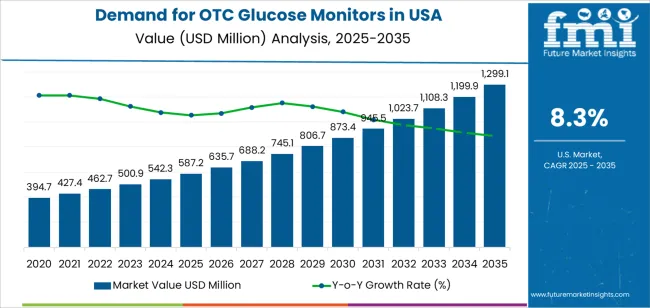

The demand for OTC (over-the-counter) glucose monitors in the USA is projected to grow from USD 587.2 million in 2025 to USD 1,299.1 million by 2035, reflecting an 8.3% CAGR. OTC glucose monitors are becoming increasingly popular among diabetic patients, health-conscious individuals, and those seeking to manage blood sugar levels at home. The increasing prevalence of diabetes and pre-diabetes, along with growing awareness about self-care and health monitoring, is driving this market expansion. Additionally, advancements in technology have made glucose monitors more user-friendly, accurate, and affordable, making them widely accessible to a broader population.

The rising trend of preventive healthcare, combined with the shift towards home-based health monitoring, has contributed significantly to the demand for OTC glucose monitors. The continuous development of smart glucose monitoring devices that are integrated with mobile applications and provide real-time data to patients will further drive this growth. Increased focus on early detection of diabetes, health management, and patient empowerment are all factors expected to support the sustained growth of this market.

From 2025 to 2030, the demand for OTC glucose monitors in the USA is expected to grow from USD 587.2 million to USD 873.4 million, reflecting an increase of USD 286.2 million over this period. This represents a significant expansion driven by the increasing adoption of personal health monitoring and diabetes management tools. With the rise in the number of people diagnosed with diabetes and the growing awareness around pre-diabetes management, the demand for glucose monitors will see a sharp increase.

The growth during this phase will be further supported by the adoption of digital health tools and the integration of glucose monitors with smart devices like smartphones and wearables, offering users more convenient, accurate, and real-time monitoring. Additionally, more healthcare providers are encouraging patients to self-monitor their glucose levels as part of a holistic approach to managing diabetes, further driving demand for OTC glucose monitors. As consumer interest in preventive healthcare rises, and the demand for convenient, non-invasive monitoring options increases, this period will see substantial growth in the market.

By 2030, the market is expected to reach USD 873.4 million, with continued investments in innovation and accessibility leading the market forward. The adoption of advanced technologies and the growing evidence-based healthcare approach will make OTC glucose monitors a staple in diabetes care and general health monitoring. This phase will mark accelerated growth, reflecting the broader trend toward self-care and preventive health management in the USA.

| Metric | Value |

|---|---|

| USA OTC Glucose Monitors Industry Sales Value (2025) | USD 587.2 million |

| USA OTC Glucose Monitors Industry Forecast Value (2035) | USD 1,299.1 million |

| USA OTC Glucose Monitors Industry Forecast CAGR (2025-2035) | 8.3% |

Demand for over the counter (OTC) glucose monitors in the USA is rising due to increased prevalence of diabetes, prediabetes, and metabolic health awareness among consumers. Many American adults live with diabetes or are diagnosed as prediabetic, which drives interest in home use devices that allow frequent monitoring without relying on clinical visits. Ease of access, online purchase options, and devices that appeal to lifestyle and preventive health users are supporting rapid expansion beyond traditional patient populations.

Another factor supporting growth is technological advancement and regulatory change that enable devices to be sold without prescription and enhance consumer engagement. Modern glucose monitors offer sensor wear, smartphone integration, AI driven trend analysis, and lower cost of entry for non insulin users. These elements expand the market to wellness oriented adults, not just those with diagnosed diabetes. Challenges remain, such as device accuracy, data privacy, reimbursement support, and consumer education needs. Despite these issues, the convergence of rising chronic conditions, consumer empowerment in health management, and improved device availability suggests the demand for OTC glucose monitors in the USA will continue to grow steadily.

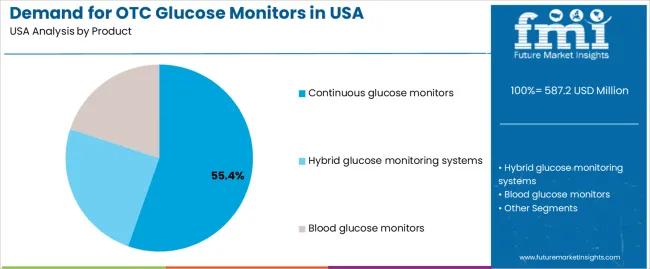

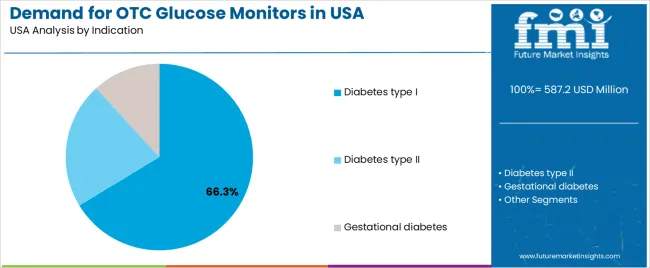

The demand for over-the-counter (OTC) glucose monitors in the USA is largely driven by product type and indication. The leading product type is continuous glucose monitors, which hold 55% of the market share, while diabetes type I is the dominant indication, accounting for 66.3% of the demand. OTC glucose monitors are crucial for people managing diabetes and other glucose-related conditions, offering improved monitoring capabilities for blood sugar levels. As awareness of diabetes management grows and patients increasingly seek more advanced, convenient, and accurate monitoring solutions, the demand for glucose monitors continues to expand.

Continuous glucose monitors (CGMs) lead the OTC glucose monitor market in the USA, holding 55% of the market share. CGMs are advanced devices that track blood glucose levels continuously throughout the day and night, providing real-time data to users. Unlike traditional blood glucose meters that require finger-prick tests, CGMs use sensors placed under the skin to monitor glucose levels continuously, offering a more convenient and less invasive approach to managing blood sugar.

The increasing demand for CGMs is driven by their ability to provide more accurate and comprehensive data on glucose fluctuations, allowing individuals to make more informed decisions about their diet, exercise, and insulin use. This is particularly beneficial for people with diabetes type I, who need to monitor their glucose levels more frequently. With the growing focus on personalized healthcare, the demand for continuous glucose monitoring systems is expected to continue growing, solidifying their dominance in the market for OTC glucose monitors.

Diabetes type I is the leading indication for OTC glucose monitors in the USA, accounting for 66.3% of the demand. Diabetes type I is a chronic condition where the pancreas produces little or no insulin, requiring lifelong management of blood glucose levels. Individuals with diabetes type I are often dependent on regular glucose monitoring to avoid hypoglycemia or hyperglycemia, making accurate and continuous monitoring tools essential.

The large demand for glucose monitors in diabetes type I is driven by the need for frequent and precise monitoring, especially for those who require insulin therapy. The availability of OTC glucose monitors, such as continuous glucose monitors, has become vital in providing real-time insights into glucose levels, allowing individuals to manage their condition effectively and reduce the risk of complications. As the prevalence of diabetes type I continues to rise and more people with the condition seek convenient, non-invasive solutions for glucose monitoring, the demand for OTC glucose monitors in this segment will remain strong.

The over the counter (OTC) glucose monitor market in the United States is experiencing steady growth as consumers increasingly adopt self monitoring tools for diabetes management, pre diabetes monitoring and general metabolic health tracking. In 2024 the USA OTC continuous glucose monitoring (CGM) segment was valued around USD 48.6 million and is projected to nearly double to USD 93.5 million by 2033, indicating a compound annual growth rate (CAGR) of about 8%. Growth is driven by consumer health awareness, wearable device uptake and more accessible monitoring solutions.

What Are the Primary Growth Drivers for OTC Glucose Monitor Demand in the United States?

Key drivers include the growing prevalence of diagnosed and undiagnosed diabetes, high rates of pre diabetes and metabolic syndrome, which increase demand for convenient monitoring tools. In addition, technological advances in sensor accuracy, connectivity (smartphones, wearables), and minimal invasive or needle free designs enhance user appeal. The shift toward preventive health and consumer driven wellness also supports adoption of OTC monitors among non insulin dependent individuals and health conscious consumers. Improved regulatory frameworks and broader retail access further enable market expansion.

What Are the Key Restraints Affecting OTC Glucose Monitor Demand in the United States?

Despite growth potential, there are significant restraints. Accuracy and reliability concerns persist, especially for non medical or wellness use devices, which can limit adoption among consumers who require clinical grade data. The cost of advanced monitoring systems including sensors and associated subscriptions may deter budget sensitive users, particularly where insurance does not reimburse OTC devices. Additionally, technology obsolescence and rapid innovation cycles create risk for buyers who may hesitate to commit until devices are proven. Finally, consumer awareness and trust may still lag for non insulin patients or wellness focused segments.

What Are the Key Trends Shaping OTC Glucose Monitor Demand in the United States?

Emerging trends include the transition of CGM devices from prescription only to OTC availability, broadening access to users with type 2 diabetes, pre diabetes or wellness interests. The integration of glucose monitors with mobile apps, cloud platforms and health data ecosystems is increasing, enabling richer analytics, alerts and lifestyle insights. Retail expansion both online and brick and mortar makes OTC monitors more accessible. Additionally, new usage models are emerging where wellness and fitness oriented consumers use glucose data for diet, activity and metabolic health management beyond traditional disease contexts.

The demand for over-the-counter (OTC) glucose monitors in the USA is growing as consumers become more proactive about their health, particularly in managing diabetes and monitoring blood sugar levels. OTC glucose monitors provide individuals with a convenient, at-home method for tracking their glucose levels, supporting better management of conditions like diabetes and prediabetes. The rise in health consciousness, increased diabetes awareness, and a growing number of individuals diagnosed with type 2 diabetes are significant factors contributing to the demand for these devices.

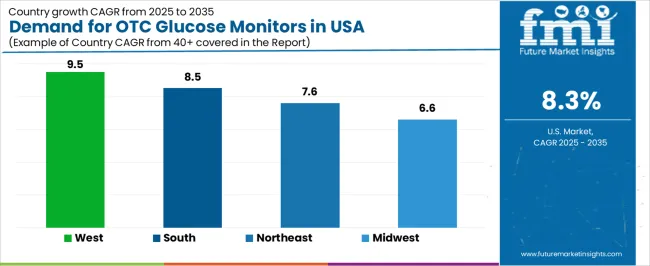

Additionally, the widespread availability of these devices through pharmacies, online platforms, and retail outlets further fuels adoption. Regional variations in demand are influenced by factors such as population health, access to healthcare resources, and consumer preferences. The West leads in demand, driven by higher health consciousness, while the South, Northeast, and Midwest also show steady adoption. This analysis explores the regional drivers behind the demand for OTC glucose monitors across the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 9.5% |

| South | 8.5% |

| Northeast | 7.6% |

| Midwest | 6.6% |

The West region leads the USA in demand for OTC glucose monitors with a CAGR of 9.5%. The West is known for its high level of health-consciousness and its emphasis on preventive healthcare, which has contributed to the widespread use of OTC glucose monitors. States like California, Washington, and Oregon have large populations of individuals who prioritize wellness, exercise, and monitoring their health, which fuels the demand for at-home glucose monitoring devices.

Additionally, the region's robust healthcare infrastructure, along with greater access to health education and resources, encourages the adoption of OTC glucose monitors. As the prevalence of type 2 diabetes continues to rise, especially in the aging population, the demand for easy-to-use and accessible monitoring devices like glucose meters will continue to grow in the West. Moreover, the increasing trend of telemedicine and digital health tools in the region further supports the use of at-home health monitoring products.

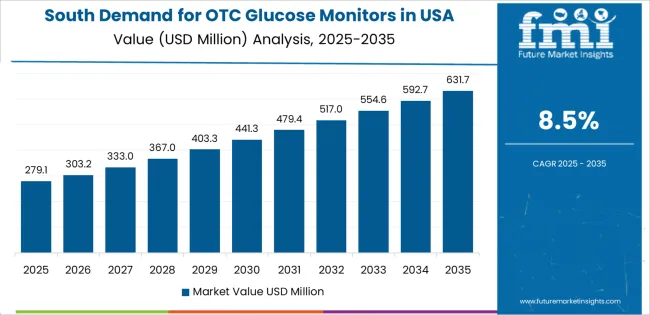

The South region shows strong demand for OTC glucose monitors with a CAGR of 8.5%. The South has a large diabetic population, which is driving the increased use of glucose monitors for better management of the condition. States like Texas, Florida, and Georgia have a high incidence of type 2 diabetes, partially due to lifestyle factors and a higher prevalence of obesity, which has increased the demand for monitoring devices.

Furthermore, the growing accessibility of OTC glucose monitors through retail chains and online platforms in the South has made it easier for individuals to monitor their blood sugar levels at home. The region’s healthcare focus on improving chronic disease management, combined with rising awareness about diabetes, continues to drive demand for these devices. As healthcare providers encourage more self-monitoring and disease management, the adoption of OTC glucose monitors in the South is expected to continue to grow.

The Northeast demonstrates steady demand for OTC glucose monitors with a CAGR of 7.6%. The region’s focus on health and wellness, along with high levels of healthcare awareness, supports the use of OTC glucose monitors. Cities like New York and Boston have large healthcare and pharmaceutical markets, where consumers are increasingly aware of the importance of early detection and management of diabetes.

The Northeast also has a higher concentration of individuals with diabetes or at risk for diabetes, driving steady demand for these monitoring devices. Additionally, the availability of OTC glucose monitors in retail stores and pharmacies throughout the region makes it easier for consumers to access these products. While growth in the Northeast is steady, the region’s increasing health-consciousness and emphasis on preventive healthcare will support continued demand for OTC glucose monitors.

The Midwest shows moderate growth in the demand for OTC glucose monitors with a CAGR of 6.6%. While the Midwest has a strong healthcare and pharmaceutical market, the adoption of OTC glucose monitors is somewhat slower compared to other regions due to a combination of factors such as regional health disparities and lower levels of health consciousness in some areas.

However, with the increasing prevalence of type 2 diabetes and rising awareness of the benefits of self-monitoring, the demand for glucose monitoring devices in the Midwest is gradually increasing. The region's healthcare providers are also emphasizing the importance of diabetes management, which encourages consumers to invest in OTC glucose monitors for better tracking and self-care. As diabetes rates continue to rise and healthcare access improves, demand for OTC glucose monitors in the Midwest will continue to grow.

Demand for over-the-counter (OTC) glucose monitors in the United States is increasing, driven by the rising prevalence of diabetes and the growing interest in personal health monitoring and preventative care. Companies like Abbott Laboratories (holding approximately 28.2% market share), Dexcom, Inc., Medtronic Plc., Roche Diabetes Care, and Senseonics Holdings, Inc. are key players in the market. The growing trend towards self-care and the desire for more convenient and accurate methods of monitoring blood glucose levels are major factors fueling the demand for OTC glucose monitors. These devices, often marketed for home use, provide users with an easy way to manage their diabetes and monitor their blood sugar levels without the need for a prescription.

Competition in the OTC glucose monitor market is primarily driven by accuracy, ease of use, and the ability to offer real-time data for better health management. Companies are focusing on enhancing the technology behind glucose monitors, such as non-invasive monitoring methods, continuous glucose monitoring (CGM) systems, and integration with mobile apps for better data tracking. Another competitive advantage lies in the development of smaller, more discreet devices that appeal to consumers looking for a more user-friendly experience. Marketing materials typically highlight features such as blood sugar tracking capabilities, comfort, ease of calibration, and compatibility with mobile devices for continuous data analysis. By aligning their products with the increasing demand for health-conscious, tech-driven solutions in diabetes management, these companies are strengthening their position in the OTC glucose monitor market in the USA

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | USA |

| Product | Continuous glucose monitors, Hybrid glucose monitoring systems, Blood glucose monitors |

| Indication | Diabetes type I, Diabetes type II, Gestational diabetes |

| Key Companies Profiled | Abbott Laboratories, Dexcom, Inc., Medtronic Plc., Roche Diabetes Care, Senseonics Holdings, Inc. |

| Additional Attributes | The market analysis includes dollar sales by product and indication categories. It also covers regional demand trends in the United States, driven by the rising prevalence of diabetes and the growing adoption of OTC glucose monitors. The competitive landscape focuses on key manufacturers innovating in continuous and hybrid glucose monitoring systems. Trends in the increasing demand for more accurate and user-friendly glucose monitoring solutions are explored, along with advancements in sensor technology and integration with digital health platforms. |

The global demand for OTC glucose monitors in USA is estimated to be valued at USD 587.2 million in 2025.

The market size for the demand for OTC glucose monitors in USA is projected to reach USD 1,299.1 million by 2035.

The demand for OTC glucose monitors in USA is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in demand for OTC glucose monitors in USA are continuous glucose monitors, hybrid glucose monitoring systems and blood glucose monitors.

In terms of indication, diabetes type i segment to command 66.3% share in the demand for OTC glucose monitors in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA