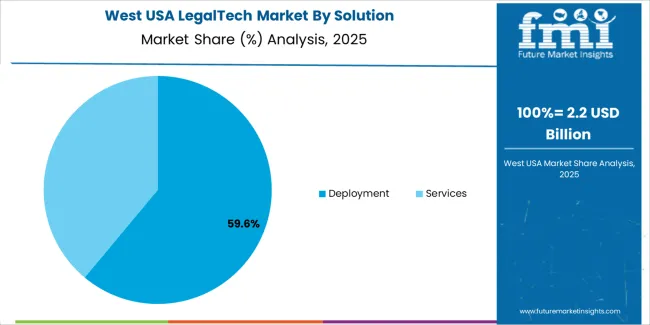

Deployment solutions account for 62.0%, including cloud and on premise platforms used to manage cases, documents, and client interactions through configurable digital environments. These tools support workflow automation, secure records management, and scalable access across distributed legal teams. Services hold 38.0%, covering integration, customization, and technical support needed to ensure compatibility with existing information systems. Services remain relevant for firms requiring specialized configurations aligned with practice area procedures. The distribution reflects the U.S. legal sector’s focus on system modernization driven by operational efficiency, standardized processes, and secure data governance practices supporting both external client service and internal compliance requirements.

Key points:

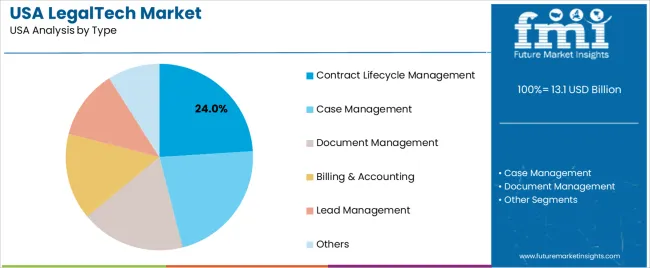

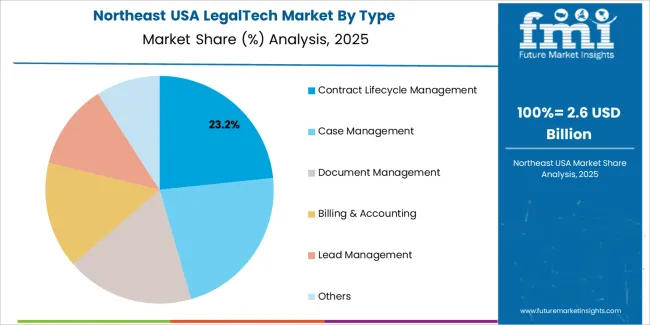

Contract lifecycle management (CLM) software represents 24.0%, supporting drafting, negotiation, execution, and archival processes in corporate and commercial practices. Case management holds 22.0%, driven by litigation activity and structured docketing requirements. Document management accounts for 18.0%, responding to high file volumes in regulatory and litigation matters. Billing and accounting represent 15.0%, supporting time tracking and invoicing needs. Lead management accounts for 12.0%, used primarily in growing or marketing-focused legal practices. Other tools hold 9.0%, covering compliance monitoring and e-discovery workflows. Adoption reflects the importance of improving contract performance, case oversight, and documentation control across U.S. legal workflows.

Key points:

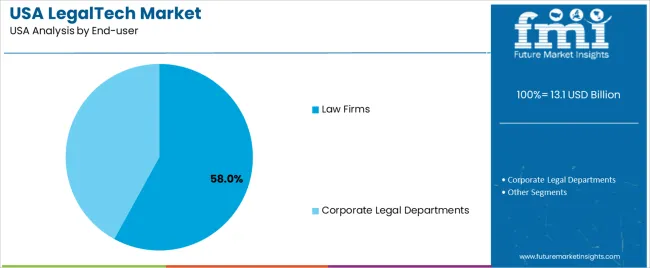

Law firms represent 58.0%, driven by structured client representation, billing requirements, and case scheduling workflows that benefit from automation. Corporate legal departments account for 42.0%, with adoption focused on managing internal contracts, compliance obligations, and audit-ready documentation. Utilization patterns reflect the U.S. focus on shortening administrative cycles and improving accuracy in research, filings, and communications. Both segments rely on system flexibility, secure data environments, and controlled access hierarchies to support routine legal operations. Demand across firms and corporate departments continues to expand as organizations seek reliable digital tools that maintain information consistency and reduce manual activities affecting service delivery timelines.

Key points:

In the United States, LegalTech solutions gain adoption as law firms modernize document workflows, courtroom scheduling and matter management to improve productivity under fixed fee structures. Companies in healthcare, finance and energy expand compliance programs that require standardized contract tracking and audit-ready recordkeeping, which increases enterprise demand for contract lifecycle management and e-discovery platforms. Remote and hybrid work environments continue across many U.S. legal departments, prompting investment in secure video consultation tools, cloud document repositories and real-time case collaboration features. Legal service providers to small businesses also adopt digital intake, payment and client-communication tools to maintain efficient service across geographically dispersed clients.

Many small U.S. law firms operate with narrow technology budgets and hesitate to adopt new platforms if subscription fees are high or onboarding support is limited. Corporate legal teams with lean staffing may delay replacing manual processes if internal training resources are insufficient. Cybersecurity risks and strict confidentiality standards lead firms to proceed cautiously when adopting cloud-based systems, especially those handling sensitive litigation records or personal data. These factors contribute to a mixed pace of adoption across the legal sector.

AI-assisted contract review, predictive document classification and automated compliance checking are increasingly embedded into U.S. LegalTech tools to reduce manual research hours. Legal operations teams inside corporations are expanding the use of analytics platforms to track matter budgets, outside counsel spending and case progress. Client-facing portals, digital identity verification for onboarding and self-service legal forms are gaining traction among firms serving consumers and small enterprises. These trends indicate steady modernization of legal services infrastructure throughout the United States.

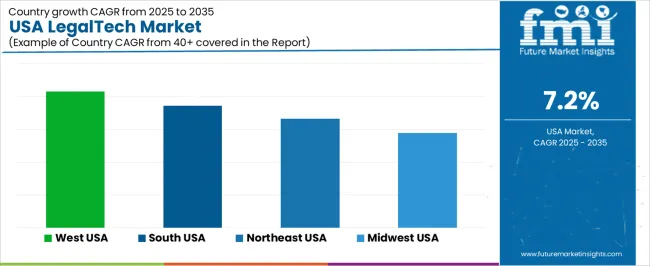

Demand for LegalTech in the United States is expanding as law firms, corporate legal departments, courts, and compliance-driven industries adopt digital workflows for case management, e-discovery, contract automation, and regulatory monitoring. Adoption reflects regional concentrations of legal services, technology investment, litigation volume, and corporate presence. West USA leads at 8.3%, followed by South USA (7.4%), Northeast USA (6.6%), and Midwest USA (5.8%).

| Region | CAGR (2025 to 2035) |

|---|---|

| West USA | 8.3% |

| South USA | 7.4% |

| Northeast USA | 6.6% |

| Midwest USA | 5.8% |

West USA grows at 8.3% CAGR, influenced by technology ecosystems, high corporate compliance needs, and digital-first practices adopted across California, Washington, and Colorado. Legal teams in Silicon Valley and Seattle integrate AI-based contract review, intellectual property portfolio management, and automated privacy-compliance systems linked to frequent software product releases and data-governance obligations. Regional courts test digital document workflows for filings, mediation scheduling, and remote hearings. Corporate legal departments in the entertainment and technology industries use analytics to manage high volumes of contractual transactions, NDAs, and licensing activities. Law firms adopt e-discovery tools to organize extensive digital evidence from cybersecurity, advertising, and IP-related litigation. Managed service providers support deployment and cybersecurity validation.

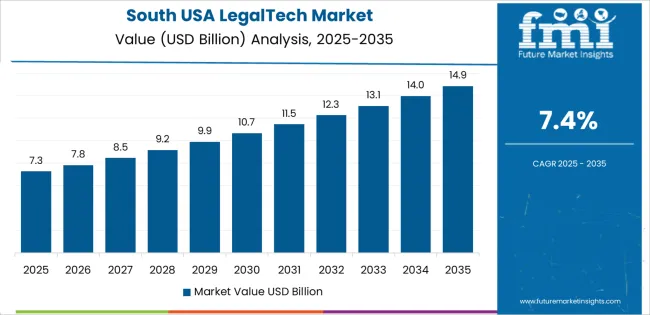

South USA grows at 7.4% CAGR, driven by expanding corporate relocation zones in Texas, Florida, Georgia, and North Carolina. Legal departments in fast-growth industries, including energy, logistics, and healthcare, rely on automated contract lifecycle systems tied to complex vendor networks. E-discovery USAge rises in regions with significant commercial disputes and employment litigation. Professional-services outsourcing hubs offer document review and workflow processing to law firms adopting cost-efficient technology operations. Courts and municipal legal offices deploy platforms that streamline case scheduling and digital requests, improving administrative throughput. Universities with growing legal programs introduce training exposure to digital tools supporting internship and early-career readiness.

Northeast USA expands at 6.6% CAGR, supported by financial compliance enforcement and high-tier legal services concentrated in New York, New Jersey, and Massachusetts. Corporate law firms adopt LegalTech for securities documentation, transaction review, and due diligence linked to finance-sector regulations. Courts in large metropolitan areas continue implementation of secure filing systems and case-access portals. Regulatory monitoring tools gain adoption among firms advising on complex reporting requirements. Document-management platforms improve control of structured case archives in dense litigation industries. LegalTech providers benefit from proximity to specialized counsel collaborating on improvements in analytics accuracy and workflow reliability.

Midwest USA grows at 5.8% CAGR, shaped by manufacturing, insurance, academic institutions, and regional law operations across Illinois, Ohio, and Michigan. Law firms adopt LegalTech for structured case tracking, discovery storage, and collaborative workflow tools supporting mixed on-site and remote legal practices. Corporate compliance teams in manufacturing rely on automated documentation linked to supplier contracts and technical certifications. Universities developing legal programs encourage technology exposure through clinic-based case systems. Government entities improve administrative efficiency by processing forms and filings electronically. Local firms use LegalTech selectively based on cost-benefit alignment, balancing automation with established service practices.

Demand for LegalTech in the USA is shaped by software providers that support litigation management, e-discovery, legal research, document automation, and digital contracting across law firms, corporate legal departments, and government institutions. Thomson Reuters holds an estimated 28.2% share, driven by Westlaw research tools, contract workflow platforms, and case-management software with consistent performance and broad integration across U.S. legal workflows.

LexisNexis maintains strong participation in legal research, citation validation, and compliance-support systems. Its tools provide dependable search accuracy, continuous indexing updates, and structured analytics resources utilized across firms of varying size. Clio contributes significant adoption among small and mid-sized law firms through cloud-based case-management systems that deliver stable scheduling, task coordination, and billing functionality designed for distributed legal teams.

Relativity supports litigation discovery and document review with platforms providing reliable search precision and structured review workflows across U.S. litigation practices. Its e-discovery systems maintain predictable scalability for high-volume data management. DocuSign holds a prominent role in digital contracting, offering dependable signature authentication, document-routing stability, and secure process control valued by corporate legal departments.

Competition in the USA centers on research accuracy, workflow reliability, data-security compliance, litigation-support capabilities, pricing flexibility, and integration with legal-practice platforms. Demand continues to expand as U.S. legal professionals adopt cloud-based, analytics-enabled, and automation-focused tools that support consistent documentation control, efficient case execution, and secure digital collaboration across professional legal environments.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Solution | Deployment, Services |

| Type | Contract Lifecycle Management, Case Management, Document Management, Billing & Accounting, Lead Management, Others |

| End-user | Law Firms, Corporate Legal Departments |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Key Companies Profiled | Thomson Reuters, LexisNexis, Clio, Relativity, DocuSign |

| Additional Attributes | Dollar sales by type and end-user segments; adoption of cloud-first legal software across corporate and law practice workflows; USAge in e-discovery, compliance automation, and digital document authentication; subscription-based models, API-integrated legal operations platforms, and workflow modernization driven by data security and regulatory requirements in U.S. legal environments. |

The demand for legaltech in USA is estimated to be valued at USD 13.1 billion in 2025.

The market size for the legaltech in USA is projected to reach USD 26.3 billion by 2035.

The demand for legaltech in USA is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in legaltech in USA are deployment and services.

In terms of type, contract lifecycle management segment is expected to command 24.0% share in the legaltech in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA