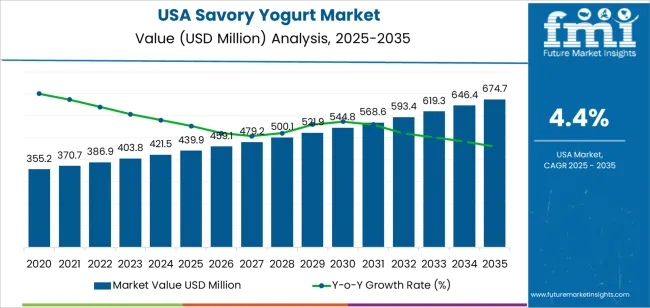

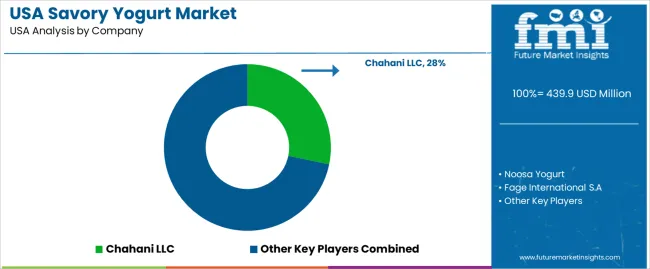

The USA savory yogurt demand is valued at USD 439.9 million in 2025 and is estimated to reach USD 674.7 million by 2035, recording a CAGR of 4.4%. Demand is shaped by increased interest in protein-rich dairy formats, wider acceptance of global flavour profiles, and expanding placement of savoury yogurt across retail and foodservice channels. The category benefits from rising consumption of fermented foods, steady household adoption of convenient meal components, and product development focused on spice, herb, and vegetable-based formulations. Growth is also supported by manufacturers incorporating cultured dairy into nutritionally oriented snacking and beverage applications.

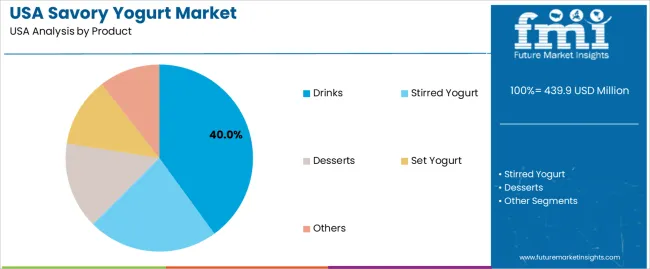

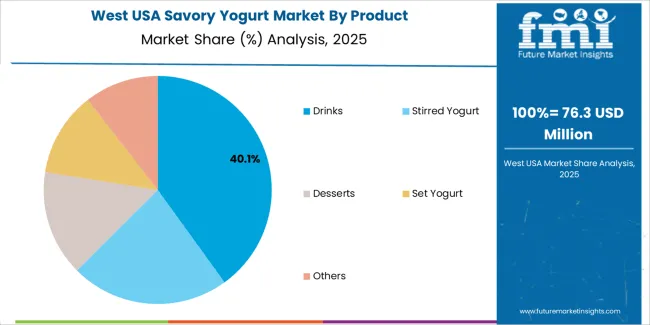

Drinks represent the leading product category, reflecting strong consumer preference for portable, ready-to-consume dairy beverages that combine savoury flavouring with probiotic content. These products are adopted across breakfast, mid-day snacking, and on-the-go consumption patterns. Flavour development in this segment draws on culinary ingredients such as cucumber, tomato, roasted pepper, herbs, and savoury spice blends, offering alternatives to traditional sweet yogurt beverages.

Demand is strongest in the West, South, and Northeast, where diversified retail networks, health-oriented consumer groups, and foodservice operators drive product placement. Key suppliers include Chahani LLC, Noosa Yogurt, Fage International S.A., General Mills Inc., and Blue Hill Inc., offering savoury yogurt drinks and spoonable varieties supported by structured cold-chain distribution.

Peak-to-trough analysis shows a modest cyclical pattern shaped by product-innovation activity, consumer acceptance levels, and competitive dynamics within the broader yogurt category. From 2025 to 2028, the segment is expected to reach an early peak as manufacturers expand herb-based, spice-based, and vegetable-blended formulations. Increased placement in refrigerated snack sections and broader use in meal-adjacent applications will reinforce this early uplift.

A mild trough may occur between 2029 and 2031 as flavour experimentation reaches a temporary saturation point and retailers adjust shelf space in response to category rotation and pricing strategies. Competitive pressure from protein-enhanced dairy, fermented snacks, and plant-based refrigerated products may also moderate short-term purchasing cycles. After 2031, the segment is expected to regain momentum as new formulations focus on cleaner ingredient lists, improved texture consistency, and global-inspired savoury profiles. Expanded culinary positioning, including usage in dips, spreads, and savoury breakfast options, will support the recovery. The peak-to-trough pattern reflects a developing category influenced by flavour-innovation cycles, consumer trial behaviour, and gradual integration of savoury yogurt into mainstream refrigerated food preferences in the United States.

| Metric | Value |

|---|---|

| USA Savory Yogurt Sales Value (2025) | USD 439.9 million |

| USA Savory Yogurt Forecast Value (2035) | USD 674.7 million |

| USA Savory Yogurt Forecast CAGR (2025 to 2035) | 4.4% |

Demand for savory yogurt in the USA is growing as consumers look for snack options that combine flavour innovation with nutrition and versatility. Traditional yogurt has been sweet-centred, but interest in herb, vegetable and spice infused varieties is rising. These products appeal to consumers seeking alternatives to dessert-type yogurts and those who value yoghurt’s role as a base for dips, sauces or meal-additions. Foodservice and retail channels respond by offering more savory flavours as indulgence and functional-snack trends intersect.

Brand awareness built via social media and health influencers supports experimentation and trial of new formats and taste profiles. Constraints include consumer perception challenges since many buyers’ associate yogurt with sweet taste, formulation hurdles in ensuring savoury flavours work while preserving texture and probiotic benefits, and limited distribution of savoury profiles compared with mass sweet flavors. Some production lines may need adjustment and retailers may hesitate until clear demand patterns emerge.

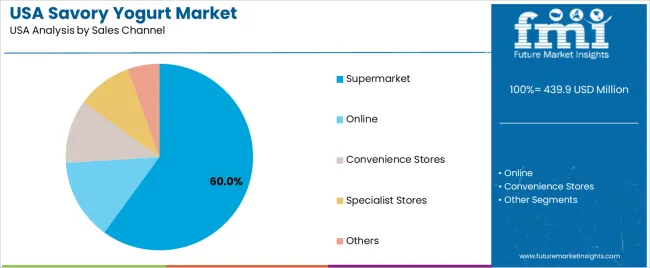

Demand for savory yogurt in the United States reflects growing acceptance of fermented foods with reduced sweetness and expanded culinary versatility. Product-category distribution aligns with consumption habits across beverages, ready-to-eat yogurt formats, and savoury meal accompaniments. Sales-channel patterns reflect the structure of U.S. retail operations, balancing supermarket distribution with online platforms and convenience-driven outlets. These patterns illustrate how savory yogurt is integrated into snacking, meal-replacement, and functional-food routines across varied consumer groups.

Savory yogurt drinks hold 40.0% of U.S. demand and form the leading product category. Their portability, ease of consumption, and suitability for meal-replacement or snack occasions support broad adoption. Drinks also accommodate vegetable, herb, and spice-based formulations that appeal to consumers seeking low-sugar and protein-rich alternatives. Stirred yogurt accounts for 22.5%, serving users who prefer spoonable textures with savoury inclusions. Desserts represent 15.0%, offering mild savoury–sweet combinations. Set yogurt holds 12.0%, supporting structured textures suitable for culinary applications. The remaining 10.5% includes dips, spreads, and innovative savoury blends used in meals and snacking contexts.

Key drivers and attributes:

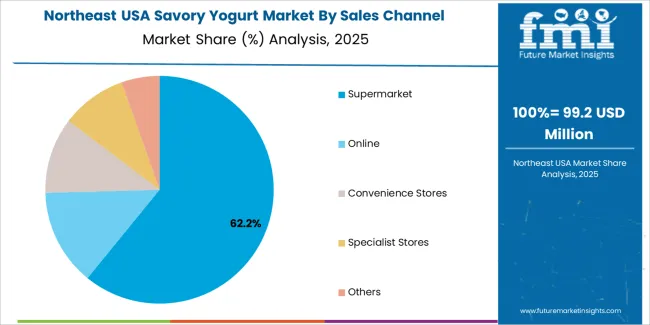

Supermarkets hold 60.0% of national demand and represent the primary sales channel for savory yogurt in the United States. Their broad product selection, refrigeration capacity, and high shopping frequency support consistent purchasing. Online channels represent 14.0%, driven by home delivery and subscription-based grocery services. Convenience stores account for 11.0%, offering ready-to-consume options for quick purchases. Specialist stores hold 9.5%, supporting gourmet, organic, and international savory yogurt selections. The remaining 5.5% includes institutional and small-format retailers. Channel distribution reflects differences in product availability, refrigeration needs, and purchasing habits across diverse consumer groups.

Key drivers and attributes:

Growing demand for healthier snacks, culinary innovation, and interest in versatile food formats are driving growth.

Demand for savoury yogurt in the United States is increasing as consumers look for convenient, protein-rich snacks that go beyond traditional sweet-flavoured yogurts. Savoury yogurts flavoured with herbs, spices, vegetables or global cuisine influences, provide new taste experiences and align with trends in functional and meal-component snacks. The plain yogurt segment is growing because it supports both sweet and savoury applications, which provides a foundation for savoury variants. Culinary-inspired flavours, on-the-go packaging and multi-use formats (such as dips, sauces or meal bases) further support adoption of savoury yogurt in the U.S. industry.

Consumer taste habits, category familiarity and shelf-life challenges restrain faster adoption.

Yogurt has traditionally been perceived in the U.S. as a sweet or fruit-flavoured product. Shifting consumer habits toward savoury flavour profiles requires education and trial, which slows rapid category growth. Some manufacturers face technical challenges in formulating savoury yogurts that balance flavour, texture, shelf stability and live culture performance without increasing cost. As a niche segment compared with mainstream flavoured yogurt, sales volumes remain relatively modest, which may make shelf-space allocation and retailer commitment more cautious.

Expansion of dip and spread formats, use of global and ethnic flavour profiles, and rise of plant-based and functional savoury yogurts define industry trends.

Manufacturers are developing savoury yogurt formats that work as dips, salad toppings or meal bases, offering consumers alternative ways to use yogurt beyond breakfast. Ethnic-inspired flavour profiles, such as Mediterranean herb & olive, roasted tomato & basil, or spicy chilli & lime are gaining traction as consumers pursue more adventurous tastes. Plant-based savoury yogurts (using almond, oat or soy bases) and functional variants (fortified with probiotics, extra protein or lower sugar) are appearing, broadening the target demographic. These trends support steady growth for savoury yogurt in the U.S. industry, especially among younger consumers and food-service channels.

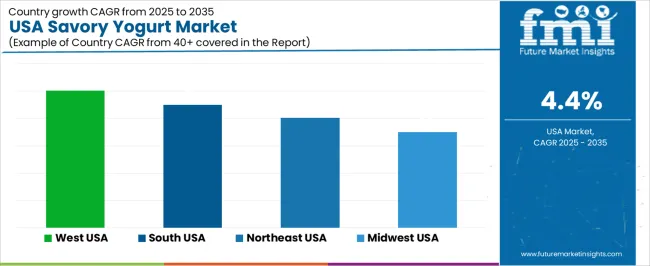

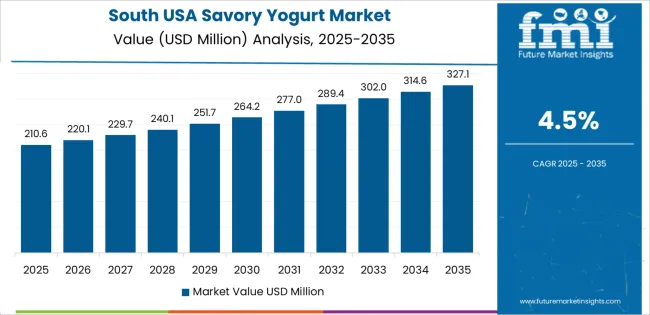

Demand for savory yogurt in the USA is increasing through 2035 as manufacturers expand flavour options featuring vegetables, herbs, spices, and probiotic-forward formulations suited for health-conscious consumers. Growth reflects rising interest in high-protein snacks, reduced-sugar dairy options, and culinary-style yogurt formats used as dips, spreads, and meal accompaniments. Retailers introduce wider assortments across mainstream supermarkets, specialty stores, and online grocery channels. Product adoption varies by region based on culinary preferences, health-trend penetration, and refrigerated-distribution strength. The West leads with a 5.0% CAGR, followed by the South (4.5%), the Northeast (4.0%), and the Midwest (3.5%).

| Region | CAGR (2025-2035) |

|---|---|

| West | 5.0% |

| South | 4.5% |

| Northeast | 4.0% |

| Midwest | 3.5% |

The West grows at 5.0% CAGR, supported by strong adoption across urban industries in California, Washington, and Colorado. Consumers in these states favor clean-label, high-protein foods incorporating vegetable-based flavours such as cucumber, beet, and roasted pepper. Retailers maintain broad assortments of savory yogurt cups, culinary-style blends, and multipurpose dips positioned for snacking and meal preparation. Food innovators in the region experiment with Mediterranean- and Middle Eastern–inspired flavour profiles using herbs, garlic, and citrus components. Co-manufacturers work closely with regional brands to develop dairy and plant-based variants with balanced salt profiles and stable textures. Online distribution contributes additional volume through meal-kit platforms using savory yogurt as a functional ingredient.

The South grows at 4.5% CAGR, supported by expanding retail distribution and rising interest in high-protein, low-sugar dairy snacks across Texas, Florida, and Georgia. Supermarkets and big-box retailers add savory yogurt options featuring chili, garlic, dill, and vegetable blends suited for local flavor preferences. Food-service operators use savory yogurt as a lighter alternative to mayonnaise-based dips and sauces. Regional dairy processors develop options tailored to family-sized packaging and broader culinary use. Consumers adopt savory yogurt as an accompaniment for grilled foods, sandwiches, and snack platters. Steady growth in refrigerated storage infrastructure strengthens availability across suburban and metropolitan industries.

The Northeast grows at 4.0% CAGR, supported by strong interest in Mediterranean and culinary-inspired flavors across New York, Massachusetts, and Pennsylvania. Retailers maintain reliable assortments of savory yogurt featuring ingredients such as mint, lemon, roasted vegetables, and herb blends. Specialty stores distribute premium and small-batch products that appeal to consumers seeking high-protein snack alternatives. Food developers in the region incorporate savory yogurt into wrap fillings, grain bowls, and prepared meals sold through deli sections. Consistent demand for clean-label foods sustains adoption across both dairy and plant-based yogurt lines. The region’s dense urban industries support stable refrigerated distribution and product turnover.

The Midwest grows at 3.5% CAGR, supported by increasing retail visibility and gradual interest in protein-focused culinary snacks across Illinois, Wisconsin, Minnesota, and Ohio. Dairy manufacturers incorporate savory yogurt into product lines featuring herbs, vegetables, and mild spices suited for broad household preferences. Retailers expand listings for single-serve cups and family-size tubs used as dips for vegetables, crackers, and prepared foods. Home-cooking trends encourage adoption of savory yogurt for marinades and sandwich spreads. Although growth is slower than in coastal regions, strong dairy-production capacity and established refrigerated supply chains support reliable category expansion.

Demand for savory yogurt in the USA is shaped by a focused group of dairy and specialty producers supplying seasoned, vegetable-based, and protein-forward yogurt formats for retail and food-service use. Chahani LLC holds the leading position with an estimated 28.2% share, supported by consistent product texture, controlled seasoning profiles, and reliable placement in premium and health-oriented retail channels. Its position is reinforced by stable fermentation quality and dependable sourcing of dairy inputs.

Noosa Yogurt and Fage International S.A. follow as significant participants, offering strained and blended yogurt varieties that support savory formulations used in snacks, dips, and ready-to-eat meals. Their strengths include predictable flavour balance, controlled fat content, and standardized production practices that ensure consistent mouthfeel and protein integrity. General Mills Inc. maintains a notable presence through established yogurt brands adapted to savoury or mildly seasoned formats that appeal to mainstream consumers seeking alternatives to sweet yogurt profiles. Blue Hill Inc. contributes additional capability with vegetable-focused and culinary-inspired yogurt offerings that support niche demand for sophisticated savory flavours and clean-label compositions.

Competition across this segment centers on flavour consistency, fermentation stability, protein integrity, ingredient transparency, and refrigeration-shelf performance. Demand is supported by growing interest in protein-rich snacks, reduced-sugar alternatives, and culinary-styled yogurt products suited to both standalone consumption and pairing with grains, vegetables, and savoury meal components.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product | Drinks, Stirred Yogurt, Desserts, Set Yogurt, Others |

| Sales Channel | Supermarket, Online, Convenience Stores, Specialist Stores, Others |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Chahani LLC, Noosa Yogurt, Fage International S.A., General Mills Inc., Blue Hill Inc |

| Additional Attributes | Dollar sales by product category and sales channel; regional consumption trends across West, Midwest, South, and Northeast; competitive landscape of savory yogurt producers; developments in high-protein, probiotic-rich, and clean-label savory yogurt varieties; integration with retail distribution, online grocery platforms, and specialty health-focused stores in the USA. |

The global demand for savory yogurt in USA is estimated to be valued at USD 439.9 million in 2025.

The market size for the demand for savory yogurt in USA is projected to reach USD 674.7 million by 2035.

The demand for savory yogurt in USA is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in demand for savory yogurt in USA are drinks, stirred yogurt, desserts, set yogurt and others.

In terms of sales channel, supermarket segment to command 60.0% share in the demand for savory yogurt in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA