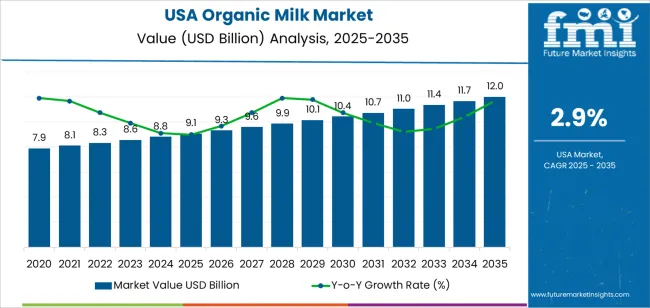

The USA organic milk demand is valued at USD 9.1 billion in 2025 and is forecasted to reach USD 12.0 billion by 2035, recording a CAGR of 2.9%. Demand is shaped by steady consumption of certified-organic dairy products, wider distribution across national retailers, and continued reliance on regulated organic farming systems. The category benefits from structured certification requirements, traceable production standards, and consistent integration of organic milk into mainstream dairy portfolios. Growth is also influenced by household preferences for minimally processed dairy options and stable procurement by foodservice operators that incorporate organic ingredients into standard menu formats.

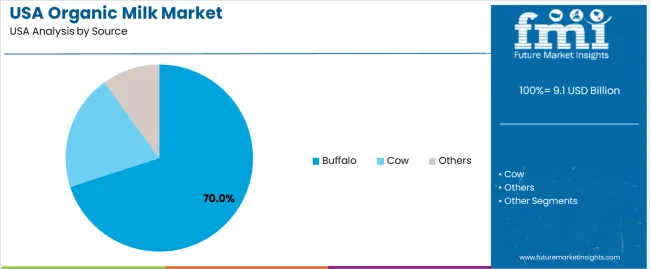

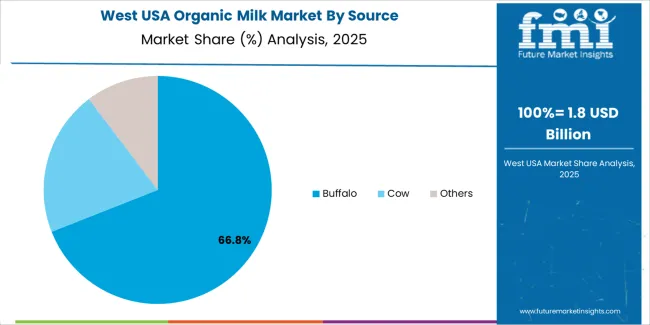

Buffalo milk represents the leading source due to its nutrient profile and its suitability for specialised dairy applications. Its higher fat and protein content supports its use in value-added organic dairy items such as cultured products and premium fluid milk lines. This segment gains visibility through targeted production efforts by regional processors and expanded placement in natural-food retail channels. Broader acceptance among consumers seeking alternatives to conventional cow-milk varieties contributes to its share within the organic category.

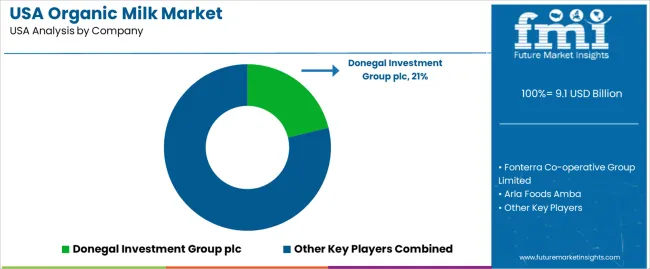

Demand is concentrated in the West, South, and Northeast, where supermarket networks, natural-food chains, and established cold-chain systems support continuous product availability. Key suppliers include Donegal Investment Group plc, Fonterra Co-operative Group Limited, Arla Foods Amba, Govind Milk and Milk Products, and Organic Valley. These suppliers maintain certified-organic dairy portfolios and structured distribution arrangements across national retail and foodservice channels.

Year-on-year growth analysis indicates a stable, low-fluctuation pattern shaped by steady household consumption and consistent retail placement across natural-food channels. Between 2025 and 2028, YoY growth will track close to the long-term average as demand remains supported by interest in certified-organic dairy, established supply contracts, and predictable procurement from supermarkets and specialty retailers. Incremental gains will come from expanded lactose-free and pasture-based product lines.

From 2029 to 2032, YoY growth may show mild variation due to shifts in feed costs, farm-gate pricing, and competition from plant-based dairy alternatives. These factors may influence annual purchasing behaviour but will not significantly disrupt baseline consumption because organic milk retains a stable core customer base. Between 2033 and 2035, YoY growth is expected to stabilise as production volumes and retail participation align with mature demand patterns. Modest gains will be driven by packaging improvements, cold-chain efficiency, and standardised certification practices. The YoY profile reflects a mature dairy segment characterised by consistent consumer preferences, predictable farming cycles, and stable utilisation across U.S. retail and food-service channels.

| Metric | Value |

|---|---|

| USA Organic Milk Sales Value (2025) | USD 9.1 billion |

| USA Organic Milk Forecast Value (2035) | USD 12.0 billion |

| USA Organic Milk Forecast CAGR (2025-2035) | 2.9% |

Demand for organic milk in the USA is rising as consumers prioritise health, environmental sustainability and product traceability in their dietary choices. Organic milk offers attributes such as pasture-based feeding, absence of synthetic hormones and antibiotics and certification under the USDA Organic standard, which appeal to wellness-oriented shoppers. Despite a decline in overall fluid milk consumption in the conventional category, organic offerings continue to expand in industry share, signalling substitution rather than mere category shift.

Retailers and brands are expanding store-level distribution, premium packaging and value-added variants (for example high-protein or grass-fed) to capitalise on this trend. Growth is supported by increased availability of organic milk across supermarket chains, enhanced promotional efforts, and consumer willingness to pay premium prices for perceived quality attributes. Smaller niche and regional brands secure shelf space and develop direct-to-consumer channels, which broaden reach.

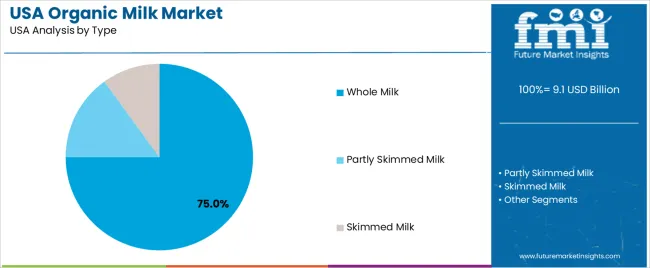

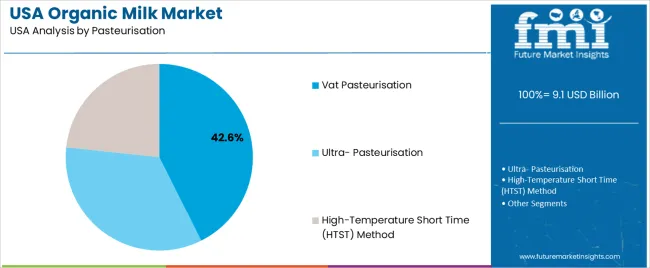

Demand for organic milk in the United States reflects sourcing patterns, fat-content preferences, and processing requirements across retail and institutional channels. Distribution across source, type, and pasteurisation categories is shaped by animal supply, consumer nutrition choices, and shelf-life expectations. These patterns indicate how organic milk is selected for household consumption, food-service use, and value-added dairy production.

Buffalo-derived organic milk holds 70.0% of national demand, making it the dominant source category. Its higher fat content, richer texture, and suitability for specialty dairy products support broad consumer adoption. Buffalo milk is used in ghee, yogurt, and high-fat dairy preparations that align with culinary habits and premium consumption. Cow milk represents 20.0%, meeting preferences for lighter drinking milk and everyday household use. The remaining 10.0% includes goat and other sources supporting niche dietary preferences. Source distribution reflects nutritional expectations, regional consumption patterns, and availability of certified-organic supply chains across farming regions.

Key drivers and attributes:

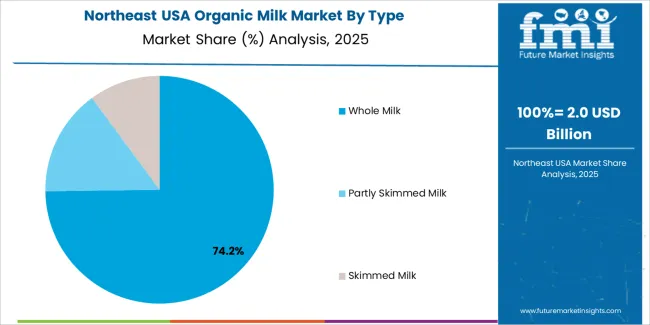

Whole organic milk holds 75.0% of U.S. demand and forms the leading type category. Its full-fat composition supports taste preferences, nutritional expectations, and use in cooking and beverage preparation. Whole milk remains preferred in households seeking minimally processed dairy with complete nutrient retention. Partly skimmed milk accounts for 15.0%, serving consumers balancing fat reduction with flavour retention. Skimmed milk represents 10.0%, supporting calorie-controlled diets and institutional use in meal programmes. Type distribution reflects differences in dietary choices, product versatility, and purchasing patterns across age groups and regions.

Key drivers and attributes:

Vat pasteurisation holds 42.6% of national demand and represents the leading processing category. This low-temperature, longer-duration technique preserves flavor and supports traditional organic-dairy expectations among consumers prioritising minimal processing. Ultra-pasteurisation accounts for 34.1%, offering extended shelf life suited for long-distance distribution and retail inventory requirements. High-Temperature Short Time (HTST) processing represents 23.3%, supporting mid-scale production environments needing balanced efficiency and flavour retention. Pasteurisation distribution reflects shelf-life requirements, regional manufacturing infrastructure, and consumer preference for either minimally processed or long-stability organic milk.

Key drivers and attributes:

Growing health and ecofriendly awareness, premium positioning of dairy, and recovery of milk consumption drive demand.

Demand for organic milk in the United States is increasing as consumers look for dairy products perceived as free from synthetic hormones, antibiotics and chemical-based feed inputs. Producers of organic milk command higher prices and are seeing volume growth, even as conventional milk volumes decline. The organic dairy segment is expanding as shoppers trade up from standard milk to organic whole milk or specialty formats. Ecofriendly considerations such as pasture-based systems, animal welfare and lower-input farming appeal to ethical and premium-segment buyers, reinforcing consumption of organic milk.

Higher cost, constrained organic herd conversions and competition from plant-based alternatives restrain growth.

Organic milk typically costs significantly more than conventional milk due to higher feed, pasture access, certification requirements and farm labour. This price premium limits accessibility among cost-sensitive consumers and restricts frequent consumption. Converting a conventional dairy operation to certified organic status takes multiple years and affects supply volume, which limits short-term expansion of organic milk availability. Growth of plant-based “milks” serves as competition for dairy milk organic or otherwise especially among younger or health-oriented consumers, which modestly reduces incremental demand for organic dairy.

Shift toward direct-to-consumer formats, expansion of premium specialty products and renewed interest in traditional dairy are shaping industry trends.

Retailers and dairy brands are increasingly offering organic milk via subscription or home-delivery models to appeal to convenience-seeking consumers. Product innovation in organic dairy, such as ultra-filtered organic whole milk with higher protein content, lactose-reduced organic milk and flavored organic varieties is broadening the value-proposition for organic milk. Recent trends show renewed interest in dairy milk overall, which supports organic milk by association. These shifts reinforce continued growth in the organic milk segment in the USA.

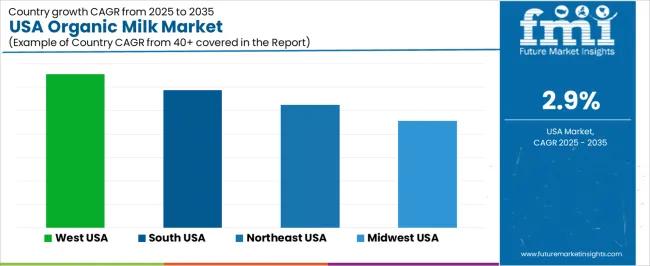

Demand for organic milk in the USA is rising as households, retailers, and food-service operators adopt products sourced from certified-organic farms using regulated feed, antibiotic restrictions, and verified animal-welfare standards. Growth reflects consumer interest in clean-label dairy, stable retail availability, and broader distribution through supermarkets and online grocery platforms. Regional variation is shaped by supply-chain capacity, dairy-farm density, purchasing power, and the maturity of organic retail channels. The West leads with a 3.3% CAGR, followed by the South (2.9%), the Northeast (2.6%), and the Midwest (2.3%).

| Region | CAGR (2025-2035) |

|---|---|

| West | 3.3% |

| South | 2.9% |

| Northeast | 2.6% |

| Midwest | 2.3% |

The West grows at 3.3% CAGR, supported by extensive retail availability, developed dairy infrastructure, and strong consumer interest in organic categories across states such as California, Washington, and Oregon. Supermarkets and natural-food retailers maintain broad organic milk assortments, including whole, reduced-fat, lactose-free, and grass-fed variants. Regional processors invest in certified-organic supply chains to meet steady demand from urban and suburban industries. Food-service operators, including cafés and school-meal providers, adopt organic milk for standardized menu requirements. Online grocery channels show consistent turnover due to home-delivery adoption across metropolitan areas. Stable dairy production and established certification programs reinforce long-term consumption trends across the region.

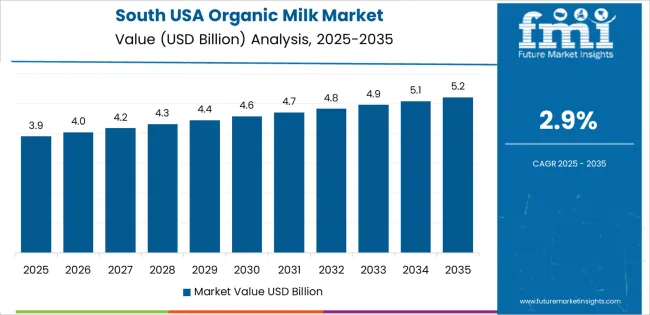

The South grows at 2.9% CAGR, driven by rising household interest in organic dairy and expanding retail coverage across Texas, Florida, Georgia, and surrounding states. Supermarkets and big-box chains increase shelf space for organic milk to meet demand from suburban families and health-conscious consumers. Dairy processors strengthen supply networks by partnering with certified-organic farms, particularly in regions with favorable livestock-grazing conditions. Food-service providers incorporate organic options into school and healthcare programs. Although conventional milk remains dominant, steady growth in clean-label preferences supports broader availability of organic products across retail channels. Online shopping platforms contribute additional volume through scheduled delivery services.

The Northeast grows at 2.6% CAGR, supported by a long-established organic dairy sector and steady retail demand across states such as New York, Massachusetts, and Pennsylvania. Regional dairy cooperatives supply a large share of the organic milk sold through supermarkets, specialty stores, and home-delivery services. Consumers show strong interest in certified-organic dairy linked to traceability and regulated production standards. Retailers maintain consistent assortment depth, including grass-fed and extended-shelf-life organic milk. Colleges, hospitals, and institutional food networks integrate organic dairy into procurement programs. Despite slower population growth, stable consumption habits and developed distribution networks sustain regular industry activity.

The Midwest grows at 2.3% CAGR, supported by a large dairy-farming base and moderate but dependable consumer interest in organic products across states such as Wisconsin, Minnesota, and Illinois. Retailers expand organic milk options to meet gradual shifts in household purchasing preferences. Dairy processors combine local production with organic-certified sourcing to serve both regional supermarkets and food-service operators. Home-delivery services supply organic dairy to suburban households seeking consistent weekly supply. Although conventional milk remains widely consumed, essential retail demand supports predictable volumes for organic variants. Certification programs and steady dairy-farm participation enable reliable production capacity across the region.

Demand for organic milk in the USA is shaped by a group of international and domestic dairy producers supplying fluid milk, value-added dairy products, and certified organic ingredients. Donegal Investment Group plc holds the leading position with an estimated 21.2% share, supported by controlled sourcing practices, consistent organic-certification compliance, and stable supply relationships with U.S. distributors. Its position is reinforced by predictable quality standards and reliable delivery across retail and food-service channels.

Fonterra Co-operative Group Limited and Arla Foods Amba follow as significant participants, providing certified organic milk and dairy components sourced from structured cooperative networks. Their strengths include dependable herd-management systems, traceability throughout production, and consistent composition suitable for fluid milk, yogurt, and cheese applications. Govind Milk and Milk Products maintains a developing presence through selective export programmes that align with U.S. organic-certification requirements.

Organic Valley contributes strong domestic capability through a nationwide cooperative structure focused on pasture-based production, chemical-free feed, and consistent quality verification. Its role is supported by broad retail placement and established consumer recognition.

Competition across this segment centers on certification compliance, herd-management practices, milk-composition consistency, traceability, and supply reliability. Demand remains steady due to continued interest in clean-label dairy, growth in premium fluid-milk consumption, and reliance on suppliers capable of delivering verified organic production with stable year-round availability.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Source | Buffalo, Cow, Others |

| Type | Whole Milk, Partly Skimmed Milk, Skimmed Milk |

| Pasteurisation | Vat Pasteurisation, Ultra-Pasteurisation, High-Temperature Short Time (HTST) Method |

| Flavour | Flavoured (Chocolate, Strawberry, Vanilla, Others), Non-Flavoured |

| Packaging | Bottle, Tetra Packs, Pouches, Cans, Bulk Packs |

| Distribution Channel | Modern Trade, Retailer, Speciality Store, HORECA, Convenience Store |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Donegal Investment Group plc, Fonterra Co-operative Group Limited, Arla Foods Amba, Govind Milk and Milk Products, Organic Valley |

| Additional Attributes | Dollar sales by source, type, pasteurisation method, flavour, packaging, and distribution channel categories; regional demand patterns across West, Midwest, South, and Northeast; competitive landscape of organic dairy producers; certification and traceability requirements for organic milk; integration with retail channels, specialty stores, food service (HORECA), and rising consumer preference for clean-label and sustainably sourced dairy in the USA. |

The global demand for organic milk in USA is estimated to be valued at USD 9.1 billion in 2025.

The market size for the demand for organic milk in USA is projected to reach USD 12.0 billion by 2035.

The demand for organic milk in USA is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in demand for organic milk in USA are buffalo, cow and others.

In terms of type, whole milk segment to command 75.0% share in the demand for organic milk in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Milk Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Organic milk powder market

USA Calf Milk Replacers Market Outlook – Share, Growth & Forecast 2025–2035

USA Human Milk Oligosaccharides Market Insights – Growth & Demand 2025-2035

Organic Protein Milk Market

Demand for Organic Milk in Japan Size and Share Forecast Outlook 2025 to 2035

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Milking Automation Market Size and Share Forecast Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

Milking Robots Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA