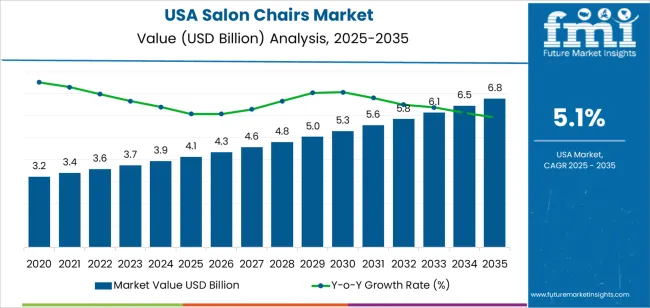

The demand for salon chairs in the USA is projected to increase from USD 4.1 billion in 2025 to USD 6.8 billion by 2035, reflecting a steady compound annual growth rate (CAGR) of 5.1%. The growth curve for salon chairs can be described as a consistent upward trajectory with moderate acceleration over time. From 2025 to 2030, the demand increases gradually, from USD 4.1 billion to USD 4.8 billion, driven by steady consumer demand and the continuing expansion of the beauty and personal care industry. This period represents the early growth phase, where the adoption of salon chairs remains relatively stable but still experiencing consistent upward growth.

From 2030 to 2035, the demand is expected to experience an acceleration, rising from USD 4.8 billion to USD 6.8 billion. This sharp rise indicates that the industry for salon chairs is entering a phase of accelerated adoption, likely driven by a surge in salon establishments, increasing disposable incomes, and a growing focus on luxury and comfort in beauty treatments. The later phase reflects heightened demand as beauty services become increasingly popular, and as salon chairs are upgraded for enhanced comfort, functionality, and technology integration. The curve represents steady growth initially, followed by a pronounced acceleration, with the demand reaching its peak in the later part of the forecast period.

Between 2025 and 2030, the demand for salon chairs will grow steadily, driven by a combination of industry expansion and incremental upgrades to salon furniture. During this period, growth is expected to be moderate, as salon businesses adopt new and improved seating solutions in line with increasing customer demand for comfort and style. The demand for salon chairs will rise from USD 4.1 billion to USD 4.8 billion, representing a steady growth of approximately 5.1%. This phase is marked by gradual adoption, with incremental improvements in product features and more salons recognizing the need for quality chairs to improve the customer experience.

From 2030 to 2035, the demand will see a noticeable acceleration, rising from USD 4.8 billion to USD 6.8 billion. This acceleration reflects the growing popularity of beauty and wellness services and the increasing expectation for luxurious, high-performance salon equipment. The demand surge is likely driven by the broader adoption of high-tech, adjustable, and more ergonomically designed salon chairs, which provide enhanced comfort and functionality for both clients and salon staff. During this period, salons are expected to expand and invest in more advanced and durable furniture, reflecting the industry’s shift toward premium services. Thus, while the initial phase of growth is steady, the latter half of the forecast period will see significant acceleration as demand for quality salon furniture surges in response to evolving customer expectations and technological advancements.

| Metric | Value |

|---|---|

| Demand for Salon Chairs in USA Value (2025) | USD 4.1 billion |

| Demand for Salon Chairs in USA Forecast Value (2035) | USD 6.8 billion |

| Demand for Salon Chairs in USA Forecast CAGR (2025 to 2035) | 5.10% |

Demand for salon chairs in the USA is rising as the beauty and grooming industry continues to expand. With more salons, spas, and barbershops opening across the country, the need for high‑quality seating equipment has increased. Salon chairs are a critical part of the customer experience comfortable, adjustable, and stylish chairs enhance client satisfaction and support longer appointment durations, which benefits service providers in the long run.

The growth in beauty services and the frequent adoption of new treatments are also driving demand. As consumer interest in personal grooming, skincare, and in‑salon experiences grows, businesses are investing in furniture that can support diverse service offerings from hair styling and coloring to aesthetic treatments and brow services. Salon chairs that offer ergonomics, ease of cleaning, and multiple adjustment features are becoming more desirable.

Innovation in salon chair design such as integrated massage features, hydraulic or electronic height adjustment, premium upholstery, and modular accessories is further boosting demand. Salons recognise that differentiated equipment can help elevate brand positioning and attract clientele. As competition in the beauty industry intensifies and service expectations rise, suppliers of salon chairs are expected to see stable growth through 2035.

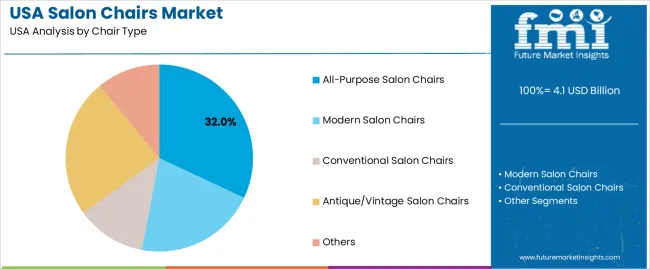

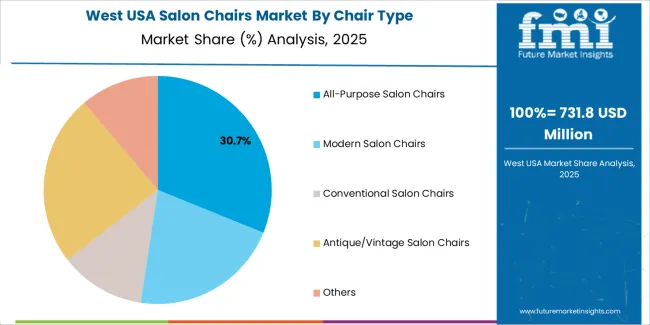

Demand for salon chairs in the USA is segmented by chair type and functionality. By chair type, demand is divided into all-purpose salon chairs, modern salon chairs, conventional salon chairs, antique/vintage salon chairs, and others, with all-purpose salon chairs holding the largest share. In terms of functionality, the industry is categorized into electric, reclining, hydraulic, heavy duty, and others, with electric chairs leading the demand. Regionally, demand is divided into West, South, Northeast, and Midwest.

All-purpose salon chairs account for 32% of the demand for salon chairs in the USA. These chairs are designed to accommodate a variety of services in salons, from haircuts to styling, coloring, and other beauty treatments. Their versatility and adaptability make them a go-to choice for many salons, especially those that offer a broad range of services. The demand for all-purpose salon chairs is driven by the need for flexible, functional seating that can accommodate different treatments and a variety of customer needs.

These chairs typically feature adjustable height, reclining options, and comfortable cushioning, allowing salons to provide a high level of service to a wide range of clients. As salons aim to optimize space and improve service efficiency, all-purpose salon chairs continue to be favored due to their ability to serve multiple functions, making them an essential fixture in both small and large salons. The continued trend toward multifunctional, space-saving furniture further drives their demand in the industry.

Electric salon chairs account for 39% of the demand for salon chairs in the USA. These chairs are equipped with electric motors that allow for smooth and effortless adjustments, such as reclining and height adjustments, making them highly convenient and efficient for both salon staff and customers. Electric salon chairs are particularly popular in high-end salons that focus on providing superior customer experiences, where comfort and convenience are prioritized.

The demand for electric salon chairs is driven by the increasing focus on automation, customer comfort, and the need to speed up service in busy salon environments. With features like easy adjustability and precision positioning, electric chairs improve both the quality of service and operational efficiency in salons. As salons continue to prioritize customer experience and streamline their operations, the demand for electric salon chairs is expected to rise, making them a dominant feature in modern salons.

Hydraulic salon chairs remain a popular choice in the salon chair industry due to their reliable and durable functionality. These chairs use a hydraulic pump mechanism to adjust the height, providing stability and ease of use. Hydraulic chairs are favored for their simplicity and cost-effectiveness, making them an excellent option for a wide variety of salon types.

Despite the rise in demand for electric chairs, hydraulic salon chairs continue to hold a strong position in the industry due to their lower initial cost and long-lasting durability. Their ease of maintenance and straightforward functionality make them ideal for high-traffic salons, where reliability and efficiency are essential. The continued need for reliable, low-maintenance salon equipment ensures that hydraulic chairs remain a staple in the salon chair industry, especially for budget-conscious salons and those seeking straightforward, functional seating solutions.

Many salons are upgrading equipment to enhance client comfort, aesthetic appeal and operational efficiency therefore investing in higher‑quality, ergonomic, multifunctional chairs (hydraulic, electric, reclining). Key drivers include the proliferation of grooming services, the human‑wellness trend, social‑media‑influenced beauty habits, and the need for salons to stand out in the competitive environment. Restraints include the relatively high cost of premium chairs, tight budgets for small or independent salons, material cost volatility (steel, upholstery fabrics), and competition from second‑hand or lower‑cost imports which can put pressure on pricing and margins.

Why is Demand for Salon Chairs Growing in the USA?

In the USA, the demand is growing because salons and beauty service providers face greater pressure to deliver elevated client experiences—and the chair is a key piece of equipment in that experience. As beauty services become more sophisticated (hair styling, colouring, treatments, spa services, barbershop expansions, men’s grooming), salons invest in furniture that supports comfort, stylists’ ergonomics, durable materials, branding and aesthetics.

Rising consumer expectations (for comfort, style, hygiene) mean that salons differentiate via their environment, boosting demand for modern chair designs. The growth of private‑owner salons, pop‑up beauty studios, mobile salons and chain expansions also increases the volume of equipment procurement. Online channels make salon equipment more accessible and facilitate purchase decisions by smaller operators.

How are Technological and Product Innovations Driving Growth of Salon Chairs in USA?

Product and technological innovations are playing a significant role in the salon chair industry in the USA. Innovations include: chairs with hydraulic or fully electric adjustment systems (height, tilt, reclining) for greater comfort and stylists’ ergonomics; chairs using premium upholstery, antimicrobial or stain‑resistant surfaces to handle salon wear and tear; chairs designed for multipurpose use (styling, shampooing, pedicure, spa) reducing the need for multiple pieces of equipment; and chairs with aesthetic appeal that fit modern salon design (sleek lines, mixed materials, colours). Manufacturers also focus on modular design to cater to smaller salon studios or boutique spaces. Such innovations make newer chairs more attractive investments for salons looking to upgrade or expand, contributing to increased demand.

What are the Key Challenges Limiting Adoption of Salon Chairs in USA?

Despite positive growth, there are several key challenges. The cost of premium salon chairs (especially electric or high‑end models) can be a barrier for smaller salons or startups, making them opt for lower‑cost models or delay upgrades. Some salons may prefer to refurbish rather than replace chairs, slowing turnover of equipment. Material and manufacturing cost fluctuations (steel, foams, upholstery) can raise prices and squeeze margins for sellers.

Also, the emergence of home‑based or mobile beauty services may reduce equipment spending by some practitioners. The industry is somewhat mature in many U.S. metro areas, meaning incremental growth may be slower and reliant on replacement cycles rather than new salon openings alone.

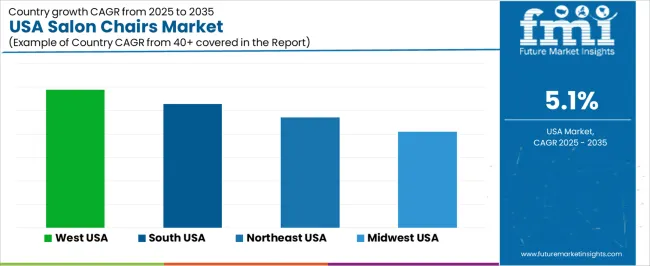

| Region | CAGR (%) |

|---|---|

| West | 5.9% |

| South | 5.3% |

| Northeast | 4.7% |

| Midwest | 4.1% |

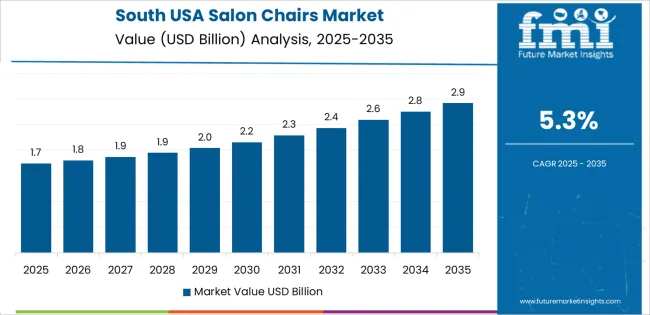

The demand for salon chairs in the USA is growing across all regions, with the West leading at a 5.9% CAGR. This growth is driven by the increasing number of salons, spas, and beauty-related services, alongside a rising demand for high-quality, comfortable, and durable salon furniture. The South follows with a 5.3% CAGR, supported by an expanding beauty and wellness industry, particularly in urban areas. The Northeast shows a 4.7% CAGR, driven by strong consumer spending in urban centers. The Midwest experiences moderate growth at 4.1%, with demand rising in both urban and suburban areas as beauty services expand.

The West is experiencing the highest demand for salon chairs in the USA, with a 5.9% CAGR. This is driven by the region’s thriving beauty and wellness industry, with cities like Los Angeles, San Francisco, and Las Vegas serving as major hubs for salons, spas, and beauty centers. The growing demand for high-end beauty services in these urban areas contributes to the rise in demand for premium salon furniture, including comfortable and durable salon chairs.

The West's trend toward health-consciousness and personal grooming has led to increased spending on beauty services. The region's population is more willing to invest in high-quality salon equipment to improve the client experience. With the ongoing growth of beauty businesses and the increasing focus on customer comfort and luxury, the West is expected to continue leading the industry for salon chairs.

The South is experiencing steady growth in demand for salon chairs, with a 5.3% CAGR. The region’s expanding beauty and wellness sector, particularly in states like Texas, Florida, and Georgia, is driving the adoption of high-quality salon equipment. As the beauty and haircare industries continue to thrive in the South, salons are seeking comfortable, durable, and stylish chairs that enhance their client experience.

The rising number of beauty professionals and independent salons in the South also contributes to the demand for salon chairs. With the increasing number of beauty services being offered, particularly in urban and suburban areas, salon owners are prioritizing investments in quality equipment. The South’s growing focus on personal care and grooming, combined with a strong desire for aesthetic appeal in salons, supports continued demand for salon chairs in the region.

The Northeast is experiencing steady demand for salon chairs, with a 4.7% CAGR. The region’s large concentration of urban areas, such as New York City and Boston, has a significant influence on this trend. These cities have a high number of salons, spas, and beauty professionals, all of which rely on quality salon chairs to enhance the customer experience. As the demand for beauty services continues to rise, so does the need for comfortable and stylish salon furniture.

The Northeast’s high-income population and cultural focus on personal grooming and beauty also support the growth in demand for salon chairs. As consumers increasingly prioritize comfort and luxury in their beauty treatments, salons are investing in high-quality equipment. Additionally, the growing trend of eco-friendly and sustainable salon furniture in the Northeast is influencing purchasing decisions, driving the need for specialized salon chairs that align with these values.

The Midwest is experiencing moderate growth in demand for salon chairs, with a 4.1% CAGR. The region's increasing number of beauty service establishments, particularly in cities like Chicago and Detroit, is driving the adoption of quality salon furniture. As salons expand and more beauty services become available in urban and suburban areas, the demand for comfortable, durable, and aesthetically pleasing salon chairs is on the rise.

The growing interest in personal care and beauty services across the Midwest is also contributing to the demand for salon equipment. As consumers seek more professional beauty treatments, salon owners are investing in modern, comfortable chairs to improve their clients' overall experience. Although growth in the Midwest is slower compared to the West and South, the region’s expanding beauty and wellness industry continues to support the demand for salon chairs, especially as businesses prioritize customer comfort and high-quality service.

The demand for salon chairs in the United States is growing steadily as the beauty and wellness industry continues to expand. Key drivers include an increase in the number of salons, spas, and grooming centers; the rising importance of customer experience and aesthetics in service environments; and a shift toward premium, ergonomic, and technologically enhanced furniture solutions. Installing high‑quality salon chairs is becoming a priority for salon owners looking to attract and retain clientele by offering comfort, style, and durability.

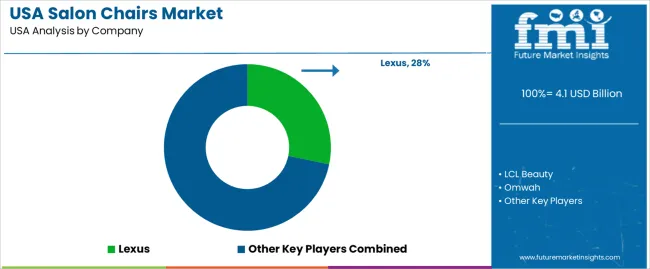

In the U.S. industry landscape, Lexus holds approximately 28.2% of demand for salon chairs, reflecting its strong brand presence and distribution network. Other suppliers contributing to U.S. demand include LCL Beauty, Omwah, Icarus, Memphis, and Delano, each providing a range of chairs tailored for salons, spas, and barbershops.

Innovations in design and function are influencing demand significantly: chairs with hydraulic lifts, recline features, and aesthetic finishes are increasingly preferred. The rise of boutique salons and freelance stylists has also created demand for chairs that are space‑efficient and visually appealing. While cost pressures and the competitive environment pose ongoing challenges for suppliers and salon owners alike, the outlook for salon chair demand in the U.S. remains positive as the service industry evolves and modernizes.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Product Type | All-Purpose Salon Chairs, Modern Salon Chairs, Conventional Salon Chairs, Antique/Vintage Salon Chairs, Others |

| Functionality | Electric, Reclining, Hydraulic, Heavy Duty, Others |

| Distribution Channel | Direct Sales, Hypermarkets/Supermarkets, Specialty Stores, Distributors/Wholesalers, Online Stores |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Lexus, LCL Beauty, Omwah, Icarus, Memphis, Delano |

| Additional Attributes | Dollar sales by chair type, functionality, distribution channel, and regional trends focused on salons and beauty sectors |

The global demand for salon chairs in USA is estimated to be valued at USD 4.1 billion in 2025.

The market size for the demand for salon chairs in USA is projected to reach USD 6.8 billion by 2035.

The demand for salon chairs in USA is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in demand for salon chairs in USA are all-purpose salon chairs, modern salon chairs, conventional salon chairs, antique/vintage salon chairs and others.

In terms of functionality, electric segment to command 39.0% share in the demand for salon chairs in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA