The demand for nutritive sweeteners in the USA is projected to reach USD 12.5 billion by 2035, reflecting an absolute increase of USD 4.2 billion over the forecast period. The demand, valued at USD 8.3 billion in 2025, is expected to grow at a CAGR of 4.20%. This growth is driven by the increasing demand for healthier and lower-calorie sweetening alternatives in the food and beverage industries, particularly as consumers continue to focus on healthier eating habits and reducing sugar intake.

Nutritive sweeteners, including sugars like sucrose, glucose, and fructose, as well as sugar alcohols and natural sweeteners like honey and agave, are widely used across various products, including beverages, bakery goods, confectionery, and dairy products. These sweeteners provide a source of energy and flavor while meeting consumer demand for products that do not compromise on taste. As the demand for sugar alternatives rises, manufacturers are turning to nutritive sweeteners as solutions that offer the right balance of sweetness and nutritional value.

The growth is also fueled by innovations in sweetener formulations and a growing trend toward clean-label products. As more consumers become aware of the potential negative health impacts of excessive sugar consumption, the demand for natural and less-processed sweeteners is expected to continue growing, driving growth over the next decade.

The growth curve for nutritive sweeteners in the USA is expected to follow a steady and gradual upward trajectory, with a slight acceleration in the latter half of the forecast period. Between 2025 and 2030, the demand is projected to grow moderately, increasing by USD 1.5 billion (approximately 18%), driven by the rising consumer interest in healthier alternatives to sugar. During this period, there will be continued innovation in sweetener options, along with an expanding variety of products catering to health-conscious consumers. As people seek to reduce their sugar intake, demand for alternative sweeteners, including natural and low-calorie options, will remain consistent.

From 2030 to 2035, demand is expected to grow more rapidly, increasing by USD 2.7 billion (approximately 27%). This acceleration in growth can be attributed to the growing trend of sugar reduction in processed foods and beverages, coupled with the rising popularity of natural sweeteners. Technological advancements in sweetener formulations, offering better taste and improved health benefits, will further boost adoption. As the focus on healthier eating continues, more consumers are likely to seek products with cleaner labels, further fueling demand. The shift towards low-calorie and natural sweeteners will be a key factor in driving stronger growth during the latter part of the forecast period.

| Metric | Value |

|---|---|

| Nutritive Sweetener Value (2025) | USD 8.3 billion |

| Nutritive Sweetener Forecast Value (2035) | USD 12.5 billion |

| Nutritive Sweetener Forecast CAGR (2025-2035) | 4.20% |

The demand for nutritive sweeteners in the USA is growing due to the increasing focus on healthier, lower-calorie alternatives to sugar in food and beverage products. Nutritive sweeteners, such as fructose, glucose, and sucrose, provide sweetness while also offering nutritional benefits, such as energy content, making them an attractive option for consumers looking to balance taste with better dietary choices. The rise in health-conscious consumers, along with the growing prevalence of lifestyle diseases related to sugar consumption, is driving the demand for these sweeteners.

The growing interest in functional foods and beverages is also fueling market growth. As more consumers seek out sweeteners that provide not only taste but also nutritional value, manufacturers are increasingly turning to nutritive sweeteners as ingredients in their products. These sweeteners are often used in diet foods, beverages, and products aimed at specific dietary needs, such as diabetic-friendly or weight-management products.

The increasing focus on reducing artificial ingredients in food products and the shift towards more natural, plant-based sweeteners are contributing to the growing demand for nutritive sweeteners. As consumers become more aware of the potential negative health effects of excessive sugar consumption, nutritive sweeteners are gaining traction as an alternative that offers both taste and health benefits. Despite challenges such as fluctuating raw material prices and consumer preferences for more natural options, the demand for nutritive sweeteners is expected to continue growing as the food and beverage industry responds to changing consumer preferences.

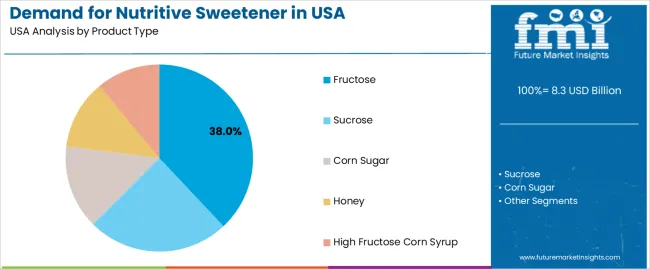

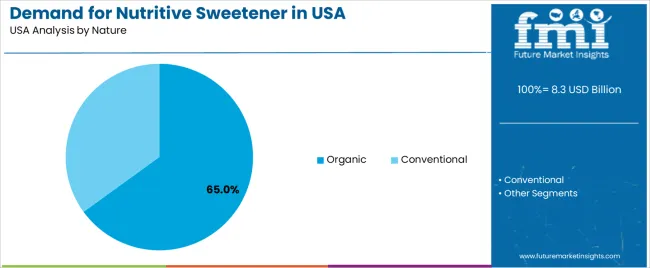

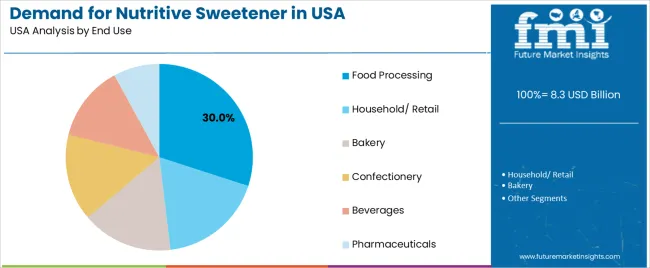

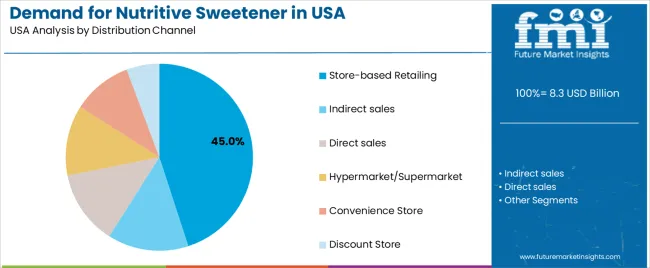

Demand is segmented by product type, nature, end use, and distribution channel. By product type, demand is divided into fructose, sucrose, corn sugar, honey, and high fructose corn syrup, with fructose leading the demand. Based on nature, demand is categorized into organic and conventional, with organic products representing the largest share. By end use, demand is segmented into food processing, household/retail, bakery, confectionery, beverages, and pharmaceuticals, with food processing holding the largest share. Regionally, demand is divided into North America, Europe, Asia Pacific, and other key regions.

Fructose leads the demand for nutritive sweeteners in the USA, accounting for 38% of the total demand. This dominance is driven by fructose’s high sweetness potency, which makes it an efficient and cost-effective sweetener in a variety of food and beverage products. High-fructose corn syrup (HFCS), a form of fructose, is commonly used in soft drinks, processed foods, and baked goods due to its ability to enhance flavor without adding excessive calories.

Fructose is used to improve moisture retention and texture in food products, which is particularly important in beverages, confectionery, and dairy items. As consumers increasingly demand lower-calorie and reduced-sugar options, fructose continues to be favored by manufacturers for its ability to meet these needs without compromising taste. This combination of versatility, cost-effectiveness, and functional benefits makes fructose the leading sweetener in the USA.

Organic nutritive sweeteners account for 65% of the demand in the USA. The rising preference for organic ingredients is driven by consumers seeking more natural, clean-label products free from pesticides, GMOs, and artificial additives. Organic sweeteners, including organic fructose and honey, align with growing health-conscious trends, making them highly sought after by premium food manufacturers.

The organic food sector continues to expand as consumers prioritize sustainability and transparency in product sourcing, further boosting the demand for organic sweeteners. The organic certification ensures that these products meet high standards of quality and safety, which increases consumer confidence and loyalty. As the shift towards organic foods accelerates, organic sweeteners are increasingly integrated into a wide range of food categories, from beverages to snacks, keeping them as the leading choice in the sweetener category.

The food processing sector holds 30% of the demand for nutritive sweeteners in the USA. This is primarily driven by the critical role that sweeteners play in the production of a wide variety of food and beverage products. Sweeteners like fructose and sucrose are essential for flavor enhancement, moisture retention, and texture improvement in products such as beverages, baked goods, snacks, dairy, and ready-to-eat meals.

As the demand for health-conscious options rises, food processors are increasingly turning to sweeteners like high-fructose corn syrup (HFCS) and organic fructose to meet consumer preferences for reduced-calorie, lower-sugar, and clean-label products. The food processing industry's focus on product innovation and the integration of nutritional enhancements ensures continued growth and the ongoing need for nutritive sweeteners. With the rise of processed food consumption, the food processing sector remains the largest end-user segment in the USA.

Store-based retailing accounts for 45% of the demand for nutritive sweeteners in the USA. This segment dominates because grocery stores, supermarkets, and health food stores offer convenient access to a wide variety of sweeteners, including both conventional and organic options. Retail stores provide consumers with the opportunity to select from a broad range of sweeteners for home use, whether they are looking for sugar substitutes, low-calorie options, or organic alternatives.

The growth of health-conscious consumer preferences has led to an increased availability of sweeteners in retail outlets, as consumers seek more natural and healthier options. The large-scale presence of supermarkets and hypermarkets in the USA ensures that store-based retailing remains the most accessible and widely used distribution channel. As consumers continue to prioritize convenience and a wider selection of products, store-based retailing remains the dominant channel for purchasing nutritive sweeteners.

Nutritive sweeteners are used in a wide range of food & beverage applications including bakery, confectionery, dairy, beverages and processed foods. Key drivers include reformulation efforts to improve taste while maintaining "clean‑label" positioning, the rising use of alternative sweetening systems for functionality and the volume of legacy sweetening in the processing sector. Restraints include increasing regulatory and consumer pressure to reduce added sugars, rising competition from low‑calorie or non‐nutritive sweeteners, and cost/volatility in raw materials affecting supply and pricing.

Demand in the USA remains significant because food and beverage manufacturers still require nutritive sweeteners for sensory, functional and cost reasons even as low‑calorie alternatives gain share. Nutritive sweeteners deliver bulk, mouth‑feel, browning, texture and ferment ability that many large‑scale processed foods rely on. US industrial food system continues to process high volumes of sweetened categories (snacks, beverages, bakery) where sugar or sugar alcohols play a key role. At the same time, consumers and formulators are seeking high‑performing nutritive sweeteners that align with "natural" and "clean‑label" expectations e.g., sugar alcohols or rare sugars which is driving innovation and hence demand for upgraded nutritive sweetener ingredients rather than only old forms.

Innovations are helping the nutritive sweetener segment evolve in the USA by delivering improved performance, better consumer perception and operational advantages. Ingredient suppliers are introducing sugar‑alcohol blends (like maltitol, erythritol), rare sugars (e.g., allulose, tagatose) and dual‑function sweetening/bulking agents that preserve texture and taste while lowering caloric load or glycemic impact. Advances in process technology allow more efficient production from alternative raw‑materials and improved taste/sweetness profiles, making these nutritive options more acceptable in reformulated products. There is also trend toward "better‑for‑you" nutritive sweeteners that support functional claims (e.g., lowers calories, supports digestive health) which broadens their USAge beyond legacy sweetening.

Despite the opportunities, several challenges limit growth of nutritive sweeteners in the USA market. One major barrier is the regulatory and consumer pressure to reduce added sugars, which shifts formulators toward non‑nutritive or minimal‑calorie options rather than traditional nutritive sweeteners. Another is cost and supply instability of certain nutritive ingredients (e.g., rare sugars or specialty sugar alcohols) which may make them less cost‑competitive compared to standard sugar or corn sweeteners. There is also taste and functionality trade‑offs some nutritive sweeteners can have off‑flavours, cooling effects or different bulking behaviour, which makes reformulation complex. Consumer perception and clean‑label trends may favour non‑nutritive sweeteners or "no added sugar" claims, reducing growth potential for some nutritive sweetener types despite their functional importance.

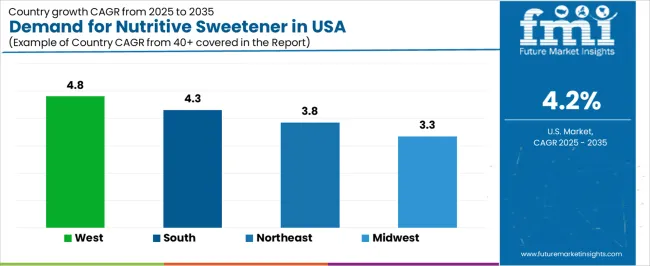

| Region | CAGR (%) |

|---|---|

| West | 4.8% |

| South | 4.3% |

| Northeast | 3.8% |

| Midwest | 3.3% |

The demand for nutritive sweeteners in the USA is growing across various regions, with the West leading at a 4.8% CAGR. This growth is driven by the region's strong health-conscious culture, particularly in states like California and Washington, where consumers increasingly seek healthier alternatives to refined sugars. The South follows with a 4.3% CAGR, supported by a growing food manufacturing sector and rising consumer awareness of the benefits of reducing sugar intake. The Northeast shows a 3.8% CAGR, fueled by urban centers with a focus on functional foods and wellness. The Midwest, while growing at a more moderate 3.3%, continues to adopt these sweeteners in food production as consumers prioritize healthier eating options and reduce sugar consumption.

The West is seeing the highest demand growth for nutritive sweeteners in the USA, with a 4.8% CAGR. The region’s growing health and wellness trends, particularly in states like California and Washington, are key drivers of this growth. Health-conscious consumers in the West are increasingly seeking alternatives to refined sugar, and nutritive sweeteners provide a healthier option that satisfies both taste and nutritional needs. As the demand for products that support health and well-being continues to grow, the use of mineral-enriched ingredients is becoming more common.

The increased focus on plant-based and organic foods in the West is contributing to the demand for mineral enrichment ingredients to supplement diets. The region’s progressive food industry is responding to this demand by incorporating enriched ingredients into a wide range of food products, from snacks to beverages. Personalized nutrition, a growing trend, is further propelling the use of minerals to meet specific health needs. As consumers seek healthier, nutrient-dense food options, the West is expected to continue leading the demand for mineral enrichment in the coming years.

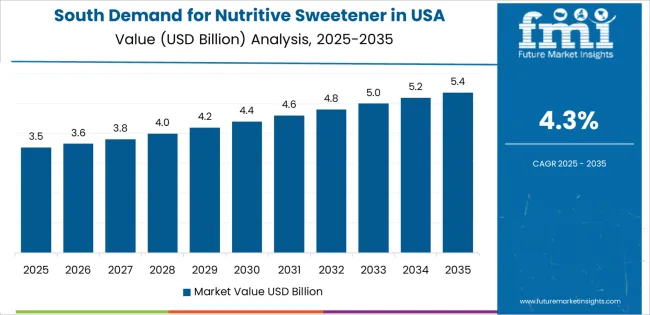

The South is witnessing steady growth in the demand for nutritive sweeteners, with a 4.3% CAGR. The region’s robust food processing and manufacturing sectors are key contributors to this trend, particularly in states like Texas, Georgia, and Florida. As the South continues to expand its food production capabilities, there is a growing need for fortified ingredients that can enhance the nutritional value of products, especially in processed foods, beverages, and nutritional supplements. This trend is supported by a growing number of food companies adopting healthier and more nutrient-dense ingredients.

The increasing awareness among consumers about the importance of health and nutrition is contributing to the demand for mineral-enriched products. As people seek foods that offer more than just basic nutrition, the need for functional foods with added minerals is increasing. The South’s diverse and evolving population also drives the demand for products that cater to various dietary preferences and health needs. With the growing focus on healthier lifestyles and nutrition, the use of mineral-enriched ingredients in food and beverages is expected to continue its upward trajectory in the South.

The Northeast is experiencing moderate growth in the demand for nutritive sweeteners, with a 3.8% CAGR. The region’s focus on healthy living, particularly in urban centers like New York and Boston, plays a significant role in this trend. As more consumers prioritize functional foods and beverages to support their health, the demand for products with added vitamins and minerals is steadily increasing. The region’s active lifestyle culture and health-conscious population are key factors driving the adoption of mineral-enriched products.

The Northeast also has a strong presence in the pharmaceutical and nutritional supplement industries, which further supports the demand for enriched ingredients in food and supplements. As preventive healthcare becomes a growing priority, more consumers are turning to fortified foods to enhance their overall health and well-being. The availability of fortified foods is expanding, making it easier for consumers to access products that meet their nutritional needs. As these health trends continue, the demand for mineral enrichment ingredients is expected to grow, especially as the food and beverage industry adapts to meet the region’s evolving health and wellness preferences.

The Midwest is seeing moderate growth in the demand for nutritive sweeteners, with a 2.9% CAGR. The region’s strong agricultural base, particularly in states like Illinois and Michigan, is a key driver of this growth. The Midwest is known for its food production and manufacturing industries, and as these industries innovate, the demand for fortified ingredients in food products is rising. Health-conscious consumers are seeking food options that provide added nutritional value, leading to increased use of mineral-enriched ingredients, especially in processed foods and supplements.

As the food industry in the Midwest focuses more on improving the nutritional quality of food, the demand for mineral enrichment is expected to grow steadily. The rising focus on nutrition and wellness among consumers, combined with a growing demand for healthier food options, is further supporting this trend. While the Midwest’s growth rate is slower compared to other regions, the region’s continued commitment to improving the health profile of food products and meeting consumer demand for enhanced nutritional benefits ensures steady growth in mineral enrichment USAge.

The demand for nutritive sweeteners in the USA is being driven by a dual trend: the persistent need for traditional energy‑providing sweeteners in food and beverage manufacturing, and the evolving nutritional focus of consumers. As food companies reformulate products and consumers seek both taste and functionality, nutritive sweeteners those that provide calories and energy continue to occupy a significant place in sweetening solutions. The broad USAge of these sweeteners spans bakery goods, confectionery, dairy, beverages and snacks, where manufacturers rely on them for texture, mouthfeel and cost‑effectiveness.

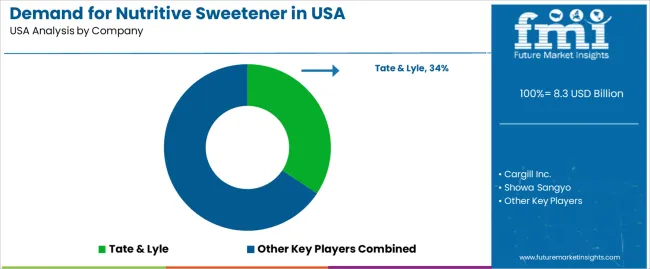

Within the USA, Tate & Lyle holds approximately 34.3% share of demand for nutritive sweeteners, underlining its strong position and breadth of ingredient capabilities across national food applications. Other key companies contributing to this demand include Cargill Inc., Showa Sangyo, Japan Corn Starch Co., and COFCO International, each providing ingredients that support formulation needs in major sectors of the USA food industry.

The main factors fueling demand include continued consumption of processed foods and beverages, the need for clean‑label and functionally sweetened formulations, and cost pressures on manufacturers who seek stable, high‑performing sweetening solutions. Importantly, while nutritive sweeteners remain essential, they face headwinds from health‑and‑wellness trends, sugar‑reduction strategies and regulatory pressures which prompt reformulation toward lower‑calorie alternatives. Despite these challenges, the demand outlook for nutritive sweeteners remains strong in the USA, as they continue to play a vital role in many applications where full‑body sweetness and functional performance are required.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Form | Powder, Granule |

| Ingredient Type | Zinc, Sodium, Potassium, Calcium, Phosphorous, Magnesium |

| End Use | Food Industry, Dairy, Bakery & Confectionery, Breakfast Cereals, Meat & Fish, Ready-to-eat Meals |

| Distribution Channel | Store-based Retailing, Indirect Sales, Direct Sales, Hypermarket/Supermarket, Convenience Store, Discount Store |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Tate & Lyle, Cargill Inc., Showa Sangyo, Japan Corn Starch Co., COFCO International |

| Additional Attributes | Dollar sales by form, ingredient type, end-use categories, distribution channels, regional adoption trends, competitive landscape, advancements in nutritive sweeteners technologies, integration with the food industry sectors. |

The global demand for nutritive sweetener in USA is estimated to be valued at USD 8.3 billion in 2025.

The market size for the demand for nutritive sweetener in USA is projected to reach USD 12.5 billion by 2035.

The demand for nutritive sweetener in USA is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in demand for nutritive sweetener in USA are fructose, sucrose, corn sugar, honey and high fructose corn syrup.

In terms of nature, organic segment to command 65.0% share in the demand for nutritive sweetener in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA