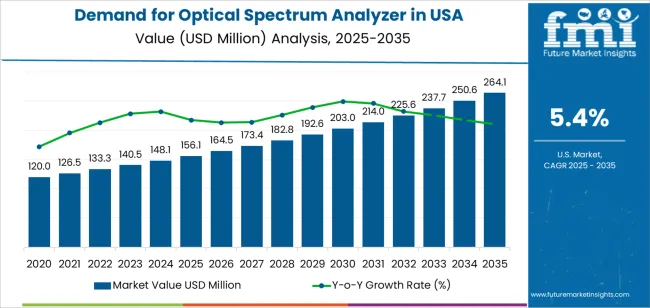

The demand for optical spectrum analyzers in the USA is projected to reach USD 264.5 million by 2035, reflecting an absolute increase of USD 108.4 million over the forecast period. The demand, valued at USD 156.1 million in 2025, is expected to grow at a CAGR of 5.4%. Optical spectrum analyzers are essential instruments used to measure the optical spectrum of light, and they play a critical role in applications such as telecommunications, fiber optic networks, and scientific research. As industries continue to expand their reliance on high-speed data transmission and optical communication technologies, the demand for these analyzers is expected to rise steadily.

The increasing adoption of optical technologies in industries like telecommunications, healthcare, and research is a significant driver of this growth. Optical spectrum analyzers are increasingly used for monitoring and maintaining optical networks, ensuring optimal performance, and troubleshooting potential issues in high-speed fiber optic systems. As the need for faster, more efficient data transmission grows, these analyzers will play an integral role in ensuring system integrity and performance.

Innovations in optical technologies, such as the expansion of 5G networks, advancements in fiber optics, and the rising use of optical sensors in various industries, will further drive the demand for optical spectrum analyzers. The need for precision measurement tools and enhanced data transfer speeds will continue to fuel this industry’s growth.

The peak-to-trough analysis for the demand for optical spectrum analyzers in the USA highlights a steady growth trajectory with key shifts in the forecast period. The trough year is expected to occur in 2025, when the demand is valued at USD 156.1 million. At this point, demand will be driven by the initial adoption of optical communication technologies, with industries realizing the need for advanced measurement tools. The industry will experience moderate growth, primarily driven by the adoption of fiber optic technologies and the ongoing development of high-speed data transmission systems, particularly in telecommunications and research sectors.

The peak year is anticipated to be 2035, when the demand for optical spectrum analyzers is projected to rise sharply to USD 264.5 million. This significant increase will be driven by the widespread adoption of 5G networks, advancements in optical communication technologies, and greater integration of optical spectrum analyzers across industries such as healthcare and automotive.

The demand surge from 2030 to 2035 will be substantial, with the demand growing from USD 164.5 million to USD 264.5 million, adding USD 100 million. This growth will be fueled by the expansion of fiber optic infrastructure, the increasing adoption of 5G networks, and the growing applications of optical technologies in various sectors. The shift from moderate to accelerated growth during this phase reflects the maturation of optical technologies and their widespread integration into emerging industries.

| Metric | Value |

|---|---|

| USA Optical Spectrum Analyzer Value (2025) | USD 156.1 million |

| USA Optical Spectrum Analyzer Forecast Value (2035) | USD 264.5 million |

| USA Optical Spectrum Analyzer Forecast CAGR (2025 2035) | 5.40% |

The demand for optical spectrum analyzers (OSAs) in the USA is increasing as the telecommunications and data‑center sectors expand rapidly. OSAs are critical instruments for testing and validating high‑speed optical fiber links, dense wavelength division multiplexing (DWDM) systems, and coherent optics used in 5G/6G networks and hyperscale data‑centres. These developments require precise measurement of wavelength, power distribution and signal quality functions that OSAs provide.

Growth in cloud computing, streaming services and enterprise data‑traffic is driving expansion of fibre‑optic networks and equipment manufacturing in the US. As network operators deploy higher‑capacity fibre back‑haul, metro links and data‑centre interconnects, the need for accurate spectral analysis rises. OSAs are also used in R&D labs and in production testing of photonics components, laser sources and optical integrated circuits, further supporting demand.

Technological advances such as higher resolution measurement, miniaturised form‑factors, handheld instruments and integrated analytics are enhancing functionality and lowering the barrier to adoption. Stricter compliance standards and quality control requirements in optical communications compel manufacturers and service providers to invest in OSAs. As infrastructure build‑out continues and optical systems become more complex, the requirement for advanced spectral test equipment in the USA is expected to remain strong.

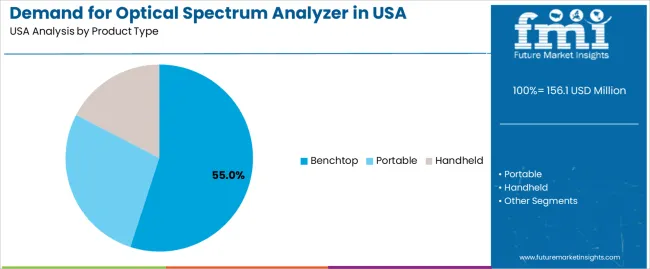

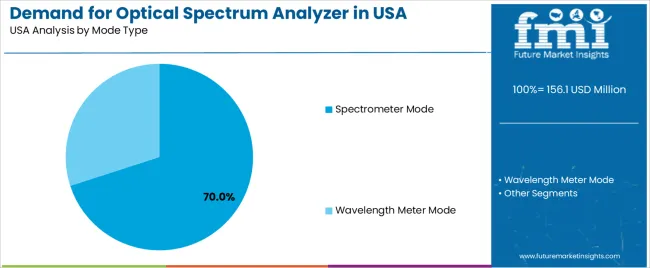

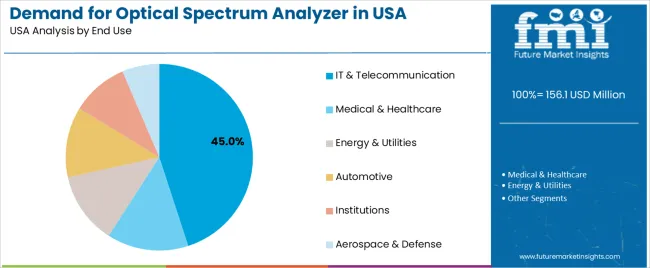

Demand is segmented by product type, mode type, and end use. By product type, demand is divided into benchtop, portable, and handheld. In terms of mode type, demand is categorized into spectrometer mode and wavelength meter mode. The end-use segmentation includes IT & telecommunication, medical & healthcare, energy & utilities, automotive, institutions, and aerospace & defense. This segmentation showcases the broad USAge of optical spectrum analyzers across diverse industries in the USA. Regionally, demand is divided into West, South, Northeast, and Midwest.

Benchtop optical spectrum analyzers account for 55% of total demand in the USA. They are widely preferred due to their high precision, advanced measurement capabilities, and superior stability compared to portable or handheld models. These analyzers provide enhanced resolution and wider wavelength coverage, making them indispensable in laboratories, research facilities, and telecom testing environments. Their robust performance supports detailed spectral analysis required for fiber-optic communication networks, laser testing, and component characterization.

The growing complexity of communication systems and the rising demand for high-speed data transmission have increased the need for equipment capable of offering reliable and accurate measurements. Benchtop analyzers are also favored in R&D environments where continuous, high-accuracy monitoring is essential. As industries like telecom, photonics research, and aerospace increasingly adopt advanced optical technologies, the demand for benchtop analyzers continues to grow due to their unmatched precision and versatility.

Spectrometer mode accounts for 70% of the demand because it allows detailed analysis of optical signals across a wide wavelength range. This mode is essential for evaluating signal quality, identifying spectral components, and monitoring wavelength stability critical tasks in fiber-optic communication, optical component manufacturing, and research applications. Its ability to deliver comprehensive spectral profiles makes it the preferred choice for both laboratory and field testing environments.

The increasing deployment of fiber-optic networks across the USA, along with rising investments in high-bandwidth communication technologies, drives the demand for spectrometer-based optical testing. Industries rely on this mode for tasks such as DWDM testing, optical amplifier assessment, and spectrum monitoring. As optical networks expand and require tighter performance validation, spectrometer mode remains the dominant operational mode for optical spectrum analyzers.

The IT & telecommunication sector accounts for 45% of the demand for optical spectrum analyzers in the USA. This industry relies heavily on optical communication systems such as fiber-optic networks, 5G infrastructure, and high-speed data transmission technologies. Optical spectrum analyzers are essential for testing network performance, identifying signal distortions, optimizing wavelength USAge, and maintaining system reliability.

With growing data consumption, expansion of cloud services, and rapid deployment of 5G networks, telecom operators require precise optical testing tools to ensure efficient network performance. These analyzers are also used extensively in R&D for developing next-generation communication technologies. As the USA continues to invest in advanced telecom infrastructure and fiber-optic expansion, the IT & telecommunication sector remains the largest end-use segment, strongly driving overall demand for optical spectrum analyzers.

Optical Spectrum analyzers help characterize lasers, validate high‑speed optical links, and ensure performance in dense‑wavelength‑division‑multiplexing (DWDM) systems. Key drivers include roll‑out of 400 G/800 G coherent networks, growth of cloud‑data traffic, and expansion of silicon‑photonics/quantum‑optics research. Important restraints include high cost of precision equipment, requirement for skilled operators, and the increasing availability of alternative lower‑cost test methods which may reduce new equipment purchases.

Demand for optical spectrum analyzers in the USA is growing due to the increasing need for precise optical testing in modern telecommunications and manufacturing sectors. USA network operators are under pressure to meet the demands of faster, high-capacity fiber-optic infrastructures, including the rollout of 5G/6G networks, data-center backhaul upgrades, and enhanced IoT connectivity. These upgrades require more sophisticated spectral-analysis tools to ensure performance and reliability across high-speed optical networks.

Optical analyzers are becoming increasingly important for research institutions and defense programs focused on advanced photonics, quantum technologies, and sensing applications. Furthermore, innovations in portability, such as modular and handheld optical spectrum analyzers, make on-site verification and field deployment more practical, broadening the user base. These factors combined drive the growing adoption of optical spectrum analyzers across various sectors in the USA, expanding their usage beyond traditional laboratories.

Technological innovations are significantly driving the growth of the optical spectrum analyzer industry in the USA. Advances in miniaturization have led to the development of portable, handheld analyzers that provide convenience and flexibility for fieldwork and on-site testing. Newer analyzers cover a broader wavelength range, including short-wave infrared (SWIR) bands, which is crucial for emerging applications in telecommunications and industrial sectors.

The integration of embedded analytics and artificial intelligence (AI) enables faster and more accurate signal interpretation, reducing the need for manual data processing. Moreover, the ability to seamlessly integrate optical spectrum analyzers into network test workflows enhances operational efficiency and speeds up the deployment of high-capacity optical links. These innovations make optical spectrum analyzers more precise, efficient, and adaptable, making them indispensable tools for industries and researchers, thus accelerating their adoption across various applications in the USA.

Despite the increasing demand, several challenges hinder the widespread adoption of optical spectrum analyzers in the USA. One of the key obstacles is the high capital cost of advanced analyzers, which limits their use to large network operators, research labs, and high-end commercial users, leaving smaller enterprises with fewer resources to adopt such technology. The skilled operator requirement and specialized training needed to effectively use these instruments can slow adoption, particularly in industries without dedicated technical staff.

Moreover, alternative testing methods and the availability of refurbished equipment may reduce the demand for new units, as companies opt for lower-cost options. The rapid pace of technological change in optical networks can also lead to concerns over equipment lifecycle where buyers hesitate to invest in expensive analyzers due to the fear that new technologies will quickly replace existing ones. These factors limit the broader penetration of optical spectrum analyzers across all industry segments.

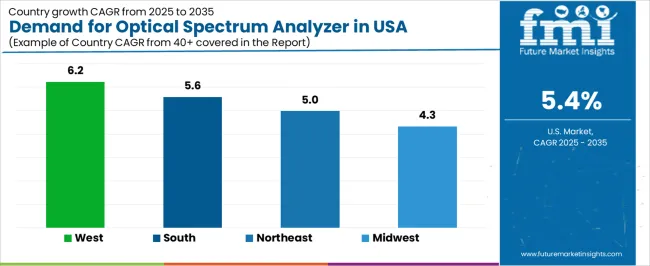

| Region | CAGR (%) |

|---|---|

| West | 6.2% |

| South | 5.6% |

| Northeast | 5.0% |

| Midwest | 4.3% |

The demand for optical spectrum analyzers in the USA is growing across all regions, with the West leading at a 6.2% CAGR, driven by advancements in telecommunications, R&D, and high-tech industries. The South follows at 5.6%, supported by a growing presence of tech companies and research institutions. The Northeast shows a 5.0% CAGR, fueled by its strong academic and tech sectors. The region’s focus on innovation in optical communications and data networks contributes to this demand. The Midwest experiences moderate growth at 4.3%, driven by steady adoption in manufacturing and telecommunications sectors. This ongoing growth reflects the increasing reliance on optical technologies in communication infrastructure and research.

The West is experiencing the highest growth in demand for optical spectrum analyzers, with a 6.2% CAGR. This growth is primarily driven by the region's leading role in the telecommunications, high-tech, and semiconductor industries, where optical spectrum analyzers are essential for testing and optimizing optical networks and systems. Cities like San Francisco, Los Angeles, and Seattle are hubs for tech companies and research institutions, all of which rely on advanced testing equipment like optical spectrum analyzers to ensure the performance of optical communications systems.

The West's focus on innovation and its strong presence in sectors such as telecommunications, data centers, and semiconductor manufacturing is fueling the demand for these analyzers. As the region continues to push forward with 5G development, optical spectrum analyzers play a critical role in testing the performance and efficiency of optical networks. With continuous growth in data transmission needs and the expansion of high-speed internet infrastructure, the West is expected to maintain its leadership in optical spectrum analyzer adoption.

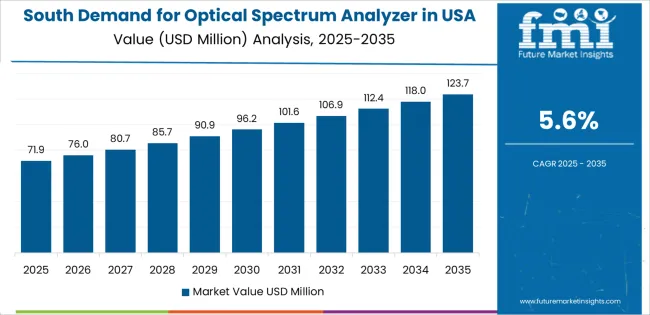

The South is seeing steady growth in demand for optical spectrum analyzers, with a 5.6% CAGR. This is primarily due to the region’s growing tech and telecommunications industries, with states like Texas, Georgia, and Florida becoming major centers for optical network expansion and semiconductor development. As more companies invest in cutting-edge technologies like fiber-optic networks, the demand for testing and diagnostic equipment such as optical spectrum analyzers is rising.

The South’s expanding focus on R&D in telecommunications and the rise of tech startups are further driving the adoption of optical spectrum analyzers. The growth of large data centers and the push for 5G infrastructure are key factors contributing to the increased demand for these devices. The South’s strong emphasis on technological advancements and the ongoing demand for high-performance communication systems will continue to propel the growth of optical spectrum analyzers in the region.

The Northeast is experiencing steady growth in demand for optical spectrum analyzers, with a 5.0% CAGR. The region's strong academic, research, and technology sectors are key contributors to this demand. Cities like New York, Boston, and Philadelphia host leading universities and research institutions that are at the forefront of optical communications and advanced network research, which drives the need for precise testing and measurement equipment such as optical spectrum analyzers.

In addition, the region’s prominent role in high-tech industries, including telecommunications, healthcare, and electronics, further boosts demand. The Northeast’s ongoing investment in innovation, coupled with the rise of 5G and smart city technologies, ensures sustained growth in the use of optical spectrum analyzers for optimizing optical networks. As the region continues to lead in research and technological development, demand for these analyzers is expected to remain strong and grow steadily.

The Midwest is experiencing moderate growth in demand for optical spectrum analyzers, with a 4.3% CAGR. The region’s growth is driven by steady adoption in sectors such as telecommunications, manufacturing, and semiconductor testing. Cities like Chicago, Detroit, and Minneapolis are increasingly becoming hubs for optical testing and diagnostics as industries seek to optimize their optical networks and data transmission systems.

While growth in the Midwest is slower compared to other regions, the steady demand for optical spectrum analyzers is being fueled by the region’s investments in manufacturing and high-tech infrastructure. The ongoing expansion of broadband and telecom networks, along with a focus on improving the efficiency of optical communication systems, continues to drive demand for these devices. As industries in the Midwest continue to adopt more advanced technologies, demand for optical spectrum analyzers will likely continue to grow at a moderate pace.

Demand for optical spectrum analyzers in the USA is accelerating, fueled by the rapid deployment of high‑capacity optical networks, advances in photonic technologies, and increasing requirements for precise optical signal testing in telecommunications, data‑centres and manufacturing. As network operators and OEMs roll out next‑generation coherent links and fibre‑optic systems, the need for instruments capable of analysing and validating optical spectra has become crucial.

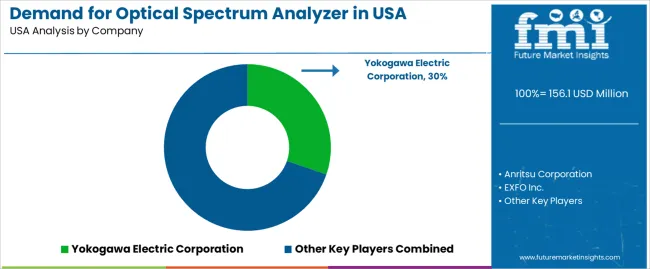

In the USA demand landscape, Yokogawa Electric Corporation holds an approximate 30.3% share, highlighting its strong presence and established reputation within the optical test‑equipment segment. Other significant suppliers in the industry include Anritsu Corporation, EXFO Inc., Keysight Technologies, and VIAVI Solutions Inc., each providing advanced optical spectrum analyzer platforms tailored for rugged field use, benchtop precision testing and high‑throughput manufacturing environments.

Key drivers of demand include the rollout of 400 G/800 G coherent optical modules, stricter optical‑layer compliance standards, and the continual shift toward higher‑speed optical networks requiring finer spectral resolution and enhanced signal integrity. In addition, the expansion of photonic‑chip manufacturing, silicon‑photonics research and advanced sensing applications are broadening the use‑case for optical spectrum analyzers. While challenges such as high equipment cost and component lead‑time pressures exist, the outlook remains strong. USA demand is set to grow steadily as optical networks and photonics technologies evolve, making optical spectrum analyzers indispensable for testing, validation and quality assurance across the sector.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Product Type | Benchtop, Portable, Handheld |

| Mode Type | Spectrometer Mode, Wavelength Meter Mode |

| End Use | IT & Telecommunication, Medical & Healthcare, Energy & Utilities, Automotive, Institutions, Aerospace & Defense |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Yokogawa Electric Corporation, Anritsu Corporation, EXFO Inc., Keysight Technologies, VIAVI Solutions Inc. |

| Additional Attributes | Dollar sales by product type, mode type, and end use, with increasing adoption in medical and telecom industries. |

The global demand for optical spectrum analyzer in USA is estimated to be valued at USD 156.1 million in 2025.

The market size for the demand for optical spectrum analyzer in USA is projected to reach USD 264.1 million by 2035.

The demand for optical spectrum analyzer in USA is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in demand for optical spectrum analyzer in USA are benchtop, portable and handheld.

In terms of mode type, spectrometer mode segment to command 70.0% share in the demand for optical spectrum analyzer in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA