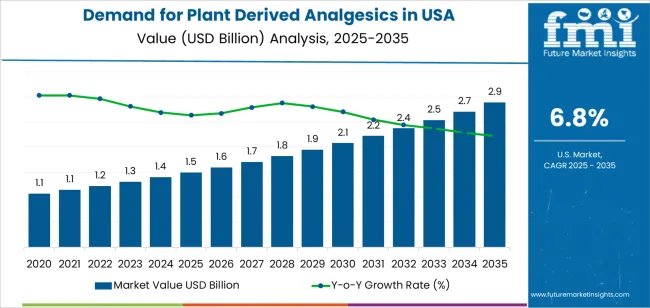

The demand for plant-derived analgesics in the USA is expected to grow from USD 1.5 billion in 2025 to USD 2.9 billion by 2035, reflecting a CAGR of 6.8%. The rise in the adoption of natural pain relief solutions is driven by growing consumer preferences for plant-based remedies and increasing awareness of the potential side effects of synthetic painkillers. As the demand for holistic healthcare and alternative medicine increases, plant-derived analgesics, including CBD-based products, turmeric, willow bark, and capsaicin, are becoming more popular for the management of chronic pain, inflammation, and muscle soreness. The market is also driven by the growing acceptance of cannabis-derived products, especially in states where CBD and THC have been legalized for medicinal use.

As consumer demand for safer alternatives to opioids continues to rise, plant-derived analgesics are positioned to capture a significant share of the pain relief market. This trend is further supported by regulatory changes that allow for more widespread use of natural pain management solutions. Additionally, the rising focus on wellness, self-care, and preventive health measures will drive the adoption of plant-based analgesics over the next decade.

The demand for plant-derived analgesics in the USA is projected to grow from USD 1.5 billion in 2025 to USD 2.9 billion by 2035, contributing an absolute growth of USD 1.4 billion over the 10-year period. This represents consistent and strong growth, reflecting an increasing shift toward natural pain relief alternatives as consumers seek safer and more effective treatments for chronic pain and inflammation.

Between 2025 and 2030, the market will expand from USD 1.5 billion to USD 2.1 billion, contributing USD 0.6 billion in value. This early phase will be marked by rising awareness of the side effects of traditional painkillers and a growing trend towards natural wellness products. The demand for plant-derived analgesics will benefit from the continued rise of the CBD market, the adoption of herbal remedies, and increased research into the efficacy of plant-based treatments.

From 2030 to 2035, the market will grow from USD 2.1 billion to USD 2.9 billion, contributing another USD 0.8 billion in growth. The second half of the decade will experience stronger adoption, driven by greater regulatory acceptance, increased consumer confidence, and more mainstream distribution of plant-derived analgesics. As demand for alternative pain management solutions continues to rise, particularly for chronic pain, joint issues, and muscle recovery, plant-derived analgesics are expected to capture an increasingly larger share of the pain relief market.

| Metric | Value |

|---|---|

| USA Plant Derived Analgesics Industry Sales Value (2025) | USD 1.5 billion |

| USA Plant Derived Analgesics Industry Forecast Value (2035) | USD 2.9 billion |

| USA Plant Derived Analgesics Industry Forecast CAGR (2025 to 2035) | 5.6% |

Demand for plant derived analgesics in the USA is growing as healthcare systems and consumers seek alternatives to traditional synthetic pain medications. Persistent prevalence of chronic pain conditions such as arthritis, neuropathy and post surgical recovery drives interest in analgesic therapies that are seen as more natural or have fewer side effects compared with conventional drugs. The plant derived analgesics market is projected to grow globally at a compound annual growth rate (CAGR) of approximately 5.6% over the next decade. In the USA, the convergence of pharmaceutical innovation, consumer wellness trends and regulatory pathways for botanical drugs supports increasing uptake of analgesics derived from sources such as curcumin, CBD, salicin and traditional plant based opioids.

Another supporting factor is the rise of wellness oriented consumers who prefer treatments with natural origins and transparent ingredient sourcing. OTC or prescription botanical analgesic products are gaining traction as supplementary or alternative pain management options. At the same time, pharmaceutical firms are investing in extraction technologies, standardised formulations and clinical studies to validate plant derived analgesic efficacy and safety. Challenges remain, including regulatory complexity for botanical drugs, variability in plant based raw materials and physician hesitancy to replace established synthetic therapies. Nonetheless, the combination of chronic pain management demand, natural product preference and industry innovation suggests that demand for plant derived analgesics in the USA is positioned for steady growth.

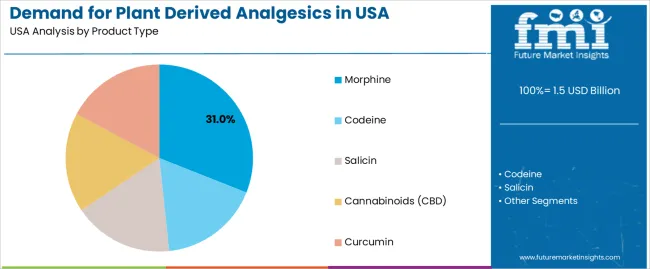

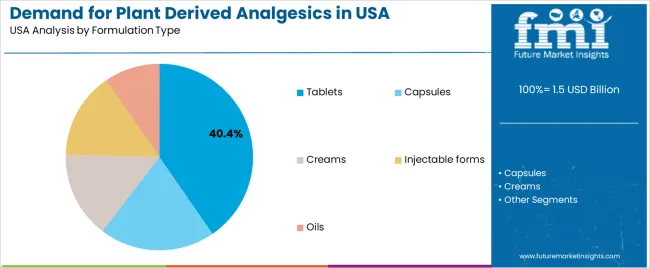

The demand for plant-derived analgesics in the USA is influenced by product type and formulation type. The leading product type is morphine, holding 31% of the market share, while tablets dominate the formulation type segment, accounting for 40.4% of the demand. Plant-derived analgesics, including opioids like morphine, cannabinoids, and natural compounds like curcumin, are increasingly sought after for their pain-relieving properties. As consumer interest in natural and plant-based alternatives to synthetic painkillers grows, the demand for these products continues to expand, particularly in chronic pain management and alternative medicine.

Morphine is the leading product type in the plant-derived analgesics market in the USA, accounting for 31% of the demand. Morphine, derived from the opium poppy, is one of the most widely used plant-based painkillers, particularly for managing moderate to severe pain. Despite the rise of alternatives like cannabinoids (CBD) and curcumin, morphine remains a staple in pain management, particularly in medical settings like hospitals and for patients with severe chronic pain, such as cancer patients.

Morphine’s continued dominance in the analgesic market is driven by its effectiveness in providing rapid and strong pain relief. It is especially favored in acute pain management, such as post-surgery recovery or palliative care. Although concerns about opioid use and addiction have prompted the search for alternatives, morphine remains critical for certain medical applications. As new methods of using and administering morphine, including controlled-release formulations, are developed, it is expected to maintain a significant share of the plant-derived analgesic market in the USA.

Tablets are the most popular formulation type for plant-derived analgesics in the USA, accounting for 40.4% of the market share. Tablets are favored due to their ease of administration, accurate dosing, and convenient packaging. They are widely used for both prescription and over-the-counter pain relief, offering a reliable way to administer plant-based analgesics such as morphine, codeine, or curcumin.

The demand for tablets is particularly strong because they provide a controlled, consistent dose of medication, which is essential in pain management. For chronic pain sufferers, tablets offer a convenient and discrete way to manage symptoms daily. Additionally, plant-derived analgesics in tablet form are increasingly used as part of holistic or integrative treatment plans that combine natural remedies with conventional medicine. As the focus on pain management continues to emphasize ease of use and accessibility, the tablet form will likely remain the leading choice in the plant-derived analgesic market in the USA.

The demand for plant derived analgesics in the USA is being driven by the growing need for alternative pain management solutions, particularly for chronic pain and musculoskeletal conditions. As consumers shift toward natural remedies, plant-based analgesics offer a promising option due to their perceived safety and effectiveness. However, challenges related to regulatory complexity, standardisation of botanical extracts, and competition from pharmaceutical analgesics remain key barriers. At the same time, trends such as the rise in cannabidiol (CBD) USAge, innovations in delivery methods, and increasing consumer demand for sustainable, clean-label products are shaping the market landscape.

Several drivers support expansion. First, the high occurrence of chronic and musculoskeletal pain conditions encourages interest in non opioid and complementary treatment options. Second, rising consumer awareness of wellness, healthy aging and clean label botanicals boosts preference for plant derived analgesics. Third, improvements in extraction technologies, formulation performance (such as enhanced bioavailability) and delivery systems (topicals, capsules) make plant based analgesics more clinically acceptable. Fourth, e commerce growth and increased retail distribution enable broader access to botanical analgesic products beyond traditional pharmacy channels.

Despite opportunity, the market faces constraints. Variability in botanical extract potency, standardisation and clinical evidence may reduce confidence among healthcare providers and consumers. Regulatory complexity, especially where botanical ingredients straddle dietary supplement and drug categories, can elevate development and marketing costs. Competition from well established synthetic analgesics-with proven efficacy, large physician networks and reimbursement support-limits substitution by plant based therapies. Additionally, higher price points for premium botanical based products may deter cost sensitive segments of the patient population.

Important trends include increased focus on cannabidiol and other novel botanical analgesics targeting specific pain pathways, along with advanced formulation formats such as transdermal patches, gels and orally dissolving films. Integration of digital health tools-such as pain tracking apps or wearables-to support botanical analgesic therapies is gaining ground. There is growing collaboration between pharmaceutical firms and botanical extract suppliers to improve standardisation, evidence base and market acceptance. Additionally, increased emphasis on sustainability, ethical sourcing and transparency in botanical supply chains enhances appeal among eco aware consumers.

The demand for plant-derived analgesics in the USA is growing as consumers increasingly seek natural and holistic alternatives to synthetic pain relief medications. Plant-derived analgesics, such as CBD, turmeric, and willow bark, are gaining popularity due to their potential to manage pain while avoiding the side effects often associated with pharmaceutical pain relievers. This shift towards natural remedies is driven by a growing focus on wellness, self-care, and the desire for more sustainable, plant-based options in healthcare.

Additionally, the increasing awareness of the potential benefits of these products, coupled with ongoing research into their efficacy, is fueling their adoption. Regional variations in demand are influenced by factors such as consumer health trends, population demographics, and local preferences for natural remedies. The West leads in demand, driven by a larger market for alternative health solutions, followed by the South, Northeast, and Midwest with steady adoption. This analysis explores the regional drivers behind the growing demand for plant-derived analgesics across the USA.

| Region | CAGR (2025 to 2035) |

|---|---|

| West | 7.9% |

| South | 7.0% |

| Northeast | 6.3% |

| Midwest | 5.5% |

The West region leads the USA in the demand for plant-derived analgesics with a CAGR of 7.9%. The region's health-conscious and environmentally aware population, particularly in states like California, Oregon, and Washington, is a key driver for this trend. The West has a long history of embracing natural health solutions, including plant-based pain relief options such as CBD, turmeric, and other herbal remedies. Additionally, the growing popularity of holistic wellness practices, including alternative medicine and self-care routines, contributes to the increased demand for plant-derived analgesics.

California, a hub for the cannabis industry, plays a significant role in driving demand for plant-derived analgesics, especially CBD products, which are widely used for pain management and inflammation relief. As consumers in the West continue to prioritize natural and plant-based alternatives, the region will remain a leading market for plant-derived analgesics.

The South shows strong demand for plant-derived analgesics with a CAGR of 7.0%. The region’s increasing focus on wellness and natural health solutions is a key factor driving this growth. As more consumers in the South seek natural remedies for pain management and inflammation, plant-derived analgesics are becoming a popular choice. States like Texas, Florida, and Georgia have large populations and growing consumer interest in plant-based health products, including herbal supplements, CBD, and essential oils.

The South's emphasis on sustainable and holistic health practices, along with the rise of e-commerce and retail availability of plant-based products, is contributing to the adoption of plant-derived analgesics. Additionally, the region’s growing awareness of the potential benefits of natural alternatives to pharmaceuticals is expected to continue driving demand in the coming years.

The Northeast demonstrates steady demand for plant-derived analgesics with a CAGR of 6.3%. The region’s high population density and its focus on alternative health and wellness practices are key factors driving this demand. Major cities like New York and Boston have seen an increase in the availability of plant-based analgesics, particularly CBD and other herbal supplements used for pain relief.

Consumers in the Northeast are increasingly aware of the potential benefits of plant-derived analgesics as part of a holistic approach to healthcare. The region's growing interest in clean, green living and sustainability further supports the demand for natural pain relief alternatives. While growth is steady compared to the West and South, the Northeast will continue to see increasing adoption of plant-derived analgesics as consumers seek alternatives to conventional pain relief medications.

The Midwest shows moderate growth in the demand for plant-derived analgesics with a CAGR of 5.5%. While the region has historically been more focused on traditional pharmaceutical solutions, there is a growing awareness and interest in plant-based alternatives, particularly as the prevalence of chronic pain and inflammation increases. The use of CBD and other herbal pain relievers is gaining traction among consumers who prefer natural and non-addictive options.

States like Illinois and Michigan are seeing increased availability and acceptance of plant-derived analgesics, driven by the rise in wellness and self-care trends. As the region’s consumer base continues to seek natural alternatives for pain management, demand for plant-derived analgesics will gradually grow, although at a slower pace compared to regions like the West and South.

Demand for plant-derived analgesics in the United States is growing as consumers seek natural alternatives to traditional pain management medications, driven by a greater focus on wellness and holistic healthcare. Companies like Pfizer Inc. (holding approximately 26.2% market share), Mallinckrodt Pharmaceuticals, Teva Pharmaceuticals, Johnson & Johnson, and NOW® Foods are key players in this market. Plant-derived analgesics, including products made from turmeric, willow bark, and other herbal sources, are gaining popularity due to their perceived lower risk of side effects and addiction compared to synthetic opioids.

Competition in the plant-derived analgesics market is driven by product efficacy, consumer education, and the growing trend toward natural health products. Companies focus on extracting and standardizing active ingredients from plants to ensure consistency and potency in their products. Additionally, there is an increasing demand for formulations that combine plant-based ingredients with other complementary health benefits, such as anti-inflammatory properties or enhanced bioavailability.

Marketing materials often emphasize the natural, non-addictive, and holistic qualities of these analgesics, along with scientific research supporting their effectiveness. By aligning their offerings with the rising demand for safer, plant-based alternatives to traditional pain relief medications, these companies are positioning themselves to capture growth in the USA plant-derived analgesics market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product Type | Morphine, Codeine, Salicin, Cannabinoids (CBD), Curcumin |

| Formulation Type | Tablets, Capsules, Creams, Injectable forms, Oils |

| Key Companies Profiled | Pfizer Inc., Mallinckrodt Pharmaceuticals, Teva Pharmaceuticals, Johnson & Johnson, NOW® Foods |

| Additional Attributes | The market analysis includes dollar sales by product type and formulation categories. It also covers regional demand trends in the United States, driven by the increasing adoption of plant-derived analgesics for pain management. The competitive landscape highlights major players focusing on innovations in plant-based pain relief solutions. Trends in the growing use of cannabinoids (CBD) and curcumin for therapeutic purposes, as well as advancements in product formulations, are explored. |

The global demand for plant derived analgesics in USA is estimated to be valued at USD 1.5 billion in 2025.

The market size for the demand for plant derived analgesics in USA is projected to reach USD 2.9 billion by 2035.

The demand for plant derived analgesics in USA is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in demand for plant derived analgesics in USA are morphine, codeine, salicin, cannabinoids (cbd) and curcumin.

In terms of formulation type, tablets segment to command 40.4% share in the demand for plant derived analgesics in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA