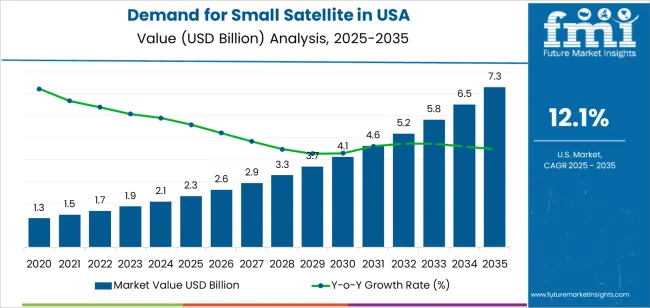

The demand for small satellites in the USA is projected to reach USD 7.3 billion by 2035, reflecting an absolute increase of USD 5.0 billion over the forecast period. The demand, valued at USD 2.3 billion in 2025, is expected to grow at a robust CAGR of 12.10%. This growth is primarily driven by advancements in satellite technology, the growing demand for satellite services in communication, earth observation, and data collection, as well as a rising number of private and commercial ventures entering space.

Small satellites, also known as smallsats, are gaining popularity due to their lower cost, quicker deployment times, and ability to deliver specialized services, such as high-resolution imaging, global internet connectivity, and real-time data analysis. The rise of satellite constellations, particularly for global internet services and data connectivity, has led to an increased demand for these smaller, more agile space systems. Furthermore, the growing use of small satellites for scientific research, weather monitoring, and agricultural applications is contributing to this sector's growth.

As more countries and private companies invest in satellite infrastructure, the need for small, cost-effective, and highly efficient satellites will continue to expand, further driving the demand for smallsats.

Between 2025 and 2030, the contribution of volume growth is expected to be the dominant driver of demand. During this period, the industry will grow from USD 2.3 billion to USD 2.6 billion, adding USD 0.3 billion. This growth will primarily result from the increased volume of small satellites launched, as more companies and government agencies invest in satellite constellations for global internet connectivity, earth observation, and other commercial uses. The need for larger constellations, with numerous small satellites working in tandem, will significantly push the volume growth in this phase.

From 2030 to 2035, price growth will play a more substantial role in driving the overall demand increase. The demand is expected to rise from USD 2.6 billion to USD 7.3 billion, adding USD 4.7 billion. While the volume of satellites launched will continue to grow, the increasing sophistication and capabilities of small satellites will drive up their individual prices. As technologies advance, the satellites will feature enhanced capabilities, such as higher resolution imaging, more powerful communication systems, and greater data transmission capacity, justifying higher price points.

| Metric | Value |

|---|---|

| USA Small Satellite Sales Value (2025) | USD 2.3 billion |

| USA Small Satellite Forecast Value (2035) | USD 7.3 billion |

| USA Small Satellite Forecast CAGR (2025 to 2035) | 12.10% |

The demand for small satellites in the USA is growing due to the increasing need for cost-effective, flexible, and scalable satellite solutions across a range of industries, including telecommunications, Earth observation, defense, and scientific research. Small satellites, or CubeSats, are significantly cheaper to build and launch compared to traditional, larger satellites, making them an attractive option for both commercial and government space operations.

The rapid advancements in satellite miniaturization, as well as improvements in propulsion and communication technologies, are key factors driving the demand for small satellites. These advancements allow for a broader range of applications, including real-time Earth monitoring, remote sensing, and high-resolution imaging, which are in demand for applications such as climate research, agriculture, and disaster management.

The rise of satellite constellations for global internet coverage, such as those being developed by companies like SpaceX and Amazon, is contributing to the industry’s growth. Small satellites offer a cost-effective solution for creating these large-scale constellations, enabling global connectivity and communication. The increasing reliance on satellite-based services for both commercial and defense purposes in the USA is expected to drive the continued demand for small satellites in the coming years.

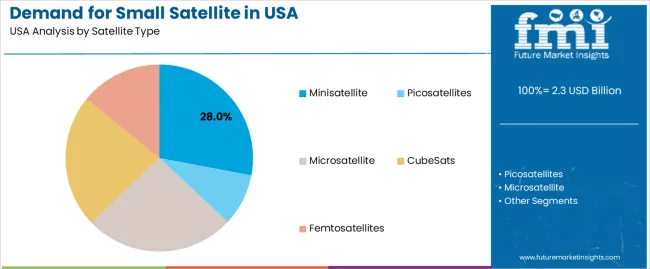

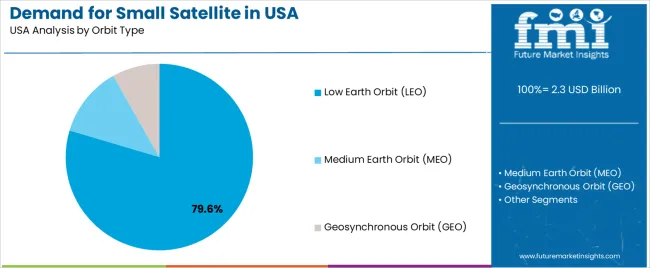

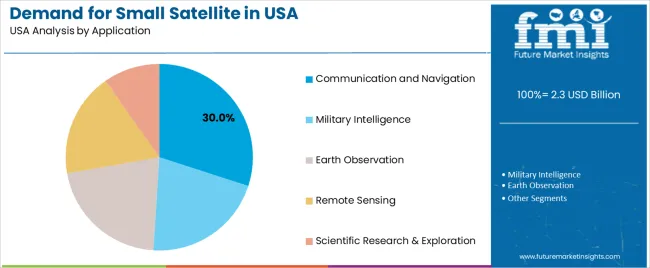

By satellite type, demand is divided into Minisatellite, Picosatellites, Microsatellite, CubeSats, and Femtosatellites, with Minisatellite holding the largest share. In terms of orbit type, the industry is categorized into Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geosynchronous Orbit (GEO), with LEO dominating. Applications include Communication and Navigation, Military Intelligence, Earth Observation, Remote Sensing, and Scientific Research & Exploration, with Communication and Navigation leading the demand. Regionally, demand is divided into West, South, Northeast, and Midwest.

Minisatellites account for 28% of the demand for small satellites in the USA. They are preferred for their balanced size, weight, and capabilities, making them ideal for a wide range of commercial, governmental, and scientific applications. Minisatellites offer a larger payload capacity compared to smaller satellites, allowing for the integration of more advanced instruments and sensors. This versatility makes them suitable for tasks like communication, earth observation, and scientific research. Despite their larger payload, minisatellites remain cost-effective, offering a practical solution for both military and civilian space missions.

Relatively small size and lightweight structure allow them to be launched at lower costs, making them accessible for both established organizations and emerging companies. As demand grows for satellite services in sectors such as telecommunications, remote sensing, and climate monitoring, the role of minisatellites becomes increasingly crucial. Their ability to meet diverse mission needs while maintaining affordability positions them to remain a dominant force in the small satellite industry in the years to come.

Low Earth Orbit (LEO) accounts for 79.6% of the small satellite demand in the USA, making it the most commonly used orbit. The proximity of LEO to Earth provides several advantages, including reduced latency and faster data transfer, which are essential for applications like communication, earth observation, and remote sensing. LEO satellites are particularly suited for real-time communication and imaging, making them ideal for sectors such as disaster monitoring, environmental data collection, and military surveillance.

Launching satellites into LEO is more affordable compared to higher orbits, which significantly lowers the cost of deploying satellite constellations. The ease of access to LEO and the ability to send satellites in and out of orbit quickly have made it the preferred choice for many satellite operators. As the demand for global satellite networks and comprehensive earth monitoring systems continues to increase, LEO’s cost-effectiveness, low latency, and coverage advantages position it as the dominant orbit for small satellite missions, ensuring its continued growth and popularity in the industry.

The Communication and Navigation application accounts for 30% of the demand for small satellites in the USA. Small satellites are increasingly used in this sector to enhance global communication networks, especially in remote or underserved areas where traditional infrastructure is difficult or expensive to deploy. These satellites provide reliable connectivity in areas like rural regions, maritime zones, and remote islands. Additionally, small satellites are crucial for satellite-based navigation systems, such as GPS, which offer precise location and timing data for a variety of purposes, from military operations to commercial logistics and navigation.

The growth of broadband internet demand, particularly in rural and underserved areas, is further fueling the need for small satellites in communication. As global satellite constellations continue to expand and the technology behind satellite-based navigation systems advances, small satellites will play an increasingly important role in providing seamless connectivity and data transfer. This continued growth in satellite-based communication services ensures that the Communication and Navigation application remains a key driver of demand in the small satellite industry.

Demand for small satellites in the USA is growing rapidly due to cost‑effective missions in low Earth orbit (LEO) for communications, Earth observation, scientific research, and defence. Key drivers include satellite Internet constellations, rising demand for geospatial data, and USA government support for space and security. Challenges include limited payload capacity, short lifespan, orbital debris, and regulatory hurdles in licensing and spectrum coordination.

In the USA, demand for small satellites is rising because operators can deploy capabilities more quickly and at lower cost than traditional large spacecraft. Commercial entrants and start‑ups are launching constellations for broadband, IoT connectivity and Earth‑imaging services, tapping into underserved industrys. At the same time, government agencies and the Department of Defense increasingly rely on small satellites for rapid mission deployment, space situational awareness, and dual‑use applications. The ride‑share launch model, declining launch costs and the ecosystem of launch‑services providers in the USA make small satellites an attractive option for both experimental and operational missions.

Technological innovations are accelerating small‑satellite adoption in the USA by improving miniaturisation, standardisation and mission flexibility. Advances include more capable small‑satellite buses, improved propulsion and power systems, enhanced miniaturised payloads (imaging sensors, communications modules), and more frequent rideshare/constellation launch opportunities. AI‑enabled onboard processing and inter‑satellite communications are enhancing value for operators. Together, these advancements reduce time to orbit, allow scalable constellation deployment, and expand the range of viable missions for small satellites across commercial and government domains.

Despite strong momentum, several challenges restrict broader adoption of small satellites in the USA. One major issue is payload and performance limitations smaller satellites have constraints on power, sensor size and lifetime compared to larger platforms, which limits some mission types. Another concern is orbital congestion and debris risk, as growing small‑satellite constellations increase traffic and regulatory scrutiny in LEO. Regulatory and licensing complexity, including launch and spectrum approvals, can slow deployment. Although launch costs are falling, the total cost of development, integration, ground systems and fleet operations can still be significant, especially for smaller operators, which may constrain wider entry.

| Region | CAGR (%) |

|---|---|

| West | 13.9% |

| South | 12.4% |

| Northeast | 11.1% |

| Midwest | 9.7% |

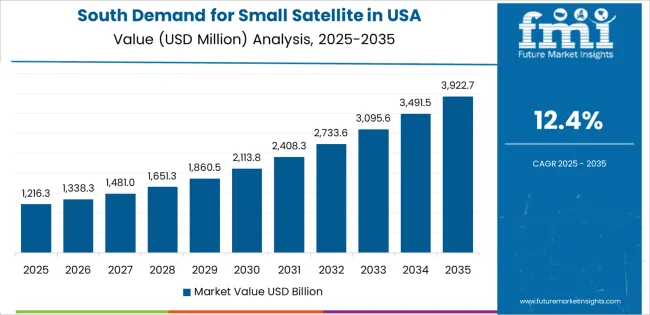

The demand for small satellites in the USA is growing across regions, with the West leading at a 13.9% CAGR. This growth is primarily driven by the concentration of space technology companies, aerospace innovation, and satellite services in California and nearby states. The South follows at 12.4%, with strong contributions from Texas and Florida, which are key hubs for aerospace and commercial space ventures. The Northeast shows a 11.1% CAGR, supported by universities, research institutions, and government agencies investing in satellite technology. The Midwest experiences a more moderate growth rate of 9.7%, driven by the development of space infrastructure and commercial satellite applications.

The West is experiencing the highest demand growth for small satellites, with a 13.9% CAGR. The region is home to Silicon Valley and aerospace giants, such as SpaceX and other satellite service providers, which drive the demand for small satellites. California and neighboring states are leading in the development of space technologies, including satellite manufacturing, testing, and deployment. The growing need for communication, Earth observation, and navigation services from commercial and governmental entities fuels this demand.

The West's strong presence in space exploration, private sector investments, and advanced technological infrastructure contribute significantly to the rise in small satellite adoption. Commercial space launches, satellite constellations, and the ongoing trend toward affordable satellite technology are boosting growth in this region. As more satellite missions are launched for both research and commercial purposes, the West remains at the forefront of small satellite advancements.

The South is seeing strong demand for small satellites, with a 12.4% CAGR. The region is home to key aerospace facilities, such as those in Texas and Florida, which have contributed to the rise of commercial space ventures. Florida’s Cape Canaveral is one of the most prominent launch sites, and Texas hosts numerous companies focused on satellite development and deployment. The South’s active involvement in space missions, as well as private companies working on satellite-based communications and Earth observation, plays a significant role in this growth.

With the increasing focus on satellite constellations and the growing involvement of private space companies, the South’s demand for small satellites is expected to continue to rise. The region’s investments in infrastructure, launch sites, and commercial satellite applications are strengthening the sector. As demand for communication, surveillance, and scientific satellites grows, the South is becoming a major player in the small satellite industry.

The Northeast is experiencing steady growth in small satellite demand, with an 11.1% CAGR. The region benefits from its strong presence of academic institutions, research organizations, and governmental agencies, such as NASA’s Goddard Space Flight Center. Universities and private research facilities in the Northeast are involved in developing cutting-edge space technologies, including small satellite systems. The region also benefits from collaborations between academia, government, and private companies, which drive innovation in satellite technology.

The Northeast’s emphasis on environmental monitoring, remote sensing, and scientific research contributes to the growing demand for small satellites. As more satellite-based data is used for scientific research, climate monitoring, and communications, the Northeast is expected to continue to play a key role in small satellite development, further supporting growth in the sector.

The Midwest is seeing moderate growth in small satellite demand, with a 9.7% CAGR. The region has a growing space industry, particularly in satellite applications for communications, agriculture, and defense. Companies and research institutions in states like Ohio, Illinois, and Michigan are involved in small satellite development, contributing to the region’s steadily increasing demand. The Midwest’s focus on technological innovation in aerospace and its role in supporting satellite infrastructure are key drivers for growth in this area.

While the Midwest’s space industry is not as large as those in the West and South, the region is catching up with increasing investments in satellite technology and space exploration. As the demand for satellite-based services continues to rise, particularly in sectors like agriculture and communication, the Midwest will likely see continued growth in small satellite applications.

The demand for small satellites in the USA is expanding rapidly, fueled by both commercial and government initiatives. As technology becomes more affordable, satellite constellations for earth observation, communication, and defense applications are becoming increasingly popular. The rise of the NewSpace ecosystem, alongside decreasing launch and manufacturing costs, is driving this growth. Both private companies and government agencies are leveraging small satellites for a variety of purposes, ranging from broadband internet provision to national security needs.

Airbus S.A.S. leads the USA industry with a 40.4% share, thanks to its advanced satellite platforms and reliable components tailored to USA customers. Other significant players in the small satellite industry include CASIC, OHB SE, Lockheed Martin Corporation, and Boeing. These companies contribute to the sector by offering satellite manufacturing, integrated systems, and launch services, supporting the growing demand for small satellite operations across various sectors.

Key drivers of the demand for small satellites in the USA include the expansion of Low Earth Orbit (LEO) constellations to provide global broadband internet, real-time earth observation for climate monitoring and agriculture, and the modernization of national security satellites. Technological advancements such as electric propulsion and miniaturized payloads are making satellite launches more cost-effective and efficient. While challenges like regulatory issues and spectrum competition remain, the outlook for small satellites in the USA is strong, with continued growth expected as the need for satellite-based services increases.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Satellite Type | Minisatellite, Picosatellites, Microsatellite, CubeSats, Femtosatellites |

| Orbit Type | Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geosynchronous Orbit (GEO) |

| Application | Communication and Navigation, Military Intelligence, Earth Observation, Remote Sensing, Scientific Research & Exploration |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Airbus S.A.S., CASIC, OHB SE, Lockheed Martin Corporation, Boeing |

| Additional Attributes | Dollar sales by satellite type, orbit type, application, and regional trends |

The global demand for small satellite in USA is estimated to be valued at USD 2.3 billion in 2025.

The market size for the demand for small satellite in USA is projected to reach USD 7.3 billion by 2035.

The demand for small satellite in USA is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in demand for small satellite in USA are minisatellite, picosatellites, microsatellite, cubesats and femtosatellites.

In terms of orbit type, low earth orbit (leo) segment to command 79.6% share in the demand for small satellite in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA